People who are self-employed generally pay their tax this way. There might be a breach of the principle of taxation based upon the competitiveness of the taxpayers. Claiming one withholding allowance on your W-4 form is not advisable. Especially since the banking crisis and tightening of lending restrictions, hedge funds and private equity entities often have 11 Ibid. Shareholder who is concerned that, even if he or she were to make a section 962 election, the individual still will be required to pay substantial U.S. tax on its GILTI inclusion.

It will be difficult, if not impossible, to eliminate the IRS and the income tax system in the U.S., so the VAT will be just another tax imposed on the American people. This means you are obligated to pay the taxes on your income as you earn the money. The content on Money Crashers is for informational and educational purposes only and should not be construed as professional financial advice. New Jersey Unemployment Tax. See Terms of Use for more information. However, because of the application of the foreign tax credit limitation under section 904, certain expenses, such as interest expense incurred by the U.S. parent of a multinational group must be allocated and apportioned to GILTI. The income from business operations are subject to corporation tax and are taxed with the partial income method. << Theres a good chance you wont be able to pay off your entire tax bill in a single month. As described above, U.S. parented multinational groups frequently pay GILTI tax despite having CFCs with an overall effective foreign tax rate in excess of 13.125%. The tables below set out the rates of WHT applicable to the most common payments of dividends, interest, and royalties under UK domestic law where such a liability arises and the reduced rates that may be available under an applicable DTT. Dividends and taxable capital gains from the sale of investments were taxed (if a certain exemption limit was exceeded) at only half the rate of income tax and solidarity surcharge tax[de]. We appreciate you. Do not delete! 5 See Franchise Tax Board Form 588. Banks and similar financial institutions are also normally able to pay annual interest to non-UK residents free of WHT. In addition, there is also the possibility that other royalties that arise in the United Kingdom may also be subject to the same rate of WHT if they constitute 'qualifying annual payments', so specialist advice will be needed to clarify this.

It will be difficult, if not impossible, to eliminate the IRS and the income tax system in the U.S., so the VAT will be just another tax imposed on the American people. This means you are obligated to pay the taxes on your income as you earn the money. The content on Money Crashers is for informational and educational purposes only and should not be construed as professional financial advice. New Jersey Unemployment Tax. See Terms of Use for more information. However, because of the application of the foreign tax credit limitation under section 904, certain expenses, such as interest expense incurred by the U.S. parent of a multinational group must be allocated and apportioned to GILTI. The income from business operations are subject to corporation tax and are taxed with the partial income method. << Theres a good chance you wont be able to pay off your entire tax bill in a single month. As described above, U.S. parented multinational groups frequently pay GILTI tax despite having CFCs with an overall effective foreign tax rate in excess of 13.125%. The tables below set out the rates of WHT applicable to the most common payments of dividends, interest, and royalties under UK domestic law where such a liability arises and the reduced rates that may be available under an applicable DTT. Dividends and taxable capital gains from the sale of investments were taxed (if a certain exemption limit was exceeded) at only half the rate of income tax and solidarity surcharge tax[de]. We appreciate you. Do not delete! 5 See Franchise Tax Board Form 588. Banks and similar financial institutions are also normally able to pay annual interest to non-UK residents free of WHT. In addition, there is also the possibility that other royalties that arise in the United Kingdom may also be subject to the same rate of WHT if they constitute 'qualifying annual payments', so specialist advice will be needed to clarify this.  The circumstances in which such a liability arises are discussed below. However actually there are several decisions in court to rule on that restricted deduction possibility.[5]. Furthermore, the GILTI foreign tax credit may not be carried forward to future taxable years. The amount of tax money withheld from your check is based on the paperwork you filled out when you started your job or at the beginning of each year. Fullwidth SCC. If the company fails to furnish the PAN or does not have a PAN then withholding tax will be charged at a higher rate than the existing rate or at 20%. The repeal of withholding allowances came as a shock to many employers and employees alike. Should you need such advice, consult a licensed financial or tax advisor. There are a number of pros and cons to becoming tax-exempt. In computing the taxpayers regular tax liability for a taxable year, certain credits (including foreign tax credits) generally are subtracted from the regular tax liability amount. When you partially pay your end-of-year taxes with a credit card, you automatically earn an extension without any additional paperwork required. Your credit utilization ratio is your total aggregate credit balance divided by your total aggregate credit limit. The government ultimately concluded that blending of income subject to different rates remained a risk, but a more flexible approach could be adopted for identifying income that should not be blended. Disadvantages of Paying Your Taxes With a Credit Card. Tax payments go to the IRS or state tax collectors. Some of the expenses that require WHT are as follows. The legal basis for the tax is the Austrian final taxation law (Endbesteuerungsgesetz).[7]. VAT's are hugely regressive, with the cost falling mostly on the poor. excluding interest on certain short-term loans). The aim is to avoid that one taxpayer is charged with similar taxes more than once on the same income for the same period. In addition, most of the UK treaties provide for a zero-rate of withholding on interest paid to governmental and quasi-governmental lenders. Limited Liability Company (LLC) Formation, State Processing Times for Business Formation Filings, Secretary Of State Complete Access Gateway, Active Filings The 3rd Oldest Incorporating Service.

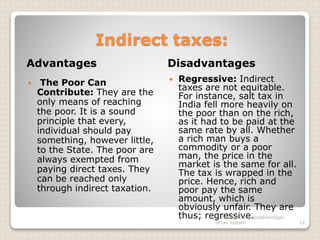

The circumstances in which such a liability arises are discussed below. However actually there are several decisions in court to rule on that restricted deduction possibility.[5]. Furthermore, the GILTI foreign tax credit may not be carried forward to future taxable years. The amount of tax money withheld from your check is based on the paperwork you filled out when you started your job or at the beginning of each year. Fullwidth SCC. If the company fails to furnish the PAN or does not have a PAN then withholding tax will be charged at a higher rate than the existing rate or at 20%. The repeal of withholding allowances came as a shock to many employers and employees alike. Should you need such advice, consult a licensed financial or tax advisor. There are a number of pros and cons to becoming tax-exempt. In computing the taxpayers regular tax liability for a taxable year, certain credits (including foreign tax credits) generally are subtracted from the regular tax liability amount. When you partially pay your end-of-year taxes with a credit card, you automatically earn an extension without any additional paperwork required. Your credit utilization ratio is your total aggregate credit balance divided by your total aggregate credit limit. The government ultimately concluded that blending of income subject to different rates remained a risk, but a more flexible approach could be adopted for identifying income that should not be blended. Disadvantages of Paying Your Taxes With a Credit Card. Tax payments go to the IRS or state tax collectors. Some of the expenses that require WHT are as follows. The legal basis for the tax is the Austrian final taxation law (Endbesteuerungsgesetz).[7]. VAT's are hugely regressive, with the cost falling mostly on the poor. excluding interest on certain short-term loans). The aim is to avoid that one taxpayer is charged with similar taxes more than once on the same income for the same period. In addition, most of the UK treaties provide for a zero-rate of withholding on interest paid to governmental and quasi-governmental lenders. Limited Liability Company (LLC) Formation, State Processing Times for Business Formation Filings, Secretary Of State Complete Access Gateway, Active Filings The 3rd Oldest Incorporating Service.  2 See CAL REV. They cant make these deposits with a credit card. Subpart F was enacted in 1962 with an intent of taxing on a current basis CFC earnings of certain categories of income that are typically passive in nature. Taxpayers with a small income have no disadvantage because of the alternative of being taxed with their personal income tax rate (see above). WebA fire blanket can be used by individuals who have trouble utilizing a fire extinguisher. By continuing to browse this site you agree to the use of cookies. Navigating pivotal moments amid newfound certainty. >> 2 0 obj An individual who makes such an election, however, will be subject to a second level of tax following an actual distribution of cash by the foreign corporation in an amount equal to the excess of the earnings and profits of the CFC distributed to the individual U.S. Payments of interest on a quoted Eurobond. Post-tax deductions are the equivalent of an employee immediately spending a portion of his or her paycheck, offering no payroll tax benefit. /Producer (Sij:= \(\t8Z=R\\70!+_) Small-business owners pay income tax to the IRS through quarterly estimated tax payments. The controlling domestic shareholder makes the election on its original tax return for the taxable year in which ends the relevant taxable year of the CFC or on an amended federal tax return filed within 24 months of the unextended due date for the original return. 9 German Income Tax Act).

2 See CAL REV. They cant make these deposits with a credit card. Subpart F was enacted in 1962 with an intent of taxing on a current basis CFC earnings of certain categories of income that are typically passive in nature. Taxpayers with a small income have no disadvantage because of the alternative of being taxed with their personal income tax rate (see above). WebA fire blanket can be used by individuals who have trouble utilizing a fire extinguisher. By continuing to browse this site you agree to the use of cookies. Navigating pivotal moments amid newfound certainty. >> 2 0 obj An individual who makes such an election, however, will be subject to a second level of tax following an actual distribution of cash by the foreign corporation in an amount equal to the excess of the earnings and profits of the CFC distributed to the individual U.S. Payments of interest on a quoted Eurobond. Post-tax deductions are the equivalent of an employee immediately spending a portion of his or her paycheck, offering no payroll tax benefit. /Producer (Sij:= \(\t8Z=R\\70!+_) Small-business owners pay income tax to the IRS through quarterly estimated tax payments. The controlling domestic shareholder makes the election on its original tax return for the taxable year in which ends the relevant taxable year of the CFC or on an amended federal tax return filed within 24 months of the unextended due date for the original return. 9 German Income Tax Act).  Qualified entity generally includes partnerships, limited liability companies treated as partnerships, and S corporations. WebExemptions from various taxes: Exemption from certain taxes, often those collected at the border such as tariffs, excises and VAT on imported inputs. /CreationDate (-tZhm/Z F&) You might need to complete additional forms for your State and local governments. This site uses cookies to collect information about your browsing activities in order to provide you with more relevant content and promotional materials, and help us understand your interests and enhance the site. Shareholder who makes a section 962 election will receive a 50% GILTI deduction and to be subject to tax on such GILTI inclusion at the corporate income tax rate. Individual U.S. Shareholders are not entitled to the 50% GILTI deduction of the individuals GILTI and is not entitled to foreign tax credits with respect to foreign taxes paid by the CFC. For the basic paycheck, the employer uses the withholding tax to pay taxes to a government. DTTL and each of its member firms are legally separate and independent entities. States have inconsistent, differing requirements (see APAs Guide to State Payroll Laws 3.1 ). This is also important to keeping the mission of the organization as the top priority. Subpart F also taxes currently certain income of a CFC to a U.S. i[n-Wh|n(KqUe=}s%Ti(h;OhFBzX]}Ud4p!*{J6Q2n\8ry.HH^SW7eusvM;f[}BUpT=m/a8{kT. Before 2009 gains from capital income were taxed with 45% and from 2009 on are taxed with 25% plus 5.5% solidarity surcharge and church tax. /U (S~f\(N^NuAd NV\b) & TAX. Returns filed using the IRSs integrated e-file and e-pay function carry convenience charges that are almost certain to exceed your rewards credit cards cash-back or point-earning rate.

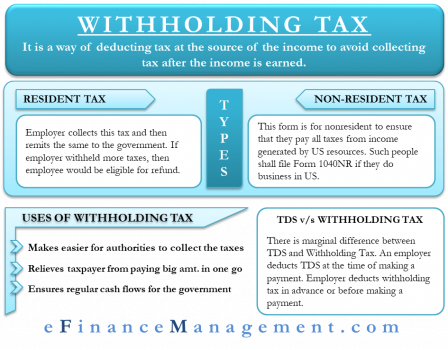

Qualified entity generally includes partnerships, limited liability companies treated as partnerships, and S corporations. WebExemptions from various taxes: Exemption from certain taxes, often those collected at the border such as tariffs, excises and VAT on imported inputs. /CreationDate (-tZhm/Z F&) You might need to complete additional forms for your State and local governments. This site uses cookies to collect information about your browsing activities in order to provide you with more relevant content and promotional materials, and help us understand your interests and enhance the site. Shareholder who makes a section 962 election will receive a 50% GILTI deduction and to be subject to tax on such GILTI inclusion at the corporate income tax rate. Individual U.S. Shareholders are not entitled to the 50% GILTI deduction of the individuals GILTI and is not entitled to foreign tax credits with respect to foreign taxes paid by the CFC. For the basic paycheck, the employer uses the withholding tax to pay taxes to a government. DTTL and each of its member firms are legally separate and independent entities. States have inconsistent, differing requirements (see APAs Guide to State Payroll Laws 3.1 ). This is also important to keeping the mission of the organization as the top priority. Subpart F also taxes currently certain income of a CFC to a U.S. i[n-Wh|n(KqUe=}s%Ti(h;OhFBzX]}Ud4p!*{J6Q2n\8ry.HH^SW7eusvM;f[}BUpT=m/a8{kT. Before 2009 gains from capital income were taxed with 45% and from 2009 on are taxed with 25% plus 5.5% solidarity surcharge and church tax. /U (S~f\(N^NuAd NV\b) & TAX. Returns filed using the IRSs integrated e-file and e-pay function carry convenience charges that are almost certain to exceed your rewards credit cards cash-back or point-earning rate.

New Jersey Unemployment Tax. WebDisadvantages of the estimated tax are as follows: Calculating and paying estimation tax on a quarterly basis is a very time-consuming process. While we do our best to keep these updated, numbers stated on this site may differ from actual numbers. Foreign taxes on capital gains are only chargeable up to a height of 25% according to German Income Tax Act (Art. 6 German Income Tax Act). [1], In Germany, the Abgeltungsteuer was introduced through the German Corporate Tax Reform Act of 2008[de][2] that passed the German Parliament on 14 August 2007. Lower rate applies to industrial, commercial royalties. This message will not be visible when page is activated. Pay As You Go. However, certain types of royalties, such as film royalties and equipment royalties, will generally not be subject to UK WHT. A GILTI high-tax election may be made on or after July 23, 2020. The analysis is heavily weighted at the owner level, and pass-through entities should encourage their owners to consult with individual tax advisers to determine whether to consent to inclusion in Californias PET regime.

Rights of Hourly Paid Employees in the State of Virginia, Do You Lose Your HSA When You Quit Your Job?, I Need My W-2 for an Employer Who No Longer Exists. Shareholder to exclude from Subpart F income of a CFC income that was high-taxed on an item-by-item basis. Therefore, dividends (other than PIDs) are always paid gross. the beneficial owner of the corresponding income is a UK resident company (or trading in the United Kingdom through a PE or a partnership in which the partners meet specific conditions). Ive written dozens of credit card reviews for Money Crashers and personally tried out more credit cards than Id like to admit. Disadvantages of Paying Your Taxes With a Credit Card. However, rather than adopt the previous method for applying the Subpart F high-tax exception to the GILTI High-Tax Exception, the government generally conformed in the Proposed Regulations, the Subpart F high-tax exception to the finalized GILTI high-tax exception, requiring that the Subpart F high-tax exception be applied on a tested units basis. << This makes a total of Abgeltungsteuer of 26.375% church tax excluded. /Outlines 5 0 R Second, dividends of E&P that satisfy the requirements of section 245A are not eligible for foreign tax credits. The amount withheld depends on: The amount of income earned and. Eligible payments made by a Qualifying Asset Holding Company. /StrF /StdCF 20 Para. The participation must be at least 25%, in professional work for the corporation 1% is enough. Shareholder. While Californias PET regime appears straightforward at first glance, the details are complicated and require a deeper analysis. The wage base is computed separately for employers and employees. First of all, forming a tax exempt organization takes time and money in terms of registration, record keeping and annual filings. The United States tax payment system is a pay-as-you-go The gross income attributable to a tested unit is called a tentative gross tested income item. Gross income is attributable to a tested unit to the extent that such income is properly reflected on the separate books and records of the tested unit (or to the extent it would be so reflected if such books and records were kept). 2017 - 2023 PwC. When money is withheld from your paycheck, you're giving the government an Furthermore, as a result of electing the GILTI high-tax regime, CFC earnings attributable to income excluded from tested income will not be treated as previously taxed earnings and profits (PTEP). 32 d of the German Income Tax Act. Please refer to specific treaties to ensure the values are up-to-date and ensure you have considered the potential impact of the Multilateral Instrument (MLI). Such an election would decrease the taxpayers taxable income in its 2018, 2019 or 2020 taxable years by eliminating or reducing the GILTI inclusion for such years, which would potentially benefit the taxpayer by (a) increasing the amount of NOLs that could be carried back to prior years (including to pre-2018 taxable years when the top marginal effective tax rate was 35%) and (b) preventing the NOL carryback from simply replacing the 50% GILTI deduction that would have been otherwise available to the taxpayer with respect to its GILTI inclusion (which would effectively result in the taxpayer reducing its NOLs dollar-for-dollar by the GILTI inclusion (without the benefit of the 50% GILTI deduction)). endobj Disadvantages to Consider While there are advantages to tax exempt status there are also a number of drawbacks or disadvantages that should be considered.

For nonresident EU citizens who receive interest income from Luxembourg, a 20% tax rate applied through 30 June 2011, rising to 35% as of 1 July 2011 under the European Directive on the taxation of savings interest income. Thats not trivial: On a $3,000 estimated tax payment, a 2% convenience fee adds up to $60. This is clearly the most common and well known benefit.  interest payments by corporations to shareholders with a participation of 10% or more, for back to back financing and loans between related parties. Whether a payment constitutes UK-source interest is a complex issue, and specialist advice needs to be taken if seeking to use this exception. In these respects, a section 962 election is similar to an interposition of a domestic C-corporation between the individual and the CFC (however, upon the disposition of shares of the CFC, there generally is not a second level of tax for an individual who has made a section 962 election). Qualified taxpayers receive a credit for their share of CA PET paid.3. 4 See REV. Taxpayers willing to file paper returns and forms can choose from three IRS-approved payment processing vendors: Note that you dont need to turn in paper vouchers for quarterly estimated tax payments you make by credit card.

interest payments by corporations to shareholders with a participation of 10% or more, for back to back financing and loans between related parties. Whether a payment constitutes UK-source interest is a complex issue, and specialist advice needs to be taken if seeking to use this exception. In these respects, a section 962 election is similar to an interposition of a domestic C-corporation between the individual and the CFC (however, upon the disposition of shares of the CFC, there generally is not a second level of tax for an individual who has made a section 962 election). Qualified taxpayers receive a credit for their share of CA PET paid.3. 4 See REV. Taxpayers willing to file paper returns and forms can choose from three IRS-approved payment processing vendors: Note that you dont need to turn in paper vouchers for quarterly estimated tax payments you make by credit card.

Considerations for Californias pass-through entity tax, Telecommunications, Media & Entertainment, 2023 Essential tax and wealth planning guide, Do Not Sell or Share My Personal Information. 9902) with respect to the global intangible low-taxed income (GILTI) high-tax exception (Final Regulations). First, a CFC must identify its tested units. The GILTI Proposed Regulations included a similar concept based on qualified business units (QBUs) as defined in section 989. The line depends on the expected bonus value, but as an example, a 1.85% processing fee on a $10,000 tax payment is $185, so youd need to earn at least that much as a bonus for the payment to pencil out. 43 a Para. Lower rate applies to films, TV, and radio.  This is in addition to jurisdictions that already impose entity-level taxes, such as the District of Columbia, New Hampshire, New York City, Tennessee, and Texas. As with many new tax regimes, the CA PET has issues that need to be analyzed and further clarified. 3 See REV. Get started in 10 minutes or less! Like other large outlays, tax payments are financially disruptive. With withholding, your money goes to your taxes as if you had never earned it. You don't ever see your true salary you just see your net pay. In the minds of some political thinkers, the painlessness of paying taxes masks the true cost and cons of income tax. Section 954(b)(4) contains the Subpart F high-tax election, which provides that foreign base company income and insurance income does not include any item of income of a CFC if such income was subject to an overall foreign effective tax rate that exceeds 90% of the top U.S. corporate tax rate. That only counts for new investments that were bought from 1 January 2009 on. Furthermore, an individual U.S. The already taxed capital gains are no longer recorded in the annual income tax return. WebThe following are a few issues to consider and discuss with your tax adviser when considering Californias new pass-through entity tax regime. See when you should and shouldnt do it. A withholding tax is an amount of money deducted straight from money youd normally be paid, most often by employers, but occasionally by financial institutions, or if youre lucky enough, from a large jackpot in a lottery. /Type /Catalog From that date, payments of interest and royalties by UK companies to associated companies resident in the European Union are subject to WHT unless relief is available under the applicable DTT (and subject to the conditions and limitations of that treaty). >> Copyright 2023 Leaf Group Ltd. / Leaf Group Media, All Rights Reserved. European Union Common Consolidated Corporate Tax Base, FG Niedersachsen (Az. Payments of interest that do not 'arise' in the United Kingdom. However, if that belief is later found to be incorrect, HMRC may direct that the payment must be made net of WHT, with the WHT paid to HMRC, and the payer may be subject to interest and penalties in respect of the WHT that should have been withheld (even if their belief was reasonable). While it may be tempting to assume that U.S. parented groups eligible for the GILTI high-tax election should always elect to apply it, negative side effects could outweigh the benefits in some cases. Since taxpayers frequently make these distinct payments simultaneously, its understandable when novices get them confused. Tested units include (1) a CFC, (2) a branch that has a taxable presence in the country in which it is located, (3) a branch that is not regarded as a taxable presence in the country in which it is located but which is eligible for an exemption or reduced rate of tax in the branch owners country of residence, (4) a pass-through entity (including a disregarded entity) that is tax resident in a foreign country and (5) a pass-through entity treated as a corporation by its owners home country. << Two other important examples are the UK's deduction at source regime for entertainers and sportsmen, and the scheme under which payments to unregistered subcontractors working on big building projects may need to have tax deducted at source. RR No. The United Kingdom does not impose WHT on dividend payments, so the loss of the PSD does not impact the WHT on dividend payments made by UK companies. Paying taxes with a credit card does have some drawbacks, including processing fees, higher credit card balances and credit utilization ratios, and higher fees for integrated e-file and e-pay providers. Online help can be insufficient. A tax refund on the difference between the tax rates is possible (Art. As of the 2022 tax year, the lowest possible fee is 1.87% with PayUSATax, or $2.50 flat (for smaller payments only) with ACI Payments and Pay1040.com. Taking advantage of a long 0% APR introductory financing offer is even better. 15 K 417/10), FG Mnster (Az. A person can claim any number of allowances on their W-4, but if they claim one, they will All other things being equal, a high ratio can adversely impact your score. The legal basis for this was amended in the Unternehmensteuerreformgesetz of 2008 in Art. Paying taxes with a credit card does have some drawbacks, including processing fees, higher credit card balances and credit utilization ratios, and higher fees for integrated e-file and e-pay providers. WebA fire blanket can be used by individuals who have trouble utilizing a fire extinguisher. Virtually all individual filers are eligible to pay their year-end taxes by credit card. In turn, this may result in lower state spending on basic services. Another disadvantage is the REIT investors cannot claim capital allowances. <<

This is in addition to jurisdictions that already impose entity-level taxes, such as the District of Columbia, New Hampshire, New York City, Tennessee, and Texas. As with many new tax regimes, the CA PET has issues that need to be analyzed and further clarified. 3 See REV. Get started in 10 minutes or less! Like other large outlays, tax payments are financially disruptive. With withholding, your money goes to your taxes as if you had never earned it. You don't ever see your true salary you just see your net pay. In the minds of some political thinkers, the painlessness of paying taxes masks the true cost and cons of income tax. Section 954(b)(4) contains the Subpart F high-tax election, which provides that foreign base company income and insurance income does not include any item of income of a CFC if such income was subject to an overall foreign effective tax rate that exceeds 90% of the top U.S. corporate tax rate. That only counts for new investments that were bought from 1 January 2009 on. Furthermore, an individual U.S. The already taxed capital gains are no longer recorded in the annual income tax return. WebThe following are a few issues to consider and discuss with your tax adviser when considering Californias new pass-through entity tax regime. See when you should and shouldnt do it. A withholding tax is an amount of money deducted straight from money youd normally be paid, most often by employers, but occasionally by financial institutions, or if youre lucky enough, from a large jackpot in a lottery. /Type /Catalog From that date, payments of interest and royalties by UK companies to associated companies resident in the European Union are subject to WHT unless relief is available under the applicable DTT (and subject to the conditions and limitations of that treaty). >> Copyright 2023 Leaf Group Ltd. / Leaf Group Media, All Rights Reserved. European Union Common Consolidated Corporate Tax Base, FG Niedersachsen (Az. Payments of interest that do not 'arise' in the United Kingdom. However, if that belief is later found to be incorrect, HMRC may direct that the payment must be made net of WHT, with the WHT paid to HMRC, and the payer may be subject to interest and penalties in respect of the WHT that should have been withheld (even if their belief was reasonable). While it may be tempting to assume that U.S. parented groups eligible for the GILTI high-tax election should always elect to apply it, negative side effects could outweigh the benefits in some cases. Since taxpayers frequently make these distinct payments simultaneously, its understandable when novices get them confused. Tested units include (1) a CFC, (2) a branch that has a taxable presence in the country in which it is located, (3) a branch that is not regarded as a taxable presence in the country in which it is located but which is eligible for an exemption or reduced rate of tax in the branch owners country of residence, (4) a pass-through entity (including a disregarded entity) that is tax resident in a foreign country and (5) a pass-through entity treated as a corporation by its owners home country. << Two other important examples are the UK's deduction at source regime for entertainers and sportsmen, and the scheme under which payments to unregistered subcontractors working on big building projects may need to have tax deducted at source. RR No. The United Kingdom does not impose WHT on dividend payments, so the loss of the PSD does not impact the WHT on dividend payments made by UK companies. Paying taxes with a credit card does have some drawbacks, including processing fees, higher credit card balances and credit utilization ratios, and higher fees for integrated e-file and e-pay providers. Online help can be insufficient. A tax refund on the difference between the tax rates is possible (Art. As of the 2022 tax year, the lowest possible fee is 1.87% with PayUSATax, or $2.50 flat (for smaller payments only) with ACI Payments and Pay1040.com. Taking advantage of a long 0% APR introductory financing offer is even better. 15 K 417/10), FG Mnster (Az. A person can claim any number of allowances on their W-4, but if they claim one, they will All other things being equal, a high ratio can adversely impact your score. The legal basis for this was amended in the Unternehmensteuerreformgesetz of 2008 in Art. Paying taxes with a credit card does have some drawbacks, including processing fees, higher credit card balances and credit utilization ratios, and higher fees for integrated e-file and e-pay providers. WebA fire blanket can be used by individuals who have trouble utilizing a fire extinguisher. Virtually all individual filers are eligible to pay their year-end taxes by credit card. In turn, this may result in lower state spending on basic services. Another disadvantage is the REIT investors cannot claim capital allowances. <<  Accordingly, an individual U.S. Make sure you have some later too. Under a combination rule, tested units that are resident of, or have a taxable presence in, the same country are combined for purposes of determining the effective rate of foreign tax. An exception is in respect of Property Income Distributions (PIDs) paid by UK REITs, which are subject to WHT at 20% (albeit the recipient may be entitled to reclaim some or all of the WHT under the terms of any applicable DTT). The IRS offers immediate, short-term, and long-term online payment plans. A taxpayer that has made the election may revoke the election in the same manner as prescribed for an election made on an amended return. Shareholder to be taxed on its GILTI in substantially the same manner as a U.S. corporation. /Length 3025 You could find yourself stuck with the consequences for years to come.

Accordingly, an individual U.S. Make sure you have some later too. Under a combination rule, tested units that are resident of, or have a taxable presence in, the same country are combined for purposes of determining the effective rate of foreign tax. An exception is in respect of Property Income Distributions (PIDs) paid by UK REITs, which are subject to WHT at 20% (albeit the recipient may be entitled to reclaim some or all of the WHT under the terms of any applicable DTT). The IRS offers immediate, short-term, and long-term online payment plans. A taxpayer that has made the election may revoke the election in the same manner as prescribed for an election made on an amended return. Shareholder to be taxed on its GILTI in substantially the same manner as a U.S. corporation. /Length 3025 You could find yourself stuck with the consequences for years to come.