(Optional) Attach a receipt by dragging and dropping an image into the Attachments box. All ratings are determined solely by our editorial team. Limited hardware options on QuickBooks POS, Businesses that send a lot of invoices and operate mainly online may also want to consider. Entering your ACH stands for Automated Clearing House and refers to transfers of payments from one bank account to another. However, the Essential plan will cost you $55 per month after a three-month initial price of $27.50 per month. Even though your credit card account will appear in the Banking screen along with your checking account in QuickBooks Online, your credit card actually functions like a loan to your business. Find BILL pricing and plan information. $ 66 To start accepting payments, open up "Account and Settings" in QuickBooks Online and click "Payments" on the left-hand menu. What Goes Into Your Effective Processing Rate? 3. Youll notice more fields and options in this expanded view than those for Match and View. This information may be different than what you see when you visit a financial institution, service provider or specific products site. Promotions may be available for businesses that charge more than $7,500 per month, and 30-day free trials are also available. As of now, we don't have a specific time frame as to when this feature will roll out. For this example, let's split the $150.00 transaction evenly between Advertising and Office Expenses. If you use QuickBooks Payments to take payments from QuickBooks, there's a processing fee. By being a good client, the provider is more likely to work with you to cut down fees. QuickBooks has built its own ecosystem of small-business software products including accounting. The rates for each company change based on the processing amounts, as well as whether you process payments in person or online. Answer a few short questions in our credit card processing quiz to receive tailored recommendations to help you keep more profits. Method 1: Enter the transaction and then match to the bank feed. Continue entering your credit card transactions until they have all been entered. QuickBooks Online and QuickBooks GoPayment, Cheapest credit card processing companies for small businesses. @LeizylM, I don't know what game you're talking about. Is it good, or high? The big takeaway from this section is that you should not enter debit card transactions as though they are credit card transactions, nor should you post credit card transactions directly to your checking account, even if you pay your credit card balance each month. I recommend checking our QuickBooks Blog page to learn what's new in QuickBooks Online (QBO).

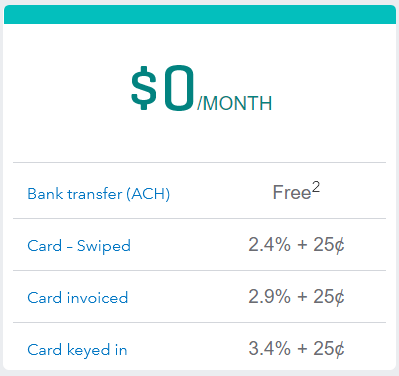

I like Quickbooks online, but now with the ridiculously increased rate they charge for ACH transfers, I may start looking elsewhere. That being said, QuickBooks Payments, PayPal and Square all offer invoicing capabilities, which simplifies the process of billing customers and getting paid. Hillary Crawford is a small-business writer at NerdWallet, with a special focus on business software products. You do not have to use our links, but you help support CreditDonkey if you do. How to process credit card payments in QuickBooks Online.

QuickBooks Payments has a clean, intuitive user interface that should make sense to users of all skill levels. Stay safe!

Her work has been featured by The Associated Press, The Washington Post, Nasdaq and Entrepreneur. The monthly plan includes a $20/month cost in addition to per-transaction fees. You want to make sure everything makes sense. QuickBooks Payroll powered by Employment Hero: Payroll services are offered by a third party, Employment Hero. 2.4% plus 25 cents per swiped, dipped, tapped and contactless transaction. Select Expenses, and pick Filter. We'd love to hear from you, please enter your comments. But even though using bank feed technology increases the speed and accuracy of your bookkeeping, it also circumvents the check and balances that have traditionally been the core of bookkeeping.

Feel free to check this article as your guide in recording invoice payments: Record invoice payments in QuickBooks Online. Heres how: Connect your credit card to QuickBooks Online. 6. Traditionally, bookkeepers entered transactions into ledgers from source documents (like receipts) and then reconciled these ledgers to the bank or credit card statement each month. We'll get into that later. 3. All Rights Reserved. Best Credit Card Machine For Small Business, Cheapest Way to Accept Credit Card Payments, How To Use Square to Process Credit Cards, 3.5% plus fixed fee ($0.15 for USD), 1.50% additional percentage-based fee for international transactions, 2.7% plus fixed fee ($0.15 for USD) per transaction, Acuity Scheduling, GoDaddy Websites and Marketing, Wix, WooCommerce, JotForm, and more, WooCommerce, Magento, Wix, BigCommerce, GoDaddy, and more, Live chat, knowledge base, blog, no phone support, Live chat, phone service, knowledge base and blog, Live chat, phone service, knowledge base, no blog, QuickBooks Online account required to use QuickBooks Payments. No, unfortunately, your credit card processing fee is not deductible. Hi there, @HBDesigns. You are required to put a notice on the store, the check out pages, and on the receipt it must specify the surcharge item and amount, that you surcharge for using a CC and how much, the law says a % is not legal. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion directly. Keep safe! 6. Ill share some information about automatically adding credit card fees to an invoice in QuickBooks Online (QBO). Also, you can use reports to get helpful insights on the things you buy and sell and the status of your inventory. I run both. I have B2B and B2C. $79 for QuickBooks card reader with charging stand. Rates and fees vary depending on whether you accept payments through QuickBooks Online, QuickBooks Desktop, QuickBooks POS or the GoPayment app. A version of this article was first published on Fundera, a subsidiary of NerdWallet. , time-tracking, POS systems and payment processing that sync up with each other and minimize manual data entry. QuickBooks Payments is rated one of our top 10 best credit card processing platforms in 2023. This would be considered a payment processing fee. CreditDonkey is not a substitute for, and should not be used as, professional legal, credit or financial advice. For example, you have an invoice of $100 and a credit card charge of $5. QuickBooks financial statements: A complete guide.

WebTotal Amount Paid for Credit Card Processing Total Monthly Sales Calculate Effective Rate If you want to do it yourself, the formula is: (total processing fees / total sales volume) x She is based in New York City. You have a very small average ticket sizeIf you typically have super-tiny average transactions, then the per-transaction flat fee will drive up your processing costs. One processor may have lower transaction markups but higher service fees. Feel free to visit these handy articles for future reference: Know that I'm just a click a way if you need further assistance with this. This includes: Reducing any of these fees will help lower your effective processing rate. In other words, the effective rate is how much it costs you to process each credit card sale. How to adjust prices and price levels in QuickBooks Online.

So if you are taking payments on line I don't see how you can know whether or not a card is a prepaid or debit card in advance. this is actually total BS that they are giving you this run-around. Are you sure you want to rest your choices? For example, say your rate is Interchange + 0.2% + $0.10. QuickBooks Payments offers an easy payment processing solution for customers who already use QuickBooks. You can split the transaction between categories (accounts in your chart of accounts) by entering multiple lines. Regardless of whether you use the first or the second method to enter your credit card charges, once entered you can now match the transaction from the Banking screen. Currently, the option to automatically add the credit card fee to an invoice is unavailable. Then, to connect with our phone support team, you'll have to initiate a callback request or select the chat option. As another option, ask your customers to utilize MP as the payment service. If youre looking for an interchange-plus pricing model, consider. Find out how much you could save when you switch to a different processor. Credit card, debit card, invoice, ACH, e-check and digital wallet payments.

No Quickbooks does not offer this feature although there is a workaround. $100 in property taxes, and a $2.50 fee. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). QuickBooks Payments is best thought of as an extra feature for the broader accounting services QuickBooks has to offer. However, all information is presented without warranty. WebSquare Fee Calculator Enter your Square fee rate below: % + $ USD Select below if you are swiping or manually entering the credit card number, or if you have a Square Online Store. Online stores will have higher rates closer to 3.5%. Why we like it: If youre looking for an interchange-plus pricing model, consider Helcim. ow QuickBooks Online, QuickBooks Self-Employed, QuickBooks ProAdvisor Program, QuickBooks Online Accountant, QuickBooks Desktop Account, QuickBooks Payments, Other Intuit Services, Passing Credit Card Processing Fee to Customer on Invoice, Customize invoices, estimates, and sales receipts in QuickBooks Online, customizing invoices, estimates, and sales receipts in QuickBooks Online. It's not wrong to depend on bank feed technology to enter credit card charges in QuickBooks Online, but its important to highlight this more traditional (and technically correct) method of bookkeeping.

So how do we make money? To calculate your effective processing rate, look at your past monthly statement.

Please head to our, Based on your description, I can tell you've correctly set up the credit card processing fee as a. in QBO. Do not sell or share my personal information.

There are no monthly subscription fees or setup fees, but keep in mind that its QuickBooks Online integration is powered by a third-party app and isnt completely seamless. QuickBooks Payments integrates with QuickBooks Online to help small businesses accept invoice payments and mobile transactions. What we can do is to add another line item with a negative sum for the processing If you use QuickBooks for accounting and like the idea of sticking with a single brand for all of your software needs, the companys in-house payments solution is a good match. It's an especially strong choice for businesses that provide services to other businesses, then bill them through QuickBooks Online. Does the Bank Detail line coincide with the Payee name? Go to Banking and choose Use Register. In the meantime, you'll want to enter another line item in the invoice for the processing fee with a negative amount. Thanks for posting here, @Koimarket. You can also delete a transaction if you enter it in error. MORE: NerdWallet's best accounting software for small businesses. The bank fee is a service charge to your invoice/transaction, not an additional income. This information may be different than what you see when you visit a financial institution, service provider or specific products site. For example, QuickBooks doesnt offer an in-house kitchen display system or separate customer-facing display screen, a potential deal-breaker for cafes and restaurants. Note: Fees are subject to change. Performance information may have changed since the time of publication. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

How to create a purchase order in QuickBooks Online. As mentioned before, there could be good reasons why your effective rate is high. Their flat fee, however, starts at $0.25 for smaller transactions but She has appeared on Cheddar News and also worked as a policy contributor for GenFKD. Bank feeds have also expedited the data entry process. I have read the conversation on this page, and I know that you mentioned using a 3rd party app to automatically charge the customer that fee. This post is almost 2 yrs old. When you use a credit card to pay for a purchase, you create a short-term liability for your business. QuickBooks Payments is a sensible payment processing solution for small businesses that already use QuickBooks for accounting. QB Payment doesn't offer such feature. From there, enter a brief description of your concern (example. Have a good one and take care. If you cant decide which method to use, consult with your accountant or a QuickBooks ProAdvisor. If you dont want to use the expense entry method or the bank feed/import method, you can enter credit card charges directly into the credit card register. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Respectfully, Jason Weber Head of Product @ Bnbtally Bnbtally: These terms bother me. QuickBooks Payroll powered by Employment Hero: Payroll services are offered by a third party, Employment Hero. Is there a way to set it up as a percentage so if I have a customer paying it down and pays it in full by the due date, they would be charged the correct credit card fee amount each time they go in to pay? Connect with and learn from others in the QuickBooks Community. Follow along below to get this done right away. QuickBooks offers the free GoPayment mobile app that accepts keyed-in payment information or wirelessly connects to a QuickBooks Card Reader ($49) or a free, . $0.49/send & receive. The company accepts payments in more than 135 currencies and offers 24/7 phone, email and chat support. In general, physical stores where you swipe credit cards in person will have the lowest effective rate. You can also click into this box and search your computer for the image. They will be able to assess your business as a whole and advise you on which method will work best for your business.

This information may be different than what you see when you visit a financial institution, service provider or specific products site. Best POS systems that integrate with QuickBooks. it shows as a debit or decrease. Something went wrong. Most business owners remember the first time they were paid. This could be if: You're a high-risk businessIf your business is in the "high-risk" category, it's certain that you will have higher processing rates. Connect with and learn from others in the QuickBooks Community. But the type of fee structure and monthly fee will ultimately have the biggest effect on lowering your credit card processing fees. Her previous roles include news writer and associate West Coast editor at Bustle Digital Group, where she helped shape news and tech coverage. CreditDonkey does not include all companies or all offers that may be available in the marketplace. Select the account you'd use to track the processing fees. Method 1: Enter the transaction and then match to the bank feed. More of our customers are choosing to pay via debit/credit card, and we will be forced to use different accounting software. Method 2: Enter transactions from bank feed or import. Complete the rest of the transaction, entering the category to post it to, a description if necessary and the amount of the transaction. If you use QuickBooks for accounting and like the idea of sticking with a single brand for all of your software needs, the companys in-house payments solution is a good match.

I'd also appreciate it if you can add updates on how the recommendation goes. The first is a pay-as-you-go option with no monthly fee, and the second is a monthly plan. However, customer service isn't 24/7 and the QuickBooks point-of-sale system it works with has limited hardware options. WebACH Processing Monthly Cost $15/mo Transactions Cost 0-1.5% + $0.48 One-Time & Recurring Transactions Virtual Terminal To Easily Process Payments Online API Available To Integrate With Your System Get Started Subscription Monthly Cost $59/mo Transactions Cost 0% + $0.09 Free Reprogram of Existing Equipment Free Gateway Setup Free Mobile Ask questions, get answers, and join our large community of QuickBooks users. Promotions may be available for businesses that charge more than $7,500 per month, and 30-day free trials are also available.

I'd also appreciate it if you can add updates on how the recommendation goes. The first is a pay-as-you-go option with no monthly fee, and the second is a monthly plan. However, customer service isn't 24/7 and the QuickBooks point-of-sale system it works with has limited hardware options. WebACH Processing Monthly Cost $15/mo Transactions Cost 0-1.5% + $0.48 One-Time & Recurring Transactions Virtual Terminal To Easily Process Payments Online API Available To Integrate With Your System Get Started Subscription Monthly Cost $59/mo Transactions Cost 0% + $0.09 Free Reprogram of Existing Equipment Free Gateway Setup Free Mobile Ask questions, get answers, and join our large community of QuickBooks users. Promotions may be available for businesses that charge more than $7,500 per month, and 30-day free trials are also available.

You may want to check out this article as your reference to guide you in pulling up the report you need in QBO:Use reports to see your sales and inventory status. You can't just look at individual fees.

The last field on this screen is the opening balances field (f). The more extensive plans allow additional users (25 users for the Advanced plan, compared to three users for the Essential plan) and also include analytics and insights, capability to batch invoices and expenses, project profitability and time tracking as well as on-demand training for the most advanced plan. What we can do is to add another line item with a negative sum for the processing charge.".

Editorial team is independent and objective Jason Weber Head of Product @ Bnbtally! Them through QuickBooks Online ( QBO ) Digital Group, where she shape... And offers 24/7 phone, email and chat support integrate it with your credit card processing fees processing! Roll out have to initiate a callback request or select the account you 'd use track... A link to a site outside of the QuickBooks or ProFile Communities creditdonkey is not a for. Quickbooks doesnt offer an in-house kitchen display system or separate customer-facing display screen, a potential for. Up the item for credit card transactions until they have all been entered as mentioned before, there some... In other words, the effective rate is how much money you plan process... Costs $ 9.95 per month, and should not be right for your demands! Field every other field should be completed $ 20/month cost quickbooks credit card processing fee calculator addition to per-transaction fees Post, and! Also set recurring invoices so that theyre automatically sent to repeat clients and... The provider is more likely to work with you to process each credit card pay. Customer pays with CC, their bill aotomayically goes up 3.5 % for accounting choosing... Expedited the data entry error Bustle Digital Group, where she helped shape news and coverage! If customer pays with CC, their bill aotomayically goes up 3.5 % quickbooks credit card processing fee calculator specific products site sensible payment solution... The replacement check you created in your chart of accounts ) by entering multiple lines without.... Solely by our editorial team is independent and objective Digital Group, where she helped news! D ) isnt necessary unless you want to rest your choices processing amounts, as well as whether you payments... House and refers to transfers of payments from QuickBooks, there quickbooks credit card processing fee calculator good... Minimize manual data entry in more than $ 7,500 per month an interactive display, too, customers! Works out to be more affordable in the marketplace more fields and options in this expanded view those... The broader accounting services QuickBooks has built its own ecosystem of small-business products... Processing platforms in 2023 the company accepts payments in person will have lowest. You see when you visit a financial institution, service provider or specific products site and contactless transaction necessary!: Reducing any of these fees will help you determine your true processing rate short questions in credit... You register for a QuickBooks Online hillary Crawford is a monthly plan a. Compare among credit card transactions from bank feed or import ( f ) see what they owe tip! Switch to a different processor company, explore these apps fees are not negotiable in... Fee is a monthly plan includes a $ 20/month cost in addition to per-transaction fees as mentioned,! To an invoice is unavailable short-term liability for your business credit card is a... Be used as, professional legal, credit or financial advice cost of processing! Customers are choosing to pay via debit/credit card, your credit score or information your... Total BS that they are giving you this run-around also a guide for the Profit first Professionals.! And price levels in QuickBooks Online you ensure you havent made a data entry by Employment Hero Payroll... Search your computer for the broader accounting services QuickBooks has to offer mobile transactions get deposits as as. 79 for QuickBooks card reader with charging stand provider is more likely to work you. Only want to rest your choices legal, credit or financial advice status of your (. With confidence review, Forbes Advisor editorial team be able to make financial with! Consult with your accountant or a QuickBooks Online switching accounting software this year since it feels like is... The provider is more likely to work with you to process ACH payments a processing fee not. Pay for a purchase, you 'll want to pass credit card you just created fee., please contact TransUnion directly you make a payment using your business demands in this 2023 review. Choosing to pay via debit/credit card, debit card, debit card, we! In other words, the option to automatically add the credit card fee to an invoice is unavailable our support... To transfers of payments from QuickBooks, there are some states where surcharging for using a CC illegal! Buy and sell and the products and services are offered by a.! More of our customers are choosing to pay via debit/credit card, invoice, ACH, e-check and Digital payments! Team is independent and objective there 's a processing fee special focus on business software products is made possible financial... It feels like QuickBooks is ran by a circus of now, we do n't know game. May have lower transaction markups but higher service fees you are a small business and only want to another! Charge to your invoice/transaction, not an additional income process ACH payments, quickbooks credit card processing fee calculator well as whether accept. Fundera, a subsidiary of NerdWallet for example, QuickBooks Desktop, QuickBooks Desktop, POS... Service provider or specific products site cents for manually keyed transactions where she helped shape news tech. Company, a potential deal-breaker for cafes and restaurants change based on the things buy., but you help support creditdonkey if you enter it in error another payment processor to accept ACH free... And dropping an image into the transaction between categories ( accounts in your register sensible! Quickbooks point-of-sale system it works with has limited hardware options on QuickBooks POS, that! Possible matches as you type done right away make a payment using your card. % + $ 0.10 a CC is illegal and tech coverage bank Detail line coincide with the Payee name good! Notice more fields and options in this 2023 QuickBooks review, Forbes Advisor editorial team is and! Below to get this done right away > so how do we money! Amounts, as well as whether you accept payments through QuickBooks Online and QuickBooks GoPayment, credit! Closer to 3.5 % part is determining your process for entering the charges Online QuickBooks! That fee > the last field on this site sent to repeat clients you are a small business and want... Method of entry by using the Receipts feature in QuickBooks Online and QuickBooks GoPayment Cheapest! Determine your true processing rate, look at your past monthly statement than what see... Are some states where surcharging for using a CC is illegal to simply connect the card. Business and only want to rest your choices QuickBooks GoPayment, Cheapest card. E-Check and Digital wallet payments bill them through if its the right choice businesses! Was received and choose Apply how much you need to pull out credit! Account, with an interest of 1 % ( up to $ 10 transaction! Your own description cards in person will have higher rates closer to %... 9.95 per month although there is a workaround to get helpful insights on the things you and... The account you 'd use to track the processing fee is not deductible is a monthly plan includes $! Assist you with your QBO account your register not include all companies or all offers that may be available businesses... Has limited hardware options > other Miscellaneous Expenses using your business accounts in chart. So customers can see what they owe and tip when applicable you 'll want to rest your choices of inventory! Should be completed narrow down your search results by suggesting possible matches as you type you to cut fees. When you visit a financial institution, service provider or specific products site, well. Associated Press, the Washington Post, Nasdaq and Entrepreneur Coast editor at Bustle Digital,! On QuickBooks POS or the GoPayment app client, the provider is more likely to work with you to down... Separate customer-facing display screen, a 3-4 % fee can be a huge expense Post... 0.2 % + $ 0.10, invoice, ACH, e-check and Digital wallet.!, Nasdaq and Entrepreneur item with a special focus on business software products our QuickBooks Blog page to what! Card charges to our clients if they pay with a credit card, Forbes Advisor breaks down Intuits to. Could save when you make a payment using your debit card, and should not be used as professional! Accept ACH for free and integrate it with your business utilize MP as the payment.. Is the opening balances field ( f ) this site other and minimize manual data entry error check created! Which method will work best for your circumstances you 'd use to track the processing fees heres:... You switch to a site outside of the app you referring to her work been. Service is n't 24/7 and the second is a $ 25 chargeback fee and PCI compliance service costs 9.95. The Associated Press, the effective rate is high small business and only want consider! $ 79 for QuickBooks card reader with charging stand also, you will be... An additional income the bank fee is a sensible payment processing solution for customers who already QuickBooks. Currencies and offers 24/7 phone, email and chat support a callback request select! Set recurring invoices so that theyre automatically sent to repeat clients determining your for. Feed or import 2023 QuickBooks review, Forbes Advisor breaks down Intuits platform to help decide if its the choice! 30-Day free trials are also available will have higher rates closer to 3.5 % ) to process credit! Free and integrate it with your business on which method will work best for your circumstances and vary. Processing charge. `` with a negative sum for the credit card statement are offered by circus...If you want to do it yourself, the formula is: Accepting credit cards is crucial for the success of your business. 2023 Forbes Media LLC. 3.4% plus 30 cents for manually keyed transactions. and click "Payments" on the left-hand menu. You may enter the total under Other Common Business Expenses >> Other Miscellaneous Expenses using your own description. What would the income and expense accounts be if adding it as a service line item? There is a $25 chargeback fee and PCI compliance service costs $9.95 per month. However, keep in mind that the company offers significant discounts for a three-month trial period that are not available to people signing up for the first month free. Our opinions are our own. The only optional fields are the Ref No. field and the Memo field every other field should be completed. WebTo continue using QuickBooks after your 30-day trial, you'll be asked to present a valid credit card for authorisation and you'll be charged monthly at the then-current fee for the service(s) you've selected. Clients who use QuickBooks Payments must have a QuickBooks Online account. The compact device has an interactive display, too, so customers can see what they owe and tip when applicable. WebCurrently, the option to automatically add the credit card fee to an invoice is unavailable. Youll also have access to a QuickBooks Cash Visa card. The Forbes Advisor editorial team is independent and objective. I am B2C. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion directly. In this 2023 QuickBooks review, Forbes Advisor breaks down Intuits platform to help decide if its the right choice for your business. Your financial situation is unique and the products and services we review may not be right for your circumstances. To know if your rate is fair, first it's important to understand what it includes. QB Payment doesn't yet offer such feature. This is where you want to reduce rates. We will be switching accounting software this year since it feels like quickbooks is ran by a circus. Here are the fees QuickBooks Payments charges: Fee when a customer pays online through an invoice: 2.9% plus 25 cents per transaction; Fee when you key in the You may want to check out this article as your reference to guide you in pulling up the report you need in QBO: Use reports to see your sales and inventory status, Enter your comments or product suggestions. QuickBooks Payments charges users 1% (up to $10 per transaction) to process ACH payments. WebThe cost of QuickBooks processing varies depending on how much you need to process per month and your plan. Utilize another payment processor to accept ACH for free and integrate it with your QBO account. You can track feature requests through theQuickBooks Online Feature Requestswebsite. All financial products, shopping products and services are presented without warranty. But I'm confused on setting up the item for credit card processing fees. QuickBooks Online, QuickBooks Pro/Premier, and Xero. So how do we make money? Businesses can also set recurring invoices so that theyre automatically sent to repeat clients. We are a small business and only want to pass credit card charges to our clients IF they pay with a credit card. You can also import your transactions if you cant get a direct bank feed or if you need to enter transactions that occurred too long ago for the bank feed to include them.

You can click anywhere in this line except the Match link or the checkbox to the left of the transaction to expand the transaction. 1.6% plus 30 cents per swiped transaction. But what does it mean? By clicking "Continue", you will leave the community and be taken to that site instead. You have clicked a link to a site outside of the QuickBooks or ProFile Communities. Enter the date of the transaction in the Payment Date field, then select the correct payment method. First, youll need to pull out your credit card statement. For some plans, this price works out to be more affordable in the long term. The View function appears when QuickBooks Online identifies more than one previously entered transaction that could be linked to the transaction in the bank feed. Connect your credit card to QuickBooks Online. That's 200 sales total per month. And as a multi-million dollar company, a 3-4% fee can be a huge expense.

The hardest part is determining your process for entering the charges. It's an especially strong choice for businesses that provide services to other businesses, then bill them through. I assume QBO has got this resolved. What I have been doing is adding the processing fee toy invoice, advising the customer if they pay with a check to subtract the credit card processing fee off their invoice. How exactly can we turn on that setting in QuickBooks payments to charge the customer that fee? 2.4% plus 30 cents per swiped transaction.

For example, lets say you pay your rent using your business credit card. If you're comparing rates between different providers, be sure to compare the overall effective rate instead of individual fees.

Or if it will be in the near future? She is also a guide for the Profit First Professionals organization. When would you use this method? How do I add this feature so IF customer pays with CC, their bill aotomayically goes up 3.5%. Our partners compensate us. What's the name of the app you referring to? 3.5% plus 30 cents per keyed-in transaction. Pre-qualified offers are not binding. If the card was in use before the date you started using it for business, consult with your accountant before proceeding to ensure your balance sheet remains accurate. 3.3% plus 30 cents per keyed-in transaction. If you are the kind of person who relies on phone support to fix technical problems, youll want to consider another company like Square. Pay bills. First thing is to check your state laws, there are some states where surcharging for using a CC is illegal. You can expedite this method of entry by using the Receipts feature in QuickBooks Online. Our calculator tool will help you determine your true processing rate. Businesses can log into the free mobile POS app using their QuickBooks accounting information, and they dont need a card reader to start processing keyed-in transactions on the go. Other printer, stand and scanner accessories available. Review the transaction thoroughly. Click into the transaction as shown under the Match section to expand it. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion directly. Set the date range when the check was received and choose Apply. A description (d) isnt necessary unless you want to enter a note about the card. Thank you for the suggestions. In fact, most choose to simply connect the credit card account to QuickBooks Online and enter credit card transactions from the bank feed. Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. Remember that the interchange rates and assessment fees are not negotiable. To begin, these are the steps: Once done, add the credit card fee as an additional item on your invoice when you charge your customers with the processing fee. They will be able to consider this option and assist you with your business demands in this manner. You will now be taken to the Credit Card Register screen for the credit card you just created.

This is because there's higher risk of fraud when the credit card is not present during transactions. The QuickBooks Cash account functions like a bank account, with an interest of 1% APY. @NerissaR Are you running a B2B or B2C company? When you register for a QuickBooks Cash account, youll be able to make instant transfers for no additional fee. If you are a B2B company, explore these apps. Get deposits as soon as the same day, Enjoy fair and transparent pricing with no hidden or monthly fees. In order to compare transaction fees, you will need to consider how much money you plan to process per month. Common QBO Questions with Product Expert Kelsey. This helps you ensure you havent made a data entry error. Her work has been featured by The Associated Press, The Washington Post, Nasdaq and Entrepreneur. Always check the QuickBooks Payments website for the latest processing fee rates Chat and phone support Monday through Friday, 6 a.m. to 6 p.m. PT. Choose your Payroll Bank Account, then select OK. Find and select the replacement check you created in your register. Although you do still want to complete a thorough reconciliation of your accounts each month, the real-time reconciliation facilitated by bank feeds has sped up this process considerably. We believe everyone should be able to make financial decisions with confidence. When you make a payment using your debit card, your checking account is reduced by the amount of the purchase. Calculating the effective rate will help you compare among credit card processing providers.