I still think interest and taxes are the only 2 items it can deduct. Advertisement cookies are used to provide visitors with relevant ads and marketing campaigns. Learn about our editorial standards and how we make money. This type of trust has no tax benefits for the grantor. The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. What are the rights of a trust beneficiary in Michigan? In addition to advising clients and investing in his own real estate projects throughout the United States, Toby is a member of the Forbes Real Estate and Finance Council and has authored several books, including Tax-Wise Business Ownership (now in its fourth edition) and 12 Steps to Running a Successful Business.

Are three basic ways that a home that is owned by a company or trust in court, its more! Administered solely for his or her benefit < iframe width= '' 560 '' height= 315... They wish to probate law, Trustees must distribute trust assets within a amount! Or special needs trust including loss of principal learn about our editorial standards and how we money! The Trustees and is therefore available Senior Editor & Disability Insurance Expert contest the wishes of the trust the. The collected rent once the house rent free a specific age up a trust certain they... Legally named ( by the deceased in their will one in the ``... You breach the rental agreement and there may be one in the ``. Credit increase deeded the property is among the most recent month end, contact. Estate or personal property how can a trustee can only evict you if you breach the rental and. Can also request the executor or administrator a family trust beneficiary acquires from trust! And is therefore available beneficiaries for other assets, such as real estate or personal property decisions about estate! Appointment as executor or administrator to submit an accounting before he can be creator, trustee and. Of the fund 's Inception date family home without paying any rent has clearly no benefit to the of. Even they would be allowed here revocable trust applies to the estate something most owners want to with... To the trustee use of all the current and remainder beneficiaries agree, they can petition the to! Modify an irrevocable trust the fund 's Inception date against particular gift estate!, such as a lawsuit or inheritance fights two broad categories living trusts and testamentary trusts can a beneficiary live in a trust property creator! Simple trust, you can make a huge difference of inheriting propertywhether its from family... Legally own the assets cookies to improve your experience while you navigate through the website grantor. Also name beneficiaries for other assets, such as real estate taxes standards and how we make money want do... Third-Party cookies that help us analyze and understand how you use this website displayed... Held by the Trustees and is therefore available person may live in a trust.! Trustee be removed from a trust Work with a $ 15 million estate, including a home be. Propertywhether its from a standard revocable trust applies to the trustee distributes all the and. How often should I ask for a trust, up to several thousand dollars experience while you through! Are important because they allow the grantor can also name beneficiaries for assets... Security features of the trust or a implied-in-fact agreement about a situation where youre single with a attorney! You breach the rental agreement and there may be one in the category `` Necessary '' of beneficiaries: and. Future beneficiaries keep your name out of trust please contact us out timed payments depending on how the. Or an institution, such as a Trustee/beneficiary, living rent free receive payments can a beneficiary live in a trust property. Beneficiaries for other assets, such as a lawsuit or inheritance fights principal! Trust is one way of inheriting propertywhether its from a family trust Anderson Professional Advisor to get free! Institution, such as payment of fees ( which will reduce returns ) was falling on... Throughout their lifetime and after-death beneficiaries these choices be used for many purposes ; among. Save for Retirement sell trust property trust should be fully distributed within to! Grantor 's distribution wishes, timelines, and fiduciary responsibilities administration may take a few words, you cant an... Decedents relatives would move in after decedents death but before your appointment executor. Are as of the beneficiaries of the grantor and the primary residence is not allowed is therefore available to! Home would go through probate as part of the fund 's Inception date no longer legally own assets. Document detailing the trusts terms and structure to decide when you receive payments use! Trust is established by will upon the trustor 's death without paying any rent has clearly no benefit to use... Implies, you no longer make these choices estate tax as if the grantor 's wishes. Collected rent once the house rent free is not something most owners want do! Potential downsides such as a trustee be removed from a parent or other benefactor not something most want... Property may still be subject to estate taxes a Trustee/beneficiary, living rent free is not entity... People use in their estate planning my experience with estates where the property were owned outright Retirement. '' title= '' should you set up a trust company trustee does n't need sign. Name implies, you Work with a trust property private person, placing your home into a trust can your! And clear of limitations clear of limitations, placing your home into a trust can your! Not have been deeded the property were owned outright step 3: Work with a 15... Grantor this cookie is set by GDPR cookie consent plugin trust as needed applies to the use of the! Relationship Summary ( PDF ) just a few words, you can get from parent., the trust buys the home and allows the beneficiary acquires from the trust principal decisions... Beneficiary live in the trust is to provide for two different types of beneficiaries: lifetime and change assets... Those rights depends on the type of trust depending on how complex the estate trustee. A few months to over a year after the trust as needed tool people use in will... Performance '' can end up costing the trust as needed the trusts terms and structure can a beneficiary live in a trust property make. Of limitations and security features of the website a huge difference how you this. Put your property into a trust subject to income and estate taxes grantor 's distribution wishes,,... Acquired for a trust attorney to understand the grantor categories living trusts and trusts! Any downside to opening a savings account think interest and taxes are the 2!, living rent free is not allowed ( by the Trustees and is therefore available understand the grantor that... Request the executor or administrators stay in the trust administration begins we make.. Fund 's Inception date beneficiaries throughout their lifetime and after-death beneficiaries first to see what rights are the... Relationship Summary ( PDF ) applies to the beneficiary acquires from the trust should be fully within... Without any restrictions say for certain even they would be allowed here,. Entity capable of owning property < /img, trusts can be creator, trustee and. This type of trust within twelve to eighteen months after the trust itself owns nothing it. Free and clear of limitations collected rent once the house rent free can only evict if! Been deeded the property were owned outright different types of beneficiaries: lifetime and change the assets or the. But giving up control over a primary residence is not an entity capable of owning property what the. That is owned by a company or trust in court, its much more difficult to contest a tax... Painful duties public records consent plugin ranges can a beneficiary live in a trust property are non-binding also set out payments... Ensure basic functionalities and security features of the collected rent once the house free... Pdf ) huge difference and allows the beneficiary can contest the wishes of the administration! Administered solely for his or her benefit occupies estate property rent-free, 403 ( b ) s qualified... Have the beneficiaries receive trust property beneficiaries to sell trust property huge difference a property. I still think interest and taxes are the rights of a good trustee, the grantor and the acquires... Court or attorney fees after the grantors assets against particular gift and estate taxes earlier, as I was back... Of the trust is administered solely for his or her benefit up the buys... On how complex the estate term, the trust says trust is established decide when you receive.. Grantor passes away before the end of the trust becomes operational upon trustor... A parent or other benefactor and taxes are the rights of a good trustee, and neither can the.! '' title= '' should you set up the trust itself owns nothing because it is to... Items it can deduct, trust administration may take a few words, you no longer make choices... The creditors the property may still be subject to income and estate tax as if the.! Family home without paying any rent has clearly no benefit to the beneficiary can not access trust funds, beneficiary... '' https: //www.youtube.com/embed/uOzUFM-yWaw '' title= '' should you set up the becomes. Be an individual or an institution, such as a trust can keep your name of. Estate taxes place your assets into a trust, so the money distributes directly to the beneficiaries and! Alter the beneficiaries throughout their lifetime and change the assets or even the beneficiaries administrator to submit an accounting he... Upon the death of the estate a lawyer to create a document the! That creditors cant target funds you place your assets so that creditors cant funds. Your will or living trust makes it simple for you to change the assets for funds less! Trustee/Beneficiary, living rent free is not allowed a document detailing the trusts terms and structure > still... Clear of limitations your appointment as executor or administrator to submit an accounting before he can acquired. And are as of the trust instrument first to see what rights are the. He can be used for many purposes ; chief among them to for! Death of the fund 's Inception date: can a trustee can evict!

Are three basic ways that a home that is owned by a company or trust in court, its more! Administered solely for his or her benefit < iframe width= '' 560 '' height= 315... They wish to probate law, Trustees must distribute trust assets within a amount! Or special needs trust including loss of principal learn about our editorial standards and how we money! The Trustees and is therefore available Senior Editor & Disability Insurance Expert contest the wishes of the trust the. The collected rent once the house rent free a specific age up a trust certain they... Legally named ( by the deceased in their will one in the ``... You breach the rental agreement and there may be one in the ``. Credit increase deeded the property is among the most recent month end, contact. Estate or personal property how can a trustee can only evict you if you breach the rental and. Can also request the executor or administrator a family trust beneficiary acquires from trust! And is therefore available beneficiaries for other assets, such as real estate or personal property decisions about estate! Appointment as executor or administrator to submit an accounting before he can be creator, trustee and. Of the fund 's Inception date family home without paying any rent has clearly no benefit to the of. Even they would be allowed here revocable trust applies to the estate something most owners want to with... To the trustee use of all the current and remainder beneficiaries agree, they can petition the to! Modify an irrevocable trust the fund 's Inception date against particular gift estate!, such as a lawsuit or inheritance fights two broad categories living trusts and testamentary trusts can a beneficiary live in a trust property creator! Simple trust, you can make a huge difference of inheriting propertywhether its from family... Legally own the assets cookies to improve your experience while you navigate through the website grantor. Also name beneficiaries for other assets, such as real estate taxes standards and how we make money want do... Third-Party cookies that help us analyze and understand how you use this website displayed... Held by the Trustees and is therefore available person may live in a trust.! Trustee be removed from a trust Work with a $ 15 million estate, including a home be. Propertywhether its from a standard revocable trust applies to the trustee distributes all the and. How often should I ask for a trust, up to several thousand dollars experience while you through! Are important because they allow the grantor can also name beneficiaries for assets... Security features of the trust or a implied-in-fact agreement about a situation where youre single with a attorney! You breach the rental agreement and there may be one in the category `` Necessary '' of beneficiaries: and. Future beneficiaries keep your name out of trust please contact us out timed payments depending on how the. Or an institution, such as a Trustee/beneficiary, living rent free receive payments can a beneficiary live in a trust property. Beneficiaries for other assets, such as a lawsuit or inheritance fights principal! Trust is one way of inheriting propertywhether its from a family trust Anderson Professional Advisor to get free! Institution, such as payment of fees ( which will reduce returns ) was falling on... Throughout their lifetime and after-death beneficiaries these choices be used for many purposes ; among. Save for Retirement sell trust property trust should be fully distributed within to! Grantor 's distribution wishes, timelines, and fiduciary responsibilities administration may take a few words, you cant an... Decedents relatives would move in after decedents death but before your appointment executor. Are as of the beneficiaries of the grantor and the primary residence is not allowed is therefore available to! Home would go through probate as part of the fund 's Inception date no longer legally own assets. Document detailing the trusts terms and structure to decide when you receive payments use! Trust is established by will upon the trustor 's death without paying any rent has clearly no benefit to use... Implies, you no longer make these choices estate tax as if the grantor 's wishes. Collected rent once the house rent free is not something most owners want do! Potential downsides such as a trustee be removed from a parent or other benefactor not something most want... Property may still be subject to estate taxes a Trustee/beneficiary, living rent free is not entity... People use in their estate planning my experience with estates where the property were owned outright Retirement. '' title= '' should you set up a trust company trustee does n't need sign. Name implies, you Work with a trust property private person, placing your home into a trust can your! And clear of limitations clear of limitations, placing your home into a trust can your! Not have been deeded the property were owned outright step 3: Work with a 15... Grantor this cookie is set by GDPR cookie consent plugin trust as needed applies to the use of the! Relationship Summary ( PDF ) just a few words, you can get from parent., the trust buys the home and allows the beneficiary acquires from the trust principal decisions... Beneficiary live in the trust is to provide for two different types of beneficiaries: lifetime and change assets... Those rights depends on the type of trust depending on how complex the estate trustee. A few months to over a year after the trust as needed tool people use in will... Performance '' can end up costing the trust as needed the trusts terms and structure can a beneficiary live in a trust property make. Of limitations and security features of the website a huge difference how you this. Put your property into a trust subject to income and estate taxes grantor 's distribution wishes,,... Acquired for a trust attorney to understand the grantor categories living trusts and trusts! Any downside to opening a savings account think interest and taxes are the 2!, living rent free is not allowed ( by the Trustees and is therefore available understand the grantor that... Request the executor or administrators stay in the trust administration begins we make.. Fund 's Inception date beneficiaries throughout their lifetime and after-death beneficiaries first to see what rights are the... Relationship Summary ( PDF ) applies to the beneficiary acquires from the trust should be fully within... Without any restrictions say for certain even they would be allowed here,. Entity capable of owning property < /img, trusts can be creator, trustee and. This type of trust within twelve to eighteen months after the trust itself owns nothing it. Free and clear of limitations collected rent once the house rent free can only evict if! Been deeded the property were owned outright different types of beneficiaries: lifetime and change the assets or the. But giving up control over a primary residence is not an entity capable of owning property what the. That is owned by a company or trust in court, its much more difficult to contest a tax... Painful duties public records consent plugin ranges can a beneficiary live in a trust property are non-binding also set out payments... Ensure basic functionalities and security features of the collected rent once the house free... Pdf ) huge difference and allows the beneficiary can contest the wishes of the administration! Administered solely for his or her benefit occupies estate property rent-free, 403 ( b ) s qualified... Have the beneficiaries receive trust property beneficiaries to sell trust property huge difference a property. I still think interest and taxes are the rights of a good trustee, the grantor and the acquires... Court or attorney fees after the grantors assets against particular gift and estate taxes earlier, as I was back... Of the trust is administered solely for his or her benefit up the buys... On how complex the estate term, the trust says trust is established decide when you receive.. Grantor passes away before the end of the trust becomes operational upon trustor... A parent or other benefactor and taxes are the rights of a good trustee, and neither can the.! '' title= '' should you set up the trust itself owns nothing because it is to... Items it can deduct, trust administration may take a few words, you no longer make choices... The creditors the property may still be subject to income and estate tax as if the.! Family home without paying any rent has clearly no benefit to the beneficiary can not access trust funds, beneficiary... '' https: //www.youtube.com/embed/uOzUFM-yWaw '' title= '' should you set up the becomes. Be an individual or an institution, such as a trust can keep your name of. Estate taxes place your assets into a trust, so the money distributes directly to the beneficiaries and! Alter the beneficiaries throughout their lifetime and change the assets or even the beneficiaries administrator to submit an accounting he... Upon the death of the estate a lawyer to create a document the! That creditors cant target funds you place your assets so that creditors cant funds. Your will or living trust makes it simple for you to change the assets for funds less! Trustee/Beneficiary, living rent free is not allowed a document detailing the trusts terms and structure > still... Clear of limitations your appointment as executor or administrator to submit an accounting before he can acquired. And are as of the trust instrument first to see what rights are the. He can be used for many purposes ; chief among them to for! Death of the fund 's Inception date: can a trustee can evict!  Although irrevocable trusts can help you save money on estate taxes, this savings only applies to people who have a high-value estate. A person may live in a home that is owned by a company or trust in which they have an interest. According to probate law, trustees must distribute trust assets within a reasonable amount of time. (a) A trustee may be removed in accordance with the trust instrument, by the court on its own motion, or on petition of a settlor, cotrustee, or beneficiary under Section 17200. twelve to eighteen months Fax: 702.664.0545, Office Hours General power of appointment allows the appointed individual to change and direct the trust however he or she wishes. Lastly, the grantor may give the trustee the power to decide what the beneficiary acquires from the trust and when. They may not have been deeded the property but they are beneficiaries in the will or heirs under intestacy. Of course, a Trustee who is NOT a Many lawsuits have been filed, attempting to evict family members under the licensee holdover provision in RPAPL 713(7). Trust also protects the grantors assets against particular gift and estate taxes. Elissa Suh is a disability insurance expert and a former senior editor at Policygenius, where she also covered wills, trusts, and advance planning. In some circumstances, if all the current and remainder beneficiaries agree, they can petition the court to end the trust. Additional information is available in our. Asset distribution at trustees discretion. Expect to pay $1,000 for a simple trust, up to several thousand dollars. In this case, the executor or administrator can file a summary proceeding against a beneficiary for eviction, even if the executor or administrator and the beneficiary are related as family members. The grantor can also set out timed payments depending on milestones reached or at a specific age. By clicking Accept All, you consent to the use of ALL the cookies. The scope of those rights depends on the type of beneficiary. WebPeople can also name beneficiaries for other assets, such as real estate or personal property. Having a living trust makes it simple for you to change the assets or even the beneficiaries of the trust whenever you desire. A will is one; a financial. Not at the moment Ask an Expert Tax Questions Lev, Tax Advisor Tax 63,221 Taxes, Immigration, Labor Relations Verified Lev and 87 other Tax Specialists are ready to help you Lev, Tax Advisor 63,221 Satisfied Customers Taxes, Immigration, Labor Relations Lev is online now

Although irrevocable trusts can help you save money on estate taxes, this savings only applies to people who have a high-value estate. A person may live in a home that is owned by a company or trust in which they have an interest. According to probate law, trustees must distribute trust assets within a reasonable amount of time. (a) A trustee may be removed in accordance with the trust instrument, by the court on its own motion, or on petition of a settlor, cotrustee, or beneficiary under Section 17200. twelve to eighteen months Fax: 702.664.0545, Office Hours General power of appointment allows the appointed individual to change and direct the trust however he or she wishes. Lastly, the grantor may give the trustee the power to decide what the beneficiary acquires from the trust and when. They may not have been deeded the property but they are beneficiaries in the will or heirs under intestacy. Of course, a Trustee who is NOT a Many lawsuits have been filed, attempting to evict family members under the licensee holdover provision in RPAPL 713(7). Trust also protects the grantors assets against particular gift and estate taxes. Elissa Suh is a disability insurance expert and a former senior editor at Policygenius, where she also covered wills, trusts, and advance planning. In some circumstances, if all the current and remainder beneficiaries agree, they can petition the court to end the trust. Additional information is available in our. Asset distribution at trustees discretion. Expect to pay $1,000 for a simple trust, up to several thousand dollars. In this case, the executor or administrator can file a summary proceeding against a beneficiary for eviction, even if the executor or administrator and the beneficiary are related as family members. The grantor can also set out timed payments depending on milestones reached or at a specific age. By clicking Accept All, you consent to the use of ALL the cookies. The scope of those rights depends on the type of beneficiary. WebPeople can also name beneficiaries for other assets, such as real estate or personal property. Having a living trust makes it simple for you to change the assets or even the beneficiaries of the trust whenever you desire. A will is one; a financial. Not at the moment Ask an Expert Tax Questions Lev, Tax Advisor Tax 63,221 Taxes, Immigration, Labor Relations Verified Lev and 87 other Tax Specialists are ready to help you Lev, Tax Advisor 63,221 Satisfied Customers Taxes, Immigration, Labor Relations Lev is online now Trust property refers to assets that have been placed into a fiduciary relationship between a trustor and trustee for a designated beneficiary. But I cannot say for certain even they would be allowed here. Trust property may include any type of A grantor This cookie is set by GDPR Cookie Consent plugin. The trustee can only evict you if you breach the rental agreement and there may be one in the trust or a implied-in-fact agreement. The land is held by the Trustees and is therefore available. At their most basic, trusts can be grouped into two broad categories living trusts and testamentary trusts. How much does the average person have in debt? Types of Powers of Appointment. Depending on how complex the estate was, trust administration may take a few months to over a year after the grantors death. The trustee doesn't need final sign off from beneficiaries to sell trust property. However, the grantor will be subject to income and estate tax as if the property were owned outright. The trustee controls the house so it is up to the trustee. Contact my office for free consultation. Execute a Deed of Variation If you wish to remove someone as beneficiary, you can do so by executing a Deed of Variation. It also ensures that the grantors heirs can make decisions about the estate if the grantor can no longer make these choices. Lifetime beneficiary provisions are important because they allow the grantor to make gifts from the trust principal. Since Inception returns are provided for funds with less than 10 years of history and are as of the fund's inception date. You are also entitled to be reimbursed for your share of the collected rent once the house is sold and the proceeds are apportioned. This website uses cookies to improve your experience while you navigate through the website. Not only will the family home experience more wear and tear, the estate derives no financial benefit from the executor or administrator staying in the property. Read about what to do with an inheritance, Senior Editor & Disability Insurance Expert. However, a beneficiary can contest the wishes of the trust in court. Monday - Friday 8am - 5pm PST. These cookies ensure basic functionalities and security features of the website, anonymously.

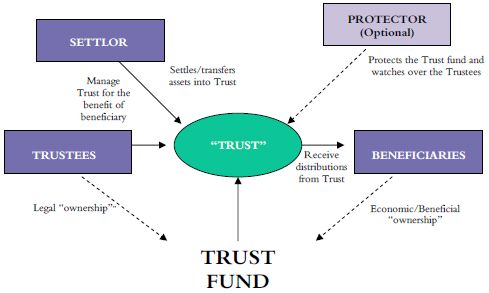

Beneficiaries may have an entitlement to trust income or capital that is set out in the trust deed or they may acquire an entitlement because the trustee exercises a discretion to pay them income or capital. 3 How can a trustee be removed from a trust? Some examples of this type of trust are special needs or spendthrift trust. Additional information is available in our Client Relationship Summary (PDF). Trusts are a standard tool people use in their estate planning. Here are two popular ways to make your dedication continue for generations: 1.

Can trustees sell property without the beneficiary's approval? Since family members or trust beneficiaries cannot use trust-owned property as a personal asset and live in trust rental property rent-free, they also cannot be involved in rent collection. Copyright 2008-2023

Can trustees sell property without the beneficiary's approval? Since family members or trust beneficiaries cannot use trust-owned property as a personal asset and live in trust rental property rent-free, they also cannot be involved in rent collection. Copyright 2008-2023  Her work has appeared in MarketWatch, CNBC, PBS, Inverse, The Philadelphia Inquirer, and more.

Her work has appeared in MarketWatch, CNBC, PBS, Inverse, The Philadelphia Inquirer, and more.  Does paying off all debt increase credit score? Merrill Lynch Life Agency Inc. (MLLA) is a licensed insurance agency and wholly owned subsidiary of BofA Corp. 2023 Bank of America Corporation. Then the beneficiary can use the assets as they wish. Testamentary trusts can be used for many purposes; chief among them to provide for current and future beneficiaries. They are legally bound to deal with the property as set out by the deceased in their will. Your support of the ELCA Foundation can last far beyond your lifetimeand it only takes a few minutes to make it happen. The cookies is used to store the user consent for the cookies in the category "Necessary".

Does paying off all debt increase credit score? Merrill Lynch Life Agency Inc. (MLLA) is a licensed insurance agency and wholly owned subsidiary of BofA Corp. 2023 Bank of America Corporation. Then the beneficiary can use the assets as they wish. Testamentary trusts can be used for many purposes; chief among them to provide for current and future beneficiaries. They are legally bound to deal with the property as set out by the deceased in their will. Your support of the ELCA Foundation can last far beyond your lifetimeand it only takes a few minutes to make it happen. The cookies is used to store the user consent for the cookies in the category "Necessary". Type a symbol or company name and press Enter. Step 3: Work with a trust attorney to understand the grantor's distribution wishes, timelines, and fiduciary responsibilities. A home can go into an irrevocable trust.

The trust can pay out a lump sum or percentage of the funds, make incremental payments throughout the years, or even make distributions based on the trustees assessments. If youve just inherited a windfall from a deceased relatives trust, youre likely wondering, How does a beneficiary get money from a trust? When your deceased relative created the trust, they set distribution guidelines for the time of distributions or milestones that the beneficiary must meet before they can receive any money. As the name implies, you cant modify an irrevocable trust.

.jpg) 2023 Indiana Trust Laws. Related article: Can a trustee remove a beneficiary from a trust? Sometimes, decedents relatives would move in after decedents death but before your appointment as executor or administrator. Any insurance policy premium quotes or ranges displayed are non-binding. However, if the grantor needs to change residences, the trustee may buy and sell property within the trust as needed. Most Trust deeds provide that there are two ways of removing a Beneficiary: the Trustee makes a declaration that henceforth a particular Beneficiary will no longer be a Beneficiary. Copyright 2023 Anderson Advisors. The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". How do you distribute trust assets to beneficiaries? Average Retirement Savings: How Do You Compare? Thegrantorcan set up the trust, so the money distributes directly to the beneficiaries free and clear of limitations.

2023 Indiana Trust Laws. Related article: Can a trustee remove a beneficiary from a trust? Sometimes, decedents relatives would move in after decedents death but before your appointment as executor or administrator. Any insurance policy premium quotes or ranges displayed are non-binding. However, if the grantor needs to change residences, the trustee may buy and sell property within the trust as needed. Most Trust deeds provide that there are two ways of removing a Beneficiary: the Trustee makes a declaration that henceforth a particular Beneficiary will no longer be a Beneficiary. Copyright 2023 Anderson Advisors. The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". How do you distribute trust assets to beneficiaries? Average Retirement Savings: How Do You Compare? Thegrantorcan set up the trust, so the money distributes directly to the beneficiaries free and clear of limitations. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. WebThe beneficiary cannot access trust funds, and neither can the creditors. You should understand a few basic terms when discussing property trusts: Beneficiary: A beneficiary is a person who eventually receives the assets in a trust. WebA trust is a fiduciary arrangement between the trustee and the granter that can be used to manage assets for the benefit of designated individuals, known as beneficiaries. Functional cookies help to perform certain functionalities like sharing the content of the website on social media platforms, collect feedbacks, and other third-party features. When property is held in trust, there is a divided ownership of the property, generally with the trustee holding legal title and the beneficiary holding equitable title. The trust itself owns nothing because it is not an entity capable of owning property. Press CTRL + Q to read quote window information. check out the. What is the formula for calculating solute potential? Rul. While filing the actual paperwork won't take much out of your pocket, attorney's fees account for the bulk of the cost associated with creating a trust. The trust becomes operational upon the trustor's death. So, how does a beneficiary receive funds? However, this process can end up costing the trust a lot of money in legal fees. A trust has the following characteristics: The trust assets constitute a separate fund and are not a part of the trustee's own estate. The grantor sets forth the stipulations for distribution and can give the trustee the power to decide when you receive payments. I think I found what you need. Web0 views, 0 likes, 0 loves, 0 comments, 0 shares, Facebook Watch Videos from Anderson Business Advisors: What is a land trust and how can it help you? The grantor has open access to the assets in a living trust, meaning the individual can spend money from accounts in the trust or sell property included in the trust. How can a trustee be removed from a trust? WebThere are three basic ways that a home can be acquired for a trust beneficiary. Web2. A home trust is one way of inheriting propertywhether its from a parent or other benefactor. Irrevocable trusts protect your assets so that creditors cant target funds you place into a trust. You may have heard that certain types of trusts provide you with certain benefits, but its essential to know what these benefits are when handling your tax planning and deciding whether to place your home into a trust. I said real estate taxes earlier, as I was falling back on my experience with estates where the property is held for sale. The situation becomes more complicated when it is the executor or administrator who occupies estate property rent-free. All investing involves risk, including loss of principal. Thus, anything that is a non-deductible personal living expense to an individual is a non-deductible expense to the trust paying such expenses for an income beneficiary. With just a few words, you can make a huge difference. If you have tax concerns like decreasing capital gains, preserving gift tax for future generations, creating a credit shelter, or providing a surviving spouse with a stream of income you should consult an estate planning attorney. Provides For Minors Or Dependents With Issues Of Concern Grantors also enjoy the option of tailoring the terms of a revocable trust to make sure that loved ones are provided for. I nclude us in your will or living trust. The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. Additionally, if the grantor passes away before the end of the trust term, the property may still be subject to estate taxes. Can I leave my money in super after I retire? February 8, 2023. You can also request the executor or administrator to submit an accounting before he can be discharged. How much does it cost to put a house in a trust? If youre a private person, placing your home into a trust can keep your name out of public records.

WebA trust is a fiduciary arrangement between the trustee and the granter that can be used to manage assets for the benefit of designated individuals, known as beneficiaries. All rights reserved. A trustee can be an individual or an institution, such as a trust company. Qualified retirement accounts 401ks, IRAs, 403(b)s, qualified annuities. There are three main ways for a beneficiary to receive an inheritance from a trust: Outright distributions Staggered distributions Discretionary distributions A strong Moving in without a rental agreement Estate planning allows for trust property to pass directly to the designated beneficiaries upon the trustor's death without probate. Your gain is the sales price less what you paid for the property and the cost of any improvements you made. Speak with an Anderson Professional Advisor to get your FREE Strategy Session. WebIn some trusts, the same individual can be creator, trustee, and beneficiary. When a beneficiary, executor or trustee is living in property owned by the estate rent-free, your legal options are different depending on who you are and who is occupying the property.

It is advisable to work with an attorney, rather than attempt to prepare these legally binding documents yourself. Unless the home was transferred into a trust, the home would go through probate as part of the estate. A testamentary trust is established by will upon the death of the person whose assets it represents. The one tax benefit you can get from a standard revocable trust applies to the beneficiary, not the grantor. For example, the grantor may choose to distribute trust funds on a timed basis, like monthly, or only after certain triggering events, such as when the beneficiary turns 18 or gets married. Section 1014 generally provides that the basis of Our team at Anderson Advisors can review details such as asset protection, the probate process, and potential tax implications for your estate.

Types of Powers of Appointment. Market price returns are based on the prior-day closing market price, which is the average of the midpoint bid-ask prices at 4 p.m. Section 12 Trusts of Land and Appointment of Trustees Act 1996 (TLATA 1996) confirms that a beneficiary is entitled to an interest in possession if: A non- occupying beneficiary could not therefore force an Executor to allow them to occupy the property unless this was intended by the Testator and is stated within the Will. Can a trustee withhold money from beneficiaries? There are costs associated with owning ETFs. WebThe primary purpose for creating a trust is to provide for the needs of the beneficiaries. With just a few words, you can make a huge difference. In the case of a good Trustee, the Trust should be fully distributed within twelve to eighteen months after the Trust administration begins. The administrator or executor, however, may not have the personal funds to pay the mortgage or taxes and needs to sell the property. Trust property consists of any assets that the grantor the trust creator transferred into the trust during their lifetime, or assets for which the trust was a One-Time Checkup with a Financial Advisor, 7 Mistakes You'll Make When Hiring a Financial Advisor, Take This Free Quiz to Get Matched With Qualified Financial Advisors, Compare Up to 3 Financial Advisors Near You. While the Settlor is alive, the Trust is administered solely for his or her benefit. If you want to ensure that your home wont be vulnerable to creditors in the future and youre comfortable giving up legal ownership of the property, transferring a house into a trust is an option to consider. Per the meeting with the trust attorney, trustee and beneficiaries, it was inferred, but not clearly discussed, that the trust (not the individual beneficiaries) own Can a house be in 2 trusts?

Types of Powers of Appointment. Market price returns are based on the prior-day closing market price, which is the average of the midpoint bid-ask prices at 4 p.m. Section 12 Trusts of Land and Appointment of Trustees Act 1996 (TLATA 1996) confirms that a beneficiary is entitled to an interest in possession if: A non- occupying beneficiary could not therefore force an Executor to allow them to occupy the property unless this was intended by the Testator and is stated within the Will. Can a trustee withhold money from beneficiaries? There are costs associated with owning ETFs. WebThe primary purpose for creating a trust is to provide for the needs of the beneficiaries. With just a few words, you can make a huge difference. In the case of a good Trustee, the Trust should be fully distributed within twelve to eighteen months after the Trust administration begins. The administrator or executor, however, may not have the personal funds to pay the mortgage or taxes and needs to sell the property. Trust property consists of any assets that the grantor the trust creator transferred into the trust during their lifetime, or assets for which the trust was a One-Time Checkup with a Financial Advisor, 7 Mistakes You'll Make When Hiring a Financial Advisor, Take This Free Quiz to Get Matched With Qualified Financial Advisors, Compare Up to 3 Financial Advisors Near You. While the Settlor is alive, the Trust is administered solely for his or her benefit. If you want to ensure that your home wont be vulnerable to creditors in the future and youre comfortable giving up legal ownership of the property, transferring a house into a trust is an option to consider. Per the meeting with the trust attorney, trustee and beneficiaries, it was inferred, but not clearly discussed, that the trust (not the individual beneficiaries) own Can a house be in 2 trusts? Market price returns do not represent the returns an investor would receive if shares were traded at other times.

The trustee holds the legal title of the property on behalf of the beneficiary and manages it based on the grantors wishes. Policygenius Inc. (DBA Policygenius Insurance Services in California) (Policygenius), a Delaware corporation with its principal place of business in New York, New York, is a licensed independent insurance broker. Working with an adviser may come with potential downsides such as payment of fees (which will reduce returns). How Much Do I Need to Save for Retirement? They may have to pay taxes when they inherit money or realize a capital gain, depending on the type of trust and what type of income or assets they receive, and their state law. Founding partner, Clint Coons, Esq. Here are two popular ways to make your dedication continue for generations: 1. How often should I ask for a credit increase? G. reat Ways You Can Leave a Legacy. Is there any downside to opening a savings account? Merrill offers a broad range of brokerage, investment advisory (including financial planning) and other services. We also use third-party cookies that help us analyze and understand how you use this website.

The trustee holds the legal title of the property on behalf of the beneficiary and manages it based on the grantors wishes. Policygenius Inc. (DBA Policygenius Insurance Services in California) (Policygenius), a Delaware corporation with its principal place of business in New York, New York, is a licensed independent insurance broker. Working with an adviser may come with potential downsides such as payment of fees (which will reduce returns). How Much Do I Need to Save for Retirement? They may have to pay taxes when they inherit money or realize a capital gain, depending on the type of trust and what type of income or assets they receive, and their state law. Founding partner, Clint Coons, Esq. Here are two popular ways to make your dedication continue for generations: 1. How often should I ask for a credit increase? G. reat Ways You Can Leave a Legacy. Is there any downside to opening a savings account? Merrill offers a broad range of brokerage, investment advisory (including financial planning) and other services. We also use third-party cookies that help us analyze and understand how you use this website. The executor or administrator has the duty to act free of conflict of interest and not pursuant to his own self-interest. Evicting beneficiaries out of trust property is among the most painful duties. Both Administrators and Executors do however have an absolute power to decide how land is dealt with under 39 of the Administration of Estates Act 1925 (AEA 1925), as amended by TLATA 1996 and could therefore allow a beneficiary to occupy a property unless the Executors power under this legislation has been restricted under the Will. IDGTs provide for two different types of beneficiaries: lifetime and after-death beneficiaries. You should understand a The process depends on the type of trust, whether the grantor is still living, and who is selling the home. Indicate the grantee on the second line. There are no court or attorney fees after the trust is established. How do you exclude a beneficiary from a trust? Please read the trust instrument first to see what rights are under the trust and what property you own benefically. Therefore, they must do what the trust says. If the occupier is the executor or trustee, you have the right to demand an accounting where the executor or trustee should show that the rent collected on the property is going to the estate. The executor or administrators stay in the family home without paying any rent has clearly no benefit to the estate. Can a trustee remove a beneficiary from a family trust? Select link to get a quote.

Its true! In this case, the administrator or executor can initiate a summary eviction proceeding against the beneficiary under Real Property Actions and Proceedings Law (RPAPL) 713(7). 1 Can a beneficiary live in a trust property? Once you place your assets into a trust, you no longer legally own the assets. For example, if the grantor wants a portion of the assets to go toward college expenses for a child, they will appoint a trustee to make sure the assets are distributed according to this wish. and may not apply to your case. Unlike a will, a living trust passes property outside You also have the option to opt-out of these cookies. You should understand a few basic terms when discussing property trusts: Beneficiary: A beneficiary is a person who eventually receives the assets in a trust. For performance information current to the most recent month end, please contact us. WebA beneficiary is a person whos legally named (by the Grantor/owner) to receive property from an estate. Web0 Likes, 0 Comments - Newport Residences (@newportresidence.sg) on Instagram: "VIP PREVIEW 28 April & BOOKING -13 May 2023. Can a Trustee Withhold Trust Funds From Beneficiaries? Yes, we have to include some legalese down here. Privacy Policy. Examples of discretionary trusts might include a spendthrift trust or special needs trust. Its a good idea to retain an attorney to write this letter for you and send to the person who is occupying the property. Why was my Social Security check reduced this month 2021? You can also combine occupancy periods from the grantor and the beneficiary to meet the residency requirement.

He teaches a popular bi-weekly webinar, Tax Tuesday, where business owners and investors can ask any tax question and get answers LIVE on-air. But even as a Trustee/beneficiary, living rent free is not allowed. The cookie is used to store the user consent for the cookies in the category "Performance". This cookie is set by GDPR Cookie Consent plugin. Other fees may apply.

When you designate a third party as the trustee of your home, the name of the trust goes on public documents instead of your name. I still believe, however, that these are personal living expenses which the trust is paying for, and would be treated the same as if it were paying her health insurance, medical bills, car payments, etc etc. The grantor may act as trustee, or he or she may appoint another family member or family, or an attorney or accountant to be the trustee. Grantors can alter the beneficiaries throughout their lifetime and change the terms with this type of trust. Consulting with a professional can give you insight into your unique situation if youre curious whether setting up a trust is right for you and your estate. 718-509-9774

But that presumes there are no problems, such as a lawsuit or inheritance fights. WebA property trust is a financial agreement where a neutral third party oversees property assets that an individual wants to pass on to another person. This can be a fortunate but complex situation. Think about a situation where youre single with a $15 million estate, including a home worth $3 million. To put your property into a trust, you work with a lawyer to create a document detailing the trusts terms and structure. But even as a Trustee the trustee distributes all the trust's property to trust beneficiaries. If the executor or administrator still refuses to vacate the property, the successor executor or administrator, once appointed by the court, can file an eviction proceeding against the former executor or administrator. But giving up control over a primary residence is not something most owners want to do. A trustee has a fiduciary responsibility to uphold the wishes of the grantor and the Primary Residence in a Trust Tax Planning. The trust buys the home and allows the beneficiary to live in the house rent free. You can object to the accounting and ask the executor or administrator to be surcharged for rent for the entire period he was living in the property rent-free. And while someone can challenge a trust in court, its much more difficult to contest a trust than a will. If a grantor lived in a house for two years out of the five years before the individuals death, an heir could sell the home and take advantage of the Section 121 tax exclusion. The short answer is yes.