Default account created by QuickBooks Online to assign unknown balance sheet transfers. WebIn This QuickBooks Online Training Video, You will learn reclassifying expenses to the correct category using QuickBooks Desktop. The amount in this account should be the stated (or par) value of the stock. With QuickBooks, you can track all of your business expenses by taking a snapshot of receipts with the mobile app or connecting your bank and credit card accounts to QuickBooks. Sign up for your free 30-day trial of QuickBooks so you can see how easy it is to keep track of all of your business finances. If you have a business in your home, consult your accountant or IRS Publication 587.  Eliminate manual data entry and create customized dashboards with live data. QuickBooks Self-Employed uses simplified expense method to calculate the allowable business expense for your car, van, or motorcycle. Typically amounts are above IRS safe harbor thresholds such as $2,500; see Notice 2015-82 from IRS, Furniture purchased and tracked as a Fixed Asset in the balance sheet to track its value and depreciation over time, instead of expensed. Membership fees include those paid to professional or trade associations that can help promote your business and even to your local Chamber of Commerce. Besides that workers compensation insurance, you can deduct premiums for business-related insurance, including for liability, malpractice and real estate. Use Depreciation to track how much you depreciate fixed assets. You can categorize these types of transactions as other expenses: Use this category to categorize rental and lease expenses for equipment, office space, and property rentals. Costs must be reasonable. Remember that you will have to declare that amount as income on your personal income taxes, so you will pay tax on it.. You can refer to this article for a detailed explanation on simplified expenses: Simplified Expenses if You're Self-Employed. You can amend or add as needed, and it will automatically compile transactions. This type of account is often used in the construction industry, and only if you record income on an accrual basis. These are for retail businesses that receive Tips from customers, but are payable (or a portion is) to Employees.

Eliminate manual data entry and create customized dashboards with live data. QuickBooks Self-Employed uses simplified expense method to calculate the allowable business expense for your car, van, or motorcycle. Typically amounts are above IRS safe harbor thresholds such as $2,500; see Notice 2015-82 from IRS, Furniture purchased and tracked as a Fixed Asset in the balance sheet to track its value and depreciation over time, instead of expensed. Membership fees include those paid to professional or trade associations that can help promote your business and even to your local Chamber of Commerce. Besides that workers compensation insurance, you can deduct premiums for business-related insurance, including for liability, malpractice and real estate. Use Depreciation to track how much you depreciate fixed assets. You can categorize these types of transactions as other expenses: Use this category to categorize rental and lease expenses for equipment, office space, and property rentals. Costs must be reasonable. Remember that you will have to declare that amount as income on your personal income taxes, so you will pay tax on it.. You can refer to this article for a detailed explanation on simplified expenses: Simplified Expenses if You're Self-Employed. You can amend or add as needed, and it will automatically compile transactions. This type of account is often used in the construction industry, and only if you record income on an accrual basis. These are for retail businesses that receive Tips from customers, but are payable (or a portion is) to Employees.  The account is reported under the balance sheet classification property, plant, and equipment. Success, Support

Examples include marketing and employee training costs. top 10 financial challenges for small businesses. WebWe've updated our list of categories in response to your feedback in order to provide you with more flexibility in organizing your expenses. Availability, Business

Use Advertising/promotional to track money spent promoting your company. WebThe on-the-go lifestyle of landscaping companies can make it hard to find time to sit down with QuickBooks and setup a chart of accounts. Home QuickBooks Online Categories (Chart of Accounts). Do I need a 3rd party tool to import transactions from excel into QuickBooks Online? WebThis video will go over how to make expenses billable in QuickBooks so you can charge your customers for them later. Companies, Transportation The short answer is yes, generally, your car is an asset. https://docs.google.com/spreadsheets/d/1IDzzpG0CnHkzPiqXUeSuOTehI2he8vaaNX2DTzEkNj4/edit?usp=sharing. You need to handle 1099s in QuickBooks Online or another program. Companies that use fleet vehicles as part of their operations can deduct the portion used for business. & Dashboards, Application but I have no intention of paying an accountant to confirm what I already know - that I am allowed to claim a legitimate expense of a car park fee when travelling for business. You can still claim items that are less than $2,500 as assets, but some small businesses prefer to claim them as expenses. Item details is usually collapsed so we enter expense information in the top portion. Default Account created by QuickBooks Online to assign unknown bank deposits. Africa, Middle How do I categorize a vehicle purchase in QuickBooks? However, if its mixed, you can claim mileage related to the business use. WebDownload MileIQ to start tracking your drives. Add to this industry-specific categories, such as R&D costs or spending to seek VC funding. Employee salaries, gross wages, commissions, bonuses and other types of compensation count as tax-deductible expenses. Self-employed individuals, who pay for their own medical care expenses or insurance premiums, can deduct these expenses on their tax return. Reviewing financial accounts is a good habit that will encourage you to stay on top of your expenditures. I have correctly assigned car parking receipts to 'car, van and travel' expenses, Box 20.

The account is reported under the balance sheet classification property, plant, and equipment. Success, Support

Examples include marketing and employee training costs. top 10 financial challenges for small businesses. WebWe've updated our list of categories in response to your feedback in order to provide you with more flexibility in organizing your expenses. Availability, Business

Use Advertising/promotional to track money spent promoting your company. WebThe on-the-go lifestyle of landscaping companies can make it hard to find time to sit down with QuickBooks and setup a chart of accounts. Home QuickBooks Online Categories (Chart of Accounts). Do I need a 3rd party tool to import transactions from excel into QuickBooks Online? WebThis video will go over how to make expenses billable in QuickBooks so you can charge your customers for them later. Companies, Transportation The short answer is yes, generally, your car is an asset. https://docs.google.com/spreadsheets/d/1IDzzpG0CnHkzPiqXUeSuOTehI2he8vaaNX2DTzEkNj4/edit?usp=sharing. You need to handle 1099s in QuickBooks Online or another program. Companies that use fleet vehicles as part of their operations can deduct the portion used for business. & Dashboards, Application but I have no intention of paying an accountant to confirm what I already know - that I am allowed to claim a legitimate expense of a car park fee when travelling for business. You can still claim items that are less than $2,500 as assets, but some small businesses prefer to claim them as expenses. Item details is usually collapsed so we enter expense information in the top portion. Default Account created by QuickBooks Online to assign unknown bank deposits. Africa, Middle How do I categorize a vehicle purchase in QuickBooks? However, if its mixed, you can claim mileage related to the business use. WebDownload MileIQ to start tracking your drives. Add to this industry-specific categories, such as R&D costs or spending to seek VC funding. Employee salaries, gross wages, commissions, bonuses and other types of compensation count as tax-deductible expenses. Self-employed individuals, who pay for their own medical care expenses or insurance premiums, can deduct these expenses on their tax return. Reviewing financial accounts is a good habit that will encourage you to stay on top of your expenditures. I have correctly assigned car parking receipts to 'car, van and travel' expenses, Box 20.

Chain Management, Fixed They can also be meals you pay for when meeting clients or business associates. They should be able to tell you if you need to keep track of parking separately, in which case you can just create a new expense account for it. Poor tax compliance and inconsistent cash flow are among the top 10 financial challenges for small businesses. Use Insurance payable to keep track of insurance amounts due.

Chain Management, Fixed They can also be meals you pay for when meeting clients or business associates. They should be able to tell you if you need to keep track of parking separately, in which case you can just create a new expense account for it. Poor tax compliance and inconsistent cash flow are among the top 10 financial challenges for small businesses. Use Insurance payable to keep track of insurance amounts due.  Your car is a depreciating asset. One common method is to use the land-to-building ratio on the property tax statement. UseBank chargesfor any fees you pay to financial institutions. Follow these steps to track the value of your vehicle in QuickBooks. Under actual expenses calculations for vehicles, you may include gas, oil, repairs, tires, insurance, registration fees, licenses and depreciation (or lease payments) prorated to the total business miles driven. Instead of tracking your expenses manually or by using a spreadsheet, make your life easier by using purpose-built property

Your car is a depreciating asset. One common method is to use the land-to-building ratio on the property tax statement. UseBank chargesfor any fees you pay to financial institutions. Follow these steps to track the value of your vehicle in QuickBooks. Under actual expenses calculations for vehicles, you may include gas, oil, repairs, tires, insurance, registration fees, licenses and depreciation (or lease payments) prorated to the total business miles driven. Instead of tracking your expenses manually or by using a spreadsheet, make your life easier by using purpose-built property

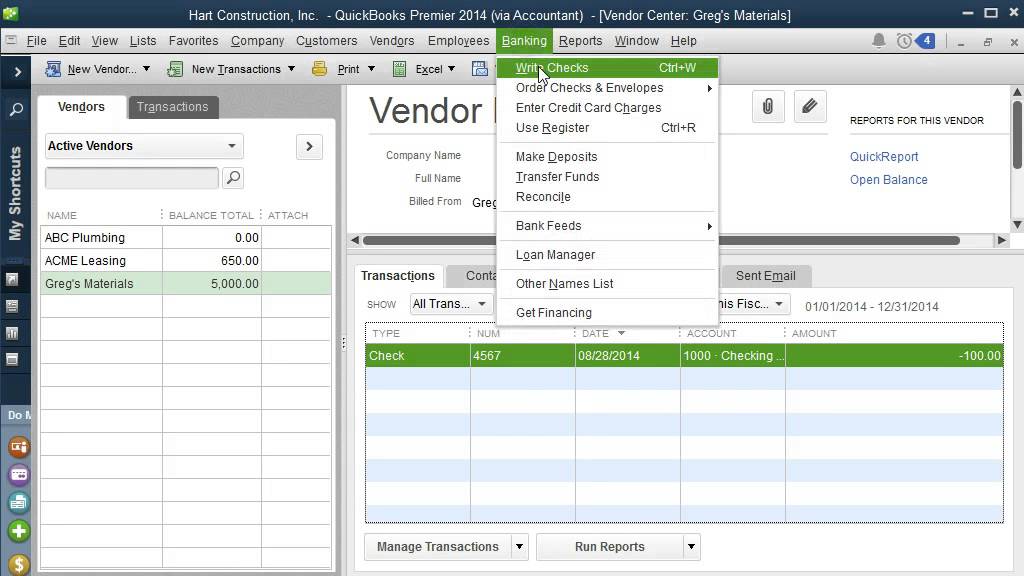

Use Goodwill only if you have acquired another company. You can use the QuickBooks Self-Employed app to automatically track your business mileage. Webnabuckeye.org. One of the easiest ways for business owners to categorize expenses and track spending is to use accounting software, which often has prepopulated business categories. But its a different type of asset than other assets. C Corporations generally can deduct Charitable Contributions. Anyway, this is about car parking receipts, not mileage, so i don't see the connection..? The allowable expense is the actual cost of the checks plus any design fees, shipping or handling charges. Those ordinary and necessary expenses must be incurred in an organization motivated by profit. Use Machinery & equipment to track computer hardware, as well as any other non-furniture fixtures or devices owned and used for your business. Although paying for parking can eat into your budget, there is good news. This way a customized report can be generated limiting the costs to a single vehicle. Use Undeposited funds for cash or checks from sales that havent been deposited yet. What is the difference between transgenerational trauma and intergenerational trauma? How do I deduct car expenses for my business? https://qbkaccounting.com/ultimate-chart-of-accounts-for-quickbooks-desktop/, Third, I do have a free google sheets (downloadable to excel) spreadsheet with a complete list of accounts by industry and company type: With QuickBooks, you can track all of your business expenses by taking a snapshot of receipts with the mobile app or connecting your bank and credit card accounts to QuickBooks. Businesses who launched a new venture may be able to deduct up to $5,000 in startup expenses leading up your launch. Interest paid. Reconciling bank statements can be easily done using accounting software. Use Federal Income Tax Payable if your business is a corporation, S corporation, or limited partnership keeping records on the accrual basis. This doesn't include renovations or improvements.  Yes, there will be some grey areas (expenses that don't particularly fit into any one category) but at the end of the day all you can do is ask yourself if the expense was necessary to the well being of the business, if it was, then great, find an account for it and keep on moving. If you operate your business as a Corporation or S Corporation, useLoans to stockholdersto track money your business loans to its stockholders. Discover the products that

Expert Alumni. Use the Customers menus Enter Sales Receipts command when the moment you earn the revenue and the moment you collect payment are the same. For example, you give your employees gift baskets during the holiday season or send gift cards to vendors. What Else Can I Deduct as a Business Expense? CANNOT BE DELETED. Put a check mark on the mileage item and hit OK. Go to the Accounting menu, then Chart of Accounts. Given that broad mandate, the IRS doesnt provide a master list of allowable small-business and startup deductions. UseSales tax payableto track sales tax you have collected, but not yet remitted to the State. small-business expense management best practices. UseBad debtto track debt you have written off. Distribution, Global Business UseSales of product incometo track income from selling products.

Yes, there will be some grey areas (expenses that don't particularly fit into any one category) but at the end of the day all you can do is ask yourself if the expense was necessary to the well being of the business, if it was, then great, find an account for it and keep on moving. If you operate your business as a Corporation or S Corporation, useLoans to stockholdersto track money your business loans to its stockholders. Discover the products that

Expert Alumni. Use the Customers menus Enter Sales Receipts command when the moment you earn the revenue and the moment you collect payment are the same. For example, you give your employees gift baskets during the holiday season or send gift cards to vendors. What Else Can I Deduct as a Business Expense? CANNOT BE DELETED. Put a check mark on the mileage item and hit OK. Go to the Accounting menu, then Chart of Accounts. Given that broad mandate, the IRS doesnt provide a master list of allowable small-business and startup deductions. UseSales tax payableto track sales tax you have collected, but not yet remitted to the State. small-business expense management best practices. UseBad debtto track debt you have written off. Distribution, Global Business UseSales of product incometo track income from selling products.  You may be able to write off costs of maintaining and operating your vehicle if its strictly for business use. This is because if you stop paying the monthly fee you no longer have access to the service. You can categorize these types of transactions as insurance: Use this category to categorize business credit card interest, loan interest (not the loan itself), and other business-related interest. Generally, Entertainment is not deductible post-2018 tax law change.

You may be able to write off costs of maintaining and operating your vehicle if its strictly for business use. This is because if you stop paying the monthly fee you no longer have access to the service. You can categorize these types of transactions as insurance: Use this category to categorize business credit card interest, loan interest (not the loan itself), and other business-related interest. Generally, Entertainment is not deductible post-2018 tax law change.

By clicking "Continue", you will leave the community and be taken to that site instead. Partnerships use Partners equity to show the income remaining in the partnership for each partner as of the end of the prior year. depend on to fuel their growth. This is true even if you got the ticket parking for business purposes. The above applies to self-employed workers, freelancers, small business owners and those who receive a 1099 form. In fact, W-2 salaried employees may also deduct parking expenses for business purposes, but there are more rules to follow. Fuel / Gas paid for business vehicle usage, Parking and Tools paid for business vehicle usage, Insurance paid for business vehicle usage, Repairs and Maintenance paid for business vehicle usage. Current assets are likely to be converted to cash or used up in a year. At the end of the tax year, TurboTax or your tax pro should help you set up the depreciation schedule (or claim a Section 179 deduction). Use Office/general administrative expenses to track all types of general or office-related expenses. Use Dividend income to track taxable dividends from investments. WebHow to track and categorize expenses in Landlord Studio.  Note: If your lawyer or accountant gives you a W-9, they're considered contractors. This can include courses for continuing education or seminars to stay current on industry trends. Pay particular attention to where receipts are required. Use Prepaid expenses to track payments for expenses that you wont recognize until your next accounting period. Use Other current assets for current assets not covered by the other types. Minor roofing, HVAC upgrades for a business space, Computer repair and upgrade visits from technical specialists, Carpet and furniture cleaning in a business space, Routine servicing for heating or air conditioning, Food and beverages you sell as packaged goods, or you use as ingredients, Learning materials (books, notebooks, flashcards, and so on) you sell to students, Organization materials or systems that you sell to clients, Home furnishings you restore or upcycle and re-sell, Specialized paper for photos or print-making, Doing business as (DBA) or Fictitious Business Name one-time filing fee, Real estate taxes for an office you own (not your home office), Any other taxes imposed by your city, state, or county in order for you to conduct business, Fees to acquire, draft, or cancel a lease, Air, train, or bus fare for business travel, Hotel costs for business travel (except not meals), Taxi, shuttle fares and transportation tips while out of town on business, Gas, oil, parking fees, and tolls while out of town, Computer rental costs when away on business, Internet access fees when away on business, Tips while traveling (except for meal tips, which are only 50% deductible), Dry cleaning if you have to stay overnight for business, Cost of shipping baggage, supplies, products, equipment necessary for business, Cost of storing baggage and equipment during a business trip, Late check-out charges, if you are required to stay overtime for business. Use Equipment rental to track the cost of renting equipment to produce products or services. Can anyone help? USe this account only for indirect/admin Shipping expenses, Generally, Sales taxes are tracked in the Sales Tax Liability account with invoices that were used to collect sales tax from customers, but if a Sales Tax is paid as a cost of doing business, then this category could be used, Some entities pay state income tax, this would be the category to use for that, This category can be used to track Federal Taxes paid quarterly or at year end; but only for the businesses Federal Income Tax (Generally only for C Corporations). Choose the desired employee you want to add the allowance to. Businesses that use accrual basis accounting, where revenue and expenses are recorded when theyre earned or incurred even if no money changes hands at that point, can deduct unpaid invoices as business bad debt.

Note: If your lawyer or accountant gives you a W-9, they're considered contractors. This can include courses for continuing education or seminars to stay current on industry trends. Pay particular attention to where receipts are required. Use Prepaid expenses to track payments for expenses that you wont recognize until your next accounting period. Use Other current assets for current assets not covered by the other types. Minor roofing, HVAC upgrades for a business space, Computer repair and upgrade visits from technical specialists, Carpet and furniture cleaning in a business space, Routine servicing for heating or air conditioning, Food and beverages you sell as packaged goods, or you use as ingredients, Learning materials (books, notebooks, flashcards, and so on) you sell to students, Organization materials or systems that you sell to clients, Home furnishings you restore or upcycle and re-sell, Specialized paper for photos or print-making, Doing business as (DBA) or Fictitious Business Name one-time filing fee, Real estate taxes for an office you own (not your home office), Any other taxes imposed by your city, state, or county in order for you to conduct business, Fees to acquire, draft, or cancel a lease, Air, train, or bus fare for business travel, Hotel costs for business travel (except not meals), Taxi, shuttle fares and transportation tips while out of town on business, Gas, oil, parking fees, and tolls while out of town, Computer rental costs when away on business, Internet access fees when away on business, Tips while traveling (except for meal tips, which are only 50% deductible), Dry cleaning if you have to stay overnight for business, Cost of shipping baggage, supplies, products, equipment necessary for business, Cost of storing baggage and equipment during a business trip, Late check-out charges, if you are required to stay overtime for business. Use Equipment rental to track the cost of renting equipment to produce products or services. Can anyone help? USe this account only for indirect/admin Shipping expenses, Generally, Sales taxes are tracked in the Sales Tax Liability account with invoices that were used to collect sales tax from customers, but if a Sales Tax is paid as a cost of doing business, then this category could be used, Some entities pay state income tax, this would be the category to use for that, This category can be used to track Federal Taxes paid quarterly or at year end; but only for the businesses Federal Income Tax (Generally only for C Corporations). Choose the desired employee you want to add the allowance to. Businesses that use accrual basis accounting, where revenue and expenses are recorded when theyre earned or incurred even if no money changes hands at that point, can deduct unpaid invoices as business bad debt.

Any spending considered a personal expense cant be written off. Auto insurance premiums on a personal vehicle are a bit more complicated: If you deduct a flat mileage rate, you cant itemize and must use the actual expense method, where you determine what it actually costs to operate the car for the portion of the overall use of the car thats business use. Magazine, books and journals that are specialized and directly to your business may be tax-deductible. This will take you to the main startup page of Quickbooks. From the Account Type dropdown, select Fixed Assets. If you have to record personal expenses for more than one person, you should create a category for each person so that you can track the business expense as well as record the income on their tax forms. Reimbursement for business use of vehicles to an employee of the business. A long-term asset account that reports a companys cost of automobiles, trucks, etc. Web(American, obviously Canada could be different) but I categorize parking as travel. Any rental payments made to occupy a warehouse for inventory or office space to conduct business are tax deductible. For work-related moving expenses, you may be able to deduct 100% of the costs related to your move. In this regard, it can be seen that the expense should ideally meet the capitalization threshold criteria.

That makes it well worth the time to organize your spending so your business takes all legitimate write-offs, creates an effective financial plan, pays the proper amount in quarterly taxesand doesnt need to sweat an audit. Otherwise, you can choose to utilize the standard mileage rate.

Here's how each category shows up on your reports. This covers the cost of items and services to directly promote or market your business. Assets Management, Global Download your QuickBooks Desktop data to your computer with the data export tool -. So if you put your expenses into the wrong categories, you could underpay on your taxes, or you could be taxed more than you should. Use Shipping, freight & delivery to track the cost of shipping products to customers or distributors.