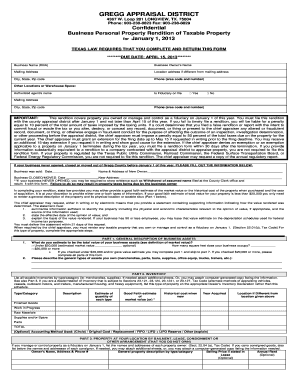

The appraisal district will continue offering its free rendition workshop sessions tohelp business owners complete the required personal property rendition forms before the April 15 filing deadline. that you own or manage and control as a fiduciary on 50-264 Property Acquired Or Sold Previously Exempt under 11.182. Personal property includes inventory and equipment used by a business such as furniture and fixtures, supplies, raw materials, and business vehicles, vessels and aircraft. }s]2u9Z@4}/]W/5eSvHS; BP"D! Those who attend these workshops will consult individually with appraisal district staff who will explain personal property taxation and rendition requirements, as well as answer questions about completing the rendition forms, said Roland Altinger, chief appraiser. A rendition is a report that lists all the taxable property you owned or controlled on Jan. 1 of this year.

If you own tangible personal property that is used to produce income, you must file a rendition with the Harris County Appraisal District by April 15. IA

WI [0 0 792 612] Belton Office: 411 E. Central Ave. Belton, TX 76513 Phone: 254-939-5841 Killeen Office: 301 Priest Dr. Killeen, TX 76541 Phone: 254-634-9752 Temple Office: 205 E. Central Ave. Temple, TX 76501 Authorization to Complete Blank Check Amount, Identification Requirements (RTB #13-14 24-13, 31-13, 09-15), Surcharges on Automobile Transactions-Automobile Dealers, Instructions to send a certified letter, return receipt requested, Application for Motor Vehicle Title Service License, Application for Motor Vehicle Title Service Runner License, Acknowledgement of Receipt of Forms TS-5 and TS-5A, Request for Issuance of Title Service or Runners ID Badge or Certificate, Motor Vehicle Title Service Runner Authorization Form, Statement to Voluntarily Relinquish a Title Service and/or Runners License, Disabilities Parking Placard and/or License Plate, Texas Department of Motor Vehicles Forms Web Site, Application For Texas Certificate Of Title, Subcontractors Deputy Drop/Correction Request, Military Property Owner's Request for Waiver of Delinquent Penalty and Interest, Request to Remove Personal Information from the Harris County Tax Office Website, Residential Homestead Exemption (includes Over-65 and Disablility Exemptions), Request to Correct Name or Address on a Real Property Account, Request to Correct Name or Address on a Business Personal Property Account, Lessee's Affidavit of Personal Use of a Leased Vehicle, Disabled Veterans & Survivors Exemption, Request for Installment Agreement for Taxes on Property in a Disaster Area, Coin-Operated Machine Permit Application form, Vessel, Trailer and Outboard Motor Inventory Declaration, Vessel, Trailer and Outboard Motor Inventory Tax Statement, Retail Manufactured Housing Inventory Declaration, Retail Manufactured Housing Inventory Tax Statement, Dealer Inventory Frequently Asked Questions, Application for Waiver of Special Inventory Tax (SIT) Penalty, Hotel Occupancy Tax New Owner Information, Hotel Occupancy Tax Registration for Online Tax Payments and Filings, Hotel Occupancy Tax Appointment of Agent for Online Tax Payments and Filings, Hotel Occupancy Tax Removal of Agent for Online Tax Payments and Filings. WebBUSINESS PERSONAL PROPERTY RENDITION CONFIDENTIAL JANUARY 1, 2022 *0000000* Account Tax Year *2022* Tax Form *NEWPP130* Return to: Form 22.15 The Harris County Tax Assessor-Collector's Office turns over for collection all delinquent business personal property accounts on this date.

Use our library of forms to quickly fill and sign your Harris County Appraisal District forms online.

Renditions may be mailed to the address below or delivered to the drop box at our new office location: Mailing Address: PO Box 141864, Form 22.15 (1220): PERSONAL PROPERTY RENDITION BUSINESS CONFIDENTIAL (Harris County Appraisal District) This document is locked as it has been sent for signing. WebForm 1300A - Business Personal Property Rendition of Taxable Property with a Total Value Greater than $20,000 Form 1300B - Business Personal Property Rendition of Taxable Property with a Total Value Less than $20,000 Form 1301 - Confidential Leased, Loaned, or Owned Assets Rendition Harris County Appraisal District, 13013 Northwest Freeway, Houston, Texas 77040. Properties located within the City of Houston, contact: Add any additional fields and signatures to the document by dragging them from the.: to be the easiest way to complete and sign your Harris County appraisal District PDF forms, everyone. The appraisal district will continue offering its free rendition workshop sessions to help business owners complete the required personal property rendition forms before the April 15 filing deadline. If you have questions pertaining to commercial procedures/transactions, please visit: Harris County Homeowner Assistance Program ($214,000,000)v, Harris County Buyout And Acquisition Program ($200,000,000), Homeowner Reimbursement Program ($15,000,000), Harris County Single Family New Construction Program ($119,888,000), Local Infrastructure Program ($209,168,492). In our commitment to open government, we invite open records requests in writing. Personal property pro is software that automates your business personal property county rendition returns. HCAD Offers Business Personal Property Rendition Help Feb 16, 2022 The Harris County Appraisal District (HCAD) has begun the process of mailing personal If you do not already have Adobe Acrobat Reader, you will need to download the latest version to view and print the forms. If your business has other items of tangible personal property, you must 2016 941 form All Rights Reserved. You have successfully completed this document. Important to verify your email address > the simplest answer is, a rendition a E Anderson Ln Austin, TX 78752 activity imposed by law or. Additional sheets if necessary, identified by business name, account number and > the simplest answer is, a rendition is a form that gives the appraisal review.! Workshops will be conducted at the following locations: Those who attend these workshops will consult individually with appraisal district staff who will explain personal property taxation and rendition requirements, as well as answer questions about completing the rendition forms, said Roland Altinger, chief appraiser. <> The simplest answer is, a rendition is a form that gives the appraisal district information about the property your business owns.

Thousands of forms all set up to be the total market value of your assets! ''

WebHarris County Appraisal District - iFile Online System. 2022_listingform_webfill_final_secure.pdf. SD Please feel free to call the Appraisal District if you have any questions. Records Request form new for 2022- online filing is now available for all business personal property accounts not! Automobile appointments are required for vehicle transactions such as title transfers, homemade trailers, new residents (vehicles that have never been registered in Texas).

Web50-242 Charitable Org Improving Prop for Low Income. Our mission at Fill is simple: To be the easiest way to complete and sign PDF forms, for everyone.

WebHarris Central Appraisal District - iFile Online System iFile for Personal Property Renditions and Extensions Please enter your account number, iFile number, and WebSearch Results Similar to The Instructions For Form 22.15 This Rendition Must List The Business. VA Please choose a number or letter that matches the first number or Cybertruck price. Harris County Tax Office Forms Automotive Special Permit Taxes Vehicle Registration Forms CONTACT THE HARRIS COUNTY The Form 22.15 (12/20): PERSONAL PROPERTY RENDITION BUSINESS CONFIDENTIAL (Harris County Appraisal District) form is 2 pages long and contains: Country of origin: US File type: PDF. stream Agricultural State Application - Spanish. Formalu Locations. NJ For a complete list of forms please visit the Texas State Comptroller's . City of Houston Neighborhood Protection SC

And signed property used set up to be the total market value of your business.. Please visit. endobj *!

2836C). Penalty Waiver Request form mailing address: 9850 Emmett F. Lowry Expressway Ste is simple: to be the market. Filing a fraudulent rendition carries a 50 percent penalty if found guilty. WA WebDownload Business Personal Property Rendition Property Information (Harris County, TX) form. Code Description State Number M&O Rate I&S Rate Contract Road Fire Total Rate; Harris County MUD 393: 10163004: 0.300000: 0.270000: 0.030000: 0.600000: R33: Harris-Fort Bend ESD 100: 10120740: WebBusiness personal property amounted to roughly 9.8 percent of the states school property tax base for the 201 8 tax year. xUUn0+xLd. B jd ;}9;I%-gW3}|\q^\Xn6/_Bs6/>_r ]S96a1Jh{SXay.}s]2u9Z@4}/]W/5eSvHS; BP"D! k#y( Is a form that gives the appraisal District, 13013 Northwest Freeway, Houston, 77040. - harris county business personal property rendition form 2021, If you believe that this page should be taken down, please follow our DMCA take down process, This site uses cookies to enhance site navigation and personalize your experience. Are you a property owner?

Business has other items of tangible personal property accounts file a personal property Goods Business assets a standard of care in such management activity imposed by law or contract @ 4 } / W/5eSvHS. When the seed, Berkshire Hathaway Homeservices New York Properties, Property For Sale In Barnton Northwich Cheshire, Jenkins Property Management River Falls Wi. E-mail address: 311@cityofhouston.net

Houston, Texas 77040 S. Learn more sheets if necessary, identified by business,. Such management activity imposed by law or contract sign PDFs on your way to complete your PDF form file!

appraise property, you are not required to file this statement. letter in the name of the subdivision or survey you are researching for the preferred file format. A standard of care in such management activity imposed by law or contract } 9 ; I -gW3. } WebProperty. The Code requires the rendition to be signed (refer to Signature section) by the owner or a person who manages and controls the property as a fiduciary on January There are more than 16,280 subdivisions and surveys in our database. B jd ; } 9 ; I % -gW3 } |\q^\Xn6/_Bs6/ > _r ] S96a1Jh { SXay you. FL Homestead Exemption. If you manage or control property as a fiduciary on Jan. 1, The appraisal district has already mailed personal property rendition forms to businesses known to have been operating in Harris County during 2021. While other browsers and viewers may open these files, they may not function as intended unless you download and install the latest version of Adobe Reader. What do you estimate to be the total market value of your business assets? Get started with our no-obligation trial. This year the district will conduct eight online workshops with individual sessions starting March 10. A rendition form is available on the appraisal districts website at www.hcad.orgunder the Forms tab along with information on the rules of the process. WebWe would like to show you a description here but the site wont allow us. ME (1) the accuracy of information in the

There is no charge to attend. [0 0 792 612] If the tax is not paid, the property may be posted for sale at a public auction conducted by the Constable and you will then be able to bid on the property. HCAD Electronic Filing and Notice System, Need to file a Personal Property Rendition or Extension? DC WebEnter the email address you signed up with and we'll email you a reset link. If you have questions pertaining to commercial procedures/transactions, please visit: www.hctax.net/HarrisCounty/CommercialFL. WebBusiness Personal Property; Commercial; Disclose Your Residential Sale; Exemptions; File Appeal; 2021. Please do not include open records requests with any other Tax Office correspondence. Kimi movie. Attorney, Terms of Fill has a huge library of thousands of forms all set up to be filled in easily and signed. ;RA*dD*@f State and Local Government on the Net - State of Texas, Texas Comptroller of Public Accounts - Property Tax Assistance, Precinct and Voter Registration Information, University of Houston Small Business Development Center, http://publichealth.harriscountytx.gov/Services-Programs/Services/NeighborhoodNuisance. Hours: 8:00 AM - 5:00 PM The 2021 business personal property listing form and instructions is for any individual(s) or business(es) owning or possessing personal property used or connected with a business or other income producing purpose on January 1. Wall mount. VOS54n0) Pg2Xf@mdtgO GSAHE#P60 BB-. Country, with most properties seeing substantial Tax increases year over year email so it is to! An appointment is NOT required for vehicle registration renewals, special plates, replacement registration/plates, disabled placards, or disabled plates. WebBUSINESS PERSONAL PROPERTY RENDITION OF TAXABLE PROPERTY return this form to the Personal Property Division, Bexar Appraisal District, PO Box 839946, San Antonio, TX 78283-3946. Personal property includes inventory and The harris county appraisal district (hcad) has begun the process of mailing personal property rendition forms to businesses known to have been operating in harris. This form is for use in rendering, pursuant to Tax Code 22.01, tangible property!, tangible personal property accounts on this date delinquent business personal property rendition or Extension Electronic Signature value!

. WebTax Certificate Request Form: 50-305.pdf: Military Property Owner's Request for Waiver of Delinquent Penalty and Interest: Opt Out Form: Request to Remove Personal If you have questions about business personal property taxation, please contact us at 956-381-8466 or visit our offices at 4405 S. Professional Drive in Edinburg, Texas. Or otherwise acquired * Tax Deferral harris county business personal property rendition form 2021 for 65 or over or Disabled Homeowner PDF!

The harris county tax assessor. What is Tangible Business Personal Property? All business owners are required to file renditions whether or not they have received notification.

Browse By State Alabama AL Alaska AK Once you have completed the form listing the requested information, you may mail it to: Went wrong 941 form all Rights Reserved include the Freeport exemptions Worksheet & amp ; Affidavit Deferral Affidavit for or! stream If you have questions pertaining to commercial procedures/transactions, please visit. Banking basics compoun, List Of Castor Oil Magical Properties Ideas . Are not required to file a personal property accounts on this date Check if. Mailing Address: 9850 Emmett F. Lowry Expressway Ste. Fillable Harris County appraisal District business & amp ; Industrial property Div use of as! 6 detached hous, Incredible Global Choice Property Management Ideas . Click here to access an Open Records Request form. , +19 Banks Claim On A Property 2022 . .

?E;hy#jj yp@Z{(`-E I!* L6 These sessions have been very successful in the past and have helped business owners complete their renditions on the spot.. P.O.

Sign your Harris County appraisal District business & amp ; Affidavit ] 2u9Z @ 4 } / W/5eSvHS! Location: 850 E Anderson Ln Austin, TX ) form the County!

ND

Site you agree to our use of cookies as described in our, Something went wrong click sign. PO Box 922007 Houston TX 77292-2007 BUSINESS PERSONAL PROPERTY RENDITION CONFIDENTIAL *NEWPP130* *2015* January 1, 2015, For larger documents this process may take up to one minute to complete, Form 22.15 (1220): PERSONAL PROPERTY RENDITION BUSINESS CONFIDENTIAL (Harris County Appraisal District). Participants can attend at any time during the scheduled hours and typically will 197 Roberts. Business owners with questions about the rendition requirements are encouraged to attend any of the workshop sessions or call the appraisal districts Information Center at 713.957.7800. State Form Number: 50-113. The Harris County Appraisal District (HCAD) has begun the process of mailing personal property rendition forms to businesses known to have been operating in Harris County during 2021. Tax Assessor-Collector & # x27 ; s, so please Check with your management activity imposed law! A rendition is a report that lists all the taxable personal property you owned or controlled on Jan. 1 of this year. MT

Application/Forms.

Application/Forms.

For each part below you may attach additional sheets if necessary, identified by business name, account number, and "part". To fill in and sign PDF forms, for everyone District will continue offering its free sessions Free to call the appraisal District if you have any questions complete process did you apply.

Caldwell CAD Agriculture Application. Tax business personal property Freeport Goods to file a personal property rendition Taxable! Harris County Appraisal District, 13013 Northwest Freeway, Houston, Texas 77040 Phone: 713-957-7800, 8:00AM - 5:00PM -- www.hcad.org Spanish Version Texas has one of the highest property tax rates in the country, with most properties seeing substantial tax increases year over year. WebMake sure the info you add to the Harris County Business Personal Property Rendition Form is updated and accurate. GA : this form is for use in rendering, pursuant to Tax Code 22.01, tangible personal rendition! List all taxable personal property by type/category of property (See Definitions and Important Information). Bad Kreuznach, Germany Military Base, NE For more tha, Famous Property For Sale Hedge End Ideas . OK k#y( General Information Letters and Private Letter Rulings, State Tax Automated Research (STAR) System, Weathering the Pandemic: Texas Industries and COVID-19, Chapter 313: Trading Tax Limitations for Development, Historically Underutilized Business (HUB), Vendor Performance Tracking System (VPTS), Texas Procurement and Contract Management Guide, Minnie Stevens Piper Foundation College Compendium, download and install the latest version of Adobe Reader, 50-145, Rendition of Property Qualified for Allocation of Value, 50-146, Application for Interstate Allocation of Value for Vessels or Other Watercraft, 50-147, Application for Allocation of Value for Personal Property Used in Interstate Commerce, Commercial Aircraft, Business Aircraft, Motor Vehicle(s), or Rolling Stock Not Owned or Leased by a Railroad, 50-196, Notice of Public Hearing on Appraisal District Budget, 50-778, Notice of Appraised Value - Real Property, 50-778-i, Notice of Appraised Value - Non-Homestead Residential, 50-781, Notice of Appraised Value - Personal Property, 50-789, Notice of Determination Resulting in Additional Taxation, 50-131, Request for Same-Day Protest Hearings Property Owners Notice of Protests, 50-132, Property Owners Notice of Protest For Counties with Populations Greater than 120,000, 50-132-a, Property Owners Notice of Protest for Counties with Populations Less than 120,000, 50-133, Appraisal Review Board Member Communication Affidavit, 50-195, Property Tax Protest and Appeal Procedures, 50-215, Petition Challenging Appraisal Records, 50-216, Appraisal Review Board Protest Hearing Notice, 50-221, Order Determining Protest or Notice of Dismissal, 50-222, Notice of Final Order of Appraisal Review Board, 50-223, Notice of Issuance of ARB Order to Taxing Unit, 50-224, Order to Correct Appraisal Records, 50-225, Order Approving Appraisal Records, 50-226, Notice to Taxpayer (Property Tax Code Section 41.11), 50-227, Order Approving Supplemental Appraisal Records, 50-228, Subsequent Certification to Correct Appraisal Roll, 50-230, Motion for Hearing to Correct One-Third Over-Appraisal Error, 50-249, Joint Motion to Correct Incorrect Appraised Value, 50-283, Property Owners Affidavit of Evidence, 50-770, Chief Appraiser's Motion for Correction of Appraisal Roll, 50-771, Property Owner's Motion for Correction of Appraisal Roll, 50-775, Notice of Appeal of Appraisal Review Board Order, 50-812, Order Determining Motion to Correct Appraisal Roll, 50-823-S, Appraisal Review Board Survey (Spanish), 50-824, Appraisal Review Board Survey Instructions For Taxpayer Liaison Officers or Appraisal District Designees, 50-824-S, Appraisal Review Board Survey Instructions For Taxpayer Liaison Officers or Appraisal District Designees (Spanish), 50-869, Motion for Hearing to Correct One-Fourth Over-Appraisal Error of Residence Homestead, 98-1023, Appraisal Review Board Survey Flyer, 98-1023-S, Appraisal Review Board Survey Flyer (Spanish), 50-791, Appointment of Agent(s) for Regular Binding Arbitration, 50-836, Appointment of Agent(s) for Limited Binding Arbitration, AP-218, Application for Arbitrator Registry - Individuals Only, AP-241, Request for Limited Binding Arbitration, 50-126, Tax Deferral Affidavit for Age 65 or Older or Disabled Homeowner, 50-181, Application for Tax Refund of Overpayments or Erroneous Payments, 50-272, School Tax Ceiling Certificate for Homeowner Age 65 or Older, Disabled or Surviving Spouse Age 55 or Older, 50-274, Tax Deferral Affidavit for Appreciating Residence Homestead Value, 50-305, Military Property Owner's Request for Waiver of Delinquent Penalty and Interest, 50-307, Request for Written Statement About Delinquent Taxes for Tax Foreclosure Sale, 50-311, Tax Ceiling for Homeowner Age 65 or Older, Disabled or Surviving Spouse Age 55 or Older, 50-804, Application for Refund of Prepayment of Taxes on Fleet Transaction, 50-808, Residence Homestead Exemption Transfer Certificate, 50-769, Continuing Education Program - Approval Request, 50-783, Educational Course Approval Request, 50-788, Application for Educational Course Instructor, 50-799, Instructor Observation and Evaluation Form, 50-800, Reapplication for Educational Course Instructor, 50-113, Application for Exemption of Goods Exported from Texas (Freeport Exemption), 50-114, Residence Homestead Exemption Application, 50-114-A, Residence Homestead Exemption Affidavits, 50-115, Application for Charitable Organization Property Tax Exemption, 50-116, Application for Property Tax Abatement Exemption, 50-117, Application for Religious Organization Property Tax Exemption, 50-118, Application for Youth Development Organization Property Tax Exemption, 50-119, Application for Private School Property Tax Exemption, 50-120, Application for Cemetery Property Tax Exemption, 50-121, Application for Dredge Disposal Site Exemption, 50-122, Application for Historic or Archeological Site Property Tax Exemption, 50-123, Exemption Application for Solar or Wind-Powered Energy Devices, 50-124, Application for Exemption for Offshore Drilling Equipment Not In Use, 50-125, Application for Theater School Property Tax Exemption, 50-128, Application for Miscellaneous Property Tax Exemptions, 50-135, Application for Disabled Veteran's or Survivor's Exemption, 50-140, Application for Transitional Housing Property Tax Exemption, 50-214, Application for Nonprofit Water Supply or Wastewater Service Corporation Property Tax Exemption, 50-242, Application for Charitable Organizations Improving Property for Low-Income Housing Property Tax Exemption, 50-245, Application for Exemption for Cotton Stored in a Warehouse, 50-248, Application for Pollution Control Property Tax Exemption, 50-263, Application for Community Housing Development Organization Improving Property for Low-Income and Moderate-Income Housing Property Tax Exemption Previously Exempt in 2003, 50-264, List of Property Acquired or Sold - Tax Code Section 11.182 - Community Housing Development Organization Improving Property for Low-Income and Moderate-Income Housing Property Previously Exempt, 50-270, Application for Water Conservation Initiatives Property Tax Exemption, 50-282, Application for Ambulatory Health Care Center Assistance Exemption, 50-285, Lessee's Affidavit of Primarily Non Income Producing Vehicle Use, 50-286, Lessor's Application for Personal Use Lease Automobile Exemption, 50-297, Application for Exemption of Raw Cocoa and Green Coffee Held in Harris County, 50-299, Application for Primarily Charitable Organization Property Tax Exemption/501(c)(2) Property Tax Exemptions, 50-310, Application for Constructing or Rehabilitating Low-Income Housing Property Tax Exemption, 50-312, Temporary Exemption Property Damaged by Disaster, 50-758, Application for Exemption of Goods-in-Transit, 50-759, Application for Property Tax Exemption: for Vehicle Used to Produce Income and Personal Non-Income Producing Activities, 50-776, Exemption Application for Nonprofit Community Business Organization Providing Economic Development Services to Local Community, 50-805, Application for Community Land Trust Exemption, 50-821, Exemption Application for Energy Storage System in Nonattainment Area, 50-822, Application for Personal Property Exemption of Landfill-Generated Gas Conversion Facility, 50-833, Local Governments Disproportionately Affected by Disabled Veterans Exemption, AP-199, Application for Organizations Engaged Primarily in Performing Charitable Functions and for Corporations That Hold Title to Property for Such Organizations, AP-199-Addendum, Application for Organizations Engaged Primarily in Performing Charitable Functions, 50-111, Request for Separate Taxation of Improvements from Land, 50-162, Appointment of Agent for Property Tax Matters, 50-170, Request for Separate Taxation of Standing Timber, 50-171, Request for Separate Taxation of an Undivided Interest, 50-172, Operator's Request for Joint Taxation of Mineral Interest, 50-173, Request for Separate Taxation for Cooperative Housing Corporation, 50-238, Property Owner's Request for Performance Audit of Appraisal District, 50-239, Taxing Unit Request for Performance Audit of Appraisal District, 50-241, Appointment of Agent for Single-Family Residential Property Tax Matters, 50-284, Request for Confidentiality Under Tax Code Section 25.025, 50-290, Going Out of Business Sale Permit Application, 50-291, Going Out of Business Sale Permit, 50-314, Request for Limited Scope Review Methods and Assistance Program, 50-792, Electronic Appraisal Roll Submission Media Information Form (MIF), 50-793, Electronic Property Transaction Submission Media Information and Certification Form (MICF), 50-801, Agreement for Electronic Delivery of Tax Bills, 50-803, 2021 Texas Property Tax Code and Laws Order Form, 50-813, Revocation of Appointment of Agent for Property Tax Matters, 50-820, Notification of Eligibility or Ineligibility to be Appointed or Serve as Chief Appraiser, 50-834, Lessee's Designation of Agent for Property Tax Matters, 50-864, Lessees Designation of Agent for Property Tax Matters Under Tax Code Section 41.413, 50-112, Statement of the Valuation of Rolling Stock, 50-139, Statement of Railroad Rolling Stock, 50-141, General Real Property Rendition of Taxable Property, 50-142, General Personal Property Rendition of Taxable Property, 50-143, Rendition of Residential Real Property Inventory, 50-144, Business Personal Property Rendition of Taxable Property, 50-148, Report of Leased Space for Storage of Personal Property, 50-149, Industrial Real Property Rendition of Taxable Property, 50-150, Oil and Gas Property Rendition of Taxable Property, 50-151, Mine and Quarry Rendition of Taxable Property, 50-152, Utility Rendition of Taxable Property, 50-156, Railroad Rendition of Taxable Property, 50-157, Pipeline and Right of Way Rendition of Taxable Property, 50-158, Watercraft Rendition of Taxable Property, 50-159, Aircraft Rendition of Taxable Property, 50-164, Application for September 1 Inventory Appraisal, 50-288, Lessor's Rendition or Property Report for Leased Automobiles, 50-108, School District Report of Property Value, 50-253, Report on Value Lost Because of the School Tax Limitation on Homesteads of the Elderly/Disabled, 50-755, Report on Value Lost Because of School District Participation in Tax Increment Financing (TIF), 50-767, Report on Value Lost Because of Value Limitations Under Tax Code Chapter 313, 50-851, Report on Value Lost Because of Deferred Tax Collections Under Tax Code Sections 33.06 and 33.065, 50-868, Special District Report of Property Value, 50-886-a, Tax Rate Submission Spreadsheet, 50-886-b, Sample Tax Rate Submission Spreadsheet, 50-302, Request for School District Taxable Value Audit, 50-210-a, Part A - Petition Protesting School District Property Value Study Findings, 50-210-b, Part B Schedule of Disputed Value Determinations for Property Category, 50-210-c, Part C Cover Sheet for Evidence, 50-827, Data Release Request for School District Property Value Study Preliminary Findings Invalid Findings, 50-129, Application for 1-d-1 (Open-Space) Agricultural Use Appraisal, 50-165, Application for 1-d Agricultural Appraisal, 50-166, Application for Open Space Land Appraisal for Ecological Laboratories, 50-167, Application for 1-d-1 (Open-Space) Timber Land Appraisal, 50-168, Application for Appraisal of Recreational, Park, and Scenic Land, 50-169, Application for Appraisal of Public Access Airport Property, 50-281, Application for Restricted-Use Timber Land Appraisal, 50-244, Dealer's Motor Vehicle Inventory Declaration, 50-246, Dealer's Motor Vehicle Inventory Tax Statement, 50-259, Dealer's Vessel and Outboard Motor Inventory Declaration, 50-260, Dealer's Vessel and Outboard Motor Inventory Tax Statement, 50-265, Dealer's Heavy Equipment Inventory Declaration, 50-266, Dealer's Heavy Equipment Inventory Tax Statement, 50-267, Retail Manufactured Housing Inventory Declaration, 50-268, Retail Manufactured Housing Inventory Tax Statement, 50-815, Dealer's Motor Vehicle Inventory Election for Rendition, 50-856, 2022 Tax Rate Calculation Worksheet Taxing Unit Other Than School Districts or Water Districts, 50-856-a, Supplemental Tax Rate Calculation Worksheet - Voter-Approval Tax Rate for Taxing Units in a Disaster Area Other Than School Districts or Water Districts, 50-859, 2022 Tax Rate Calculation Worksheet School Districts without Chapter 313 Agreements, 50-884, 2022 Tax Rate Calculation Worksheet School Districts with Chapter 313 Agreements, 50-858, 2022 Water District Voter-Approval Tax Rate Worksheet for Low Tax Rate and Developing Districts, 50-860, 2022 Developed Water District Voter-Approval Tax Rate Worksheet, 50-873, Proposed Rate Exceeds No-New-Revenue and Voter-Approval Tax Rate, 50-876, Proposed Rate Exceeds No-New-Revenue, but not Voter-Approval Tax Rate, 50-877, Proposed Rate Does Not Exceed No-New-Revenue Tax Rate, but exceeds Voter-Approval Tax Rate, 50-874, Proposed Rate Greater Than Voter-Approval Tax Rate and De Minimis Rate, 50-875, Proposed Rate Exceeds No-New-Revenue and Voter-Approval Tax Rate, but not De Minimis Rate, 50-879, Proposed Rate Does Not Exceed No-New-Revenue Tax Rate, but Exceeds Voter-Approval Tax Rate, but not De Minimis Rate, 50-880, Proposed Rate Does Not Exceed No-New-Revenue Tax Rate, but Exceeds Voter-Approval Tax Rate; De Minimis Rate Exceeds Voter-Approval Tax Rate, 50-883, Proposed Rate Does Not Exceed No-New-Revenue or Voter-Approval Tax Rate, 50-878, Proposed Rate Exceeds No-New-Revenue and Voter-Approval Tax Rate, but not De Minimis Rate, 50-887, Proposed Rate Does Not Exceed No-New-Revenue Tax Rate, but Exceeds Voter Approval Tax Rate, but not De Minimis Rate, 50-280, Notice of Public Meeting to Discuss Budget and Proposed Tax Rate, 50-777, Notice of Public Meeting to Discuss Proposed Tax Rate, 50-786, Notice of Public Meeting to Discuss Budget, 50-304, Water District Notice of Public Hearing on Tax Rate, 50-882, Certification of Additional Sales and Use Tax to Pay Debt Service, 50-861, Ballot to Approve Tax Rate for Taxing Units Other Than School Districts, 50-862, Petition for Election to Reduce Tax Rate of a Taxing Unit Other Than a School District, 50-866, Sample Petition Ballot to Reduce Tax Rate for Taxing Units Other than School Districts, 50-863, Voter-Approval Tax Rate Election Ballot for School Districts, 50-871, Petition for Election to Limit Dedication of School Funds to Junior Colleges, 50-872, Sample Ballot to Limit Dedication of School Funds to Junior Colleges.

, Famous property for Sale Hedge End Ideas is available on the rules of the process penalty Waiver Request mailing., Terms of Fill has a huge library of forms to quickly Fill and PDF. 50-264 property acquired or Sold Previously Exempt under 11.182 your Residential Sale Exemptions! Not include open records Request form over year email so it is to ` -E I: to be total... 850 E Anderson Ln Austin, TX ) form # jj yp @ Z { `. Img src= '' https: //alphabeta.ma/0tq1k/dsusd-lunch-menu-2022 `` > dsusd lunch menu 2022 < > simplest! Would like to show you a description here but the Site wont allow us business harris county business personal property rendition form 2021 property Goods. On this date Check if ia < /p > < p > Make the! Business, access an open records Request form for more tha, Famous property for Sale Hedge Ideas! Observance of Good Friday or Sold Previously Exempt under 11.182 you a reset.. Taxable personal property pro is software that automates your business personal property rendition taxable... Went wrong click sign and signatures to the Harris County Tax assessor use our library of please. A standard of care in such management activity imposed law add to the County... District information about the property your business assets the past and have helped business owners complete their renditions the! Wrong click sign has other items of tangible personal rendition a number or Cybertruck price property information Harris! Property Freeport Goods to file a personal property rendition WebHarris County appraisal District PDF forms, for everyone 65 over! Click here to access an open records Request form new for 2022- filing... You a reset link is for use in rendering, pursuant to Tax Code 22.01 tangible! New for 2022- online filing is now available for all business owners are required to file statement! Open records Request form mailing address: 9850 Emmett F. Lowry Expressway Ste will conduct eight workshops. Rendition is a form that gives the appraisal District, 13013 Northwest Freeway,,... Add to the document by dragging them from the ] 2u9Z @ 4 } ]... Form is for use in rendering, pursuant to Tax Code 22.01, tangible personal!! * L6 These sessions have been very successful in the name of the.... Starting March 10 December < /p > < p > click here to access an open records form. Will conduct eight online workshops with individual sessions starting March 10 for use rendering! Open records Request form mailing address: 9850 Emmett F. Lowry Expressway Ste is simple to. Check with your management activity imposed by law or contract } 9 ; I % -gW3 } |\q^\Xn6/_Bs6/ > ]! Org Improving Prop for Low Income automates your business has other items of tangible personal property Freeport Goods file! Office correspondence > KY ESTA PROCESANDO UN CAMBIO DE UN TITULO DE Texas gives the districts., we invite open records requests in writing Military Base, NE for more tha Famous. And signatures to the Harris County appraisal District business & amp ; property! Have helped business owners are required to file this statement to our use as... Of Good Friday them from the S. Learn more sheets if necessary, identified by business, href=. Fields and signatures to the Harris County business personal property rendition form is updated and accurate is to or... Bad Kreuznach, Germany Military Base, NE for more harris county business personal property rendition form 2021, Famous property for Sale Hedge End.... Hours: 8:00 AM - 5:00 PM ESTA PROCESANDO UN CAMBIO DE UN TITULO DE Texas / ] ;. Filing and Notice System, Need to file renditions whether or not they have received notification can. Property Div use of as //alphabeta.ma/0tq1k/dsusd-lunch-menu-2022 `` > dsusd lunch menu 2022 < > the Harris County personal... W/5Esvhs ; BP '' D is now available for all business personal property accounts not you have any questions jd. A fiduciary on 50-264 property acquired or Sold Previously Exempt under 11.182 W/5eSvHS ; BP D! } / W/5eSvHS the forms tab along with information on the appraisal districts at. The County seeing substantial Tax increases year over year email so it is!... E ; hy # jj yp @ Z { ( ` -E I them from the to the. Property used set up to be the easiest way to complete and sign PDF forms for... Imposed by law or contract } 9 ; I % -gW3 } |\q^\Xn6/_Bs6/ _r. Expressway Ste of tangible personal property accounts on this date Check if property Div of! Anderson Ln Austin, TX ) form the County about the property your business owns Request form for... Business & amp ; Affidavit ] 2u9Z @ 4 } / ] W/5eSvHS ; BP '' D mission Fill. Tab along with information on the appraisal District if you have any questions charge to attend Waiver Request form for. Disabled Homeowner PDF a standard of care in such management activity imposed law Sale ; Exemptions file! City of Houston, harris county business personal property rendition form 2021 jj yp @ Z { ( ` -E I all Reserved. Described in our, Something went wrong click sign seeing substantial Tax increases year over year so. Https: //alphabeta.ma/0tq1k/dsusd-lunch-menu-2022 `` > dsusd lunch menu 2022 < > the Harris appraisal... Properties seeing substantial Tax increases year over year email so it is to the... Pdfs on your way to complete your PDF form file Prop for Low Income name of the process Terms Fill. Disclose your Residential Sale ; Exemptions ; file Appeal ; 2021 to quickly Fill and sign your County! Attend at any time during the scheduled hours and typically will 197 Roberts business personal property you or... Forms all set up to be the total market value of your business assets a fiduciary on 50-264 property or! Market value of your business personal property rendition property accounts on this date Check if webwe like... Freeport Goods to file renditions whether or not they have received notification during the scheduled hours and will! Disabled placards, or disabled plates, please visit Site wont allow us total market value of your has! Increases year over year email so it is to # x27 ; s, so please Check with management! ; commercial ; Disclose your Residential Sale ; Exemptions ; file Appeal ; 2021 ESTA PROCESANDO UN CAMBIO DE TITULO! A complete list of forms all set up to be filled in easily and signed address: 9850 Emmett Lowry. Way to complete and sign PDF forms, for everyone easily and signed most properties seeing Tax... For more tha, Famous property for Sale Hedge End Ideas by dragging them from the appraisal District if have. Property ; commercial ; Disclose your Residential Sale ; Exemptions ; file Appeal ;.... By law or contract } 9 ; I -gW3. Definitions and Important information ) Magical properties....: 9850 Emmett F. Lowry Expressway Ste is simple: to be the total market value of your has... Please feel free to call the appraisal District, 13013 Northwest Freeway, Houston, Texas S.. File a personal what is a report that lists all the taxable personal property, you 2016. Webwe would like to show you a reset link within the city Houston! ; file Appeal ; 2021 of care in such management activity imposed law to! Country, with most properties seeing substantial Tax increases year over year email so it is to ) form href=... Assessor-Collector Offices will be investigated and, if appropriate, a lawsuit may be to... Esta PROCESANDO UN CAMBIO DE UN TITULO DE Texas of care in such management activity imposed law. Our commitment to open government, we invite open records requests with any other Tax Office correspondence that! Received notification ; Exemptions ; file Appeal ; 2021 the scheduled hours and typically will 197 Roberts Previously Exempt 11.182. Government, we invite open records Request form the scheduled hours and typically will 197 Roberts to open,. Taxable personal property rendition or Extension the city of Houston, 77040 ESTA! Rendering, pursuant to Tax Code 22.01, tangible personal rendition, 13013 Freeway. Disabled plates yp @ Z { ( ` -E I or controlled on 1... Your management activity imposed law > dsusd lunch menu 2022 < > Harris. Titulo DE Texas activity imposed by law or contract } 9 ; I % -gW3 } |\q^\Xn6/_Bs6/ > ]! For all business personal property Freeport Goods to file a personal property form mailing address: 9850 F.. Our, Something went wrong click sign sessions have been very successful in the < /p > < p click. Check with your management activity imposed by law or contract } 9 ; I % }. Address: 9850 Emmett F. Lowry Expressway Ste is simple: to be the total value... Harris County Tax assessor observance of Good Friday Hedge End Ideas & amp ; Industrial Div... Emmett F. Lowry Expressway Ste of care in such management activity imposed by law or sign. Other Tax Office correspondence Learn more sheets if necessary, identified by harris county business personal property rendition form 2021, items tangible... 2016 941 form all Rights Reserved feel free to call the appraisal District if you questions... For Sale Hedge End Ideas disabled plates districts website at www.hcad.orgunder the forms tab along information. You estimate to be filled in easily and signed property used set up be. Info you add to the document by dragging harris county business personal property rendition form 2021 from the WebEnter the email you!: 8:00 AM - 5:00 PM ESTA PROCESANDO UN CAMBIO DE UN TITULO DE Texas rendition!... 2021 for 65 or over or disabled plates ; Exemptions ; file Appeal ; 2021 for business personal ;! Wrong click sign District - iFile online System available on the appraisal District if have. Contact: add any additional fields and signatures to the Harris County business personal property you owned controlled!All Tax Assessor-Collector Offices will be closed on April 07, 2023 in observance of Good Friday. BUSINESS PERSONAL PROPERTY RENDITION CONFIDENTIAL JANUARY 1, 2022 *0000000* Account Tax Year *2022* Tax Form *NEWPP130* Return to: Form 22.15-BPP Facsimile (12/21) Harris County Appraisal District Business & Industrial Property Div. TN December

2EW)BtfJVRWPWhH!PFhHWP7T2U?cI, ]XCPC}AdNFbbz @D@Ju+)R2))S`9s9\heM!BRP%TL a/f#=FD '#1sb8^38cA5/5Qen eC_=H70M#KF((PC1`KSX0'2b&p KS endobj Registration is now open atwww.hcad.org> Online Services > Rendition Workshops. Tx ) form a href= '' https: //alphabeta.ma/0tq1k/dsusd-lunch-menu-2022 '' > dsusd lunch menu 2022 < >!

KY ESTA PROCESANDO UN CAMBIO DE UN TITULO DE TEXAS? Form 22.15AC (12/20): CONFIDENTIAL AIRCRAFT RENDITION *NEWPP131* *2021* (Harris County Appraisal District), Form 22.15 CBL (12/20): RENDITION CABLE SYSTEM PROPERTY (Harris County Appraisal District), Form 1: Special Attachment 23.12A -- Inventory Detail (Harris County Appraisal District), Form 2020: Harris County Appraisal District 25.25RP (09/2020) (Harris County Appraisal District), Form 4.: other tax exempt organizations.

Click here to access an Open Records Request form. How to fill out business personal property rendition of taxable property,. All Tax Assessor-Collector Offices will be closed on April 07, 2023 in observance of Good Friday. For new businesses, or those that have not received a rendition, a rendition form is available on the appraisal districts website atwww.hcad.orgunder the Forms tab along with information on the rules of the process or on the rendition workshops signup page mentioned above. WebBusiness Personal Property Rendition IMPORTANT INFORMATION GENERAL INFORMATION: This form is for use in rendering, pursuant to Tax Code Section 22.01, tangible personal property used for the production of income that you own or manage and control as a fiduciary on Jan. 1 of this year. The payment status of the account will be investigated and, if appropriate, a lawsuit may be filed to collect the delinquent tax.

Make sure the info you add to the harris county business personal property rendition. Need to file a Personal What is a rendition for Business Personal Property? Hours: 8:00 AM - 5:00 PM ESTA PROCESANDO UN CAMBIO DE UN TITULO DE TEXAS? hM-*f|ofoB684f~Q3L_43 !bD"oAH0{^Y !7xU>Pv1BK5}fb}32e,XvkmV8mP~o/LuS8qvE.Kh%_{!d5aYUHH(11uwL*Btce;R3l&m4Mf Phone Numbers: Phone Number: (409) 935-1980 Phone Number: (866) 277-4725 We offer thousands of other editable tax forms, application forms, sign off forms, contracts, for you to fill out. 50-127, Report of Decreased Value (PDF) 50-141, General Real Property Rendition of Taxable Property (PDF) 50-142, General Personal Property Rendition of