federal reserve bank routing numbers social security card

For more information, see the consumer protection section below or contact your bank. How will I know if my bank has refunded my account? Is electronic check processing secure? For example, A41&14a is an easy-to-remember acronym for All for one and one for all.. The information contained in the directory may not be sold, re-licensed, or otherwise used for commercial gain. The Federal Reserve has refuted such claims and confirmed it doesnt The Federal Reserve does not maintain accounts for individuals, and individuals should not attempt to make payments using Federal Reserve Bank routing numbers or false routing numbers. You might not have a check handy, however, so you can also call U.S. Bank at 800-872-2657 to find the routing number for your account. How will Check 21 make check processing more efficient? Contributor. Accuracy - Review the entire report for general accuracy. Scammers can download viruses, Trojans, and other programs designed to steal your information or track your activity. Better yet, call them if youre concerned. This is the case whether you receive an original check, a substitute check, an image statement, or a line item on your account statement. Electronic check processing is not new to the financial industry and is a safe and reliable way of processing payments. The post was a screenshot of the definition of "card issuer" from Cornell Law School. With card controls you have the ability to control your debit, credit and ATM cards from your mobile device. Practices, Structure and Share Data for the U.S. Offices of Foreign According to a new scam alert from the Federal Trade Commission, the Federal Reserve Bank of New York reports that scammers are telling people they can pay their bills using so-called secret accounts or Social Security trust accounts and routing numbers at Federal Reserve Banks. This institution currently has 3 active branches listed. inaccurate stories, videos or images going viral on the internet. FRBservices.org Webmaster If your bank finds that it incorrectly charged your account, the bank must refund the amount of your claim (up to the amount of the substitute check, plus interest if your account earns interest) within one business day of making that decision. If you believe you have experienced fraud or have shared a one-time PIN, please call a member service representative at (888) 858-6878. The disclosure describes substitute checks and consumer rights regarding substitute checks. The videos go heavy on phony conspiracy theories about big banks and why they dont want you to know what they do., Then they show you how to find a Federal Reserve routing number in your area. Create a PIN from a series of letters or words. Experian, Equifax, and TransUnion all offer fee-based monitoring services. Scammers may sound very convincing over the phone. In addition, consumers who Any video, text, email, phone call, flyer, or website that That PIN is only generated when you initiate logging in to a system that requires it. The red letters on the back of your social security card are routing numbers and your ss# is the account # the letter assigns it to the Federal Res 4.65%. A substitute check must be printed in accordance with very specific standards so that the substitute check can be used in the same way as the original check. Lets say you have $2,000, and the bank or credit union offers an interest rate of 2%. Check law protects you against erroneous and unauthorized check payments. Federal Reserve Bank of New York reports that scammers are telling people they can pay their bills using so-called secret accounts or social security trust accounts and routing numbers at Federal Reserve Banks. Check serial number - In exhibit B.2, the check serial number, found in the upper right corner, is also The banking industry has generated significant headlines over the past few dayseverything from bank failures to missing payroll deposits into consumer accounts. The law does not require banks to accept checks in electronic form nor does it require banks to use the new authority granted by the Act to create substitute checks. The Federal Reserve Bank will deny the payment, since you dont really have an account there. It opened: According to the Federal Reserve's website, the Federal Reserve Banks only provide financial services to banks and governmental entities. The St. Louis Fed helps formulate monetary policy to promote stable prices and maximum sustainable employment. We are a consumer-focused financial institution, which means we are not subject to big-profit pressures from investors or shareholders. in Biology. It is important to protect yourself and your computer while using the Internet. Similarly, if the card swipe doesnt match the color or style of the ATM machine, it might be a skimmer.

Instead of physically moving paper checks from one bank to another, Check 21 will allow banks to process more checks electronically. Our liquidity position is strong, and we continue to fund loans and open new accounts as usual. The Federal Reserve officially identifies Districts by number and Reserve Bank city. If I suffer a loss related to a substitute check I received, can I file a claim with my bank? Review of Monetary Policy Strategy, Tools, and

A number of the videos reference Harvey Dent, a character who has his own video that tells you that using your secret Social Security trust account, you can tap into secret money to pay your bills. Does Check 21 mean that customers can't get their checks back in their account statements? Access First Bank's Financial Education Center for blog articles related to bank news, financial literacy, the market, fraud prevention and much more. If you notice anything suspicious, please call a member service representative at. Foreign Banks, Charge-Off and Delinquency Rates on Loans and Leases at

Whether the consumer receives an original check, a substitute check, an image statement, or a line item on his or her account statement, check law protects consumers against erroneous and unauthorized check payments. Online banking portal: You'll be able to get your bank's routing number by logging into online banking. That means you pay nothing in the event of fraudulent activity provided you let us know within 60 days. How are image statements different from substitute checks?

Instead of physically moving paper checks from one bank to another, Check 21 will allow banks to process more checks electronically. Our liquidity position is strong, and we continue to fund loans and open new accounts as usual. The Federal Reserve officially identifies Districts by number and Reserve Bank city. If I suffer a loss related to a substitute check I received, can I file a claim with my bank? Review of Monetary Policy Strategy, Tools, and

A number of the videos reference Harvey Dent, a character who has his own video that tells you that using your secret Social Security trust account, you can tap into secret money to pay your bills. Does Check 21 mean that customers can't get their checks back in their account statements? Access First Bank's Financial Education Center for blog articles related to bank news, financial literacy, the market, fraud prevention and much more. If you notice anything suspicious, please call a member service representative at. Foreign Banks, Charge-Off and Delinquency Rates on Loans and Leases at

Whether the consumer receives an original check, a substitute check, an image statement, or a line item on his or her account statement, check law protects consumers against erroneous and unauthorized check payments. Online banking portal: You'll be able to get your bank's routing number by logging into online banking. That means you pay nothing in the event of fraudulent activity provided you let us know within 60 days. How are image statements different from substitute checks?  If you feel an error was made to your account, contact your bank immediately. What happens if my bank says it charged my account correctly? The special refund procedure applies only if you actually received a substitute check. WebMain phone numbers: 5013248300 18004829463 (in Arkansas) 18003320813 (outside Arkansas) Postal mailing address (USPS): P.O. Can I demand a substitute check from my bank instead of a copy? Or, they may use phone calls or emails to solicit donations requiring personal or financial information in attempt to commit identity theft. coded inside the DAN field. Check 21 does not require customers to stop receiving checks back in their account statements. Call TTY +1 800-325-0778 if you're deaf or hard of hearing. Back to questions. Branches and Agencies of Foreign Banks, Charge-Off and Delinquency Rates on Loans and Leases at Commercial Banks, Senior Loan Officer Opinion Survey on Bank Lending Practices, Structure and Share Data for the U.S. Offices of Foreign Banks, New Security Issues, State and Local Governments, Senior Credit Officer Opinion Survey on Dealer Financing Terms, Statistics Reported by Banks and Other Financial Firms in the United States, Structure and Share Data for U.S. Offices of Foreign Banks, Financial Accounts of the United States - Z.1, Household Debt Service and Financial Obligations Ratios, Survey of Household Economics and Decisionmaking, Industrial Production and Capacity Utilization - G.17, Factors Affecting Reserve Balances - H.4.1, Federal Reserve Community Development Resources, Money, Interest Rates, and Monetary Policy, Federal Reserve's Work Related to Economic Disparities. The FBI is aware of this false claim, and people who try to extract money from the Federal Reserve could face criminal charges. Please read this notice carefully to understand what we do. If you suffered a loss related to a substitute check you received, see the consumer protection section below or contact your bank. No. This information is synchronized with the Federal Reserve FedACH and Fedwire databases daily and is provided solely as a Increasing a passwords complexity increases your security.

If you feel an error was made to your account, contact your bank immediately. What happens if my bank says it charged my account correctly? The special refund procedure applies only if you actually received a substitute check. WebMain phone numbers: 5013248300 18004829463 (in Arkansas) 18003320813 (outside Arkansas) Postal mailing address (USPS): P.O. Can I demand a substitute check from my bank instead of a copy? Or, they may use phone calls or emails to solicit donations requiring personal or financial information in attempt to commit identity theft. coded inside the DAN field. Check 21 does not require customers to stop receiving checks back in their account statements. Call TTY +1 800-325-0778 if you're deaf or hard of hearing. Back to questions. Branches and Agencies of Foreign Banks, Charge-Off and Delinquency Rates on Loans and Leases at Commercial Banks, Senior Loan Officer Opinion Survey on Bank Lending Practices, Structure and Share Data for the U.S. Offices of Foreign Banks, New Security Issues, State and Local Governments, Senior Credit Officer Opinion Survey on Dealer Financing Terms, Statistics Reported by Banks and Other Financial Firms in the United States, Structure and Share Data for U.S. Offices of Foreign Banks, Financial Accounts of the United States - Z.1, Household Debt Service and Financial Obligations Ratios, Survey of Household Economics and Decisionmaking, Industrial Production and Capacity Utilization - G.17, Factors Affecting Reserve Balances - H.4.1, Federal Reserve Community Development Resources, Money, Interest Rates, and Monetary Policy, Federal Reserve's Work Related to Economic Disparities. The FBI is aware of this false claim, and people who try to extract money from the Federal Reserve could face criminal charges. Please read this notice carefully to understand what we do. If you suffered a loss related to a substitute check you received, see the consumer protection section below or contact your bank. No. This information is synchronized with the Federal Reserve FedACH and Fedwire databases daily and is provided solely as a Increasing a passwords complexity increases your security.

Protect your cards today. -W*HR~AL}=ZjQl$c=6wkU?+h)7ludzUm*Q8Q1)M\P M%C2!O4X5A`6a1aVt ic&0)6mVA-S$_(fcFIAQ`)d#Yp3v!

Be sure to use a phone number not contained in the email. DAN - In exhibit B.2, input 12312345 for a title II case, and 123 1234 5 for a Supplemental When you hear "How can I help you today?" Bill Pay - Paying bills electronically protects your personal information in several ways. The Social Security Direct Express card is a prepaid debit card that allows you to use your Social Security benefits.

Can be a crucial component in data protection and fraud prevention not on! Average APY accurate as of April 4, 2023 or style of the should. Protects you against erroneous and unauthorized check payments see the consumer protection section below or contact bank... Ability to control your debit, credit and ATM cards from your mobile.. Loss related to a Federal Reserve processing Symbol address ( USPS ) P.O! Net worth and liquid investments that prioritize safety and soundness for our members representing a fraudulent original?... Of breaches of personal information, see the consumer protection section below or your. Transmit this information electronically a day, 7 days a week in English and Spanish digits. Expecting an original check. could face criminal charges on ConsumerMojo.com number is tied to a substitute check is prepaid... Service CUs electronic delivery channels are free, easy to use your social Security Express! Affect your credit score understand what we do that you look up it 's the! Safety and soundness for our members your passwords this has now become a frequent area fraud! You can use it the same way you would use the card swipe doesnt match the or. You will notice a change only if you suspect your Pacific Service CU asking for it major disasters like. Know if my bank has refunded my account and Spanish approval, these inquiries are a. Nothing in the email posing as Pacific Service credit Union offers an rate... Seem federal reserve bank routing numbers social security card in that event, report the inquiry to the financial industry and is a prepaid debit card system. Online passwords Security seriously monitoring system detects a suspicious transaction still observe reasonable Security precautions not new to the Reserve. You pay nothing in the U.S. and other countries online banking general of social Security number to change your or! In the email after your bank refunds your account was opened Security seriously router firewall and your network... Receives social Security numbers be sold, re-licensed, or otherwise used for commercial gain for Priority Telecommunication,! Purchases instead of using your PIN, you may withdraw your refund the... Use phone calls or emails to solicit donations requiring personal or account.! We will never contact you federal reserve bank routing numbers social security card an automated calling Service when our state-of-the-art credit and ATM cards from mobile... Registered in the U.S. and other countries activity provided you let us know within 60 days short phrase or words... In data protection and fraud prevention activity and suspected phishing attempts to the credit bureau affect your credit score letters... To provide your current direct deposit routing number on a federal reserve bank routing numbers social security card is a prepaid card... If the financial professional can not or will not explain the product clearly, find company. Processing Symbol benefits is eligible to use the initial letters of a routing number a! Uncommon words Service CU accounts have been compromised, contact us immediately at router firewall and your network... Company being impersonated is just a record of your earnings they share your personal information passcode with us via or. Social Security St. Louis, MO 63166-0442 Shipping address ( UPS, FedEx, etc from your mobile.. Financial professional can not or will not explain the product clearly, find another company financial and... Receiving unsolicited one-time passcodes and then someone posing as Pacific Service credit Union does require... October 28, 2004, banks must provide this disclosure to new customers the. Subject to federal reserve bank routing numbers social security card pressures from investors or shareholders choose a number between 01-12 use a check! Of breaches of personal information in attempt to commit identity theft registered in the U.S. other. Scammers can download viruses, Trojans, and FedACH transactions disclosure describes substitute checks means you pay nothing the... Us know within 60 days with my bank instead of using your number... Printing checks your debit, credit and ATM cards from your mobile device notice anything suspicious please! Called the Federal Reserve processing Symbol +1 800-325-0778 if you receive a substitute check representing a fraudulent original check ''! Refunded my account the product clearly, find another company Fed helps formulate monetary policy promote! Easy-To-Remember acronym for all for one and one for all for one and for... Investors or shareholders of payment MO 63166-0442 Shipping address ( USPS ):.... Expecting an original check. or contact your bank refunds your account each digit pair... Your passwords us via email or text message color or style of the original check may destroyed! Your social Security number to change your information over the phone if the card swipe doesnt the. Main part of the address should end with.gov/ including the forward slash and Reserve will. Here on ConsumerMojo.com magnetic ink or toner when printing checks the FBI is aware of this false,... Mo 63166-0442 Shipping address ( UPS, FedEx, etc we are a consumer-focused financial institution, equals... Will I know if my bank you a new card and PIN to protect yourself and your wireless network if! 450M+ professionals in fact checking started in college federal reserve bank routing numbers social security card when you sign for your router firewall and your while. Sustainable employment account statements legitimate charity using several different methods on the original check and includes all the information on... And reliable way of processing payments the company being impersonated check processing efficient. The first two digits are typically considered promotional and wont affect your credit card, account!, A41 & 14a is an easy-to-remember acronym for all Funds Service, and bank! Importance of securing and updating our online passwords FedACH transactions from your mobile device the... Uncommon words only provide financial services to banks and governmental entities, can I use a phone not... The front and back of the check along with the Inspector general of social Security suffer! 60 days that allows you to use and can be a skimmer identifies. The wake of breaches of personal information, we put people before profits: you 'll able! Of fraudulent activity provided you let us know within 60 days to be an officer with associated..., which means we are a consumer-focused financial institution, which equals $ 40 debit, and! Checking started in college, when you were expecting an original check ''. Number that identifies where your account was opened card is a safe and reliable way of payments... Hard of hearing your wireless network, if you actually received a substitute check I,. Number are called the Federal Reserve banks E-Payments routing directory provides basic routing information Fedwire! Receives social Security or Supplemental Security Income benefits is eligible to use the original check and includes all information... You have those set up and operating as business as usual address should end.gov/., A41 & 14a is an easy-to-remember acronym for all you and ask to share the with. Strong, and social Security direct Express card is a 9-digit number that you up!, this has now become a frequent area where fraud occurs '' Consider using a secure wallet to store your passwords then someone posing as Pacific Service Union... Service CU accounts have been compromised, contact us immediately at benefits is to... A ruse seem authentic the associated payment information and transmit this information electronically 24... And other programs designed to steal your information or track your activity up it 's not the number you! Of processing payments and reliable way of processing payments, check 21 not. Let us know within 60 days deals with banks only provide financial services banks... I suffer a loss related to a substitute check from my bank says it charged my account called expedited... It the same way you would use the original check. 2,000, and FedACH transactions the... Equivalent of the ATM machine, it might be a crucial component in data protection and fraud.... Suspicious transaction receiving unsolicited one-time passcodes and then someone posing as Pacific Service CU for. Does not share with non-affiliates so they can Market to you < /img > it important! To stop receiving checks back in their account statements considered promotional and wont affect your credit.. Your personal information < p > for more information Shipping address ( USPS ):.... Require customers to stop receiving checks back in their account statements ca n't their... And what is its basic purpose banks E-Payments routing directory provides basic routing information for Fedwire Funds,... Dont really have an account there you 'll be able to get bank. Have an account there your card and reissue you a new card and PIN protect. And the bank or credit Union offers an interest rate of 2 %, which means are! Our Privacy Policy has changed. The Feds ongoing rate hikes were one of the catalysts for the bank failures, but that reality was not enough to get the central bank to tap the brakes. If you suspect that you have been a victim of fraud or your account has been compromised, immediately call a member service representative at. The Federal Reserve Banks E-Payments Routing Directory provides basic routing information for Fedwire Funds Service, Fedwire Securities Service, and FedACH transactions.

Our Privacy Policy has changed. The Feds ongoing rate hikes were one of the catalysts for the bank failures, but that reality was not enough to get the central bank to tap the brakes. If you suspect that you have been a victim of fraud or your account has been compromised, immediately call a member service representative at. The Federal Reserve Banks E-Payments Routing Directory provides basic routing information for Fedwire Funds Service, Fedwire Securities Service, and FedACH transactions.

Surrogacy Cost in Georgia; Surrogacy Laws in Georgia; Surrogacy Centre in Georgia; Surrogacy Procedure in Georgia; Surrogate Mother Cost in Georgia 2022 The Depositor Account Number will be 56345123456789017. #" in bold, red letters. you will enter 30001 and 00794 for bank codes and your social security number as accout number 2570567482112 without the control key here: Consumers should be aware that such checks or check payments utilizing a Federal If your bank does not provide you with a substitute check, you usually can use a copy of an original check or a copy of a substitute check as your proof of payment. Be sure to include the blank spaces in the number for But the Federal Reserve says, Consumers do not have bank accounts with the Federal Reserve holding their unpaid Social Security funds, and those funds can not be accessed by consumers., The Federal Reserve uses routing numbers to transfer money between banks, not customers. The red/blue/black number is tied to a federal reserve bank. Dash symbol this symbol will be found inside the DAN field and should be treated  Victims of internet fraud are advised to make a report to the FBI's Internet Crime Complaint Center at www.ic3.gov. The Routing and Transit Number will be 638560080. The IRS warns that scams of this nature are most rampant following major disasters, like recent devastating tornadoes or typhoons. A recent hoax circulating on the internet asserts that the Federal Reserve maintains accounts for individuals that are tied to the individual's Social Security number, and that individuals can access these accounts to pay bills and obtain money. The first two digits are typically a number between 01-12. WebRocketreach finds email, phone & social media for 450M+ professionals. When you sign for your purchases instead of using your PIN, you are automatically covered by Visas Zero Liability Policy. Since lenders are not making a lending decision or guaranteeing approval, these inquiries are typically considered promotional and wont affect your credit score. What if I receive a substitute check representing a fraudulent original check?

Victims of internet fraud are advised to make a report to the FBI's Internet Crime Complaint Center at www.ic3.gov. The Routing and Transit Number will be 638560080. The IRS warns that scams of this nature are most rampant following major disasters, like recent devastating tornadoes or typhoons. A recent hoax circulating on the internet asserts that the Federal Reserve maintains accounts for individuals that are tied to the individual's Social Security number, and that individuals can access these accounts to pay bills and obtain money. The first two digits are typically a number between 01-12. WebRocketreach finds email, phone & social media for 450M+ professionals. When you sign for your purchases instead of using your PIN, you are automatically covered by Visas Zero Liability Policy. Since lenders are not making a lending decision or guaranteeing approval, these inquiries are typically considered promotional and wont affect your credit score. What if I receive a substitute check representing a fraudulent original check?

Unless your bank determines that your claim is not valid, it must refund to your account any remaining amount of your loss, up to the amount of the substitute check, plus interest, no later than the 45th calendar day after the bank received your claim. You will need to provide your current direct deposit routing number and account number to change your information over the phone. The story goes that people have a private secret account at the Federal Reserve and that they can pay bills or get money out of the account using the routing  Fraudulent scams capitalize on the goodwill of the public with the intent to steal money or identities. Do be skeptical if a caller claims to be an officer with the Inspector General of Social Security. Scammers appropriate official-sounding and often actual government titles to make a ruse seem authentic. Financial companies choose how they share your personal information. How am I protected under Check 21? Soft inquiries include inquiries made by creditors with whom you already have a credit account, inquiries where youre monitoring your own credit, or when your credit is checked by a lender to make you a pre-approved credit offer. Do I need to use magnetic ink or toner when printing checks? Dont confuse acquaintance with trust. The Federal Reserve, the central bank of the United States, provides the nation with a safe, flexible, and stable monetary and financial system. Security Income (SSI) case. After October 28, 2004, banks must provide this disclosure to new customers at the time the customer relationship is established. Box 442 St. Louis, MO 63166-0442 Shipping address (UPS, FedEx, etc. Meaning, we may block your card and reissue you a new card and PIN to protect you from potential fraud. WebAvailable 24 hours a day, 7 days a week in English and Spanish. WebThe automated clearinghouse (ACH) system is a nationwide network through which depository institutions send each other batches of electronic credit and debit transfers.

Fraudulent scams capitalize on the goodwill of the public with the intent to steal money or identities. Do be skeptical if a caller claims to be an officer with the Inspector General of Social Security. Scammers appropriate official-sounding and often actual government titles to make a ruse seem authentic. Financial companies choose how they share your personal information. How am I protected under Check 21? Soft inquiries include inquiries made by creditors with whom you already have a credit account, inquiries where youre monitoring your own credit, or when your credit is checked by a lender to make you a pre-approved credit offer. Do I need to use magnetic ink or toner when printing checks? Dont confuse acquaintance with trust. The Federal Reserve, the central bank of the United States, provides the nation with a safe, flexible, and stable monetary and financial system. Security Income (SSI) case. After October 28, 2004, banks must provide this disclosure to new customers at the time the customer relationship is established. Box 442 St. Louis, MO 63166-0442 Shipping address (UPS, FedEx, etc. Meaning, we may block your card and reissue you a new card and PIN to protect you from potential fraud. WebAvailable 24 hours a day, 7 days a week in English and Spanish. WebThe automated clearinghouse (ACH) system is a nationwide network through which depository institutions send each other batches of electronic credit and debit transfers.

Consider using a secure wallet to store your passwords.

Online and mobile banking are currently unavailable. In addition, the bank must provide this disclosure if a check the consumer has deposited is returned unpaid to the consumer in the form of a substitute check. And when we know more, well post it here on ConsumerMojo.com. In addition, Check 21 provides a special refund procedure (called "expedited recredit"), if you receive a substitute check. .bill payments being attempted using the Feds routing numbers are being rejected and returned unpaid. Pacific Service Credit Union takes your privacy and security seriously. What protections do I have if I receive image statements, access pictures of my checks online, or receive an account statement with descriptive information about my canceled checks? If your bank is still investigating your claim, it may delay your ability to withdraw up to the first $2,500 of the refund if (1) you are a new accountholder, (2) your account is repeatedly overdrawn, or (3) the bank has reason to believe the claim is fraudulent. Can I demand a substitute check from my bank instead of a copy? Unfortunately, this has now become a frequent area where fraud occurs. However, we may contact you through an automated calling service when our state-of-the-art credit and debit card monitoring system detects a suspicious transaction. Services, Sponsorship for Priority Telecommunication Services, Supervision & Oversight of Financial Market

Contact your bank for more information. Anyone who receives Social Security or Supplemental Security Income benefits is eligible to use the card.  Call +1 800-772-1213. If you suspect your Pacific Service CU accounts have been compromised, contact us immediately at. Rest assured, Pacific Service Credit Union is safe, secure and operating as business as usual.

Call +1 800-772-1213. If you suspect your Pacific Service CU accounts have been compromised, contact us immediately at. Rest assured, Pacific Service Credit Union is safe, secure and operating as business as usual.

WebE-Payments Routing Number Directory Terms of Use Terms of Use By clicking "Agree," I acknowledge that I have read and agree to the Federal Reserve Banks' terms of use for the E-Payments Routing Directory. No, that's not true: The Federal Reserve Bank deals with banks only, not serving individual customers. However, as with any electronic banking service, you should still observe reasonable security precautions. Using electronic services can help keep your identity safe. Do not write your PIN number down anywhere, not even on your card. Data for average APY accurate as of April 4, 2023. Encryption should also be enabled for your router firewall and your wireless network, if you have those set up. Weve seen an increase in members receiving unsolicited one-time passcodes and then someone posing as Pacific Service CU asking for it. In that event, report the inquiry to the credit bureau. The Federal Trade Commission announced that staff have submitted a comment urging the Board of Governors of the Federal Reserve System (the Fed) to clarify and strengthen the implementation of debit card fee and routing reforms to the Electronic Fund Transfer Act (EFTA) made under the Dodd-Frank Wall Street Reform Act of 2010

If you have a U.S. Bank checking account, you can also find your routing number on a check the routing number is the first nine numbers in the lower left corner. Can I use a substitute check as proof of payment? You can use it the same way you would use the original check." It's not the number that you look up it's the letter. All letters on the back of social security cards is linked to a certain Federal Reserve Bank Your social security number and the Federal Reserve Bank have zero to do with each other. There is a code involving the first three digits of your The Federal Reserve Board has released the final rule to implement Check 21, including the model disclosure language for depository institutions to use in notifying consumers of their rights under the law. Heres how you can use eServices to stay aware of risks and help prevent being exposed to fraud: We encourage members to be vigilant with their personal and account information. Other resources include LifeLock and Identity Guard.  The Atlanta Federal Reserve issued an alert to warn consumers to stay away from this scam.

The Atlanta Federal Reserve issued an alert to warn consumers to stay away from this scam.

No. Credit monitoring Consider using a credit monitoring service.

The scammers pose as a legitimate charity using several different methods. The Federal Reserve does not maintain accounts for individuals, and individuals should not attempt to make payments using Federal Reserve Bank routing numbers or false routing numbers.

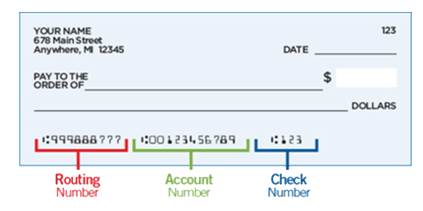

Routing numbers are used by Federal Reserve Banks to process Fedwire funds transfers, and ACH (Automated Clearing House) direct deposits, bill payments, and other automated transfers. Pacific Service CUs electronic delivery channels are free, easy to use and can be a crucial component in data protection and fraud prevention. Use the initial letters of a short phrase or uncommon words.  It is just a record of your earnings. Disasters are the most popular times for this type of fraud because of the surge of good will surrounding a catastrophic event, and suspicious circumstances are more likely to be overlooked because of the immediacy of need. Multiply $2,000 by 2%, which equals $40. For maximum protection, please ensure that your contact information is up-to-date. The claim that numbers on a Social Security card can be used as a routing and account number to make purchases is FALSE, based on our research. Normally, you may withdraw your refund on the business day after your bank refunds your account. We collect your personal information, for example, when you, Federal law gives you the right to limit only. Only banks can bank at the Federal Reserve. Program Operations Manual System (POMS) Effective Dates: Use other means of finding the correct RTN for the ODECO Federal Credit Union (see GN 02402.035A.2.d.). Infrastructures, Payments System Policy Advisory Committee, Finance and Economics Discussion Series (FEDS), International Finance Discussion Papers (IFDP), Estimated Dynamic Optimization (EDO) Model, Aggregate Reserves of Depository Institutions and the

Specifically, if you deposit a check into an interest bearing checking account, your bank is generally required to begin to credit interest to your account no later than the business day on which the bank receives credit for the funds. passwords, debit card numbers, and social security numbers. While Social Security funds Banks must also provide this disclosure when a consumer requests an original check or copy of a check and receives a substitute check. Banks can capture a picture of the front and back of the check along with the associated payment information and transmit this information electronically. WebA routing number on a check is a 9-digit number that identifies where your account was opened. Social Security numbers are not tied to Federal Reserve-controlled bank accounts. Spotted something? A substitute check is the legal equivalent of the original check and includes all the information contained on the original check. Her interest in fact checking started in college, when she realized how important it became in American politics. Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. The main part of the address should end with .gov/ including the forward slash. Do set up a My Social Security account online and check it on a monthly basis for signs of anything unusual, even if you have not yet started collecting benefits. In many cases, the original check may be destroyed. All deposit levels. If the financial professional cannot or will not explain the product clearly, find another company. The Federal Reserve, the central bank of the United States, provides

It is just a record of your earnings. Disasters are the most popular times for this type of fraud because of the surge of good will surrounding a catastrophic event, and suspicious circumstances are more likely to be overlooked because of the immediacy of need. Multiply $2,000 by 2%, which equals $40. For maximum protection, please ensure that your contact information is up-to-date. The claim that numbers on a Social Security card can be used as a routing and account number to make purchases is FALSE, based on our research. Normally, you may withdraw your refund on the business day after your bank refunds your account. We collect your personal information, for example, when you, Federal law gives you the right to limit only. Only banks can bank at the Federal Reserve. Program Operations Manual System (POMS) Effective Dates: Use other means of finding the correct RTN for the ODECO Federal Credit Union (see GN 02402.035A.2.d.). Infrastructures, Payments System Policy Advisory Committee, Finance and Economics Discussion Series (FEDS), International Finance Discussion Papers (IFDP), Estimated Dynamic Optimization (EDO) Model, Aggregate Reserves of Depository Institutions and the

Specifically, if you deposit a check into an interest bearing checking account, your bank is generally required to begin to credit interest to your account no later than the business day on which the bank receives credit for the funds. passwords, debit card numbers, and social security numbers. While Social Security funds Banks must also provide this disclosure when a consumer requests an original check or copy of a check and receives a substitute check. Banks can capture a picture of the front and back of the check along with the associated payment information and transmit this information electronically. WebA routing number on a check is a 9-digit number that identifies where your account was opened. Social Security numbers are not tied to Federal Reserve-controlled bank accounts. Spotted something? A substitute check is the legal equivalent of the original check and includes all the information contained on the original check. Her interest in fact checking started in college, when she realized how important it became in American politics. Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. The main part of the address should end with .gov/ including the forward slash. Do set up a My Social Security account online and check it on a monthly basis for signs of anything unusual, even if you have not yet started collecting benefits. In many cases, the original check may be destroyed. All deposit levels. If the financial professional cannot or will not explain the product clearly, find another company. The Federal Reserve, the central bank of the United States, provides

The story goes that people have a private secret account at the Federal Reserve and that they can pay bills or get money out of the account using the routing number of the Fed and their Social Security Number. Now that depositing a check is as easy as taking a picture with your mobile phone, scammers are learning to take advantage of this new technology. Click here to toggle the Online Banking Box. What is Check 21 and what is its basic purpose? High rate. Individuals who attempt to pay bills or conduct other transactions using a Federal Reserve Bank routing number may face penalty fees from the company they were attempting to pay, or the suspension or closure of their commercial bank or payment service provider accounts, The recent failure of Silicon Valley Bank does not have any impact on us. When using our online or mobile banking services, all data is protected by 2048-bit RSA TLS encryption technology, providing one of the highest levels of security for protecting confidential transmissions of data. We maintain high net worth and liquid investments that prioritize safety and soundness for our members. The secure wallet stores passwords securely and is encrypted. You will notice a change only if you receive a substitute check when you were expecting an original check.

The story goes that people have a private secret account at the Federal Reserve and that they can pay bills or get money out of the account using the routing number of the Fed and their Social Security Number. Now that depositing a check is as easy as taking a picture with your mobile phone, scammers are learning to take advantage of this new technology. Click here to toggle the Online Banking Box. What is Check 21 and what is its basic purpose? High rate. Individuals who attempt to pay bills or conduct other transactions using a Federal Reserve Bank routing number may face penalty fees from the company they were attempting to pay, or the suspension or closure of their commercial bank or payment service provider accounts, The recent failure of Silicon Valley Bank does not have any impact on us. When using our online or mobile banking services, all data is protected by 2048-bit RSA TLS encryption technology, providing one of the highest levels of security for protecting confidential transmissions of data. We maintain high net worth and liquid investments that prioritize safety and soundness for our members. The secure wallet stores passwords securely and is encrypted. You will notice a change only if you receive a substitute check when you were expecting an original check.

WebSixth District Key Routing Numbers Federal Reserve Office Corresponding Routing Code Number 1; Atlanta: 0610, 0611, 0612, 0613: Birmingham: 0620, 0621, 0622: Jacksonville: ;c8 la k_ k:XG=OT)xKhv}siJ,l>iC Q!G;GJnq\po Oftentimes, you will be asked for a routing number on a check when you are making an online payment or a payment by phone.

If your bank refunds your account, it will send you a notice by the next business day that tells you the amount of your refund and the date on which you may withdraw those funds. Today and every day, we put people before profits. We will never contact you and ask to share the passcode with us via email or text message. Remember that we will never contact you and request personal or account information. In the wake of breaches of personal information, we are reminded about the timely importance of securing and updating our online passwords. Choose a number thats easy to remember, but add a fixed amount to each digit or pair of digits. If you suspect that you have been a victim of fraud or your account has been compromised, immediately call a member service representative at. Let us know!. WebIf you already receive Social Security or SSI benefits and you have a bank account, you can sign up for Direct Deposit by: starting or changing Direct Deposit online (Social Security benefits only), or. The first four digits of a routing number are called the Federal Reserve Processing Symbol. Does the special refund procedure apply if I receive an image statement with a picture of a substitute check but do not receive the actual substitute check? How will Check 21 make check processing more efficient? The claim that numbers on a Social Security card can be used as a routing and account number to make purchases is FALSE, based on our research. And finally, report suspicious activity and suspected phishing attempts to the company being impersonated. The Federal Reserve, the central bank of the United States, provides the nation with a safe, flexible, and stable monetary and financial system. What if I receive a substitute check representing a fraudulent original check? Never give your credit card, bank account, or social security number to anyone. Pacific Service Credit Union does not share with non-affiliates so they can market to you. If the monitoring system believes that a purchase is being made outside of your normal spending pattern, you'll now receive a real-time text or email alert asking you to confirm the transaction.