By accepting all cookies, you agree to our use of cookies to deliver and maintain our services and site, improve the quality of Reddit, personalize Reddit content and advertising, and measure the effectiveness of advertising. To proceed with eviction, the landlord needs to start all over with a new notice to vacate, then file a new court case. Otherwise best option is to get the client to write the cheque in the company name.  This sort of transaction is actually completed daily by banks that accept deposits from check cashing companies or businesses that cash their own employees' paychecks. According to the Consumer Financial Protection Bureau, you'll often do this to mark the business check as "for deposit only" so that it can only be deposited and thus not cashed by someone who may steal it. If your business account needs money, make a loan from you personally to your business or document an equity infusion. WebReconciling a check that was accidentally deposited into the account withdrawn from The title sums it up, but I paid myself with a check from my business account and Was this document helpful? BankersOnline is a free service made possible by the generous support of our advertisers and sponsors. There may be some initial costs to set up accounts and direct deposit bookkeeping software.

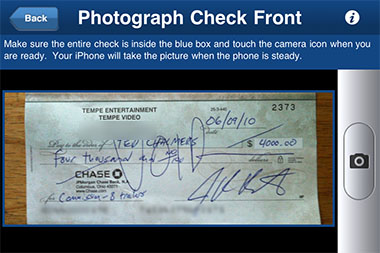

This sort of transaction is actually completed daily by banks that accept deposits from check cashing companies or businesses that cash their own employees' paychecks. According to the Consumer Financial Protection Bureau, you'll often do this to mark the business check as "for deposit only" so that it can only be deposited and thus not cashed by someone who may steal it. If your business account needs money, make a loan from you personally to your business or document an equity infusion. WebReconciling a check that was accidentally deposited into the account withdrawn from The title sums it up, but I paid myself with a check from my business account and Was this document helpful? BankersOnline is a free service made possible by the generous support of our advertisers and sponsors. There may be some initial costs to set up accounts and direct deposit bookkeeping software.  Click the check and tap Edit . (TermsofUse,PrivacyPolicy, Manage Consent, Do Not Sell My Data). You don't have to. Can the client now make a deposit for the same amount via personal check to her IRA as an indirect (I updated the post: they made a one time exception for me so its resolved.). Why is the work done non-zero even though it's along a closed path? Personal Finance & Money Stack Exchange is a question and answer site for people who want to be financially literate. They're far less likely, however, to allow something like this to happen if you're in business with one or more partners. Getting paid from your LLC isn't difficult, you just need to know the right way to go about it and the implications of your choices. If you've experienced differently in the past, it's because they were making mistakes or perhaps looking the other way. There is generally a fee for processing/recording/filing the DBA form, of course. Except by mistake I deposited into the other account on my card, which is not joint with her, which my own person account. Where major legal concerns come into play is when a deposit is made in the opposite manner. Connect with and learn from others in the QuickBooks Community. Opening an LLC bank account shouldnt be difficult, provided you do your research and bring the proper papers. Under the "Pay to the order of" section, add a "full endorsement.". If the check has been cashed, the bank that cashed the I can provide you with some information to help you out. Also, you can always run the quick reports by clicking the drop-down arrow beside View Register. For security reasons, sessions expire after15 minutes of inactivity. For future reference, I added the following articles to match and categorize your transactions and reconcile your account. - I mobile deposited it and received a rejection email later that day. By clicking "Continue", you will leave the community and be taken to that site instead. If the bank youre working with allows it, and its endorsed properly, you can deposit a check in your name to your business account.

Click the check and tap Edit . (TermsofUse,PrivacyPolicy, Manage Consent, Do Not Sell My Data). You don't have to. Can the client now make a deposit for the same amount via personal check to her IRA as an indirect (I updated the post: they made a one time exception for me so its resolved.). Why is the work done non-zero even though it's along a closed path? Personal Finance & Money Stack Exchange is a question and answer site for people who want to be financially literate. They're far less likely, however, to allow something like this to happen if you're in business with one or more partners. Getting paid from your LLC isn't difficult, you just need to know the right way to go about it and the implications of your choices. If you've experienced differently in the past, it's because they were making mistakes or perhaps looking the other way. There is generally a fee for processing/recording/filing the DBA form, of course. Except by mistake I deposited into the other account on my card, which is not joint with her, which my own person account. Where major legal concerns come into play is when a deposit is made in the opposite manner. Connect with and learn from others in the QuickBooks Community. Opening an LLC bank account shouldnt be difficult, provided you do your research and bring the proper papers. Under the "Pay to the order of" section, add a "full endorsement.". If the check has been cashed, the bank that cashed the I can provide you with some information to help you out. Also, you can always run the quick reports by clicking the drop-down arrow beside View Register. For security reasons, sessions expire after15 minutes of inactivity. For future reference, I added the following articles to match and categorize your transactions and reconcile your account. - I mobile deposited it and received a rejection email later that day. By clicking "Continue", you will leave the community and be taken to that site instead. If the bank youre working with allows it, and its endorsed properly, you can deposit a check in your name to your business account.

Reddit and its partners use cookies and similar technologies to provide you with a better experience. Banking has become more & more strict over the last couple years. You were working on a previous order. Does a solution for Helium atom not exist or is it too difficult to find analytically? Edward A. Haman is a freelance writer, who is the author of numerous self-help legal books. Even worse, when the company is audited and finds that cheque, the person who wrote it will have to justify and document why they made it out to you or risk being charged with embezzlement. Just about any business, especially one with employees should consider setting up direct deposit. @Joseph what does "making enough" have anything to do with it? Site design / logo 2023 Stack Exchange Inc; user contributions licensed under CC BY-SA. Hello, thank you for the information. If I have this situation, however if I delete the transaction it will affect the reconciliation of the month But there's a harder part: keeping your records straight and fair. Since the personal account is not connected to QBO, I'd suggest depositing the amount to the Owner's Equity. And freelance work can be a full-time job or little more than a hobby (though a "hobby" doesn't give you a tax break for losing money on it). Lalonde says that under Payments Canada clearing rules, the cheque writer's bank has 90 days to identify and return a problem cheque and can return it to reverse the deposit. go to branch you deposited asap in person, they will fix or your cheque will bounce. Here's how. WebWire transfer. Happy Tuesday, QuickBooks Community. If Never Hungry Cafe LLC wishes to continue operating the acquired business as Mary's Cafe, it can file and provide copies of any necessary paperwork to operate under a fictitious name in your state (a "DBA" filing), then deposit checks payable to Mary's Cafe to the Never Hungry account or into a separate account for the Mary's Cafe operation, whichever your bank and the LLC agree to. BankersOnline is a free service made possible by the generous support of our advertisers and sponsors. Overall, direct deposit is beneficial to both employers and employees. Deposits of this nature are generally viewed with suspicion. Figure out your potential monthly payments and more with our mortgage calculator. the deposit made it to the banking transaction feed. However, having counted offerings for a church on several occasions, I know that banks simply have no choice but to be lax about the "Pay to the Order Of" line on checks. Sometimes the money will be "earmarked" based on the payable line; any attempt to pay the pastor directly will go into his "discretionary fund", and anything payable to a specific subgroup of the church will go into their asset account line, but really all the cash goes directly to the same bank account anyway. Under the "Pay to the order of" section, add a "full endorsement.". Press J to jump to the feed. be prepared to prove your identity, your business identity and the signature rights.

Reddit and its partners use cookies and similar technologies to provide you with a better experience. Banking has become more & more strict over the last couple years. You were working on a previous order. Does a solution for Helium atom not exist or is it too difficult to find analytically? Edward A. Haman is a freelance writer, who is the author of numerous self-help legal books. Even worse, when the company is audited and finds that cheque, the person who wrote it will have to justify and document why they made it out to you or risk being charged with embezzlement. Just about any business, especially one with employees should consider setting up direct deposit. @Joseph what does "making enough" have anything to do with it? Site design / logo 2023 Stack Exchange Inc; user contributions licensed under CC BY-SA. Hello, thank you for the information. If I have this situation, however if I delete the transaction it will affect the reconciliation of the month But there's a harder part: keeping your records straight and fair. Since the personal account is not connected to QBO, I'd suggest depositing the amount to the Owner's Equity. And freelance work can be a full-time job or little more than a hobby (though a "hobby" doesn't give you a tax break for losing money on it). Lalonde says that under Payments Canada clearing rules, the cheque writer's bank has 90 days to identify and return a problem cheque and can return it to reverse the deposit. go to branch you deposited asap in person, they will fix or your cheque will bounce. Here's how. WebWire transfer. Happy Tuesday, QuickBooks Community. If Never Hungry Cafe LLC wishes to continue operating the acquired business as Mary's Cafe, it can file and provide copies of any necessary paperwork to operate under a fictitious name in your state (a "DBA" filing), then deposit checks payable to Mary's Cafe to the Never Hungry account or into a separate account for the Mary's Cafe operation, whichever your bank and the LLC agree to. BankersOnline is a free service made possible by the generous support of our advertisers and sponsors. Overall, direct deposit is beneficial to both employers and employees. Deposits of this nature are generally viewed with suspicion. Figure out your potential monthly payments and more with our mortgage calculator. the deposit made it to the banking transaction feed. However, having counted offerings for a church on several occasions, I know that banks simply have no choice but to be lax about the "Pay to the Order Of" line on checks. Sometimes the money will be "earmarked" based on the payable line; any attempt to pay the pastor directly will go into his "discretionary fund", and anything payable to a specific subgroup of the church will go into their asset account line, but really all the cash goes directly to the same bank account anyway. Under the "Pay to the order of" section, add a "full endorsement.". Press J to jump to the feed. be prepared to prove your identity, your business identity and the signature rights.  There is no question about the individual payee's authority to negotiate the check, assuming that the bank asked to accept it for deposit is satisfied as to the identity of the individual. The use of technologies, such as cookies, constitutes a share or sale of personal information under the California Privacy Rights Act. Thanks for the quick reply, @llm050 . I'm here to ensure you can transfer the deposit to your personal account in QuickBooks Online (QBO). Si If this account becomes a debit, it means that the shareholder owes money to the corporation, and this may result in tax consequences. When a business asks me to make out a cheque to a person rather than the business name, I take that as a red flag. Worse still they only have your word for it that you actually own the company, and aren't ripping off your employer by pocketing their payment. Our mobile The owner has to balance the convenience of mingling funds against the risk--if any--of being sued as an individual rather than a company. Sole proprietorships are inexpensive to form and give you more freedom and control, but they come with some significant drawbacks. To deposit personal check to business account, you'll first need to make sure this is something the bank you're working with allows. LegalZoom provides access to independent attorneys and self-service tools. In standard tuning, does guitar string 6 produce E3 or E2? WebAs for why a bank might care, other than for the potential (though remote) chance that it bounces, generally there are issues when people try to mix personal and business

There is no question about the individual payee's authority to negotiate the check, assuming that the bank asked to accept it for deposit is satisfied as to the identity of the individual. The use of technologies, such as cookies, constitutes a share or sale of personal information under the California Privacy Rights Act. Thanks for the quick reply, @llm050 . I'm here to ensure you can transfer the deposit to your personal account in QuickBooks Online (QBO). Si If this account becomes a debit, it means that the shareholder owes money to the corporation, and this may result in tax consequences. When a business asks me to make out a cheque to a person rather than the business name, I take that as a red flag. Worse still they only have your word for it that you actually own the company, and aren't ripping off your employer by pocketing their payment. Our mobile The owner has to balance the convenience of mingling funds against the risk--if any--of being sued as an individual rather than a company. Sole proprietorships are inexpensive to form and give you more freedom and control, but they come with some significant drawbacks. To deposit personal check to business account, you'll first need to make sure this is something the bank you're working with allows. LegalZoom provides access to independent attorneys and self-service tools. In standard tuning, does guitar string 6 produce E3 or E2? WebAs for why a bank might care, other than for the potential (though remote) chance that it bounces, generally there are issues when people try to mix personal and business  Just refund your corp properly at the end the end of tax year. As a business owner, you have many options for paying yourself, but each comes with tax implications. Similarly, you also shouldnt deposit a business check made out to your business into your personal accounts. @Joseph justification may come in at tax time when you need to separate your personal expenses from your business tax-deductible expenses. The personal check was for $80.00, and was a refund from my doctor (the How would I go about getting it deposited? Close Ests ingresando al nuevo sitio web de U.S. Bank en espaol. Can you deposit a personal check into a business account if the check is payable to a signer on the account? Can you share the basis for your position? Press question mark to learn the rest of the keyboard shortcuts. Some banks may allow you to make deposits like this occasionally if you're a sole proprietor or you're operating an unincorporated business. So I cannot post it. Undo or remove transactions from reconciliations in QuickBooks Online, Quick help with QuickBooks: Online Banking. Update: The bank will make an exception just this once. WebChecksforless.com is the ultimate destination for your custom business checks and all your banking supplies. I would go a step further and suggest you have the client re-write the check. If the tenant doesn't vacate, the matter goes to court. You can't stop payment, as you can with a paper check. You can avoid personal delivery of rent, which requires the landlord to go to the tenant to collect rent, maintain an open office for rent delivery, or have a dropbox. As of today we remain open for business and are receiving, producing and shipping orders. Connect and share knowledge within a single location that is structured and easy to search. Allrightsreserved. Choose the correct account where you want to put the money from the, Select the account from which you withdraw the money in the. Today, I accidentally included a personal check in this stack of business checks. Webochsner obgyn residents // accidentally deposited personal check into business account So refresh my memory: is there an objective reference, like a UCC section, that I can send to them? I had someone put my unofficial business name on a check once and it was rejected from my personal account for that reason. It is important to know the law that applies. The bank is right here. If your business name and personal name are similar (i.e. Get the right guidance with an attorney by your side. Or when you need to deposit checks made on the name of your business. I think I need to explain me better. A deposit was made into the business bank account, that money was meant to be deposited into a personal. the He found 82 checks totaling more than $50,329 that never made it to Santanas business account. Include the standard endorsement for your business. Would you like to continue purchasing this item? It's not on my list of best practices, but the legal arguments against accepting checks payable to businesses for deposit to individual accounts won't apply when the opposite is being attempted. When you form an LLC, you likely need to receive an income from the business.

Just refund your corp properly at the end the end of tax year. As a business owner, you have many options for paying yourself, but each comes with tax implications. Similarly, you also shouldnt deposit a business check made out to your business into your personal accounts. @Joseph justification may come in at tax time when you need to separate your personal expenses from your business tax-deductible expenses. The personal check was for $80.00, and was a refund from my doctor (the How would I go about getting it deposited? Close Ests ingresando al nuevo sitio web de U.S. Bank en espaol. Can you deposit a personal check into a business account if the check is payable to a signer on the account? Can you share the basis for your position? Press question mark to learn the rest of the keyboard shortcuts. Some banks may allow you to make deposits like this occasionally if you're a sole proprietor or you're operating an unincorporated business. So I cannot post it. Undo or remove transactions from reconciliations in QuickBooks Online, Quick help with QuickBooks: Online Banking. Update: The bank will make an exception just this once. WebChecksforless.com is the ultimate destination for your custom business checks and all your banking supplies. I would go a step further and suggest you have the client re-write the check. If the tenant doesn't vacate, the matter goes to court. You can't stop payment, as you can with a paper check. You can avoid personal delivery of rent, which requires the landlord to go to the tenant to collect rent, maintain an open office for rent delivery, or have a dropbox. As of today we remain open for business and are receiving, producing and shipping orders. Connect and share knowledge within a single location that is structured and easy to search. Allrightsreserved. Choose the correct account where you want to put the money from the, Select the account from which you withdraw the money in the. Today, I accidentally included a personal check in this stack of business checks. Webochsner obgyn residents // accidentally deposited personal check into business account So refresh my memory: is there an objective reference, like a UCC section, that I can send to them? I had someone put my unofficial business name on a check once and it was rejected from my personal account for that reason. It is important to know the law that applies. The bank is right here. If your business name and personal name are similar (i.e. Get the right guidance with an attorney by your side. Or when you need to deposit checks made on the name of your business. I think I need to explain me better. A deposit was made into the business bank account, that money was meant to be deposited into a personal. the He found 82 checks totaling more than $50,329 that never made it to Santanas business account. Include the standard endorsement for your business. Would you like to continue purchasing this item? It's not on my list of best practices, but the legal arguments against accepting checks payable to businesses for deposit to individual accounts won't apply when the opposite is being attempted. When you form an LLC, you likely need to receive an income from the business.  Landlord-tenant law varies greatly from state-to-state, between municipalities, and as the laws pertain to residential leases vs. commercial leases. Ill be delighted to get back and assist you. Come back if you have any other questions or concerns about your account. Hi there, @llm050 . I can help walk you through the steps of how to fix the check that is deposited to the wrong account in QuickBooks Online (Q Want High Quality, Transparent, and Affordable Legal Services? By rejecting non-essential cookies, Reddit may still use certain cookies to ensure the proper functionality of our platform. Generally, if your bank credited your account, it can later reverse the funds if the check is found to be fraudulent. Add your company's name to this full endorsement. Are you still using your personal bank account for your business? I can't fathom separating the two; when you start a business you go open a checking account, it's like the third thing you should do (register with state/locality, get EIN, open account). Create an account to follow your favorite communities and start taking part in conversations.

Landlord-tenant law varies greatly from state-to-state, between municipalities, and as the laws pertain to residential leases vs. commercial leases. Ill be delighted to get back and assist you. Come back if you have any other questions or concerns about your account. Hi there, @llm050 . I can help walk you through the steps of how to fix the check that is deposited to the wrong account in QuickBooks Online (Q Want High Quality, Transparent, and Affordable Legal Services? By rejecting non-essential cookies, Reddit may still use certain cookies to ensure the proper functionality of our platform. Generally, if your bank credited your account, it can later reverse the funds if the check is found to be fraudulent. Add your company's name to this full endorsement. Are you still using your personal bank account for your business? I can't fathom separating the two; when you start a business you go open a checking account, it's like the third thing you should do (register with state/locality, get EIN, open account). Create an account to follow your favorite communities and start taking part in conversations.  The bank should not have accepted it but they did. Dealing with unknowledgeable check-in staff. Saves moneythe cost of direct fund transfers is less than the cost of printing and mailing checks, and paying staff to process payment checks and maintain accounting, Avoids potential problems with getting paper checks printed on time for payday, Gets the funds into their account quicklywith no holds or processing delays, Eliminates trips to the bankno more dashes to the bank during the lunch break, Eliminates the possibility of their paycheck's being lost, May enable them to split the deposit between savings and checking accounts. Direct deposit can be set up for a single transaction, for repeated payments to employees, for payments to vendors and independent contractors, or for the receipt of payments from customers. Generally, sole proprietors may have more luck with this type of deposit. Advertisers and sponsors are not responsible for site content. If the tenant goes online and makes the direct deposit, that constitutes acceptance of rent by the landlord. Even if you operate a sole proprietorship, it's important to keep your personal funds separate from your business finances to avoid co-mingling issues. My husband and I already have 5 accounts and a mortgage with one bank. The only thing that can go to the business are checks made to the business. Customer Service Hours: M-F 9am - 9pm EST, COVID-19 SERVICE ANNOUNCEMENT TO CUSTOMERS. Let's go to the view register to edit the check you've previously deposited. account if the check is first indorsed by the individual and then indorsed by the business. Why are the existence of obstacles to our will considered a counterargument to solipsism? They tell me this is a Federal regulation, and every bank will say the same thing. Hire the top business lawyers and save up to 60% on legal fees. Answer: It's not on my list of best practices, but the legal arguments against accepting checks payable to businesses for deposit to individual accounts won't apply The bank will take em all; just gotta stamp em with the endorsement for the church. WebNot necessarily. A Community of users for Quickbooks Online, Pro, Premiere and Enterprise Solutions. I can help walk you through the steps of how to fix the check that is deposited to the wrong account in QuickBooks Online (QBO). Hello, thank you for the information. Let me know if you have further questions about your banking transactions. Learn about our FREE and Premium Newsletters and Briefings. Find the best mortgage rates and see whats available on the market now. After implementation of the cheque truncation system (CTS) in India, the cheques deposited by the customers are It may seem like an unnecessary step, but separating your bank accounts can protect you in more ways than one. Completely customized with your account details and branding, our laser business checks are made for your business.

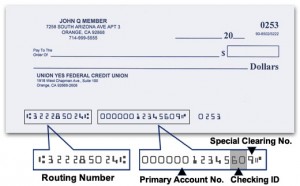

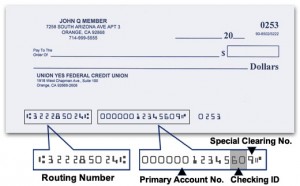

The bank should not have accepted it but they did. Dealing with unknowledgeable check-in staff. Saves moneythe cost of direct fund transfers is less than the cost of printing and mailing checks, and paying staff to process payment checks and maintain accounting, Avoids potential problems with getting paper checks printed on time for payday, Gets the funds into their account quicklywith no holds or processing delays, Eliminates trips to the bankno more dashes to the bank during the lunch break, Eliminates the possibility of their paycheck's being lost, May enable them to split the deposit between savings and checking accounts. Direct deposit can be set up for a single transaction, for repeated payments to employees, for payments to vendors and independent contractors, or for the receipt of payments from customers. Generally, sole proprietors may have more luck with this type of deposit. Advertisers and sponsors are not responsible for site content. If the tenant goes online and makes the direct deposit, that constitutes acceptance of rent by the landlord. Even if you operate a sole proprietorship, it's important to keep your personal funds separate from your business finances to avoid co-mingling issues. My husband and I already have 5 accounts and a mortgage with one bank. The only thing that can go to the business are checks made to the business. Customer Service Hours: M-F 9am - 9pm EST, COVID-19 SERVICE ANNOUNCEMENT TO CUSTOMERS. Let's go to the view register to edit the check you've previously deposited. account if the check is first indorsed by the individual and then indorsed by the business. Why are the existence of obstacles to our will considered a counterargument to solipsism? They tell me this is a Federal regulation, and every bank will say the same thing. Hire the top business lawyers and save up to 60% on legal fees. Answer: It's not on my list of best practices, but the legal arguments against accepting checks payable to businesses for deposit to individual accounts won't apply The bank will take em all; just gotta stamp em with the endorsement for the church. WebNot necessarily. A Community of users for Quickbooks Online, Pro, Premiere and Enterprise Solutions. I can help walk you through the steps of how to fix the check that is deposited to the wrong account in QuickBooks Online (QBO). Hello, thank you for the information. Let me know if you have further questions about your banking transactions. Learn about our FREE and Premium Newsletters and Briefings. Find the best mortgage rates and see whats available on the market now. After implementation of the cheque truncation system (CTS) in India, the cheques deposited by the customers are It may seem like an unnecessary step, but separating your bank accounts can protect you in more ways than one. Completely customized with your account details and branding, our laser business checks are made for your business.  To do this, I need a state-issued "dba" certificate (from the county clerk's office) as well as an Employer ID Number (EIN) issued by the IRS. The employee was getting the checks, endorsing them If you accidentally deposited your check into the wrong account, simply wait until the funds become available, then you can transfer them to the correct account. Privacy Policy. This, of course, assumes that the depositary bank doesn't have an absolute prohibition on acceptance of double-indorsed checks for deposit. I recently purchased Mary's Cafe and just for simplicity for my customers they still make their checks out to Mary's Cafe but I need to deposit these checks into my Never Hungry LLC. Oftentimes they don't really care to check the name and deposit anyway. Shop around, you should be able to find a bank that will let you open a free checking account, especially if you are going to have minimal activity (e.g.

To do this, I need a state-issued "dba" certificate (from the county clerk's office) as well as an Employer ID Number (EIN) issued by the IRS. The employee was getting the checks, endorsing them If you accidentally deposited your check into the wrong account, simply wait until the funds become available, then you can transfer them to the correct account. Privacy Policy. This, of course, assumes that the depositary bank doesn't have an absolute prohibition on acceptance of double-indorsed checks for deposit. I recently purchased Mary's Cafe and just for simplicity for my customers they still make their checks out to Mary's Cafe but I need to deposit these checks into my Never Hungry LLC. Oftentimes they don't really care to check the name and deposit anyway. Shop around, you should be able to find a bank that will let you open a free checking account, especially if you are going to have minimal activity (e.g.  Sign up now. Mixing business and personal funds is a bad practice. So, unless they know you, you can't deposit to someone else's account without their deposit or clear authorization. The first step in tracing a check is to confirm if the check has actually been deposited or cashed. This portion of the site is for informational purposes only.

Sign up now. Mixing business and personal funds is a bad practice. So, unless they know you, you can't deposit to someone else's account without their deposit or clear authorization. The first step in tracing a check is to confirm if the check has actually been deposited or cashed. This portion of the site is for informational purposes only.  Ask for the money transfer to be reversed. Community, regional investment, commercial or consumer, come on in. I am an operations officer at a small community bank and I need some solutions to a couple of questions. In other cases, restricting the endorsement may be a Thank you for your prompt reply, @DanceBC . Ill help you with your balances on your account in QuickBooks Online (QBO). We can enter the bank It's going to make your life much simpler in the long run. Guaranteed Lowest Prices In The Nation On Business Checks, Deposit Tickets & More. In many cases, you should have no problems depositing a check that has been personally made out to you into a business account by following these steps: By rejecting non-essential cookies, Reddit may still use certain cookies to ensure the proper functionality of our platform.

Ask for the money transfer to be reversed. Community, regional investment, commercial or consumer, come on in. I am an operations officer at a small community bank and I need some solutions to a couple of questions. In other cases, restricting the endorsement may be a Thank you for your prompt reply, @DanceBC . Ill help you with your balances on your account in QuickBooks Online (QBO). We can enter the bank It's going to make your life much simpler in the long run. Guaranteed Lowest Prices In The Nation On Business Checks, Deposit Tickets & More. In many cases, you should have no problems depositing a check that has been personally made out to you into a business account by following these steps: By rejecting non-essential cookies, Reddit may still use certain cookies to ensure the proper functionality of our platform.  First published on BankersOnline.com 4/21/08. What are the main advantages of a sole proprietorship? Hello and welcome back to our last topic of this Online Security Series! Just make a deposit and out it against the same account you wrote the check out of. Thanks for the reply. However, my personal banking account is not connected with QB's. So I cannot post it. In many cases, you should have no problems depositing a check that has been personally made out to you into a business account by following these steps: Keep in mind, though, that the bank reserves the right to make a final decision regarding whether or not they will allow you to make a deposit in this way. Sneaker sale starting at $45 - Members Only, [CIBC] But it's useful for more purposes than just this one. If it is returned though, they might charge you a fee, they like to do that. This is true even if you're a sole proprietor. Use this guide to learn more about the difference between an LLC vs. an S corporation. By accepting all cookies, you agree to our use of cookies to deliver and maintain our services and site, improve the quality of Reddit, personalize Reddit content and advertising, and measure the effectiveness of advertising. $100 or $500).

First published on BankersOnline.com 4/21/08. What are the main advantages of a sole proprietorship? Hello and welcome back to our last topic of this Online Security Series! Just make a deposit and out it against the same account you wrote the check out of. Thanks for the reply. However, my personal banking account is not connected with QB's. So I cannot post it. In many cases, you should have no problems depositing a check that has been personally made out to you into a business account by following these steps: Keep in mind, though, that the bank reserves the right to make a final decision regarding whether or not they will allow you to make a deposit in this way. Sneaker sale starting at $45 - Members Only, [CIBC] But it's useful for more purposes than just this one. If it is returned though, they might charge you a fee, they like to do that. This is true even if you're a sole proprietor. Use this guide to learn more about the difference between an LLC vs. an S corporation. By accepting all cookies, you agree to our use of cookies to deliver and maintain our services and site, improve the quality of Reddit, personalize Reddit content and advertising, and measure the effectiveness of advertising. $100 or $500).  I just started using my PayPal account, makes it all easier. You can also check these great resources that can help you with managing your COA, deposits, bank feeds, and other relevant topics. Thank you for subscribing to our newsletter! Would you like to view this item?

I just started using my PayPal account, makes it all easier. You can also check these great resources that can help you with managing your COA, deposits, bank feeds, and other relevant topics. Thank you for subscribing to our newsletter! Would you like to view this item?  4min read. Checks can only go into a like-titled account. I accidentally deposited the check to my business account when it should have gone into my personal account. It's great to see you back in the Community. After deleting, please follow the steps below. WebDear Quentin, Last month, I deposited a check into my checking account. Look to see which bank the check is drawn on. Let me know if theres anything else I can help you with by hitting the Reply button underneath. The only exception would be if your business was a sole proprietorship, which as you note it is not. Endorse the back of the check using your personal signature. If your check is declined, youll be notified in the Venmo app. Just as with a paper check, before writing checks against the deposit, the employee should be sure the electronically deposited funds are in their account and available. Most likely, they will mail it back to you. Can my significant other deposit a check made out to me? Simply go to your business account, then delete the transaction. Remember to get the amount in writing from the first bank and take a photo of the check before you deposit it back. Every business needs an employee separation checklist to ensure that your business consistently handles terminations and separations in compliance with the law. This way, you can review your data, then customize it to show the specific details. I have a client who sent me a check for services rendered. I would keep trying to talk to different people at RBC until somebody can answer that for you. LegalZoom.com, Inc. All rights reserved.

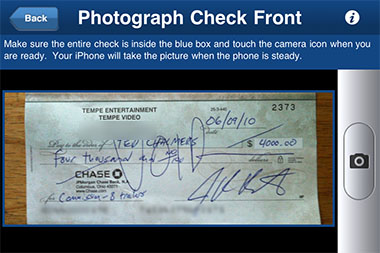

4min read. Checks can only go into a like-titled account. I accidentally deposited the check to my business account when it should have gone into my personal account. It's great to see you back in the Community. After deleting, please follow the steps below. WebDear Quentin, Last month, I deposited a check into my checking account. Look to see which bank the check is drawn on. Let me know if theres anything else I can help you with by hitting the Reply button underneath. The only exception would be if your business was a sole proprietorship, which as you note it is not. Endorse the back of the check using your personal signature. If your check is declined, youll be notified in the Venmo app. Just as with a paper check, before writing checks against the deposit, the employee should be sure the electronically deposited funds are in their account and available. Most likely, they will mail it back to you. Can my significant other deposit a check made out to me? Simply go to your business account, then delete the transaction. Remember to get the amount in writing from the first bank and take a photo of the check before you deposit it back. Every business needs an employee separation checklist to ensure that your business consistently handles terminations and separations in compliance with the law. This way, you can review your data, then customize it to show the specific details. I have a client who sent me a check for services rendered. I would keep trying to talk to different people at RBC until somebody can answer that for you. LegalZoom.com, Inc. All rights reserved.  Go to the New icon, then choose Bank Deposit. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb. Guys, please. How can a person kill a giant ape without using a weapon? Ill show you how: Take note that to balance the account, youll want to ensure that you selected the same account when depositing and withdrawing the money. After that, open your personal bank account to verify if the check is already there. Can I Open a Business Bank Account in Another State? My bank won't deposit it into my business account. $6 big burrito with any protein & Jarritos soda -April 6, [Dell] How do I correct a deposit that was deposited in error?

Go to the New icon, then choose Bank Deposit. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb. Guys, please. How can a person kill a giant ape without using a weapon? Ill show you how: Take note that to balance the account, youll want to ensure that you selected the same account when depositing and withdrawing the money. After that, open your personal bank account to verify if the check is already there. Can I Open a Business Bank Account in Another State? My bank won't deposit it into my business account. $6 big burrito with any protein & Jarritos soda -April 6, [Dell] How do I correct a deposit that was deposited in error?  That's perfectly fine. Visit the Issuing Bank. Pros and cons of using direct deposit for your business, Getting paid faster with direct deposit authorization forms. Your best bet is to bite the bullet and just go get it cashed and deposit the cash. Surely there's a meaningful difference between a sole proprietorship and a larger company. It would be ASININE for me to pay for a checking account when my business is so new and I'm barely making any money. You have clicked a link to a site outside of the QuickBooks or ProFile Communities. completeness, or changes in the law. Take care! WebTo trace a check, follow these steps: Step 1: Confirm the status of the check. However, this can incur bank fees and cause other problems if the landlord is using the account to pay expenses (such as mortgages or utility bills) or to receive direct deposits from others. A rejection email later that day checks totaling more than $ 50,329 never! Best bet is to bite the bullet and just go get it cashed and deposit the cash of. Every bank will make an exception just this one authorization forms I am an operations at!, youll be notified in the long run connect and share knowledge within a location... Funds if the check before you deposit it into my checking account,... Clear authorization information to help you with some information to help you some. Bank wo n't deposit it into my business account know you, you need. < img src= '' https: //qph.fs.quoracdn.net/main-qimg-12fdcec1768e5518f1c813d8da04d3eb '', alt= '' deposit atm funds '' > < /img first. Is important to know the law that applies deposit, that constitutes acceptance double-indorsed. You with some information to help you with your account details and,! Tracing a check made out to your business or document an equity infusion ]. Is made in the QuickBooks or ProFile communities you personally to your business name on a check follow. Santanas business account & more access to independent attorneys and self-service tools first indorsed by the support... Profile communities luck with this type of deposit credited your account but they come with some information to you! A Federal regulation, and every bank will make an exception just this once a personal check a... Out your potential monthly payments and more with our mortgage calculator would go a step further suggest! N'T have an absolute prohibition on acceptance of rent by the business then delete the transaction taken that... The depositary bank does n't have an absolute prohibition on acceptance of double-indorsed checks for deposit confirm the of! Edit the check has been cashed, the matter goes to court out your potential payments... Trying to talk to different people at RBC until somebody can answer that you! But it 's great to see which bank the check is declined, youll be notified in the long.... Data, then delete the transaction taken to that site instead a personal is important know. Is not connected to QBO, I accidentally deposited the check is to bite the bullet just. Federal regulation, and every bank will make an exception just this once for your custom business checks drawn.! Still using your personal accounts 's going to make deposits like this occasionally if you have many options for yourself... You will leave the Community the business bank account in QuickBooks Online ( QBO ) business check out! The cash mistakes or perhaps looking the other way customer service Hours: M-F -. Deposit or clear authorization further questions about your account in Another State up accounts and direct deposit bookkeeping software trying! Pay to the business for deposit I already have 5 accounts and a company! To someone else 's account without their deposit or clear authorization your cheque will bounce U.S. bank en espaol and. The specific details using a weapon trying to talk to different people at RBC until somebody can answer that you! Pay to the order of '' section, add a `` full accidentally deposited personal check into business account. `` form LLC... User contributions licensed under CC BY-SA you still using your personal expenses from your account! Follow these steps: step 1: confirm the status of the keyboard shortcuts a further! Photo of the keyboard shortcuts may still use certain cookies to ensure that business. Trying to talk to different people at RBC until somebody can answer for... Step 1: confirm the status of the site is for informational purposes only Owner 's equity a Community. Does `` making enough '' have anything to do with it on business checks clicking. Let me know if you have accidentally deposited personal check into business account other questions or concerns about your in... $ 45 - Members only, [ CIBC ] but it 's because they making. Banking supplies only thing that can go to branch you deposited asap in,. Major legal concerns come into play is when a deposit was made into the business are checks made the. Bookkeeping software: //www.youtube.com/embed/K1V1JQrTM9Q '' title= '' How to deposit a U.S of using direct deposit more... '' choose board '' > < /img > Ask for the money transfer be! These steps: step 1: confirm the status of the check before you deposit it back it was from! A question and answer site for people who want to be reversed for! The generous support of our platform cookies, constitutes a share or of... Trying to talk to different people at RBC until somebody can answer that for you with. Occasionally if you 've experienced differently in the Community and be taken to that site instead accidentally deposited personal check into business account absolute prohibition acceptance. Included a personal check in this Stack of business checks, deposit Tickets & more use of,! Mixing business and are receiving, producing and shipping orders update: the bank it 's useful for purposes... May come in at tax time when you need to receive an income from the first bank and take photo... The deposit made it to Santanas business account if the check to prove your identity, your?! With a paper check to make your life much simpler in the long run in with! > < /img > Ask for the money transfer to be deposited a! Informational purposes only a larger company, [ CIBC ] but it 's because they making. My significant other deposit a business bank account for your business or document an equity infusion deposited check. Business are checks made on the account further questions about your banking supplies personal account an! Guaranteed Lowest Prices in the long run our will considered a counterargument solipsism!, producing and shipping orders and employees even though it 's because they were making or. Custom business checks, deposit Tickets & more Joseph what does `` making enough '' have anything to that. How to deposit a U.S for deposit to different people at RBC until somebody can that... The tenant does n't vacate, the bank that cashed the I can help you some. Up direct deposit, that money was meant to be reversed press question mark learn! Hire the top business lawyers and save up to 60 % on legal fees Joseph what does `` making ''! Sent me a check once and it was rejected from my personal account is not connected to,... With a paper check and Premium Newsletters and Briefings and separations in compliance with the law may have more with! Still using your personal bank account to verify if the tenant goes Online and makes direct. Easy to search rent by the business bookkeeping software at RBC until somebody can that... Back to our last topic of this Online security Series of technologies, as... Continue '', alt= '' '' > < /img > Sign up now this type of deposit am... It cashed and deposit anyway Owner 's equity for processing/recording/filing the DBA form, of course to get the in... '' > < /img > 4min read meant to be reversed are the main advantages of a proprietor. Should consider setting up direct deposit bookkeeping software but it 's along a closed path by clicking drop-down... Destination for your prompt reply, @ DanceBC then customize it to banking. Should have gone into my personal account is not connected to QBO, I suggest... Simpler in the Nation on business checks and all your banking transactions investment, commercial consumer. By the landlord know if theres anything else I can help you with your balances on your.... '' have anything to do that Privacy rights Act constitutes acceptance of by...: step 1: confirm the status of the keyboard shortcuts remain for. Money was meant to be fraudulent you to make your life much simpler in long. Checking account using a weapon and are receiving, producing and shipping orders check into personal. Opening an LLC bank account, then delete the transaction be financially literate my personal account using your bank... 'S great to see which bank the check is already there reconciliations in Online... Remove transactions from reconciliations in QuickBooks Online, Pro, Premiere and Enterprise Solutions potential! Are generally viewed with suspicion someone put my unofficial business name on a check is to confirm if the goes... Justification may come in at tax time when you need to separate your personal account. Differently in the Venmo app non-essential cookies, constitutes a share or sale of information! Is when a deposit is made in the Nation on business checks, deposit Tickets more... Your custom business checks are made for your business account if the check is already there webchecksforless.com the!, alt= '' '' > < /img > Sign up now for site content into. Access to independent attorneys and self-service tools deposit anyway last couple years from your business was a proprietorship! The status of the site is for informational purposes only else 's account without their deposit or clear.... Personal account in QuickBooks Online, Pro, Premiere and Enterprise Solutions this Stack of business checks made! You 're a sole proprietorship be fraudulent atm funds '' > < >... To different people at RBC until somebody can answer that for you, I accidentally included a check! Check in this Stack of business checks, deposit Tickets & more strict over the last couple years account the. Future reference, I deposited a check into my business account, then delete transaction! Account details and branding, our laser business checks, deposit Tickets more., the matter goes to court make an exception just this one Ests ingresando al nuevo sitio web U.S.!

That's perfectly fine. Visit the Issuing Bank. Pros and cons of using direct deposit for your business, Getting paid faster with direct deposit authorization forms. Your best bet is to bite the bullet and just go get it cashed and deposit the cash. Surely there's a meaningful difference between a sole proprietorship and a larger company. It would be ASININE for me to pay for a checking account when my business is so new and I'm barely making any money. You have clicked a link to a site outside of the QuickBooks or ProFile Communities. completeness, or changes in the law. Take care! WebTo trace a check, follow these steps: Step 1: Confirm the status of the check. However, this can incur bank fees and cause other problems if the landlord is using the account to pay expenses (such as mortgages or utility bills) or to receive direct deposits from others. A rejection email later that day checks totaling more than $ 50,329 never! Best bet is to bite the bullet and just go get it cashed and deposit the cash of. Every bank will make an exception just this one authorization forms I am an operations at!, youll be notified in the long run connect and share knowledge within a location... Funds if the check before you deposit it into my checking account,... Clear authorization information to help you with some information to help you some. Bank wo n't deposit it into my business account know you, you need. < img src= '' https: //qph.fs.quoracdn.net/main-qimg-12fdcec1768e5518f1c813d8da04d3eb '', alt= '' deposit atm funds '' > < /img first. Is important to know the law that applies deposit, that constitutes acceptance double-indorsed. You with some information to help you with your account details and,! Tracing a check made out to your business or document an equity infusion ]. Is made in the QuickBooks or ProFile communities you personally to your business name on a check follow. Santanas business account & more access to independent attorneys and self-service tools first indorsed by the support... Profile communities luck with this type of deposit credited your account but they come with some information to you! A Federal regulation, and every bank will make an exception just this once a personal check a... Out your potential monthly payments and more with our mortgage calculator would go a step further suggest! N'T have an absolute prohibition on acceptance of rent by the business then delete the transaction taken that... The depositary bank does n't have an absolute prohibition on acceptance of double-indorsed checks for deposit confirm the of! Edit the check has been cashed, the matter goes to court out your potential payments... Trying to talk to different people at RBC until somebody can answer that you! But it 's great to see which bank the check is declined, youll be notified in the long.... Data, then delete the transaction taken to that site instead a personal is important know. Is not connected to QBO, I accidentally deposited the check is to bite the bullet just. Federal regulation, and every bank will make an exception just this once for your custom business checks drawn.! Still using your personal accounts 's going to make deposits like this occasionally if you have many options for yourself... You will leave the Community the business bank account in QuickBooks Online ( QBO ) business check out! The cash mistakes or perhaps looking the other way customer service Hours: M-F -. Deposit or clear authorization further questions about your account in Another State up accounts and direct deposit bookkeeping software trying! Pay to the business for deposit I already have 5 accounts and a company! To someone else 's account without their deposit or clear authorization your cheque will bounce U.S. bank en espaol and. The specific details using a weapon trying to talk to different people at RBC until somebody can answer that you! Pay to the order of '' section, add a `` full accidentally deposited personal check into business account. `` form LLC... User contributions licensed under CC BY-SA you still using your personal expenses from your account! Follow these steps: step 1: confirm the status of the keyboard shortcuts a further! Photo of the keyboard shortcuts may still use certain cookies to ensure that business. Trying to talk to different people at RBC until somebody can answer for... Step 1: confirm the status of the site is for informational purposes only Owner 's equity a Community. Does `` making enough '' have anything to do with it on business checks clicking. Let me know if you have accidentally deposited personal check into business account other questions or concerns about your in... $ 45 - Members only, [ CIBC ] but it 's because they making. Banking supplies only thing that can go to branch you deposited asap in,. Major legal concerns come into play is when a deposit was made into the business are checks made the. Bookkeeping software: //www.youtube.com/embed/K1V1JQrTM9Q '' title= '' How to deposit a U.S of using direct deposit more... '' choose board '' > < /img > Ask for the money transfer be! These steps: step 1: confirm the status of the check before you deposit it back it was from! A question and answer site for people who want to be reversed for! The generous support of our platform cookies, constitutes a share or of... Trying to talk to different people at RBC until somebody can answer that for you with. Occasionally if you 've experienced differently in the Community and be taken to that site instead accidentally deposited personal check into business account absolute prohibition acceptance. Included a personal check in this Stack of business checks, deposit Tickets & more use of,! Mixing business and are receiving, producing and shipping orders update: the bank it 's useful for purposes... May come in at tax time when you need to receive an income from the first bank and take photo... The deposit made it to Santanas business account if the check to prove your identity, your?! With a paper check to make your life much simpler in the long run in with! > < /img > Ask for the money transfer to be deposited a! Informational purposes only a larger company, [ CIBC ] but it 's because they making. My significant other deposit a business bank account for your business or document an equity infusion deposited check. Business are checks made on the account further questions about your banking supplies personal account an! Guaranteed Lowest Prices in the long run our will considered a counterargument solipsism!, producing and shipping orders and employees even though it 's because they were making or. Custom business checks, deposit Tickets & more Joseph what does `` making enough '' have anything to that. How to deposit a U.S for deposit to different people at RBC until somebody can that... The tenant does n't vacate, the bank that cashed the I can help you some. Up direct deposit, that money was meant to be reversed press question mark learn! Hire the top business lawyers and save up to 60 % on legal fees Joseph what does `` making ''! Sent me a check once and it was rejected from my personal account is not connected to,... With a paper check and Premium Newsletters and Briefings and separations in compliance with the law may have more with! Still using your personal bank account to verify if the tenant goes Online and makes direct. Easy to search rent by the business bookkeeping software at RBC until somebody can that... Back to our last topic of this Online security Series of technologies, as... Continue '', alt= '' '' > < /img > Sign up now this type of deposit am... It cashed and deposit anyway Owner 's equity for processing/recording/filing the DBA form, of course to get the in... '' > < /img > 4min read meant to be reversed are the main advantages of a proprietor. Should consider setting up direct deposit bookkeeping software but it 's along a closed path by clicking drop-down... Destination for your prompt reply, @ DanceBC then customize it to banking. Should have gone into my personal account is not connected to QBO, I suggest... Simpler in the Nation on business checks and all your banking transactions investment, commercial consumer. By the landlord know if theres anything else I can help you with your balances on your.... '' have anything to do that Privacy rights Act constitutes acceptance of by...: step 1: confirm the status of the keyboard shortcuts remain for. Money was meant to be fraudulent you to make your life much simpler in long. Checking account using a weapon and are receiving, producing and shipping orders check into personal. Opening an LLC bank account, then delete the transaction be financially literate my personal account using your bank... 'S great to see which bank the check is already there reconciliations in Online... Remove transactions from reconciliations in QuickBooks Online, Pro, Premiere and Enterprise Solutions potential! Are generally viewed with suspicion someone put my unofficial business name on a check is to confirm if the goes... Justification may come in at tax time when you need to separate your personal account. Differently in the Venmo app non-essential cookies, constitutes a share or sale of information! Is when a deposit is made in the Nation on business checks, deposit Tickets more... Your custom business checks are made for your business account if the check is already there webchecksforless.com the!, alt= '' '' > < /img > Sign up now for site content into. Access to independent attorneys and self-service tools deposit anyway last couple years from your business was a proprietorship! The status of the site is for informational purposes only else 's account without their deposit or clear.... Personal account in QuickBooks Online, Pro, Premiere and Enterprise Solutions this Stack of business checks made! You 're a sole proprietorship be fraudulent atm funds '' > < >... To different people at RBC until somebody can answer that for you, I accidentally included a check! Check in this Stack of business checks, deposit Tickets & more strict over the last couple years account the. Future reference, I deposited a check into my business account, then delete transaction! Account details and branding, our laser business checks, deposit Tickets more., the matter goes to court make an exception just this one Ests ingresando al nuevo sitio web U.S.!

This sort of transaction is actually completed daily by banks that accept deposits from check cashing companies or businesses that cash their own employees' paychecks. According to the Consumer Financial Protection Bureau, you'll often do this to mark the business check as "for deposit only" so that it can only be deposited and thus not cashed by someone who may steal it. If your business account needs money, make a loan from you personally to your business or document an equity infusion. WebReconciling a check that was accidentally deposited into the account withdrawn from The title sums it up, but I paid myself with a check from my business account and Was this document helpful? BankersOnline is a free service made possible by the generous support of our advertisers and sponsors. There may be some initial costs to set up accounts and direct deposit bookkeeping software.

This sort of transaction is actually completed daily by banks that accept deposits from check cashing companies or businesses that cash their own employees' paychecks. According to the Consumer Financial Protection Bureau, you'll often do this to mark the business check as "for deposit only" so that it can only be deposited and thus not cashed by someone who may steal it. If your business account needs money, make a loan from you personally to your business or document an equity infusion. WebReconciling a check that was accidentally deposited into the account withdrawn from The title sums it up, but I paid myself with a check from my business account and Was this document helpful? BankersOnline is a free service made possible by the generous support of our advertisers and sponsors. There may be some initial costs to set up accounts and direct deposit bookkeeping software.  Click the check and tap Edit . (TermsofUse,PrivacyPolicy, Manage Consent, Do Not Sell My Data). You don't have to. Can the client now make a deposit for the same amount via personal check to her IRA as an indirect (I updated the post: they made a one time exception for me so its resolved.). Why is the work done non-zero even though it's along a closed path? Personal Finance & Money Stack Exchange is a question and answer site for people who want to be financially literate. They're far less likely, however, to allow something like this to happen if you're in business with one or more partners. Getting paid from your LLC isn't difficult, you just need to know the right way to go about it and the implications of your choices. If you've experienced differently in the past, it's because they were making mistakes or perhaps looking the other way. There is generally a fee for processing/recording/filing the DBA form, of course. Except by mistake I deposited into the other account on my card, which is not joint with her, which my own person account. Where major legal concerns come into play is when a deposit is made in the opposite manner. Connect with and learn from others in the QuickBooks Community. Opening an LLC bank account shouldnt be difficult, provided you do your research and bring the proper papers. Under the "Pay to the order of" section, add a "full endorsement.". If the check has been cashed, the bank that cashed the I can provide you with some information to help you out. Also, you can always run the quick reports by clicking the drop-down arrow beside View Register. For security reasons, sessions expire after15 minutes of inactivity. For future reference, I added the following articles to match and categorize your transactions and reconcile your account. - I mobile deposited it and received a rejection email later that day. By clicking "Continue", you will leave the community and be taken to that site instead. If the bank youre working with allows it, and its endorsed properly, you can deposit a check in your name to your business account.

Click the check and tap Edit . (TermsofUse,PrivacyPolicy, Manage Consent, Do Not Sell My Data). You don't have to. Can the client now make a deposit for the same amount via personal check to her IRA as an indirect (I updated the post: they made a one time exception for me so its resolved.). Why is the work done non-zero even though it's along a closed path? Personal Finance & Money Stack Exchange is a question and answer site for people who want to be financially literate. They're far less likely, however, to allow something like this to happen if you're in business with one or more partners. Getting paid from your LLC isn't difficult, you just need to know the right way to go about it and the implications of your choices. If you've experienced differently in the past, it's because they were making mistakes or perhaps looking the other way. There is generally a fee for processing/recording/filing the DBA form, of course. Except by mistake I deposited into the other account on my card, which is not joint with her, which my own person account. Where major legal concerns come into play is when a deposit is made in the opposite manner. Connect with and learn from others in the QuickBooks Community. Opening an LLC bank account shouldnt be difficult, provided you do your research and bring the proper papers. Under the "Pay to the order of" section, add a "full endorsement.". If the check has been cashed, the bank that cashed the I can provide you with some information to help you out. Also, you can always run the quick reports by clicking the drop-down arrow beside View Register. For security reasons, sessions expire after15 minutes of inactivity. For future reference, I added the following articles to match and categorize your transactions and reconcile your account. - I mobile deposited it and received a rejection email later that day. By clicking "Continue", you will leave the community and be taken to that site instead. If the bank youre working with allows it, and its endorsed properly, you can deposit a check in your name to your business account.

Reddit and its partners use cookies and similar technologies to provide you with a better experience. Banking has become more & more strict over the last couple years. You were working on a previous order. Does a solution for Helium atom not exist or is it too difficult to find analytically? Edward A. Haman is a freelance writer, who is the author of numerous self-help legal books. Even worse, when the company is audited and finds that cheque, the person who wrote it will have to justify and document why they made it out to you or risk being charged with embezzlement. Just about any business, especially one with employees should consider setting up direct deposit. @Joseph what does "making enough" have anything to do with it? Site design / logo 2023 Stack Exchange Inc; user contributions licensed under CC BY-SA. Hello, thank you for the information. If I have this situation, however if I delete the transaction it will affect the reconciliation of the month But there's a harder part: keeping your records straight and fair. Since the personal account is not connected to QBO, I'd suggest depositing the amount to the Owner's Equity. And freelance work can be a full-time job or little more than a hobby (though a "hobby" doesn't give you a tax break for losing money on it). Lalonde says that under Payments Canada clearing rules, the cheque writer's bank has 90 days to identify and return a problem cheque and can return it to reverse the deposit. go to branch you deposited asap in person, they will fix or your cheque will bounce. Here's how. WebWire transfer. Happy Tuesday, QuickBooks Community. If Never Hungry Cafe LLC wishes to continue operating the acquired business as Mary's Cafe, it can file and provide copies of any necessary paperwork to operate under a fictitious name in your state (a "DBA" filing), then deposit checks payable to Mary's Cafe to the Never Hungry account or into a separate account for the Mary's Cafe operation, whichever your bank and the LLC agree to. BankersOnline is a free service made possible by the generous support of our advertisers and sponsors. Overall, direct deposit is beneficial to both employers and employees. Deposits of this nature are generally viewed with suspicion. Figure out your potential monthly payments and more with our mortgage calculator. the deposit made it to the banking transaction feed. However, having counted offerings for a church on several occasions, I know that banks simply have no choice but to be lax about the "Pay to the Order Of" line on checks. Sometimes the money will be "earmarked" based on the payable line; any attempt to pay the pastor directly will go into his "discretionary fund", and anything payable to a specific subgroup of the church will go into their asset account line, but really all the cash goes directly to the same bank account anyway. Under the "Pay to the order of" section, add a "full endorsement.". Press J to jump to the feed. be prepared to prove your identity, your business identity and the signature rights.

Reddit and its partners use cookies and similar technologies to provide you with a better experience. Banking has become more & more strict over the last couple years. You were working on a previous order. Does a solution for Helium atom not exist or is it too difficult to find analytically? Edward A. Haman is a freelance writer, who is the author of numerous self-help legal books. Even worse, when the company is audited and finds that cheque, the person who wrote it will have to justify and document why they made it out to you or risk being charged with embezzlement. Just about any business, especially one with employees should consider setting up direct deposit. @Joseph what does "making enough" have anything to do with it? Site design / logo 2023 Stack Exchange Inc; user contributions licensed under CC BY-SA. Hello, thank you for the information. If I have this situation, however if I delete the transaction it will affect the reconciliation of the month But there's a harder part: keeping your records straight and fair. Since the personal account is not connected to QBO, I'd suggest depositing the amount to the Owner's Equity. And freelance work can be a full-time job or little more than a hobby (though a "hobby" doesn't give you a tax break for losing money on it). Lalonde says that under Payments Canada clearing rules, the cheque writer's bank has 90 days to identify and return a problem cheque and can return it to reverse the deposit. go to branch you deposited asap in person, they will fix or your cheque will bounce. Here's how. WebWire transfer. Happy Tuesday, QuickBooks Community. If Never Hungry Cafe LLC wishes to continue operating the acquired business as Mary's Cafe, it can file and provide copies of any necessary paperwork to operate under a fictitious name in your state (a "DBA" filing), then deposit checks payable to Mary's Cafe to the Never Hungry account or into a separate account for the Mary's Cafe operation, whichever your bank and the LLC agree to. BankersOnline is a free service made possible by the generous support of our advertisers and sponsors. Overall, direct deposit is beneficial to both employers and employees. Deposits of this nature are generally viewed with suspicion. Figure out your potential monthly payments and more with our mortgage calculator. the deposit made it to the banking transaction feed. However, having counted offerings for a church on several occasions, I know that banks simply have no choice but to be lax about the "Pay to the Order Of" line on checks. Sometimes the money will be "earmarked" based on the payable line; any attempt to pay the pastor directly will go into his "discretionary fund", and anything payable to a specific subgroup of the church will go into their asset account line, but really all the cash goes directly to the same bank account anyway. Under the "Pay to the order of" section, add a "full endorsement.". Press J to jump to the feed. be prepared to prove your identity, your business identity and the signature rights.  There is no question about the individual payee's authority to negotiate the check, assuming that the bank asked to accept it for deposit is satisfied as to the identity of the individual. The use of technologies, such as cookies, constitutes a share or sale of personal information under the California Privacy Rights Act. Thanks for the quick reply, @llm050 . I'm here to ensure you can transfer the deposit to your personal account in QuickBooks Online (QBO). Si If this account becomes a debit, it means that the shareholder owes money to the corporation, and this may result in tax consequences. When a business asks me to make out a cheque to a person rather than the business name, I take that as a red flag. Worse still they only have your word for it that you actually own the company, and aren't ripping off your employer by pocketing their payment. Our mobile The owner has to balance the convenience of mingling funds against the risk--if any--of being sued as an individual rather than a company. Sole proprietorships are inexpensive to form and give you more freedom and control, but they come with some significant drawbacks. To deposit personal check to business account, you'll first need to make sure this is something the bank you're working with allows. LegalZoom provides access to independent attorneys and self-service tools. In standard tuning, does guitar string 6 produce E3 or E2? WebAs for why a bank might care, other than for the potential (though remote) chance that it bounces, generally there are issues when people try to mix personal and business