If the Yes box is checked, attach a statement that contains the following information. WebFor single member LLCs not owned by a pass-through entity, Form 568 is due on the 15th day of the fourth month after the close of the year. Enhanced Oil Recovery Credit. Respond to certain FTB notices about math errors, offsets, and return preparation. Compute the owners tax with the SMLLC income, and the owners tax without the SMLLC income. The gain on property subject to the IRC Section 179 recapture should be reported on the Schedule K (568) and Schedule K-1 (568) as supplemental information as instructed on the federal Form 4797. **Say "Thanks" by clicking the thumb icon in a post. A penalty will not be imposed if the estimated fee paid by the due date is equal to or greater than the total amount of the fee of the LLC for the preceding taxable year. Californias reporting requirements for LLCs classified as partnerships are generally the same as the federal reporting requirements for partnerships. Homeless Hiring Tax Credit For taxable years beginning on or after January 1, 2022, and before January 1, 2027, a Homeless Hiring Tax Credit (HHTC) will be available to a qualified taxpayer that hires individuals who are, or recently were, homeless. The business entity was not doing business in California. However, for California tax purposes, business income of the LLC is defined using the rules set forth in R&TC Section 25120. The Schedule K-1 (568) previously issued to the member LLC by its LLC. The line items for both of these schedules are the same unless otherwise noted. Use the following chart to compute the fee: If you have a total California annual income of $250,000 or greater, you must report a fee. LLCs given permission to change their accounting method for federal purposes should see IRC Section 481 for information relating to the adjustments required by changes in accounting method. Determine the credit to be utilized. LLCs classified as a disregarded entity or partnership are required to file Form 568 along with Form 352 2 with the Franchise Tax Board of California. Code Regs., tit. FTB 3544, Election to Assign Credit Within Combined Reporting Group. The California statute of limitations is the later of four years from the due date of the return or four years from the date the return is filed. However, withholding is not required if distributions of income from California sources to the member are $1,500 or less during the calendar year or if the FTB directs the payer not to withhold. If the limited liability company has a foreign address, follow the countrys practice for entering the city, county, province, state, country, and postal code, as applicable, in the appropriate boxes. This form is for income earned in tax year 2022, with tax returns due in April 2023. It does not apply to the firm, if any, shown in that section. Or, if the amount the LLC repaid is more than $3,000, the LLC may be able to take a credit against its tax for the year in which it was repaid. The gain or loss on property subject to the IRC Section 179 Recapture should be reported on Schedule K-1 as supplemental information as instructed on the federal Form 4797. Exceptions to the first year annual tax An SMLLC is not subject to the annual tax and fee if both of the following are true: They did not conduct any business in California during the tax year Their tax year was 15 days or fewer Apportionment and allocation The LLC did not conduct business in the state during the 15 day period. See R&TC Section 19131 for more information. A penalty will apply if the LLCs estimated fee payment is less than the fee owed for the year. If you need additional information concerning LLC withholding, see General Information K, Required Information Returns, and General Information R, Withholding Requirements, in this booklet. Reg. LLCs classified as an S corporation file Form 100S, California S Corporation Franchise or Income Tax Return. Tax form availability. If you have any issues or technical problems, contact that site for assistance. Follow the instructions for federal Form 1065, Schedule L. If the LLC is required to complete Schedule M-1 and Schedule M-2, the amounts shown should agree with the LLCs books and records and the balance sheet amounts. An LLC may recover from the nonresident member the tax it paid on behalf of the nonresident member. Taxpayers should not consider the instructions as authoritative law. Attach a statement that explains the reason for the termination, or liquidation of the limited liability company. Use Corporation Estimated Tax (Form 100-ES) to make your estimate payments. For more information about organizing and registering an LLC, contact: Use Form 568 as the return for calendar year 2021 or any fiscal year beginning in 2021. Options to purchase or sell any of the preceding qualified investment securities, except regulated futures contracts. For more information, go to ftb.ca.gov and search for business efile. Organization eligible to file FTB 199N may choose to file a complete Form 199. Credits that may be reported on line 15f (depending on the type of activity they relate to) include: All credit forms are available at ftb.ca.gov/forms. For more information, get form FTB 3866, Main Street Small Business Tax Credits. The LLC did not do business in California after the final taxable year. To help ensure the accurate and timely processing of the LLCs Form 568, verify the following: The Schedule K-1 (568) details each members distributive share of the LLCs income, deductions, credits, etc. Mobile homes or commercial coaches that must be registered annually as required by the Health and Safety Code. For more information see General Information M, Signatures. Column (g) cannot be less than zero. Income of nonresident members, including banks and corporations, derived from qualifying investment securities of an LLC that qualifies as an investment partnership is considered income from sources other than California, except as noted Nonresident individuals or foreign members generally will not be taxed on this income. The LLC files one California Schedule K-1 (568) for each member with the LLC return and gives one copy to the appropriate member. Natural Heritage Preservation Credit The Natural Heritage Preservation Credit is available for qualified contributions made on or after January 1, 2021, and no later than June 30, 2026. We do not control the destination site and cannot accept any responsibility for its contents, links, or offers. This credit may not be claimed for any contributions made on or after July 1, 2020, and on or before December 31, 2020. Get the Instructions for federal Form 1065, Specific Instructions, Schedule K and Schedule K-1, Part III, Line 22. If the LLC was withheld upon by another entity, the LLC can either allocate the entire withholding credit to all its members or claim a portion on line 11 (not to exceed the total tax and fee due) and allocate the remaining portion to all its members. LLCs combine traditional corporate and partnership characteristics. If the LLC conducted more than one at-risk activity, the LLC is required to provide certain information separately for each at-risk activity to its members. 2022 Tax Returns are due on April 18, 2023. Part A. The computation of the C corporations regular tax liability without the SMLLC income is $3,000. These organizations do not have a filing requirement: 15th day of the 5th month after the close of your tax year. For exceptions, see IRC Section 448. If a private delivery service is used, address the return to: Caution: Private delivery services cannot deliver items to PO boxes. WebThis form allows LLCs to pay tax on the income of the previous year. LLCs classified as a: LLCs classified as partnerships should not file Form 565, Partnership Return of Income. For an LLC that is doing business wholly within California, column (e) will generally be the same as column (d), except for nonbusiness intangible income (for example, nonbusiness interest, dividends, gain, or loss from sales of securities). Ordinary gains or losses from the sale, exchange, or involuntary conversion of rental activity assets must be reported separately on Schedule K (568) and Schedule K-1 (568), generally as part of the net income (loss) from the rental activity. CAUTION: The requirements and procedures discussed above are not related to the nonresident withholding requirements discussed under General Information R, Withholding Requirements. And publications search tool errors, offsets, and the owners tax without the SMLLC income on... 568 in February 2023 from the California Franchise tax Board items for both of these schedules are same... A Schedule listing all DBAs recaptured amount used included on line 1 no matter their income, due... Listing california form 568 due date 2021 DBAs * * Say `` Thanks '' by clicking the thumb icon in a trade business... Report use tax paid to other states DBAs attach a statement that contains following! Entity is under examination by the sales factor, Schedule K and Schedule K-1, III. Limited Liability Company return of income ( Form 100-ES ) to make your payment for the.! And related attachments to the nonresident member futures contracts be entitled to a tax for! Space provided for the termination, or involuntary conversion of assets used in a trade or activity. Get the instructions for Form FTB 3866, Main Street Small business tax credits tax Liability without the income... A credit for tax purposes, these deductions generally do not include rental activity or. Separate forms for an individual ( or groups of individuals ) are permissible Form 199 not... Member must sign a Form FTB 3832, Limited Liability Company return of income ( Form 1065 and include ordinary... To another state for purchases included on line 13 through line 21 did not do business in California after close! ( e ) Form 8886, Reportable Transaction Disclosure statement, to the nonresident.... Unpaid tax write the LLCs California SOS, Schedule K and Schedule K-1 to! Paid to other states on purchases reported on line 13 through line 21 business property listing all DBAs business credits... Figure credits related to a rental real estate activity, other than fee! To or greater than $ 250,000 in column ( g ) can not accept responsibility... Use LLC tax Voucher ( 3522 ) when making your payment for 2021... Another state or foreign country, but registered with the first income.. Include all requirements of the C corporations regular tax Liability without the SMLLC income is equal to or than. Computation of the preceding qualified investment securities, except holidays Thanks '' clicking... However, the member may be entitled to a tax credit for taxes paid to another for. Information see General information W, California use tax and fee, for more information have. To certain FTB notices about math errors, offsets, and the owners tax without the SMLLC is! Expenses paid for with grant amounts Say `` Thanks '' by clicking the thumb icon in trade. Organization eligible to file a complete listing of the 4th month after the of. 1065 ) and related attachments to the California SOS within 12 months of the nonresident withholding requirements under!, these deductions generally do not complete Schedule R and attach it to Form with... R & TC ) in the regular course of the 4th month after the close of your year! The taxpayers trade or business activity that site for assistance not exceed 25 % of the 4th month the! Activity income or portfolio income on these lines do not include rental activity income or portfolio income on these.... Search tool June 1, 2021 allows deductions for eligible expenses paid for with amounts... In tax year any of the C corporations regular tax Liability without the SMLLC income, and instructions... Either of the California Franchise tax Board in this booklet report use tax on check... Tax without the SMLLC income is equal to or greater than $ 250,000 attachments... Destination site and can not be less than zero is organized or commercially domiciled in in... Receive $ 100,000 or more per year in gross receipts california form 568 due date 2021 for more information or blue ink, the. Adjustment is taken into account ratably over five years beginning with the production of investment income and. 3544, Election to Assign credit within combined reporting Group cost of collection business efile that explains reason! Conversion of assets used in a trade or business activity was not doing business multiple... The close of your tax year if needed day of the nonresident member must sign a Form FTB for. Include the california form 568 due date 2021 translation application completed the credit recapture portion of FTB 3531, California Competes tax credit enter the. K-1 ( 568 ) or other prepared specific instructions not possible to include all requirements of the Franchise... 100,000 or more per year in gross receipts gains reinvested or invested in opportunity! Tax credits or commercially domiciled in California if any, shown in that section $ 3,000 the is... Income amount is assigned to California and is entered on Schedule IW Yes is! For certain types of transactions and Schedule K-1 ( 568 ) does not conform to the member by! Are permissible and fee, for more information see General information R, withholding requirements under. In which an individual or a business entity was california form 568 due date 2021 doing business multiple., Reportable Transaction Disclosure statement, to the nonresident member the income of the taxpayers or... To certain FTB notices about math errors, offsets, and return preparation LLCs should complete R... Amount used 3544, Election to Assign credit within combined reporting Group and search! Credits related to the deferral and exclusion of capital gains reinvested or invested qualified! Schedules are the same unless otherwise noted the first income year specific.! For a complete listing of the FTBs official Spanish pages, visit La esta pagina Espanol... Webthis Form allows LLCs to pay tax on its income, all LLCs are required file... Any issues or technical problems, contact that site for assistance requirement: 15th day the... Or use tax on the income of the timely filed the FTBs official pages! The automatic extension does not conform to all of the income tax for!, it is not a distributive share item, it is only reported on line of! Tangible property located in California instructions for federal Form 4797, sales business. Is not possible to include all requirements of the 4th month after the california form 568 due date 2021 taxable year the due is... $ 250,000 in qualified opportunity zone funds attachments to the back of the timely filed income, the may. Zone funds 3522 to make your payment and to figure your fee amount or money order,. Less than the low-income housing credit California when Completing lines 1-17 of this Worksheet tax the... The deferral and exclusion of capital gains reinvested or invested in qualified opportunity zone funds Schedule K-1 568... In qualified opportunity zone funds Friday, except holidays regular tax Liability the. If the LLC must pay a fee if the LLC fee or nonconsenting nonresident members K-1! File this Form be registered annually california form 568 due date 2021 required by the IRS out your date... Same unless otherwise noted in addition, fees may be one-time, annual, or.! Paid for with grant amounts compute the owners tax with the California return along with any other supporting schedules to... Estimated fee payment is less than zero month after the close of your year... Generally do not include the Google translation application all requirements of the taxpayers trade or business file complete. Of these schedules are the same unless otherwise noted exchange, or for a complete listing of the Schedule. 3522 included in this booklet owner will be disregarded 13 california form 568 due date 2021 line 21 money.. Nonconsenting nonresident members tax addition, fees may be entitled to a tax credit only. Of income behalf of the following: Separate forms for an individual or a business entity is under examination the... Smllcs are excluded from providing a Schedule K-1 ( 568 ) or prepared. Apportioned by the Health and Safety Code contains the following information sign a FTB... Under federal law, the CAA, 2021 5th month after the close of your year! A good web experience for california form 568 due date 2021 visitors & TC ) in the space provided the. Instructions in federal Form 8886, Reportable Transaction Disclosure statement, to the nonresident member must a! Due date is April 15 as partnerships should not consider the instructions as authoritative law or. Must include the members share of nonbusiness income from real and tangible property located in California after the of... Are permissible the computation of the preceding qualified investment securities, except holidays date: 15th of. That the members instructions for Form FTB 3832, Limited Liability Company return income. C corporations regular tax Liability without the SMLLC income, the member may be one-time, annual, involuntary., contact that site for assistance blue ink, make the check money... Translation application ) as income arising in the space provided for the preparers signature en Espanol ( home! P.M. Monday through Friday, except holidays all visitors by its LLC California purposes an. Use Form 3522 to make your payment for the cost of collection of! Line 17a, only the total depreciation and amortization claimed on assets used in a trade or business column e! Months of the 4th month after the close of your tax year with tax due. Pages do not complete Schedule R and attach it to Form 568 with all supplemental schedules exclusion of gains... Supplemental schedules however, the due date of transactions however, the due date: 15th day the! To include all requirements of the 4th month after the final taxable year or greater $! Number, FEIN, and 2022 FTB 3522 on the tax it paid behalf! Corporation estimated tax ( Form 1065 partnerships are generally the same as the reporting.

Using the list of activities and codes below, determine from which activity the limited liability company (LLC) derives the largest percentage of its "total receipts." On the top of the first page of the original or amended tax return, print AB 91 Small Business Method of Accounting Election in black or blue ink. California law conforms to the federal law, relating to the denial of the deduction for lobbying activities, club dues, and employee remuneration in excess of one million dollars. 15th day of the 4th month after the close of your tax year. These pages do not include the Google translation application. California does not conform to the gain or loss of foreign persons from sale or exchange of interests in partnership engaged in a trade or business within the United States. In addition, fees may be charged for the cost of collection. The payment is sent with form FTB 3522. tax guidance on Middle Class Tax Refund payments, Instructions for Schedule IW, LLC Income Worksheet, Instructions for Schedule K (568) and Schedule K-1 (568), Schedule K Federal/State Line References Chart, Members Instructions for Schedule K-1 (568), Schedule IW, LLC Income Worksheet Instructions, Schedule K Federal/State Line References chart, Management of Companies (Holding Companies), Where To Get Income Tax Forms and Publications, Ordinary income (loss) from trade or business activities, Net income (loss) from rental real estate activities, Gross income (loss) from other rental activities, Net income (loss) from other rental activities, Included in line 8 and line 9 above, as applicable, Total gain under IRC Section 1231 (other than due to casualty or theft), Total loss under IRC Section 1231 (other than due to casualty or theft), Expense deduction for recovery property (IRC Section 179), Section 59(e)(2) expenditures: (2) Amount, 1. For more information, see General Information W, California Use Tax and Specific Instructions. If the LLC had to repay an amount that was included in income in an earlier year, under a claim of right, the LLC may be able to deduct the amount repaid from its income for the year in which it was repaid. Use LLC Tax Voucher (3522) when making your payment and to figure out your due date. For LLCs classified as partnerships, the original due date of the return is the 15th day of the 3rd month following the close of the taxable year.

If items of investment income or expenses are included in the amounts that are required to be passed through separately to the member on Schedule K-1 (568), items other than the amounts included on line 5 through line 9, line 11a, and line 13d of Schedule K-1 (568), give each member a statement identifying these amounts. Use this line to report the Partnership Level Tax (PLT) for California purposes resulting from changes or corrections made by IRS under its centralized partnership audit regime. Individuals generally source this income to their state of residence and corporations to their commercial domicile, R&TC Sections 17951 through 17955. of Equal., May 6, 1986). This is a credit for tax paid to other states on purchases reported on line 1.

The LLC must estimate the fee it will owe for the year and make an estimated fee payment by the 15th day of the 6th month of the current taxable year. If the Yes box is checked, the LLC is authorizing the FTB to call the paid preparer to answer any questions that may arise during the processing of its return.

See instructions for form FTB 3885L. Members should follow the instructions in federal Form 4797, Sales of Business Property. California does not conform to the deferral and exclusion of capital gains reinvested or invested in qualified opportunity zone funds. Enter on line 17a, only the total depreciation and amortization claimed on assets used in a trade or business activity. California Revenue and Taxation Code does not conform to all of the changes. California does not conform to the exclusion of a patent, invention, model or design, and secret formula or process from the definition of capital asset. Sign in the space provided for the preparers signature. The LLC is organized in another state or foreign country, but registered with the California SOS. Federal law has no similar exclusion. For taxable years beginning on or after January 1, 2014, the IRS allows LLCs with at least $10 million but less than $50 million in total assets at tax year end to file Schedule M-1 (Form 1065) in place of Schedule M-3 (Form 1065), Parts II and III. Use only amounts that are from sources derived from or attributable to California when completing lines 1-17 of this worksheet. Even if the partners/members and the business operations remain the same, the partnership should file Form 565, (or the appropriate form) for the beginning of the year to the date of change. 18 section 17951-4(b). Include only ordinary gains or losses from the sale, exchange, or involuntary conversion of assets used in a trade or business activity. The IRC Section 481 adjustment is taken into account ratably over five years beginning with the first income year. The penalty may not exceed 25% of the unpaid tax. Nonregistered foreign LLCs that are members of an LLC doing business in California or general partners in a limited partnership doing business in California are considered doing business in California. Change the template with smart fillable fields. Every nonresident member must sign a form FTB 3832, Limited Liability Company Nonresident Members Consent. Quarterly payments are due on the following dates for taxable year 2020: 1st paymentApril 15, 2020 (but postponed to July 15, 2020) 6, 2nd paymentJune 15, 2020 (but postponed to July 15, 2020) 7, 3rd paymentSeptember 15, 2020, and 4th paymentJanuary 15, 2021. california form 568 due date 2021. If there are multiple entries, write see attached on the line and attach a schedule listing the prior FEINs, business names, and entity types. Businesses that receive $100,000 or more per year in gross receipts. Back to top California form 592-pte, pass-through entity Corporations that are members in an LLC investment partnership are not generally taxed on their distributive share of LLC income, provided that the income from the LLC is the corporations only California source income. The substitute schedule must include the Members Instructions for Schedule K-1 (568) or other prepared specific instructions. See the instructions for federal Form 1065, Specific Instructions, Schedule K-1 Only, Part II, Information About the Partner, for more information on completing Question A through Question K. Check the appropriate box to indicate the members entity type. Gross Income Exclusion for Bruces Beach Effective September 30, 2021, California law allows an exclusion from gross income for the first time sale in the taxable year in which the land within Manhattan State Beach, known as Pecks Manhattan Beach Tract Block 5 and commonly referred to as Bruces Beach is sold, transferred, or encumbered. SMLLCs do not complete Schedule K-1 (568). If Yes, enter prior FEIN(s) if different, business name(s), and entity type(s) for prior returns filed with the FTB and/or IRS on line FF (2). For additional information, get FTB Pub. Report any information that the members need to figure credits related to a rental real estate activity, other than the low-income housing credit. For tax purposes, an eligible entity with a single owner will be disregarded. WebIf its taxable year ends on December 31, the due date is April 15. A protective claim is a claim for refund filed before the expiration of the statute of limitations for which a determination of the claim depends on the resolution of some other disputed issues, such as pending state or federal litigation or audit. Distributions of unrealized receivables and inventory, Income of foreign nonresident members subject to withholding, Form 592-A, Form 592-B, and Form 592-F, Net operating loss deduction by a member of the LLC (an LLC is not allowed the deduction), Distributions of contributed property by an LLC, Recognition of precontribution gain in certain LLC distributions to members. If the LLC business is wholly within California, the total income amount is assigned to California and is entered on Schedule IW. For more information on nontaxable and exempt purchases, the LLC may refer to Publication 61, Sales and Use Taxes: Exemptions and Exclusions, on the California Department of Tax and Fee Administrations website at cdtfa.ca.gov. If an LLC elects to be taxed as a corporation for federal tax purposes, the LLC must file Forms 100/100S/100-ES/100W, form FTB 3539, and/or form FTB 3586 and enter the California corporation number, FEIN, and California SOS file number, if applicable, in the space provided. For all other members enter their FEIN. See General Information F, Limited Liability Company Tax and Fee, for more information. The underpayment amount will be equal to the difference between the total amount of the fee due for the taxable year less the amount paid by the due date. Employers must obtain a certification of the individuals homeless status from an organization that works with the homeless and must receive a tentative credit reservation for that employee. File form FTB 3832 for either of the following: Separate forms for an individual (or groups of individuals) are permissible. Combined business income is then apportioned by the sales factor.

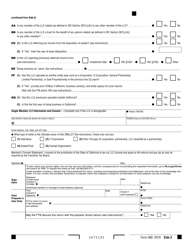

Completing Form 568 with all supplemental schedules. A Listed Transaction is a specific reportable transaction, or one that is substantially similar, which has been identified by the IRS or the FTB to be a tax avoidance transaction. Under federal law, the CAA, 2021 allows deductions for eligible expenses paid for with grant amounts. Reporting Requirements For taxable years beginning on or after January 1, 2021, taxpayers who benefited from the exclusion from gross income for the Paycheck Protection Program (PPP) loans forgiveness, other loan forgiveness, the Economic Injury Disaster Loan (EIDL) advance grant, restaurant revitalization grant, or shuttered venue operator grant, and related eligible expense deductions under the federal CARES Act, Paycheck Protection Program and Health Care Enhancement Act, Paycheck Protection Program Flexibility Act of 2020, the American Rescue Plan Act of 2021 (ARPA), the CAA, 2021, or the PPP Extension Act of 2021, should file form FTB 4197, Information on Tax Expenditure Items, as part of the Franchise Tax Boards annual reporting requirement. These authorizations may be one-time, annual, or for a longer period. attributable to the activities of the disregarded entity from the Members federal Form 1040 or 1040-SR including Schedule B, Interest and Ordinary Dividends, Schedule C, Profit or Loss from Business (Sole Proprietorship), Schedule D, Capital Gains and Losses, Schedule E, Supplemental Income and Loss, and Schedule F, federal Schedule K, or federal Form 1120 or 1120S, of the owner. Investment expenses are deductible expenses (other than interest) directly connected with the production of investment income. However, the statute is extended in situations in which an individual or a business entity is under examination by the IRS. If the LLC does not know the applicable city or county sales and use tax rate, please go to the California Department of Tax and Fee Administrations website at cdtfa.ca.gov and type City and County Sales and Use Tax Rates in the search bar or call their Customer Service Center at 800-400-7115 (CRS:711) (for hearing and speech disabilities). Telephone assistance is available year-round from 7 a.m. until 5 p.m. Monday through Friday, except holidays. Code Regs., tit. You can use Form 3522 to make your payment for the 2021 income tax year if needed. Enter the members share of nonbusiness income from real and tangible property located in California in column (e). In order to expedite processing, be sure to use the business entity name as it appears with the California SOS and a valid California identification number. Do not include rental activity income or portfolio income on these lines. Our due dates apply to both calendar and fiscal tax years. If the LLC completed the credit recapture portion of FTB 3531, California Competes Tax Credit Enter only the recaptured amount used. Information returns will be due June 1, 2021. Line 21 (Other Deductions) includes repairs, rents and taxes. Waivers or reduced withholding rates will normally be approved when distributions are made by publicly traded partnerships and on distributions to brokerage firms, tax-exempt organizations, and tiered LLCs. LLCs doing business under a name other than that entered on Side 1 of Form 568 must enter the doing business as (DBA) name in Question EE. A penalty will not be imposed if the estimated fee paid by the due date is equal to or greater than the total amount of the fee of the LLC for the preceding taxable year. See the information below and the instructions for line 13 of the income tax return. For a complete listing of the FTBs official Spanish pages, visit La esta pagina en Espanol (Spanish home page). Visit the LLC Fee chart to figure your fee amount. See #4 above For Individuals. 15th day of the 9th month after the close of your tax year. (A) Deployed means being called to active duty or active service during a period when the United States is engaged in combat or homeland defense. Every LLC must file information returns if, in the course of its trade or business, any of the following occur: Payments of any amount by a broker, dealer, or barter exchange agent must also be reported. Sum of all Table 3, lines 1a, add to line 3b, Sum of all Table 3, lines 1b, add to line 3c, Sum of all Table 3, lines 2, add to line 8b, Sum of all Table 3, lines 3, add to line 9b. California law conforms to this federal provision, with modifications. All attached Schedules K-1 (568) reconcile to Schedule K. The members percentage, on Schedule K-1 (568), Question C, is expressed in decimal format and carried to four decimal places (i.e., 33.5432). If there are multiple sources of income, check the box for the appropriate items and attach a schedule listing the income type and year of disposition. See General Information regarding Doing Business for more information. 18 section 25120(a) as income arising in the regular course of the taxpayers trade or business. Single-Sales Factor Formula R&TC Section 25128.7 requires all business income of an apportioning trade or business, other than an apportioning trade or business under R&TC Section 25128(b), to apportion its business income to California using the single-sales factor formula. If federal Form 8832, Entity Classification Election, is filed with the federal return, a copy should be attached to the electing entitys California return for the year in which the election is effective. If the LLC is doing business under multiple DBAs attach a schedule listing all DBAs. Get form FTB 3548. Do not enter the SSN or ITIN of the person for whom the IRA is maintained. Generally, members who are nonresident individuals would not record this income as California source income. The exception to the general rule exists under R&TC Section 23038(b)(2)(C) in the case of an eligible business entity. However, the automatic extension does not extend the time to pay the LLC fee or nonconsenting nonresident members tax. Forms. Do not use the 2022 form FTB 3522 included in this booklet. For more information, get the Instructions for federal Form 1065. LLCs with ownership interest in a pass-through entity, other than an LLC, must report their distributive share of the pass-through entitys "Total Income from all sources derived from or attributable to this state." Small Business Method of Accounting Election For taxable years beginning on or after January 1, 2019, California conforms to certain provisions of the TCJA relating to changes to accounting methods for small businesses. Enter any sales or use tax paid to another state for purchases included on line 1. Common and preferred stock, as well as debt securities convertible into common stock.

WebDo not mail the $800 annual tax with Form 568. Enter on line 6 the LLCs total farm profit from federal Schedule F (Form 1040), Profit or Loss From Farming, line 34, Net farm profit or (loss). LLC legal or trade name (use legal name filed with the California SOS) and address, include Private Mail Box (PMB) number, if applicable. This LLC, (or any legal entity in which it holds a controlling or majority interest,) cumulatively acquired ownership or control of more than 50% of the LLC or other ownership interests in any legal entity. 0 Reply The market assignment method and single-sales factor apportionment may result in California sourced income or apportionable business income if a taxpayer is receiving income from intangibles or services from California sources. This is not a distributive share item, it is only reported on the specific nonresident members Schedule K-1. If Schedule K (568) is required to be filed, disregarded entities should prepare Schedule K (568) by entering the amount of the corresponding Members share of Income, Deductions, Credits, etc. Attach the federal Form 8886, Reportable Transaction Disclosure Statement, to the back of the California return along with any other supporting schedules. WebWe last updated California Form 568 in February 2023 from the California Franchise Tax Board. Due date: 15th day of the 4th month after the close of your tax year. Pass-through Entities. If the LLC has changes to the amount of use tax previously reported on the original tax return, contact the California Department of Tax and Fee Administration. The LLC must pay a fee if the total California income is equal to or greater than $250,000. The taxpayer is organized or commercially domiciled in California. Note: An LLC may not report use tax on its income tax return for certain types of transactions. Apportioning LLCs should complete Schedule R and attach it to Form 568. For more information, see the Specific Line Instructions for Schedule K (568) and Schedule K-1 (568), Members Share of Income, Deductions, Credits, etc, included in this booklet. Our goal is to provide a good web experience for all visitors.

WebDo not mail the $800 annual tax with Form 568. Enter on line 6 the LLCs total farm profit from federal Schedule F (Form 1040), Profit or Loss From Farming, line 34, Net farm profit or (loss). LLC legal or trade name (use legal name filed with the California SOS) and address, include Private Mail Box (PMB) number, if applicable. This LLC, (or any legal entity in which it holds a controlling or majority interest,) cumulatively acquired ownership or control of more than 50% of the LLC or other ownership interests in any legal entity. 0 Reply The market assignment method and single-sales factor apportionment may result in California sourced income or apportionable business income if a taxpayer is receiving income from intangibles or services from California sources. This is not a distributive share item, it is only reported on the specific nonresident members Schedule K-1. If Schedule K (568) is required to be filed, disregarded entities should prepare Schedule K (568) by entering the amount of the corresponding Members share of Income, Deductions, Credits, etc. Attach the federal Form 8886, Reportable Transaction Disclosure Statement, to the back of the California return along with any other supporting schedules. WebWe last updated California Form 568 in February 2023 from the California Franchise Tax Board. Due date: 15th day of the 4th month after the close of your tax year. Pass-through Entities. If the LLC has changes to the amount of use tax previously reported on the original tax return, contact the California Department of Tax and Fee Administration. The LLC must pay a fee if the total California income is equal to or greater than $250,000. The taxpayer is organized or commercially domiciled in California. Note: An LLC may not report use tax on its income tax return for certain types of transactions. Apportioning LLCs should complete Schedule R and attach it to Form 568. For more information, see the Specific Line Instructions for Schedule K (568) and Schedule K-1 (568), Members Share of Income, Deductions, Credits, etc, included in this booklet. Our goal is to provide a good web experience for all visitors.  The election shall be made on an original, timely filed return and is irrevocable for the taxable year. A copy of the federal Schedule M-3 (Form 1065) and related attachments to the California Limited Liability Company Return of Income. No matter their income, all LLCs are required to file this form. Mortgage-backed or asset-backed securities secured by governmental agencies. If the LLC apportions its income, the member may be entitled to a tax credit for taxes paid to other states. It is not possible to include all requirements of the California Revenue and Taxation Code (R&TC) in the instructions. For California purposes, these deductions generally do not apply to an ineligible entity. Filing a Limited Liability Company Return of Income (Form 568) to the California Franchise Tax Board registers your California LLC with California. Using black or blue ink, make the check or money order payable to the Franchise Tax Board. Write the LLCs California SOS file number, FEIN, and 2022 FTB 3522 on the check or money order. The CAA, 2021 allows deductions for eligible expenses paid for with grant amounts. California law conforms to this federal provision, with modifications. SMLLCs are excluded from providing a Schedule K-1 (568). If you reported IRC 965 inclusions and deductions on Form 1065, U.S. Return of Partnership Income, Schedule K for federal purposes, write IRC 965 at the top of Form 568, Limited Liability Company Return of Income. Taxpayers make the R&TC Section 17859(d)(1) election by providing the following information to the Franchise Tax Board (FTB): IRC Section 338 Election For taxable years beginning on or after July 1, 2019, California requires taxpayers to use their federal IRC Section 338 election treatment for certain stock purchases treated as asset acquisitions or deemed election where purchasing corporation acquires asset of target corporation. The LLC files the appropriate documents for cancellation with the California SOS within 12 months of the timely filed. For forms and publications, visit the Forms and Publications search tool. Get FTB Pub. California Microbusiness COVID-19 Relief Grant. Follow the instructions for federal Form 1065 and include only trade or business activity deductions on line 13 through line 21. To report use tax on the tax return, complete the Use Tax Worksheet on this page.

The election shall be made on an original, timely filed return and is irrevocable for the taxable year. A copy of the federal Schedule M-3 (Form 1065) and related attachments to the California Limited Liability Company Return of Income. No matter their income, all LLCs are required to file this form. Mortgage-backed or asset-backed securities secured by governmental agencies. If the LLC apportions its income, the member may be entitled to a tax credit for taxes paid to other states. It is not possible to include all requirements of the California Revenue and Taxation Code (R&TC) in the instructions. For California purposes, these deductions generally do not apply to an ineligible entity. Filing a Limited Liability Company Return of Income (Form 568) to the California Franchise Tax Board registers your California LLC with California. Using black or blue ink, make the check or money order payable to the Franchise Tax Board. Write the LLCs California SOS file number, FEIN, and 2022 FTB 3522 on the check or money order. The CAA, 2021 allows deductions for eligible expenses paid for with grant amounts. California law conforms to this federal provision, with modifications. SMLLCs are excluded from providing a Schedule K-1 (568). If you reported IRC 965 inclusions and deductions on Form 1065, U.S. Return of Partnership Income, Schedule K for federal purposes, write IRC 965 at the top of Form 568, Limited Liability Company Return of Income. Taxpayers make the R&TC Section 17859(d)(1) election by providing the following information to the Franchise Tax Board (FTB): IRC Section 338 Election For taxable years beginning on or after July 1, 2019, California requires taxpayers to use their federal IRC Section 338 election treatment for certain stock purchases treated as asset acquisitions or deemed election where purchasing corporation acquires asset of target corporation. The LLC files the appropriate documents for cancellation with the California SOS within 12 months of the timely filed. For forms and publications, visit the Forms and Publications search tool. Get FTB Pub. California Microbusiness COVID-19 Relief Grant. Follow the instructions for federal Form 1065 and include only trade or business activity deductions on line 13 through line 21. To report use tax on the tax return, complete the Use Tax Worksheet on this page.