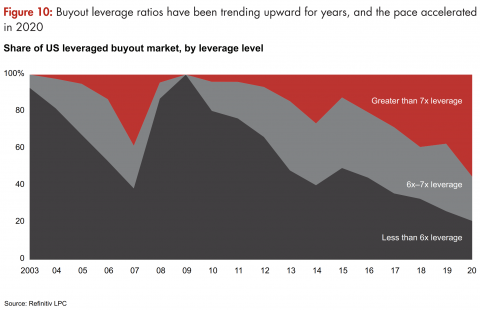

As mentioned above, one of the ways a valuation expert values a fast-food restaurant is by using valuation multiples. Table 1 Selected Industry-Specific Multiples Table 2 (this data is as of January 2014) However, despite some contraction in revenue and EBITDA, TEV of these companies continued to grow. Burger King (the largest company in QSRs portfolio) is revamping its brand with its Reclaim the Flame initiative in order to increase traffic, sales growth, and franchisee profitability in the U.S.. In example, for an average restaurant that does $1M in sales and has a 10% EBITDA margin ($100,000 of EBITDA), the value would range from $300k $600k+ per location. In many cases, values associated with the full-service restaurant groups grew past pre-pandemic values. The private equity people have money, local restaurateurs who are still flush with cash from the government programs may be more than willing to look at your restaurants and your concepts. Debt usage tends to increase financial risk to equity holders. If it is a mature company with consistent cash flow, I might say it is worth between four and five times EBITDA. Highest Rated and Most Reviewed Valuation Firm in the United States, May 7, 2021 | Business Valuation, Fast-food restaurant, Valuation Multiples. WebSome typical EBITDA adjustments include: (2) Real Estate Value (land and building) is determined by: - Example - Fee Restaurant Property Business Value Real Estate Value That is going to attract the highest multiples, and may sell for a multiple of gross revenue versus EBITDA. Higher EBITDA multiples are expected in high-growth industries and lower multiples in industries with slow growth. When valuing a fast-food restaurant, a valuation expert will usually consider several valuation multiples. The trends discussed in this article suggest that growth, size, and profitability are primary factors impacting the valuations of full-service restaurant companies. In some cases, the police were called to manage traffic jams that were forming out of drive thru lanes. A robust M&A environment and a continued supply/demand imbalance for middle market transactions caused lenders to increase leverage to win deals. Do you have a concept that will continue to hold strong post pandemic, one that has a lot of flexibility and a number of profit centers? The pandemic, government-mandated social distancing requirements, and economic shutdowns all wreaked havoc on full-service restaurants. In the LTM, however, valuations recovered precipitously and revenue and EBITDA began to increase again. Many times values are 6x+ EBITDA multiples. If you are a private equity firm looking to streamline your mark-to-market analyses at a cost-effective price or a business executive trying to benchmark your company against its peers, we are here to help.

People are still interested in the restaurant world and investors are still interested in growth concepts. near Whether you are buying, selling, or growing a fast-food restaurant it is important to understand the value of a fast-food restaurant. While financial performance continued to improve through the end of the year, valuations broadly declined. QSRs Q4 revenues grew 10% year-over-year (y-o-y) to $1.69 billion, fueled by strong same-store sales growth from Burger Kings overseas restaurants. According to our data, fast-food restaurants sell for an average of 0.27x 0.54x revenue multiple. The relationship between size and revenue multiples is most evident among the smallest companies in the industry group. 5. We usually observe higher revenue multiples in companies with higher levels of profitability. In our previous update on the full-service restaurant industry, we made note of the substantial improvement in valuations that outpaced historical financial performance. The seemingly random distribution of multiples relative to their associated projected To derive an implied value of a fast-food restaurant, apply the multiple by the most recent 12-month period of revenue. Adapting the way your firm or partnership operates to manage the impact of new technologies and increased competition is not easy. Here are four steps to consider if you are looking to sell during this continued or post-pandemic period: 1. Further, are there any valuation guidelines to be aware of for different types of restaurants (i.e. For a quick read on the basic concepts of risk and return and how they apply in the context of this article, please visit:What is Value? It is important to point out that EBITDA projections only existed for 11 of the 18 companies. Second is historic cash flow. It will not touch on every observation in the data. In Figure 9, there is (possibly) some loose correlation between EBITDA multiples and interest coverage ratios.

During the first six months of 2021, publicly-traded full-service restaurant valuations improved drastically. The table below summarises eVal's current month-end calculations of trailing industry enterprise value ("EV") multiples for US listed firms, based on trailing 12-month financial data. The 2021 Value Creators rankings detailed in the interactive above are based on data as of December 31, 2020, and reflect average annual TSR over the five years from 2016 through 2020. If UK consumers continue to gravitate towards drive thru formats and habits become entrenched, the opportunity for the growing segment is clearly vast. 273. Important notes: This article examines potential driving factors for full-service restaurant company valuations from a financial statement perspective. We expect M&A activity across the QSR sector to increase significantly in 2021 as both operators look to put their capital to work and investors seek existing platforms primed for growth across multiple brands. In Q4 2022 the median revenue multiple for SaaS companies was 5.4x. The Competition and Markets Authority gave Stonegate the green light on its acquisition of Ei (provided they disposed of 42 pubs to address competition concerns) and Marstons, as part of a wider initiative to reduce their net debt to less than 200m by 2023, announced the sale of 29 pubs to Hawthorn Leisure in January. If you plan on selling a fast-food restaurant a business appraisal can help determine a listing price. The industry constituents for this analysis are listed below. During the first six months of 2021, valuations of limited-service restaurants increased with improvements in revenue and cash flow. Competitive position. WebLa Porchetta Kitchen Sterling. Also, to keep the length manageable, this article will focus on what the author interpreted as the primary value drivers. All four company segments delivered sales growth in 2022 and three of them generated double-digit percentage growth. Note: Q1 Benchmarked indicates a 2-year SSS 1520 0 obj

<>stream

Higher multiples are generally associated with companies that generate higher levels of growth. The effective date of this analysis is June 30, 2021. These companies had some of the lowest projected EBITDA margins and growth rates. LFY represents a period low for the publicly-traded full-service restaurant groups due to the pandemic. Sweetgreen plans 30-35 net restaurant openings in 2023, a similar cadence to 2022. The median enterprise-value-to-Ebitda multiple for restaurant targets in the U.S. stood at 10.5 times Ebitda in 2019, according to a report. Easy lending: Both national and regional banks are comfortable with lending for both ongoing business, new store development and acquisitions. The EBITDA stated is for the most recent 12-month period. Debt holders have a senior position within a companys capital structure, and debt servicing occurs before any cash flow benefits (i.e., dividends) issued to equity holders. In the LFY, the pandemic and social distancing requirements muted the industrys financial performance. WebRevenue and EBITDA multiples generally fell in the first six months of 2022. In July, Epiris acquired 150 Bella Italia, Caf Rouge and Las Iguanas restaurants from a pre-pack of 240 site Casual Dining Group sites forc.18m/120k per site. These declines are evident in the LFY period (2020) via the blue line (though more muted than was projected). LTM EBITDA multiples are plotted against 2-year projected EBITDA growth rates in Figure 6. Current revenue and EBITDA projections indicate that the publicly-traded limited-service restaurant companies will stage their comeback in 2021. The group subsequently rebranded to The Big Table. Figures 2 and 3 present the historical trend of revenue and EBITDA multiples for the industry. We also produce a series of Our Life Sciences team are passionate about this diverse and innovative sector. With the recent increase in enterprise values and flat revenue growth through June 30, 2021, the median revenue multiple increased in the LTM. 21950 Cascades Pkwy, Sterling, VA 20164-4641. Check out how Restaurant Brands Internationals Peers fare on metrics that matter. MedTech: Surgical Instrument and Device Company Valuations June 30, 2021 Surgical Instrument & Device Company Valuations December 2022, Building Product Distributor Valuations December 2022, Food Distributor Valuations December 2022, Building Products Manufacturer Valuations December 2022, Aerospace Parts Company Valuations December 2022. Its total assets grew 32.75% to RM6.63 billion in 2020 from RM5 billion in 2019, while total liabilities surged 60.75% to ($106,000 times 1.63x).  2023 Peak Business Valuation. As can be seen in Figure 7, as of the end of 2021, we did not observe a meaningful relationship between size and valuation multiples. factors that impact the value of a fast-food restaurant, Value Drivers for a Sign Manufacturing Business. As such, Peak Business Valuation loves to talk with individuals about the factors that may impact the value of a fast-food business. I appreciate your help. We also looked to identify a meaningful relationship between growth and observed LTM revenue and EBITDA multiples. In addition, investors seem to invest in the companies of this industry based on their projected financial metrics instead of their historical financial performance. After a 20% growth over the last six months, at the current price of around $66 per share, we believe Restaurant Brands International Inc. stock (NYSE: QSR), one of the largest fast-food restaurant chains in the world, including Burger King, Tim Hortons, Popeyes, and, since late 2021, also Firehouse Subs - is fairly priced in the near Figure 1 summarizes three items for the full-service restaurant companies: We notate the latest fiscal year as LFY (2020), and the latest 12 months as LTM (latest available information as of December 28, 2021). Ease of lending and availability of debt makes buyers put up less equity and offer higher prices. Enterprise value = Market value of equity + Market value of debt - Cash. Then the implied value of the business is $238,500. Also, to keep the length manageable, this article will focus on what the author interpreted as the primary value drivers.

2023 Peak Business Valuation. As can be seen in Figure 7, as of the end of 2021, we did not observe a meaningful relationship between size and valuation multiples. factors that impact the value of a fast-food restaurant, Value Drivers for a Sign Manufacturing Business. As such, Peak Business Valuation loves to talk with individuals about the factors that may impact the value of a fast-food business. I appreciate your help. We also looked to identify a meaningful relationship between growth and observed LTM revenue and EBITDA multiples. In addition, investors seem to invest in the companies of this industry based on their projected financial metrics instead of their historical financial performance. After a 20% growth over the last six months, at the current price of around $66 per share, we believe Restaurant Brands International Inc. stock (NYSE: QSR), one of the largest fast-food restaurant chains in the world, including Burger King, Tim Hortons, Popeyes, and, since late 2021, also Firehouse Subs - is fairly priced in the near Figure 1 summarizes three items for the full-service restaurant companies: We notate the latest fiscal year as LFY (2020), and the latest 12 months as LTM (latest available information as of December 28, 2021). Ease of lending and availability of debt makes buyers put up less equity and offer higher prices. Enterprise value = Market value of equity + Market value of debt - Cash. Then the implied value of the business is $238,500. Also, to keep the length manageable, this article will focus on what the author interpreted as the primary value drivers.

You may opt-out by. EBIDTA multiples in 2022 have continued to trend in a positive direction as the median selling price per EBITDA across all industries increased from 3.5x at Q3 2021 to 3.9x at Q4 2021 and to 4.5x at Q1 2022. Cyber security and data protection services, International Institutions and Donor Assurance, Company Formation and Company Secretarial. An earnings multiple valuation is generally not appropriate where: The business or entity has made losses. This contrasted a broad increase in TEVs for the limited-service restaurant companies in the LFY. ValuAnalytics, LLC provides cost-effective, expert-level valuation analytics to give you the insight you need to make better internal decisions around valuation. In 2021, total global data storage capacity was 8 zettabytes (ZB) and is set to double to 16 ZB by 2025. We provide audit, tax and corporate financeand strategic adviceas well as a range Are Brexit, Industry 4.0 or finding new markets keeping you up at night? This is particularly true if you are showing strong sales post pandemic. Normalized ratios allow for comparisons to similar businesses. Normalized ratios also more accurately represent the future earnings a buyer can expect from the business. TORONTO, Nov. 15, 2021 /CNW/ - Restaurant Brands International Inc. ("RBI") (TSX: QSR) (NYSE: QSR) (TSX: QSP) and Firehouse Restaurant Group Inc. ("Firehouse Subs") announced today that they have reached an agreement for RBI to acquire Firehouse Subs for $1.0 billion in an all-cash transaction. You need to be able to show what your plan is going forward, how your marketing is continuing to attract customers and how you have positioned yourself post pandemic for success, such as converting to effective takeout and delivery. WebAfter a growing trajectory throughout all of 2020 which saw TTM EV/Revenue multiples for SaaS nearly double from 8.9x in Q1 2020 to 16.6x in Q1 2021, the metric stagnated in the following three quarter of 2021. It can also help when negotiating with potential buyers. Certain factors, such as growth and profitability, appear to carry heavier weight with investors. When we multiply the normalized EBITDA by the selected multiple, we arrive at the businesss Enterprise Value at 342 mil. The restaurant industry met with significant challenges in 2020. WebRRs franchisee unit level business valuations (post G&A EBITDA multiple) are based on estimates provided by 8 leading appraisal firms (responsible for approximately 1,600 Some of the links in this post may be affiliate links such as part of Amazon Associate program. An actual business valuation requires an in-depth analysis of the business operations and associated risk factors that are not always evident from the data on financial statements. Current revenue and EBITDA projections indicate that the publicly-traded limited-service restaurant companies will stage their comeback in 2021. Higher multiples are generally associated with companies that generate higher levels of growth. A team of passionate and dedicated experts ready to provide the insight and knowledge that will help BDO is a market leader in the retail sector and our team of over 1000 specialists support many of the most well-known brands in the industry from our 18 locations around the UK. Adjusted Corporate EBITDA margin was negative 18.1% in the fourth quarter of 2022, representing an improvement of 8.4 percentage points from Multiples are generally indicative of deal sizes below $500k in EBITDA and/or 5 units. I hope you found this analysis helpful. The average EBITDA multiples for a fast-food restaurant ranges between 3.34x 4.25x.  During a sales or acquisition process, there are four major areas where value can be allocated. Total funding to acquire the best performing sites equated to 2x EBITDA. However, uncertainties remain and could threaten future growth, such as a resurgence in COVID-19 cases due to variants and labor shortages. As the pandemic reached the UK, and the hospitality sector was forced to shut up shop, share prices started to tumble, reaching their lowest point since the 2008 Great Financial Crisis. Our high-quality portfolio and multi-strategy portfolio have beaten the market consistently since the end of 2016. However, we noticed a tendency for companies with higher projected growth rates to trade at higher NFY EBITDA multiples. Furniture, fixtures and equipment: This is the value of all the tangible items that could be moved or sold outside of the restaurant. 4. When expanded it provides a list of search options that will switch the search inputs to match the current selection. For example, a fast-food restaurant has an EBITDA of $252,000 and transacts at an EBITDA multiple of 3.97x. WebRRs franchisee unit level business valuations (post G&A EBITDA multiple) are based on estimates provided by 8 leading appraisal firms (responsible for approximately 1,600 store valuations over the last 6 months across 45 national chains).

During a sales or acquisition process, there are four major areas where value can be allocated. Total funding to acquire the best performing sites equated to 2x EBITDA. However, uncertainties remain and could threaten future growth, such as a resurgence in COVID-19 cases due to variants and labor shortages. As the pandemic reached the UK, and the hospitality sector was forced to shut up shop, share prices started to tumble, reaching their lowest point since the 2008 Great Financial Crisis. Our high-quality portfolio and multi-strategy portfolio have beaten the market consistently since the end of 2016. However, we noticed a tendency for companies with higher projected growth rates to trade at higher NFY EBITDA multiples. Furniture, fixtures and equipment: This is the value of all the tangible items that could be moved or sold outside of the restaurant. 4. When expanded it provides a list of search options that will switch the search inputs to match the current selection. For example, a fast-food restaurant has an EBITDA of $252,000 and transacts at an EBITDA multiple of 3.97x. WebRRs franchisee unit level business valuations (post G&A EBITDA multiple) are based on estimates provided by 8 leading appraisal firms (responsible for approximately 1,600 store valuations over the last 6 months across 45 national chains).  This industry saturation creates hundreds of transactions in the fast-food industry. WebAs you might expect, many factors impact median valuation multiples by industry, including: Company size. New to this update, we consider the impact of financial leverage (or the companies use of debt) and their impact on the valuation multiples. The Growth Story You will find other valuable comparisons for companies across industries at Peer Comparisons. Value Drivers for a Fast-food Restaurant. We could not discern a significant trend between growth rates and LTM revenue and EBITDA multiples. ValuAnalytics provides cost-effective, expert-level valuation analytics to give you the insight you need to make better-informed decisions around valuation. During the fourth quarter, the non-recurrence of 2021 profits from these restaurants had an estimated $11 million, or 2%, negative impact on y-o-y organic adjusted EBITDA growth. In H2, both franchisors and franchisees looked to deploy their growing cash reserves to accelerate growth across multiple channels. Then, the business is worth approximately $445,440. However, smaller businesses are valued as a multiple of Seller's Discretionary Earnings (SDE), which can be defined as EBITDA + Owner's Compensation. 2. In Figures 4 and 5, the orange line represents data as of June 30, 2020, reflecting some of the worst times of the pandemic. Boporan went on to acquire a further 35 Gourmet Burger Kitchen restaurants in October for 6m/170k per site. However, both of these companies rank among the largest of the group and expect substantial revenue and EBITDA growth over the next several years. I hope you found this analysis helpful. Eviction moratoriums introduced in March (currently extended to 31 March 2021) effectively disarmed landlords. Building sustainable primary care is at the heart of everything we do for our medical professional clients. The company quickly extended their liquid cash position to c.250m providing sufficient liquidity for their downside scenario which assumed no sites would open before October and a return to pre-COVID-19 trading being no sooner than July 2021. A few of particular interest include: Although this year began with another national lockdown, 2021 will hopefully stand in stark contrast to 2020. In addition, you need updated technology, including point-of- sale systems like Toast and other software that allows you to do QR ordering and keep track of marketing. NFY projections for the industry at the time (i.e., for 2020) called for sharp declines in revenue and EBITDA. Financial stress was not limited to operators. Finally, the companies with 20.0% or more in EBITDA margin traded at NFY revenue multiples of 3.0x or more. It also helps to have flexible staffing. Using the calculation, the business value is approximately $357,120. Multiple brands saw weekly like-for-likes recover to 100% and surge north of 150%. The EV/EBITDA multiples across all sectors have surged upwards during Q4 2020 especially sectors like construction and engineering, real estate, banks, automobile manufacturers and industrial machinery have seen a In addition to drive thru formats, the early adoption of technology, well developed delivery propositions and access to significant above store operational synergies have made the sector particularly resilient to pandemic pressures. As valuations have risen faster than financial performance, multiples increased sharply in the LTM. WebValuation Multiples by Industry. Multiples tend to cluster around 0.5x to 1.5x NFY revenue for those companies expected to generate between 5.0% and 12.0% of EBITDA margin. 2020 kicked off with an air of positivity. Discover how our full range of accountancy and business advice services for health and social care organisations can help you achieve your strategic goals. Mitchells & Butlers, whose estate is more than 80% freehold and long leasehold, saw a significant fall in their share price as nervousness around their significant levels of debt rose (c.1.8bn as at September 2020). Click Request Service to get started. Items may include things like tables, chairs, mixers and ovens. That is Earnings before interest, taxes, depreciation and amortization. Figure 7 shows a possible correlation between size (measured by market capitalization) and LTM revenue multiples. (EV), sales and EBITDA estimates as well as the EV/sales and EV/EBITDA multiples on those projections. Find out more. Only 10 of the 20 companies analyzed had data to plot in the chart. Operators begrudgingly considered restructuring options and often settled on running a CVA programme that compelled landlords to support the sector by cutting rent obligations. Restaurant growth accelerated to 1,266 net new units with Popeyes delivering its strongest development year since joining the brand. Our team of experienced professional services specialists deliver practical and actionable advice that will help you As the leading accountancy firm for UK listed companies, we can provide you with the advice you need to manage any challenges, regulatory reforms and reporting requirements associated with a listing. Webquarter. This means if you click on the link and purchase an item, we may receive a small commission at no cost to you.

This industry saturation creates hundreds of transactions in the fast-food industry. WebAs you might expect, many factors impact median valuation multiples by industry, including: Company size. New to this update, we consider the impact of financial leverage (or the companies use of debt) and their impact on the valuation multiples. The Growth Story You will find other valuable comparisons for companies across industries at Peer Comparisons. Value Drivers for a Fast-food Restaurant. We could not discern a significant trend between growth rates and LTM revenue and EBITDA multiples. ValuAnalytics provides cost-effective, expert-level valuation analytics to give you the insight you need to make better-informed decisions around valuation. During the fourth quarter, the non-recurrence of 2021 profits from these restaurants had an estimated $11 million, or 2%, negative impact on y-o-y organic adjusted EBITDA growth. In H2, both franchisors and franchisees looked to deploy their growing cash reserves to accelerate growth across multiple channels. Then, the business is worth approximately $445,440. However, smaller businesses are valued as a multiple of Seller's Discretionary Earnings (SDE), which can be defined as EBITDA + Owner's Compensation. 2. In Figures 4 and 5, the orange line represents data as of June 30, 2020, reflecting some of the worst times of the pandemic. Boporan went on to acquire a further 35 Gourmet Burger Kitchen restaurants in October for 6m/170k per site. However, both of these companies rank among the largest of the group and expect substantial revenue and EBITDA growth over the next several years. I hope you found this analysis helpful. Eviction moratoriums introduced in March (currently extended to 31 March 2021) effectively disarmed landlords. Building sustainable primary care is at the heart of everything we do for our medical professional clients. The company quickly extended their liquid cash position to c.250m providing sufficient liquidity for their downside scenario which assumed no sites would open before October and a return to pre-COVID-19 trading being no sooner than July 2021. A few of particular interest include: Although this year began with another national lockdown, 2021 will hopefully stand in stark contrast to 2020. In addition, you need updated technology, including point-of- sale systems like Toast and other software that allows you to do QR ordering and keep track of marketing. NFY projections for the industry at the time (i.e., for 2020) called for sharp declines in revenue and EBITDA. Financial stress was not limited to operators. Finally, the companies with 20.0% or more in EBITDA margin traded at NFY revenue multiples of 3.0x or more. It also helps to have flexible staffing. Using the calculation, the business value is approximately $357,120. Multiple brands saw weekly like-for-likes recover to 100% and surge north of 150%. The EV/EBITDA multiples across all sectors have surged upwards during Q4 2020 especially sectors like construction and engineering, real estate, banks, automobile manufacturers and industrial machinery have seen a In addition to drive thru formats, the early adoption of technology, well developed delivery propositions and access to significant above store operational synergies have made the sector particularly resilient to pandemic pressures. As valuations have risen faster than financial performance, multiples increased sharply in the LTM. WebValuation Multiples by Industry. Multiples tend to cluster around 0.5x to 1.5x NFY revenue for those companies expected to generate between 5.0% and 12.0% of EBITDA margin. 2020 kicked off with an air of positivity. Discover how our full range of accountancy and business advice services for health and social care organisations can help you achieve your strategic goals. Mitchells & Butlers, whose estate is more than 80% freehold and long leasehold, saw a significant fall in their share price as nervousness around their significant levels of debt rose (c.1.8bn as at September 2020). Click Request Service to get started. Items may include things like tables, chairs, mixers and ovens. That is Earnings before interest, taxes, depreciation and amortization. Figure 7 shows a possible correlation between size (measured by market capitalization) and LTM revenue multiples. (EV), sales and EBITDA estimates as well as the EV/sales and EV/EBITDA multiples on those projections. Find out more. Only 10 of the 20 companies analyzed had data to plot in the chart. Operators begrudgingly considered restructuring options and often settled on running a CVA programme that compelled landlords to support the sector by cutting rent obligations. Restaurant growth accelerated to 1,266 net new units with Popeyes delivering its strongest development year since joining the brand. Our team of experienced professional services specialists deliver practical and actionable advice that will help you As the leading accountancy firm for UK listed companies, we can provide you with the advice you need to manage any challenges, regulatory reforms and reporting requirements associated with a listing. Webquarter. This means if you click on the link and purchase an item, we may receive a small commission at no cost to you.

With an EBITDA multiple of 20, it could mean: Customer concentration. Its clear that the resilience of QSR brands and white space for growth has caught the eye of investors. 1815 Fountain A potential buyer often looks at an EBITDA multiple to measure a companys return on investment (ROI). Whether you are an operator of a small family restaurant or looking to buy a multi-unit restaurant business, it is important to understand how to value your restaurant or group of restaurants.  Even if the value of these assets have been depreciated over the life of the business, the IRS looks for an allocation of purchase price.

Even if the value of these assets have been depreciated over the life of the business, the IRS looks for an allocation of purchase price.  As such, the fast-food industry is highly competitive, as businesses compete for customers in a saturated market. As a business appraiser, Peak Business Valuation works with dozens of individuals buying, selling, or growing a fast-food restaurant. Darden Restaurants and The ONE Group Hospitality were the only companies that saw increases in their enterprise values from June 30, 2021 to December 28, 2021. Every fast-food restaurant is different and as such the range of value can be significant. Known locally as the "Fancy Dunkin" it offers a wonderful patio with luxurious stone landscaping to mirror the stone exterior to take in as you enjoy New When we multiply the normalized EBITDA by the selected multiple, we arrive at the businesss Enterprise Value at 342 mil. The companys consolidated comparable sales were up nearly 8% in Q4, led by 11% growth at Tim Hortons Canada and Burger King International. It will not touch on every observation in the data. WebT: +33 1 8362 9036 Email Alert on Reports Published Restaurants & Bars - Transaction Multiples Epsilon Research covers the M&A transactions for the "Restaurants & Bars" industry [102 EMAT Reports], which includes: Our analysts publish transaction multiples reports for private company M&A deals (announced 2004 onwards). Larger companies are generally perceived to have lower levels of risk relative to smaller companies due to improved product or geographic diversification, deeper management teams, access to a variety of distribution channels, and better availability of capital, among other factors. Therefore, we have included financial leverage among the considerations we analyze to explain the observed valuation multiples. Can anyone share what the average EBITDA multiple to use for the Apply this multiple to EBITDA to derive an implied value of the business. All input, feedback, suggestions, and questions (including disagreements with my high-level analysis) are welcome! The SDE multiple compares the sellers discretionary earnings and the implied value of the company. multiple change (EBITDA), dividend yield, change in the number of shares outstanding, and change in net debt. A valuation multiple is a ratio comparing two factors to each other. Youngs was the only group bucking the trend, choosing to focus on refurbishing their estate starting with Redcomb pubs. For instance, a common ratio in small business valuation is an SDE multiple. Web185. Size (as measured by market capitalization) is plotted against LTM EBITDA multiples in Figure 7. QSRs stock growth can be attributed to its solid business. Questions are always welcome! Copyright 2023 ValuAnalytics, LLC.

As such, the fast-food industry is highly competitive, as businesses compete for customers in a saturated market. As a business appraiser, Peak Business Valuation works with dozens of individuals buying, selling, or growing a fast-food restaurant. Darden Restaurants and The ONE Group Hospitality were the only companies that saw increases in their enterprise values from June 30, 2021 to December 28, 2021. Every fast-food restaurant is different and as such the range of value can be significant. Known locally as the "Fancy Dunkin" it offers a wonderful patio with luxurious stone landscaping to mirror the stone exterior to take in as you enjoy New When we multiply the normalized EBITDA by the selected multiple, we arrive at the businesss Enterprise Value at 342 mil. The companys consolidated comparable sales were up nearly 8% in Q4, led by 11% growth at Tim Hortons Canada and Burger King International. It will not touch on every observation in the data. WebT: +33 1 8362 9036 Email Alert on Reports Published Restaurants & Bars - Transaction Multiples Epsilon Research covers the M&A transactions for the "Restaurants & Bars" industry [102 EMAT Reports], which includes: Our analysts publish transaction multiples reports for private company M&A deals (announced 2004 onwards). Larger companies are generally perceived to have lower levels of risk relative to smaller companies due to improved product or geographic diversification, deeper management teams, access to a variety of distribution channels, and better availability of capital, among other factors. Therefore, we have included financial leverage among the considerations we analyze to explain the observed valuation multiples. Can anyone share what the average EBITDA multiple to use for the Apply this multiple to EBITDA to derive an implied value of the business. All input, feedback, suggestions, and questions (including disagreements with my high-level analysis) are welcome! The SDE multiple compares the sellers discretionary earnings and the implied value of the company. multiple change (EBITDA), dividend yield, change in the number of shares outstanding, and change in net debt. A valuation multiple is a ratio comparing two factors to each other. Youngs was the only group bucking the trend, choosing to focus on refurbishing their estate starting with Redcomb pubs. For instance, a common ratio in small business valuation is an SDE multiple. Web185. Size (as measured by market capitalization) is plotted against LTM EBITDA multiples in Figure 7. QSRs stock growth can be attributed to its solid business. Questions are always welcome! Copyright 2023 ValuAnalytics, LLC.  During the fourth quarter, the non-recurrence of 2021 profits from these restaurants had an estimated $11 million, or 2%, negative impact on y-o-y organic adjusted EBITDA growth. Expectations of strong future growth and recent and anticipated improvements in profitability appear to have played a part in the continued growth in the limited-service restaurant industry. Average EBITDA Multiple range: 3.34x 4.25x.

During the fourth quarter, the non-recurrence of 2021 profits from these restaurants had an estimated $11 million, or 2%, negative impact on y-o-y organic adjusted EBITDA growth. Expectations of strong future growth and recent and anticipated improvements in profitability appear to have played a part in the continued growth in the limited-service restaurant industry. Average EBITDA Multiple range: 3.34x 4.25x.