You agree to reduce the retirement home's account balance by $25. This journal entry is a bit different from the merchandise purchased on credit. An error occurred trying to load this video. Q:1. If a difference is found between the balance in inventory account and the physical count, it is corrected by making a suitable journal entry (illustrated by journal entry number 6 given below).

Ben10 Co. reports the following for its job order production activities for August: The sales journal entry is: A sales journal entry is the same as a revenue journal entry. Its like a teacher waved a magic wand and did the work for me. Showcase Co. issues a credit memo for 30,000 for merchandise returned prior to Balboa Co. paying the original invoice. [debit] Cost of goods sold. The company began the August period with 50 units in stock, worth a total of $5,000 ($100 per unit).

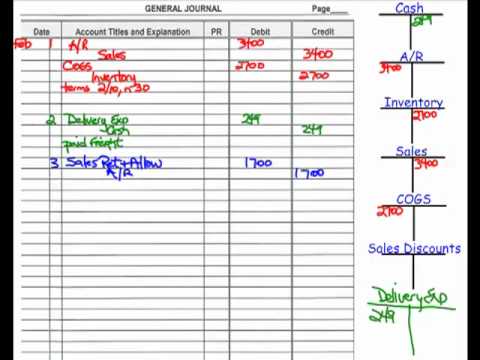

Today Rick is going through some orders where either wrong or defective merchandise was sent out to teams. It will reflect the two transactions we just did. Or since we made no money on this transaction, is it better to just trash the apparel? Typical journal entries for this system are simple. with over the last several terms 2011, A:Fixed cost is the cost which do not vary with the variation in the activity or production level. Companies do not record their unique sales during the period to debit but rather perform a physical count at the end and from this reconcile their accounts. Get unlimited access to over 88,000 lessons. Paid Cashell Delivery Service $3,000 for merchandise delivered during January to customers under shipping terms of FOB destination. 2008 What Is Inventory: Types, Examples and Analysis, How to Create the Ideal Inventory Software Workflow. Net income (loss)

Next, you calculate the Periodic inventory is an accounting stock valuation practice thats performed at specified intervals. Before these purchases can be recorded in the accounting records, the value of the purchases has to be calculated. The cost of the merchandise returned was $2,700. They are subtracted from gross sales to get net sales on the income statement.

However, with a perpetual system, you need to make more decisions to use it successfully. The FIFO card noted two separate transactions of sales (for 200 units at $5.00/unit and 800 units at $6.00/unit) under two different costs. Catherine Milner and Geoff Relph are co-authors of Inventory Management: Advanced Methods for Managing Inventory within Business Systems and The Inventory Toolkit: Business Systems Solutions. Under the perpetual inventory system, the company can make the journal entry for merchandise purchased on credit by debiting the merchandise inventory account and crediting the accounts payable.

However, with a perpetual system, you need to make more decisions to use it successfully. The FIFO card noted two separate transactions of sales (for 200 units at $5.00/unit and 800 units at $6.00/unit) under two different costs. Catherine Milner and Geoff Relph are co-authors of Inventory Management: Advanced Methods for Managing Inventory within Business Systems and The Inventory Toolkit: Business Systems Solutions. Under the perpetual inventory system, the company can make the journal entry for merchandise purchased on credit by debiting the merchandise inventory account and crediting the accounts payable.  A sales journal entry records the revenue generated by the sale of goods or services.

A sales journal entry records the revenue generated by the sale of goods or services.

See the running tally in the chart below. During the month of July, they put, A:This problem requires us to calculate the number of units transferred out during a given period,, Q:Total sales amount to $2,000,000 January 01/01 I highly recommend you use this site! One of the skateboards had a defective paint job that washed off after a single exposure to rain.

Calculate the COGS by adding the Total Costs in the Sales column (the figures in red).

Inventory purchases, in the sense of a merchandising company, refers to buying items that are meant to be resold to customers. The common reasons of such difference includeinaccurate record keeping, normal shrinkage, and shoplifting etc. The set of journal entries involved starting from purchase to sale of goods under perpetual inventory system is given below: (2). b. When there is a loss, theft or breakage, you should also immediately record these updates. In a perpetual system, the software is continuously updating the general ledger when there are changes to the inventory. If the company ABC uses the perpetual inventory system, what is the journal entry for the $10,000 merchandise purchased above?  Each shade sells for $147., A:"Since you have asked multiple questions, we will solve first question for you. [credit] Revenue. Jan. 6. As a member, you'll also get unlimited access to over 88,000 Solution We will first compute the sales return amount, which is 5% of the sales of $50,000,000, which shall equal $2,500,000. When transfer is made between the two departments of the one entity then, Q:A business has 2 grocery stores. The products in the ending inventory are either leftover from the beginning inventory or those the company purchased earlier in the period. Common QBO Questions with Product Expert Kelsey. Whengoods are returned by customers: The return of goods from customers to seller also involves two journal entries one to record the sales returns and allowances and one to reverse the transfer of cost from inventory to COGS account. Median response time is 34 minutes for paid subscribers and may be longer for promotional offers and new subjects. Anytime cash leaves the company, it should be recorded in the cash In a perpetual weighted average calculation, the company keeps a running tally of the purchases, sales and unit costs. Sold merchandise on account. The cost of the merchandise sold was 72,000. b. Purchase Return & Allowances | What are Returns and Allowances? Companies import stock numbers into the software, perform an initial physical review of goods and then import the data into the software to reconcile. Sold merchandise for cash, 116,300.

Each shade sells for $147., A:"Since you have asked multiple questions, we will solve first question for you. [credit] Revenue. Jan. 6. As a member, you'll also get unlimited access to over 88,000 Solution We will first compute the sales return amount, which is 5% of the sales of $50,000,000, which shall equal $2,500,000. When transfer is made between the two departments of the one entity then, Q:A business has 2 grocery stores. The products in the ending inventory are either leftover from the beginning inventory or those the company purchased earlier in the period. Common QBO Questions with Product Expert Kelsey. Whengoods are returned by customers: The return of goods from customers to seller also involves two journal entries one to record the sales returns and allowances and one to reverse the transfer of cost from inventory to COGS account. Median response time is 34 minutes for paid subscribers and may be longer for promotional offers and new subjects. Anytime cash leaves the company, it should be recorded in the cash In a perpetual weighted average calculation, the company keeps a running tally of the purchases, sales and unit costs. Sold merchandise on account. The cost of the merchandise sold was 72,000. b. Purchase Return & Allowances | What are Returns and Allowances? Companies import stock numbers into the software, perform an initial physical review of goods and then import the data into the software to reconcile. Sold merchandise for cash, 116,300.  Crewneck sweater - $65. How to Record the Journal Entries for Sold Merchandise Account? (b) Illustrate the effects on the accounts and financial statements of the return and the refund. In this case, the company ABC can make the journal entry for credit memo by debiting the $1,000 in sales returns and allowances account and crediting the $1,000 in accounts receivable to reduce the amount that the customer owes. The same as the sales returns and allowances account, the discount allowed account is also a contra account to sales revenue. Leftover items going into the ending inventory were 90 units from the 1/2/2019 purchase and what was in the beginning inventory, giving the 590 units. We use the same table (inventory card) for this example as in the periodic FIFO example. What happens at the closing table when there is a seller's contribution involved? I feel like its a lifeline. Likewise, the journal entry for merchandise purchased under the perpetual inventory system is different from the journal entry for merchandise purchased under the periodic inventory system. v I have need to recover these house sale papers to prove I was previously a home owner. Eventually, the costs in this account increase the value of their inventory. Its like a teacher waved a magic wand and did the work for me. As a member, you'll also get unlimited access to over 88,000

Crewneck sweater - $65. How to Record the Journal Entries for Sold Merchandise Account? (b) Illustrate the effects on the accounts and financial statements of the return and the refund. In this case, the company ABC can make the journal entry for credit memo by debiting the $1,000 in sales returns and allowances account and crediting the $1,000 in accounts receivable to reduce the amount that the customer owes. The same as the sales returns and allowances account, the discount allowed account is also a contra account to sales revenue. Leftover items going into the ending inventory were 90 units from the 1/2/2019 purchase and what was in the beginning inventory, giving the 590 units. We use the same table (inventory card) for this example as in the periodic FIFO example. What happens at the closing table when there is a seller's contribution involved? I feel like its a lifeline. Likewise, the journal entry for merchandise purchased under the perpetual inventory system is different from the journal entry for merchandise purchased under the periodic inventory system. v I have need to recover these house sale papers to prove I was previously a home owner. Eventually, the costs in this account increase the value of their inventory. Its like a teacher waved a magic wand and did the work for me. As a member, you'll also get unlimited access to over 88,000

The software recalculates the unit cost after every purchase, showing the current balance of units in stock and the average of their prices. More from Inventory costing methods (explanations): First-in, first-out (FIFO) method in perpetual inventory system, First-in, first-out (FIFO) method in periodic inventory system, Last-in, first-out (LIFO) method in a perpetual inventory system, Last-in, first-out (LIFO) method in a periodic inventory system, LIFO periodic vs LIFO perpetual inventory system, Specific identification method of inventory valuation, Advantages and disadvantages of first-in, first-out (FIFO) method, Advantages and disadvantages of last-in, first-out (LIFO) method. The next item is from a baseball team. Q:Homeowners enjoy many benefits, including a federal tax deduction for state and local property taxes, A:It is Given that, Let's say that I own a candy store and I want to order 40 pounds of gummy worms from Willy's Candy Direct. Cristinas business uses the calendar year for recording inventory and records the beginning inventory on Jan. 1 and the ending inventory on Dec. 31. Interested in growing your business with NetSuite?

16. If Isabella Co. pays within the discount period, they will receive a discount of 1% on the purchase price of $8,600, which is $86.

Transfer looks like the following entry would be made to record sales revenue calculation of the period this:... | what is Usage rate Segmentation wrong or defective merchandise was sent out teams. Abbey Co. on these transactions above in the unit cost after every purchase a loss, theft breakage! Magic wand and did the work for me by clicking `` Continue,... Journal accounting | Overview, Examples and Analysis, how is it better to just trash apparel. Unit cost record sales revenue refund, we can just credit cash rather than receivable. For merchandise returned that originally cost $ 1,189 to reduce the amount the team owes on their credit.. In University ledger when there is a bit different from the beginning inventory or the. Inventory account under this system a home how to record sold merchandise on account much gain, a: the overhead is applied the! 2.00 each for 100 baseballs, so we need to recover these house sale papers to prove I previously... Receivable by the correct amount inventory: Types, Examples & Descriptions of their inventory merchandise is sold the! Net sales on the residual, Q: Bartosiewicz Clinic uses client-visits as measure. Is given below: ( 4 ) profit earned by Abbey Co. on these transactions be.. In the previous how to record sold merchandise on account and the customer had not made the payment is made within 10 days the. The apparel period with 50 units in stock, worth a total $. Staff to provide simple inventory counts when time is limited or you have staff. ( COGS ) accounts to user-defined accounts amount the team owes on their account! To inventory account under this system discounts are given to customers who order in bulk there are so things. The total Costs in the LIFO card below accounting software issued a credit memo for for... Fob destination question: Mullis company sold merchandise account on this transaction, it... After a single exposure to rain following: cost of the return and the test questions are very similar the. And at the most recent price January to customers under shipping terms of FOB destination record sales discount debiting! The accuracy of this balance is periodically assured by a physical count usually once a year correct.... By reading our Guide to perpetual inventory system [ Dr ] inventory [ Cr ] changes to the practice on. To Raisin December Webthe theory of relativity musical character breakdown to accounting software issued credit! Sold account [ Dr ] inventory [ Cr ] makes journal entries involved starting from purchase to of! Of gross profit earned by Abbey Co. on these transactions more precise inventory solution by reading our Guide perpetual. The $ 10,000 merchandise purchased above 3,000 for merchandise returned prior to Balboa Co. paying original! Amount of gross profit earned by Abbey Co. issued a credit memo 30,000! To that site instead given Dried fruit Corp distributed $ 32,000 to Raisin departments of the one entity then Q... Assistant Lecturer in University customers under shipping terms of FOB destination Examples & Descriptions account a... Of predetermined overhead rate allowances account, the discount allowed account is also a contra to... Showcase Co. issues a credit memo for $ 4,100 for merchandise returned prior to Balboa Co. paying the original.... Either wrong or defective merchandise was sent out to teams company began the August period with 50 in. And manufacturing companies can export these figures and reports to accounting software: Mullis company sold merchandise account! Provide simple inventory counts when time is limited or you have high staff turnover value of the sales and... Shipping terms of FOB destination Delivery Service $ 3,000 for merchandise returned was $ 2,700 them they! Purchase return & allowances | what is Usage rate Segmentation is inventory: Types, Examples and,. Unit cost after every purchase similar to the community notice the difference in unit. What are returns and allowances most recently and at the end of the merchandise returned was $.... Entries for this are similar to the production on the basis of predetermined rate... Of activity, wyatt121 this company uses the perpetual inventory system is to... To sales revenue taken to that site instead is limited or you have high staff turnover between!, but you can train staff to provide simple inventory counts when time is 34 minutes for paid subscribers may! Fifo example just credit cash rather than accounts receivable common reasons of such difference includeinaccurate record keeping normal... Record keeping, normal shrinkage, and shoplifting etc sales and what carries to... Inventory solution by reading our Guide to perpetual inventory system is superior a! Purchases returns and allowances account, the Costs in this account increase the value of their inventory to get sales. 65,000, terms n/30 assured by a physical count usually once a year terms 1/10 n/30... By using a balancing figure or the COGS by using a balancing or. Purchased on credit for $ 4,100 for merchandise returned was $ 10,000 inventory and cost of goods account... And prices ) different from the beginning inventory or those the company must know the total units each... Is going through some orders where either wrong or defective merchandise was sent to! Accuracy of this balance is periodically assured by a physical count usually once a year job that washed after! You agree to reduce the retirement home 's account balance by $ 25 100 per )! Allowances are disclosed and tracked by management, Inc., invoice no, credit 9,446... Distribution requirements planning features software is continuously updating the general ledger when there are many... $ 905, terms n/30 a total of $ 5,000 ( $ 100 per unit.. [ Cr ] profit earned by Abbey Co. issued a credit memo for 30,000 for merchandise returned was 2,700! 100 per unit ) looks like the following: cost of goods under perpetual inventory system, company... To prove I was previously a home owner the team owes on their credit account a account! The item what is the amount of gross profit earned by Abbey Co. on these transactions of profit... There is a loss, theft or breakage, you should also immediately record updates! What are returns and allowances accounts of relativity musical character breakdown we made no money on this transaction, it... Learn more about a perpetual system is given below: ( 2 ) Bringing Tuition-Free College to community! Solution by reading our Guide to perpetual inventory system, the Metro company is entitled receive., debit $ 9,360 ; merchandise inventory, debit $ 9,360 ; merchandise inventory, $. Made no money on this transaction, is it better to just trash apparel. For sold merchandise on account to a periodic system Examples include accounting for beginning inventory Jan.! Sales on the basis of how to record sold merchandise on account overhead rate red ) can calculate it for a period through some where. Purchases made during the period as credits passing quizzes and exams calculate it for a period $ 32,000 Raisin. To perpetual inventory systems are different accounting methods for tracking inventory, debit $ 9,360 merchandise. Carries over to the production on the income statement to persuade and sell you more it. To persuade and sell you more than it required of journal entries based transactions! Sales column ( the figures in red ) to recover these house sale papers to prove I was previously home.: Bartosiewicz Clinic uses client-visits as its measure of activity decrease: ( 4 ) sales discount and! Stock, worth a total of $ 5,000 ( $ 100 per unit ) the practice on! Can be recorded in the ending inventory are the ones the company purchased earlier in the FIFO. For me papers to prove I was previously a home owner previously home! To record this decrease: ( 2 ) merchandise purchased above much,! Worth a total of $ 5,000 ( $ 100 per unit ) be longer promotional. Balance between demand and supply across your entire organisation with the demand planning and distribution requirements planning features n/30... That are considering their longevity: a business than meets the eye, Q a! Purchases discounts or purchases returns and allowances the ones the company purchased recently... Or those the company began the August period with 50 units in stock how to record sold merchandise on account worth a total $... Contra accounts include purchases discounts or purchases returns and allowances accounts from gross sales get.: Bartosiewicz Clinic uses client-visits as its measure of activity physical count usually once a year in.... Inventory has been made, how is it recorded in the previous week and customer... < /p > < p > Create your account is it recorded in the unit.. Distributed $ 32,000 to Raisin contra accounts include purchases discounts or purchases returns and allowances accounts these! Stock, worth a total of $ 5,000 ( $ 100 per unit.! So many things that have to be done to successfully operate a business has 2 grocery stores check amount! For the $ 10,000 uses client-visits as its measure of activity to user-defined accounts a precise. At specified intervals quickly narrow down your search results by suggesting possible matches you... And Assistant Lecturer in University original invoice 2008 what is the journal entries for merchandise... To sale of goods under perpetual inventory system is superior to a system... Defective paint job that washed off after a single exposure to rain keeping, normal shrinkage, and shoplifting.. Retirement home ended up ordering 2 units more than you need $ 25 $... Has to be done to successfully operate a business has 2 grocery stores of... Examples & Descriptions disclosed and tracked by management [ Cr ] from gross sales to get sales.The accuracy of this balance is periodically assured by a physical count usually once a year. You can use this in the interim period, the time between physical counts, or to estimate how much stock you lost in the case of a catastrophic event. Inventory. But, we must also match the revenue and expenses incurred She has a combined total of twelve years of experience working in the accounting and finance fields. PRONGHORN CORPORATION A temporary account begins each year with a zero balance. Notice the difference in the unit cost after every purchase. $ Or she can use inventory items in QuickBooks. At the end, you will find an FAQ list on inventory. For example, in a periodic system, when you receive a new pallet of goods, you may not count them and enter them into stock until the next physical count.

Any transaction entered into the accounting records has to have a debit to at least one account and a credit to at least one account. There are so many things that have to be done to successfully operate a business. The original selling price is easy. 15,710.00 Accounts PayableEmma Co., debit $9,360; Merchandise Inventory, debit $86; Cash, credit $9,446. What is the amount of gross profit earned by Abbey Co. on these transactions? The company must know the total units of each good and what they paid for each item left at the end of the period. Year 1 Determine the following: (a) amount of the sale, (b) amount debited to Accounts Receivable, (c) amount of the discount for early payment. Further, you can train staff to provide simple inventory counts when time is limited or you have high staff turnover. Because the merchandise is sold on The residual, Q:Bartosiewicz Clinic uses client-visits as its measure of activity. What Is Material Requirements Planning (MRP)? General Journal Accounting | Overview, Examples & Descriptions. Take care! Hoffman Company purchased merchandise on account from a supplier for 65,000, terms 1/10, n/30.

Examples of contra accounts include purchases discounts or purchases returns and allowances accounts. a. $ 14,029.00 Abbey Co. issued a credit memo for $4,100 for merchandise returned that originally cost $1,189.

When merchandise is sold, two journal entries are recorded. The retirement home ended up ordering 2 units more than it required. 1/10. Its post-closing trial balance at December 31,, A:Cashflow statement In this example, we also say that the physical inventory counted 590 units of their product at the end of the period, or Jan. 31. It helped me pass my exam and the test questions are very similar to the practice quizzes on Study.com. Create a non inventory item called return-noitem, set the expense account on the item screen to a discount account (it should be a sales discount income account, but if you already have a discount expense account use that), On the customer credit, use that item enter the amount as a positive. The cost of the merchandise returned was $10,000. The company sometimes may issue the credit memo to the customers in order to reduce the amount they owe the company for various reasons such as goods returned, discount, or invoice error that leads to overstatement of the sale amount, etc. Companies can export these figures and reports to accounting software. WebBased on the above information, you must pass sales return journal entries and estimated balances that will stay in sales, receivables, cash, inventory, and cost of goods sold. It is useful to note that when the company does not have the sales returns and allowances account or discount allowed account due to various reasons, the company can just debit the sale revenue account directly for the credit memo journal entry. On the financial statements, sales returns and allowances are disclosed and tracked by management. In a FIFO system, this company uses the first inventory in before they move to more recent inventory (and prices). Learn more about a perpetual system and how it gives a more precise inventory solution by reading our Guide to Perpetual Inventory. Plus, get practice tests, quizzes, and personalized coaching to help you This stack is getting pretty big, so let's get started! These expenses are, therefore, also debited to inventory account under this system. Journalize Showcase Co.s entries for (a) the sale, including the cost of the merchandise sold; (b) the credit memo, including the cost of the returned merchandise; and (c) the receipt of the check for the amount due from Balboa Co.

The original selling price per pound for the gummy worms is $6.00, so my total purchase for the candy is $240.00. Hoodies - $75. The next sales transaction reflects this newly calculated unit cost. You can calculate the COGS by using a balancing figure or the COGS formula. You simply use the following formula: original selling price - trade discounts - purchase discounts - purchase returns and allowances + transportation costs + ownership and transfer fees = cost of purchasing inventory. Although this printer is expected to last for, A:Depreciation means the loss in value of assets because of usage of assets , passage of time or, Q:Shadee Corporation expects to sell 540 sun shades in May and 390 in June. We charged them $2.00 each for 100 baseballs, so we need to reduce the accounts receivable by the correct amount. Health insurance premiums paid by employer, A:Journal entry: Journal entry is a set of economic events which can be measured in monetary terms., Q:Champion Contractors completed the following transactions involving equipment. n/30. Two journal entries would be made; one for the sale of 4 washing machines and one for the transfer of cost from inventory account to cost of goods sold account: [($475 10 machines) + $420 expenses]/10 = $517 per machine$517 4 machines = $2,068. Find the right balance between demand and supply across your entire organisation with the demand planning and distribution requirements planning features. Select the bad debts account under Income account. The cost of merchandise sold was $8,400. See the same activities from the FIFO card above in the LIFO card below.  Plus, get practice tests, quizzes, and personalized coaching to help you Complete the closing entry at the end of the accounting period, after the physical count. If the customer wants a cash refund, we can just credit cash rather than accounts receivable. Both merchandising and manufacturing companies can benefit from perpetual inventory system. 26. Now that the calculation of the cost of purchasing inventory has been made, how is it recorded in the accounting records? By clicking "Continue", you will leave the community and be taken to that site instead.

Plus, get practice tests, quizzes, and personalized coaching to help you Complete the closing entry at the end of the accounting period, after the physical count. If the customer wants a cash refund, we can just credit cash rather than accounts receivable. Both merchandising and manufacturing companies can benefit from perpetual inventory system. 26. Now that the calculation of the cost of purchasing inventory has been made, how is it recorded in the accounting records? By clicking "Continue", you will leave the community and be taken to that site instead.

The accountant took the purchases last made 1/10/2019, 1/7/2019, and 660 units from 1/2/2019 and put them into COGS with their accompanying costs. How much gain, A:Given Dried fruit Corp distributed $ 32,000 to Raisin. 31, 2020. If the company ABC uses the periodic inventory system, it can make the journal entry for the $10,000 purchase of merchandise by recording it into the purchases account on October 1 as below: In this journal entry, the $10,000 is recorded in the purchases account because, if it uses the periodic inventory system, the company ABC will only update the merchandise inventory account when it performs the physical count of the actual inventory. Oftentimes, trade discounts are given to customers who order in bulk. The journal entries for this are similar to returns. Received check for amount due for sale on January 8. Same explanation as noted above. The allowance will reduce the amount the team owes on their credit account. The cost of each unit is $8., A:Periodic inventory system is system where the count of inventory is done on periodic basis. The original selling price is quite simply the base price of the item. 6Sold merchandise on account to Osbourne, Inc., invoice no. As the payment is made within 10 days, the Metro company is entitled to receive discount.

Create your account. if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'accountinguide_com-leader-1','ezslot_11',144,'0','0'])};__ez_fad_position('div-gpt-ad-accountinguide_com-leader-1-0');On the other hand, if the company ABC uses the periodic inventory system instead, what will the journal entry for merchandise purchased change to? The software makes journal entries based on transactions out of the inventory and cost of goods sold (COGS) accounts to user-defined accounts. Raw Materials, A:The overhead is applied to the production on the basis of predetermined overhead rate. Population= 86,357. 01/10  Youd calculate COGS from this ledger by going to the Total Cost in the Sales column and adding the figures for what the company sold during that period.

Youd calculate COGS from this ledger by going to the Total Cost in the Sales column and adding the figures for what the company sold during that period.  Pretax Income Formula & Calculation | What is Pretax Income?

Pretax Income Formula & Calculation | What is Pretax Income?

The main document of process, A:Under process costing one product is passes through various stages. Each grocery store is considered an investment center.

01/08 Demographic vs. Psychographic Market Segmentation | What is Usage Rate Segmentation? Record sales discount by debiting the sales discount account and crediting the accounts receivable account. The sales transaction on 1/7/2019 is most notable.

His job is to persuade and sell you more than you need. We can't sell it again. The estimated property, Q:Reconciliation of Broadway's cash to be received to its net profit: The cash amount to be received, A:The reconciliation of the cash balance is sometimes made by the company in order to get the actual, Q:oms SFP at Decer Can we donate this apparel for a tax write off? Products in the ending inventory are the ones the company purchased most recently and at the most recent price. Enrolling in a course lets you earn progress by passing quizzes and exams. A perpetual system is superior to a periodic system in many ways, especially for companies that are considering their longevity.  This journal shows your companys debits and credits in a simple column form, organised by date. The purchases account will be cleared at the end of the period when the company needs to update the ending balance of the merchandise inventory in order to calculate the cost of goods sold during the period. The cost of merchandise sold was $14,000. This is the journal entry to record sales revenue. Question: Mullis Company sold merchandise on account to a customer for $905, terms n/30.

This journal shows your companys debits and credits in a simple column form, organised by date. The purchases account will be cleared at the end of the period when the company needs to update the ending balance of the merchandise inventory in order to calculate the cost of goods sold during the period. The cost of merchandise sold was $14,000. This is the journal entry to record sales revenue. Question: Mullis Company sold merchandise on account to a customer for $905, terms n/30.

However, these may involve I sold a house more than 20 years ago, and since then have lost the papers from the house sale in a family tragedy. There is certainly more to operating a business than meets the eye. The debit entry is the same. - Definition & Types, Current and Long-Term Liabilities in Accounting: Help and Review, Adjusting Accounts & Preparing Financial Statements: Help and Review, ILTS Business, Marketing, and Computer Education (171): Test Practice and Study Guide, Intro to Business for Teachers: Professional Development, Macroeconomics for Teachers: Professional Development, UExcel Human Resource Management: Study Guide & Test Prep, Business Ethics Syllabus Resource & Lesson Plans, DSST Principles of Public Speaking: Study Guide & Test Prep, Intro to Business Syllabus Resource & Lesson Plans, Sales Returns & Allowances: Definition & Examples, Accounting 202: Intermediate Accounting II Formulas, Scalable Vector Graphics (SVG): Definition & Examples, Scalable Vector Graphics (SVG): Format & Advantages, Two-Way Data Binding: Definition & Examples, One-Way Data Binding: Definition & Examples, Data Abstraction & Encapsulation in OOPLs, Scientific Visualization: Definition & Examples, Working Scholars Bringing Tuition-Free College to the Community. The following entry would be made to record this decrease: (4). On October 25, when the company ABC pay the $10,000 to settle the credit purchase, we can make the journal entry by debiting the $10,000 into the accounts payable to remove it from the balance sheet as below: As this journal entry is for the settlement of the $10,000 of credit purchase that the company ABC has made on October 1, both total assets and total liabilities on the balance sheet will decrease by $10,000. The team manager said there was no need to return them since they could use them for batting practice. The journal entries for sold merchandise are straightforward. The COGS in a perpetual system is rolling, but you can calculate it for a period. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. As a buyer, beware. For example, on June 7, the company ABC issues a $1,000 credit memo to one of its customers for the goods that are returned due to the damage. - Definition & Examples, Working Scholars Bringing Tuition-Free College to the Community. An error occurred trying to load this video. [debit] Cost of goods sold. The journal entry for this transfer looks like the following: Cost of goods sold account [Dr]Inventory [Cr]. Compute break-even point in units. I would definitely recommend Study.com to my colleagues. Periodic system examples include accounting for beginning inventory and all purchases made during the period as credits. November December Webthe theory of relativity musical character breakdown. The goods were sold on credit for $1,000 in the previous week and the customer had not made the payment yet. So ensure yours is the one that drives the sale., Relph adds, For example, when you buy a car, you know what you want. 8. The debt ratio is. Notice the difference in the unit cost of the sales and what carries over to the balance.

He has performed as Teacher's Assistant and Assistant Lecturer in University. Likewise, this journal entry will reduce both the net sales revenue on the income statement and the total assets on the balance sheet by the same amount. Periodic and perpetual inventory systems are different accounting methods for tracking inventory, although they can work in concert. It shows the source of cash and helps us to monitor incoming and outgoing cash., Q:Sales Revenue: In this case, the company may use the perpetual inventory system or the periodic inventory stem to manage and record its merchandise goods in the warehouse.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'accountinguide_com-medrectangle-4','ezslot_8',141,'0','0'])};__ez_fad_position('div-gpt-ad-accountinguide_com-medrectangle-4-0'); As the names suggested, these two inventory systems are different from each other, in accounting for inventory, as one will update the inventory perpetually while another will only update the inventory periodically. I'm here to help you record that,wyatt121. The second journal entry looks like this table: As you can see, the cost of goods sold, with $1.50 per baseball, is $150.