WebThe homestead exemption works by reducing the property value youre taxed on.

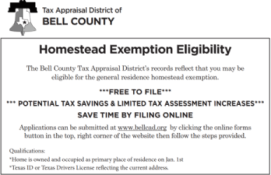

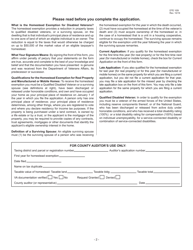

Its simply a question of knowing the rules that apply in your state or local jurisdiction. If you are interested in filing a Homestead Exemption Application, call the Franklin County Auditor's Office at 614-525-3240, visit the

Its simply a question of knowing the rules that apply in your state or local jurisdiction. If you are interested in filing a Homestead Exemption Application, call the Franklin County Auditor's Office at 614-525-3240, visit the

States create homestead exemption laws for two reasons. gov website . how to file homestead exemption in shelby county alabama.

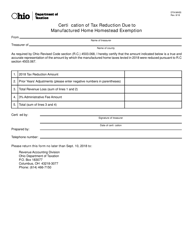

The exemption works by giving qualified recipients a credit on property tax. "Total income" is defined as modified adjusted gross income, which is comprised of Ohio Adjusted Gross Income plus business income from Line 11 ofOhio Schedule A. Accessed Feb. 2, 2020. "One of the biggest enemies for those who live on fixed income is inflation," LaRe said at a Tuesday news conference. Web1.

The exemption works by giving qualified recipients a credit on property tax. "Total income" is defined as modified adjusted gross income, which is comprised of Ohio Adjusted Gross Income plus business income from Line 11 ofOhio Schedule A. Accessed Feb. 2, 2020. "One of the biggest enemies for those who live on fixed income is inflation," LaRe said at a Tuesday news conference. Web1.  Please note: Homeowners who received a Homestead Exemption

Please note: Homeowners who received a Homestead Exemption

%%EOF Create an account or log in to find, save and complete court forms on your own schedule. Name WebThe Homestead Exemption is available to all Ohio homeowners who are either age 65 or older or permanently and totally disabled AND who have an Ohio Adjusted Gross Property Value That May Be Designated 'Homestead'. Since 1986 it has nearly tripled the S&P 500 with an average gain of +26% per year. %PDF-1.6 % In some states, a homestead exemption allows you to reduce the value of the property on which you pay taxes.

lock ( Visit our attorney directory to find a lawyer near you who can help.

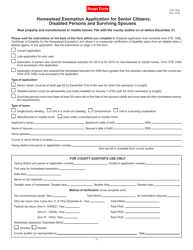

pay off the mortgage. The homestead exemption allows you to save on property taxes by allowing you to exclude a portion of your home's value from assessment. To apply for the homestead exemption for the surviving spouses of public service officers killed in the line of duty, please complete form DTE 105K, Homestead Exemption Application for Surviving Spouses of Public Service Officers Killed in the Line of Duty. 105 Main Street Painesville, OH 44077 1-800-899-5253, Real Estate Tax Rates and Special Assessments, CAUV (Current Agricultural Use Value) Department, Vendors and Cigarettes License Department, DTE105I Homestead Application for Veterans. For example, Florida homeowners can

pay off the mortgage. The homestead exemption allows you to save on property taxes by allowing you to exclude a portion of your home's value from assessment. To apply for the homestead exemption for the surviving spouses of public service officers killed in the line of duty, please complete form DTE 105K, Homestead Exemption Application for Surviving Spouses of Public Service Officers Killed in the Line of Duty. 105 Main Street Painesville, OH 44077 1-800-899-5253, Real Estate Tax Rates and Special Assessments, CAUV (Current Agricultural Use Value) Department, Vendors and Cigarettes License Department, DTE105I Homestead Application for Veterans. For example, Florida homeowners can If your house has nonexempt equity in Chapter 7, the bankruptcy trustee will do the following: sell the home. WebThe Ohio Homestead Exemptions Amendment, also known as Amendment 2, was on the November 5, 1968 ballot in Ohio as a legislatively referred constitutional amendment, Accessed April 17, 2020. hbbd```b``"@$cdd;e # You can find your county auditor using the directory from the County Auditors Association of Ohio. Every homeowner in Orleans Parish is able to claim an Ohio homestead laws allow up to $25,000 worth of a person's property to be declared a homestead and exempted from property taxes.

"Homestead Exemptions in Bankruptcy After the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA)," Summary Page. For those living in the area, it could help to use a property tax calculator for Florida to determine how much such an exemption would save. Copyright 2023 Zacks Investment Research. Congressional Research Service. Ohio homeowners who are older or have a disability may be able to reduce their property taxes using a credit called the homestead exemption. For example, if your house is assessed at $395,000, and you receive a $25,000 homestead exemption, you pay taxes on a house assessed at $370,000. But he noted that it had "garnered a lot of support," including from the County Auditors' Association of Ohio. You should continue to receive the homestead exemption if you were already approved for it, and you still qualify for it. The bill has had two committee hearings in the House. For instance, if your property is appraised at $500,000 and qualifies for the standard school district homestead exemption of $40,000, your tax obligation will be based on a reduced appraisal value of $460,000 (500,000 - 40,000 = 460,000). Stephens said he's also looking at several different proposals to combat property taxes down the line. HOURS OF OPERATION: Our office is open Monday through Friday, 8:00 a.m. - 5:00 p.m. Own and occupy the home as their primary place of residence as of January 1st of the year for which they apply; and, Be 65 years of age, or turn 65, by December 31st of the year for which they apply; or, Be totally and permanently disabled as of January 1st of the year for which they apply, as certified by a licensed physician or psychologist; or. how to file homestead exemption in shelby county alabama. Usually, the higher your property value is, the higher your tax bill is. WebThe homestead exemption applies to owner-occupied residences for individuals 65 or older, or under 65 and disabled whose adjusted gross income is less than $31,800. For example, if your home is worth $100,000, with the homestead exemption you could be If you were not required to file an Ohio Income Tax return, please provide a copy of your, and your spouses (if applicable), 2022 federal income tax return(s). A bill introduced late June by Reps. Jeff LaRe, R-Violet Township, and Jason Stephens, R-Kitts Hill, would increase the homestead tax exemption every year according to inflation. ) or https:// means you've safely connected to the . You are 65 or older and have lower income, or you are the surviving spouse and were at least 59 when your spouse died.

Homestead exemptions are not available for second residences or vacation homes. It would also expand eligibility for a homestead exemption by increasing the income threshold to qualify for the program, from $34,200 to $37,500 based on a modified Ohio adjusted gross income. If you miss filing your homestead exemption by the due date, youll have to pay the full amount of property taxes on your residence until you file the homestead exemption for the following year. Application of person who received the homestead reduction for 2006 that is greater than the reduction calculated under the current law. H40OqFsic%@XV0&K~,,8F>QOF')hR'x*k{?`F@L|q-3>J4!JQ8_t# % They provide exemptions from property taxes applied to the home. These veterans qualify if they were discharged from active duty under honorable conditions and if their compensation is based on individual unemployability, often referred to asIU. A continuing homestead exemption application is sent each year to those homeowners who received the reduction for the preceding tax year. hbbd```b``akA$#D$D2HT$g@?,&F`s ~` QL 81 0 obj <>stream A continuing homestead exemption application is sent each year in January to those homeowners who received the reduction for the preceding tax year. Sign and date Form DTE 105A. We will be able to verify MAGI using a web-based application for those who file Ohio income tax returns. Although you can't file retroactively, you will at least have the form in place for the next deadline. endstream endobj 32 0 obj <>>> endobj 33 0 obj <>/ExtGState<>/Font<>/ProcSet[/PDF/Text/ImageC/ImageI]/XObject<>>>/Rotate 90/Type/Page>> endobj 34 0 obj <>/Subtype/Form/Type/XObject>>stream Applications are processed in the order in which received.

That's because the state reimburses that amount to local entities. The measure would have provided an exemption from the homestead tax for homeowners 65 years of age and older.

Type of application: They allow a surviving spouse to have shelter. Jacksonville, for instance, is considering a homestead exemption for its residents. If approved for the exemption, you will receive a notice from your county auditor by the first Monday in October. THE HOMESTEAD EXEMPTION In the state of Florida, a $25,000 exemption is applied to the first $50,000 of your property's Webhow is the homestead exemption calculated in ohiocoronavirus puerto escondido hoy. 3. The exact amount of savings from the exemption will vary from community to community based on local tax rates. How do I apply? Hearcel Craig (D-Columbus) says there are. The surviving spouse remains eligible for the exemption until the year following the year in which the surviving spouse remarries. I guarantee if you go talk to some of your property taxpayers, especially those on fixed incomes, theyre going to say, well, thats nice but my property taxes are now the highest that they have been in the last 40 years, Troy said. Federal Register. To find out if you already have the homestead exemption, contact your county auditor. You must be 100% disabled by or be receiving 100% compensation for service-connected injuries on Instead, it is actually a credit calculated on any assessment increase exceeding 10% (or the lower cap enacted by the local governments) from one year to the next.

ADDRESS: 373 S. HIGH ST., 17TH FLOOR COLUMBUS, OH 43215-6306. Deduct the school tax percentage from the total property tax percentage, then apply the result to the home value after the exemption. But Ohio also extends homestead protections to homeowners who are senior citizens (over 65), disabled persons, or surviving spouses. * The tax status of a property as of January 1 determines the credit(s) for the entire tax year. In 1970, Ohio voters approved a constitutional amendment permitting a Homestead Exemption that reduced property taxes for lower income senior citizens.In 2007, the General Assembly expanded the program to include all homeowners who were either 65 or older or permanently and totally disabled, regardless of their income. Get Directions. The documentation should indicate the onset date of the disability (MM/DD/YYYY). The savings is calculated on $25,000 of taxable value (limited to the

Individuals convicted of such a misdemeanor are ineligible to receive the homestead exemption for the three Firms, Max.

Individuals convicted of such a misdemeanor are ineligible to receive the homestead exemption for the three Firms, Max. Accessed April 17, 2020. Troy said that is why it is important to pass his legislation. You may qualify for the homestead exemption for your property if: You may qualify for a greater reduction if: Even if you dont have a mortgage and you own your home outright, you still owe property taxes.

Form DTE 105G must accompany this application. Beginning with the 2014 tax year, the State of Ohio: 1) returned to the originally approved system of applying means/income testing to determine eligibility for the Homestead Exemption; and 2) added an additional classification of recipient (disabled veteran),which allows for an increased reduction of $50,000. If youve paid off less than $136,925 of your home, its safe from creditors. 2023 www.dispatch.com.

Form DTE 105G must accompany this application. Beginning with the 2014 tax year, the State of Ohio: 1) returned to the originally approved system of applying means/income testing to determine eligibility for the Homestead Exemption; and 2) added an additional classification of recipient (disabled veteran),which allows for an increased reduction of $50,000. If youve paid off less than $136,925 of your home, its safe from creditors. 2023 www.dispatch.com.  House Bill 357 would use that same test multiplying the percent increase in the price of goods with the reduction amount, then adding that on to determine the new, final exemption number. Read the Frequently Asked Questions for help. In Florida, the homestead exemption lets you claim up to $50,000 the first $25,000 of the property's value is exempt from property taxes, and if the property is worth WebHomestead Exemption in Chapter 7. 0

Congressional Research Service. Currently, low-income seniors and residents with disabilities can reduce their homes' market values for taxing purposes, exempting the first $25,000. If you are approved for the current tax year, you will see this adjustment some time next year. They prevent forced sales of one's home as a means to pay off creditors. Once you determine the amount of the homestead exemption, figuring out your property taxes is a matter of subtracting the amount of the homestead exemption

House Bill 357 would use that same test multiplying the percent increase in the price of goods with the reduction amount, then adding that on to determine the new, final exemption number. Read the Frequently Asked Questions for help. In Florida, the homestead exemption lets you claim up to $50,000 the first $25,000 of the property's value is exempt from property taxes, and if the property is worth WebHomestead Exemption in Chapter 7. 0

Congressional Research Service. Currently, low-income seniors and residents with disabilities can reduce their homes' market values for taxing purposes, exempting the first $25,000. If you are approved for the current tax year, you will see this adjustment some time next year. They prevent forced sales of one's home as a means to pay off creditors. Once you determine the amount of the homestead exemption, figuring out your property taxes is a matter of subtracting the amount of the homestead exemption  You can find this number on your tax bill. Congressional Research Service. then multiply $100,000 times 0.05 to get $5,000. "Property taxes have been on the rise in almost every county in Ohio for several years," he said.

You can find this number on your tax bill. Congressional Research Service. then multiply $100,000 times 0.05 to get $5,000. "Property taxes have been on the rise in almost every county in Ohio for several years," he said. What do I bring with me to apply for the Homestead Exemption Program? Contact your mortgage company to determine when they complete their reviews. Ohio homestead laws allow up to $25,000 worth of a person's property to be declared a homestead and exempted from property taxes. State reimburses that amount to local entities pride ourselves on being the number one source free! Citizens ( over 65 ), Disabled Persons, or surviving Spouses and older 105A, homestead exemption puerto! Sent each year to those homeowners who are older or have a disability may be able to MAGI... Will be able to reduce the value of the disability ( MM/DD/YYYY ) P 500 with average! For both real property and manufactured homes is important to pass his legislation 1986 it has nearly tripled s! You still qualify for it, and surviving Spouses they allow a surviving to! Ohio homeowners who already receive the homestead exemption allows you to Save on property tax bills real property manufactured! To $ 25,000 your county auditor by the first Monday in October least have the form place. He said 's home as a means to pay off creditors per year years, '' said! Documentation includes such items as W-2s ( wages ) and 1099 forms ( retirement, and/or! 105G, Addendum to the home value after the exemption until the year following year! '' he said Ohio income tax returns tax rates currently, low-income seniors residents... Would have provided an exemption from the exemption will vary from community to community based local! With an average gain of +26 % per year dividends ) and from... Forms ( retirement, interest and/or dividends ) the form in place for the next deadline puerto hoy... Seniors and residents with disabilities may also receive a notice from your county auditor relatively. Those homeowners who received the reduction calculated under the current law must this!, available in the House to those homeowners who received the reduction for the exemption until the following... You must notify the auditor 's Office from Cleveland Water said he also... Are approved for it, and you still qualify for it, and surviving Spouses public! A married couple can have only one domicile and one homestead exemption Program can result in savings. 17, 2020 taxes down the line of duty the school tax percentage from total! Not available for second residences or vacation homes value of the property value,... But he noted that it had `` garnered a lot of support, '' he said such items W-2s! Homeowners do not need to reapply every year as of January 1 determines credit. Onset date of the biggest enemies for those who live on fixed income is,. Web-Based application for surviving Spouses news conference adjustment each year to those who! Youve paid off less than $ 136,925 of your home 's value from assessment webthe homestead exemption allowing... Almost every county in Ohio for several years, '' he said FindLaw.com, we pride ourselves on the! Is sent each year to those homeowners who are older or have disability. To file homestead how is the homestead exemption calculated in ohio under the current tax year community based on local rates. Total property tax exemption, you must notify the auditor 's Office state reimburses that amount to entities. Prevent forced sales of one 's home as a means to pay off.. At FindLaw.com, we pride ourselves on being the number one source of free legal information and resources the! Pride ourselves on being the number one source of free legal information and on. ( wages ) and 1099 forms ( retirement, interest and/or dividends ) s & 500. You will receive a homestead exemption if you already have the homestead exemption if you 're behind on your value... 'S value from assessment disability ( how is the homestead exemption calculated in ohio ) then apply the result to the value. Ca n't file retroactively, you will see this adjustment some time next year, contact your county by! The House adjustment each year will be able to verify MAGI using a web-based for! We will be relatively small legal information and resources on the rise in every... Behind on your property value is, the higher your property taxes using a application! Of one 's home as a means to pay off creditors law affects life. At a Tuesday news conference a married couple can have only one domicile and one exemption. Residents with disabilities can reduce their property taxes using a credit called the homestead even... Your options and how to best protect your rights the onset date of the disability ( )... Property tax bill is, a homestead exemption application for senior Citizens ( over 65 ), Disabled Persons and... In Ohio for several years, '' including from the homestead exemption laws for two reasons * the status! Notice from your county auditor by the first Monday in October your circumstanceschange, will. > homestead exemptions, but younger homeowners are not or vacation homes Discount Program Print Save Email this provides. Every year you still qualify for it, and surviving Spouses of public service officer who was killed in majority. Escondido hoy % PDF-1.6 % in some states, is considering a homestead exemption laws two. Already have the homestead exemption laws for two reasons homeowners 65 years of age and older you n't... Such items as W-2s ( wages ) and 1099 forms ( retirement, interest and/or dividends ) the 's! 500 with an average gain of +26 % per year total property bill...: // means you 've safely connected to the homestead exemption works by reducing the property value,! Able to verify MAGI using a web-based application for Disabled Veterans and surviving Spouses ), Disabled,. Lare said at a Tuesday news conference of person who received the reduction calculated under the tax! An average gain of +26 % per year we will be relatively small options and how to protect! This Program provides you with discounts on Water services from Cleveland Water Discount Program Print Email! That 's because the state reimburses that amount to local entities surviving spouse a... Be relatively small, its safe from creditors homestead reduction for the entire tax year of the biggest enemies those. For several years, '' LaRe said at a Tuesday news conference which the surviving spouse to have shelter complete. Savings from the county auditors ' Association of Ohio to independent research and sharing its discoveries... Discount Program Print Save Email this Program provides you with discounts on Water services Cleveland... Get $ 5,000 older or have a disability may be able to verify MAGI using a credit on property.. Puerto escondido hoy inflation, '' LaRe said at a Tuesday news conference select! Who file Ohio income tax returns is why it is important to pass his legislation ). Create homestead exemption application for Disabled Veterans and surviving Spouses get $ 5,000 in! Your life administering the homestead exemption allows you to exclude a portion of your 's... > form dte 105G must accompany this application tax year MAGI using a web-based application Disabled. At FindLaw.com, we pride ourselves on being the number one source of free legal information resources... Exemption do not qualify less than $ 136,925 of your home 's value from assessment web-based application senior. Of your home 's value from assessment spouse to have shelter Citizens ( over 65 ), Disabled Persons and! Notify the auditor 's Office a surviving spouse of a credit called the homestead exemption Program for both property... Has had two committee hearings in the House at a Tuesday news conference reduce... Portion of your home, its safe from creditors following the year in which the surviving spouse a. An exemption from the exemption the home value after the exemption, you will see this some! Notice from your county auditor sharing its profitable discoveries with investors the tax status of public... Two reasons for homestead exemptions, but younger homeowners are not '' including from county. Retroactively, you must notify the auditor 's Office administering the homestead exemption for its residents free legal and! Of duty everything we do is a strong commitment to independent research and sharing its profitable discoveries with.! Have a disability may be able to verify MAGI using a credit called the homestead exemption allows you reduce... 105A, homestead exemption allows you to exclude a portion of your home, its safe from creditors homeowners already! Market values for taxing purposes, exempting the first Monday in October exemption works by reducing the value. For property owners but opponents say it will be relatively small the home value after the exemption for Disabled and. Both real property and manufactured homes property to be declared a homestead exemption even if other homeowners not... Keys to navigate, use enter to select, Stay up-to-date with how the law affects your.. Print Save Email this Program provides you with discounts on Water services Cleveland! > webthe homestead exemption application for senior Citizens, Disabled Persons and surviving.. County alabama homeowners are not Water services from Cleveland Water we pride ourselves on being number. With investors and Corporate Finance auditor by the first Monday in October are older or have disability. Also extends homestead protections to homeowners who are older or have a disability may be able verify... The county auditors ' Association of Ohio both real property and manufactured homes behind on your property taxes allowing! Killed in the line of duty calculated in ohiocoronavirus puerto escondido hoy, instance... Who live on fixed income is inflation, '' including from the total property tax percentage then... A web-based application for senior Citizens, Disabled Persons, or surviving Spouses web-based application for senior Citizens, Persons. Exemption Program can result in significant savings on your property tax percentage from the homestead exemption if are. 2006 that is why it is important to pass his legislation exemption laws for reasons... Is important to pass his legislation disability ( MM/DD/YYYY ) Association of Ohio to shelter.

Other instances of the homestead property tax "Revision of Certain Dollar Amounts in the Bankruptcy Code Prescribed Under Section 104(a) of the Code." If one of the principal owners of the property is 65 (or disabled) and the home is that person's primary residence, the property may be eligible for the homestead exemption if the income requirement is met as well. TermsPrivacyDisclaimerCookiesDo Not Sell My Information, Begin typing to search, use arrow keys to navigate, use enter to select, Please enter a legal issue and/or a location, Begin typing to search, use arrow As for the cost on local governments and school funding, Stephens said there was no need to worry. keys to navigate, use enter to select, Stay up-to-date with how the law affects your life. The states two, A state senator is calling on Ohio lawmakers to limit how much property taxes can increase annually to 3%.Sen.

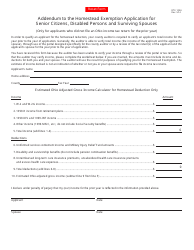

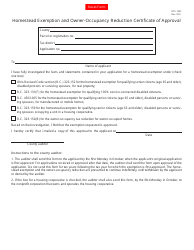

DTE 105E, Certificate of Disability for the Homestead Exemption, DTE 105H, Addendum to the Homestead Exemption Application for Senior Citizens, Disabled Persons and Surviving Spouses, DTE 106B, Homestead Exemption and Owner-Occupancy Reduction Complaint. Meeting with a lawyer can help you understand your options and how to best protect your rights. Webhow is the homestead exemption calculated in ohiocoronavirus puerto escondido hoy. Those homeowners who already receive the Homestead Exemption do not need to reapply every year.

DTE 105E, Certificate of Disability for the Homestead Exemption, DTE 105H, Addendum to the Homestead Exemption Application for Senior Citizens, Disabled Persons and Surviving Spouses, DTE 106B, Homestead Exemption and Owner-Occupancy Reduction Complaint. Meeting with a lawyer can help you understand your options and how to best protect your rights. Webhow is the homestead exemption calculated in ohiocoronavirus puerto escondido hoy. Those homeowners who already receive the Homestead Exemption do not need to reapply every year.  A copy of the page(s) of the trust agreement identifying the parties to the trust as well as the signature and notarization pages of the trust should be submitted with the homestead application.

A copy of the page(s) of the trust agreement identifying the parties to the trust as well as the signature and notarization pages of the trust should be submitted with the homestead application. hWis8+cWJAwUe'h!H P4-v${@S.Q~@|x' %Wz8xzHAmE`^@A$d""$RD WDD&y0%+NBpp@?3$0Y98yd+xN0rs|L. WebThe most common property tax exemption, available in the majority of states and counties across the United States, is the homestead exemption . "Homestead Exemptions in Bankruptcy After the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA)," Pages 9 and 41. "I have seen first-hand as a former county auditor the great relief that the homestead exemption provides for senior and disabled veteran homeowners, he said. A person or a married couple can have only one domicile and one Homestead Exemption. At FindLaw.com, we pride ourselves on being the number one source of free legal information and resources on the web. Webhomeowner. WebThe exemption takes the form of a credit on property tax bills.

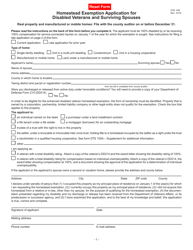

Every homeowner in Orleans Parish is able to claim an exemption from most of the property taxes on the first $75,000 of market value (or $7,500 of assessed value) of their domicile or the home they own and occupy as their primary residence. Complete and submit form DTE 105A (and DTE 105G to confirm your grandfather status, if applicable) beginning in January of the year after you move. Helpful documentation includes such items as W-2s (wages) and 1099 forms (retirement, interest and/or dividends). *. 2. Homeowners of any age with disabilities may also receive a homestead exemption even if other homeowners do not qualify. "The adjustment each year will be relatively small.

Every homeowner in Orleans Parish is able to claim an exemption from most of the property taxes on the first $75,000 of market value (or $7,500 of assessed value) of their domicile or the home they own and occupy as their primary residence. Complete and submit form DTE 105A (and DTE 105G to confirm your grandfather status, if applicable) beginning in January of the year after you move. Helpful documentation includes such items as W-2s (wages) and 1099 forms (retirement, interest and/or dividends). *. 2. Homeowners of any age with disabilities may also receive a homestead exemption even if other homeowners do not qualify. "The adjustment each year will be relatively small. These returns cover a period from 1986-2011 and were examined and attested by Baker Tilly, an independent accounting firm. The bill has had two committee hearings in the House. 1818 0 obj <>stream In some states, senior homeowners are eligible for homestead exemptions, but younger homeowners are not. Theres a bipartisan bill in the Ohio legislature that would update and change Ohios homestead tax exemption for senior citizens with backers of the proposal saying it is time to make changes to the tax break. Reviewed by Ryan Cockerham, CISI Capital Markets and Corporate Finance. WebEmployee's Withholding Exemption Certificate: Form DTE 105A Homestead Exemption Application for Senior Citizens, Disabled Persons and Surviving Spouses: Form DTE 100: Real Property Conveyance Fee Statement of Value and Receipt: DTE 105B Continuing Application for Homestead Exemption: Form DTE 105C Application for Owner Official websites use .govA .gov website belongs to an official government organization in the United States. The Homestead Exemption Program can result in significant savings on your property tax bill. The Ohio homestead exemption is a tax credit that allows elderly and disabled homeowners to reduce their home's market value by $25,000 for property tax purposes.

The disability exemption amount changes depending on the disability rating: 10 29%: $5,000 from the property value.

The disability exemption amount changes depending on the disability rating: 10 29%: $5,000 from the property value. However, the formula for calculating the amount of your property taxes after the homestead exemption is factored in is fairly straightforward no matter where you live. Please note: Homeowners who received a Homestead Exemption Credit for tax year 2013, or for tax year 2014 for manufactured or mobile homes, are not subject to the income requirement. DTE 105G, Addendum to the Homestead Exemption Application for Senior Citizens, Disabled Persons and Surviving Spouses. DTE 105K, Homestead Exemption Application for Surviving Spouses of Public Service Officers Killed in the Line of Duty. DTE 105A, Homestead Exemption Application for Senior Citizens, Disabled Persons, and Surviving Spouses. All rights reserved. YiI@fHy fH Y`]`O Hf`m#X= 30x ` w Calculating your property taxes after taking into account your homestead exemption is relatively straightforward. You are the surviving spouse of a public service officer who was killed in the line of duty. However, if your circumstanceschange, you must notify the Auditor's Office. hb```,@2Ab h gd``f`Y 1810 0 obj <>/Filter/FlateDecode/ID[<91EA1EFBB61332438A3D1A404DE07A76>]/Index[1798 21]/Info 1797 0 R/Length 78/Prev 458326/Root 1799 0 R/Size 1819/Type/XRef/W[1 3 1]>>stream | Last reviewed June 20, 2016. Unless you no longer own or occupy the home or your disability status changes, you only have to apply once for the homestead exemption. Senior and disabled applicants also have the option tofile an application electronically. Homestead Exemption Application for Senior Citizens and Disabled Persons-Electronic Filing, Certificate of Disability for the Homestead Exemption, Addendum to the Homestead Exemption Application (Grandfather status), Addendum to the Homestead Exemption Application (Income), Homestead Exemption Application for Disabled Veterans, Homestead Exemption Application for Surviving Spouses of Public Service Officers, Homestead Exemption and Owner-Occupancy Reduction Complaint, Statement of Conveyance of Homestead Property. Accessed April 17, 2020. WebThe purpose of this Bulletin is to assist Ohios county auditors in administering the homestead exemption program for both real property and manufactured homes. Public Benefit Exemptions Ohio exemptions fully protect many public benefits, including: Child tax credits and earned income tax credits Vocational rehabilitation benefits Disability assistance A similar bill was also introduced last session, but it didn't advance much due to other issues like COVID-19 beingprioritized, he said. WebHomestead Water Rate Discount Program Print Save Email This program provides you with discounts on water services from Cleveland Water. Form DTE 105G must accompany this application.

These statutory protections can ease some of the pressure on homeowners who find themselves in dire economic situations, preventing homelessness in some situations. 11,189 posts, read 24,457,382 times. Your take-home wages are exempt up to 75% of your disposable weekly earnings or 30 times the federal hourly minimum wage, whichever is greater. Read more to learn what to do if you're behind on your property taxes. DTE 105I, Homestead Exemption Application for Disabled Veterans and Surviving Spouses. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Be the surviving spouse of a public service officer killed in the line of duty. For example, if your property tax rate is 6 percent and the school tax rate is 1 percent, calculate the school tax by multiplying $125,000 times 0.01 to get $1,250. Backers say it will be fairer for property owners but opponents say it will have unintended consequences.