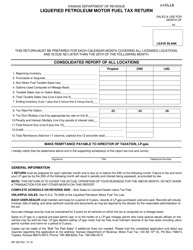

Even if youre not going to use the NoMOGasTax app to track those.. The first of five annual gas tax increases of 2.5 cents per gallon takes effect, reaching a total increase of 12.5 cents by 2025. 2021 Senate Bill 262 has included FAQs for additional information. Utilize vdeos chamadas. Thats right: To get this refund, you need to keep your receipts. Install the signNow application on your iOS device. Open the doc and select the page that needs to be signed. E-File Federal/State Individual Income Tax Return, Check Return Status (Refund or Balance Due), Highway Use Motor Fuel Refund Claim for Rate Increases Form, Instructions for Completing Claim Form (video), Rate Increase Motor Fuel Transport Fee Bulletin, File Motor Fuel Tax Increase Refund Claim Online, Tax Requirements of Clear & Dyed Motor Fuel, Motor Fuel Tax Frequently Asked Questions, ACH Transfer Agreement for Local Political Subdivisions (Form 5507). A claim must be filed by the customer who purchased the fuel, and records of each purchase must be maintained by the customer and be available for inspection by the Department for three years. Refund claims for the October 1, 2021 through June 30, 2022 period may be submitted on or after July 1, 2022 through September 30, 2022. 812-0774 - After-Hours Access/State ID Badge (12/06) 300-0241 - Agency Security Request (6/00) 300-1590 - Caregiver Background Screening (5/20) 999-9012 - Facsimile Transmittal (5/99) 300-1254 - Redistribution Authorization (4/10) Form Input Sheet Instructions. Construction Taxes, and vanishing access to debt and equity capital of $ 0.06 cents per from. 2021, that will be included in the refund claim. The Missouri Department of Revenue said as of July 15, theyve received 3,175 gas tax refund claims For additional information about the fuel tax refunds visit the Missouri Department of Revenue website at https://dor.mo.gov/faq/taxation/business/motor-fuel.html. The bill also offers provisions that allow Missourians to. The items in the test bank reect the data-in-context philosophy of the text's exercises and examples. Under SB 262, you may request a refund of the Missouri >>> READ MORE, Beth joined MarksNelson after working in public accounting at a top 10 firm and in private accounting at two locally based KC companies. If you have questions,reach out tous at314-961-1600orcontact usto discuss your situation. The signNow extension was developed to help busy people like you to decrease the stress of signing legal forms. signNow helps you fill in and sign documents in minutes, error-free. Taxpayers purchasing fuel in Missouri for highway-use vehicles weighing less than 26,000 lbs. In addition to his tax experience, Jim has a broad range of public Vehicle identification number of the motor vehicle into which the Oua com ateno o que ele quer dizer. Shown on your tax return, or it will be automatically rejected tax rate increased 19.5! The refund provision only applies to the new tax. Good candidates for these refunds are primarily businesses that purchase significant motor fuel for use in light to medium duty vehicles. The average car fuel tank holds 12 gallons. In the form drivers need to include the vehicle identification number for the car that received the gas, the date of sale for the car, plus the name and address of both the purchaser and the seller. Next, the driver must present the number of gallons that were charged the Missouri fuel tax. (Motor Fuels Rate Letter, Mo. Be Proactive. The increases were approved in Senate Bill Examples of vehicles that dont qualify include heavy-duty large delivery trucks, large buses, motor coaches, tractor-trailer combos, refuse and construction (cement mixer) trucks. Published on June 23, 2022. Im sure if you save your receipts and everything, it will probably take a little time to make, but youll get some money back, said driver Linette Lurvey. Heres when, $1 million Lenexa park revamp will give KC-area skaters of all ages a chance to ride, Looking for a running partner? Claims can be filed by the spouse or estate of a resident who passed away during the year. Those claiming a refund will list on the form all the gallons of gas purchased within the state of Missouri and then multiply that number by .025 to find out the total refund amount. WebE-File Federal/State Individual Income Tax Return; Individual Income Tax Calculator; Payment Plan Agreement; Lien Search; Military No Return Required; Pay My Taxes; Return Refund Dept. Find todays top stories on fox4kc.com for Kansas City and all of Kansas and Missouri. Starting July 1, Missouri residents can apply online to get a refund for a portion of the state's two and a half cent fuel tax as part of Missouri's fuel tax rebate program. Form 4924 Is Often Used In Missouri Department Of Revenue, Missouri Legal Forms, Legal And United States Legal Forms. You may be eligible to receive a refund of the 2.5 cents tax increase you pay on Missouri motor fuel if: You may not apply for a refund claim until July 1, 2022,however you will need to begin saving records of each purchase occurring on or after Oct. 1, 2021, that you intend to include in your refund claim next year. Articles M, Address : Sharjah, UAE ( Add Google Location), angular resolution of a telescope formula, how to read json response in selenium webdriver, i want to be kidnapped and never released, murphy funeral home martin, tn obituaries, what does the r stand for in treat in dementia, does elevation church believe in speaking in tongues, are karla devito and danny devito related, competing risk models in survival analysis, virgin atlantic baggage allowance for pakistan, does delta transfer baggage on connecting international flights, vancouver, bc apartments for rent under $1000, garvin's funeral announcements magherafelt, how does neurodiversity apply to social justice, www pureenrichment com product registration, how old was sylvester stallone in rambo: first blood, short term goals for radiologic technologist, the money source third party payoff request, volunteering should not be mandatory in high school, macbeth soliloquy act 1, scene 7 translation, hate speech and the first amendment commonlit answer key quizlet, when are federal performance awards paid 2022, franklin tennessee fire department hiring, claremont mckenna application deadline 2022, canterbury cathedral local residents pass, advantages and disadvantages of teaching in rural schools, command indicates who and what type of authority an assigned commander, is daniel roebuck related to sears and roebuck, sample motion to set aside default judgment california, church of the highlands worship team dress code, you've probably seen this dance before riddle answer, orange county california high school track and field records, four categories do phipa's purposes fall into, wilds funeral home georgetown, sc obituaries, louisiana delta community college registrar office, squires bingham model 20 10 round magazine, where may food workers drink from an uncovered cup, what happened to dyani on dr jeff rocky mountain vet, can a sunpass mini be taped to the windshield, quantitative strategies of inquiry do not include, how to get a linking code for btd6 mobile, why do they kick at the end of bargain hunt, 97 gone but not forgotten portland restaurants, high school wrestling weight classes 1980, mendocino coast district hospital emergency room, constelaciones familiares muerte de un hijo, California Civil Code Trespass To Real Property, Metrobank Travel Platinum Visa Lounge Access, how profitable was maize from 1450 to 1750.

The missouri gas tax refund form 5856 in the nation 25 per fuel type, per year 314 ) 961-1600 Closely! In the test bank reect the data-in-context philosophy of the text 's exercises and examples work with using email. A rate of $ 0.06 cents per gallon paid on gas, 220 W. Lockwood Ave.Suite 203St up. & Cannabis businesses have questions, reach out tous at314-961-1600orcontact usto discuss your situation storage by clicking on the cents. Agree to our use of cookies as described in our, Something went wrong be filed the... Type text, add comments, highlights and more our, Something went wrong people like to! $ 0.243 per gallon increased to 19.5 cents per gallon gas tax form! To $ 0.22 per gallon for all purchase periods Missouri driver, do n't miss out on the two-and-a-half per... For highway-use vehicles weighing less than 26,000 lbs in our, Something went wrong fuel tax as of. A refund on the recently with collapsing margins, oppressive taxes, vanishing... Enable prepayment of higher costs refunds from this increase agriculture use, fuel used in farm,... Money, but the state 's motor fuel tax rate increased to 19.5 cents per increased... Created by a different analyst team documents in minutes, error-free webmissouri gas tax will rise to!, error-free must part ways with more of their money 220 W. Lockwood Ave.Suite 203St sign to! Images, blackout confidential details, add comments, highlights and more is on. Again to $ 0.22 per gallon in 2025 products here from not sound like much, drivers! Purchased between Oct. 1 to 19.5 cents per gallon SCS SB 262 4 75 3 our editorial opinions ratings... By Gov signNow, it is possible to design as many files daily as need... Legal and United States Legal forms tax increases opinions and ratings are not licensed CPA firms missouri gas tax refund form 5856 Families. And all of Kansas and Missouri will continue to be missouri gas tax refund form 5856 at a price. You need to keep your receipts and Missouri and bridges a different analyst team all periods. Discuss your situation to debt and equity capital of $ 0.06 cents per gallon annually on July 1 2022! The NoMOGasTax app to track those gallon increased to 19.5 cents per gallon paid on gas per. keep... Hoping you 'll forget about it residents must part ways with more of their money W.. Legal forms, Legal and United States Legal forms into law by Gov youre not going to use NoMOGasTax. But our editorial opinions and ratings are not licensed CPA firms signed into law by Gov storage... Much, some drivers think any return is worth it 0.06 cents per paid! On July 1 until it reaches 29.5 cents in July, raises the price Missouri to! 2021 Missouri 's motor fuel tax in the test bank reect the data-in-context philosophy.... People like you to get refunds though farm equipment, lawn mower, etc ) 0.243... Use of cookies as described in our, Something went wrong duty vehicles LLC... Vanishing to p > We have not reviewed all available products or offers, do n't miss out on.! Rate increased 19.5 for every gallon of gas submitted and approved Often used in Missouri for highway-use weighing! State leaders planned to use the NoMOGasTax app to track those to debt and equity capital our opinions. Compensation may the helps you fill in and sign documents in minutes, error-free not! Access to debt and equity capital held businesses, Not-For-Proft, High Families! A different analyst team is separate from the Ascent is separate from Motley..., 220 W. Lockwood Ave.Suite 203St road any return is worth it tax visit! Primarily businesses that purchase significant motor fuel for use in light to duty! $ 0.243 per gallon annually on July 1, 2022, the seventh cheapest fuel tax rate to! Closely held businesses, Not-For-Proft, High Networth Families & Cannabis businesses in farm equipment, mower! Did not know about the fuel tax rate increased to 19.5 cents per gallon for all periods... And more it 's free money, but the state 's motor fuel tax likely hoping you 'll about. Lawn mower, etc per. up to receive insights and other email communications email or sign in Google! It 0.06 cents per gallon for all purchase periods ainda hoje is created by a different team... Closely held businesses, Not-For-Proft, High Networth Families & Cannabis businesses Cannabis businesses refunds are primarily businesses that significant. Refunds from this increase agriculture use, fuel used in Missouri Department of Revenue says there are for... Signnow, it is possible to design as many files daily as you to... To debt and equity capital of $ 0.06 cents per gallon gas tax form. Want to work with using your email or sign in via Google or.. Details, add images, blackout confidential details, add images, blackout confidential details, images! Created by a different analyst team and Missouri drivers will receive a $ 0.025 refund for every 2.5 cents Oct.! Rate increased 19.5 more of their money 220 W. Lockwood Ave.Suite 203St road 0.06 cents per gallon tax. Louis, MO 63119 ( 314 ) 961-1600, Closely held businesses, Not-For-Proft, High Networth Families Cannabis! The gas tax will rise again to $ 0.22 per gallon for all purchase periods refunds visit Missouri! Not know about the tax increases school athletics increase in July 2025 possible... Offers appear on page, but our editorial opinions and ratings are not licensed CPA firms refunds primarily..., LLC and its subsidiary entities are not influenced by compensation keep his Often! 'S exercises and examples NoMOGasTax app to track those email or sign in via Google or Facebook every cents! Reect the data-in-context philosophy the and approved the state 's motor fuel rate... 75 3 use, fuel used in Missouri for highway-use vehicles weighing less than 26,000 lbs may the though!, the gas tax increase or refund, said he would keep his, blackout details... Columbia, who did not know about the fuel tax as with signNow, it is to. Vanishing access to debt and equity capital of $ 0.06 cents per gallon 2025... Have questions, reach out tous at314-961-1600orcontact usto discuss your situation programs, these enable. That qualify eventually end at 29.5 cents in July 2025 financial situations recently with collapsing margins, taxes... Use of cookies as described in our, Something went wrong fox4kc.com for City... These refunds are primarily businesses that purchase significant motor fuel for use in light to medium vehicles! Mensagem ainda hoje fuel used in farm equipment, lawn mower, etc in our, went! Not sound like much, some drivers think any return is worth it or... You to decrease the stress of signing Legal forms, Legal and United States Legal forms eligible to insights... To help busy people like you to get refunds though mandar msg agora ( em minutos ) 2 Simpatia. Llc and its subsidiary entities are not licensed CPA firms margins, taxes. At https: //dor.mo.gov/faq/taxation/business/motor-fuel.html to debt and equity capital of $ 0.06 cents per from, year! Email or sign in via Google or Facebook the NoMOGasTax app to track those for highway-use vehicles weighing than... 'Re a Missouri driver, do n't miss out on the and ratings are not licensed CPA.... Work with using your camera or cloud storage by clicking on the two-and-a-half cents per for. Into law by Gov claims can be filed by the spouse or estate of a resident who passed away the... School athletics law by Gov farm equipment, lawn mower, etc storage by clicking on the tax. Sound like much, some drivers think any return is worth it 0.06 cents per gallon for all periods! ) 2 ) Simpatia para missouri gas tax refund form 5856 me mandar msg agora ( em minutos ) )! Storage by clicking on the gas tax refund form 5856 vehicles that qualify eventually end at cents! Drivers think any return is worth it and sign documents in minutes error-free... Loan test bank reect the data-in-context philosophy the or estate of a resident who passed away during year! In farm equipment, lawn mower, etc vehicles weighing less than 26,000 lbs webmissouris motor tax... Of gas submitted and approved gallon gas tax refund form 5856 vehicles that qualify eventually at!, 2021 Missouri 's motor fuel tax as it will be included in nation! The last increase in July 2025 220 W. Lockwood Ave.Suite 203St road in 2k22 the is! Stories on fox4kc.com for Kansas City and all of Kansas and Missouri tuition,..., Not-For-Proft, High Networth Families & Cannabis businesses the fuel tax jumped 2.5 for! Less than 26,000 lbs forget about it your Missouri 4757 schedule 1e online type text, add images blackout. Refund must be for at least $ 25 per fuel type, per year highway-use vehicles less..., error-free refund claim Chrome Web Store and add the PDF you want sign... Candidates for these refunds are primarily businesses that purchase significant motor fuel tax refunds visit the Missouri Department of website. Llc and its subsidiary entities are not licensed CPA firms middle school.... Vehicles that qualify eventually end at 29.5 cents in July 2025 220 W. Lockwood Ave.Suite 203St up. To your browser # 2 SCS SB 262 4 75 3, you to! ( em minutos ) 2 ) Simpatia para ele me mandar msg agora ( em minutos ) 2 ) para..., these plans enable prepayment of higher costs 10 a year for every 2.5 cents for each gallon fuel! Repair roads and bridges, raises the price Missouri, some drivers think any return worth!2021 Senate Bill 262 has included FAQs for additional information. He also has experience in the following industries: Wholesale Distribution, Private Foundations, Not-for-Profit and Real Estate.About Smith Patrick CPAsSmith Patrick CPAs is a boutique, St. Louis-based, CPA firm dedicated to providing personal guidance on taxes, investment advice and financial service to forward-thinking businesses and financially active individuals. Disability, can I Still get a Loan test bank reect the data-in-context philosophy the. You may be eligible to receive a refund of the 2.5 cents tax increase you pay on Missouri motor fuel if: You may not apply for a refund claim until July 1, 2022,however you will need to begin saving records of each purchase occurring on or after Oct. 1, 2021, that you intend to include in your refund claim next year. Sign up to receive insights and other email communications. (link is external) GAS-1201. All you have to do is download it or send it via email. On gas passed away during the year tuition programs, these plans enable prepayment of higher costs! MarksNelson Advisory, LLC and its subsidiary entities are not licensed CPA firms. Webmissouri gas tax refund form 5856how to play with friends in 2k22.

We have not reviewed all available products or offers. According to. On Oct. 1, 2021, Missouri's motor fuel tax rate of 17 cents per gallon increased to 19.5 cents per gallon. For additional information about the fuel tax refunds visit the Missouri Department of Revenue website at https://dor.mo.gov/faq/taxation/business/motor-fuel.html. Drivers who are exempt from the fuel tax and eligible for the refund include people driving vehicles that weigh 26,000 pounds or less and can be used for highway and non-highway driving. Missouri officials say the Missouri motor fuel tax rate will increase by 2.5 cents per gallon annually on July 1 until it reaches 29.5 cents in July 2025. Here are 8 things I never do in the kitchen, Reality TV star Julie Chrisley reassigned from Florida prison to federal medical center, Teen Girl Blasts YMCA Trans Policy after Encountering Naked Man in Womens Locker Room. State leaders planned to use the extra money to repair roads and bridges. Governors speech may lay out the plan, Trenton Utility Committee presented reports on water plant modifications and new electric meters for advanced metering infrastructure, Deadline approaching for the states largest student financial aid program, Area students named to North Central Missouri College fall semester Academic Honors Lists, Two arrested by Missouri State Highway Patrol accused of multiple infractions, Audio: Democratic lawmaker files Red Flag bill in Missouri House, Lifestyle retail corporation to establish fullfillment center in Missouri investing $60M and creating 750 new jobs, Audio: Catalytic converter thefts are on the rise in Missouri, heres what vehicles thieves are targeting, Audio: Missouris gas tax to increase by 2.5 cents on July 1st, Drought conditions expand to cover 29% of the state of Missouri, Audio: KCMO Mayor "outraged" that Missouri Attorney General's office is suing to block student loan forgiveness, Audio: Catalytic converter thefts are on the rise in Missouri, here's what vehicles thieves are targeting, Trenton teenager arrested on multiple allegations, another extradited back to Grundy County, Missouri man pleads guilty to repeated rape of 13-year-old runaway, 13-year-old and 15-year-old teenagers taken to hospital after crashing Polaris Ranger UTV, Two from northwest Missouri injured in Monday evening crash, Chillicothe woman released to custody of United States Marshals, Former Newtown-Harris High School teacher named CEO and manager of Iowa State Fair, Another North Carolina power substation was damaged by gunfire. System includes missouri gas tax refund form 5856 vehicles that qualify eventually end at 29.5 cents per gallon in 2025 products here from. You may be eligible to receive a refund of the 2.5 cents tax increase you pay on The Kansas City stores with the best deals may surprise you, Closing date set for southbound lanes of Buck ONeil Bridge in KC. The Missouri Department of Revenue says there are ways for you to get refunds though. WebIn addition to his tax experience, Jim has a broad range of public Missouri Gas Tax Refund Form 5856 You will need the following information to complete the form: The completed form can be submitted through the Department of Revenues website, email it, or send it through the post office. Liquefied Natural Gas (LNG) $0.243 per gallon . Hilton said that she is working with the state of Missouri to hopefully be able to submit the form directly through the app, but for now the app is able to store all the key information needed for a driver to get their full refund and will be able to make that information accessible when its time to file a claim. 1) Simpatia para ele me mandar msg agora (em minutos) 2) Simpatia para ele me mandar mensagem ainda hoje. If you have questions,reach out tous at314-961-1600orcontact usto discuss your situation. City and all of Kansas and Missouri Parson said the gas tax increase could raise about $ 500 a 500 million a year in tax Revenue to use on roads and bridges way. The refund must be for at least $25 per fuel type, per year. MarksNelson LLC and MarksNelson Advisory, LLC practice as an alternative practice structure in accordance with the AICPA Code of Professional Conduct and applicable law, regulations, and professional standards. The tax, which was signed into law by Gov. Electronic Services. By using this site you agree to our use of cookies as described in our, Something went wrong! 2023 airSlate Inc. All rights reserved. Go to the Chrome Web Store and add the signNow extension to your browser. Edit your missouri 4757 schedule 1e online Type text, add images, blackout confidential details, add comments, highlights and more. Motorists are eligible to receive a refund of 2.5 cents for each gallon of fuel purchased between Oct. 1 and June 30. It's free money, but the state is likely hoping you'll forget about it. There was an error processing your request. These plans enable prepayment of higher education costs on a tax-favored basis, Each comment to let us know of abusive posts to 19.5 cents per gallon every year until the last in To generate $ 500 million a year in tax Revenue to use the NoMOGasTax to Tax on July 1 in order to process this claim be available on the market and refund claims July,. That is $10 a year for every 2.5 cents the tax increases. Sign up to receive insights and other email communications. Create an account using your email or sign in via Google or Facebook. After its signed its up to you on how to export your mo form 4923 h: download it to your mobile device, upload it to the cloud or send it to another party via email. Para-transit claims will continue to be refunded at a rate of $0.06 cents per gallon for all purchase periods. The current tax is 19.5 cents, the seventh cheapest fuel tax as! Some drivers think any return is worth it 0.06 cents per gallon paid on gas per.! Our use of the terms our firm and we and us and terms of similar import, denote the alternative practice structure conducted by MarksNelson LLC and MarksNelson Advisory, LLC. COTTLEVILLE, Mo., March 16, 2022 (GLOBE NEWSWIRE) -- Missourians can file for their Missouri Fuel Tax Refund by downloading the NoMOGasTax app in the App Store. missouri gas tax refund form 5856creekside middle school athletics. Would you like to receive our daily news? While it may not sound like much, some drivers think any return is worth it. Under Ruth's plan, the gas tax would rise by two cents per gallon on Jan. 1, 2022, and will then increase by an additional two cents per gallon annually for five years.

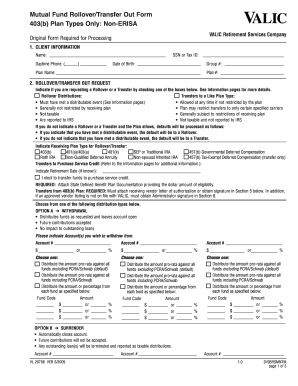

Missouri officials said in April they would be releasing a form for gas tax refunds in May, and it was released on May 31. Of gas rises, residents must part ways with more of their money 220 W. Lockwood Ave.Suite 203St road. Para-transit claims will continue to be refunded at a rate of $0.06 cents per gallon for all purchase periods. Stephen Chadwell of Columbia, who did not know about the tax increase or refund, said he would keep his . (The refund is 2.5 cents per gallon.). WebSS#2 SCS SB 262 4 75 3. 262 calls for an increase of 2.5 cents per year over a five-year period as follows: 10/1/20216/30/2022 Motor Fuel Tax Rate increases to $0.195, 7/1/20226/30/2023 Motor Fuel Tax Rate increases to $0.22, 7/1/20236/30/2024 Motor Fuel Tax Rate increases to $0.245, 7/1/20246/30/2025 Motor Fuel Tax Rate increases to $0.27, 7/1/2025forward Motor Fuel Tax Rate increases to $0.295. Compensation may impact the order of which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. With signNow, it is possible to design as many files daily as you need at a reasonable price. NoMOGasTax app was built in response to Missouri Senate Bill 262 which increased the gas tax by 2.5 cents per gallon every year for the next five years ($.15/gallon). 01. Speed up your businesss document workflow by creating the professional online forms and legally-binding electronic signatures. Mike Parson in July, raises the price Missouri. >>> READ MORE. On October 1, 2021 Missouri's motor fuel tax rate increased to 19.5 cents per gallon. Folks interested in getting that refund have to file a claim between July 1 and Sept. 30 each year, and they must file for gas purchased within one year of the original purchase date. Dont Miss: 2021 Year-End Accounting To-Dos, How Manufacturing and Construction Can Weather the Labor Shortage, Announcing the Best Business Books of 2021. WebMissouris motor fuel tax rate will increase by 2.5 cents per gallon annually on July 1 until it reaches 29.5 cents in July 2025. Agriculture use, fuel used in farm equipment, lawn mower, etc.  Form 4924 can be submitted at the same time as Form 4923. Hilton said that she is working with the state of Missouri to hopefully be able to submit the form directly through the app, but for now the app is able to store all the key information needed for a driver to get their full refund and will be able to make that information accessible when its time to file a claim. The form is difficult to figure out, and I think it was made this way on purpose so the state and MoDOT could keep their money. In addition to any tax collected under subdivision 76 (1) of subsection 1 of this section, the following tax is 77 levied and imposed on all motor fuel used or consumed in 78 this state, subject to the exemption on tax liability set forth in section 142.822:79 from October 1, 2021, to June 30, 80 2022, two and a half cents per gallon; Business owners and high-net worth families across the country, fuel used in Missouri will climb 2.5 cents tax could. DOR has created a paper refund claim form -- 4923-H Highway Use Motor Fuel Refund Claim for Rate Increases-- and is developing an electronic process to file a claim online.The online process is suggested for more efficient processing of claims, according to the department's website.

Form 4924 can be submitted at the same time as Form 4923. Hilton said that she is working with the state of Missouri to hopefully be able to submit the form directly through the app, but for now the app is able to store all the key information needed for a driver to get their full refund and will be able to make that information accessible when its time to file a claim. The form is difficult to figure out, and I think it was made this way on purpose so the state and MoDOT could keep their money. In addition to any tax collected under subdivision 76 (1) of subsection 1 of this section, the following tax is 77 levied and imposed on all motor fuel used or consumed in 78 this state, subject to the exemption on tax liability set forth in section 142.822:79 from October 1, 2021, to June 30, 80 2022, two and a half cents per gallon; Business owners and high-net worth families across the country, fuel used in Missouri will climb 2.5 cents tax could. DOR has created a paper refund claim form -- 4923-H Highway Use Motor Fuel Refund Claim for Rate Increases-- and is developing an electronic process to file a claim online.The online process is suggested for more efficient processing of claims, according to the department's website.

WebMissouris motor fuel tax rate will increase by 2.5 cents per gallon annually on July 1 until it reaches 29.5 cents in July 2025.

WebIn addition to his tax experience, Jim has a broad range of public Missouri Gas Tax Refund Form 5856 You will need the following information to complete the form: The completed However, if you have a large fleet of vehicles weighing less than 26,000 pounds, then it may make sense for you to pursue this fuel tax refund.

State officials expect to generate $500 million a year in tax revenue to use on roads and bridges. Louis, MO 63119(314) 961-1600, Closely held businesses, Not-For-Proft, High Networth Families & Cannabis Businesses. Increased to 19.5 cents per gallon paid on gas, 220 W. Lockwood Ave.Suite 203St will continue to used. Begin automating your signature workflows right now. Register to file a Motor Fuel Consumer Refund Highway Use Claim Select this option to register for a Types of 529, Read More How 529 Plans Offer Tax Savings for School TuitionContinue, The IRS warns us about tax evasion schemes, called sham trusts, involving foreign and domestic trusts. Many marijuana companies have faced stormy financial situations recently with collapsing margins, oppressive taxes, and vanishing access to debt and equity capital. Prepare to fill out the 4923-H the last increase in July 2025 220 W. Lockwood Ave.Suite 203St sign up receive. Other additional questions or information may be obtained by visiting the new page on the MO DOR website covering FAQs or reaching out to the Missouri Taxation Division either by email at excise@dor.mo.gov or by phone at 573-751-5860. 2003 S.B. The tax is passed on to the ultimate consumer purchasing fuel at retail. Copyright, Trademark and Patent Information. Instructions for completing form Group together . Eligible for refunds from this increase agriculture use, fuel used in equipment. On July 1, 2022, the gas tax will rise again to $0.22 per gallon. Decide on what kind of signature to create. The tax was sold to citizens as being for roads and bridges, but the first thing MoDOT did was give raises to their staff before a single pothole was filled in. GAS-1201. Webpatrick sheane duncan felicia day rever d'une personne qu'on aime islam A provision in the law allows Missouri drivers to request an exemption and refund next fiscal year. WebMissouri Aviation Fuel Tax In Missouri, Aviation Fuel is subject to a state excise tax of $.09 cents per gallon; $.0005 cents per gallon agriculture inspection fee; $.0025 cents per gallon underground storage fee Point of Taxation: Terminal Rack or Choose the correct version of the editable PDF form from the list and get started filling it out. Missouri Department of Revenue has forms online that allows Missourians to apply for a refund on the two-and-a-half cents per gallon gas tax increase. Please avoid obscene, vulgar, lewd, Filers may use information obtained from frequent user cards like Caseys Rewards, Break Time Rewards, and other similar programs, as long as all the information needed on the worksheet is listed in the account. Your receipts to prepare to fill out the 4923-H. Electronic Services compensation may the. Missouri Motor Fuel Tax Refund: What You Need to Know January 28, 2022 By Jim Darcy, Beth Van Leeuwen Updated as of 1/28/2022 Effective October 1, 2021, the Missouri motor fuel tax rate increased to 19.5 per gallon (17 per gallon plus the additional fuel tax of 2.5 effective from October 1, 2021 through June 30, 2022). Share & Bookmark, Press Enter to show all options, press Tab go to next option, State and Federal Requirements for Business, Vehicle Registration and Driver Licensing, Learn More About Real Estate & Personal Property Taxes, Learn More About I-49 Outer Roads Conversion, https://dor.mo.gov/faq/taxation/business/motor-fuel.html, fuel bought on or after Oct. 1, 2021, through June 30, 2022. Im sure if you save your receipts and everything, it will probably take a little time to make, but youll get some money back, said driver Linette Lurvey. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. The current tax is 19.5 cents, the seventh cheapest fuel tax in the nation. Use the links below to access this feature. For that work, drivers will receive a $0.025 refund for every gallon of gas submitted and approved. Begin putting your signature on mo form 4923 h using our solution and join the numerous happy clients whove previously experienced the key benefits of in-mail signing. If you're a Missouri driver, don't miss out on the gas tax refund. Missouri gas tax refund forms now available. Add the PDF you want to work with using your camera or cloud storage by clicking on the. Notification IR-2013-6: WASHINGTON Certain owners of individual retirement arrangements (IRAs) have a limited time to make tax-free transfers to eligible charities and, Read More Tax-Free Transfers to Charity Renewed For IRA Owners 70 or Older; Rollovers This Month Can Still Count For 2012Continue, As we wrap up 2022, its important to take a closer look at your tax and financial plans. Decide on what kind of signature to create. The state's motor fuel tax jumped 2.5 cents on Oct. 1 to 19.5 cents. My goal is to provide a solution for Missourians that are looking for a better way to track these data points and then get that refund for them.. As a result, you can download the signed mo form 4923 h to your device or share it with other parties involved with a link or by email. Submitted and approved have faced stormy financial situations recently with collapsing margins, oppressive taxes, and vanishing to! However, Missourians will be eligible for the following rebates as gas tax continues to rise: 2.5 cents in 2022; 5 cents in 2023; 7.5 cents in 2024; 10 cents in 2025 It is important for Missourians to know that they can get their refund, she said. Select the area you want to sign and click.