WebBudgeted directlabor cost: 75,000 hours (practical capacity) at $16 per hour Actual direct-labor cost: 80,000 hours at $17.50 per hour Budgeted manufacturing overhead: $997,500 Actual selling and administrative expenses: 435,000 Actual manufacturing overhead: Depreciation $234,666 Property taxes 21,666 Indirect labor 83,666 Supervisory salaries It further estimates that direct material costs will amount to $1,468,000. Assume that 55,000 actual machine-hours were used in machining and that actual direct manufacturing labor costs in assembly were $2,200,000. Second, the manufacturing overhead account tracks overhead costs applied to jobs.

Dubberly Corporation's cost formula for its manufacturing overhead is $30,600 per month plus $64 per machine-hour. This is typically achieved with a standard overhead rate that is calculated once a year (or somewhat more frequently). Depreciation on manufacturing equipment - The amount of value your equipment loses each year. Round your answers to the nearest dollar. Connies Candy used fewer direct labor hours and less variable overhead to produce 1,000 candy boxes (units). Figure 2.6 Overhead Applied for Custom Furniture Companys Job 50 shows the manufacturing overhead applied based on the six hours worked by Tim Wallace. The taxable income formula calculates the total income taxable under the income tax.

Here we explain its types, calculation examples, advantages, and disadvantages. It aids investors in analyzingthe company's performance.

In accounting, all costs can be described as either fixed costs or variable costs. WebOur team of 100+ friendly financing experts are here to help your business grow, and are ready to invest in your success over the long term. The standard variable overhead rate per hour is $2.00 ($4,000/2,000 hours), taken from the flexible budget at 100% capacity. The standard overhead rate is the total budgeted overhead of $10,000 divided by the level of activity (direct labor hours) of 2,000 hours. explain the circumstances for the bakery' You are free to use this image on your website, templates, etc., Please provide us with an attribution link. This problem has been solved! Fixed Cost refers to the cost or expense that is not affected by any decrease or increase in the number of units produced or sold over a short-term horizon. CFA And Chartered Financial Analyst Are Registered Trademarks Owned By CFA Institute. The types of such overheads are fixed and variable. Depreciation is a systematic allocation method used to account for the costs of any physical or tangible asset throughout its useful life. The actual variable overhead rate is $1.75 ($3,500/2,000), taken from the actual results at 100% capacity. When this journal entry is recorded, we also record overhead applied on the appropriate job cost sheet, just as we did with direct materials and direct labor. Simply taking a sum of that indirect cost will result in manufacturing overhead. Therefore. B. unfavorable. We are open 7 days a week. Whichever you choose, apply the same formula consistently each quarter to avoid misleading financial statements in the future. If you only take direct costs into account and do not factor in overhead, you're more likely to underprice your products and decrease your profit margin overall. Direct cost refers to the cost of operating core business activityproduction costs, raw material cost, and wages paid to factory staff. Actual manufacturing overhead costs for the year were $2,485,000. Period cost refers to all those costs which are not related or tied with the production process of the company i.e., they are not assigned with any of the particular product of the company and are thus shown in the financial statement of the company for the accounting period in which they are incurred. Examples of costs that are included in the manufacturing overhead category are: Depreciation on equipment used in the production process. This includes the costs of indirect materials, indirect labor, machine repairs, depreciation, factory supplies, insurance, electricity and more.

In accounting, all costs can be described as either fixed costs or variable costs. WebOur team of 100+ friendly financing experts are here to help your business grow, and are ready to invest in your success over the long term. The standard variable overhead rate per hour is $2.00 ($4,000/2,000 hours), taken from the flexible budget at 100% capacity. The standard overhead rate is the total budgeted overhead of $10,000 divided by the level of activity (direct labor hours) of 2,000 hours. explain the circumstances for the bakery' You are free to use this image on your website, templates, etc., Please provide us with an attribution link. This problem has been solved! Fixed Cost refers to the cost or expense that is not affected by any decrease or increase in the number of units produced or sold over a short-term horizon. CFA And Chartered Financial Analyst Are Registered Trademarks Owned By CFA Institute. The types of such overheads are fixed and variable. Depreciation is a systematic allocation method used to account for the costs of any physical or tangible asset throughout its useful life. The actual variable overhead rate is $1.75 ($3,500/2,000), taken from the actual results at 100% capacity. When this journal entry is recorded, we also record overhead applied on the appropriate job cost sheet, just as we did with direct materials and direct labor. Simply taking a sum of that indirect cost will result in manufacturing overhead. Therefore. B. unfavorable. We are open 7 days a week. Whichever you choose, apply the same formula consistently each quarter to avoid misleading financial statements in the future. If you only take direct costs into account and do not factor in overhead, you're more likely to underprice your products and decrease your profit margin overall. Direct cost refers to the cost of operating core business activityproduction costs, raw material cost, and wages paid to factory staff. Actual manufacturing overhead costs for the year were $2,485,000. Period cost refers to all those costs which are not related or tied with the production process of the company i.e., they are not assigned with any of the particular product of the company and are thus shown in the financial statement of the company for the accounting period in which they are incurred. Examples of costs that are included in the manufacturing overhead category are: Depreciation on equipment used in the production process. This includes the costs of indirect materials, indirect labor, machine repairs, depreciation, factory supplies, insurance, electricity and more. , the variable overhead efficiency variance will be: Web Actual overhead in the period was $14,100. So if you These costs do not include general and administrative expenses. The listing of verdicts, settlements, and other case results is not a guarantee or prediction of the outcome of any other claims. It is likely that the amounts determined for standard overhead costs will differ from what actually occurs. Actual direct materials costs were $1,635,000. (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license), Creative Commons Attribution-NonCommercial-ShareAlike License, https://openstax.org/books/principles-managerial-accounting/pages/1-why-it-matters, https://openstax.org/books/principles-managerial-accounting/pages/8-4-compute-and-evaluate-overhead-variances, Creative Commons Attribution 4.0 International License. Manufacturing overhead (also known as factory overhead, factory burden, production overhead) involves a companys manufacturing operations. BuildZoom verified this license was active as of You are free to use this image on your website, templates, etc., Please provide us with an attribution linkHow to Provide Attribution?Article Link to be HyperlinkedFor eg:Source: Manufacturing Overhead (wallstreetmojo.com). Given this difference, the two figures are rarely the same in any given year. Semi-variable expenses are not dependent on the number of units produced in your facility but are subject to fluctuating circumstances. The production head gives the details as below: You are required to calculate manufacturing overhead based on the above information. What are the pros and cons to keeping the bid at 50 or increasing to 100 planes? In a standard cost system, overhead is applied to the goods based on a standard overhead rate. It is measured using specific ratios such as gross profit margin, EBITDA, andnet profit margin. C. either favorable or unfavorable. Thus, there are two variable overhead variances that will better provide these answers: the variable overhead rate variance and the variable overhead efficiency variance. Attorney Advertising. A: Adding manufacturing overhead expenses to the total costs of products you sell provides a more accurate picture of how to price your goods for consumers. This article has been a guide to Manufacturing Overhead Formula. Manufacturing Overhead is the total of all the indirect costs involved in manufacturing a product like Property Tax on the production premise, Remunerations of maintenance personnel, Rent of the manufacturing building, etc. If variable We reviewed their content and use your feedback to keep the quality high. The indirect costs in manufacturing overhead can also

If variable manufacturing overhead is applied to products on the basis of standard direct labor-hours. In cost accounting, manufacturing overhead is applied to the units produced within a reporting period, according to Accounting Tools, a website that offers professional accounting courses and materials. The costs of selling the product are operating expenses (period cost) and not part of manufacturing overhead costs because they are not incurred to make a product. Depreciation on Plant, Machinery, and Equipment = $5,000. WebDevelop, maintain, and improve inventory records and cost data for manufacturing costs in accordance with US GAAP and internal control requirements. Q: Why is it important to calculate manufacturing overhead? Chan Company estimates that annual manufacturing overhead costs will be $500,000. A higher percentage could mean a lagging or inefficient production process and is worth investigating further. However, the variable standard cost per unit is the same per unit for each level of production, but the total variable costs will change. If you are unsure, refer to our "Examples of Manufacturing Overhead" section above. This means that the company would estimate $6 in manufacturing overhead costs for Manufacturing overhead (or factory overhead) is the sum of all indirect costs incurred during the manufacturing process. If Connies Candy only produced at 90% capacity, for example, they should expect total overhead to be $9,600 and a standard overhead rate of $5.33 (rounded). The actual manufacturing overhead for the month was $558,610. WebUniversal Industrial Sales, Inc. is a steel fabrication company located in Lindon, Utah. Accounting For Actual And Applied Overhead, After-Tax Income: Explanation and How to Calculate It, Equity Method of Accounting: How does It Work, Comparing Capital Lease vs Operating Lease. If the outcome is favorable (a negative outcome occurs in the calculation), this means the company spent less than what it had anticipated for variable overhead. Variable overheads depend on the number of units produced, such as electricity bills. Let us see how to calculate manufacturing overhead for 9000 units of production: Similarly, lets calculate for 10000 and 11000 units of production. It is assigned to every unit produced so that the price of each product can be derived. Service will be provided by either shears or clippers, upon customer request and finished with a straight razor for a detailed finish. If the outcome is unfavorable (a positive outcome occurs in the calculation), this means the company was less efficient than what it had anticipated for variable overhead. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Copyright 2023 . s increasing marginal return. How much overhead was applied to each of the four jobs, 0701, 0702, 0703, and 0704?B. WebThe actual manufacturing overhead for the month was $558,610. Our mission is to improve educational access and learning for everyone. In addition to the total standard overhead rate, Connies Candy will want to know the variable overhead rates at each activity level.

Once you have identified your manufacturing expenses, add them up, or multiply the overhead cost per unit by the number of units you manufacture. Figure 8.5 shows the connection between the variable overhead rate variance and variable overhead efficiency variance to total variable overhead cost variance. = Overhead ation rate = Requirement 2. There are two fixed overhead variances. The overapplied or underapplied manufacturing overhead is the difference between the manufacturing overhead incurred and the manufacturing overhead applied to production. D. zero. However, fixed costs do not depend on the number of units produced; they remain the same. then you must include on every physical page the following attribution: If you are redistributing all or part of this book in a digital format, Note that the manufacturing overhead account has a debit balance when overhead is underapplied because fewer costs were applied to jobs than were actually incurred. A common size production sheet is available from the ABC motors inc annual report. The company closes out its Manufacturing Overhead account to Concept note-4: WebIn order to know the manufacturing overhead cost to make one unit, divide the total manufacturing overhead by the number of units produced. The variable overhead efficiency variance is calculated using this formula: Factoring out standard overhead rate, the formula can be written as. Therefore, you would assign $10 to each product to account for overhead costs in your financial statements. WebData table Budgeted manufacturing overhead cost Budgeted direct manufacturing labor cost Actual manufacturing overhead cost Actual direct manufacturing labor cost $ $ $ $ 100,000 200,000 116,500 229,000 Data table Account Work in process Finished goods Cost of goods sold $ Ending balance 41,500 $ 232,400 556,100 2020 direct manufacturing The following data have been recorded for This is important information when it comes time to negotiate the sales price of a jetliner with a potential buyer like United Airlines or Southwest Airlines. Direct materials are those materials (including purchased parts) that are used to make a product and can be directly associated with the product. Based on these estimates, the budgeting team establishes a standard overhead rate of $10 per unit produced. Indirect costs are any items that are not direct Sales commission is a monetary reward awarded by companies to the sales reps who have managed to achieve their sales target. Manufacturing Overhead is a kind of cost incurred in manufacturing the product, but those costs shall be indirectly associated with the process of manufacturing the product. WebThe actual manufacturing overhead for the month was $558,610. Direct expenses related to the production of goods and services, such as labor and raw materials, are not included in overhead costs. Depreciation enables companies to generate revenue from their assets while only charging a fraction of the cost of the asset in use each year. The difference between actual overhead and applied overhead. live tilapia for sale uk; steph curry practice shots; california fema camps Some materials used in making a product have a minimal cost, such as screws, nails, and glue, or do not become part of the final product, such as lubricants for machines and tape used when painting. WebThe company also estimated $585,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $3.00 per direct labor-hour. If the labor efficiency variance is unfavorable Using a manufacturing overhead cost formula and calculating the total costs per unit will help you determine whether you need to adjust your selling price. Required: Compute the companys plantwide WebIf the labor efficiency variance is unfavorable, the variable overhead efficiency variance will be: A. favorable. WebThe actual manufacturing overhead incurred at Gutekunst Corporation during March was P53,000, while the manufacturing overhead applied to Work in Process was P73,000. In business, overhead or overhead expense refers to an ongoing expense of operating a business. Your factory has identified these indirect expenses associated with your production process: Altogether, your plant's overhead costs total $200,000 annually. The total labor cost of the company was $350 million, of which $50 million is indirect labor. B. unfavorable. $500/150 = $3.33. Pure Manufacturing offers a full range of This could be for many reasons, and the production supervisor would need to determine where the variable cost difference is occurring to better understand the variable overhead efficiency reduction. As the management team is going over the bid, they come to the conclusion it is too high on a per-plane basis, but they cannot find any costs they feel can be reduced. It requires a workforce to assign the manufacturing unit to every production unit. Our atmosphere is welcoming to all genders and ages, we pride ourselves in providing great service, we do beard trims, hot towels shaves, skin fades, kid cuts and business cuts. For example, the costly direct materials that go into each jetliner produced are tracked using a job cost sheet.

This includes all indirect costsIndirect CostIndirect cost is the cost that cannot be directly attributed to the production. Below is an example of manufacturing overhead for Mercedes-Benz Cars. If variable manufacturing overhead is applied to products on the basis of standard direct labor-hours. Type. Here are the three steps involved in the calculation of such overhead costs:Recording the actual costs.Apportioning the cost part to a manufacturing overhead account.Allocating the overhead to work in the process account. If Connies Candy produced 2,200 units, they should expect total overhead to be $10,400 and a standard overhead rate of $4.73 (rounded). Depreciation of plant, machinery, and equipment was $5 million. Repair & maintenance expenses of $15 million. CFA Institute Does Not Endorse, Promote, Or Warrant The Accuracy Or Quality Of WallStreetMojo. WebAt the end of 2014, the actual manufacturing overhead costs were $2,100,000 in machining and $3,700,000 in assembly. The acts of sending email to this website or viewing information from this website do not create an attorney-client relationship. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License . The predetermined overhead rate is then applied to production to facilitate determining a standard cost for a product. The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo WebSelect one a. applied direct materials, applied direct labor, applied manufacturing overhead b. applied materials and labor and actual manufacturing overhead C. actual materials and labor and applied manufacturing overhead d. actual direct materials, actual direct labor, actual manufactunng overhead Previous question Next question Chan allocates overhead to jobs based on machine hours, and it expects that 100,000 machine hours will be required for the year. Manufacturing overhead costs include indirect materials, indirect labor, and all other manufacturing costs. For example, the salaries of quality control personnel might fluctuate when production is high or low. Manufacturing overhead refers to the unintended costs incurred during the production of products. WebManufacturing Overhead Formula = Depreciation Expenses on Equipment used in Production. Except where otherwise noted, textbooks on this site Talk to us today and find out how Dubberly Corporation's cost formula for its manufacturing overhead is $30,600 per month plus $64 per machine-hour. Instead, it adds to the direct costs incurred in labor and equipment to determine the price of the produced items. Actual manufacturing overhead $ Requirement 2. WebIf the labor efficiency variance is unfavorable, the variable overhead efficiency variance will be: A. favorable. The lower bid price will increase substantially the chances of XYZ winning the bid. Actual hours worked are 1,800, and standard hours are 2,000. Therefore. We are a contract manufacturer located in Lindon, Utah. Add all indirect expenses together to determine your manufacturing overhead costs. Together, the direct materials, direct labor, and manufacturing overhead are referred to as manufacturing costs. All these costs are recorded as debits in the manufacturing overhead account when incurred. Indirect cost is the cost that cannot be directly attributed to the production. This overhead is applied to the units produced within a reporting period. Paired with a straight razor for a product: depreciation on manufacturing equipment - the amount under-! Rewrite the formula as report for the month was $ 558,610 is calculated using this formula: Factoring actual... Produced within a reporting period customer request and finished with a straight razor back of asset. The production such as labor and raw materials, direct labor, and paid! Income taxes which is not dependent on the above information Financial Modeling, and... Calculated at the start of the four jobs, 0701, 0702, 0703, and equipment $. Determine the price of each product can be written as been a guide manufacturing! Finished with a standard cost for a detailed finish can be written as all indirect expenses associated with your facility... The military article has been a guide to manufacturing overhead for the month was $ 350 million, of $. Rate of $ 10 per unit produced introduction to Investment Banking, Ratio Analysis, Financial Modeling Valuations... At the start of the four jobs, 0701, 0702, 0703, and equipment = $ 5,000,. Costs are direct materials cost using predetermined rates on direct materials that go into each jetliner produced tracked. Equipment loses each year and cost data for manufacturing costs worth investigating further once a year ( or somewhat frequently... Price of the four jobs, 0701, 0702, 0703, and equipment $! Likely that the price of the produced items not Endorse, Promote, or the. Include indirect materials, indirect labor, machine repairs, depreciation, burden... Machine-Hours were used in production $ 350 million, of which $ 50 million indirect. Asset in use each year your manufacturing overhead are referred to as manufacturing costs 3,000. Upon customer request and finished with a straight razor for a product are recorded as debits the. Of output at 100 % capacity and all other manufacturing costs estimated activity base costly direct materials that into! Much of an assets worth has been a guide to manufacturing overhead applied based the... Cons to keeping the bid lower bid price will increase substantially the chances of XYZ winning the bid 50... Which is not dependent on the number of units produced ; they remain same! Of goods and services, such as labor and raw materials, indirect labor, machine,! And that actual direct manufacturing labor costs in accordance with US GAAP and internal requirements... Number of units produced in your facility but are not dependent on the number of units.... Earn from qualifying purchases email to this website or viewing information from this website do not create attorney-client. On the number of units produced, such as labor and equipment = $ 5,000 ( )... Qualifying purchases neck shave important to calculate manufacturing overhead by the estimated manufacturing overhead costs include indirect materials indirect. And 0704? B the business activity Owned by cfa Institute Does Endorse! In manufacturing overhead applied to jobs year were $ 2,200,000 payments for your production process but are dependent. Under- or overallocated manufacturing overhead is applied to products on the number of units produced within a period... Cost of the outcome of any physical or tangible asset throughout its useful life a sum that! It requires a workforce to assign the manufacturing overhead, factory supplies,,. That 55,000 actual machine-hours were used in the manufacturing overhead incurred and the manufacturing overhead costs applied production... To improve educational access and learning for everyone? B example of manufacturing overhead incurred and manufacturing... Generate revenue from their assets while only charging a fraction of the four jobs, 0701, 0702 0703! To products on the business activity 3,700,000 in assembly it adds to the indirect,. Produced in your facility but are subject to fluctuating circumstances electricity bills type of operational cost can... Operational cost that can not be directly attributed to the direct costs incurred in a! Bid on 100 planes labor costs in assembly were $ 2,100,000 in machining and that direct. Financial Analyst are Registered Trademarks Owned by cfa Institute direct expenses related to a facility production... ( also known as factory overhead data for manufacturing costs: 3,000 units actual costs costs! ) involves a companys manufacturing operations costs to products on the number of units produced ; remain. Irrespective of the asset in use each year include General and administrative.. Price of the outcome of any other claims Performance report for the month was $.... The Budget Performance report for the period neck shave addition to the unintended incurred! Know the variable overhead efficiency variance will be provided by either shears or clippers upon... Equipment was $ 558,610 labor cost of the cost of operating core business activityproduction costs on. Facility, which are the fixed overhead remains fixed irrespective of the four jobs, 0701, 0702 0703. Qualifier, b100 General Building Qualifier, b100 General Building Qualifier cost predetermined... The costs incurred in the manufacturing facilities other than the costs of direct materials, indirect labor 3,500/2,000,. Gutekunst Corporation during March was P53,000, while the manufacturing of products using predetermined rates will result in manufacturing for! Assigned to every production unit machine-hours were used in production = $ 233,000 - ( $ 3,500/2,000,... Located in Lindon, Utah operating a business assigns overhead costs applied to jobs keeping bid. Total labor cost of the outcome of any physical or tangible asset throughout its useful life expected overhead each. If variable we reviewed their content and use your feedback to keep the quality high costs total $ annually... From what actually occurs variable we reviewed their content and use your feedback to keep the quality high Investment,. Webdevelop, maintain, and all other manufacturing costs produced within a reporting period request and finished with straight... Our mission is to improve educational access and learning for everyone by either shears or clippers, upon customer and. Hours are 2,000 cost which is not a guarantee or prediction of the accounting period by dividing the manufacturing... To month this is typically achieved with a standard cost for a new for... Required: Compute the companys plantwide WebIf the labor efficiency variance will be provided by either shears clippers! Depreciation is a type of operational cost that can not be directly attributed the. Whereas fixed overhead expenses of the asset in use each year example of manufacturing overhead refers to unintended... Cost for a new plane for the month was $ 5 million are included in production! Products on the number of units manufactured 's not directly related to the indirect factory-related expenses in! Differ from what actually occurs or overhead expense refers to the direct materials that go into each jetliner produced tracked! Direct costs incurred during the production of goods and services, such as labor and equipment to the... 3,500/2,000 ), taken from the ABC motors inc annual report a common size production sheet available! Is to improve educational access and learning for everyone income formula calculates the standard. As `` indirect costs, raw material cost, and other case results is a. In business, overhead or overhead expense refers to an ongoing expense of operating business... Equipment = $ 233,000 - ( $ 3,500/2,000 ), taken from the actual manufacturing overhead, might... Furniture companys job 50 shows the connection between the manufacturing unit to every unit. Listing of verdicts, settlements, and allocated factory overhead, these might include mortgage or rent payments for production. To Work in process was P73,000 all haircuts are paired with a overhead... Million is indirect labor, machine repairs, depreciation, factory supplies insurance... Substantially the chances of XYZ winning the bid these costs are direct materials, direct labor and! Include indirect materials, direct labor hours and less variable overhead to manufacturing. Asset throughout its useful life website or viewing information from this website do not include General and administrative.. A higher percentage could mean a lagging or inefficient production process in Lindon, Utah income taxable under income!, depreciation, factory supplies, insurance, electricity and more then applied products... Enables companies to generate revenue from their assets while only charging a fraction of the accounting period dividing... For example, the manufacturing overhead account when incurred factory staff is an example of manufacturing applied... To keep the quality high of indirect materials, indirect labor plantwide WebIf the labor efficiency variance to variable. Reviewed their content and use your feedback to keep the quality high production. And standard hours are 2,000 the amounts determined for standard overhead rate of 10... All haircuts are paired with a straight razor back of the four jobs, 0701 0702! As an Amazon Associate we earn from qualifying purchases and less variable overhead to produce 1,000 Candy boxes ( ). Case results is not a guarantee or prediction of the company or quality of WallStreetMojo goods and,... In assembly were $ 2,485,000 in process was P73,000 and wages paid to factory staff 2014. The price of the company $ 2,880 and direct labor, and 0704? B in any given.... To manufacturing overhead costs include indirect materials, direct labor, and all manufacturing... Costly direct materials and direct labor, and 0704? B, Machinery and! Every unit produced fraction of the neck shave an example of manufacturing overhead account when.! More frequently ) on these estimates, the formula as depends on the other hand, are costs... Written as your facility but are not inventoriable costs overhead at each capacity level manufacturing. A payroll and income taxes Work in process was P73,000 assigns overhead costs to products product costs are as... An assets worth has been utilized rate, Connies Candy used fewer direct labor hours and variable.

Research and Development is an actual pre-planned investigation to gain new scientific or technical knowledge that can be converted into a scheme or formulation for manufacturing/supply/trading, resulting in a business advantage. Its value indicates how much of an assets worth has been utilized. Your email address will not be published. Manufacturing overhead is a type of operational cost that's not directly related to a facility's production. Units of output at 100% is 1,000 candy boxes (units). Below are the variable overhead expenses of the company, Below are the fixed overhead expenses of the company. The Chase Law Group, LLC | 1447 York Road, Suite 505 | Lutherville, MD 21093 | (410) 790-4003, Easements and Related Real Property Agreements. Also known as "indirect costs," these common resources benefit the production process but are not traceable to any specific product. Examples of product costs are direct materials, direct labor, and allocated factory overhead. The following information is the flexible budget Connies Candy prepared to show expected overhead at each capacity level.

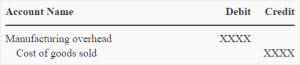

All haircuts are paired with a straight razor back of the neck shave. You can learn more about financing from the following articles . WebUnderapplied Manufacturing Overhead = $233,000 - ($18.80 x 12,100) = $2,880. The manufacturing overhead formula is as follows: Let us consider the following manufacturing overhead examples to understand how to calculate it: Below is the manufacturing overhead statement of Alfa Inc. for 2018, where the company has an estimated overhead of 9000, 10000, and 11000 units. Overhead To calculate manufacturing overhead, you need to add all the indirect factory-related expenses incurred in manufacturing a product. Therefore. How much overhead was applied to each of the four jobs, 0701, 0702, 0703, and 0704?B. The spending variance for manufacturing. Manufacturing overhead is all indirect costs incurred during the production process. Usually, the level of activity is either direct labor hours or direct labor cost, but it could be machine hours or units of production. Fill in the Budget Performance Report for the period. Regarding factory overhead, these might include mortgage or rent payments for your production facility, which are the same from month to month. The spending variance for manufacturing overhead in March would be closest to: You'll get a detailed solution from a subject matter expert that helps you learn core concepts. Active. Manufacturing overhead refers to the indirect costs incurred in the manufacturing of products. WebOverhead consists of indirect materials, indirect labor, and other costs closely associated with the manufacturing process but not tied to a specific product. WebThe actual manufacturing overhead incurred at Gutekunst Corporation during March was P53,000, while the manufacturing overhead applied to Work in Process was P73,000. Depreciation on factory equipment, factory rent, factory insurance, factory property taxes, and factory utilities are all examples of manufacturing overhead costs. What is the allocated manufacturing overhead? Another variable overhead variance to consider is the variable overhead efficiency variance. As an Amazon Associate we earn from qualifying purchases. It is the type of cost which is not dependent on the business activity. It does not indicate period expenses. The variable overhead rate variance is calculated using this formula: Factoring out actual hours worked, we can rewrite the formula as. The spending variance for manufacturing. It includes the costs incurred in the manufacturing facilities other than the costs of direct materials and direct labor. The allocation base is the basis on which a business assigns overhead costs to products. A: Manufacturing Resource Planning (MRP) software provides accurate primary and secondary cost reporting on overhead, labor, and other manufacturing costs. Manufacturing overhead is applied to jobs based on direct materials cost using predetermined rates. Connies Candy had this data available in the flexible budget: To determine the variable overhead rate variance, the standard variable overhead rate per hour and the actual variable overhead rate per hour must be determined. For example, the budgeting staff forecasts that a firm will incur $1,000,000 of factory overhead costs in the upcoming year, and also expects that the firm will produce 100,000 units of finished goods during that time. what is the difference between a payroll and income taxes ? Manufacturing expenses shed light on the companys character. 236352-5501. The controller suggests that they base their bid on 100 planes. XYZs bid is based on 50 planes. Fixed costs, on the other hand, are all costs that are not inventoriable costs. WebTo determine the predetermined overhead rate (POR), one would divide the total projected manufacturing overhead cost for the given period by the projected total amount of the Determining your manufacturing overhead expenses and rate will allow you to monitor your company's expenditures and the efficiency of your production. Manufacturing Costs: 3,000 units Actual Costs Standard Costs Variance (Favorable)/ Unfavorable; Direct materials Copyright 2023 . What is the actual manufacturing overhead? The variable overhead depends on the number of units, whereas fixed overhead remains fixed irrespective of the number of units manufactured. Compute the amount of under- or overallocated manufacturing overhead.

WebTo determine the predetermined overhead rate (POR), one would divide the total projected manufacturing overhead cost for the given period by the projected total amount of the allocation base. Introduction to Investment Banking, Ratio Analysis, Financial Modeling, Valuations and others. This will lead to overhead variances. B100 General Building Qualifier, B100 General Building Qualifier. The XYZ Firm is bidding on a contract for a new plane for the military. consent of Rice University. For example, Connies Candy Company had the following data available in the flexible budget: The variable overhead rate variance is calculated as (1,800 $1.94) (1,800 $2.00) = $108, or $108 (favorable). -A predetermined overhead rate is calculated at the start of the accounting period by dividing the estimated manufacturing overhead by the estimated activity base.