falsifying documents for 401k hardship withdrawal

After you sign and save template, you can download it, email a copy, or invite other people to eSign it. The account balance does not appear to be accurate.

For these reasons, withdrawals should be a last-ditch option for employees facing financial hardship.

A qualifying financial need doesn't have to be unexpected. ", [SHRM members-only toolkit:

1. So the title sums it up decently as a tl:dr, but to get a bit more in depth, im in a bit of a tight spot money wise and for the first 8 or so months the company i worked for was taking money out of my check to put into a retirement account of a company i shall not mention.

For example, some 401 (k) plans may allow a hardship distribution to pay for your, your spouses, your dependents or your primary plan beneficiarys: medical expenses, funeral expenses, or.

Amount of the medical expenses not covered by insurance.

Talk to the college financial aid office to find out if youre eligible for institutional grants or loans.

Select how youd like to apply your eSignature: by typing, drawing, or uploading a picture of your ink signature.

If you're at retirement age but still working, there aren't IRS restrictions about withdrawals.

Click, falsifying documents for 401k hardship withdrawal. 0000005981 00000 n

Speed up your businesss document workflow by creating the professional online forms and legally-binding electronic signatures. 0000222473 00000 n trailer << /Size 63 /Info 13 0 R /Root 15 0 R /Prev 270179 /ID[<0ea246b5b08e0eff10bb42f5fd3bb73c><0ea246b5b08e0eff10bb42f5fd3bb73c>] >> startxref 0 %%EOF 15 0 obj << /Type /Catalog /Pages 12 0 R /Outlines 11 0 R >> endobj 61 0 obj << /S 140 /O 269 /Filter /FlateDecode /Length 62 0 R >> stream

"Plan administrators who self-administer hardship distributions may want to

In this case, the deception is lying about being evicted, the financial gain is access to money that you would not have if not for the deception.

0000011185 00000 n

There are three variants; a typed, drawn or uploaded signature. When you withdraw funds from a 401(k), they could become subject to the claims of creditors. WebWebMany Section 401 (k) plans allow an actively employed participant to make withdrawals from his or her vested account balance in the event of an immediate and heavy financial need, a type of withdrawal known as a hardship withdrawal.

The recipient agrees to preserve source documents and to make them available at any time, upon request, to the employer or administrator. Open it in the editor, complete it, and place the My Signature tool where you need to eSign the document. Employers often choose to include hardship distribution provisions in their plan to eliminate a concern participants might otherwise have about making contributions being able to access funds when in dire need makes participants more confident about saving. Learn how your retirement funds could be impacted by a bank failure. "If a personal bankruptcy or long-term inability to pay your obligations looms on the horizon, it may be best to leave your money tucked away in your retirement plan where it is free from the claims of creditors, except the IRS," Weil says.

The advanced tools of the editor will guide you through the editable PDF template. 0000010026 00000 n Best Parent Student Loans: Parent PLUS and Private. The 401k or individual account statement is consistently late or comes at irregular intervals.

The IRS Softens its Position on Hardship Substantiation, Commercial Mortgage-Backed Securities (CMBS), Community Banking & Financial Institutions, Employment Discrimination & Wrongful Termination, The Hardship of Administering 401(k) Plan Hardship Withdrawals.

0000001708 00000 n If you cant find an answer to your question, please dont hesitate to reach out to us.

Contribute a modest percentage of each paycheck and your investments build in value over the years, generating a nice nest egg for your retirement. 0000002057 00000 n 401(k) plans that permit hardship distributions As explained in a newly published IRS Snapshot, a 401(k) plan may permit pre-retirement distributions to be made on account of participants experiencing financial hardships. 0000002584 00000 n Make money and stay active with these best part-time jobs for retirees. "It's up to the plan sponsor to decide whether to allow hardship withdrawals," says Kyle Ryan, executive vice president of advisory services at Personal Capital in Danville, California. 0000007760 00000 n

0000006302 00000 n

0000006144 00000 n Many plan sponsors will be excited to embark on a less-intrusive, paperless process for hardship withdrawals. Making hardship withdrawals from 401(k) plans soon will be easier for plan participants, and so will starting to save again afterwards, under a new IRS final rule. 3.

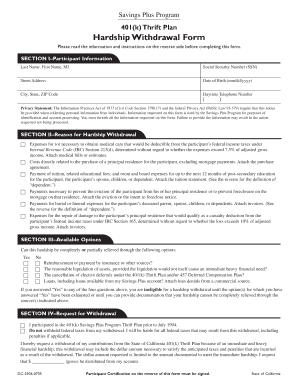

STEP 1 PARTICIPANT INFORMATION A.

), does not meet statutory requirements, according to the IRS news release. Like CNBC Make It on Facebook! But there are also many costs that will not be determined to be immediate and heavy. You are required to pay the money back within five years plus interest, but if you have a pressing need, it's a better option than a hardship distribution. To avoid jeopardizing the qualified status of the plan, employers and plan administrators must follow both the plan document and legal requirements before making hardship distributions.

The U.S. District Court for the Southern District of Ohio has ruled against a dismissal motion filed by the defendant in a lawsuit stemming from federal grand jury charges related to allegations of fraudulent hardship withdrawals taken from a tax-advantaged retirement plan. $('.container-footer').first().hide();

The government is making it easier for investors facing an economic hardship to take money from their 401 (k)s. But financial experts urge savers to be cautious before doing so. SHRM Online, October 2019, Retirement Plans Are Leaking Money.

Here is a list of the most common customer questions. Approximately 34% of American workers between the ages of 15 and 64 have a 401(k).

However, make sure you pay off your balance in full by the end of the promotional period; otherwise, hefty interest charges will apply.

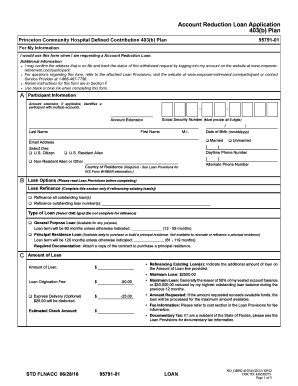

Additionally, plan sponsors will no longer need to require participants to take a loan before they can take a hardship withdrawal. An expense may be considered immediate and heavy even if it is an event you knew was coming or voluntarily pursued. Create an account using your email or sign in via Google or Facebook.

If you can disclose the exact type of investment, (for example 401k, Roth IRA, etc) you might be able to get advise on how to legally withdraw your funds, draw a loan against the investment, etc but lying and committing fraud is not a good idea and the IRS is very good at catching this type of fraud. 2023 airSlate Inc. All rights reserved. Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. The new rule removes a requirement that participants first take a plan loan, if available, before making a hardship withdrawal. New comments cannot be posted and votes cannot be cast. Get access to thousands of forms. And "having a funeral at home is better than endangering the financial health of the living."

Search for the document you need to electronically sign on your device and upload it.

0000004223 00000 n Previously, they could only take out their own contributions.

blitzalchemy 4 yr. ago If there is any other way to make your financial situation work besides dipping into your 401(k), you should opt to do that. The IRS lists the following as situations that might qualify for a 401 (k) hardship withdrawal: Certain medical expenses. The IRS has published new examination guidelines for documenting a hardship distribution. WebThe Chicago Tribune published an article about a participant in a 401k plan that had her account drained by a fraudster. Select the document you want to sign and click.  3.

3.

entities, such as banks, credit card issuers or travel companies.

1. To qualify for a 401(k) hardship withdrawal, you must have a 401(k) plan that permits hardship withdrawals. Subscribe to our daily newsletter to get investing advice, rankings and stock market news.

Don't forget to save up for these common retirement expenses. You may be allowed to take additional funds to help cover related costs, such as the taxes to be paid on the transaction. If you understand and agree with the foregoing and you are not our client and will not divulge confidential information to us, you may contact us for general information. For example, if it will cost $10,000 to fix your house after an earthquake, you won't be able to take out more than that for the repair. Answer 20 questions and get matched today. "While many loan-takers default, at least there's a good chance that the loan will be repaid," said Aaron Tabela, chief marketing officer at Custodia Financial, which provides retirement savings loan insurance.

"The IRS retained the requirement from the proposed regulations that During the 7-day trial period, you can electronically sign your documents and collect eSignatures from your partners and customers free of charge.

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.)

0000001729 00000 n A Division of NBC Universal, This simple equation will tell you if you're saving enough for retirement, 31-year-old used her $1,200 stimulus check to start a successful business, 100-year-old sisters share 4 tips for staying mentally sharp (not crosswords).

), does not meet statutory requirements, according to the IRS

You can sidestep many 401(k) fees with careful planning.

The signNow extension provides you with a selection of features (merging PDFs, adding several signers, and many others) to guarantee a better signing experience.

Hb```f````c`X B@QL{0`-{HrM&E6+EIZZZ( v@Z F20mx Need help with a specific HR issue like coronavirus or FLSA?

Like this story?

Use our eSignature solution and leave behind the old times with efficiency, affordability and security.

), does not meet statutory requirements, according to the IRS These mountain towns feature majestic peaks and reasonable housing costs. Are you sure you want to rest your choices?  Go to the Chrome Web Store and add the signNow extension to your browser.

Go to the Chrome Web Store and add the signNow extension to your browser.

We cannot represent you until we know that doing so will not create a conflict of interest with any existing clients.

According to the IRS, the withdrawals that qualify include: There are limits on how much money you can take from your 401(k) account in a hardship withdrawal. The Forbes Advisor editorial team is independent and objective. The amount of the distribution cannot exceed the immediate and heavy financial need.

0000008419 00000 n

0000008419 00000 n

Printing and scanning is no longer the best way to manage documents.

3.

Create an account in signNow.

Pick one of the signing methods: by typing, drawing your eSignature, or adding a picture. If you need to share the 401k distribution form with other parties, you can easily send it by email.

A distribution could push you into a higher income tax bracket, causing you to pay a higher marginal tax rate. Name and address of the service provider (hospital, doctor/dentist/chiropractor/other, pharmacy)?  401(k) Withdrawal Rules Most early withdrawals (those taken before age 59) from a 401(k) are taxed as ordinary income plus a 10 percent penalty. However, auditors are still instructed to ask an employer or vendor to produce the underlying documents that support the reason for the immediate and heavy financial need, if there are any notice gaps or irregularities in what participants certify when applying for a hardship.

401(k) Withdrawal Rules Most early withdrawals (those taken before age 59) from a 401(k) are taxed as ordinary income plus a 10 percent penalty. However, auditors are still instructed to ask an employer or vendor to produce the underlying documents that support the reason for the immediate and heavy financial need, if there are any notice gaps or irregularities in what participants certify when applying for a hardship.

else if(currentUrl.indexOf("/about-shrm/pages/shrm-mena.aspx") > -1) {

As explained in a newly published IRS Snapshot, a 401(k) plan may permit pre-retirement distributions to be made on account of participants experiencing financial hardships.  None of which im in danger of, but my question is more, in order to withdraw this money, is there anything technically saying its illegal if i were to have my apartment manager to draw up an "official" eviction notice so that i may "prove my hardship.". The government is making it easier for investors facing an economic hardship to take money from their 401(k)s. But financial experts urge savers to be cautious before doing so.

None of which im in danger of, but my question is more, in order to withdraw this money, is there anything technically saying its illegal if i were to have my apartment manager to draw up an "official" eviction notice so that i may "prove my hardship.". The government is making it easier for investors facing an economic hardship to take money from their 401(k)s. But financial experts urge savers to be cautious before doing so.

Many 401 (k) plans allow you to withdraw money before you actually retire to pay for certain events that cause you a financial hardship. "Some employers require that an employee exhaust a loan privilege before applying for a hardship withdrawal," says Brian Stivers, an investment advisor and founder of Stivers Financial Services in Knoxville, Tennessee. Beginning in 2020, "an employee can make a representation that he or she has insufficient cash or other liquid assets reasonably available to satisfy a financial need, even if the employee does have cash or other liquid assets on hand, provided that those assets are earmarked to pay an obligation in the near future" such as rent, he explained. Adams said "the regulations note that the amendment deadline for 403(b) plans is March 30, 2020, but indicate the Treasury and IRS are considering extending that deadline for the adoption of amendments to conform to the final hardship regulations. In general, when you make a withdrawal from your 401K before you signNow age 59 , the Internal Revenue Service may charge you a 10% early withdrawal penalty. If youre considering using a 401(k) hardship withdrawal to cover tuition or other expenses for yourself or your child, make sure you explore all the financial aid opportunities available.  Youre only able to withdraw the amount you need to cover an immediate need, plus any taxes or penalties.

Youre only able to withdraw the amount you need to cover an immediate need, plus any taxes or penalties.

To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. Burial or funeral costs.

All you have to do is download it or send it via email.

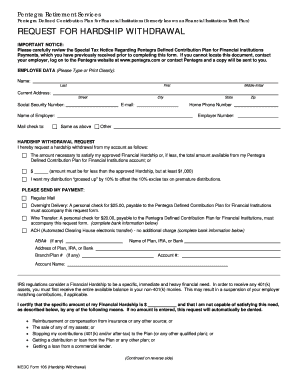

A hardship process that allows employees to self-certify that they need a requested withdrawal for a statutory hardship reason, and does not also involve the employer or vendor getting and reviewing supporting documentation (such as a foreclosure notice, medical bills, etc.

USA Today reported a similar story in January. intended to eliminate any delay or uncertainty concerning access to plan funds that might otherwise occur following a major disaster," noted Nevin Adams, chief of communications at the American Retirement Association in Arlington, Va., which represents retirement plan sponsors and service providers. 0000172905 00000 n

A 401(k) hardship withdrawal is allowed by the IRS if you have an "immediate and heavy financial need."

0000004019 00000 n

Distributions from your 401(k) plan are taxable unless the amounts are rolled over as described below in the section Distribution Options | Human Resources at MIT. The government is making it easier for investors facing an economic hardship to take money from their 401 (k)s. But financial experts urge savers to be cautious before doing so.

There is no separate form for DU CIC.

If you have an "immediate and heavy financial need," the IRS may allow a 401(k) hardship withdrawal.Getty Images. What little bit ive gathered is that fraud has some weird grey areas, but im also not a legal expert. Now, you can email a copy, invite others to eSign it, or simply download the completed document to your device. Performance information may have changed since the time of publication.

The IRS permits 401(k) hardship withdrawals only for immediate and heavy financial needs.

on this page is accurate as of the posting date; however, some of our partner offers may have expired. 0000005207 00000 n Among its key provisions, the final rule will do the following: Eliminate the six-month contribution-suspension requirement.

SHRM Online, October 2017.

To request permission for specific items, click on the reuse permissions button on the page where you find the item.

Select the area where you want to insert your eSignature and then draw it in the popup window. A low-interest credit card can give you time to pay off the emergency expense without interest accruing, and you wouldnt have to drain your retirement fund. Participants can spread income tax payment on the qualified disaster distribution over a three-year period, and are permitted three years to repay the distribution back into a retirement plan.

Heres what you need to know about moving to Puerto Rico for retirement.

Employers might also want to consider a focused annual review of hardship behavior to be alert for the possibility that the process has become so easy that participants no longer take seriously the protection of their retirement savings. "Making expenses related to certain disasters a safe harbor expense is "Every dollar withdrawn from your 401(k) early is a dollar that isn't there for retirement," Ryan says. We'd love to hear from you, please enter your comments.