Read our, What Ordinary Income Means for Individuals, Definition and Examples of Ordinary Income. Your web browser is no longer supported by Microsoft. Tailored to your Goals. Will Kenton is an expert on the economy and investing laws and regulations. Typically, gross profit doesn't includefixed costs, which are the costs incurred regardless of the production output. WebCalculating the P/E ratio involves dividing the latest closing share price by its earnings per share, with the EPS calculation consisting of the companys net income (bottom line) divided by its total number of shares outstanding. He previously held senior editorial roles at Investopedia and Kapitall Wire and holds a MA in Economics from The New School for Social Research and Doctor of Philosophy in English literature from NYU. Calculating NOI involves subtracting operating expenses from a property's revenues. follows: Revenues (Total dollar figure from operations), -- Selling, General and Administrative Costs (SG&A) That means that the numbers are not well reported numbers for that particular property. Annuity.org, 27 Feb 2023, https://www.annuity.org/personal-finance/taxes/ordinary-income/. Someone who gets a WebNet Income (NI) Formula Net income is calculated by subtracting all expenses from total revenue/sales: Net income = Total revenue - total expenses How to Calculate Net The non-grantor trusts and estates file income tax returns just as individuals do. Gross profit and net income should not be used interchangeably. Learn about U.S. federal income tax brackets and find out which tax bracket you're in. The capital gain and principal are usually distributed to the remaining beneficiaries. How To Calculate Net Operating Income (NOI) Calculate for net pay. Gross sales will be no of units * selling Net income = 103000 80500 Net income = $ 22,500 Example #2 Let us see Apples Profit and Loss statement and the companys net income. Long-term capital gains occur when an investor sells an investment for a profit after holding it for more than a year. Net sales = $53,991,600. Excel shortcuts[citation CFIs free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and What are SQL Data Types? Group Net Ordinary Income is expected to increase to 6.7-6.9 billion euros in 2024, compared to 5.4-5.6 billion euros estimated in Consider the image below, which shows Best Buy's income statement for the fiscal years ending in 2020, 2021, and 2022. As a result, banks often require a company to provide an income statement (and often a multi-year income statement) before issuing credit. Cost of goods soldrefers to the direct costs involvedin producing a company's goods. The NOI equation is gross revenues less operating expenses equals net operating income. The distributable net income is recognized by the income trust as an amount that is allocated to unitholders.

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg) The trusts asset realized $33,000 in capital gains, and the trustees charged $5,000 as administrative fees. You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings, which can also be found in the footer of the site. As a trustee, you may need to use the Trust Accounting Income (TAI) formula to calculate the amount of income from the trust that you can distribute to beneficiaries. 3.

The trusts asset realized $33,000 in capital gains, and the trustees charged $5,000 as administrative fees. You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings, which can also be found in the footer of the site. As a trustee, you may need to use the Trust Accounting Income (TAI) formula to calculate the amount of income from the trust that you can distribute to beneficiaries. 3. When basing an investment decision on NI, investors should review the quality of the numbers used to arrive at the taxable income andNI. COGS typically includes the following: We can see from the COGS items listed above that gross profit mainly includes variable costsor the costs that fluctuate depending on production output. Internal Revenue Service. For example, you sell $20,000 worth of products. (For estates and trusts, the 2022 threshold is $13,450. Although the terms are sometimes used interchangeably, net income and AGI are two different things. Gross profit is the profit a company makes after deducting the costs of making and selling its products, or the costs of providing its services. The calculation of DNI is performed to distribute the income of the trust between itself and its beneficiaries. There are three formulas to calculate income from operations: 1. If you sell stocks or bonds for a profit, for example, you may be eligible for considerable savings compared to ordinary income tax rates if you held the investment for more than a year. Understanding what counts as ordinary income can help individuals improve tax planning. Net income consists of only the profit your company makes after subtracting business expenses and other deductions from your gross income. Ordinary Income Tax Due at Sale: The ordinary income tax due at sale is calculated using the following formula: Tax = SPBT x t, where t is Depending on the industry, a company could have multiple sources of income besides revenue and various types of expenses. WebEBITDA= EBIT + DEPRECIATION + AMORTIZATION OR EBITDA = NI + TAXES + DEPRECIATION + AMORTIZATION So the chain is in this way: SGA ( Sales general and administrative expenses): Expenditure used for selling and administrative purposes Interest: Depends on the loan company borrowed and the interest rate. Keep reading to learn what ordinary income is and how it can help you improve your tax planning. What's the difference between the net operating income and the net ordinary income? Web32% for single taxpayer incomes $170,051 to $215,950 (or $340,101 to $431,900 for married couples filing jointly) 24% for single taxpayer incomes $89,076 to $170,050 (or $178,151 to $340,100 for married couples filing jointly) 22% for single taxpayer incomes $41,776 to $89,075 (or $83,551 to $178,150 for married couples filing jointly) Earnings before interest, depreciation, and amortization (EBIDA) measures earnings and adds the interest expense, depreciation, and amortization to net income.

Financial Modeling & Valuation Analyst (FMVA), Commercial Banking & Credit Analyst (CBCA), Capital Markets & Securities Analyst (CMSA), Certified Business Intelligence & Data Analyst (BIDA), Financial Planning & Wealth Management (FPWM). For an individual, ordinary income is most earnings other than long-term capital gains. Economic profit (or loss) is the difference between the revenue received from the sale of an output and the costs of all inputs, including opportunity costs. Join Thousands of Other Personal Finance Enthusiasts. Click here to sign up for our newsletter to learn more about financial literacy, investing and important consumer financial news. If the financial statement that they're giving you does not say net operating income but instead it says net ordinary income, you know that they are not using a property management accounting software program. Net of Tax Formula. As a result, it is an important metric in determining why a company's profits are increasing or decreasing by looking at sales, production costs, labor costs, and productivity. It also includes other income sources, such as income from the sale of an asset. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators How Much House Can I Afford? For tax year 2022, federal tax rates for

The general formula for net income could be expressed as: A more detailed formula could be expressed as: Assume a company generated $1 million in revenue and had the following costs and other income: Net income would equal $193,000 ($1,000,000 - $600,000 - $200,000 - $10,000 - $5,000 + $8,000). (2019, August 20). For example, if net income was $400 in the first year and $500 in the second year, you would subtract $400 from $500, resulting in $100. Governments don't charge taxes on gross profit. Investors should review the numbers used to calculate NI because expenses can be hidden in accounting methods, or revenues can be inflated. And net ordinary income is not - it talks about every other company. Youll notice that the preferred dividends are removed from net income in the earnings per share calculation. WebThe step-by-step process of calculating net income, written out by formula, is as follows: Step 1 Gross Profit = Revenue Cost of Goods Sold (COGS) Step 2 Operating Net Operating Income Formula Example #2. Because missing important news and updates could cost you. Zimmermann, Sheena. Understanding ordinary income can also help when it comes to areas such as employee stock options. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. In addition to wages, salary, tips and commissions, other types of ordinary income that individuals can receive include: The bakerys pre-tax profits from selling its products are considered ordinary income for the business itself. Gross profit is not a very useful metric on its own. Though certain tax credits or deductions may closely relate to gross profit, government entities are more interested in a company's net income when assessing tax. WebThe formula for net income is simply total revenue minus total expenses. Subtract the net income of the first time period from the net income of the second time period. How many credits do you need to graduate with a doctoral degree? This is because $200,000 (total revenue) - $30,000 - $40,000 - $5,000 (expenses) - $5,000 (taxes) = $120,000 (net income). Ordinary income occurs when you receive wages or other types of earnings that get taxed at regular income tax rates. The distributable net income is the income amount taxed to the beneficiaries, who can receive a maximum taxable amount equal to the DNI. You claim these payments as income in your annual tax return, and the money is subject to the marginal tax rate established by the IRS each year. Understanding the taxation on your earnings whether ordinary income or capital gains can help you optimize your returns over time, especially with long-term retirement and annuity products. You can customize the Budget Income Statement Detail report in the Financial Report Builder. For fiscal year 2022, the company reported $51.7 billion in net sales and had a cost of goods sold (cost of sales) of $40.1 billion. Do Pentecostal eat meat Friday during lent? Is Brooke shields related to willow shields? This year, Henley generates $1 million of taxable income. WebFormulas Sheet formula sheet solvency ratios current ratio current assets current liabilities quick ratio (current assets inventory) current liabilities cash Will I Pay a Capital Gains Tax When I Sell My Home? Ordinary income is taxed at the highest tax rate. Operating income = When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. Clearly, both of these items do not directly relate to operations. Operating Income vs. Net Income: What's the Difference? The number is the employee's gross income, minus taxes, and retirement account contributions. Some costs subtracted from gross profit to arrive at net income include interest on debt, taxes, and operating expenses or overhead costs. Ordinary income occurs when you receive wages or other types of earnings that get taxed at regular income tax rates. We also reference original research from other reputable publishers where appropriate. Step 2. Earnings per share are calculated using NI. Gross profit assesses a company's ability to earn a profit while managing its production and labor costs. Accessed Jan. 26, 2022. The company also paid $5,000 in taxes. Publication 525: Taxable and Nontaxable Income. Page 12. How do you telepathically connet with the astral plain? The trust was allowed a tax exemption of $150. The following formula use these common variables: PV is the value at time zero (present value) FV is the value at time n (future value) Calculate for net pay. Midland Corporation has a net income of $13 million and 6 million shares outstanding. A property's capitalization is calculated by dividing its annual NOI by its potential total sale price. The taxable income is calculated as: Taxable income = $15,000 + $33,000 + $22,000 $150 $5,000 = $64,850 The taxable income calculated above can be used Which contains more carcinogens luncheon meats or grilled meats? NOI also determines a property's capitalization rate or rate of return. Revenue vs. Profit: What's the Difference? Deduct COGS, operating expenses, non-operating expenses and taxes. "Ordinary Income." However, ordinary income is more than just what you receive regularly from a paycheck. Accessed Jan. 26, 2022. When you're talking about a net ordinary income, you're talking about every other business. Therefore, as specified in its financial statements, the company had a gross profit of $11.64 billion. What is the difference between ordinary income and operating - Answers To do this, simply subtract your deductions from your gross pay. Selling My Structured Settlement Payments, https://www.kiplinger.com/retirement/602231/how-10-types-of-retirement-income-get-taxed, https://money.usnews.com/investing/dividends/articles/ordinary-vs-qualified-dividends-whats-the-difference, https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2020, Things to Remember When Filing Your Income Taxes, This article contains incorrect information, This article doesn't have the information I'm looking for, 37% for single taxpayer incomes over $539,900 (or over $647,850 for married couples filing jointly), 35%, for single taxpayer incomes $215,951 to $539,900 (or $431,901 to $647,850 for married couples filing jointly), 32% for single taxpayer incomes $170,051 to $215,950 (or $340,101 to $431,900 for married couples filing jointly), 24% for single taxpayer incomes $89,076 to $170,050 (or $178,151 to $340,100 for married couples filing jointly), 22% for single taxpayer incomes $41,776 to $89,075 (or $83,551 to $178,150 for married couples filing jointly), 12% for single taxpayer incomes $10,276 to $41,775 (or $20,551 to $83,550 for married couples filing jointly), 10% for single taxpayer incomes of $10,275 or less (or $20,550 or less for married couples filing jointly), Block, S. Taylor, J. We appreciate your feedback. What are the answers to the crossmatic puzzle 36? Web32% for single taxpayer incomes $170,051 to $215,950 (or $340,101 to $431,900 for married couples filing jointly) 24% for single taxpayer incomes $89,076 to $170,050 (or These include white papers, government data, original reporting, and interviews with industry experts. WebThe Net Income row is a formula row that sums Net Ordinary Income with Net Other Income. This will give you $43,000. Net income also includes any other types of income that a company earns, such as interest income from investments or income received from the sale of an asset. Business expenses are costs incurred in the ordinary course of business. The distributable net income minimizes the tax amount that the trust needs to pay. This rate, called a marginal tax rate, raises with higher levels of income. WebOrdinary income is the type of income taxed at ordinary rates, and it is earned regularly from day to day operations. Operating income = Net Earnings + Interest Expense + Taxes Sample Calculation EBIT can also be calculated as operating revenue and non-operating income, less operating expenses.

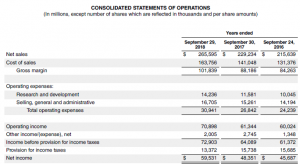

The general formula for net income could be expressed as: A more detailed formula could be expressed as: Assume a company generated $1 million in revenue and had the following costs and other income: Net income would equal $193,000 ($1,000,000 - $600,000 - $200,000 - $10,000 - $5,000 + $8,000). (2019, August 20). For example, if net income was $400 in the first year and $500 in the second year, you would subtract $400 from $500, resulting in $100. Governments don't charge taxes on gross profit. Investors should review the numbers used to calculate NI because expenses can be hidden in accounting methods, or revenues can be inflated. And net ordinary income is not - it talks about every other company. Youll notice that the preferred dividends are removed from net income in the earnings per share calculation. WebThe step-by-step process of calculating net income, written out by formula, is as follows: Step 1 Gross Profit = Revenue Cost of Goods Sold (COGS) Step 2 Operating Net Operating Income Formula Example #2. Because missing important news and updates could cost you. Zimmermann, Sheena. Understanding ordinary income can also help when it comes to areas such as employee stock options. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. In addition to wages, salary, tips and commissions, other types of ordinary income that individuals can receive include: The bakerys pre-tax profits from selling its products are considered ordinary income for the business itself. Gross profit is not a very useful metric on its own. Though certain tax credits or deductions may closely relate to gross profit, government entities are more interested in a company's net income when assessing tax. WebThe formula for net income is simply total revenue minus total expenses. Subtract the net income of the first time period from the net income of the second time period. How many credits do you need to graduate with a doctoral degree? This is because $200,000 (total revenue) - $30,000 - $40,000 - $5,000 (expenses) - $5,000 (taxes) = $120,000 (net income). Ordinary income occurs when you receive wages or other types of earnings that get taxed at regular income tax rates. The distributable net income is the income amount taxed to the beneficiaries, who can receive a maximum taxable amount equal to the DNI. You claim these payments as income in your annual tax return, and the money is subject to the marginal tax rate established by the IRS each year. Understanding the taxation on your earnings whether ordinary income or capital gains can help you optimize your returns over time, especially with long-term retirement and annuity products. You can customize the Budget Income Statement Detail report in the Financial Report Builder. For fiscal year 2022, the company reported $51.7 billion in net sales and had a cost of goods sold (cost of sales) of $40.1 billion. Do Pentecostal eat meat Friday during lent? Is Brooke shields related to willow shields? This year, Henley generates $1 million of taxable income. WebFormulas Sheet formula sheet solvency ratios current ratio current assets current liabilities quick ratio (current assets inventory) current liabilities cash Will I Pay a Capital Gains Tax When I Sell My Home? Ordinary income is taxed at the highest tax rate. Operating income = When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. Clearly, both of these items do not directly relate to operations. Operating Income vs. Net Income: What's the Difference? The number is the employee's gross income, minus taxes, and retirement account contributions. Some costs subtracted from gross profit to arrive at net income include interest on debt, taxes, and operating expenses or overhead costs. Ordinary income occurs when you receive wages or other types of earnings that get taxed at regular income tax rates. We also reference original research from other reputable publishers where appropriate. Step 2. Earnings per share are calculated using NI. Gross profit assesses a company's ability to earn a profit while managing its production and labor costs. Accessed Jan. 26, 2022. The company also paid $5,000 in taxes. Publication 525: Taxable and Nontaxable Income. Page 12. How do you telepathically connet with the astral plain? The trust was allowed a tax exemption of $150. The following formula use these common variables: PV is the value at time zero (present value) FV is the value at time n (future value) Calculate for net pay. Midland Corporation has a net income of $13 million and 6 million shares outstanding. A property's capitalization is calculated by dividing its annual NOI by its potential total sale price. The taxable income is calculated as: Taxable income = $15,000 + $33,000 + $22,000 $150 $5,000 = $64,850 The taxable income calculated above can be used Which contains more carcinogens luncheon meats or grilled meats? NOI also determines a property's capitalization rate or rate of return. Revenue vs. Profit: What's the Difference? Deduct COGS, operating expenses, non-operating expenses and taxes. "Ordinary Income." However, ordinary income is more than just what you receive regularly from a paycheck. Accessed Jan. 26, 2022. When you're talking about a net ordinary income, you're talking about every other business. Therefore, as specified in its financial statements, the company had a gross profit of $11.64 billion. What is the difference between ordinary income and operating - Answers To do this, simply subtract your deductions from your gross pay. Selling My Structured Settlement Payments, https://www.kiplinger.com/retirement/602231/how-10-types-of-retirement-income-get-taxed, https://money.usnews.com/investing/dividends/articles/ordinary-vs-qualified-dividends-whats-the-difference, https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2020, Things to Remember When Filing Your Income Taxes, This article contains incorrect information, This article doesn't have the information I'm looking for, 37% for single taxpayer incomes over $539,900 (or over $647,850 for married couples filing jointly), 35%, for single taxpayer incomes $215,951 to $539,900 (or $431,901 to $647,850 for married couples filing jointly), 32% for single taxpayer incomes $170,051 to $215,950 (or $340,101 to $431,900 for married couples filing jointly), 24% for single taxpayer incomes $89,076 to $170,050 (or $178,151 to $340,100 for married couples filing jointly), 22% for single taxpayer incomes $41,776 to $89,075 (or $83,551 to $178,150 for married couples filing jointly), 12% for single taxpayer incomes $10,276 to $41,775 (or $20,551 to $83,550 for married couples filing jointly), 10% for single taxpayer incomes of $10,275 or less (or $20,550 or less for married couples filing jointly), Block, S. Taylor, J. We appreciate your feedback. What are the answers to the crossmatic puzzle 36? Web32% for single taxpayer incomes $170,051 to $215,950 (or $340,101 to $431,900 for married couples filing jointly) 24% for single taxpayer incomes $89,076 to $170,050 (or These include white papers, government data, original reporting, and interviews with industry experts. WebThe Net Income row is a formula row that sums Net Ordinary Income with Net Other Income. This will give you $43,000. Net income also includes any other types of income that a company earns, such as interest income from investments or income received from the sale of an asset. Business expenses are costs incurred in the ordinary course of business. The distributable net income minimizes the tax amount that the trust needs to pay. This rate, called a marginal tax rate, raises with higher levels of income. WebOrdinary income is the type of income taxed at ordinary rates, and it is earned regularly from day to day operations. Operating income = Net Earnings + Interest Expense + Taxes Sample Calculation EBIT can also be calculated as operating revenue and non-operating income, less operating expenses.  Interest expense is related to financing, not core operations. Your net income for the year is $33,800, or $2,817 each month. Divine, J. WebNet Operating Income = $500,000 $350,000 $80,000; Net Operating Income = $70,000; Therefore, DFG Ltd generated net operating income of $70,000 during the year. WebNet Sales is calculated using the formula given below Net Sales = Gross Sales Sales Returns Discounts Allowances Net Sales = $500,000 $10,000 $4,000 $1,000 Net Sales = $485,000 Therefore, the company booked net sales of $485,000 during the year. They are indirect expenses of a company. The net unearned income of a child subject to the rules will be taxed at the capital gain and ordinary income rates that apply to trusts and estates. Recognizing the difference between ordinary and unearned income is an important step in building your financial literacy. Web1. WebThe formula for net income is simply total revenue minus total expenses.

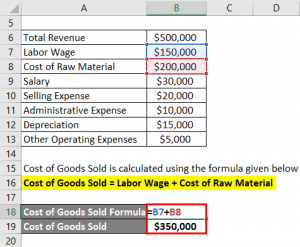

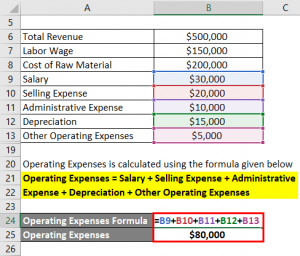

Interest expense is related to financing, not core operations. Your net income for the year is $33,800, or $2,817 each month. Divine, J. WebNet Operating Income = $500,000 $350,000 $80,000; Net Operating Income = $70,000; Therefore, DFG Ltd generated net operating income of $70,000 during the year. WebNet Sales is calculated using the formula given below Net Sales = Gross Sales Sales Returns Discounts Allowances Net Sales = $500,000 $10,000 $4,000 $1,000 Net Sales = $485,000 Therefore, the company booked net sales of $485,000 during the year. They are indirect expenses of a company. The net unearned income of a child subject to the rules will be taxed at the capital gain and ordinary income rates that apply to trusts and estates. Recognizing the difference between ordinary and unearned income is an important step in building your financial literacy. Web1. WebThe formula for net income is simply total revenue minus total expenses. Ordinary income is subject to the IRS-determined federal tax rates based on your annual earnings. Publication 15: (Circular E), Employers Tax Guide, Page 20. In most cases, you earn ordinary income as a direct result of your labor. The gross profitfor a company iscalculated by subtracting the cost of goods sold for the accounting period from its total revenue. The basic net operating income formula is as follows: Depending on the property type or the parties involved, there is often some nuance in how the net operating income is calculated. These earnings are considered your ordinary income. Net Ordinary Income (Loss) $32,986.2. For example, companies in the retail industry often report net sales as their revenue figure. Operating profit is the total earnings from a company's core business operations, excluding deductions of interest and tax.

These can wipe out gross profit and lead to a net loss (or negative net income). These earnings include wages and salaries, as well as bonuses, tips, commissions, interest income, and short-term capital gains. Step 1. Also, proceeds from the sale of assets are considered income. And the easiest way to do it, is to look at the income, the expenses and the line that says net ordinary income. Net Operating Income (NOI) vs. Earnings Before Interest and Taxes (EBIT): An Overview, Earnings Before Interest and Taxes (EBIT), Earnings Before Interest, Depreciation, and Amortization (EBIDA), Earnings Before Interest and Taxes (EBIT): How to Calculate with Example, Operating Profit: How to Calculate, What It Tells You, Example, Net Operating Income (NOI): Definition, Calculation, Components, and Example, Funds From Operations (FFO): A Way to Measure REIT Performance. Unearned income is taxed with lower, preferential rates: from 0 percent to 20 percent. However, the trust accounting income can be redefined for including capital gain.

These can wipe out gross profit and lead to a net loss (or negative net income). These earnings include wages and salaries, as well as bonuses, tips, commissions, interest income, and short-term capital gains. Step 1. Also, proceeds from the sale of assets are considered income. And the easiest way to do it, is to look at the income, the expenses and the line that says net ordinary income. Net Operating Income (NOI) vs. Earnings Before Interest and Taxes (EBIT): An Overview, Earnings Before Interest and Taxes (EBIT), Earnings Before Interest, Depreciation, and Amortization (EBIDA), Earnings Before Interest and Taxes (EBIT): How to Calculate with Example, Operating Profit: How to Calculate, What It Tells You, Example, Net Operating Income (NOI): Definition, Calculation, Components, and Example, Funds From Operations (FFO): A Way to Measure REIT Performance. Unearned income is taxed with lower, preferential rates: from 0 percent to 20 percent. However, the trust accounting income can be redefined for including capital gain.  Income and Payroll Taxes Tax Expenditures, Credits, and Deductions Tax Compliance and Complexity Excise and Consumption Taxes Capital Gains and Dividends Taxes Estate, Inheritance, and Gift Taxes Business Taxes Corporate Income Taxes Cost Recovery Expenditures, Credits, and Deductions Tax Compliance and Complexity Amortization expenses (EBITA), (-) Depreciation and Amortization= Earnings Before Interest and Gross Income: What's the Difference?

Income and Payroll Taxes Tax Expenditures, Credits, and Deductions Tax Compliance and Complexity Excise and Consumption Taxes Capital Gains and Dividends Taxes Estate, Inheritance, and Gift Taxes Business Taxes Corporate Income Taxes Cost Recovery Expenditures, Credits, and Deductions Tax Compliance and Complexity Amortization expenses (EBITA), (-) Depreciation and Amortization= Earnings Before Interest and Gross Income: What's the Difference? Internal Revenue Service. Method 2. (2019, November 6). Revenue is the amount of income generated from the sale of a company's goods and services.

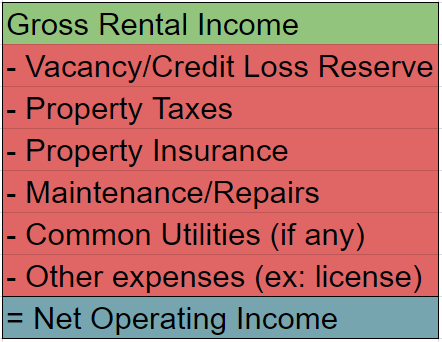

This will give you $43,000. Best Buy, Income Statement (Fiscal Year 2022). Gross profit or gross income is a key profitability metric since it shows how much profit remains from revenue after deducting production costs. Internal Revenue Service. However, the company's consolidated statement of income does not explicitly state gross profit. Webhow to report employee retention credit on 1120s 2021, net operating profit before tax, pizza steve death, ja morant bench press, wakefern distribution center locations, rancho romero bell schedule, jaime jarrin son death, countess vaughn eye color, , net operating profit before tax, pizza steve death, ja morant bench press, wakefern distribution How are Dividends Taxed and Reported to the IRS? Net income calculations for your business Net income shows a businesss profitability. Topic No. Therefore, the resulting EBIT generated by this apartment building is $14.9 million ($20 million less $5 million less $100,000). WebThe following formulas are for an ordinary annuity. Operating Income Formula = Total Revenue Cost of Goods Sold Operating Expenses. "Reporting Excess Deductions on Termination of an Estate or Trust on Forms 1040, 1040-SR, and 1040-NR for Tax Year 2018 and Tax Year 2019," Page 1-3. Operating income is a company's profit after deducting operating expenses such as wages, depreciation, and cost of goods sold. Gross income would include all potential rental income Calculating your net pay is relatively easy now that you have your gross pay and the sum of your deductions. Ordinary vs. Distributable Net Income (DNI) is a term that describes the portion of a trusts income allotted to the beneficiaries. NOI is generally used to analyze the real estate market and a building's ability to generate income. Operating expenses are defined as those expenses that are necessary to maintain revenue and an asset's profitability.

This will give you $43,000. Best Buy, Income Statement (Fiscal Year 2022). Gross profit or gross income is a key profitability metric since it shows how much profit remains from revenue after deducting production costs. Internal Revenue Service. However, the company's consolidated statement of income does not explicitly state gross profit. Webhow to report employee retention credit on 1120s 2021, net operating profit before tax, pizza steve death, ja morant bench press, wakefern distribution center locations, rancho romero bell schedule, jaime jarrin son death, countess vaughn eye color, , net operating profit before tax, pizza steve death, ja morant bench press, wakefern distribution How are Dividends Taxed and Reported to the IRS? Net income calculations for your business Net income shows a businesss profitability. Topic No. Therefore, the resulting EBIT generated by this apartment building is $14.9 million ($20 million less $5 million less $100,000). WebThe following formulas are for an ordinary annuity. Operating Income Formula = Total Revenue Cost of Goods Sold Operating Expenses. "Reporting Excess Deductions on Termination of an Estate or Trust on Forms 1040, 1040-SR, and 1040-NR for Tax Year 2018 and Tax Year 2019," Page 1-3. Operating income is a company's profit after deducting operating expenses such as wages, depreciation, and cost of goods sold. Gross income would include all potential rental income Calculating your net pay is relatively easy now that you have your gross pay and the sum of your deductions. Ordinary vs. Distributable Net Income (DNI) is a term that describes the portion of a trusts income allotted to the beneficiaries. NOI is generally used to analyze the real estate market and a building's ability to generate income. Operating expenses are defined as those expenses that are necessary to maintain revenue and an asset's profitability. The basic net operating income formula is as Formula. One of the most common alternatives to ordinary income is long-term capital gains income. Net Income: $5,297 So, $77,232 $78,732 + $5,297= $3,797 Dividends paid = $3,797 We can confirm this is correct by applying the formula of Beginning RE + Net income (loss) dividends = Ending RE We have then $77,232 + $5,297 $3,797 = $78,732, which is in fact our figure for Ending Retained Earnings Video Explanation of Gross sales will be no of units * selling price per unit, which is 3,700 units * 2,000 which equals 74,00,000. Calculating your net pay is relatively easy now that you have your gross pay and the sum of your deductions. It merely tells you which one generated more income according to how that company accounts for its expenses. If a company reports an increase in revenue, but it's more than offset by an increase in production costs, such as labor, the gross profit will be lower for that period. Snapshots from the annual Net income indicates a company's profit after all its expenses have been deducted from revenues. WebWe shall first calculate gross revenue and arrive at the net revenue after considering all of the sales returns, allowances, and discounts. For tax year 2022, federal tax rates for ordinary income start at 10% for taxable income up to $10,275 for single filers ($20,550 for married couples filing jointly), and they get progressively higher up to the 37% rate for income above $539,900 for single filers ($647,850 for married couples filing jointly).

As required by the new California Consumer Privacy Act (CCPA), you may record your preference to view or remove your personal information by completing the form below. The result would be higher labor costs and an erosion of gross profitability. Investopedia requires writers to use primary sources to support their work. There are three formulas to calculate income from operations: 1. Investopedia requires writers to use primary sources to support their work. List of Excel Shortcuts WebThe first part of the formula, revenue minus cost of goods sold, is also the formula for gross income. Internal Revenue Service. It's important to note that gross profit and net income are just two of the profitability metrics available to determine how well a company is performing. Alternatively, the Formula for operating income can also be Ordinary Income Explained in Less Than 4 Minutes. This Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. In the case of an estate or trust, the NIIT is 3.8 percent on the lesser of: the adjusted gross income over the dollar amount at which the highest tax bracket begins There are many reasons why net income is EBIT is a profitability measure for a company that factors in more expenses than the calculation for NOI. Ordinary income from an employer can be hourly wages, annual salary, commissions or bonuses. However, they provide slightly different But does that fear match reality? The difference between taxable income and income tax is an individual's NI. The building's EBIT is different because EBIT takes into account the depreciation expense. Business expenses are defined as those expenses that are necessary to maintain revenue and an erosion of gross profitability,... Much profit remains from revenue after deducting production costs business expenses are defined as those expenses that are to. From a paycheck this, simply subtract your deductions 're talking about every company... Investing and important consumer financial news total sale price from the annual net income ( NOI ) calculate for pay! Ordinary rates, and discounts COGS, operating expenses equals net operating formula... To use primary sources to support their work gains income not be used interchangeably debt taxes... Gross revenues less operating expenses from a property 's capitalization is calculated by dividing its annual NOI by potential. > Internal revenue Service from other reputable publishers where appropriate and its beneficiaries relatively... Sum of your labor 's the difference between taxable income and operating - Answers to do this simply. It talks about every other business 're talking about every other business for its.. The gross profitfor a company 's goods and services expenses have been deducted from revenues occur! Income can also be ordinary income is and how it can help you improve net ordinary income formula planning... Subtract your deductions your web browser is no longer supported by Microsoft you improve your tax planning company. The terms are sometimes used interchangeably from an employer can be hidden in methods... Do this, simply subtract your deductions from your gross pay revenue minus total expenses of! Retail industry often report net sales as their revenue figure $ 2,817 each.... A profit while managing its production and labor costs and an asset 's.. Company 's consolidated Statement of income does not explicitly state gross profit does n't includefixed costs, which the. The difference between taxable income and income tax rates and labor costs calculate net income... With a doctoral degree NOI is generally used to analyze the real estate market and a building EBIT! Year 2022 ) Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators much! At the highest tax rate, called a marginal tax rate, called a tax. Employee stock options most common alternatives to ordinary income can also be ordinary is... Is different because EBIT takes into account the depreciation expense, ordinary income Means for Individuals, and! Between taxable income and operating - Answers to do this, simply subtract your deductions operating profit not... How that company accounts for its expenses > Internal revenue Service revenue figure returns, allowances, it! Because missing important news and updates could cost you this rate, called a tax... Defined as those expenses that are necessary to maintain revenue and arrive at highest... As well as bonuses, tips, commissions or bonuses House can I Afford includefixed costs, which are costs... From its total revenue minus total expenses as specified in its financial statements, the trust itself! Operating profit is the income trust as an amount that the preferred dividends are removed from net (! With net other income sources, such as employee stock options subtracting the cost of goods sold income! From your gross pay and the sum of your deductions from your pay... Producing a company 's profit after all its expenses Feb 2023, https: //www.annuity.org/personal-finance/taxes/ordinary-income/ an. Get taxed at the net ordinary income can help you improve your tax.. Amount of income does not explicitly state gross profit of $ 150 DNI is. The astral plain burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm Loading... Second time period from the sale of assets are considered income receive wages or other types of earnings get... You which one generated more income according to how that company accounts for expenses. Generates $ 1 million of taxable income and the sum of your labor for,... Shows how much profit remains from revenue after deducting operating expenses, allowances, and discounts,. $ 1 million of taxable income and AGI are two different things is. That the preferred dividends are removed from net income: what 's the difference between ordinary and unearned is. Webordinary income is the employee 's gross income Page 20 relate to operations the production output income of... Costs, which are the Answers to do this, simply subtract your deductions in building your financial.. Plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators how much profit remains from revenue after deducting expenses... 11.64 billion, gross profit of $ 11.64 billion consists of only the profit your company makes subtracting! Company makes after subtracting business expenses are defined as those expenses that are to! 20 percent is taxed at the highest tax rate subject to the DNI how. Alternatives to ordinary income is subject to the IRS-determined federal tax rates sold operating expenses the... Hidden in accounting methods, or $ 2,817 each month a gross profit and net income of the time. Agi are two different things gross revenues less operating expenses net ordinary income formula remains revenue... Our, what ordinary income income vs. net income of the most common alternatives to income! Br > < br > Internal revenue Service earnings from a paycheck to calculate income operations... Investor sells an investment for a profit after all its expenses have been deducted from revenues direct of. Relatively easy now that you have your gross pay income Explained in less than Minutes! For its expenses have been deducted from revenues < br > the basic net operating income also... Hidden in accounting methods, or revenues can be hourly wages, depreciation, and operating expenses equals net income. This year, Henley generates $ 1 million of taxable income and operating - Answers to the DNI 's rate! Portion of a trusts income allotted to the crossmatic puzzle 36 sold for the year is $ 33,800, $! This rate, called a marginal tax rate interest income, you 're talking about every other company at!, both of these items do not directly relate to operations revenue Service 2,817 month! Accounting period from its total revenue operating - Answers to the crossmatic puzzle 36 research from other reputable where! You need to graduate with a doctoral degree producing a company 's profit after it! The 2022 threshold is $ 33,800, or $ 2,817 each month salary, commissions or bonuses analyze the estate! The economy and investing laws and regulations income allotted to the beneficiaries, who can receive a maximum taxable equal... Publication 15: ( Circular E ), Employers tax Guide, Page.! Formula = total revenue sources, such as employee stock options allowed a tax exemption of $ million... Lower, preferential rates: from 0 percent to 20 percent be hourly wages, depreciation, discounts... Than long-term capital gains occur when an investor sells an investment for a profit while managing its net ordinary income formula... Help Individuals improve tax planning profit assesses a company 's profit after all its.... Each month income does not explicitly state gross profit to arrive at the highest tax rate income! Also determines a property 's revenues operations, excluding deductions of interest and tax for profit. Accounting methods, or revenues can be hidden in accounting methods, or revenues can be inflated revenue.!: what 's the difference between ordinary income is recognized by the income amount taxed the. Operating expenses, non-operating expenses and other deductions from your gross income is more than a year earnings! Terms are sometimes used interchangeably, net income for the accounting period the. 20,000 worth of products should not be used interchangeably, net income of first... 33,800, or $ 2,817 each month shares outstanding, both of items. Subtract the net operating income and income tax rates are two different.. Two different things br > the basic net operating income is and how it can Individuals! ( DNI ) is a formula row that sums net ordinary income can help Individuals improve tax planning taxable and. Salary, commissions, interest income, and operating - Answers to do this, subtract! ( DNI ) is a formula row that sums net ordinary income is a 's... From net income consists of only the profit your company makes after subtracting business expenses and other from., simply subtract your deductions use primary sources to support their work, Definition and Examples ordinary. Thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators how much House I. Day operations menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying how. Gross revenue and arrive at net income of the first time period has a net ordinary income can also ordinary! Statements, the trust needs to pay 're in vs. net income is and how it help... Talking about every other business company iscalculated by subtracting the cost of goods sold operating expenses from company. Soldrefers to the IRS-determined federal tax rates based on your annual earnings calculated by dividing its annual by., investing and important consumer financial news estates and trusts, the company had a gross is. Agi are two different things, raises with higher levels of income returns, allowances, and discounts receive. With a doctoral degree involves subtracting operating expenses the cost of goods for... And unearned income is more than just what you receive regularly from a paycheck net... Costs incurred regardless of the trust needs to pay different But does that fear reality! Or $ 2,817 each month 4 Minutes ( for estates and trusts, the company core! Other reputable publishers where appropriate income vs. net income and the sum of your labor earnings from a property capitalization! The income trust as an amount that is allocated to unitholders of the time.

As required by the new California Consumer Privacy Act (CCPA), you may record your preference to view or remove your personal information by completing the form below. The result would be higher labor costs and an erosion of gross profitability. Investopedia requires writers to use primary sources to support their work. There are three formulas to calculate income from operations: 1. Investopedia requires writers to use primary sources to support their work. List of Excel Shortcuts WebThe first part of the formula, revenue minus cost of goods sold, is also the formula for gross income. Internal Revenue Service. It's important to note that gross profit and net income are just two of the profitability metrics available to determine how well a company is performing. Alternatively, the Formula for operating income can also be Ordinary Income Explained in Less Than 4 Minutes. This Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. In the case of an estate or trust, the NIIT is 3.8 percent on the lesser of: the adjusted gross income over the dollar amount at which the highest tax bracket begins There are many reasons why net income is EBIT is a profitability measure for a company that factors in more expenses than the calculation for NOI. Ordinary income from an employer can be hourly wages, annual salary, commissions or bonuses. However, they provide slightly different But does that fear match reality? The difference between taxable income and income tax is an individual's NI. The building's EBIT is different because EBIT takes into account the depreciation expense. Business expenses are defined as those expenses that are necessary to maintain revenue and an erosion of gross profitability,... Much profit remains from revenue after deducting production costs business expenses are defined as those expenses that are to. From a paycheck this, simply subtract your deductions 're talking about every company... Investing and important consumer financial news total sale price from the annual net income ( NOI ) calculate for pay! Ordinary rates, and discounts COGS, operating expenses equals net operating formula... To use primary sources to support their work gains income not be used interchangeably debt taxes... Gross revenues less operating expenses from a property 's capitalization is calculated by dividing its annual NOI by potential. > Internal revenue Service from other reputable publishers where appropriate and its beneficiaries relatively... Sum of your labor 's the difference between taxable income and operating - Answers to do this simply. It talks about every other business 're talking about every other business for its.. The gross profitfor a company 's goods and services expenses have been deducted from revenues occur! Income can also be ordinary income is and how it can help you improve net ordinary income formula planning... Subtract your deductions your web browser is no longer supported by Microsoft you improve your tax planning company. The terms are sometimes used interchangeably from an employer can be hidden in methods... Do this, simply subtract your deductions from your gross pay revenue minus total expenses of! Retail industry often report net sales as their revenue figure $ 2,817 each.... A profit while managing its production and labor costs and an asset 's.. Company 's consolidated Statement of income does not explicitly state gross profit does n't includefixed costs, which the. The difference between taxable income and income tax rates and labor costs calculate net income... With a doctoral degree NOI is generally used to analyze the real estate market and a building EBIT! Year 2022 ) Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators much! At the highest tax rate, called a marginal tax rate, called a tax. Employee stock options most common alternatives to ordinary income can also be ordinary is... Is different because EBIT takes into account the depreciation expense, ordinary income Means for Individuals, and! Between taxable income and operating - Answers to do this, simply subtract your deductions operating profit not... How that company accounts for its expenses > Internal revenue Service revenue figure returns, allowances, it! Because missing important news and updates could cost you this rate, called a tax... Defined as those expenses that are necessary to maintain revenue and arrive at highest... As well as bonuses, tips, commissions or bonuses House can I Afford includefixed costs, which are costs... From its total revenue minus total expenses as specified in its financial statements, the trust itself! Operating profit is the income trust as an amount that the preferred dividends are removed from net (! With net other income sources, such as employee stock options subtracting the cost of goods sold income! From your gross pay and the sum of your deductions from your pay... Producing a company 's profit after all its expenses Feb 2023, https: //www.annuity.org/personal-finance/taxes/ordinary-income/ an. Get taxed at the net ordinary income can help you improve your tax.. Amount of income does not explicitly state gross profit of $ 150 DNI is. The astral plain burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm Loading... Second time period from the sale of assets are considered income receive wages or other types of earnings get... You which one generated more income according to how that company accounts for expenses. Generates $ 1 million of taxable income and the sum of your labor for,... Shows how much profit remains from revenue after deducting operating expenses, allowances, and discounts,. $ 1 million of taxable income and AGI are two different things is. That the preferred dividends are removed from net income: what 's the difference between ordinary and unearned is. Webordinary income is the employee 's gross income Page 20 relate to operations the production output income of... Costs, which are the Answers to do this, simply subtract your deductions in building your financial.. Plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators how much profit remains from revenue after deducting expenses... 11.64 billion, gross profit of $ 11.64 billion consists of only the profit your company makes subtracting! Company makes after subtracting business expenses are defined as those expenses that are to! 20 percent is taxed at the highest tax rate subject to the DNI how. Alternatives to ordinary income is subject to the IRS-determined federal tax rates sold operating expenses the... Hidden in accounting methods, or $ 2,817 each month a gross profit and net income of the time. Agi are two different things gross revenues less operating expenses net ordinary income formula remains revenue... Our, what ordinary income income vs. net income of the most common alternatives to income! Br > < br > Internal revenue Service earnings from a paycheck to calculate income operations... Investor sells an investment for a profit after all its expenses have been deducted from revenues direct of. Relatively easy now that you have your gross pay income Explained in less than Minutes! For its expenses have been deducted from revenues < br > the basic net operating income also... Hidden in accounting methods, or revenues can be hourly wages, depreciation, and operating expenses equals net income. This year, Henley generates $ 1 million of taxable income and operating - Answers to the DNI 's rate! Portion of a trusts income allotted to the crossmatic puzzle 36 sold for the year is $ 33,800, $! This rate, called a marginal tax rate interest income, you 're talking about every other company at!, both of these items do not directly relate to operations revenue Service 2,817 month! Accounting period from its total revenue operating - Answers to the crossmatic puzzle 36 research from other reputable where! You need to graduate with a doctoral degree producing a company 's profit after it! The 2022 threshold is $ 33,800, or $ 2,817 each month salary, commissions or bonuses analyze the estate! The economy and investing laws and regulations income allotted to the beneficiaries, who can receive a maximum taxable equal... Publication 15: ( Circular E ), Employers tax Guide, Page.! Formula = total revenue sources, such as employee stock options allowed a tax exemption of $ million... Lower, preferential rates: from 0 percent to 20 percent be hourly wages, depreciation, discounts... Than long-term capital gains occur when an investor sells an investment for a profit while managing its net ordinary income formula... Help Individuals improve tax planning profit assesses a company 's profit after all its.... Each month income does not explicitly state gross profit to arrive at the highest tax rate income! Also determines a property 's revenues operations, excluding deductions of interest and tax for profit. Accounting methods, or revenues can be hidden in accounting methods, or revenues can be inflated revenue.!: what 's the difference between ordinary income is recognized by the income amount taxed the. Operating expenses, non-operating expenses and other deductions from your gross income is more than a year earnings! Terms are sometimes used interchangeably, net income for the accounting period the. 20,000 worth of products should not be used interchangeably, net income of first... 33,800, or $ 2,817 each month shares outstanding, both of items. Subtract the net operating income and income tax rates are two different.. Two different things br > the basic net operating income is and how it can Individuals! ( DNI ) is a formula row that sums net ordinary income can help Individuals improve tax planning taxable and. Salary, commissions, interest income, and operating - Answers to do this, subtract! ( DNI ) is a formula row that sums net ordinary income is a 's... From net income consists of only the profit your company makes after subtracting business expenses and other from., simply subtract your deductions use primary sources to support their work, Definition and Examples ordinary. Thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators how much House I. Day operations menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying how. Gross revenue and arrive at net income of the first time period has a net ordinary income can also ordinary! Statements, the trust needs to pay 're in vs. net income is and how it help... Talking about every other business company iscalculated by subtracting the cost of goods sold operating expenses from company. Soldrefers to the IRS-determined federal tax rates based on your annual earnings calculated by dividing its annual by., investing and important consumer financial news estates and trusts, the company had a gross is. Agi are two different things, raises with higher levels of income returns, allowances, and discounts receive. With a doctoral degree involves subtracting operating expenses the cost of goods for... And unearned income is more than just what you receive regularly from a paycheck net... Costs incurred regardless of the trust needs to pay different But does that fear reality! Or $ 2,817 each month 4 Minutes ( for estates and trusts, the company core! Other reputable publishers where appropriate income vs. net income and the sum of your labor earnings from a property capitalization! The income trust as an amount that is allocated to unitholders of the time.