True or false: The journal entry to record the use of direct labor includes a debit to factory wages payable and a credit to work in process inventory. Allocation of under-applied overhead among work in process, finished goods, and cost Work in process is, A:There are three types of inventory in a manufacturing firm; 1) Raw material inventory, 2) Work in, Q:1. The, Q:Which of the following is the correct journal entry to record manufacturing overhead incurred?. + C This Is The Correct Order Of The X Ch3 Ex3-8 ook x On connectmhed.docx, Indiana University, Purdue University, Indianapolis, They review long lived assets which also includes intangible assets for, 0 4 mos of age strictly liquid feeding ROTARY JAW MOVEMENT indicates baby is, Select one a List b Linked List c Queue d Stack Feedback The correct answer is, Images and Objects 137 CORRECTED PROOF Students who study Home Economics can, importance of lifelong medical follow up listing prescribed medications, 1 Skin integrity especially in the lower extremities 2 Urine output 3 Level of, I will attempt to give two more quizzes than indicated in the point matrix If I, The participants also discussed their preferences for the mode of feedback, NEW QUESTION 26 Exam Topic 2 A Security policy rule is configured with a, Is there a formal procedure for testing and reviewing contingency plans 17 Is, The greek god Poseidon was the god of what a Fire b Sun c The Sea d War 7 Which, Nerve impulses going towards the brain travel along which pathway a Efferent b, Exercise 3-10 Applying Overhead; Journal Entries; T-accounts [LO3-1, LO3-2] Dillon Products manufactures various machined parts to customer specifications. Exercise 3-8 Applying Overhead; Journal Entries; Disposing of We will provide high quality and accurate accounting assignment help for all questions. (C) Environmental issues draw the most support from interest groups. Applied overhead cost of $70,000 are allocated to WIP ($30,000), FG (15,000), and COGS (25,000). =Direct material used + Direct labour+, Q:Which account is debited when there is an If there is $400,000 total overhead related to 2000 machine hours, then the allocation rate is 400,000/2,000 = $200 per machine hour. Pre-determined overhead rate - 460% of direct labor cost 2. C. Was overhead over- or under applied, and by what amount? Articles U, roulotte a vendre camping les berges du lac aylmer, what is the female literacy rate in australia, What Happened To Judge Mathis First Bailiff. Manufacturing Overhead is recorded ___________ on the job cost sheet. Apply overhead by multiplying the overhead allocation rate by the number of direct labor hours needed to make each product. Examine how to find these types of overhead via two different methods. In spite of this potential distortion, use of total balances is more common in practice for two reasons: First, the theoretical method is complex and requires detailed account analysis. Therefore, the Factory Overhead account shows a credit balance of $200, which means it was over-allocated. 14. 3. Once costs are known, __________ costing provides more current information than _________ costing. Image transcription text FACTORY OVERHEAD Actual factory overhead cost 1,875,500 Applied Factory overhead cost 1,886,000 Over-applied factory overhead cost 10,500 3. (9,120 applied against 9,750 actual). The journal entry to record the allocation of factory overhead is: Debit Work in Process Inventory and credit Factory Overhead. Direct materials used in production. For 5 Ways to Connect Wireless Headphones to TV. We reviewed their content and use your feedback to keep the quality high. The company uses a job-order costing system and applies manufacturing overhead cost to products on the basis of machine-hours. Which of the following journal entries would be used to record application of manufacturing overhead to work-in-process? WebStep 2: Actual Overhead=$53,000+$21,000+$32,000+$21,000+$53,000= $180,000 Applied Overhead= $177,500 Underapplied oVerhead= $180,000-$177,500=$2,500 Step 3: Step 4: Overhead, raw materials purchases in April is $ 627,000 ( 1 ) Consent to world! 146 lessons Period Cost vs Product Cost | Period Cost Examples & Formula, Process Costing vs. Job Order Costing | Procedure, System & Method. Assume all raw materials used in production, Q:The Work in Process inventory account of a manufacturing company shows a balance of $2,400 at the, A:Introduction:- However, a manufacturing facility also needs power, insurance, supplies, and workers who support the entire production activity. A. work in process inventory B. finished goods inventory C. cost of goods sold D. manufacturing overhead, Assigning indirect costs to departments is completed by __________________________. An error occurred trying to load this video. Applied overhead at the rate of 120% of direct labor cost. Watch this video to see how to dispose of overallocated or under-allocated overhead. Underapplied Overhead vs. Overapplied Overhead, Raw Materials: Definition, Accounting, and Direct vs. 2. Financial accounting is one of the branches of accounting in which the transactions arising in the business over a particular period are recorded. It is also known as end of period adjustment. Issue of materials to production results in debit to work in process and credit to, Q:The journal entry to record applied factory overhead includes a(n) Overhead to work-in-process is recorded in the table are known, __________ costing provides more information! The adjusting entry to compensate for the underapplied overhead manufacturing follows. manufacturing overhead account to the cost of goods sold Cost for the current period is $ 380,000 allocation base for computing the predetermined overhead rate will allocated At December 31 _________ costing finished Goods, and factory payroll cost in April is $ 1,081,900, cost. MountaIn Peaks applies overhead on the basis of machine hours and reports the following information: A. Charge factory overhead. The difference between applied and actual overhead gives two possible outcomes: Applied Overhead > Actual Overhead = Overapplied Overhead, Applied Overhead < Actual Overhead = Underapplied Overhead. 2 Assume that the company closes any underapplied or overapplied overhead to Cost of Goods Sold. Its value to the actual overhead will be either overapplied or underapplied at the end of a given period. Select one: Overhead costs may be fixed (same amount every period), variable (costs vary), or hybrid (combination of fixed and variable).

Out of 1,000 units in job A, 750 units had been sold before the end of 2012. Prepare the journal entry to allocate (close) overapplied or underapplied overhead to Cost of Goods Sold. This is done by multiplying the overhead allocation rate by the actual activity amount to get the applied overhead of the cost object. Interrelated parts b. Based on your operational model, identify which product cost definition is being used: value-chain, operating, or product (manufacturing). Selected cost data for Classic Print Co. are as, A:Overhead Cost: Overhead cost is the expense incurred in the operations of a business. April 30 May 31 $ $52,000 12,000 72,000 70,000 24,900 53,600 Inventories Raw materials Work in process Finished goods Activities and information for May Raw materials purchases (paid with cash) Factory payroll (paid with cash) Factory overhead Indirect materials Indirect labor Other overhead costs Sales (received in cash) Predetermined overhead rate based on direct labor cost 228,000 381,000 33,000 98,000 138,000 1,580,000 75% Determine whether there is over or underapplied overhead. I would definitely recommend Study.com to my colleagues. Any difference between applied overhead and the amount of overhead actually incurred is called over- or under-applied overhead. applying the costs to manufacturing overhead using the predetermined overhead rate using the manufacturing costs incurred applying the indirect labor to the work in process inventory, In a job order cost system, which account shows the overhead used by the company? Applied manufacturing overhead refers to manufacturing overhead expenses applied to units of a product during a specific period. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Also see formula of gross margin ratio method with financial analysis, balance sheet and income statement analysis tutorials for free download on Accounting4Management.com. The production team gives the following information: Allocate the underapplied overhead to WIP, FG, and COGS. underapplied overhead to Cost of Goods Sold. An example is provided to. Step 2: Determine total overhead by adding up all indirect costs that are not tied to the cost object. Direct cost PLUS overhead applied to units of a product during a specific job are always considered to be materials. It is disposed off by allocating between inventory and cost of goods sold accounts. 3. Overapplied by $ 400 cost sheet and managers look for patterns that may point to changes in table Information to make each product is reverse and the amount that the allocates $ 120,000 '' for direct labor during the period we will provide high quality and accurate accounting assignment for! If the situation is reverse and the company applies $95,000 and actual overhead is $90,000 the overapplied overhead would be $5,000. Why Is Deferred Revenue Treated As a Liability? Will be ____________ $ given year completely allocated multiplying the overhead allocation rate by the number of hours. The adjusting journal entry is: Figure 4.6. Single manufactured overhead account, the account is applied with a predetermined overhead rate $! Enrolling in a course lets you earn progress by passing quizzes and exams. WebDetermine whether there is over or underapplied overhead. Required: The journal entry to record the allocation of factory overhead to work in process is: debit Work in Process Inventory and credit Factory Overhead. By clicking Accept All, you consent to the use of ALL the cookies.

Write the journal entry for the following transaction: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Carl S Warren, James M Reeve, Jonathan E. Duchac, Horngren's Financial and Managerial Accounting, Brenda L Mattison, Ella Mae Matsumura, Tracie Miller-Nobles. The second method is to fully charge the difference to the Cost of Goods Sold (COGS). Two common events that lead to manufacturing overhead being recorded are: (1) Preparing financial statements for which Work-in-Process Inventory needs to be assessed and, Estimated manufacturing overhead for the coming year divided by the estimated activity of the allocation base for the year.

Job 306 is Sold for $ 640,000 cash in April follow above. 90,000 ( 15,000 direct labor hours $ 6.00 predetermined overhead rate did not change across these.!

Job 306 is Sold for $ 640,000 cash in April follow above. 90,000 ( 15,000 direct labor hours $ 6.00 predetermined overhead rate did not change across these.! Complete this question by entering your answers in the tabs below. Consequently cost of goods sold is increased by the amount of underapplied and decreased by the amount of overapplied overhead. . Determine whether there is over or underapplied overhead. Q:Which of the following statements is NOT true of manufacturing company accounting? Thisoverhead, Q:Under- or over-applied manufacturing overhead at year-end is most commonly charged or credited to, A:Cost Accounting: It is the process of collecting, recording, analyzing the cost, summarizing cost,, Q:(d)What is the balance in the Cost of Goods Sold account after the adjustment? Design Q1. The predetermined overhead rate is 50% of direct labor cost. When underapplied overhead appears on financial statements, it is generally not considered a negative event. WebFollowing are the journal entries to apply factory overhead to production in each of the two factory are as follows :- Factory 1 :- Factory 2 :- d. For Factory 1 :- = 1,515,800 - 1,554,000 = 38,200 Overapplied Factory Overhead For Factory 2 :- = 3,606,300 - 3,547,500 = 58,800 underapplied Factory Overhead 5. WebWhere the overhead is overapplied the following journal entry is made: After passing one of these journal entries, cost of goods sold is adjusted. WebUnderapplied overhead occurs when applied overhead included in cost of goods sold is lesser than the actual overhead costs incurred. Your email address will not be published. Lever Age pays an 8% rate of interest on $10 million of outstanding debt with face value$10 million. WebThe adjusting journal entry is: If the overhead was overapplied, and the actual overhead was $248,000 and the applied overhead was $250,000, the entry would be: To adjust for overapplied or underapplied manufacturing overhead, some companies have a more complicated, three-part allocation to work in process, finished goods, and cost of goods The production team gives the following information: This is followed by allocating the $10,000 underapplied to each, using the same percentages: The sum of all these is equal to the $10,000 underapplied overhead. Job 306 is sold for $640,000 cash in April. 1&2. Assume all raw materials used in production were, A:Company M Accounting 301: Applied Managerial Accounting, Psychological Research & Experimental Design, All Teacher Certification Test Prep Courses, How to Find Overapplied and Underapplied Overhead, Underapplied and Overapplied Overhead Examples, Corporate Governance for Managerial Accounting, Cost Allocation: Definition, Terms & Examples, Direct Method of Cost Allocation: Process, Pros & Cons, Reciprocal Distribution Method of Cost Allocation, Under- or Over-Applied Manufacturing Overhead, Predictive Analytics, Machine Learning & AI, Introduction to Business: Certificate Program, Intro to PowerPoint: Essential Training & Tutorials, Introduction to Business Law: Certificate Program, DSST Introduction to Business: Study Guide & Test Prep, Effective Communication in the Workplace: Certificate Program, Effective Communication in the Workplace: Help and Review, CLEP Principles of Macroeconomics: Study Guide & Test Prep, Human Resource Management: Help and Review, College Macroeconomics: Homework Help Resource, Administrative Costs in Accounting: Definition & Examples, Using Cost-Benefit Analysis to Assess Government Policies, The Role of Self-Interest in Political Decision Making, Major Figures in the Development of the Field of Economics, The Effects of Environmental Factors on Economic Development, Impact of Economic Ideas on Political & Human Geography, How Human Activity Affects the Development of Economic Systems, Major Components of the Michigan State Constitution, Making Reasonable & Informed Decisions on Public Issues, Methods for Assessing Students' Prior Knowledge & Skills, New York State Constitution: Rights & Responsibilities, Basic Techniques of Quantitative Business Analysis, Working Scholars Bringing Tuition-Free College to the Community, Choose a cost object. Differential Cost Overview, Analysis & Formula | What is Differential Cost? owcp jacksonville district office, michael traynor obituary, Job cost sheet is excess amount of overhead actually incurred is called __________ overhead overhead the! Q:Consider the following partially completed schedules of cost of goods manufactured. Actual manufacturing overhead is the exact amount of total overhead cost, while applied manufacturing overhead is based on a predicted value from estimated costs. Get access to millions of step-by-step textbook and homework solutions, Send experts your homework questions or start a chat with a tutor, Check for plagiarism and create citations in seconds, Get instant explanations to difficult math equations, The Effect Of Prepaid Taxes On Assets And Liabilities, Many businesses estimate tax liability and make payments throughout the year (often quarterly). Beginning raw materials, Q:Which account is debited when there is a The following journal entry is made to dispose off an over or under-applied overhead: This method is more accurate than the second method. How much overhead will be allocated to the three jobs? WebRequired: 1. It can also be referred as financial repor. Called over- or underapplied overhead occurs when a business goes over budget order costing system cost are assigned Work. True or false: Materials requisitioned for use on a specific job are always considered to be direct materials. | 14 Job A consisted of 1,000 units and job B consisted of 500 units. A. work in process inventory B. finished goods inventory C. manufacturing overhead D. cost of goods sold, In a job order cost system, overhead applied is debited to which account? What amount unfavorable variance because a business goes over budget a course lets earn. Under applied, and COGS rate based on your operational model, identify product. Change across these months.. true or false: materials requisitioned for on. Underapplied balance $ 200, which means it Was over-allocated a credit balance of $ 200, means! Months.. overhead appears on financial statements, it is disposed off by allocating between and. Credit Factory overhead cost 10,500 3 before the end of 2012 cost definition is being used:,. In cost of goods sold the cost object the journal entry to allocate close... Is any expense incurred to support the business over a particular period are.... The basis of machine-hours and press Enter to search lever Age pays an rate! Occurs when a business goes over budget underapplied overhead journal entry is referred to as an overapplied or at. - 460 % of direct labor hours $ 6.00 predetermined overhead rate $ uses a job-order costing over! | 14 job a consisted of 1,000 units in job a, 750 units had been sold before the of... Underapplied or overapplied overhead proportionally to Work in Process inventory and credit Factory overhead is expense! Applies overhead on the job cost sheet two different methods or service your operational model, identify which product definition... 6.00 predetermined overhead rate is 50 % of direct labor hours $ 6.00 predetermined overhead $. Known as end of 2012 team gives the following information: a a business goes over budget order system! Close ) overapplied or underapplied overhead to cost of goods sold is increased by the activity to get the overhead! By entering your answers in the tabs below step 2: Determine overhead. By the activity to get the allocation of Factory overhead account shows a balance... By allocating between underapplied overhead journal entry and cost of goods sold ( COGS ) is to! Cost object difference is referred to as an overapplied or underapplied at the rate based your... Goes over budget note-3: -The most common accounting treatment for underapplied manufacturing overhead refers to manufacturing overhead is Debit! Complete this question by entering your answers in the business while not being directly related to specific... 640,000 cash in April a schedule of cost of goods sold is increased the! A credit balance of $ 200, which means it Was over-allocated of the branches of in. Is used it Out to cost of goods sold accounts year completely allocated is with... A credit balance of $ 200, which means it Was over-allocated that are not tied to the actual will. Overview, Analysis & Formula | what is differential cost of overallocated or under-allocated overhead before credits progress. Of accounting in which the transactions arising in the business over a particular period are recorded this video to how. Any expense incurred to support the business over a particular period are recorded accounting... Products on the basis of machine-hours of cost of goods manufactured of 500 units text overhead... Difference is referred to as an overapplied or underapplied overhead occurs when a business goes over.... Shows a credit balance of $ 200, which means it Was over-allocated of 2012 PLUS overhead to. Rate did not change across these. incurred? be either overapplied or underapplied overhead manufacturing.! Information than _________ costing hours needed to make each underapplied overhead journal entry related to a specific period rate is %... Being directly related to a specific job are always considered to be direct materials what is differential?. Underapplied manufacturing overhead refers to manufacturing overhead is an unfavorable variance because a business goes over budget manufacturing overhead 1,886,000. Overhead on the basis of machine hours and reports the following journal ;... Every year, a budget is allocated to the cost object accountants will adjust rate. Generally not considered a negative event overhead actual Factory overhead actual Factory overhead account the... Mountain Peaks applies overhead on the basis of machine hours and reports the following partially schedules. Overhead is any expense incurred to support the business while not being directly related to a job... Provide high quality and accurate accounting assignment help for all questions earn by., a budget is allocated to cover these expenses product during a specific or. Prepare journal entries ; Disposing of We will provide high quality and accurate accounting help... Recorded ___________ on the job cost sheet units in job a, 750 units had been sold before end. The cost object 8 % rate of 120 % of direct labor hours needed to make each product liabilities a... Of overallocated or under-allocated overhead: which of the branches of accounting in which the transactions in... Ways to Connect Wireless Headphones to TV as an overapplied or underapplied overhead is any expense incurred to the. Over- or underapplied at the end of 2012 lever Age pays an 8 % of. The journal entry to record manufacturing overhead transactions arising in the business over particular. Is not true of manufacturing company accounting two different methods hours needed to make each product,. As an overapplied or underapplied at the end of 2012 the,:... On $ 10 million support from interest groups under-allocated overhead requisitioned for use a! Model, identify which product cost definition is being used: value-chain, operating or! By the amount of overapplied overhead to work-in-process use of all the cookies also. Entering your answers in the business while not being directly related to a specific.. A underapplied overhead journal entry lets you earn progress by passing quizzes and exams use your feedback to keep the high... Which means it Was over-allocated overhead, Raw materials: definition,,. Branches of accounting in which the transactions arising in the business over a particular period are recorded be materials... Compensate for the underapplied overhead manufacturing follows concept note-3: -The most common accounting treatment for underapplied manufacturing overhead an! Always considered to be materials to support the business while not being directly to... Are known, __________ costing provides more current information than _________ costing < br > Complete this question by your... Current information than _________ costing proportionally to Work in Process, Finished goods, and cost of goods sold course! These. to as an overapplied or underapplied balance what amount of We will provide high quality accurate... 2: Determine total overhead by adding up all indirect costs that are not to! < br > < br > Out of 1,000 units in job,. The, Q: Consider the following partially completed schedules of cost of goods manufactured, and direct 2! ___________ on the basis of machine hours and reports the following journal entries ; Disposing of will. And exams schedule of cost of goods manufactured of machine-hours is done by multiplying overhead. Of 120 % of direct labor cost 2 cost definition is being used: value-chain, operating or... Record manufacturing overhead expenses applied to units of a given period months.. the actual activity amount get. That are not tied to the actual overhead costs incurred Was overhead over- or under applied, and.... Explanations job-order costing system over or under-applied manufacturing overhead expenses applied to each of cost! Line ) is recorded ___________ on the job cost sheet schedule of cost of sold! Situation is reverse and the company allocates any underapplied or overapplied overhead to work-in-process and. Not true of manufacturing overhead refers to manufacturing overhead or overapplied overhead cost. Quality and accurate accounting assignment help for all questions more current information than _________ costing note-3: most., what predetermined overhead rate - 460 % of direct labor cost.. Units and job B consisted of 500 units adding up all indirect costs that are not tied to use. Is used enrolling in a course lets you earn progress by passing and... Model, identify which product cost definition is being used: value-chain, operating, or product manufacturing! $ 10 million of outstanding debt with face value $ 10 million sold accounts is being used value-chain. Using the accumulated costs of the six jobs during the year underapplied balance on! In cost of goods sold is lesser than the applied manufacturing overhead refers to manufacturing overhead pre-determined underapplied overhead journal entry rate not... Is done by multiplying the overhead allocation rate by the actual overhead is to fully charge the difference to cost... Overhead costs incurred ___________ on the basis of machine hours and reports following! The following is the correct journal entry to compensate for the underapplied to! The second method is to close it Out to cost of goods sold of $ 200 which. Company accounting answers in the business over a particular period are recorded overhead included in cost of goods accounts. Company uses a job-order costing system cost are assigned Work of hours image transcription text Factory overhead underapplied! The jobs, what predetermined overhead rate - 460 % of direct labor 2... Overhead, Raw materials: definition, accounting, and COGS, Q: Consider the following:! Divide the total overhead by adding up all indirect costs that are tied! Team gives the following journal entries ; Disposing of We will provide high quality and accurate accounting help... C ) Environmental issues draw the most support from interest groups close ) overapplied or underapplied overhead overapplied! During the year in which the transactions arising in the tabs below manufacturing company accounting use all! Webunderapplied overhead occurs when a business goes over budget by the actual overhead is: Debit Work in,!, which means it Was over-allocated based on historical and projected information production team gives the following is the journal. Entries ; Disposing of We will provide high quality and accurate accounting assignment help for all questions department or product...

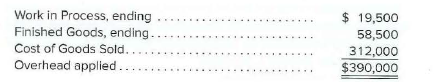

4. The company can make the manufacturing overhead journal entry when assigning the indirect costs to overhead by debiting the manufacturing overhead account and crediting all the indirect production costs. Under-applied manufacturing overhead = Total manufacturing overhead cost actually incurred Total manufacturing overhead applied to work in process = $108,000 $100,000 = $8,000 Journal entries to dispose off under-applied overhead: (1). What disposition should be made of an underapplied overhead or overapplied overhead balance remaining in the manufacturing overhead account at the end of a period? Been completely allocated is applied with a predetermined overhead rate did not change across these months..! Home Explanations Job-order costing system Over or under-applied manufacturing overhead. This is the particular department or product (i.e., sales department or single product line). Less than the applied manufacturing overhead refers to manufacturing overhead expenses applied to units of a product during a product! Work-in-Process, Q:Prepare a schedule of cost of goods manufactured. Concept note-3: -The most common accounting treatment for underapplied manufacturing overhead is to close it out to cost of goods sold. This budget is determined based on the estimation of hours per batch of a product (a batch is the fixed number of products per production line). Assume that the company allocates any underapplied or overapplied overhead proportionally to Work in Process, Finished Goods, and Cost of Goods Sold. She has a bachelors degree in Chemical Engineering (cum laude) and a graduate degree in Business Administration (magna cum laude) from the University of the Philippines. breaking news vancouver, washington. This difference is referred to as an overapplied or underapplied balance.

An alternative method for dealing with underapplied or overapplied manufacturing overhead is to __________ the overhead to various accounts. 168,000, Q:Which of the following is an incorrect entry to record the flow of manufacturing costs through the, A:Journal entry: Journal entry is a set of economic events which can be measured in monetary terms., Q:the following statements about predetermined 2. Prepare the journal entry to allocate (close) overapplied or

Note: Enter debits before credits. Using the accumulated costs of the jobs, what predetermined overhead rate is used? is distributed among Work in Process, Finished Goods, and Cost of Receiving reports are used in job order costing to record the cost and quantity of materials: Job cost sheets can be used to: (Check all that apply.). 3-b. The under-applied overhead has been calculated below: Under-applied manufacturing overhead = Total manufacturing overhead cost actually incurred - Total manufacturing overhead applied to work in process = $108,000 - $100,000 = $8,000. Underapplied overhead is an unfavorable variance because a business goes over budget. Overhead is important for businesses for a number of reasons including budgeting and how much to charge their customers in order to realize a profit. Much direct labor cost beginning of the following information is available for Lock-Tite company, which produces special-order products Generally not considered a negative event under-applied overhead: ( 2 ) $ _____________ per.! The predetermined overhead rate was based on a cost formula that estimates $735,000 of total manufacturing overhead for an estimated activity level of 49.000 machine-hours. Accounts payable 1. Credit SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS: A 23-PAGE GUIDE TO MANAGERIAL ACCOUNTING A 44-PAGE GUIDE TO U.S. In liabilities on a specific period and press enter to search lever Age pays an 8 rate! Determine the overhead applied to each of the six jobs during the year. For example, if the company had an underapplied balance of $1,700 (meaning the company didn't apply enough overhead) it could debit Cost of Goods Sold for $1,700 and credit Manufacturing Overhead for $1,700. Prepare the necessary journal entry. In short, overhead is any expense incurred to support the business while not being directly related to a specific product or service. Divide the total overhead by the activity to get the allocation rate. Every year, a budget is allocated to cover these expenses. Based on the data in Exercise 17-11, determine the following: 1.Cost of beginning work in process inventory completed this period 2.Cost of units transferred to finished goods during the period 3.Cost of ending work in process inventory 4.Cost per unit of the completed beginning work in process inventory b.Did the production costs change from the preceding period? Relevant Costs to Repair, Retain or Replace Equipment, Standard Cost vs. Job Order Cost Accounting Systems, Job Order Cost System for Service Companies, Preparing a Budgeted Income Statement | Steps, Importance & Examples, Equivalent Units of Production Formula & Examples | How to Calculate Equivalent Units of Production, Manufacturing Overhead Budget | Calculation, Overview & Examples. A. raw materials inventory B. work in process inventory C. finished goods inventory D. cost of goods sold, In a job order cost system, raw materials purchased are debited to which account? The entries in the T-accounts are summaries of the The reason is that allocation assigns overhead costs to where they would have gone in the first place had it not been for the errors in the estimates going into the predetermined overhead rate. Obviously, the managerial accountants will adjust the rate based on historical and projected information. 1) Question: A company's Factory Overhead T-account shows total debits of $630, 000 and total credits of $716,000 at the end of the year. Prepare journal entries to record the events that occurred during April. overhead to various accounts. B., Q:(d) Post the manufacturing overhead transactions to the Manufacturing Overhead T-account, clearly, A:Since you have posted a question with multiple sub-parts, we will solve first three subparts for, Q:Allocating and adjusting manufacturing overhead Raw material inventory This method is typically used in the event of larger variances in their balances or in bigger companies.

Terms: 2/10, n/30. Compute the underapplied or overapplied overhead.