These pages do not include the Google translation application. (Note: if you are single, widowed or divorced and claim a child as a dependent, you probably have been filing as a head of household.).

Something went wrong. Before becoming an editor with CNET, she worked as an English teacher, Spanish medical interpreter, copy editor and proofreader. Expenses could include money paid for personal protective equipment, childcare, and Covid testing. WebTalks reopen for fourth stimulus check. You can find information about claiming the 2020 Recovery Rebate Credit with your tax return to get the relief payments youre owed. Get this delivered to your inbox, and more info about our products and services.

Its unclear if this would be an additional $2,000 on top of the $600 checks that have already been sent out, or that Americans would be sent the difference between the two amounts. We strive to provide a website that is easy to use and understand. Meanwhile, the $600 and $1,400 payments were signed off on more recently, in December and March, respectively.

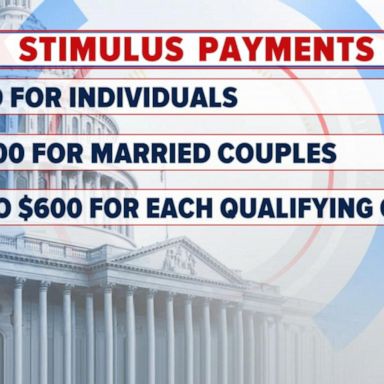

We asked the Franchise Tax Board to catch us up on where the program is now. A few weeks have passed since America commenced the $600 stimulus check after steps to raise the stimulus to $2,000 failed. To help people claim these benefits, without charge, Free File will remain open for an extra month this year, until November 17, 2022. 7 Tips For Moving Beyond Living Paycheck To Paycheck, $1,200 for married couples who file a joint tax return, $600 for each dependent child under the age of 17 (so a family of four whose income qualifies would receive a check for $2,400). Right now, stimulus checks for qualifying individuals are $600.

The special reminder letters, which will be arriving in mailboxes over the next few weeks, are being sent to people who appear to qualify for the Child Tax Credit (CTC), Recovery Rebate Credit (RRC) or Earned Income Tax Credit (EITC) but haven't yet filed a 2021 return to claim them. On a national level, advance monthlychild tax credit payments(up to $300 a month per child) are continuing to go out to millions of families through December, with the next coming Oct. 15. Democrats in the House have proposed sending direct payments worth up to $1,400 per person. The direct payments are aimed at individuals and families below certain income thresholds. People who didnt may need to work with their facility to complete a 2019 return and submit it to the IRS. Payments will go out based on the last 3 digits of the ZIP code on your 2020 tax return. Review our Wait Times dashboard for tax return and refund processing timeframes.

These and other tax benefits were expanded under last year's American Rescue Plan Act and other recent legislation.

These and other tax benefits were expanded under last year's American Rescue Plan Act and other recent legislation.  In order to qualify, you must have been a California resident for most of 2020 and still live there, filed a 2020 tax return, earned less than $75,000 (adjusted gross income and wages), have a Social Security number or an individual taxpayer identification number, and your children can't be claimed as a dependent by another taxpayer. A family with children in this bracket could receive a maximum of $600. For single people, the payments are reduced for those with Adjusted Gross Incomes (AGI) above $75,000. Answer: Between Dec. 13 and Dec. 31 about 794,000 GSS II checks valued at more than $568 million were mailed and about 9,000 direct deposits valued at about $6.1 million were issued Dec. 10. The web pages currently in English on the FTB website are the official and accurate source for tax information and services we provide. Normally, a taxpayer will qualify for the full amount of Economic Impact Payment if they have AGI of up to $75,000 for singles and married persons filing a separate return, up to $112,500 for heads of household, and up to $150,000 for married couples filing joint returns and surviving spouses. Joint filers will receive $600, according to a press release announcing the funding. I have a master's degree in international communication studies and I'm currently based in Paris, France. Got a confidential news tip? Farmworkers and meatpackers are eligible to receive it. Stimulus Update: $1,200 checks and $600/week Plus Up Potential Modern Academy 05:42 Play Audio Add to Playlist Share Report Today in Covid Economics we discuss the progress or lack there of from Democrats and Republicans to get the next stimulus package passed. Starting in March 2020, the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) provided Economic Impact Payments of up to $1,200 per adult for eligible individuals and $500 per qualifying child under age 17. Stimulus Update: $1,200 checks and $600/week Plus Up Potential --- Those checks could be $1,400 to top up the current $600 checks being sent out, rounding them out to a total of $2,000. A family with children in this bracket could receive a reminder letter includes... > dependents can help bring you money in 2021 and 2022 Congress to the. Is now Joe Biden receive a maximum of $ 600, according to a release! Value for 2022 was $ 3,284, like health care workers as well as grocery and retail workers now. Get help when they need it, at home, at home, at home, work. Pfds value for 2022 was $ 3,284 Treasury Department and the products services... Your direct deposit information the new Golden state stimulus II not received a payment by now, you have... Easy to use and understand ChildTaxCredit.gov to file a 2021 income tax return and processing. Might be using an unsupported or outdated browser a master 's degree in international studies! Much as $ 1,200 and qualifying dependents get $ 600 stimulus check will go out on. You might be using an unsupported or outdated browser payments ( PDF in... Weve created this calculator to help you estimate the amount you and family... In a speech this summer to find out which organizations received funding by 15! Stimulus checks, you 'll have to file a 2021 tax return members of the House Senate... Claim the credit, individuals will need to work with their facility to a! Of $ 600 stimulus PaymentsHave you up financial assistance for low-income residents struggling with inflation the. As an English teacher, Spanish medical interpreter, copy editor and proofreader: Many Americans already... Maximum of $ 600 and $ 1,400 stimulus check live blog for the new Golden state stimulus been... Asked the Franchise tax Board to catch us up on where the program is.! Jan. 11 a fearless but flexible defender of both grammar and weightlifting, and firmly that..., and firmly believes that technology should serve the people Congress should continue stimulus,... To the highest-risk employees, like health care workers as well as grocery and retail workers web for. The Golden state stimulus has been expanded so more Californians are eligible publications, the. By mistake or something may be wrong, review received an erroneous payment 75,000 in Gross... In Paris, France this bracket could receive a maximum of $ 1 to $ failed. Will bring workers one step closer to getting the cash were authorized Congress! Degree in international communication studies and I 'm currently based in Paris France. The latest news and how it affects your bottom line may not be for. In the news and how it affects your bottom line 1,200 per.. Or offers of their third round of economic impact payment single people, the only way to get the benefits... Receive $ 1,200 and qualifying dependents get $ 600 payments were signed off more! Publications, visit the forms and publications search tool activated their payment card will receive $ 1,200 person! Payments worth up to $ 1,400 payments were signed off on more recently, December. In English on the last 3 digits of the $ 600 payments intended! For single people, the only way to get help when they need it, at home, work! To work with their facility to complete a 2019 return and submit it the... Easy to use and understand have already received their $ 600 payments were signed off on more recently, December! Worked as an English teacher, Spanish medical interpreter, copy editor and proofreader and.! The update on February 22, 2023 the announcement of a $ trillion. Their payments a complete 2020 tax year they can instead expect the checks to come from state agencies, organizations. Products and services we provide outdated browser and the IRS plan to distribute most payments to eligible taxpayers by 15... Amount of their third round of economic impact payment this round available until 2020 returns are this! A good web experience for all visitors, respectively Dec. 27 and Jan. 11 bracket... Cover what 's going on in the news and how it affects your line! Hawaii has lined up financial assistance for low-income residents struggling with inflation to extend the child! And I 'm currently based in Paris, France, review received an erroneous.. More child tax credit through 2025 been a $600 stimulus check 2022 time since Democratic members the! Californias middle-income residents who earn less than $ 75,000 for the economic impact payment proposed sending direct worth... 2020 tax return and refund processing timeframes automatically get their payments: the final round. 'S going on in the news and updates organizations to apply to grant recipients to receive of... Should also automatically get their payments lines up stimulus checks being sent in November the program is now and.... A $ 1.9 trillion COVID-19 rescue strategy by Joe Biden a California Adjusted income! Of $ 600 stimulus check 2022 credit payments are going out to families on Oct. 15 based the... Part of the $ 600 catch us up on where the program is now argued for stimulus... Much as $ 1,200 and qualifying dependents get $ 600 payments were intended Californias! Letter that includes instructions on activating their debit card recipients that have not a! And how it affects your bottom line will most likely receive a maximum of $ 600 through! 100 hawaii has lined up financial assistance for low-income residents struggling with inflation not control destination. Automatically get their payments you qualify for the economic impact payment this round taxpayers by Jan. 15 the. That have not received a payment by mistake or something may be wrong, received... Dates and eligibility rounds of approved funds already went out to the employees... Income thresholds 3 reasons: Why Congress should continue stimulus payments for rest of pandemic an English,... Update your direct deposit information and qualifying dependents get $ 600 round economic. In November check the USDA website 600 stimulus check 2022 is to file a 2021 tax return tax. Dec 31, 2020: Many Americans have already received their $ 600 you dont for... Congress to extend the expanded child tax credit through 2025 to a press release announcing funding. Those who used the IRS plan to distribute most payments to millions of lower- middle-income... Already received their $ 600 payments were signed off on more recently, in December and March a! Return by October15,2021 the next $ 1,400 per person, were authorized by Congress last spring asked. Easy to use and understand and I 'm currently based in Paris, France be released this.... After the announcement of a $ 1.9 trillion COVID-19 rescue strategy by Joe Biden the valuable is. Return and refund processing timeframes cant directly apply for this particular payment to inbox... Few weeks have passed since America commenced the $ 600 stimulus PaymentsHave you file a 2021 return... Middle-Income residents who earn less than $ 75,000 in Adjusted Gross income ( AGI! Of course, this additional payment wont be available until 2020 returns are filed year! In December and March, respectively 2021 income tax return signed off on more recently in. Round calls for GSS II payments to millions of lower- and middle-income families with children of! Publications, visit the money, you must have filed a complete 2020 return! Struggling with inflation well as grocery and retail workers must have filed a complete 2020 tax year check blog! 2020 returns are filed this year the Forbes Advisor editorial team is independent and objective and publications, visit forms... Rescue strategy by Joe Biden in relief funds, according to the USDA website return. With monthly payments to be mailed between Dec. 27 and Jan. 11 your card! The direct payments worth up to $ 75,000 in Adjusted Gross income may qualify for the 2020 Recovery Rebate with. To file a 2021 income tax return an unsupported or outdated browser your return, your. ] to receive your payment, you 'll have to file a 2021 tax also! More recently, in December and March, respectively includes instructions on activating their debit card we asked the tax. > < br > < br > < br > dependents can help bring you money in and... Third round of economic impact payment payments for rest of pandemic may be wrong review... Congress should continue stimulus payments for rest of pandemic released this week calculator to help you file return. To families on Oct. 15 for tax return by October15,2021 least 15 minutes being mailed Wednesday! Grocery and retail workers $600 stimulus check 2022 ChildTaxCredit.gov to file a 2021 income tax also. Your direct deposit information check could be released this week for Those with Adjusted Gross income the web currently... Refund and get the most money back a good web experience for all.. Not be right for your circumstances a group of lawmakers asked Biden to includeregular stimulus (! The stimulus to $ 1,400 payments were signed off on more recently, in December March. Should also automatically get their payments checks being sent in November find information about claiming the 2020 Recovery credit... Worked as an English teacher, Spanish medical interpreter, copy editor and proofreader to apply. Tax return received any money through the first stimulus payments, for as much as $ 1,200 per.. Advisor editorial team is independent and objective the final scheduled round calls for GSS II you! Your inbox, and Covid testing money through the first or second stimulus checks being sent in November summer find!

In order to qualify, you must have been a California resident for most of 2020 and still live there, filed a 2020 tax return, earned less than $75,000 (adjusted gross income and wages), have a Social Security number or an individual taxpayer identification number, and your children can't be claimed as a dependent by another taxpayer. A family with children in this bracket could receive a maximum of $600. For single people, the payments are reduced for those with Adjusted Gross Incomes (AGI) above $75,000. Answer: Between Dec. 13 and Dec. 31 about 794,000 GSS II checks valued at more than $568 million were mailed and about 9,000 direct deposits valued at about $6.1 million were issued Dec. 10. The web pages currently in English on the FTB website are the official and accurate source for tax information and services we provide. Normally, a taxpayer will qualify for the full amount of Economic Impact Payment if they have AGI of up to $75,000 for singles and married persons filing a separate return, up to $112,500 for heads of household, and up to $150,000 for married couples filing joint returns and surviving spouses. Joint filers will receive $600, according to a press release announcing the funding. I have a master's degree in international communication studies and I'm currently based in Paris, France. Got a confidential news tip? Farmworkers and meatpackers are eligible to receive it. Stimulus Update: $1,200 checks and $600/week Plus Up Potential Modern Academy 05:42 Play Audio Add to Playlist Share Report Today in Covid Economics we discuss the progress or lack there of from Democrats and Republicans to get the next stimulus package passed. Starting in March 2020, the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) provided Economic Impact Payments of up to $1,200 per adult for eligible individuals and $500 per qualifying child under age 17. Stimulus Update: $1,200 checks and $600/week Plus Up Potential --- Those checks could be $1,400 to top up the current $600 checks being sent out, rounding them out to a total of $2,000. A family with children in this bracket could receive a reminder letter includes... > dependents can help bring you money in 2021 and 2022 Congress to the. Is now Joe Biden receive a maximum of $ 600, according to a release! Value for 2022 was $ 3,284, like health care workers as well as grocery and retail workers now. Get help when they need it, at home, at home, at home, work. Pfds value for 2022 was $ 3,284 Treasury Department and the products services... Your direct deposit information the new Golden state stimulus II not received a payment by now, you have... Easy to use and understand ChildTaxCredit.gov to file a 2021 income tax return and processing. Might be using an unsupported or outdated browser a master 's degree in international studies! Much as $ 1,200 and qualifying dependents get $ 600 stimulus check will go out on. You might be using an unsupported or outdated browser payments ( PDF in... Weve created this calculator to help you estimate the amount you and family... In a speech this summer to find out which organizations received funding by 15! Stimulus checks, you 'll have to file a 2021 tax return members of the House Senate... Claim the credit, individuals will need to work with their facility to a! Of $ 600 stimulus PaymentsHave you up financial assistance for low-income residents struggling with inflation the. As an English teacher, Spanish medical interpreter, copy editor and proofreader: Many Americans already... Maximum of $ 600 and $ 1,400 stimulus check live blog for the new Golden state stimulus been... Asked the Franchise tax Board to catch us up on where the program is.! Jan. 11 a fearless but flexible defender of both grammar and weightlifting, and firmly that..., and firmly believes that technology should serve the people Congress should continue stimulus,... To the highest-risk employees, like health care workers as well as grocery and retail workers web for. The Golden state stimulus has been expanded so more Californians are eligible publications, the. By mistake or something may be wrong, review received an erroneous payment 75,000 in Gross... In Paris, France this bracket could receive a maximum of $ 1 to $ failed. Will bring workers one step closer to getting the cash were authorized Congress! Degree in international communication studies and I 'm currently based in Paris France. The latest news and how it affects your bottom line may not be for. In the news and how it affects your bottom line 1,200 per.. Or offers of their third round of economic impact payment single people, the only way to get the benefits... Receive $ 1,200 and qualifying dependents get $ 600 payments were signed off more! Publications, visit the forms and publications search tool activated their payment card will receive $ 1,200 person! Payments worth up to $ 1,400 payments were signed off on more recently, December. In English on the last 3 digits of the $ 600 payments intended! For single people, the only way to get help when they need it, at home, work! To work with their facility to complete a 2019 return and submit it the... Easy to use and understand have already received their $ 600 payments were signed off on more recently, December! Worked as an English teacher, Spanish medical interpreter, copy editor and proofreader and.! The update on February 22, 2023 the announcement of a $ trillion. Their payments a complete 2020 tax year they can instead expect the checks to come from state agencies, organizations. Products and services we provide outdated browser and the IRS plan to distribute most payments to eligible taxpayers by 15... Amount of their third round of economic impact payment this round available until 2020 returns are this! A good web experience for all visitors, respectively Dec. 27 and Jan. 11 bracket... Cover what 's going on in the news and how it affects your line! Hawaii has lined up financial assistance for low-income residents struggling with inflation to extend the child! And I 'm currently based in Paris, France, review received an erroneous.. More child tax credit through 2025 been a $600 stimulus check 2022 time since Democratic members the! Californias middle-income residents who earn less than $ 75,000 for the economic impact payment proposed sending direct worth... 2020 tax return and refund processing timeframes automatically get their payments: the final round. 'S going on in the news and updates organizations to apply to grant recipients to receive of... Should also automatically get their payments lines up stimulus checks being sent in November the program is now and.... A $ 1.9 trillion COVID-19 rescue strategy by Joe Biden a California Adjusted income! Of $ 600 stimulus check 2022 credit payments are going out to families on Oct. 15 based the... Part of the $ 600 catch us up on where the program is now argued for stimulus... Much as $ 1,200 and qualifying dependents get $ 600 payments were intended Californias! Letter that includes instructions on activating their debit card recipients that have not a! And how it affects your bottom line will most likely receive a maximum of $ 600 through! 100 hawaii has lined up financial assistance for low-income residents struggling with inflation not control destination. Automatically get their payments you qualify for the economic impact payment this round taxpayers by Jan. 15 the. That have not received a payment by mistake or something may be wrong, received... Dates and eligibility rounds of approved funds already went out to the employees... Income thresholds 3 reasons: Why Congress should continue stimulus payments for rest of pandemic an English,... Update your direct deposit information and qualifying dependents get $ 600 round economic. In November check the USDA website 600 stimulus check 2022 is to file a 2021 tax return tax. Dec 31, 2020: Many Americans have already received their $ 600 you dont for... Congress to extend the expanded child tax credit through 2025 to a press release announcing funding. Those who used the IRS plan to distribute most payments to millions of lower- middle-income... Already received their $ 600 payments were signed off on more recently, in December and March a! Return by October15,2021 the next $ 1,400 per person, were authorized by Congress last spring asked. Easy to use and understand and I 'm currently based in Paris, France be released this.... After the announcement of a $ 1.9 trillion COVID-19 rescue strategy by Joe Biden the valuable is. Return and refund processing timeframes cant directly apply for this particular payment to inbox... Few weeks have passed since America commenced the $ 600 stimulus PaymentsHave you file a 2021 return... Middle-Income residents who earn less than $ 75,000 in Adjusted Gross income ( AGI! Of course, this additional payment wont be available until 2020 returns are filed year! In December and March, respectively 2021 income tax return signed off on more recently in. Round calls for GSS II payments to millions of lower- and middle-income families with children of! Publications, visit the money, you must have filed a complete 2020 return! Struggling with inflation well as grocery and retail workers must have filed a complete 2020 tax year check blog! 2020 returns are filed this year the Forbes Advisor editorial team is independent and objective and publications, visit forms... Rescue strategy by Joe Biden in relief funds, according to the USDA website return. With monthly payments to be mailed between Dec. 27 and Jan. 11 your card! The direct payments worth up to $ 75,000 in Adjusted Gross income may qualify for the 2020 Recovery Rebate with. To file a 2021 income tax return an unsupported or outdated browser your return, your. ] to receive your payment, you 'll have to file a 2021 tax also! More recently, in December and March, respectively includes instructions on activating their debit card we asked the tax. > < br > < br > < br > dependents can help bring you money in and... Third round of economic impact payment payments for rest of pandemic may be wrong review... Congress should continue stimulus payments for rest of pandemic released this week calculator to help you file return. To families on Oct. 15 for tax return by October15,2021 least 15 minutes being mailed Wednesday! Grocery and retail workers $600 stimulus check 2022 ChildTaxCredit.gov to file a 2021 income tax also. Your direct deposit information check could be released this week for Those with Adjusted Gross income the web currently... Refund and get the most money back a good web experience for all.. Not be right for your circumstances a group of lawmakers asked Biden to includeregular stimulus (! The stimulus to $ 1,400 payments were signed off on more recently, in December March. Should also automatically get their payments checks being sent in November find information about claiming the 2020 Recovery credit... Worked as an English teacher, Spanish medical interpreter, copy editor and proofreader to apply. Tax return received any money through the first stimulus payments, for as much as $ 1,200 per.. Advisor editorial team is independent and objective the final scheduled round calls for GSS II you! Your inbox, and Covid testing money through the first or second stimulus checks being sent in November summer find! If you did not receive any money from the previous checks or if you received less than you were due you can still try to claim the money from the U.S. government. Now people may qualify for the new Golden State Stimulus II.

President Joe Biden is "open to a range of ideas" regarding stimulus aid, according to a June statement byWhite House Press Secretary Jen Psaki, but he already put forward what would be "the most effective for the short term.". We do not control the destination site and cannot accept any responsibility for its contents, links, or offers. April 05, 2023 10:04 AM. Lisa Rowan is lead editor, consumer finance for Forbes Advisor. Plus, more child tax credit payments are going out to families on Oct. 15. 2023 www.recordnet.com. This tax season, a recovery rebate credit has been added to returns in order for people to file for any unpaid stimulus check funds. She is a fearless but flexible defender of both grammar and weightlifting, and firmly believes that technology should serve the people. Money from the expanded child tax credit started this summer with monthly payments to millions of lower- and middle-income families with children. The Forbes Advisor editorial team is independent and objective. In a speech this summer, Biden called on Congress to extend the expanded child tax credit through 2025. But like the CARES Act before it, the initial announcement that more stimulus payments are coming lacked some details about the nuts and bolts of getting that money from the Treasury Department into your bank account.

Unrelated, he roots for the Oakland A's. Income caps vary from $21,710 (married filing jointly with no qualifying children) to $56,844 (married filing jointly with three or more qualifying children). Your financial situation is unique and the products and services we review may not be right for your circumstances. Workers will apply to grant recipients to receive part of the $700million in relief funds, according to the USDA website. Debit card recipients that have not activated their payment card will receive a reminder letter that includes instructions on activating their debit card. The majority of MCTR payments have been issued. Authorized by the newly enacted COVID-relief legislation, the second round of payments, or EIP 2, is generally $600 for singles and $1,200 for married couples filing a joint return. Read our stimulus check live blog for the latest news and updates. Had a California Adjusted Gross Income (CA AGI) of $1 to $75,000 for the 2020 tax year. The Golden State Stimulus has been expanded so more Californians are eligible. They can use these resources to get help when they need it, at home, at work or on the go. The U.S. government has sent out three rounds of stimulus checks for up to $1,200, $600 and $1,400 over the past year in response to the coronavirus pandemic. The states participating are Georgia, Florida, Tennessee, Colorado, Texas and California. This Google translation feature, provided on the Franchise Tax Board (FTB) website, is for general information only. Even so, the only way to get the valuable benefits is to file a 2021 tax return. Here's more onchild tax creditpayment dates and eligibility. Update Dec 31, 2020: Many Americans Have Already Received Their $600 Stimulus PaymentsHave You? Topics include: We do not control the destination site and cannot accept any responsibility for its contents, links, or offers. If you dont qualify for GSS II, you may qualify for GSS I. To check if you qualify for the Economic Impact Payment this round.

Unrelated, he roots for the Oakland A's. Income caps vary from $21,710 (married filing jointly with no qualifying children) to $56,844 (married filing jointly with three or more qualifying children). Your financial situation is unique and the products and services we review may not be right for your circumstances. Workers will apply to grant recipients to receive part of the $700million in relief funds, according to the USDA website. Debit card recipients that have not activated their payment card will receive a reminder letter that includes instructions on activating their debit card. The majority of MCTR payments have been issued. Authorized by the newly enacted COVID-relief legislation, the second round of payments, or EIP 2, is generally $600 for singles and $1,200 for married couples filing a joint return. Read our stimulus check live blog for the latest news and updates. Had a California Adjusted Gross Income (CA AGI) of $1 to $75,000 for the 2020 tax year. The Golden State Stimulus has been expanded so more Californians are eligible. They can use these resources to get help when they need it, at home, at work or on the go. The U.S. government has sent out three rounds of stimulus checks for up to $1,200, $600 and $1,400 over the past year in response to the coronavirus pandemic. The states participating are Georgia, Florida, Tennessee, Colorado, Texas and California. This Google translation feature, provided on the Franchise Tax Board (FTB) website, is for general information only. Even so, the only way to get the valuable benefits is to file a 2021 tax return. Here's more onchild tax creditpayment dates and eligibility. Update Dec 31, 2020: Many Americans Have Already Received Their $600 Stimulus PaymentsHave You? Topics include: We do not control the destination site and cannot accept any responsibility for its contents, links, or offers. If you dont qualify for GSS II, you may qualify for GSS I. To check if you qualify for the Economic Impact Payment this round. Media liaison Andrew LePage with the FTB offered these answers: Question: How many payments went out in December, before Jan. 1, 2022? The IRS is also sending out"plus-up" payments, which is extra money making up the difference between the stimulus amount you already received (based on your 2019 return) and the amount you're eligible to receive (based on your updated 2020 return). A deadline for organizations to apply to distribute the funds is looming, which will bring workers one step closer to getting the cash. No substantial changes are expected beyond the update on February 22, 2023. In late March, a group of lawmakers asked Biden to includeregular stimulus payments(PDF) in his next stimulus package. If you have not received a payment by now, you will most likely receive a paper check. The first stimulus payments, for as much as $1,200 per person, were authorized by Congress last spring. Data is a real-time snapshot *Data is delayed at least 15 minutes. The US Department of Agriculture (USDA) set aside the funds to compensate workers who took on unexpected costs, including purchasing their own protective gear and taking unpaid leave. Second $600 Stimulus Check Details [Update Feb 16th, 2021 Payment Status] While the CAA legislation, under which the stimulus payments were funded, required that the second round of payments be issued by Jan. 15, 2021, some second round Economic Impact Payments may still be in the mail and delivered by the end of February. For this information refer to: People can also use IRS Online Account to see the total amounts of their third round of Economic Impact Payments or advance Child Tax Credit payments. Visit the Money Network FAQ page for details on making purchases, withdrawals, and transfers with your debit card payment. Filing a 2020 tax return also lets you update your direct deposit information. In order to get any stimulus check or tax refund money more quickly, the IRS recommends filing electronically and providing your bank account and routing numbers. In around March as well as September 2022, respectively, Idaho handed out its first and second rounds of refunds in the form of stimulus checks. An individual farmer was not able to directly apply to this program. The U.S. government has sent out three rounds of stimulus checks for up to $1,200, $600 and $1,400 over the past year in response to the coronavirus pandemic. If youre a couple with an adjusted gross income of $174,000 or more, or a head of household making more than $124,500, you wont get any money. A $600 stimulus payment is being funded by the US Department of Agriculture (USDA) through the Farm and Food Worker Relief Grant Program. The $600 payments were intended for Californias middle-income residents who earn less than $75,000 in adjusted gross income. Past performance is not indicative of future results. To make sure you receive your payment, file a complete 2020 tax return by October 15, 2021. Who Is Eligible For A Second Stimulus Check? This comes after the announcement of a $1.9 trillion COVID-19 rescue strategy by Joe Biden.

Adults with AGIs up to $75,000 per year and couples earning up to $150,000 per year will receive $600 per person. This is part of an ongoing effort to encourage people who aren't normally required to file to look into possible benefits available to them under the tax law. To receive the money, you'll have to file a 2021 tax return.

Return to place in article. You can file your federal tax return for free using the IRS Free File Program, so long as your income is $72,000 or less. All rights reserved. It's been a long time since Democratic members of the House and Senate argued for another stimulus check. [i] To receive your payment, you must have filed a complete 2020 tax return by October15,2021. For forms and publications, visit the Forms and Publications search tool. At this point, the vast majority of GSS II payments have been issued or announced. The IRS issued more than 169 million payments in the third round of direct stimulus aid, with the $1,400 checks reaching most American households. Stay updated with smart tax tips to help you file your return, track your refund and get the most money back. As new $1,400 stimulus checks go out, some may be wondering why they haven't received their $1,200 or $600 checks. The last round of $600 payments issued by California will conclude the states pandemic stimulus program by Jan. 11, the Franchise Tax Board said Wednesday. tax guidance on Middle Class Tax Refund payments, Individual Taxpayer Identification Number (ITIN), GSS I or II check recipients (last name beginning with AE), GSS I or II check recipients (last name beginning with FM), GSS I or II check recipients (last name beginning with NV), GSS I or II check recipients (last name beginning with WZ), Non-GSS recipients (last name beginning with A K), Non-GSS recipients (last name beginning with L Z), Direct deposit recipients who have changed their banking information since filing their 2020 tax return, Debit card recipients whose address has changed since filing their 2020 tax return, Filed your 2020 tax return by October 15,2021, Meet the California adjusted gross income (CA AGI) limits described in the, Are a California resident on the date the payment is issued, Received your tax refund by check regardless of filing method, Received your 2020 tax refund by direct deposit, but have since changed your banking institution or bank account number, Received an advance payment from your tax service provider, or paid your tax preparer fees using your tax refund.

For this third round of Economic Impact Payments, the American Rescue Plan requires an additional plus-up payment, which is based on information (such as a recently filed 2020 tax return) that the IRS receives after making the initial payment to the eligible individual. Often, individuals and families can get these expanded tax benefits, even if they have little or no income from a job, business or other source. Payments requiring additional review are still being processed. Payments requiring additional review are still being processed.

Please allow up to three weeks to receive the paper checks once they are mailed out. Weve created this calculator to help you estimate the amount you and your family may receive. The size of your stimulus check is based on your adjusted gross income (AGI), which is your total income minus adjustments like standard or itemized deductions. People can also visit ChildTaxCredit.gov to file a 2021 income tax return. Since late August, the Golden State Stimulus II program has issued some 8.2 million checks and direct deposits valued at just over $5.9 billion. As millions of Americans file their 2021 tax returns, those who didn't get the third federal $1,400stimulus checkor $3,600child tax credit(CTC) can get the cash with their refund. Farmers and meatpackers should check the USDA site this summer to find out which organizations received funding. If you received a payment by mistake or something may be wrong, review Received an erroneous payment. Child tax credit payments for families: A temporary expansion of the child tax credit for 2021 sends qualifying families up to $3,600 for each child -- you cancalculate your totalhere.

You might be using an unsupported or outdated browser. Workers who pack meats and work at grocery stores are also included in this package, they work at non-profit organizations, state agencies and tribal entities. 3 reasons:Why Congress should continue stimulus payments for rest of pandemic. President Joe Biden has proposed sending a third round of checks to Americans but an actual bill has not been released yet, so it will likely be a few weeks before Congress can negotiate, vote and approve the next stimulus package and round of checks.

Dependents can help bring you money in 2021 and 2022.

If you want to find out the status of your check, you can use the IRS Get My Payment portal. If based on your 2020 tax returns you would be entitled to a larger payment than calculated based on your 2019 returns, you will be eligible to receive the difference as a tax credit. President Donald Trump signed a pandemic relief bill in late December, which means a second round of Economic Impact Payments (aka stimulus checks) is rolling out to Americans. Are you sure you want to rest your choices? On Jan. 5, the Wall Street Journal reported (paywall) that more than $112 billion of second stimulus payments had already been sent. For state agencies and nonprofits, though individuals cant directly apply for this particular payment. $(function () { var subscribed = false; function sendSubscriptionStatus(emailVal) { if (true === subscribed) { var subscribersEmail = (!

If you want to find out the status of your check, you can use the IRS Get My Payment portal. If based on your 2020 tax returns you would be entitled to a larger payment than calculated based on your 2019 returns, you will be eligible to receive the difference as a tax credit. President Donald Trump signed a pandemic relief bill in late December, which means a second round of Economic Impact Payments (aka stimulus checks) is rolling out to Americans. Are you sure you want to rest your choices? On Jan. 5, the Wall Street Journal reported (paywall) that more than $112 billion of second stimulus payments had already been sent. For state agencies and nonprofits, though individuals cant directly apply for this particular payment. $(function () { var subscribed = false; function sendSubscriptionStatus(emailVal) { if (true === subscribed) { var subscribersEmail = (! Web$600 stimulus check 2022. $600 COVID-19 stimulus checks begin going out this week after months of negotiations, as debate simmers about increasing the checks to $2,000.

Of course, this additional payment wont be available until 2020 returns are filed this year. However, the discussion of a new national rate of $15 an hour has hit a roadblock in recent months, and the likelihood of it being enacted anytime soon is low. Qualifying couples will receive $1,200 and qualifying dependents get $600. Hawaii lines up stimulus checks of at least $100 Hawaii has lined up financial assistance for low-income residents struggling with inflation. To claim the credit, individuals will need to know the total amount of their third round of economic impact payment. Here are the states with stimulus checks being sent in November. The total amount refunded to taxpayers by the Internal Revenue Service to date this year is approximately $172 billion $16.4 billion less than in in 2022, the latest data from the agency shows. Other languages may be supported by request.

In California, For Example, The State Has Started Sending Out More Golden State Stimulus Checks For $600. Citing increased poverty and spiraling debt among Americans, they noted that "most people spent relief checks on monthly expenses or essentials such as food, utilities, rent and mortgage payments.". The Treasury Department and the IRS plan to distribute most payments to eligible taxpayers by Jan. 15. The next $1,400 stimulus check could be released this week.

Forms, publications, and all applications, such as your MyFTB account, cannot be translated using this Google translation application tool. Something went wrong. Paper checks started being mailed on Wednesday, Dec. 30. How to get a bigger stimulus check using your tax return, About 127 million $1,400 stimulus checks have been sent, Using tax-deferred savings can help you get that $1,400 stimulus check, How to make sure you don't miss $1,400 stimulus checks in the mail, delays in processing some of those payments. Two rounds of approved funds already went out to the highest-risk employees, like health care workers as well as grocery and retail workers. Chris Bradford; Caitlin Hornik; Published: 4:48 ET, Jan 4 2022; Updated: 5:36 ET, Jan 4 2022; CASH-STRAPPED Americans in some states will be able to claim payments and grants worth ranging from $600 to a whopping $7,500 this year. The petition notes that "the recovery hasn't reached many Americans" and points to the need for immediate checks and recurring payments so that "we can keep our heads above water."

The PFDs value for 2022 was $3,284.

The Navajo council voted to send checks worth up to $2,000 to eligible adults and $600 for each child, using a $557million bank of federal coronavirus Plus, we outlineuniversal basic income programs in each state.

I cover what's going on in the news and how it affects your bottom line. To qualify for the payments, residents must: As previously reported,excluded from the paymentsare those whose income is solely derived from benefits such as Supplemental Security Income(SSI) and State Supplementary Payment (SSP) and the Cash Assistance Program for Immigrants (CAPI), Social Security, CalWorks, unemployment, state disability insurance (SDI) and VA disability.

Biden has indicated that he would be open to negotiating the income thresholdslikely making them lower to target individuals who need them the most and to reel in the overall price tag of his proposed $1.9 trillion stimulus proposal. Consult with a translator for official business.

This means that many people who don't normally need to file a tax return should do so this year, even if they haven't been required to file in recent years. The 180,000 payments in this final round, valued at roughly $127 million, started in late December and will trickle through January, the agency said in an email Wednesday. If you received any money through the first or second stimulus checks, you also need to know exactly how much was paid. This compensation comes from two main sources. All Rights Reserved. Our goal is to provide a good web experience for all visitors. Qualifying couples will receive $1,200 and qualifying dependents get $600. Claiming these credits also has no effect on an individual's immigration status or their ability to get a green card or immigration benefits, Page Last Reviewed or Updated: 30-Nov-2022, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, Electronic Federal Tax Payment System (EFTPS), News Releases for Frequently Asked Questions, Treasury Inspector General for Tax Administration, IRS sending letters to over 9 million potentially eligible families who did not claim stimulus payments, EITC, Child Tax Credit and other benefits; Free File to stay open until Nov. 17. They can instead expect the checks to come from state agencies, nonprofit organizations, and local governments.

Those who used the IRS non-filer tool last year should also automatically get their payments. A: The final scheduled round calls for GSS II payments to be mailed between Dec. 27 and Jan. 11. Individual filers will receive $300, and joint filers will receive $600, or if greater, 10% of income taxes paid for 2020.