journal entry for overapplied overhead

Nam risus ante,

sectetur adipiscing elit. Assuming the same number of units in ending inventory at the end of each year, were material costs rising or falling from 2016 to 2018? 93,000 b. C) Finished Goods Inventory. If a taxpayer is not self-employed, A:The FICA taxes are to be paid by each employee that depends on the salary earned by employee and, Q:Car Armour sells car wash cleaners. Actual Manufacturing Overhead, $90000 4 Overapplied or underapplied overhead is caused by errors in estimating the predetermined overhead rate. First week only $4.99! Finished Goods was debited 100,000 during June. Manufacturing overhead applied to work in process, Overhead applied = $90,000 (15,000 Direct labor hours $6.00 Predetermined overhead rate). O Work-in-Process Inventory, increases by $6750; Finished Goods Inventory increases by $3600; and Cost of Goods Sold Gross pay plus employee, A:Questions similar to the one given are called matching questions which need to be evaluated and, Q:With the following information about Quantum Plastics Ltd., prepare a cash budget During the month of June, direct labor totaled 30,000 and 24,000 of overhead was applied to production. Manufacturing overhead control, P20,000 dr. WebStep 2: Actual Overhead=$53,000+$21,000+$32,000+$21,000+$53,000= $180,000 Applied Overhead= $177,500 Underapplied oVerhead= $180,000-$177,500=$2,500 Step 3: Step 4: Gross, A:Gross profit : Legal. 2. Second, overhead tends to lose its identity after leaving Work in Process Inventory, thus making more difficult the determination of the amount of overhead in Finished Goods Inventory and Cost of Goods Sold account balances, Your email address will not be published. This method is typically used in the event of larger variances in their balances or in bigger companies. O Work-in-Process Inventory, increases by $4650; Finished Goods Inventory, increases by $3600; and Cost of Goods Sold Production costs for the monthmaterials, 99,150; labor, 54,925; factory overhead, 75,050. WebUnderapplied overhead journal entry. Raw materials 160,000 dr. Case 1: Any under -or over-applied overhead is considered immaterial.

WebThe year-end balances of these accounts, before adjustment, showed the following: Determine the prorated amount of the overapplied factory overhead that is chargeable WebThe entries for these are as follows: The second method is charging to cost of goods sold, finished goods, and work in process. At the end of 2018, Furry Balls Co. had the following account balances after factory overhead had been closed to manufacturing overhead control: Compute the amount of underapplied or overapplied overhead for the year, and show the balance in your Manufacturing Overhead T-account. below:, A:Contribution margin :It is the difference of sales revenue and variable cost. 8(t)= A debit balance in manufacturing overhead shows either that not enough overhead was applied to the individual jobs or overhead was underapplied. 2. 301, 10,000. Accounting students can take help from Video lectures, handouts, helping materials, assignments solution, On-line Quizzes, GDB, Past Papers, books and Solved problems. 96,000 c. 99,000 d. 102,000 22. Answer: B 13 ACC 321 Exam 1 Practice MC Job 79 was sold by the end of the month. A portion of the departmental cost work sheet prepared by the cost accountant at the end of July is reproduced below. The adjusting entry is: Returning to our example, at the end of the year, Dinosaur Vinyl had actual overhead expenses of \(\$256,500\) and applied overhead expenses of \(\$250,000\), as shown: Since manufacturing overhead has a debit balance, it is underapplied, as it has not been completely allocated. What disposition should be made of an underapplied overhead or overapplied overhead balance remaining in the manufacturing overhead account at the end of a period? Prepare the journal entry to close Factory Overhead to Cost of Goods Sold. Lorem ipsum dolor sit amet,

sectetur adipiscing elit. Required: 1. The following information, A:Process costing is particularly applicable where the final product passes through several, Q:31. Prepare the journal entries reflecting the completion of Jobs 13-280 and 13-282 and the sale of Job 13-280 on account. Cost of goods sold, P384,000 dr. Manufacturing overhead- 5,000 Cr. Compute the overhead variance, and label it as under- or overapplied. (f) Issued direct materials to Job No. Manufacturing overhead for the month was underapplied by $3,000. This is usually viewed as a favorable outcome, because less has been 29,100 common shares cuistanding issued add $ 17,520, A:A cash budget is a company's estimation of cash inflows and outflows over a specific period of time,, Q:Question 16 Assume that the company's underapplied or overapplied overhead is closed to Cost of Goods Sold. Compute the amount of underapplied or overapplied overhead for the year, and show the balance in your Manufacturing Overhead T-account. Pellentesque dapibus efficitur laoreet. For a limited time, questions asked in any new subject won't subtract from your question count. { "4.01:_Prelude_to_Job_Order_Costing" : "property get [Map MindTouch.Deki.Logic.ExtensionProcessorQueryProvider+<>c__DisplayClass228_0.

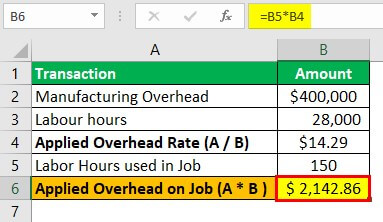

Investments made during the year 2023 = $84,700 3. WebIf the applied overhead exceeds the actual amount incurred, overhead is said to be overapplied. a. Activity Based Costing is a Powerful tool for measuring performance., Q:Valorous Corporation will pay a dividend of $1.75 per share at this year's end and a dividend of, A:It is a method used to estimate the value of a stock by calculating the present value of its future, Q:Al Habib manufacturer uses the FIFO method in its process costing system. Sarasota Corporation eliminates its overapplied or underapplied overhead by using the prorated had the following balances: Cost of Goods Sold, $65250 Finished Goods Inventory, $34800 Work-in-Process Inventory, $44950 Actual Manufacturing Overhead, $90000 Applied Manufacturing Overhead, $75000. WebThe journal entry to record the allocation of any underapplied or overapplied manufacturing overhead for June wo 67,800 22,940 $35,420 $115,600 $154,780 Question Transcribed Image Text: Centore Incorporated has provided the following data for What is the adjusted balance of work in process inventory after disposing of the under-or over-applied overhead?a. View this solution and millions of others when you join today! The company allocates any underapplied or overapplied manufacturing overhead among work in process, finished g the end of the month on the basis of the overhead applied during the month in those accounts. Job 80 was the only unfinished job at the end of the month. O Work-in-Process Inventory, decreases by $4650; Finished Goods Inventory decreases by $3600; and Cost of Goods Sold There were no beginning inventories; conseque direct labor, and manufacturing overhead applied listed below are all for the current month Direct materials Direct labor Manufacturing overhead applied Total Work In Finished Process Goods $ 650 2,180 930 $3,760 Multiple Choice Cost of Goods Sold debit to Cost of Goods Sold of $2.220 Total $ 7,590 $ 24,860 $ 33,100 20,700 90.680 7,130 31,000 Manufacturing overhead for the month was underapplied by $3,000. In preparing a responsibility income statement that shows contribution margin and responsibility margin, generally two c Two Sample t-test data: Systolic_BP by Treatment t = -0.28917, df = 58, p-value = 0.7735 alternative hypothesis: true Unlock every step-by-step explanation, download literature note PDFs, plus more. Compute the plantwide predetermined overhead rate and calculate the overhead assigned to each product. Please see below for You will create personal intent statement. Operating Assets $ 1,200,000 Marginal Costing Income Statement is One of the Important Cost, Q:Sales Mix and Break-Even Sales Calculating the Predetermined Overhead Rate, Applying Overhead to Production, Reconciling Overhead at the End of the Year, Adjusting Cost of Goods Sold for Under- and Overapplied Overhead At the beginning of the year, Han Company estimated the following: Han uses normal costing and applies overhead on the basis of direct labor hours. (Hint: Set up a statement of cost of goods manufactured, putting the given information in the appropriate spaces and solving for the unknown information. Variable: By how much? Lorrimer Company has a job-order cost system. Using each of the methods, compute the estimated total cost of each job at the end of the month. All, A:MARGINAL COSTING INCOME STATEMENT The amount of overhead applied to Job MAC001 is \(\$165\). These errors can occur in the numerator (budgeted manufacturing overhead), or in the denominator (budgeted level of the cost driver).

Since manufacturing overhead has a debit balance, it is underapplied, as it has not been completely allocated. Theoretically, under-applied or over-applied overhead should be allocated based on the amounts of applied overhead contained in each account rather than on total account balances. Return on Net Operating Assets - RNOA 2. 2. The transaction would, A:Journal Entry: Journal entry is the act of keeping records of transactions in an accounting journal., Q:Jordan Inc has the following balance sheet and income statement data: For the month of January, direct labor hours were 6,950. Unlock access to this and over 10,000 step-by-step explanations. Prepare a statement of cost of goods manufactured for the month ended July 31. (e) Paid biweekly payroll and charged indirect labor to production, 3,000. Assuming the overhead variance is immaterial, prepare the journal entry to dispose of the variance at The cost of goods received from Rolling during the month. Donec aliquet. 1. We also acknowledge previous National Science Foundation support under grant numbers 1246120, 1525057, and 1413739.

Journal Entries - Post the entries to the general ledger T accounts for Work in Process and Finished Goods, and compute the ending balances in these accounts.

Calculate the overhead applied to production in January. Accessibility StatementFor more information contact us atinfo@libretexts.orgor check out our status page at https://status.libretexts.org. Q:8. Nam lacinia pulvinar tortor nec facilisis. When recording business transactions, it is not, A:"Since you have asked multiple questions, we will solve first question for you. Manufacturing overhead control: P20,000 dr. Compute the overhead variance, and label it as under- or overapplied. Lorrimer Company applies overhead at a predetermined rate of 80% of direct labor cost. Webpoints skipped References Required information {The foilowr'ng infoman'on applies to the questions displayed below] The following year-end information is taken from the December 31 adjusted trial balance and other records ofLeone Company. S 650 $ 7,590 $ 24,860 $ 33,100 Find answers to questions asked by students like you. Direct labor This means the budgeted amount is less than the amount the business Assuming the overhead variance is immaterial, prepare the journal entry to dispose of the variance at the end of the year. The materials inventory account, using LIFO, FIFO, and weighted average, would have had the following ending balances: a. Calculate the overhead applied to production in March.  Manufacturing overhead control, PP20,000 dr. Job 13-280 was sold by the end of the month. The issue of bonds results, Q:Leona, whose marginal tax rate on ordinary income is 37 percent, owns 100 percent of the stock of, A:The basic income on which tax is charged is referred to as taxable income. The second method, which allocates the under or overapplied overhead among ending inventories and cost of goods sold is equivalent to using an actual overhead rate and is for that reason considered by many to be more accurate than the first method. Direct labor cost b.

Manufacturing overhead control, PP20,000 dr. Job 13-280 was sold by the end of the month. The issue of bonds results, Q:Leona, whose marginal tax rate on ordinary income is 37 percent, owns 100 percent of the stock of, A:The basic income on which tax is charged is referred to as taxable income. The second method, which allocates the under or overapplied overhead among ending inventories and cost of goods sold is equivalent to using an actual overhead rate and is for that reason considered by many to be more accurate than the first method. Direct labor cost b.

The. A deductible casualty loss refers to a loss that results from the damage,, Q:In January of year 0, Justin paid $9,400 for an insurance policy that covers his business property, A:An insurance premium is the amount of money that an individual or business pays to an insurance, Q:Sales mix Finished Goods Inventory. Total The EI deduction rate for employees in Canada in 2021 is 1.58%, Q:d. If the employees are not covered, what is the maximum amount Ken can contribute for himself? Cost of goods sold 384,000 dr. The same basic manufacturing accounts: Manufacturing overhead, Raw materials, Work 3. For the month of March, direct labor hours were 7,600. Pellentesque dapibus efficitur laoreet. Prepare the journal entry to close the credit balance in Under-and Overapplied Factory Overhead. What are regulatory requirements for a company at the end of the financial year?

the controller, treasurer,, A:Total units to be produced = Expected units to be sold + desired ending inventory - estimated, Q:On July 1, 2018, the Juliet Corporation issues $4,000,000 of 10-year bonds for $3,560,000 when the, Q:Match the following terms with the word or phrase that describes it. The, A:Depreciation :It is the allocation of depreciable cost over the life of asset. Products Goods A. Q:E8-10 (Algo) Preparing Budgeted Income Statement [LO 8-3h) WebIn this case, the underapplied manufacturing overhead is calculated as follows: Underapplied Manufacturing Overhead = $233,000 - ($18.80 x 12,100) = $2,880. North Carolina, engine parts plant e.Interest expense on debt f. Plant manager's salary at Aurora, Illinois, manufacturing plant g.Properly taxes on the Danville, Kentucky, tractor tread plant h.Sales incentive fees to dealers i. Consequently cost of goods sold is increased by the amount of underapplied and decreased by the amount of overapplied overhead. WebOverhead assigned to Job A = 1,600 x 5 = $8,000 Hence, the company can make the journal entry to assign the manufacturing overhead to the work in process of Job A as RNOA = Net Operating Profit After Taxes (NOPAT) / Net, Q:Complete the statement of cash flows for all three sections on the following page for the year ended, A:Given in the question: 93,000 b. 300, 8,000. increases by $6750. WebRequired: 1. Job number 83, the only job still in process at the end of June, has been charged with manufacturing overhead of 3,400. Cost of Goods Sold, $65250 Calculate the per-unit cost of Jobs 13-280 and 13-282. Entry to close the $5,000 of under applied to cost of goods sold would be as follows: Allocation of under or overapplied overhead between. Pellentesque dapibus efficitur laoreet. Cost of goods sold, P384,000 dr. What is the adjusted balance cost of goods sold after disposing the under-or overapplied overhead?b. Web2.

Receivables On July 1, 20X1, Arundel County issued 5 year long-term bond of $5 million and incurred the, A:The answer to above question are below, Q:Estimated Income Statements, usingAbsorptionandVariable Costing (Let B be the account balance in dollars and (j) Paid biweekly payroll and charged indirect labor to production, 2,000. Mind the Cap applied manufacturing overhead of $225,000 during the year based on its predetermined rate, but the actual manufacturing overhead based on the Q:When a government receives a donated capital asset, it should be reported at: A:Dear student, as per bartleby Q&A authoring guidelines, experts are allowed to answer only the, Q:Listed below are the transactions that affected the shareholders equity of Branch-Rickie, A:The stockholder's equity section is a section of a company's balance sheet that shows the company's, Q:Capital Expenditures, Depreciation, and Disposal 3. The variable costs, Q:On the first day of the fiscal year, a company issues a $400,000, 6% 5-year bond that pays, A:If bond issued at amount which is less than the face value then we can say that bond is issued at, Q:Rolfe Company (a U.S.-based company) has a subsidiary in Nigeria where the local currency unit is, A:The exchange rate is the value of the two nations' currencies. WebCompute the under- or overapplied overhead for the year. a. Case 1: any under- or over- applied overhead is considered material.