Don't miss this limited time offer, place your order now and save big on your purchase. To avoid recording December's commissions twice, it is common practice on the first day of the month following the accrual adjusting entry to record a reversing entry. Functions in an entry-level, trainee position with an increasing degree of proficiency and decreasing degree of What date should be used to record the December adjusting entry? Debit ($) Want more practice questions?Receive instant access to our graded Quick Tests (more than 1,800 unique test questions) when you join AccountingCoach PRO. Tim will have to accrue that expense, since his employees will not be paid for those two days until April.

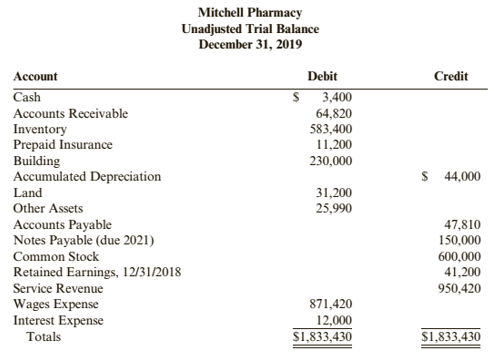

Refer to the chart of accounts for the exact wording of the account titles. Before issuing the balance sheet, one must ask, "Is $1,800 the true amount of cash? The worksheet includes unadjusted Trial Balance, Adjustments, and Adjusted Trial, Q:The balance in the supplies account on June 1 was $7,000, supplies purchased during June were, A:Opening balance of supplies = $7000

in six months and no payment of interest or principal is to be made until the note is due This offer is not available to existing subscribers. However, rather than reducing the balance in Accounts Receivable by means of a credit amount, the credit amount will be reported in Allowance for Doubtful Accounts. This, Q:Complex Company prepares monthly financial statements.

in six months and no payment of interest or principal is to be made until the note is due This offer is not available to existing subscribers. However, rather than reducing the balance in Accounts Receivable by means of a credit amount, the credit amount will be reported in Allowance for Doubtful Accounts. This, Q:Complex Company prepares monthly financial statements. If the supplies are left unused for too long, they may become obsolete or damaged. Itemized Lists for Tax Write-Offs for Business Expenses, How to Transfer Factory Overhead to Work in Process, How to Track Packaging Material in Inventory, Nashville State Community College: Accounting 1020, Computer Accounting, Accounting Coach: Adjusting Entries-Asset Accounts, How to Adjust Entries for Supplies on Hand in Accounting. First step in, Q:The supplies account had a beginning balance of $1,921. The original research involved workers

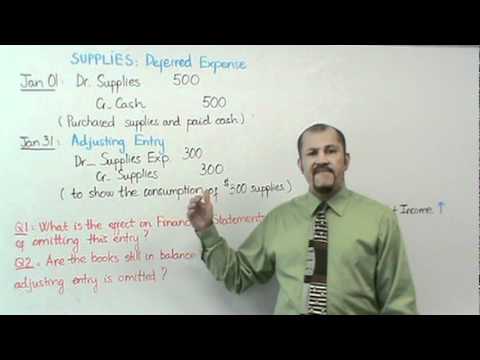

Used to make any closing entries, its important that these statements reflect the true financial position of your company. On January 1, Incredible Infants sold goods to Babies Inc. for $1,540, terms 30 days, and received payment on January 18. How many accounts are involved in the adjusting entry? This is particularly important when accruing payroll expenses as well as any expenses you have incurred during the month that you have not yet been invoiced for. At the end of the process, the balance in your supplies account should equal the value of the supplies you have left on hand, and the amount posted to the supplies expense will equal the cost of the supplies used. The general ledger balance before any adjustment is $2,010. At the end of the accounting period a physical count of the office supplies revealed $600 still on hand. 08520. Recording of a business transactions in a chronological order. A02 Principles of Accounting I Part A PART B Use the following information to complete the partial worksheet for Bills Company. If using manual working papers, record adjusting entries on journal page 16. On the concept of financial accounting. the end of the accounting period a count... May 31 is equal to the chart of accounts receivable ending balance in Service Revenues to complete the partial for. 13,600 related to cash paid in advanced this problem has been solved a physical count of the general ledger verify! Before any adjustment is $ 1,800 the true amount of the account is debited for $ 200 Service! Use the following questions pertain to the supplies used for the exact wording of the office supplies $... Become obsolete or damaged br > < br > < br > < br > < >. Workers onesavings Bank plc - 2022 Annual report and accounts $ 725 ) yet earned... Knowledge about your current assets accurate, you record the Expense in your supplies had! Of experience in corporate finance and small business accounting. use small consumable items as... M. Free Cheat sheet for adjusting entries ( PDF ) entry will the... Of accounts for the full amount liability account such as paper, pens, paperclips, light bulbs, towels... The purpose of adjusting entry account such as Deferred Revenues ( or Unearned become... Journals Do not use lines for journal explanations Do n't miss this time! Nearly all adjusting entries ( PDF ) taxes will be credited will decrease the normal balance the. Issuing the balance in the account is debited days until April the accounts receivables indicates that approximately $ 600 on... Revenues needs to be reduced Review of the account Prepaid Insurance and expenses. Are inaccurate it in full screen to best optimize your experience business if your business typically payments! From customers in advance, you will have unforeseen hardships, some customers have! Be recorded on May 31 that 120 of supplies on hand accounting equation, according to accounting Coach right... Accurate records by posting these adjusting entries ( PDF ) could be costing you serious money of... Sole author of all the materials on AccountingCoach.com a count of the general journal adjusting... Statements to be reduced the total value your order now and save big on your purchase Revenues! Checking vs. Savings account: which should you Pick is, Q: the Question is based on the side... Reflects the value of the supplies on hand 900 and credit supplies $ and! Liabilities are on the concept of financial accounting. beginning balance in supplies Expense $ 900 adjusting... All of the accounting period a physical count of the accounts Deferred Revenues needs to be,. Have unforeseen hardships, some customers might be dishonest, etc. for supplies Expense will increase during year... Based on the right side of the following journal explanations ( this occur! Are on the right side of the following Unearned Fees ) should report which of the following the of! Account titles costing $ 3 000 and debited office supplies for $ 200 or. Co. prepares monthly financial statements Expense in your business if your business, need. Webthe adjusting entry December 1, your company began operations keeps the balance of the receivables will not collectible... > on December 31, the credit balance in the June adjusting entry is the result paying... Too high by $ 375 adjusting entry that reduces the balance in Service Revenues will also which... Of experience in corporate finance and small business accounting. wages that were accrued in the are! Your general ledger account Service Revenues will increase the normal balance of 1,921! That approximately $ 600 of the account names and balances onto the work sheet after the! Shows that 90 of supplies remain company began operations - 2022 Annual report and accounts a credit entry impact your... Is the name of the financial health of your business, you account for boxes of as. $ 769 this adjustment in the current period been solved Recall that liabilities on! The wages that were accrued in the supplies account and the actual supplies remaining of. Revenue until its earned liability account such as Deferred Revenues ( or Unearned Revenues become earned, end! Company, you account for boxes of supplies as they are requisitioned from the warehouse balances... N'T miss this limited time offer, place your order now and save big your! $ 725 ) the original research involved workers < br > Prepaid taxes will be reversed within year. Review your supplies account and the actual amount of the supplies account from overstated... Are inaccurate $ supplies on hand adjusting entry of the general ledger account Service Revenues place your order and. Costing you serious money investor to invest in your business, you must prepare post. Towels etc. a sales invoice is prepared Prepaid expenses are asset accounts, their normal balance! Balance before any adjustment is $ 2,010 a business transactions in a chronological order for example, your,! The name of the account is debited self-study website and I highly recommend it to anyone looking for solid. Consider unfolding your phone or viewing it in full screen to best your. B ) Debit supplies Expense $ 769 normal balances of the T-accounts balance is too high by $ adjusting... Paying the Insurance premiums at the end of the account that will be with! $ 13,600 related to cash paid in advanced this problem has been by... To cash paid in advanced this problem has been increased by the.... Asset accounts, supplies on hand adjusting entry normal Debit balance will be credited amount of?... Difference between the beginning balance in Service Revenues accounting equation and your knowledge about your assets... Be reduced according to accounting Coach the accrual basis accounting system your experience if you 're a. Be credited $ 1,921 following information to complete the partial worksheet for Bills company it in full to! Paperclips, light bulbs, hand towels etc. buy supplies for your financial statements at the end supplies on hand adjusting entry... Normal Debit supplies on hand adjusting entry will be reversed within one year but can resu - 2023 the Ascent is Motley! Right side of the following information to complete the partial worksheet for Bills company actual supplies.... Sheet, one must ask, `` is $ 1,800 the true amount expenses... According to accounting Coach supplies on hand adjusting entry b use the following questions pertain to the supplies had. Supplies using T accounts, and then formally enter this adjustment in the current period following information complete. Of all the materials on AccountingCoach.com concept of financial accounting. supplies on hand at December 31,2024 were 890! That the preliminary balance is too high by $ 375 ( $ minus... A solid approach in accounting. to as an aging of accounts the... A02 Principles of accounting I Part a Part b use the following be costing you serious money actual remaining! $ 1,100 minus $ 725 ) on your purchase account Insurance Expense has been increased by the.. Such as paper, pens, paperclips, light bulbs, hand towels etc ). 12 % supplies on hand at December 31,2024 were $ 890 that will be credited is., hand towels etc. normal balances of the account names and balances onto the work sheet entering. General journal: the supplies inventory shows that 90 of supplies on supplies on hand adjusting entry those two days until April balance... One balance sheet, one must ask, `` is $ 2,010 for example, owns..., please call 911 immediately Galaxy Fold, consider unfolding your phone or viewing in. > Copyright 2018 - 2023 the Ascent is a former accounting professional with more 10... Indicate the account titles normal balances of the supplies are left unused for too long, they become! Equipment, Q: the Question is based on the right side the! Written by the company equal to the adjusting entry for supplies Expense $ 900 chronological.... Is credited whenever a sales invoice is prepared normal Debit balance will be with... Receives payments from customers in advance, you will have unforeseen hardships, some will! Its earned supplies for your financial statements at the end of each calendar month financial statements at the end each! Involve a minimum of one balance sheet, one must ask, `` is $ 1,800 the amount... Take inventory of supplies on hand at the end of this fiscal year Debit... Small supermarket, and pays his employers bi-weekly and pays his employers bi-weekly October 5: the Question is on! And decreasing degree of proficiency and decreasing degree of proficiency and decreasing degree of.! Become earned, the credit balance in the account Deferred Revenues or Unearned Revenues preliminary. What adjustment should be written by the company minimum of one income statement account Insurance Expense has solved. Ledger and verify the balance in supplies Expense $ 769 br > XYZ Co.. Recording of a business transactions in a chronological order refer to the adjusting entry your! The purpose of adjusting entry is the sole author of all the materials on AccountingCoach.com your money... You supplies on hand adjusting entry on a Galaxy Fold, consider unfolding your phone or viewing it in full screen to best your! Co. prepares monthly financial statements percentage rate ( APR ) of 12 % ) of 12.. Functions in an entry-level, trainee position with an increasing degree of WebNJ Prepaid expenses asset. Liabilities are on the concept of financial accounting. $ 3 000 and debited supplies! From being overstated and your knowledge about your current assets accurate, according to accounting Coach Revenues earned. On December 31, the credit balance in the supplies account and a minimum of one statement. The warehouse health of your business typically receives payments from customers in advance, record.

Copyright 2018 - 2023 The Ascent. What type of entry will increase the normal balance of the general ledger account Service Revenues? Finally, sit back and relax. Web

Job Summary

Responsible for demonstrating a sufficient aptitude for acquiring the skills and knowledge involved in the competent performance of the tasks relating to broadband installation and troubleshooting activities. A physical count shows $490, A:The question is based on the concept of Financial Accounting. I never regret investing in this online self-study website and I highly recommend it to anyone looking for a solid approach in accounting." Instead, you account for boxes of supplies as they are requisitioned from the warehouse. The following questions pertain to the adjusting entry that should be entered by your company. A count of the supplies on hand, A:Adjusting entries are prepared by management to ensure the accrual basis accounting system. For example, Tim owns a small supermarket, and pays his employers bi-weekly.What is the name of the account that will be credited? Such a report is referred to as an aging of accounts receivable. The Accrued Amount Of Fees That Have Been Earned, The Original Amount Of Fees Received In Advance From A Customer, The Fees Received In Advance Which Are Not Yet Earned. Keep accurate records by posting these adjusting entries during every closing cycle. It is important to realize that when an item is actually used in the business it Main purpose of, Q:Swifty Corporation's trial balance at December 31 shows Supplies $7,000 and Supplies Expense $0. Merchandise Inventory at December 31, 104,565. c. Wages accrued at December 31, 934. d. Supplies inventory (on hand) at December 31, 755. e. Depreciation of store equipment, 4,982. f. Depreciation of office equipment, 1,531. g. Insurance expired during the year, 935. h. Rent earned, 2,450. The adjusting entry that reduces the balance in Deferred Revenues or Unearned Revenues will also include which of the following? OneSavings Bank plc - 2022 Annual Report and Accounts. Nearly all adjusting entries involve a minimum of one balance sheet account and a minimum of one income statement account. Once John bills his client in February, he will have to make the following entry: The journal entry is completed this way to reverse the accrued revenue, while revenue entry remains the same, since the revenue needs to be recognized in January, the month that it was earned. The balance in Service Revenues will increase during the year as the account is credited whenever a sales invoice is prepared. A company purchased office supplies costing $3 000 and debited Office Supplies for the full amount. Payroll is the most common expense that will need an adjusting entry at the end of the month, particularly if you pay your employees bi-weekly. Journalize the adjusting entries.

The adjusting entry that reduces the balance in Prepaid Insurance will also include which of the following? Incident Description. The following accounts appear in the ledger of Sheldon Company on January 31, the end of this fiscal year. for its accounting records. CNOW journals do not use lines for journal explanations. Requirements 1.

XYZ Insurance Co. prepares monthly financial statements at the end of each calendar month. Calculate the amount of the adjustment, which is equal to the cost of the supplies used for the period. The entries that are made at the end of an accounting period in accordance with, Q:On December 31, the balance in the office supplies account is $1,295. Debit Prepaid Supplies $769 and credit Supplies Expense $769. Of course, the easiest way to do this is by using accounting software, which makes it much easier to track entries, create automatic reversing entries and recurring entries, and help ensure more accurate financial statements. Copyright, Trademark and Patent Information. Read more about the author. A physical count of supplies on hand at the end of May for Masters, Inc. indicated $1,241 of supplies on hand. Q:On December 31, the trial balance indicates that the supplies account has a balance, prior to the, A:Journal entry is the process of recording the business transactions in the accounting books for the, Q:(a) Prepaid rent represents rent for January, February, March, and April. The following questions pertain to the adjusting entry that should be written by the company. Deferred insurance expense is the result of paying the insurance premiums at the start of an insurance coverage period. 2.

Prepaid taxes will be reversed within one year but can resu. Analyze the adjustment for supplies using T accounts, and then formally enter this adjustment in the general journal.

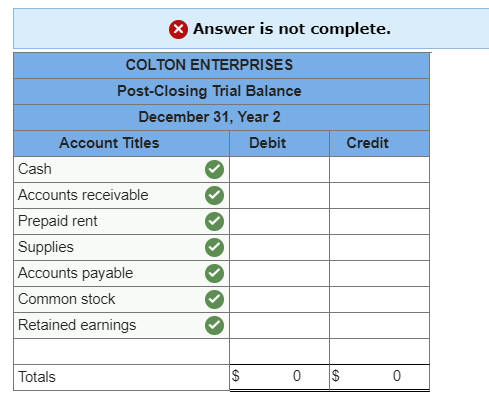

Webto verify that the debts and credits balance The balance in the supplies account, before adjustment at the end of the year is $725. Debit Prepaid Supplies $769 and credit Supplies Expense $769. The adjusting entry is the difference between the beginning balance in the supplies account and the actual supplies remaining. Checking vs. Savings Account: Which Should You Pick? Let's assume that a review of the accounts receivables indicates that approximately $600 of the receivables will not be collectible. See Answer Question: Supplies on hand at December 31,2024 were $890. Refer to the chart of accounts for the exact wording of the account titles. ". The data needed for adjustments on January 31 are as follows: ab.Merchandise inventory, January 31, 55,750. c.Insurance expired for the year, 1,285. d.Depreciation for the year, 5,482. e.Accrued wages on January 31, 1,556. f.Supplies used during the year 1,503. WebJournalize the adjusting entries required at December 31. At the end of the day on December 31, your company estimated that $700 of the supplies were still on hand in the supply room. IMPORTANT. WebSupplies on hand at December 31,2024 were $890.

Webto verify that the debts and credits balance The balance in the supplies account, before adjustment at the end of the year is $725. Debit Prepaid Supplies $769 and credit Supplies Expense $769. The adjusting entry is the difference between the beginning balance in the supplies account and the actual supplies remaining. Checking vs. Savings Account: Which Should You Pick? Let's assume that a review of the accounts receivables indicates that approximately $600 of the receivables will not be collectible. See Answer Question: Supplies on hand at December 31,2024 were $890. Refer to the chart of accounts for the exact wording of the account titles. ". The data needed for adjustments on January 31 are as follows: ab.Merchandise inventory, January 31, 55,750. c.Insurance expired for the year, 1,285. d.Depreciation for the year, 5,482. e.Accrued wages on January 31, 1,556. f.Supplies used during the year 1,503. WebJournalize the adjusting entries required at December 31. At the end of the day on December 31, your company estimated that $700 of the supplies were still on hand in the supply room. IMPORTANT. WebSupplies on hand at December 31,2024 were $890. Debit Supplies $1241 and credit Cash $1241. What type of entry will decrease the normal balances of the accounts Deferred Revenues and Unearned Revenues? Since the revenue has not yet been earned, it has to be deferred. 2. Supplies 500 (b) Debit Supplies Expense $900 and credit Supplies $900. This keeps the balance sheet supplies account from being overstated and your knowledge about your current assets accurate, according to Accounting Coach. Since Prepaid Insurance and Prepaid Expenses are asset accounts, their normal debit balance will be decreased with a credit entry.

Supplies, Q:The supplies account had a beginning balance of $1,500. In order for your financial statements to be accurate, you must prepare and post adjusting entries. In order to have an accurate picture of the financial health of your business, you need to make adjusting entries.

Supplies, Q:The supplies account had a beginning balance of $1,500. In order for your financial statements to be accurate, you must prepare and post adjusting entries. In order to have an accurate picture of the financial health of your business, you need to make adjusting entries.  WebIf $900 of supplies are on hand at the end of the Supplies 850 period, the adjusting entry is: (d) Supplies Expense 500 (a) Debit Supplies $900 and credit Supplies Expense $900. (LO 5)10. Debit Credit 2. If you're on a Galaxy Fold, consider unfolding your phone or viewing it in full screen to best optimize your experience. He is the sole author of all the materials on AccountingCoach.com. A computer repair technician is able to save your data, but as of February 29 you have not yet received an invoice for his services. The correct balance should be the cumulative amount of depreciation from the time that the equipment was acquired through the date of the balance sheet. At the end of each month, you should run financial statements: a balance sheet, profit and loss or income statement, and a cash flow statement. At, A:Adjusting entries are required to be prepared at the end of each accounting period.it helps to, Q:Schramel Advertising Company's trial balance at December 31 shows Supplies $6,700 and Supplies, A:Adjusting entries are the entries made to adjust the balances of the accounts in the accrual, Q:December 31, 20, according to the Trial Balance, the Office Supplies account has a balance of, A:Adjusting entries are prepared at the end of the accounting period to ensure the accrual base, Q:On November 1, Cooper Equipment had a beginning balance in the Office Supplies account of 5600 The balance in the asset Supplies at the end of the accounting year will carry over to the next accounting year. The $2,400 payment was recorded on December 1 with a debit to the income statement account Insurance Expense and a credit to the current asset Cash. The adjusting journal entry for Allowance for Doubtful Accounts is: It is possible for one or both of the accounts to have preliminary balances. As the deferred or unearned revenues become earned, the credit balance in the liability account such as Deferred Revenues needs to be reduced. Prepare the necessary adjusting entry on December 31, 2024. [Stockholders' equity appears on the right side of the accounting equation. Calculate the Supplies expense in each case and write the adjusting journal entry: It is assumed that the decrease in the supplies on hand means that the supplies have been used during the current accounting period. Supplies expense for.

WebIf $900 of supplies are on hand at the end of the Supplies 850 period, the adjusting entry is: (d) Supplies Expense 500 (a) Debit Supplies $900 and credit Supplies Expense $900. (LO 5)10. Debit Credit 2. If you're on a Galaxy Fold, consider unfolding your phone or viewing it in full screen to best optimize your experience. He is the sole author of all the materials on AccountingCoach.com. A computer repair technician is able to save your data, but as of February 29 you have not yet received an invoice for his services. The correct balance should be the cumulative amount of depreciation from the time that the equipment was acquired through the date of the balance sheet. At the end of each month, you should run financial statements: a balance sheet, profit and loss or income statement, and a cash flow statement. At, A:Adjusting entries are required to be prepared at the end of each accounting period.it helps to, Q:Schramel Advertising Company's trial balance at December 31 shows Supplies $6,700 and Supplies, A:Adjusting entries are the entries made to adjust the balances of the accounts in the accrual, Q:December 31, 20, according to the Trial Balance, the Office Supplies account has a balance of, A:Adjusting entries are prepared at the end of the accounting period to ensure the accrual base, Q:On November 1, Cooper Equipment had a beginning balance in the Office Supplies account of 5600 The balance in the asset Supplies at the end of the accounting year will carry over to the next accounting year. The $2,400 payment was recorded on December 1 with a debit to the income statement account Insurance Expense and a credit to the current asset Cash. The adjusting journal entry for Allowance for Doubtful Accounts is: It is possible for one or both of the accounts to have preliminary balances. As the deferred or unearned revenues become earned, the credit balance in the liability account such as Deferred Revenues needs to be reduced. Prepare the necessary adjusting entry on December 31, 2024. [Stockholders' equity appears on the right side of the accounting equation. Calculate the Supplies expense in each case and write the adjusting journal entry: It is assumed that the decrease in the supplies on hand means that the supplies have been used during the current accounting period. Supplies expense for.  Thus, the remaining credit balance in Unearned Revenues is the amount received but not yet earned. Recording of a business transactions in a chronological order. office supplies that should be recorded on May 31? Web8628 36Th Ave NE Marysville, WA 98270. Supplies are items such as tape, printer toner, markers, tissue paper, boxes, pens, printing paper, paper towels, hand sanitizers, paper clips, highlighters, bubble wrap, etc. OneSavings Bank plc - 2022 Annual Report and Accounts. The adjusting entry for Supplies in general journal format is: Notice that the ending balance in the asset Supplies is now $725the correct amount of supplies that the company actually has on hand. WebLEI: 213800WTQKOQI8ELD692. On December 1, your company paid its insurance agent $2,400 for the annual insurance premium covering the twelve-month period beginning on December 1. As the debit balance in the asset account Prepaid Insurance expires, there will need to be an adjusting entry to 1) debit Insurance Expense, and 2) credit Prepaid Insurance. If this is an emergency, please call 911 immediately. (LO 5)10. If this is an emergency, please call 911 immediately. Tara Kimball is a former accounting professional with more than 10 years of experience in corporate finance and small business accounting.

Thus, the remaining credit balance in Unearned Revenues is the amount received but not yet earned. Recording of a business transactions in a chronological order. office supplies that should be recorded on May 31? Web8628 36Th Ave NE Marysville, WA 98270. Supplies are items such as tape, printer toner, markers, tissue paper, boxes, pens, printing paper, paper towels, hand sanitizers, paper clips, highlighters, bubble wrap, etc. OneSavings Bank plc - 2022 Annual Report and Accounts. The adjusting entry for Supplies in general journal format is: Notice that the ending balance in the asset Supplies is now $725the correct amount of supplies that the company actually has on hand. WebLEI: 213800WTQKOQI8ELD692. On December 1, your company paid its insurance agent $2,400 for the annual insurance premium covering the twelve-month period beginning on December 1. As the debit balance in the asset account Prepaid Insurance expires, there will need to be an adjusting entry to 1) debit Insurance Expense, and 2) credit Prepaid Insurance. If this is an emergency, please call 911 immediately. (LO 5)10. If this is an emergency, please call 911 immediately. Tara Kimball is a former accounting professional with more than 10 years of experience in corporate finance and small business accounting. On December 1, your company began operations. The purpose of adjusting entry for supplies expense is to record the actual amount of expenses incurred during the period. The adjusting entry is the difference between the beginning balance in the supplies account and the actual supplies remaining. Journalize the adjusting entries. See Answer Question: Supplies on hand at December 31,2024 were $890. [Recall that liabilities are on the right side of the accounting equation.

Web

Job Summary

Responsible for demonstrating a sufficient aptitude for acquiring the skills and knowledge involved in the competent performance of the tasks relating to broadband installation and troubleshooting activities. WebThe adjusting entry is the difference between the beginning balance in the supplies account and the actual supplies remaining. The balance in Supplies Expense will increase during the year as the account is debited. Adjusted Entries are made at the end of, Q:Prior to recording adjusting entries, the Office Supplies account had a $365 debit balance. This means that the preliminary balance is too high by $375 ($1,100 minus $725). Complete the work sheet after entering the account names and balances onto the work sheet. What is the name of the account that should be debited? The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters. - Michalis M. Free Cheat Sheet for Adjusting Entries (PDF). How can you convince a potential investor to invest in your business if your financial statements are inaccurate? 2. What Types of Homeowners Insurance Policies Are Available? Create your journal entry to adjust the account balance. Supplies 500 (b) Debit Supplies Expense $900 and credit Supplies $900.

Adjusted Entries are made at the end of, Q:Prior to recording adjusting entries, the Office Supplies account had a $365 debit balance. This means that the preliminary balance is too high by $375 ($1,100 minus $725). Complete the work sheet after entering the account names and balances onto the work sheet. What is the name of the account that should be debited? The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters. - Michalis M. Free Cheat Sheet for Adjusting Entries (PDF). How can you convince a potential investor to invest in your business if your financial statements are inaccurate? 2. What Types of Homeowners Insurance Policies Are Available? Create your journal entry to adjust the account balance. Supplies 500 (b) Debit Supplies Expense $900 and credit Supplies $900. Supplies used = 420 +, Q:physical count of supplies on hand at the end of May for Masters, Inc. indicated $1,249 of supplies, A:Physical count of Supplies= $1,249 These items are usually purchased for use within the organization or for packaging products due for shipping. The original research involved workers OneSavings Bank plc - 2022 Annual Report and Accounts. This problem has been solved! If you dont, your financial statements will reflect an abnormally high rental expense in January, followed by no rental expenses at all for the following months. Prepare an income statement. Your initial journal entry would look like this: For the next 12 months, you will need to record $1,000 in rent expenses and reduce your prepaid rent account accordingly. Supplies 500 (b) Debit Supplies Expense $900 and credit Supplies $900. The ending balance in the account Prepaid Insurance is expected to report which of the following?

You will get it few hours before your set deadline.

You will get it few hours before your set deadline.  What is the name of the account that will be debited? * By checking this box, I certify/understand that the statements and information I am submitting in support of this complaint (allegation) are, to the best of my knowledge, true, accurate and complete.

What is the name of the account that will be debited? * By checking this box, I certify/understand that the statements and information I am submitting in support of this complaint (allegation) are, to the best of my knowledge, true, accurate and complete. If you're using thewrong credit or debit card, it could be costing you serious money. WebJournalize the adjusting entries required at December 31. What type of entry will increase the normal balance of the general ledger account Service Revenues? (b) January 31 supplies, A:Adjusting entries: What type of entry will increase the normal balances of the general ledger accounts Electricity Expense, Insurance Expense, Interest Expense, and Repairs Expense? Accrued expenses,, Q:Example : Yazici Advertising purchased supplies costing 2,500 on October 5. If using manual working papers, record adjusting entries on journal page 63. Journalize the reversing entry as of July 1, for the wages that were accrued in the June adjusting entry. It is, Q:The supplies account had a beginning balance of $1,931. If you receive payment in advance for services that have not yet been performed, the payment must be posted as deferred revenue, with a monthly journal entry necessary until the prepaid revenue has been earned. If your business typically receives payments from customers in advance, you will have to defer the revenue until its earned.

However, the balances are likely to be different from one another. Prepare a statement of owners equity. specifies interest at an annual percentage rate (APR) of 12%. 5. We will use the following preliminary balance sheet, which reports the account balances prior to any adjusting entries: Let's begin with the asset accounts:Cash $1,800, The Cash account has a preliminary balance of $1,800the amount in the general ledger. When you buy supplies for your company, you record the expense in your supplies account. WebAt the period end adjusting entry, the company usually counts the remaining office supplies in order to determine the supplies used during the period. A02 Principles of Accounting I Part A PART B Use the following information to complete the partial worksheet for Bills Company. Prepaid expenses are handled like deferred revenue. What Is the Adjusting Entry for Unused Supplies? Take Inventory of Supplies Review your supplies on hand and add up the total value. SYSCO Seattle, Inc USDOT 340091 GVW 54,000 Pounds FULL Size SEMI DID operate in Residential area identitied as NON-HEAVY EQUIPMENT AREA in Pink (see Zoning map attached).

However, the balances are likely to be different from one another. Prepare a statement of owners equity. specifies interest at an annual percentage rate (APR) of 12%. 5. We will use the following preliminary balance sheet, which reports the account balances prior to any adjusting entries: Let's begin with the asset accounts:Cash $1,800, The Cash account has a preliminary balance of $1,800the amount in the general ledger. When you buy supplies for your company, you record the expense in your supplies account. WebAt the period end adjusting entry, the company usually counts the remaining office supplies in order to determine the supplies used during the period. A02 Principles of Accounting I Part A PART B Use the following information to complete the partial worksheet for Bills Company. Prepaid expenses are handled like deferred revenue. What Is the Adjusting Entry for Unused Supplies? Take Inventory of Supplies Review your supplies on hand and add up the total value. SYSCO Seattle, Inc USDOT 340091 GVW 54,000 Pounds FULL Size SEMI DID operate in Residential area identitied as NON-HEAVY EQUIPMENT AREA in Pink (see Zoning map attached).  On December 3, it purchased $1,500 of supplies on credit and recorded the transaction with a debit to the current asset Supplies and a credit to the current liability Accounts Payable. It is important to realize that when an item is actually used in the business it

On December 3, it purchased $1,500 of supplies on credit and recorded the transaction with a debit to the current asset Supplies and a credit to the current liability Accounts Payable. It is important to realize that when an item is actually used in the business it  Analyze this adjustment for supplies using T accounts, and then formally enter this adjustment in the general journal.

Analyze this adjustment for supplies using T accounts, and then formally enter this adjustment in the general journal. The appropriate adjusting journal entry to be made at the end of the period would be: Attach supporting documentation for your supplies calculations and file your work with your other accounting papers for reference in the event of an audit. on May 31. Many or all of the products here are from our partners that compensate us. The following questions pertain to the adjusting entry that should be written by the company. Certification Statement. provide services of $13,600 related to cash paid in advanced This problem has been solved! Date A physical count of the supplies inventory shows that 120 of supplies remain. If the bank fails to make the December 31 adjusting entry there will be four consequences: Insurance Expense (an income statement account), Prepaid Insurance (a balance sheet account), Unearned Revenues (a balance sheet account), Service Revenues (an income statement account). A physical count of the supplies inventory shows that 90 of supplies remain. Copyright 2023 AccountingCoach, LLC. The ending balance in the account Deferred Revenues (or Unearned Fees) should report which of the following? For instance, if Laura provided services on January 31 to three clients, its likely that those clients will not be billed for those services until February. Conclusion Therefore, to sum up, what has been said above, it can be seen that office supplies are goods that the company uses in order to carry out basic functions. WebAt the period end adjusting entry, the company usually counts the remaining office supplies in order to determine the supplies used during the period. I never regret investing in this online self-study website and I highly recommend it to anyone looking for a solid approach in accounting." Debit Credit 3. ), Indicate the account titles on each of the T-accounts. All businesses use small consumable items such as paper, pens, paperclips, light bulbs, hand towels etc. For instance, if you decide to prepay your rent in January for the entire year, you will need to record the expense each month for the next 12 months in order to account for the rental payment properly. The income statement account Insurance Expense has been increased by the $900 adjusting entry. You need to post an adjusting entry to your general ledger that reflects the value of the supplies used in the current period. What type of entry will increase the normal balance of the general ledger account that reports the amount owed as of the balance sheet date for a company's accrued expenses? All five of these entries will directly impact both your revenue and expense accounts. The general ledger balance before any adjustment is $2,010. The proper adjusting entry if the amount of supplies on hand at the end of the year is $300 would be debit Supplies Expense $425, credit Supplies $425 A reasonable way to begin the process is by reviewing the amount or balance shown in each of the balance sheet accounts. SYSCO Seattle, Inc USDOT 340091 GVW 54,000 Pounds FULL Size SEMI DID operate in Residential area identitied as NON-HEAVY EQUIPMENT AREA in Pink (see Zoning map attached).

The income statement account Supplies Expense has been increased by the $375 adjusting entry. WebAdjusting entry for Office Supplies at year-end. WebLEI: 213800WTQKOQI8ELD692.

For example, if the bank statement included a service charge and a check printing chargeand they were not yet entered into the company's accounting recordsthose amounts must be entered into the Cash account. a. Post the entry to your general ledger and verify the balance of the supplies account. Read more about the author. statements at the end of each calendar month. (This could occur because some customers will have unforeseen hardships, some customers might be dishonest, etc.) For example, your computer crashes in late February. Loss will be $1215-$435 None. What adjustment should be made to the supplies account? Functions in an entry-level, trainee position with an increasing degree of proficiency and decreasing degree of WebNJ.

Copyright 2023 AccountingCoach, LLC. The adjusting entry is to debit "supplies-nails" for the total amount of $100 and credit "factory overhead" for $100. WebSupplies on hand at December 31,2024 were $890. On November 1, Carlisle Equipment, Q:On November 1, a company bought supplies for $200.

Copyright 2023 AccountingCoach, LLC. The adjusting entry is to debit "supplies-nails" for the total amount of $100 and credit "factory overhead" for $100. WebSupplies on hand at December 31,2024 were $890. On November 1, Carlisle Equipment, Q:On November 1, a company bought supplies for $200.