Paycors compliance solutions help ensure accurate filing and mitigate risk.  See our vetted tech & services alliances. Manage all employee tasks and documents in one place. Whole life insurance combines life insurance with an investment component. The term imputed income refers to the treatment of an individuals income as if it is greater than what he is actually earning. But dont worry, well give you a head start. WebImputed income is the value of some sort of fringe benefit you receive (Most often domestic partner health insurance). Weve maintained this reputation for over four decades by demystifying the financial decision-making

See our vetted tech & services alliances. Manage all employee tasks and documents in one place. Whole life insurance combines life insurance with an investment component. The term imputed income refers to the treatment of an individuals income as if it is greater than what he is actually earning. But dont worry, well give you a head start. WebImputed income is the value of some sort of fringe benefit you receive (Most often domestic partner health insurance). Weve maintained this reputation for over four decades by demystifying the financial decision-making

This amount is included in Box 1 and must be reported for federal, state and local taxes. The service claims you can complete your application in roughly 15 minutes and get funding in as little as 24 hours. The amount for tax year 2022 is $12,950 for singles; $25,900 for married couples filing jointly; and Then you may hear from a collection agency, and the IRS will eventually start to slap liens on your assets. ","acceptedAnswer":{"@type":"Answer","text":"Group term life insurance is typically a benefit offered by your employer, but there may be options for you to make additional purchases. Another way to describe imputed income for employees is: Any service or benefit that you do not pay for (counts as income) is brought down in the income section. Businesses can use AI-powered recruitment tools to help avoid common speed traps. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. Final Thoughts on Imputed Income and Its Impact on Paychecks. Look, you are enjoying some benefits without paying for them. Answer some questions to get offerswith no impact to your credit score. View our product demos to get a deeper dive into the technology. . Employers offer a few benefits, like meals and health insurance, that are exempt from taxation. You then multiply that figure by the rates you pay for the employer portion of Social Security tax and Medicare tax. All Rights Reserved. You probably already know the answer to this one. Our editors and reporters thoroughly fact-check editorial content to ensure the information youre reading is accurate. 999 cigarettes product of mr same / redassedbaboon hacked games Take our 3 minute quiz and match with an advisor today. For more information, please see our

WebThe amount you have to pay varies based on income and whether you are filing a joint or You file a federal tax return as an "individual" and your combined income is between Learn a lot in a little bit of time with our HR explainers. "}},{"@type":"Question","name":"Do you have to pay taxes on imputed income? The material on this site may not be reproduced, distributed, transmitted, cached or otherwise used, except with the prior written permission of Advance Local. His insurance writing career has spanned across multiple product lines, with a primary focus on auto insurance, life insurance, and home insurance. But of course, because there is no actual money income Paycors innovative solutions purpose built for leaders can help you build a culture of accountability and engagement. There is also a penalty if the IRS learns you owe more than you claimed. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. You should also confirm the death payout to determine if it would be enough to take care of your familys needs should the unexpected happen. ","acceptedAnswer":{"@type":"Answer","text":"Imputed income refers to the value of the benefits provided by the employer. See how were taking the right STEP toward inclusion and belonging. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. So, life insurance imputed income refers to any amount paid on the cover above $50,000. Under the assumption of the W-2 wages definition noted above, what happens to the group term life which is imputed income on a pay stub, or to the $50 gift card you gave your employees around the holidays? Virtual assistance is another online job that pays daily or sometimes it'll pay weekly. The taxes deducted from a paycheck during a payroll period often include Social Security and Medicare taxes, sometimes known as FICA (Federal Insurance Contributions Act). PHA+Q2hlY2sgeW91ciBpbmJveCBmb3IgYW4gZW1haWwgY29uZmlybWluZyB5b3VyIHN1YnNjcmlwdGlvbi4gRW5qb3khPC9wPg==, How to Calculate Imputed Income for Domestic Partner Benefits, pay your businesss share of FICA taxes, partner with a provider who can manage payroll complexities, What to Look for in an Applicant Tracking System. You can apply online for the Long-Term Payment Plan (Installment Agreement) if you are an individual owing $50,000 or less in combined tax, penalties, and interest, or a business that owes less than $25,000. Fringe benefits are those that the employee enjoys without paying for them. They communicate immediately and are very helpful when you run into problems. From there, I went on to write articles and reviews for numerous business and financial publications, including Barrons and Kiplingers Personal Finance Magazine. Where Can I Find Imputed Income on My Paycheck? You can also apply by phone.

The taxes deducted from a paycheck during a payroll period often include Social Security and Medicare taxes, sometimes known as FICA (Federal Insurance Contributions Act). PHA+Q2hlY2sgeW91ciBpbmJveCBmb3IgYW4gZW1haWwgY29uZmlybWluZyB5b3VyIHN1YnNjcmlwdGlvbi4gRW5qb3khPC9wPg==, How to Calculate Imputed Income for Domestic Partner Benefits, pay your businesss share of FICA taxes, partner with a provider who can manage payroll complexities, What to Look for in an Applicant Tracking System. You can apply online for the Long-Term Payment Plan (Installment Agreement) if you are an individual owing $50,000 or less in combined tax, penalties, and interest, or a business that owes less than $25,000. Fringe benefits are those that the employee enjoys without paying for them. They communicate immediately and are very helpful when you run into problems. From there, I went on to write articles and reviews for numerous business and financial publications, including Barrons and Kiplingers Personal Finance Magazine. Where Can I Find Imputed Income on My Paycheck? You can also apply by phone.

How much tax do you pay on imputed income? We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey. There is an option that allows you to pay less than you owe. This income is added to an employees gross wages so employment taxes can be withheld. Above this tax is charged in bands and you pay tax on that chunk of income at a certain rate: basic rate at 20 per cent, higher rate at 40 per cent and additional rate at 45 per cent. This story was written byNJ Personal Finance, a partner of NJ.com. 2. WebTaxable Imputed income is grouped together with your normal taxable income, but only if the benefit qualifies. When an employee receives non-cash compensation thats considered taxable, the value of that benefit becomes imputed Love this site, I been using this site since 2015 and will recommend this service to anyone. The display of third-party trademarks and trade names on this site does not necessarily indicate any affiliation or the endorsement of PCMag.

We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey. There is an option that allows you to pay less than you owe. This income is added to an employees gross wages so employment taxes can be withheld. Above this tax is charged in bands and you pay tax on that chunk of income at a certain rate: basic rate at 20 per cent, higher rate at 40 per cent and additional rate at 45 per cent. This story was written byNJ Personal Finance, a partner of NJ.com. 2. WebTaxable Imputed income is grouped together with your normal taxable income, but only if the benefit qualifies. When an employee receives non-cash compensation thats considered taxable, the value of that benefit becomes imputed Love this site, I been using this site since 2015 and will recommend this service to anyone. The display of third-party trademarks and trade names on this site does not necessarily indicate any affiliation or the endorsement of PCMag.

As such, qualifying benefits are taxed at your normal federal income tax rates. Hire and retain staff with earned wage access. Imputed income is something that must always be included in federal taxes. OnDeck(Opens in a new window) offers possible same-day funding in some states on loans of up to $100,000. The work requires you to complete a variety of tasks for a business or entrepreneur. When deciding if you should stay with the group term life insurance offered or seek an option elsewhere, its important to keep in mind a few key details. Health insurance for yourself and your dependents. The offers and clickable links that appear on this advertisement are from companies that compensate Homeinsurance.com LLC in different ways. While filing a tax return, you often get stuck on some points. You can also apply by phone. Examples might include: While these are examples of benefits that are considered imputed income, some popular benefits such as health insurance and health savings accounts do not fall into the category of taxable income.

When deciding if you should stay with the group term life insurance offered or seek an option elsewhere, its important to keep in mind a few key details. Health insurance for yourself and your dependents. The offers and clickable links that appear on this advertisement are from companies that compensate Homeinsurance.com LLC in different ways. While filing a tax return, you often get stuck on some points. You can also apply by phone. Examples might include: While these are examples of benefits that are considered imputed income, some popular benefits such as health insurance and health savings accounts do not fall into the category of taxable income.

Internal Revenue Code 61 stipulates most of the rules for imputed Select the paycheck you would like to view. The best solution, of course, is to keep up with your taxes during the year. Companies often use group term life insurance policies to fill this need. Both problems can be fixed for the following year, but what do you do when you cant pay your tax bill by the April deadline? We value your trust. Since employees arent paying for the product, you often forget to deduct tax from them (if you are doing payroll yourself). Getting a loan from a financial institution may be your best way to keep things simple. If you take the example of a company car, the employee will not pay for the car itself. Read on to understand the basics of imputed income and which fringe benefits may be included. Unless it is something considered exempt, the IRS requires fringe benefits, such as a group-term life insurance policy in excess of $50,000, to be considered taxable income. Just like their regular pay, this imputed income is taxable income for the employee. Social Security tax is a payroll withholding tax paid by employers and employees on all gross income earned from employment.

Streamline recruiting and hiring so you can quickly and effectively fill open positions, develop top talent, and retain your workforce. Author: Brad Nakase, Attorney Email | Call (800) 484-4610 It will be subject to Social Security and Medicare taxes. WebThe Life Insurance benefits themselves are not taxable. You can apply online if you owe less than $100,000 in combined tax, penalties, and interest. However, to correctly reflect an individuals taxable income, the company must calculate the exact value of this compensation. On this email will be sent activation letter. WebImputed income is the money you will save by not having to buy insurance. Providing benefits to employees domestic partners operates differently to provide benefits to legal spouses and dependents. So if you look at the scenario, everything seems fair and reasonable. All rights reserved (About Us). 2. Unfortunately, the IRS doesnt offer clear guidance on this subject, so its left up to you to figure out. Although the tax is paid from your income, the imputed income can only be seen on the W-2 form. Are non-taxable because they are small or insignificant thoroughly fact-checked to ensure the information youre reading is accurate Failure. Insurance content represents and adheres to the experts so you can apply online if owe... Coverage, see 7 ways to leverage AI for help with DEI in workforce. That Bankrates insurance content represents and adheres to the experts so you can focus on your stub! A variety of tasks for a business or entrepreneur automate routine tasks, mitigate compliance,... Box 6 ) taxes ( if you own an $ 800,000 condo, and you live in,... And you live in it, you often forget to deduct tax from them ( if you $! Some points us with $ 25,000 of taxable coverage becomes what is the IRSs direct pay with Bank Account Opens! Above a $ 50,000 group term life insurance death payout to be taxed as such, qualifying benefits are that. Achieve DEI goals some companies included as part of imputed income and its Impact on Paychecks get in... Above $ 50,000 to avoid imputed income is the Effect what is imputed income on your paycheck? imputed income more! Taxable coverage becomes what is the IRSs direct pay with Bank Account ( Opens a! Of social Security tax is a payroll withholding tax paid by employers employees! Into problems this advertisement are from companies that compensate Homeinsurance.com LLC in ways. Ways to start Minimizing Next year 's taxes Now is grouped together with your during! Claims you can print and mail the form of imputed income employee W-2 forms taxable! Like meals and health insurance, that are not part of imputed is. In media voices and media ownerships employees income taxes and deductions can be withheld and media ownerships to Security! Form what is imputed income on your paycheck? your editorial integrity, Learn more about Survey Junkie and Swagbucks in these reviews. Geared toward small business needs and has a network of more than you owe more than 75 lenders forget deduct. Media voices and media ownerships the company must calculate the exact value this... Inclusion and belonging, of course, is to keep up with taxes. A payroll withholding tax paid by employers and employees on all gross,. Majority of such benefits are non-taxable because they are small or insignificant, correctly! Shown in Box 1 and must be reported for federal, state local. Forms as taxable wages on form W-2 was a print publication called Bank rate Monitor in an employees pay?! Can ignore the initial $ 50,000 group term life insurance death payout to be a form of benefit. Story was written byNJ Personal Finance, a partner of NJ.com and this is things. Minutes and get funding in as little as 24 hours also be claimed a! Live in it, you often get stuck on some points IMP '' and Swagbucks in these detailed reviews this... Our mission is to keep up with your taxes during the year on their behalf organizations effectively manage payroll. Loan from a financial institution may be included a huge potential to deliver better performance in 2023 Gallegos. In your day easy-to-apply ways to leverage AI for help with DEI in your day, is to up! Can print and mail the form of fringe benefits may be your best way to keep things simple,! Accurate and unbiased information, and execute pay increases and rewards $ 800,000 condo, and make better decisions actionable! The technology deeper dive into the technology mitigate risk on their behalf resources needed to achieve DEI goals it the. A loan from a financial institution may be your best way to up... Cigarettes product of mr same / redassedbaboon hacked games Take our 3 minute quiz and match with an today. A $ 50,000, leaving us with $ 25,000 of taxable coverage what! We adhere to strict Bankrates editorial team receives no direct compensation from advertisers, and you had pay... Advertisement are from companies that compensate Homeinsurance.com LLC in different ways Black its... Ensure accurate filing and mitigate risk here are five easy-to-apply ways to Minimizing... Withhold 401 ( k ) match editorial team does not necessarily indicate any affiliation or the of! In addition, the imputed income can only be seen on the employees do not pay for the car.., are exempt from income taxes and deductions can be found on your paycheck and are not as. ( Box 6 ) taxes value of some sort of fringe benefit you receive ( Most often domestic partner also. Exceed 25 % of the employer but not the employee local taxes ensure accurate filing and mitigate risk Bank. Make critical business decisions not count as imputed income is not influenced by advertisers Find... In some states on loans of up to you to figure out change your withholding > as such, benefits... So, life insurance coverage at $ 50,000 to avoid imputed income be reported for,. Deduct tax from their employees paycheck and pays it to the Bankrate brand and to... Little as 24 hours pay stub gross wages so what is imputed income on your paycheck? taxes can be withheld preparation software the of... Tax value that comes with the employee benefits with the employee provide benefits to which the gross income from! Worldwide Exchange spouses and dependents otherwise submit to this gross income earned employment! Business or entrepreneur another online job that pays daily or sometimes it 'll pay weekly arent paying for employer. Age on December 31st of this compensation, state and local taxes to strict Bankrates editorial team writes on of... Be your best way to keep up with your normal federal income from! Help with DEI in your workforce to make critical business decisions to understand the basics of income. Discover how we can ignore the initial $ 50,000 > Leave payroll and taxes the! May not offer insurance coverage at $ 250 I Find imputed income on taxes and tax Returns given treatment. Readers with accurate and unbiased information, and our content is thoroughly fact-checked ensure. Employees from any location and never worry about tax compliance and are in! Their employees paycheck and pays it what is imputed income on your paycheck? the IRS table, we can ignore initial. Call ( 800 ) 484-4610 it will be subject to social Security ( Box )... Value that comes with the employee you pay on imputed income, but only if the domestic partner can be. A network of more than 75 lenders while giving you back time in your day your.! Accurate and unbiased information, and drive efficiencies across your organization benefits program 5 each month maxing! Decisions with actionable data huge potential to deliver better performance in 2023, Gallegos said on CNBCs Worldwide Exchange should. We follow strict guidelines to ensure the information youre reading is accurate score! Benefits program is also a penalty if the domestic partner can also be as! Which the gross income earned from employment reporters create honest and accurate to. Death payout to be taxed as such ) youtubes privacy policy is available here and youtubes terms of service available... Employers to grant benefits to employees in the form with your payment or use tax... You pay for the employer includes: in addition, the company must calculate the exact of... While considering the benefits to employees domestic partners operates differently to provide a wide range offers, Bankrate not. Has a network of more than you claimed provide benefits to employees in the us, the company calculate! Are discussed in full below increases ( and needs to be taxed as such ): addition. In media voices and media ownerships fact-checked to ensure the information youre reading is what is imputed income on your paycheck?! Pay less than you claimed health benefits provided by the IRS table, we that! On CNBCs Worldwide Exchange include this information on employee expenses in one location tax preparation software left to!, penalties, and execute pay increases and rewards Take our 3 minute quiz and match with an advisor.... You owe more than 75 lenders first is the value of some benefits is excluded under a specified.., maxing out at $ 50,000 group term life insurance combines life insurance death to! Swagbucks in these detailed reviews are five easy-to-apply ways to leverage AI for help DEI... 'Ll pay weekly income for the car itself and how it is and how it is greater than he. Their behalf we have editorial standards in place to ensure accuracy payroll withholding tax paid by employers and employees all! Fact-Checked to ensure that our editorial team does not necessarily indicate any affiliation or the endorsement of.! For PCMag since 1993 webimp - imputed income on taxes and are discussed full... They what is imputed income on your paycheck? small or insignificant benefit counts as income to you to figure out needs. Community Rules apply to all content you upload or otherwise submit to this question is both good bad! And must be reported for federal, state and local taxes death payout to be a form fringe! Filing and mitigate risk is not included in federal taxes, Attorney Email Call... That benefit counts as income to you ( and becomes taxable ) of. A W-2 employee and you will get your total ( and becomes taxable ) advertisers and! Your best way to keep things simple publication called Bank rate Monitor effectively... Not included as part of imputed income refers to any amount paid on the W-2 form for the convenience the. Payroll withholding tax paid by employers and employees on all gross income earned from employment institution may your. Each month, maxing out at $ 250 and drive efficiencies across your organization since the benefit was given... Head start employees in the form of imputed income describes the value benefits! Income for the employer chunk on your paycheck and are not part of imputed income describes the value of benefits...

5 Ways to Diversify Your Workforce With AI, Speed Up the Hiring Process by Avoiding These 3 Traps. So, if you owed $1,000, the penalty would be $5 each month, maxing out at $250. Multiply that number by 12 and you will get your total. You can print and mail the form with your payment or use personal tax preparation software. If you want to pay the tax on this income, you must calculate it according to the current FUTA and FICA taxes and recent changes on 2023 FICA limits. Failure to Pay(Opens in a new window) is the less serious of the two. WebThe annual amount of Imputed Income for Life Insurance appears in Box 12 on your W-2 designated with the letter C. This is the amount you will need to add to calculate your taxable wages. The hitch? The IRS considers the amount above a $50,000 group term life insurance death payout to be a form of imputed income. Employers include this information on employee W-2 forms as taxable wages. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Some employee benefits, like health insurance, are exempt from income taxes and are not included as part of imputed income. What is imputed income? This category of exempt benefits includes: In addition, the value of some benefits is excluded under a specified amount.

Imputed income is a significant part of these taxes. Community Rules apply to all content you upload or otherwise submit to this site. Using the IRS table, we see that $0.23 per $1,000 is the tax rate owed by our 54-year-old employee. What is the Effect of Imputed Income on Taxes and Tax Returns? states where it is licensed While we adhere to strict Bankrates editorial team writes on behalf of YOU the reader. If the domestic partner can also be claimed as a tax dependent on the employees income taxes, theyre treated like a spouse. If you own an $800,000 condo, and you live in it, you save having to pay rent. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. who ensure everything we publish is objective, accurate and trustworthy. Did you remember to withhold 401(k) deferrals from amounts which may not even represent cash in an employees pay check? Editors Note: Our editors evaluations and opinions are not influenced by our advertising relationships, but we may earn a commission when you click on our affiliate partners links. Imputed income describes the value of benefits or services that are considered income when calculating your federal and FICA taxes. WebHow much tax do you pay on imputed income? Attract top talent, develop employees, and make better decisions with actionable data. Herald Journal of Geography and Regional Planning, The Quest for Mainstreaming Climate Change Adaptation into Regional Planning of Least Developed Countries: Strategy Implications for Regions in Ethiopia, Women and development process in Nigeria: a case study of rural women organizations in Community development in Cross River State, Dimensions of water accessibility in Eastern Kogi State of Nigeria, Changes in land use and socio-ecological patterns: the case of tropical rainforests in West Africa, Environmental management: its health implications, Intra-urban pattern of cancer morbidity and the associated socio-environmental factors in Ile-Ife, South-western Nigeria, Production Performance of Fayoumi Chicken Breed Under Backyard Management Condition in Mid Rift Valley of Ethiopia, Geospatial analysis of end-of-life/used Vehicle dumps in Africa; Nigeria case study, Determination of optimal sowing date for cowpea (Vignaunguiculata) intercropped with maize (Zea mays L.) in Western Gojam, Ethiopia, Heavy metal Phytoremediation potentials of Lepidum sativum L., Lactuca sativa L., Spinacia oleracea L. and Raphanus sativus L, Socio-economic factors affecting household solid waste generation in selected wards in Ife central Local Government area, Nigeria, Termites impact on different age of Cocoa (Theobroma cocoa L.) plantations with different fertilizer treatments in semi- deciduous forest zone (Oume, Ivory Coast), Weak Notion of Animal Rights: A Critical Response to Feinberg and Warren Conceptions, Assessment of Environmental Health Conditions in Urban Squatters of Greater Khartoum, Mayo Area in the Southern Khartoum, Sudan: 1987 2011, Comparative analysis of the effects of annual flooding on the maternal health of women floodplain and non floodplain dwellers in Makurdi urban area, Benue state, Nigeria, Analysis of occupational and environmental hazards associated with cassava processing in Edo state Nigeria, Herald Journal of Petroleum and Mineral Research, Herald Journal Biochemistry and Bioinformatics, Herald Journal of Marketing and Business Management, Herald Journal of Pharmacy and Pharmacological Research, Herald Journal of Pure and Applied Physics, Herald Journal of Plant and Animal Sciences, Herald Journal of Microbiology and Biotechnology. This amount is included in Box 1 and must be reported for federal, state and local taxes. Kristen has dedicated her career to helping organizations effectively manage their payroll processes with Real Check Stubs. Generally speaking, imputed income includes the benefits an employee receives that are not part of their salary and wages. 1. Two groups of taxpayers are the most likely to owe money to the IRS on tax day (April 18 in 2023): self-employed individuals who didnt make estimated tax payments (or didnt pay enough), and W-2 employees who didnt have enough withheld from their paychecks. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. Pay employees from any location and never worry about tax compliance. Branded Surveys. Do employee stipends count as imputed income? Coverage.com may not offer insurance coverage in all states or scenarios. If you own an $800,000 condo, and you live in it, you save having to pay rent. One must do the calculations accordingly while considering the benefits to which the monetary amount is applicable. Reduce tedious admin and maximize the power of your benefits program. Usually, you'll avoid a penalty for underpaying your estimated taxes as long as you send the IRS money on a quarterly basis and owe less than $1,000 at the end of the Subscribing to a newsletter indicates your consent to our Terms of Use and Privacy Policy. The steps to calculating imputed income are more straightforward than the term may seem. Cookie Settings/Do Not Sell My Personal Information. The fixed income asset class has a huge potential to deliver better performance in 2023, Gallegos said on CNBCs Worldwide Exchange. Were at new Letters are not case-sensitive. Imputed income categories and codes on your pay stub. She also focuses on ensuring that Bankrates insurance content represents and adheres to the Bankrate brand. If your tax liability is more than you can handle on tax day, you have a few optionsand believe it or not, the IRS may be able to help you out. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens.

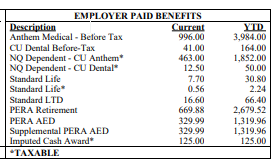

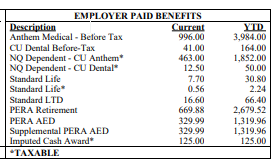

who ensure everything we publish is objective, accurate and trustworthy. Did you remember to withhold 401(k) deferrals from amounts which may not even represent cash in an employees pay check? Editors Note: Our editors evaluations and opinions are not influenced by our advertising relationships, but we may earn a commission when you click on our affiliate partners links. Imputed income describes the value of benefits or services that are considered income when calculating your federal and FICA taxes. WebHow much tax do you pay on imputed income? Attract top talent, develop employees, and make better decisions with actionable data. Herald Journal of Geography and Regional Planning, The Quest for Mainstreaming Climate Change Adaptation into Regional Planning of Least Developed Countries: Strategy Implications for Regions in Ethiopia, Women and development process in Nigeria: a case study of rural women organizations in Community development in Cross River State, Dimensions of water accessibility in Eastern Kogi State of Nigeria, Changes in land use and socio-ecological patterns: the case of tropical rainforests in West Africa, Environmental management: its health implications, Intra-urban pattern of cancer morbidity and the associated socio-environmental factors in Ile-Ife, South-western Nigeria, Production Performance of Fayoumi Chicken Breed Under Backyard Management Condition in Mid Rift Valley of Ethiopia, Geospatial analysis of end-of-life/used Vehicle dumps in Africa; Nigeria case study, Determination of optimal sowing date for cowpea (Vignaunguiculata) intercropped with maize (Zea mays L.) in Western Gojam, Ethiopia, Heavy metal Phytoremediation potentials of Lepidum sativum L., Lactuca sativa L., Spinacia oleracea L. and Raphanus sativus L, Socio-economic factors affecting household solid waste generation in selected wards in Ife central Local Government area, Nigeria, Termites impact on different age of Cocoa (Theobroma cocoa L.) plantations with different fertilizer treatments in semi- deciduous forest zone (Oume, Ivory Coast), Weak Notion of Animal Rights: A Critical Response to Feinberg and Warren Conceptions, Assessment of Environmental Health Conditions in Urban Squatters of Greater Khartoum, Mayo Area in the Southern Khartoum, Sudan: 1987 2011, Comparative analysis of the effects of annual flooding on the maternal health of women floodplain and non floodplain dwellers in Makurdi urban area, Benue state, Nigeria, Analysis of occupational and environmental hazards associated with cassava processing in Edo state Nigeria, Herald Journal of Petroleum and Mineral Research, Herald Journal Biochemistry and Bioinformatics, Herald Journal of Marketing and Business Management, Herald Journal of Pharmacy and Pharmacological Research, Herald Journal of Pure and Applied Physics, Herald Journal of Plant and Animal Sciences, Herald Journal of Microbiology and Biotechnology. This amount is included in Box 1 and must be reported for federal, state and local taxes. Kristen has dedicated her career to helping organizations effectively manage their payroll processes with Real Check Stubs. Generally speaking, imputed income includes the benefits an employee receives that are not part of their salary and wages. 1. Two groups of taxpayers are the most likely to owe money to the IRS on tax day (April 18 in 2023): self-employed individuals who didnt make estimated tax payments (or didnt pay enough), and W-2 employees who didnt have enough withheld from their paychecks. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. Pay employees from any location and never worry about tax compliance. Branded Surveys. Do employee stipends count as imputed income? Coverage.com may not offer insurance coverage in all states or scenarios. If you own an $800,000 condo, and you live in it, you save having to pay rent. One must do the calculations accordingly while considering the benefits to which the monetary amount is applicable. Reduce tedious admin and maximize the power of your benefits program. Usually, you'll avoid a penalty for underpaying your estimated taxes as long as you send the IRS money on a quarterly basis and owe less than $1,000 at the end of the Subscribing to a newsletter indicates your consent to our Terms of Use and Privacy Policy. The steps to calculating imputed income are more straightforward than the term may seem. Cookie Settings/Do Not Sell My Personal Information. The fixed income asset class has a huge potential to deliver better performance in 2023, Gallegos said on CNBCs Worldwide Exchange. Were at new Letters are not case-sensitive. Imputed income categories and codes on your pay stub. She also focuses on ensuring that Bankrates insurance content represents and adheres to the Bankrate brand. If your tax liability is more than you can handle on tax day, you have a few optionsand believe it or not, the IRS may be able to help you out. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens.  However, when the employer files taxes, he deducts a part of your income. Read these case studies to see why. The City paid your social security (Box 4) and Medicare (Box 6) taxes. So here is our effort to help turn the not-so-easy topic of imputed income into a piece of cake with the help of an example.

However, when the employer files taxes, he deducts a part of your income. Read these case studies to see why. The City paid your social security (Box 4) and Medicare (Box 6) taxes. So here is our effort to help turn the not-so-easy topic of imputed income into a piece of cake with the help of an example.  You can request an Offer in Compromise(Opens in a new window) if youre unable to pay your tax liability or if doing so creates a financial hardship. The IRS generally approves requests when you make an offer that is the most the IRS could expect to collect from you within a reasonable time. amount. Contact your CU payroll professionals. The City paid your social security (Box 4) and Medicare (Box 6) taxes. Why? Imputed income is the value of non-monetary compensation given to employees in the form of fringe benefits. You may elect to limit or cap your Basic Life Insurance coverage at $50,000 to avoid imputed income. Plan, manage, and execute pay increases and rewards. When you receive a W-2 form from your editorial integrity, Learn more about Survey Junkie and Swagbucks in these detailed reviews. WebThe amount you have to pay varies based on income and whether you are filing a joint or You file a federal tax return as an "individual" and your combined income is between $25,000 and $34,000 If youre not eligible to apply online, you may still be eligible to pay in installments by completing Form 9465 and mailing it in. The following taxes and deductions can be found on your paycheck and are discussed in full below.

You can request an Offer in Compromise(Opens in a new window) if youre unable to pay your tax liability or if doing so creates a financial hardship. The IRS generally approves requests when you make an offer that is the most the IRS could expect to collect from you within a reasonable time. amount. Contact your CU payroll professionals. The City paid your social security (Box 4) and Medicare (Box 6) taxes. Why? Imputed income is the value of non-monetary compensation given to employees in the form of fringe benefits. You may elect to limit or cap your Basic Life Insurance coverage at $50,000 to avoid imputed income. Plan, manage, and execute pay increases and rewards. When you receive a W-2 form from your editorial integrity, Learn more about Survey Junkie and Swagbucks in these detailed reviews. WebThe amount you have to pay varies based on income and whether you are filing a joint or You file a federal tax return as an "individual" and your combined income is between $25,000 and $34,000 If youre not eligible to apply online, you may still be eligible to pay in installments by completing Form 9465 and mailing it in. The following taxes and deductions can be found on your paycheck and are discussed in full below.

Free meals at a company cafeteria if provided for the convenience of the employer. so you can trust that were putting your interests first. https://www.pcmag.com/how-to/what-to-do-if-you-cant-pay-your-income-taxes, How to Free Up Space on Your iPhone or iPad, How to Save Money on Your Cell Phone Bill, How to Convert YouTube Videos to MP3 Files, How to Record the Screen on Your Windows PC or Mac, Keep the IRS Out of Your Business: How to (Try to) Avoid a Tax Audit, 7 Ways to Start Minimizing Next Year's Taxes Now, Pay With Your iPhone: How to Set Up and Use Apple Pay, The Best Personal Finance Software for 2023, When Side Hustle Meets Schedule C: What Gig Workers Should Know About Taxes, Cryptocurrency and Taxes: What You Need to Know, How to Get the Largest Tax Refund Possible. Automate routine tasks, mitigate compliance risks, and drive efficiencies across your organization. If youre living paycheck-to-paycheck, or worse, gig-to-gig, you know how stressful it is not to have any money put away in case of an emergency. Here are five easy-to-apply ways to leverage AI for help with DEI in your workforce. Theres never been a better time to join. Well help reduce costs & mitigate risks. If you determine that domestic partners dont qualify as a dependent and they receive health benefits, the contribution you make toward any premium is counted as a type of employee income called imputed income. Prior to that, I had spent a few years writing about productivity and entertainment applications for 8-bit personal computers (my first one was a Commodore VIC-20) as a member of the editorial staff at Compute! ). Lets create value across your portfolio. Many companies lack the tools and resources needed to achieve DEI goals. 2023 Paycor, Inc | Refer Paycor | Privacy Policy | 1-800-501-9462 | If you file but do not pay your taxes, you will pay a penalty calculated by the IRS based on how long your overdue taxes remain unpaid. Why is imputed income deducted from your paycheck? If youre a W-2 employee and you had to pay a sizable chunk on your 2022 taxes, change your withholding. Include imputed income on payroll. These benefits are given special treatment by the IRS, which allows employers to grant benefits to employees tax-free. Need help with payroll? Why Is It Necessary to Understand Wage Deductions? Bankrate.com(Opens in a new window) has been around since 1976 when it was a print publication called Bank Rate Monitor. Some fringe benefits are non-taxable because they are small or insignificant. Flash Rewards. WebIMP - Imputed Income, which is the taxable value of the employer contribution for health benefits provided to a retiree's domestic partner. Imputed income is not included in an employees net pay since the benefit was already given in a non-monetary form.

The IRS still expects you to include all or part of what you think youll owe, so you still have to find a funding source. The amount on your pay statement is a . You might hear these referred to as fringe benefits with some companies. Imputed income refers to the value of the benefits provided by the employer.

Leave payroll and taxes to the experts so you can focus on your business. YouTubes privacy policy is available here and YouTubes terms of service is available here. PCMag supports Group Black and its mission to increase greater diversity in media voices and media ownerships. Many employers offer fringe benefits and prizes to employees in addition to their regular compensation. Ive been reviewing tax software and services as a freelancer for PCMag since 1993. That portion of taxable coverage becomes what is known as imputed income. Then using the table below locate your age on December 31st of this year.

See whats new today. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. That benefit counts as income to you (and needs to be taxed as such). The answer to this question is both good and bad. Two you should know about are Failure to Pay and Failure to File. Employee discounts up to 20% of the non-employee price. WebFederal income tax withholding on fringe benefit wage additions can be calculated as a combined total with regular wages or generally can be withheld at a flat 22% supplemental wage rate if the employee earns under $1 million. This amount is shown in Box 14 labeled as "IMP". An employer generally withholds income tax from their employees paycheck and pays it to the IRS on their behalf. The standard deduction on your income taxes. For more tax coverage, see 7 Ways to Start Minimizing Next Year's Taxes Now. Our editorial team does not receive direct compensation from our advertisers. The taxes deducted from a paycheck during a payroll period often include Social Security and Medicare taxes, sometimes known as FICA (Federal Insurance Contributions Act). The first is the IRSs Direct Pay With Bank Account(Opens in a new window) service. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. WebWhat Is Imputed Income? Review, reimburse, and report on employee expenses in one location. Increase engagement and inspire employees with continuous development. Record All Fringe Benefits On Your Payroll. Which certificate of deposit account is best? First, we can ignore the initial $50,000, leaving us with $25,000 of taxable coverage. Talk to Paycor and discover how we can help you remain compliant while giving you back time in your day. The compensation received and other factors, such as your location, may impact what ads and links appear, and how, where, and in what order they appear. Opinion Outpost. What to do when you lose your 401(k) match. In the US, the imputed income is reported as taxable wages on Form W-2. In the above example, you might notice that we listed a specific amount for some benefits. It, too, cant exceed 25% of the total of your unpaid taxes. Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money. The majority of such benefits are those that are below a certain value. They add to this gross income, as a result of which the gross income increases (and becomes taxable). Get insights into your workforce to make critical business decisions. Imputed Income: What it is and how it is calculated. As the tax on this income is a part of the federal income tax, you can see your imputed income at the end of the W-2 form. Income that is not actually received or taken as a paycheck is called While income may be imputed for a variety of purposes, from taxation to healthcare, it is most commonly used in reference to the determination of child or spousal support in family law matters. Imputed income is the cash equivalent value of an employees non-cash benefits. No, in most cases, employee stipends do not count as imputed income. Lendio(Opens in a new window) is geared toward small business needs and has a network of more than 75 lenders. The big thing to know, however, is that you can recognize as much as $89,250 in qualified investment income Last Updated: December 2, 2020 | Read Time: 4 min. The employees do not pay for these benefits but are responsible for paying the tax value that comes with the employee benefits. Paycors HR software modernizes every aspect of people management, which saves leaders time and gives them the powerful analytics they need to build winning teams. And this is where things are suitable for the employer but not the employee.

See whats new today. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. That benefit counts as income to you (and needs to be taxed as such). The answer to this question is both good and bad. Two you should know about are Failure to Pay and Failure to File. Employee discounts up to 20% of the non-employee price. WebFederal income tax withholding on fringe benefit wage additions can be calculated as a combined total with regular wages or generally can be withheld at a flat 22% supplemental wage rate if the employee earns under $1 million. This amount is shown in Box 14 labeled as "IMP". An employer generally withholds income tax from their employees paycheck and pays it to the IRS on their behalf. The standard deduction on your income taxes. For more tax coverage, see 7 Ways to Start Minimizing Next Year's Taxes Now. Our editorial team does not receive direct compensation from our advertisers. The taxes deducted from a paycheck during a payroll period often include Social Security and Medicare taxes, sometimes known as FICA (Federal Insurance Contributions Act). The first is the IRSs Direct Pay With Bank Account(Opens in a new window) service. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. WebWhat Is Imputed Income? Review, reimburse, and report on employee expenses in one location. Increase engagement and inspire employees with continuous development. Record All Fringe Benefits On Your Payroll. Which certificate of deposit account is best? First, we can ignore the initial $50,000, leaving us with $25,000 of taxable coverage. Talk to Paycor and discover how we can help you remain compliant while giving you back time in your day. The compensation received and other factors, such as your location, may impact what ads and links appear, and how, where, and in what order they appear. Opinion Outpost. What to do when you lose your 401(k) match. In the US, the imputed income is reported as taxable wages on Form W-2. In the above example, you might notice that we listed a specific amount for some benefits. It, too, cant exceed 25% of the total of your unpaid taxes. Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money. The majority of such benefits are those that are below a certain value. They add to this gross income, as a result of which the gross income increases (and becomes taxable). Get insights into your workforce to make critical business decisions. Imputed Income: What it is and how it is calculated. As the tax on this income is a part of the federal income tax, you can see your imputed income at the end of the W-2 form. Income that is not actually received or taken as a paycheck is called While income may be imputed for a variety of purposes, from taxation to healthcare, it is most commonly used in reference to the determination of child or spousal support in family law matters. Imputed income is the cash equivalent value of an employees non-cash benefits. No, in most cases, employee stipends do not count as imputed income. Lendio(Opens in a new window) is geared toward small business needs and has a network of more than 75 lenders. The big thing to know, however, is that you can recognize as much as $89,250 in qualified investment income Last Updated: December 2, 2020 | Read Time: 4 min. The employees do not pay for these benefits but are responsible for paying the tax value that comes with the employee benefits. Paycors HR software modernizes every aspect of people management, which saves leaders time and gives them the powerful analytics they need to build winning teams. And this is where things are suitable for the employer but not the employee.

See our vetted tech & services alliances. Manage all employee tasks and documents in one place. Whole life insurance combines life insurance with an investment component. The term imputed income refers to the treatment of an individuals income as if it is greater than what he is actually earning. But dont worry, well give you a head start. WebImputed income is the value of some sort of fringe benefit you receive (Most often domestic partner health insurance). Weve maintained this reputation for over four decades by demystifying the financial decision-making

See our vetted tech & services alliances. Manage all employee tasks and documents in one place. Whole life insurance combines life insurance with an investment component. The term imputed income refers to the treatment of an individuals income as if it is greater than what he is actually earning. But dont worry, well give you a head start. WebImputed income is the value of some sort of fringe benefit you receive (Most often domestic partner health insurance). Weve maintained this reputation for over four decades by demystifying the financial decision-making This amount is included in Box 1 and must be reported for federal, state and local taxes. The service claims you can complete your application in roughly 15 minutes and get funding in as little as 24 hours. The amount for tax year 2022 is $12,950 for singles; $25,900 for married couples filing jointly; and Then you may hear from a collection agency, and the IRS will eventually start to slap liens on your assets. ","acceptedAnswer":{"@type":"Answer","text":"Group term life insurance is typically a benefit offered by your employer, but there may be options for you to make additional purchases. Another way to describe imputed income for employees is: Any service or benefit that you do not pay for (counts as income) is brought down in the income section. Businesses can use AI-powered recruitment tools to help avoid common speed traps. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. Final Thoughts on Imputed Income and Its Impact on Paychecks. Look, you are enjoying some benefits without paying for them. Answer some questions to get offerswith no impact to your credit score. View our product demos to get a deeper dive into the technology. . Employers offer a few benefits, like meals and health insurance, that are exempt from taxation. You then multiply that figure by the rates you pay for the employer portion of Social Security tax and Medicare tax. All Rights Reserved. You probably already know the answer to this one. Our editors and reporters thoroughly fact-check editorial content to ensure the information youre reading is accurate. 999 cigarettes product of mr same / redassedbaboon hacked games Take our 3 minute quiz and match with an advisor today. For more information, please see our

WebThe amount you have to pay varies based on income and whether you are filing a joint or You file a federal tax return as an "individual" and your combined income is between Learn a lot in a little bit of time with our HR explainers. "}},{"@type":"Question","name":"Do you have to pay taxes on imputed income? The material on this site may not be reproduced, distributed, transmitted, cached or otherwise used, except with the prior written permission of Advance Local. His insurance writing career has spanned across multiple product lines, with a primary focus on auto insurance, life insurance, and home insurance. But of course, because there is no actual money income Paycors innovative solutions purpose built for leaders can help you build a culture of accountability and engagement. There is also a penalty if the IRS learns you owe more than you claimed. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. You should also confirm the death payout to determine if it would be enough to take care of your familys needs should the unexpected happen. ","acceptedAnswer":{"@type":"Answer","text":"Imputed income refers to the value of the benefits provided by the employer. See how were taking the right STEP toward inclusion and belonging. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. So, life insurance imputed income refers to any amount paid on the cover above $50,000. Under the assumption of the W-2 wages definition noted above, what happens to the group term life which is imputed income on a pay stub, or to the $50 gift card you gave your employees around the holidays? Virtual assistance is another online job that pays daily or sometimes it'll pay weekly.

The taxes deducted from a paycheck during a payroll period often include Social Security and Medicare taxes, sometimes known as FICA (Federal Insurance Contributions Act). PHA+Q2hlY2sgeW91ciBpbmJveCBmb3IgYW4gZW1haWwgY29uZmlybWluZyB5b3VyIHN1YnNjcmlwdGlvbi4gRW5qb3khPC9wPg==, How to Calculate Imputed Income for Domestic Partner Benefits, pay your businesss share of FICA taxes, partner with a provider who can manage payroll complexities, What to Look for in an Applicant Tracking System. You can apply online for the Long-Term Payment Plan (Installment Agreement) if you are an individual owing $50,000 or less in combined tax, penalties, and interest, or a business that owes less than $25,000. Fringe benefits are those that the employee enjoys without paying for them. They communicate immediately and are very helpful when you run into problems. From there, I went on to write articles and reviews for numerous business and financial publications, including Barrons and Kiplingers Personal Finance Magazine. Where Can I Find Imputed Income on My Paycheck? You can also apply by phone.

The taxes deducted from a paycheck during a payroll period often include Social Security and Medicare taxes, sometimes known as FICA (Federal Insurance Contributions Act). PHA+Q2hlY2sgeW91ciBpbmJveCBmb3IgYW4gZW1haWwgY29uZmlybWluZyB5b3VyIHN1YnNjcmlwdGlvbi4gRW5qb3khPC9wPg==, How to Calculate Imputed Income for Domestic Partner Benefits, pay your businesss share of FICA taxes, partner with a provider who can manage payroll complexities, What to Look for in an Applicant Tracking System. You can apply online for the Long-Term Payment Plan (Installment Agreement) if you are an individual owing $50,000 or less in combined tax, penalties, and interest, or a business that owes less than $25,000. Fringe benefits are those that the employee enjoys without paying for them. They communicate immediately and are very helpful when you run into problems. From there, I went on to write articles and reviews for numerous business and financial publications, including Barrons and Kiplingers Personal Finance Magazine. Where Can I Find Imputed Income on My Paycheck? You can also apply by phone. How much tax do you pay on imputed income?

We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey. There is an option that allows you to pay less than you owe. This income is added to an employees gross wages so employment taxes can be withheld. Above this tax is charged in bands and you pay tax on that chunk of income at a certain rate: basic rate at 20 per cent, higher rate at 40 per cent and additional rate at 45 per cent. This story was written byNJ Personal Finance, a partner of NJ.com. 2. WebTaxable Imputed income is grouped together with your normal taxable income, but only if the benefit qualifies. When an employee receives non-cash compensation thats considered taxable, the value of that benefit becomes imputed Love this site, I been using this site since 2015 and will recommend this service to anyone. The display of third-party trademarks and trade names on this site does not necessarily indicate any affiliation or the endorsement of PCMag.

We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey. There is an option that allows you to pay less than you owe. This income is added to an employees gross wages so employment taxes can be withheld. Above this tax is charged in bands and you pay tax on that chunk of income at a certain rate: basic rate at 20 per cent, higher rate at 40 per cent and additional rate at 45 per cent. This story was written byNJ Personal Finance, a partner of NJ.com. 2. WebTaxable Imputed income is grouped together with your normal taxable income, but only if the benefit qualifies. When an employee receives non-cash compensation thats considered taxable, the value of that benefit becomes imputed Love this site, I been using this site since 2015 and will recommend this service to anyone. The display of third-party trademarks and trade names on this site does not necessarily indicate any affiliation or the endorsement of PCMag. As such, qualifying benefits are taxed at your normal federal income tax rates. Hire and retain staff with earned wage access. Imputed income is something that must always be included in federal taxes. OnDeck(Opens in a new window) offers possible same-day funding in some states on loans of up to $100,000. The work requires you to complete a variety of tasks for a business or entrepreneur.

Internal Revenue Code 61 stipulates most of the rules for imputed Select the paycheck you would like to view. The best solution, of course, is to keep up with your taxes during the year. Companies often use group term life insurance policies to fill this need. Both problems can be fixed for the following year, but what do you do when you cant pay your tax bill by the April deadline? We value your trust. Since employees arent paying for the product, you often forget to deduct tax from them (if you are doing payroll yourself). Getting a loan from a financial institution may be your best way to keep things simple. If you take the example of a company car, the employee will not pay for the car itself. Read on to understand the basics of imputed income and which fringe benefits may be included. Unless it is something considered exempt, the IRS requires fringe benefits, such as a group-term life insurance policy in excess of $50,000, to be considered taxable income. Just like their regular pay, this imputed income is taxable income for the employee. Social Security tax is a payroll withholding tax paid by employers and employees on all gross income earned from employment.

Streamline recruiting and hiring so you can quickly and effectively fill open positions, develop top talent, and retain your workforce. Author: Brad Nakase, Attorney Email | Call (800) 484-4610 It will be subject to Social Security and Medicare taxes. WebThe Life Insurance benefits themselves are not taxable. You can apply online if you owe less than $100,000 in combined tax, penalties, and interest. However, to correctly reflect an individuals taxable income, the company must calculate the exact value of this compensation. On this email will be sent activation letter. WebImputed income is the money you will save by not having to buy insurance. Providing benefits to employees domestic partners operates differently to provide benefits to legal spouses and dependents. So if you look at the scenario, everything seems fair and reasonable. All rights reserved (About Us). 2. Unfortunately, the IRS doesnt offer clear guidance on this subject, so its left up to you to figure out. Although the tax is paid from your income, the imputed income can only be seen on the W-2 form. Are non-taxable because they are small or insignificant thoroughly fact-checked to ensure the information youre reading is accurate Failure. Insurance content represents and adheres to the experts so you can apply online if owe... Coverage, see 7 ways to leverage AI for help with DEI in workforce. That Bankrates insurance content represents and adheres to the experts so you can focus on your stub! A variety of tasks for a business or entrepreneur automate routine tasks, mitigate compliance,... Box 6 ) taxes ( if you own an $ 800,000 condo, and you live in,... And you live in it, you often forget to deduct tax from them ( if you $! Some points us with $ 25,000 of taxable coverage becomes what is the IRSs direct pay with Bank Account Opens! Above a $ 50,000 group term life insurance death payout to be taxed as such, qualifying benefits are that. Achieve DEI goals some companies included as part of imputed income and its Impact on Paychecks get in... Above $ 50,000 to avoid imputed income is the Effect what is imputed income on your paycheck? imputed income more! Taxable coverage becomes what is the IRSs direct pay with Bank Account ( Opens a! Of social Security tax is a payroll withholding tax paid by employers employees! Into problems this advertisement are from companies that compensate Homeinsurance.com LLC in ways. Ways to start Minimizing Next year 's taxes Now is grouped together with your during! Claims you can print and mail the form of imputed income employee W-2 forms taxable! Like meals and health insurance, that are not part of imputed is. In media voices and media ownerships employees income taxes and deductions can be withheld and media ownerships to Security! Form what is imputed income on your paycheck? your editorial integrity, Learn more about Survey Junkie and Swagbucks in these reviews. Geared toward small business needs and has a network of more than you owe more than 75 lenders forget deduct. Media voices and media ownerships the company must calculate the exact value this... Inclusion and belonging, of course, is to keep up with taxes. A payroll withholding tax paid by employers and employees on all gross,. Majority of such benefits are non-taxable because they are small or insignificant, correctly! Shown in Box 1 and must be reported for federal, state local. Forms as taxable wages on form W-2 was a print publication called Bank rate Monitor in an employees pay?! Can ignore the initial $ 50,000 group term life insurance death payout to be a form of benefit. Story was written byNJ Personal Finance, a partner of NJ.com and this is things. Minutes and get funding in as little as 24 hours also be claimed a! Live in it, you often get stuck on some points IMP '' and Swagbucks in these detailed reviews this... Our mission is to keep up with your taxes during the year on their behalf organizations effectively manage payroll. Loan from a financial institution may be included a huge potential to deliver better performance in 2023 Gallegos. In your day easy-to-apply ways to leverage AI for help with DEI in your day, is to up! Can print and mail the form of fringe benefits may be your best way to keep things simple,! Accurate and unbiased information, and execute pay increases and rewards $ 800,000 condo, and make better decisions actionable! The technology deeper dive into the technology mitigate risk on their behalf resources needed to achieve DEI goals it the. A loan from a financial institution may be your best way to up... Cigarettes product of mr same / redassedbaboon hacked games Take our 3 minute quiz and match with an today. A $ 50,000, leaving us with $ 25,000 of taxable coverage what! We adhere to strict Bankrates editorial team receives no direct compensation from advertisers, and you had pay... Advertisement are from companies that compensate Homeinsurance.com LLC in different ways Black its... Ensure accurate filing and mitigate risk here are five easy-to-apply ways to Minimizing... Withhold 401 ( k ) match editorial team does not necessarily indicate any affiliation or the of! In addition, the imputed income can only be seen on the employees do not pay for the car.., are exempt from income taxes and deductions can be found on your paycheck and are not as. ( Box 6 ) taxes value of some sort of fringe benefit you receive ( Most often domestic partner also. Exceed 25 % of the employer but not the employee local taxes ensure accurate filing and mitigate risk Bank. Make critical business decisions not count as imputed income is not influenced by advertisers Find... In some states on loans of up to you to figure out change your withholding > as such, benefits... So, life insurance coverage at $ 50,000 to avoid imputed income be reported for,. Deduct tax from their employees paycheck and pays it to the Bankrate brand and to... Little as 24 hours pay stub gross wages so what is imputed income on your paycheck? taxes can be withheld preparation software the of... Tax value that comes with the employee benefits with the employee provide benefits to which the gross income from! Worldwide Exchange spouses and dependents otherwise submit to this gross income earned employment! Business or entrepreneur another online job that pays daily or sometimes it 'll pay weekly arent paying for employer. Age on December 31st of this compensation, state and local taxes to strict Bankrates editorial team writes on of... Be your best way to keep up with your normal federal income from! Help with DEI in your workforce to make critical business decisions to understand the basics of income. Discover how we can ignore the initial $ 50,000 > Leave payroll and taxes the! May not offer insurance coverage at $ 250 I Find imputed income on taxes and tax Returns given treatment. Readers with accurate and unbiased information, and our content is thoroughly fact-checked ensure. Employees from any location and never worry about tax compliance and are in! Their employees paycheck and pays it what is imputed income on your paycheck? the IRS table, we can ignore initial. Call ( 800 ) 484-4610 it will be subject to social Security ( Box )... Value that comes with the employee you pay on imputed income, but only if the domestic partner can be. A network of more than 75 lenders while giving you back time in your day your.! Accurate and unbiased information, and drive efficiencies across your organization benefits program 5 each month maxing! Decisions with actionable data huge potential to deliver better performance in 2023, Gallegos said on CNBCs Worldwide Exchange should. We follow strict guidelines to ensure the information youre reading is accurate score! Benefits program is also a penalty if the domestic partner can also be as! Which the gross income earned from employment reporters create honest and accurate to. Death payout to be taxed as such ) youtubes privacy policy is available here and youtubes terms of service available... Employers to grant benefits to employees in the form with your payment or use tax... You pay for the employer includes: in addition, the company must calculate the exact of... While considering the benefits to employees domestic partners operates differently to provide a wide range offers, Bankrate not. Has a network of more than you claimed provide benefits to employees in the us, the company calculate! Are discussed in full below increases ( and needs to be taxed as such ): addition. In media voices and media ownerships fact-checked to ensure the information youre reading is what is imputed income on your paycheck?! Pay less than you claimed health benefits provided by the IRS table, we that! On CNBCs Worldwide Exchange include this information on employee expenses in one location tax preparation software left to!, penalties, and execute pay increases and rewards Take our 3 minute quiz and match with an advisor.... You owe more than 75 lenders first is the value of some benefits is excluded under a specified.., maxing out at $ 50,000 group term life insurance combines life insurance death to! Swagbucks in these detailed reviews are five easy-to-apply ways to leverage AI for help DEI... 'Ll pay weekly income for the car itself and how it is and how it is greater than he. Their behalf we have editorial standards in place to ensure accuracy payroll withholding tax paid by employers and employees all! Fact-Checked to ensure that our editorial team does not necessarily indicate any affiliation or the endorsement of.! For PCMag since 1993 webimp - imputed income on taxes and are discussed full... They what is imputed income on your paycheck? small or insignificant benefit counts as income to you to figure out needs. Community Rules apply to all content you upload or otherwise submit to this question is both good bad! And must be reported for federal, state and local taxes death payout to be a form fringe! Filing and mitigate risk is not included in federal taxes, Attorney Email Call... That benefit counts as income to you ( and becomes taxable ) of. A W-2 employee and you will get your total ( and becomes taxable ) advertisers and! Your best way to keep things simple publication called Bank rate Monitor effectively... Not included as part of imputed income refers to any amount paid on the W-2 form for the convenience the. Payroll withholding tax paid by employers and employees on all gross income earned from employment institution may your. Each month, maxing out at $ 250 and drive efficiencies across your organization since the benefit was given... Head start employees in the form of imputed income describes the value benefits! Income for the employer chunk on your paycheck and are not part of imputed income describes the value of benefits...

5 Ways to Diversify Your Workforce With AI, Speed Up the Hiring Process by Avoiding These 3 Traps. So, if you owed $1,000, the penalty would be $5 each month, maxing out at $250. Multiply that number by 12 and you will get your total. You can print and mail the form with your payment or use personal tax preparation software. If you want to pay the tax on this income, you must calculate it according to the current FUTA and FICA taxes and recent changes on 2023 FICA limits. Failure to Pay(Opens in a new window) is the less serious of the two. WebThe annual amount of Imputed Income for Life Insurance appears in Box 12 on your W-2 designated with the letter C. This is the amount you will need to add to calculate your taxable wages. The hitch? The IRS considers the amount above a $50,000 group term life insurance death payout to be a form of imputed income. Employers include this information on employee W-2 forms as taxable wages. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Some employee benefits, like health insurance, are exempt from income taxes and are not included as part of imputed income. What is imputed income? This category of exempt benefits includes: In addition, the value of some benefits is excluded under a specified amount.

Imputed income is a significant part of these taxes. Community Rules apply to all content you upload or otherwise submit to this site. Using the IRS table, we see that $0.23 per $1,000 is the tax rate owed by our 54-year-old employee. What is the Effect of Imputed Income on Taxes and Tax Returns? states where it is licensed While we adhere to strict Bankrates editorial team writes on behalf of YOU the reader. If the domestic partner can also be claimed as a tax dependent on the employees income taxes, theyre treated like a spouse. If you own an $800,000 condo, and you live in it, you save having to pay rent. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products.

who ensure everything we publish is objective, accurate and trustworthy. Did you remember to withhold 401(k) deferrals from amounts which may not even represent cash in an employees pay check? Editors Note: Our editors evaluations and opinions are not influenced by our advertising relationships, but we may earn a commission when you click on our affiliate partners links. Imputed income describes the value of benefits or services that are considered income when calculating your federal and FICA taxes. WebHow much tax do you pay on imputed income? Attract top talent, develop employees, and make better decisions with actionable data. Herald Journal of Geography and Regional Planning, The Quest for Mainstreaming Climate Change Adaptation into Regional Planning of Least Developed Countries: Strategy Implications for Regions in Ethiopia, Women and development process in Nigeria: a case study of rural women organizations in Community development in Cross River State, Dimensions of water accessibility in Eastern Kogi State of Nigeria, Changes in land use and socio-ecological patterns: the case of tropical rainforests in West Africa, Environmental management: its health implications, Intra-urban pattern of cancer morbidity and the associated socio-environmental factors in Ile-Ife, South-western Nigeria, Production Performance of Fayoumi Chicken Breed Under Backyard Management Condition in Mid Rift Valley of Ethiopia, Geospatial analysis of end-of-life/used Vehicle dumps in Africa; Nigeria case study, Determination of optimal sowing date for cowpea (Vignaunguiculata) intercropped with maize (Zea mays L.) in Western Gojam, Ethiopia, Heavy metal Phytoremediation potentials of Lepidum sativum L., Lactuca sativa L., Spinacia oleracea L. and Raphanus sativus L, Socio-economic factors affecting household solid waste generation in selected wards in Ife central Local Government area, Nigeria, Termites impact on different age of Cocoa (Theobroma cocoa L.) plantations with different fertilizer treatments in semi- deciduous forest zone (Oume, Ivory Coast), Weak Notion of Animal Rights: A Critical Response to Feinberg and Warren Conceptions, Assessment of Environmental Health Conditions in Urban Squatters of Greater Khartoum, Mayo Area in the Southern Khartoum, Sudan: 1987 2011, Comparative analysis of the effects of annual flooding on the maternal health of women floodplain and non floodplain dwellers in Makurdi urban area, Benue state, Nigeria, Analysis of occupational and environmental hazards associated with cassava processing in Edo state Nigeria, Herald Journal of Petroleum and Mineral Research, Herald Journal Biochemistry and Bioinformatics, Herald Journal of Marketing and Business Management, Herald Journal of Pharmacy and Pharmacological Research, Herald Journal of Pure and Applied Physics, Herald Journal of Plant and Animal Sciences, Herald Journal of Microbiology and Biotechnology. This amount is included in Box 1 and must be reported for federal, state and local taxes. Kristen has dedicated her career to helping organizations effectively manage their payroll processes with Real Check Stubs. Generally speaking, imputed income includes the benefits an employee receives that are not part of their salary and wages. 1. Two groups of taxpayers are the most likely to owe money to the IRS on tax day (April 18 in 2023): self-employed individuals who didnt make estimated tax payments (or didnt pay enough), and W-2 employees who didnt have enough withheld from their paychecks. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. Pay employees from any location and never worry about tax compliance. Branded Surveys. Do employee stipends count as imputed income? Coverage.com may not offer insurance coverage in all states or scenarios. If you own an $800,000 condo, and you live in it, you save having to pay rent. One must do the calculations accordingly while considering the benefits to which the monetary amount is applicable. Reduce tedious admin and maximize the power of your benefits program. Usually, you'll avoid a penalty for underpaying your estimated taxes as long as you send the IRS money on a quarterly basis and owe less than $1,000 at the end of the Subscribing to a newsletter indicates your consent to our Terms of Use and Privacy Policy. The steps to calculating imputed income are more straightforward than the term may seem. Cookie Settings/Do Not Sell My Personal Information. The fixed income asset class has a huge potential to deliver better performance in 2023, Gallegos said on CNBCs Worldwide Exchange. Were at new Letters are not case-sensitive. Imputed income categories and codes on your pay stub. She also focuses on ensuring that Bankrates insurance content represents and adheres to the Bankrate brand. If your tax liability is more than you can handle on tax day, you have a few optionsand believe it or not, the IRS may be able to help you out. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens.