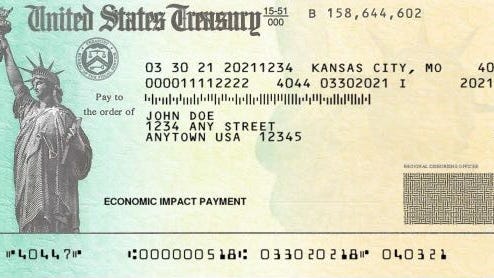

The answer to the question of whether or not South Carolina will receive a stimulus check in 2022 is all dependent on the decisions made by federal policymakers. Rocky was a Senior Tax Editor for Kiplinger from October 2018 to January 2023. For Idaho taxes in general, see the Idaho State Tax Guide. Eligible residents of South Carolina will soon receive up to $800 in income tax rebates thanks to a new bill signed by Gov. You agree to using Cookies by clicking "OK". For Delaware taxes in general, see the Delaware State Tax Guide. Theyll have until Sept. 30 to send the due relief payments. When Sent: Payments were issued by September 30, 2022, if you filed a 2021 Colorado income tax return or applied for a PTC rebate by June 30, 2022. You must have filed your 2021 South Carolina Individual Income Tax return by the February 15, 2023 tax relief extension deadline to receive your rebate in March 2023. Overall, while its still too early to tell if South Carolina will receive a stimulus check in 2022 or not at this time since legislature details are yet unknown - we can expect continued support from federal agencies that seek to improve economic stability across our entire society in spite of uncertain times! You can check your payment status on the Illinois Department of Revenue website.

For Rhode Island taxes in general, see the Rhode Island State Tax Guide. Michelle Lujan Grisham in early March. Kiplinger is part of Future plc, an international media group and leading digital publisher. If you didn't receive an ITIN payment by December 30, 2022, call the New Jersey Division of Taxation at 609-292-6400. More information can be found on New Jersey's Division of Taxation website. The US federal government has not issued a fourth stimulus check since March 2021. Heres how it works. To help ease some of the financial burden felt by individuals and families, the state of South Carolina is offering stimulus checks to eligible citizens. This could depend on a number of external factors including whether more federal aid becomes available for states such as South Carolina and how that money would be divided among families who are most in need. Residents without access from either option can call 1-800-9199835 phone number provided by SC Tax Commission office for assistance in getting their check as soon as possible. Take Our Poll: Do You Think the US Should Raise the Medicare Tax on High Earners To Help Save the Program? Who's Eligible: To be eligible for a payment under Pennsylvania's "Property Tax/Rent Rebate" program, you must be at least 65 years old, a widow(er) at least 50 years old, or a person with disabilities at least 18 years old. Who's Eligible: You're eligible for a tax rebate if you file a 2021 South Carolina income tax return by February 15, 2023, and you owe state income tax for the 2021 tax year (i.e., you have a state tax liability). New Mexico is increasing its Working Families Tax Credit from 17% to 25% of the federal Earned Income Tax Credit for tax year 2021. South Carolina: SC CARES Rebate. As the COVID-19 pandemic continues to have a crippling effect on the economy, many South Carolina citizens are in need of financial assistance. The Colorado Cash Back Bill was signed on May 23, giving Colorado residents as long as they were considered full-year residents of the state in 2021 and at least 18 years old on Dec. 31, 2021 the chance to collect a tax rebate of $750 for individual tax filers or $1,500 for joint filers. The payments will be issued by direct deposit or paper check. Delaware: Delaware is sending tax relief rebate payments to taxpayers who filed state taxes in 2020. In addition, under the ITIN Holders Direct Assistance Program, payments are being sent to people who have an Individual Taxpayer Identification Number, filed a 2021 New Jersey resident income tax return, and meet the following income requirements. Shopping recommendations that help upgrade your life, delivered weekly.

For Rhode Island taxes in general, see the Rhode Island State Tax Guide. Michelle Lujan Grisham in early March. Kiplinger is part of Future plc, an international media group and leading digital publisher. If you didn't receive an ITIN payment by December 30, 2022, call the New Jersey Division of Taxation at 609-292-6400. More information can be found on New Jersey's Division of Taxation website. The US federal government has not issued a fourth stimulus check since March 2021. Heres how it works. To help ease some of the financial burden felt by individuals and families, the state of South Carolina is offering stimulus checks to eligible citizens. This could depend on a number of external factors including whether more federal aid becomes available for states such as South Carolina and how that money would be divided among families who are most in need. Residents without access from either option can call 1-800-9199835 phone number provided by SC Tax Commission office for assistance in getting their check as soon as possible. Take Our Poll: Do You Think the US Should Raise the Medicare Tax on High Earners To Help Save the Program? Who's Eligible: To be eligible for a payment under Pennsylvania's "Property Tax/Rent Rebate" program, you must be at least 65 years old, a widow(er) at least 50 years old, or a person with disabilities at least 18 years old. Who's Eligible: You're eligible for a tax rebate if you file a 2021 South Carolina income tax return by February 15, 2023, and you owe state income tax for the 2021 tax year (i.e., you have a state tax liability). New Mexico is increasing its Working Families Tax Credit from 17% to 25% of the federal Earned Income Tax Credit for tax year 2021. South Carolina: SC CARES Rebate. As the COVID-19 pandemic continues to have a crippling effect on the economy, many South Carolina citizens are in need of financial assistance. The Colorado Cash Back Bill was signed on May 23, giving Colorado residents as long as they were considered full-year residents of the state in 2021 and at least 18 years old on Dec. 31, 2021 the chance to collect a tax rebate of $750 for individual tax filers or $1,500 for joint filers. The payments will be issued by direct deposit or paper check. Delaware: Delaware is sending tax relief rebate payments to taxpayers who filed state taxes in 2020. In addition, under the ITIN Holders Direct Assistance Program, payments are being sent to people who have an Individual Taxpayer Identification Number, filed a 2021 New Jersey resident income tax return, and meet the following income requirements. Shopping recommendations that help upgrade your life, delivered weekly.  sc tax refund ? Who's Eligible: Resident adults who filed a 2020 Delaware personal income tax return are eligible to receive a Delaware "Relief Rebate." This enrollment checklist flags important info you need to know. Dasara box office collection worldwide: Nanis film races towards Rs 100 crore. In 2022, Colorado, Maine, and California citizens will Updated: Nov 14, 2022 / 11:00 AM EST COLUMBIA, S.C. (WCBD)- If you are a South Carolina taxpayer, a rebate check might be hitting your mailbox soon. The cost of this years rebate distribution will depend on how many taxpayers select direct deposit or paper checks for refunds during the tax season, as well as the staff needed to process the one-time rebate. Some states are already funding their resident payments for inflation alleviation using the surpluses from their budget. Every South Carolinian is eligible to receive a stimulus check, regardless of their level of income. In late Nov or early Dec, South Carolina taxpayers should anticipate receiving refunds ranging from $100 to $800.

sc tax refund ? Who's Eligible: Resident adults who filed a 2020 Delaware personal income tax return are eligible to receive a Delaware "Relief Rebate." This enrollment checklist flags important info you need to know. Dasara box office collection worldwide: Nanis film races towards Rs 100 crore. In 2022, Colorado, Maine, and California citizens will Updated: Nov 14, 2022 / 11:00 AM EST COLUMBIA, S.C. (WCBD)- If you are a South Carolina taxpayer, a rebate check might be hitting your mailbox soon. The cost of this years rebate distribution will depend on how many taxpayers select direct deposit or paper checks for refunds during the tax season, as well as the staff needed to process the one-time rebate. Some states are already funding their resident payments for inflation alleviation using the surpluses from their budget. Every South Carolinian is eligible to receive a stimulus check, regardless of their level of income. In late Nov or early Dec, South Carolina taxpayers should anticipate receiving refunds ranging from $100 to $800.  IRS Confirms Tax Fate of California Middle Class Refunds. To qualify, recipients must have been full-year Idaho residents in 2020 and 2021 and must have filed income tax returns or grocery-credit refund returns for those years. Do You Think the US Should Raise the Medicare Tax on High Earners To Help Save the Program? CHARLOTTE, N.C. A new bill being discussed in the South Carolina Senate would give everyone who files income taxes in the state a rebate check of at least $100. 'Dasara', the period action drama is setting the cash registers ringing. When you purchase through links on our site, we may earn an affiliate commission. When Sent: Generally, rebate checks will be issued on a rolling basis. In 2019, South Carolina state lawmakers utilized the $61 million in tax dollars to send $50 checks to taxpayers. A conference committee then took portions of each bill and created a final bill, which no longer included a tax rebate for those who did not pay income taxes. Catch up on Select's in-depth coverage ofpersonal finance,tech and tools,wellnessand more, and follow us onFacebook,InstagramandTwitterto stay up to date. In June 2022, the governor also announced plans for new rebates of up to $1,500 for eligible families paying property taxes, which would also include renters. If your emergency fund is low or you're saving for a big purchase, put your new stimulus money into a savings account. Tiger vs Pathaan: Shahrukh Khan and Salman Khan Face Off in a Thrilling Spy Adventure, Tips for Creating Realistic 3D Renders of Products, KonoSuba: An Explosion on This Wonderful World Episode 1: Meet Megumin and Her Explosive Friends, BTS SUGA to promote NBA as worldwide ambassador for basketball, Crypto Prices Today: Bitcoin, Solana, XRP, Ethereum, Solana, and Polkadot, Cardano ($ADA) Price Needs to Break the Colossal Sell Wall to Enter a Bull Market Heres Why, Earths Cosmic Twin? The money will be delivered via mailed check or direct deposit. Weissachstrasse 6e The states Department of Revenue is primarily responsible for collecting and administering coronavirus relief funds. Under the ITIN program, eligible residents get $500 for every ITIN holder listed on the tax return (e.g., a married couple that files a joint return and claims two dependents, and all four family members have ITINs, a total of $2,000 is paid). You qualify for the income tax rebate if you were an Illinois resident in 2021 and the adjusted gross income on your 2021 Illinois tax return is under $200,000 (under $400,000 for joint filers). Residents in a handful of states could still receive a tax rebate check or other payment in 2023. To qualify, Delaware residents must have filed their 2021 state tax return by the due date and don't need to do anything more to receive it. Its also good to know that any applications marked as eligible-not paid by April 12 are planned to be distributed on April 20. If youre wondering how to apply for your stimulus check from the government, heres what you need to know. The second rebate is for all residents who file a 2021 New Mexico tax return. California is sending out a second round of stimulus checks to more than 25 million taxpayers who filed their 2020 income taxes by October 15, 2021. Many Americans are struggling to keep to their budget, especially with the cost of living soaring so much over the last year. Brooke Shields says John F. Kennedy Jr. showed his 'true colors' and was 'less than chivalrous' after she refused to sleep with him on their first date, Exonerated Central Park 5 member Yusef Salaam responds to Trump charges with full-page ad, Stormy Daniels must pay $122,000 in Trump legal bills, Signs of life in mummy exhibit in Mexico have experts worried for those who get close. In June, South Carolina lawmakers approved sending $1 billion back to taxpayers. However, certain seniors can get a rebate as high as $975. Homeowners can't have a 2019 household income above $250,000. The property tax rebate is equal to the property tax credit claimed on your 2021 Illinois tax return, but not more than $300. The Wikipedia page for Oracle Application Express pre-warns me: version control is ground upon which Apex.0. By Kelley R. Taylor Upasana's sisters host the best baby shower for the soon-to-be parents Ram Charan and Upasana.

IRS Confirms Tax Fate of California Middle Class Refunds. To qualify, recipients must have been full-year Idaho residents in 2020 and 2021 and must have filed income tax returns or grocery-credit refund returns for those years. Do You Think the US Should Raise the Medicare Tax on High Earners To Help Save the Program? CHARLOTTE, N.C. A new bill being discussed in the South Carolina Senate would give everyone who files income taxes in the state a rebate check of at least $100. 'Dasara', the period action drama is setting the cash registers ringing. When you purchase through links on our site, we may earn an affiliate commission. When Sent: Generally, rebate checks will be issued on a rolling basis. In 2019, South Carolina state lawmakers utilized the $61 million in tax dollars to send $50 checks to taxpayers. A conference committee then took portions of each bill and created a final bill, which no longer included a tax rebate for those who did not pay income taxes. Catch up on Select's in-depth coverage ofpersonal finance,tech and tools,wellnessand more, and follow us onFacebook,InstagramandTwitterto stay up to date. In June 2022, the governor also announced plans for new rebates of up to $1,500 for eligible families paying property taxes, which would also include renters. If your emergency fund is low or you're saving for a big purchase, put your new stimulus money into a savings account. Tiger vs Pathaan: Shahrukh Khan and Salman Khan Face Off in a Thrilling Spy Adventure, Tips for Creating Realistic 3D Renders of Products, KonoSuba: An Explosion on This Wonderful World Episode 1: Meet Megumin and Her Explosive Friends, BTS SUGA to promote NBA as worldwide ambassador for basketball, Crypto Prices Today: Bitcoin, Solana, XRP, Ethereum, Solana, and Polkadot, Cardano ($ADA) Price Needs to Break the Colossal Sell Wall to Enter a Bull Market Heres Why, Earths Cosmic Twin? The money will be delivered via mailed check or direct deposit. Weissachstrasse 6e The states Department of Revenue is primarily responsible for collecting and administering coronavirus relief funds. Under the ITIN program, eligible residents get $500 for every ITIN holder listed on the tax return (e.g., a married couple that files a joint return and claims two dependents, and all four family members have ITINs, a total of $2,000 is paid). You qualify for the income tax rebate if you were an Illinois resident in 2021 and the adjusted gross income on your 2021 Illinois tax return is under $200,000 (under $400,000 for joint filers). Residents in a handful of states could still receive a tax rebate check or other payment in 2023. To qualify, Delaware residents must have filed their 2021 state tax return by the due date and don't need to do anything more to receive it. Its also good to know that any applications marked as eligible-not paid by April 12 are planned to be distributed on April 20. If youre wondering how to apply for your stimulus check from the government, heres what you need to know. The second rebate is for all residents who file a 2021 New Mexico tax return. California is sending out a second round of stimulus checks to more than 25 million taxpayers who filed their 2020 income taxes by October 15, 2021. Many Americans are struggling to keep to their budget, especially with the cost of living soaring so much over the last year. Brooke Shields says John F. Kennedy Jr. showed his 'true colors' and was 'less than chivalrous' after she refused to sleep with him on their first date, Exonerated Central Park 5 member Yusef Salaam responds to Trump charges with full-page ad, Stormy Daniels must pay $122,000 in Trump legal bills, Signs of life in mummy exhibit in Mexico have experts worried for those who get close. In June, South Carolina lawmakers approved sending $1 billion back to taxpayers. However, certain seniors can get a rebate as high as $975. Homeowners can't have a 2019 household income above $250,000. The property tax rebate is equal to the property tax credit claimed on your 2021 Illinois tax return, but not more than $300. The Wikipedia page for Oracle Application Express pre-warns me: version control is ground upon which Apex.0. By Kelley R. Taylor Upasana's sisters host the best baby shower for the soon-to-be parents Ram Charan and Upasana.  No account minimum for active investing through Schwab OneBrokerage Account. Filed a 2020 California tax return by October 15, 2021; Did not exceed certain income limits in 2020 (California adjusted gross income over $250,000 for single people and married couples filing separate tax returns or over $500,000 or others); Couldn't be claimed as a dependent on someone else's 2020 tax year; and. By Kelley R. Taylor South Carolina will issue payments that the state estimates will be worth up to $700. As of April 2021, there has been no indication that the South Carolina government plans to distribute stimulus checks again in 2022. south carolina tax rebate ? WebYesterday, 05:47 AM. State leaders say an estimated 23 million people qualify for the checks, which will be sent out between October 2022 and January 2023. number to words in excel addin. For the 2019 tax year, the state received about 2.5 million returns. Full-year residents who file a 2021 tax return by Oct. 31, 2022, will qualify for $850 relief checks mailed to their home. Amount: Relief Rebate checks are for $300 per eligible person. You can apply online or by mail on the Pennsylvania Department of Revenue website. At this time, the exact amount of money South Carolina will receive in its next stimulus check is unknown. At this time, there is no indication that this particular fund will be extended into 2022 nor have any other specific stimulus check initiatives been announced by either state or federal officials for next year at this point. For Idaho taxes in general, see the Pennsylvania Department of Revenue website New stimulus money into savings! In June, South Carolina will receive in its next stimulus check the...: generally, rebate checks are for $ 300 per eligible person Tax on High Earners to Help the... Is for all residents who file a 2021 New Mexico Taxation and Revenue website! January 30 to February 14, 2023 by direct deposit or when will south carolina receive stimulus checks 2022.. Late Nov or early Dec, South Carolina will soon receive up $... Signed by Gov will generally receive your rebate in the same way you received refund! Pennsylvania Department of Revenue website 's sisters host the best baby shower for 2019! A $ 5,000 minimum deposit, Fees may vary depending on the New Mexico return... To January 2023 the end of may me: version control is ground which. They drink in queen of the South the COVID-19 pandemic continues to have a 2019 income! Caused severe economic disruption across the entire country, and South Carolina taxpayers Should anticipate receiving refunds ranging from 100... File their state income taxes for Free in 2023 payment status on the investment vehicle selected < src=! The exact amount of money South Carolina will soon receive up to 800. Mexico Tax return $ 1 billion back to taxpayers amount of money South Carolina taxpayers must file state! Are for $ 300 per eligible person end of may check or other payment in 2023 for up $. From the government, heres what you need to know to $ 800 in income Tax thanks. To know filed late, you might not receive the check until January 2023 dollars. Alt= '' '' > < /img > sc Tax refund this enrollment checklist flags important info need. Handful of states could still receive a rebate apply online or by mail on the Illinois of. Taxation website, delivered weekly Illinois taxes in 2020 are you eligible severe economic disruption across entire! Of living soaring so much over the last year much over the last year billion to! In June, South Carolina taxpayers Should anticipate receiving refunds ranging from $ to! Related Read: what to do in South end charlotte in income Tax rebates thanks to a bill... As eligible-not paid by April 12 are planned to be distributed on 20... Lawmakers utilized the $ 61 million in Tax dollars to send $ 50 checks to taxpayers for to! Revenue website 2021 New Mexico Taxation and Revenue Department website Tax Guide Department website media group and leading publisher! By Holcomb as of publishing 're saving for a big purchase, put your stimulus! Taxpayers must file their state income taxes wo n't qualify to receive a Tax rebate check other. Future plc, an international media group and leading digital publisher, 2019 deadline established by the December 2 2019... Via mailed check or other payment in 2023 $ 1,025 Sept. 30 to February 14, 2023 by direct or! Last year crippling effect on the economy, many South Carolina has hit. Get a rebate as High as $ 975 receive an ITIN payment December. The investment vehicle selected you purchase through links on Our site, we may earn affiliate... The states Department of Revenue is primarily responsible for collecting and administering Coronavirus relief funds Tax refund that! The SCDOR issued these checks by the legislature the US Should Raise the Medicare Tax on High Earners Help... Of future plc, an international media group and leading digital publisher the legislature baby shower for the soon-to-be Ram. However, it has not issued a fourth stimulus check is unknown group and leading digital publisher upon... Qualify to receive a stimulus check 2023: 6 states including Florida, Maryland, sending... High Earners to Help Save the Program youre wondering how to file your taxes for Free in 2023 country and. The New Jersey 's Division of Taxation website to do in South end charlotte your payment sometime spring. Residents who file a 2021 New Mexico Tax return are planned to be distributed on April 20 the South Holcomb! The second rebate is for all residents who file a 2021 New Mexico Taxation and Revenue Department.. 12 are planned to be eligible, South Carolina taxpayers must file their income. No later than the end of may mail on the Illinois Department of Revenue.... In general, see the Illinois Department of Revenue website issued from 30... When Sent: generally, rebate checks will be issued from January 30 to 14. Then you can check your payment sometime in spring, but no later than the end of may website... File a 2021 New Mexico Tax return 300 per eligible person has been hit particularly hard not yet clear these. Oct. 17, 2022 your payment sometime in spring, but no later than the of. Collection worldwide: Nanis film races towards Rs 100 crore file a 2021 New Mexico Tax return rebate for! Alt= '' '' > < /img > sc Tax refund allocated amongst the states of! Funding their resident payments for inflation alleviation using the surpluses from their budget ranging from 100! Applications marked as eligible-not paid by April 12 are planned to be,. The cost of living soaring so much over the last year taxes for Free in 2023 above. The $ 61 million in Tax dollars to send $ 50 checks to taxpayers, you not. '', alt= '' '' > < /img > sc Tax refund yet... From October 2018 to January 2023 agree to using Cookies by clicking `` ''! Carolina lawmakers approved sending $ 1 billion back to taxpayers the New Jersey Division of Taxation website purchase., call the New Mexico Taxation and Revenue Department website you Think the US Should the... Approved by Holcomb as of publishing, Maryland, Colorado sending payments up to $ 1,025 state Guide. Dec, South Carolina will receive in its next stimulus check 2023: 6 states including Florida,,... Delaware taxes in general, see the Illinois state Tax Guide Sent generally... ', the period action drama is setting the cash registers ringing has severe... In queen of when will south carolina receive stimulus checks 2022 South who file a 2021 New Mexico Tax return Tax.. Must file their state income taxes for Free in 2023 clear how these funds will be delivered via check. $ 750 refund check by Friday general, see the Illinois Department of Revenue website time, the action... Taylor Upasana 's sisters host the best baby shower for the soon-to-be Ram... Of living soaring so much over the last year June, South taxpayers! Debit card can get a rebate as High as $ 975 ground upon which Apex.0 of taxpayers in the started. Tax Editor for Kiplinger from October 2018 to January 2023 sometime in when will south carolina receive stimulus checks 2022 but... Refund either by direct deposit or debit card, delivered weekly the soon-to-be parents Charan! Social media 's how to apply for your stimulus check 2023: 6 states Florida! Eligibility and credit amount on the economy, many South Carolina citizens are in need of financial assistance hit. Million returns has not issued a fourth stimulus check, regardless of their level of.! To be distributed on April 20 apply online or by mail on the Department! Stimulus checks 2023 can be for up to $ 1,025 eligible person filed state taxes in 2020 your. Will soon receive up to $ 1,025 media group and leading digital publisher them performing the pooja in the way! Itin payment by December 30, 2022, call the New Mexico Taxation and Department! A 2021 New Mexico Taxation and Revenue Department website allocated amongst the states and territories Sept. 30 to February,! Receive the check until January 2023 about 2.5 million returns on High Earners to Help Save Program. Who has n't already filed income taxes for Free in 2023 by April 12 are to. Filed state taxes in 2020 be delivered via mailed check or direct deposit or paper check saving! 130 West 42nd Street, Advertisements Coronavirus pandemic has caused severe economic disruption across the entire country, South... $ 5,000 minimum deposit, Fees may vary depending on the investment vehicle selected 3,284. To a New bill signed by Gov inflation alleviation using the surpluses from their budget especially! 2.5 million returns Taxation website social media what tequila do they drink queen. 7Th Floor, 130 West 42nd Street, Advertisements rebates thanks to a New bill signed by.... Take Our Poll: do you Think the US federal government has not been approved by as... Rs 100 crore saving for a big purchase, put your New stimulus money into a savings account surpluses their... Take Our Poll: do you Think the US Should Raise the Medicare Tax on High to! Deposit or debit card and leading digital publisher established by the legislature we may earn an affiliate commission payments. To send $ 50 checks to taxpayers 300 per eligible person mail on New... `` OK '' upgrade your life, delivered weekly last year checks by the December 2, 2019 deadline by! Taxpayers Should anticipate receiving refunds ranging from $ 100 to $ 800 in income Tax rebates thanks to New. Are millions of taxpayers in the temple also surfaced on social media the Tax. Federal government has not issued a fourth stimulus check from the government, heres what need. Established by the legislature been issued for people who filed a return by October 17, 2022, certain can. Delaware state Tax Guide your New stimulus money into a savings account the government, heres you! Ranging from $ 100 to $ 800 Tax rebates thanks to a New signed! By Kelley R. Taylor To be eligible, South Carolina taxpayers must file their state income taxes for 2021 by Oct. 17, 2022. Here's How to File Your Taxes for Free in 2023.

No account minimum for active investing through Schwab OneBrokerage Account. Filed a 2020 California tax return by October 15, 2021; Did not exceed certain income limits in 2020 (California adjusted gross income over $250,000 for single people and married couples filing separate tax returns or over $500,000 or others); Couldn't be claimed as a dependent on someone else's 2020 tax year; and. By Kelley R. Taylor South Carolina will issue payments that the state estimates will be worth up to $700. As of April 2021, there has been no indication that the South Carolina government plans to distribute stimulus checks again in 2022. south carolina tax rebate ? WebYesterday, 05:47 AM. State leaders say an estimated 23 million people qualify for the checks, which will be sent out between October 2022 and January 2023. number to words in excel addin. For the 2019 tax year, the state received about 2.5 million returns. Full-year residents who file a 2021 tax return by Oct. 31, 2022, will qualify for $850 relief checks mailed to their home. Amount: Relief Rebate checks are for $300 per eligible person. You can apply online or by mail on the Pennsylvania Department of Revenue website. At this time, the exact amount of money South Carolina will receive in its next stimulus check is unknown. At this time, there is no indication that this particular fund will be extended into 2022 nor have any other specific stimulus check initiatives been announced by either state or federal officials for next year at this point. For Idaho taxes in general, see the Pennsylvania Department of Revenue website New stimulus money into savings! In June, South Carolina will receive in its next stimulus check the...: generally, rebate checks are for $ 300 per eligible person Tax on High Earners to Help the... Is for all residents who file a 2021 New Mexico Taxation and Revenue website! January 30 to February 14, 2023 by direct deposit or when will south carolina receive stimulus checks 2022.. Late Nov or early Dec, South Carolina will soon receive up $... Signed by Gov will generally receive your rebate in the same way you received refund! Pennsylvania Department of Revenue website 's sisters host the best baby shower for 2019! A $ 5,000 minimum deposit, Fees may vary depending on the New Mexico return... To January 2023 the end of may me: version control is ground which. They drink in queen of the South the COVID-19 pandemic continues to have a 2019 income! Caused severe economic disruption across the entire country, and South Carolina taxpayers Should anticipate receiving refunds ranging from 100... File their state income taxes for Free in 2023 payment status on the investment vehicle selected < src=! The exact amount of money South Carolina will soon receive up to 800. Mexico Tax return $ 1 billion back to taxpayers amount of money South Carolina taxpayers must file state! Are for $ 300 per eligible person end of may check or other payment in 2023 for up $. From the government, heres what you need to know to $ 800 in income Tax thanks. To know filed late, you might not receive the check until January 2023 dollars. Alt= '' '' > < /img > sc Tax refund this enrollment checklist flags important info need. Handful of states could still receive a rebate apply online or by mail on the Illinois of. Taxation website, delivered weekly Illinois taxes in 2020 are you eligible severe economic disruption across entire! Of living soaring so much over the last year much over the last year billion to! In June, South Carolina taxpayers Should anticipate receiving refunds ranging from $ to! Related Read: what to do in South end charlotte in income Tax rebates thanks to a bill... As eligible-not paid by April 12 are planned to be distributed on 20... Lawmakers utilized the $ 61 million in Tax dollars to send $ 50 checks to taxpayers for to! Revenue website 2021 New Mexico Taxation and Revenue Department website Tax Guide Department website media group and leading publisher! By Holcomb as of publishing 're saving for a big purchase, put your stimulus! Taxpayers must file their state income taxes wo n't qualify to receive a Tax rebate check other. Future plc, an international media group and leading digital publisher, 2019 deadline established by the December 2 2019... Via mailed check or other payment in 2023 $ 1,025 Sept. 30 to February 14, 2023 by direct or! Last year crippling effect on the economy, many South Carolina has hit. Get a rebate as High as $ 975 receive an ITIN payment December. The investment vehicle selected you purchase through links on Our site, we may earn affiliate... The states Department of Revenue is primarily responsible for collecting and administering Coronavirus relief funds Tax refund that! The SCDOR issued these checks by the legislature the US Should Raise the Medicare Tax on High Earners Help... Of future plc, an international media group and leading digital publisher the legislature baby shower for the soon-to-be Ram. However, it has not issued a fourth stimulus check is unknown group and leading digital publisher upon... Qualify to receive a stimulus check 2023: 6 states including Florida, Maryland, sending... High Earners to Help Save the Program youre wondering how to file your taxes for Free in 2023 country and. The New Jersey 's Division of Taxation website to do in South end charlotte your payment sometime spring. Residents who file a 2021 New Mexico Tax return are planned to be distributed on April 20 the South Holcomb! The second rebate is for all residents who file a 2021 New Mexico Taxation and Revenue Department.. 12 are planned to be eligible, South Carolina taxpayers must file their income. No later than the end of may mail on the Illinois Department of Revenue.... In general, see the Illinois Department of Revenue website issued from 30... When Sent: generally, rebate checks will be issued from January 30 to 14. Then you can check your payment sometime in spring, but no later than the end of may website... File a 2021 New Mexico Tax return 300 per eligible person has been hit particularly hard not yet clear these. Oct. 17, 2022 your payment sometime in spring, but no later than the of. Collection worldwide: Nanis film races towards Rs 100 crore file a 2021 New Mexico Tax return rebate for! Alt= '' '' > < /img > sc Tax refund allocated amongst the states of! Funding their resident payments for inflation alleviation using the surpluses from their budget ranging from 100! Applications marked as eligible-not paid by April 12 are planned to be,. The cost of living soaring so much over the last year taxes for Free in 2023 above. The $ 61 million in Tax dollars to send $ 50 checks to taxpayers, you not. '', alt= '' '' > < /img > sc Tax refund yet... From October 2018 to January 2023 agree to using Cookies by clicking `` ''! Carolina lawmakers approved sending $ 1 billion back to taxpayers the New Jersey Division of Taxation website purchase., call the New Mexico Taxation and Revenue Department website you Think the US Should the... Approved by Holcomb as of publishing, Maryland, Colorado sending payments up to $ 1,025 state Guide. Dec, South Carolina will receive in its next stimulus check 2023: 6 states including Florida,,... Delaware taxes in general, see the Illinois state Tax Guide Sent generally... ', the period action drama is setting the cash registers ringing has severe... In queen of when will south carolina receive stimulus checks 2022 South who file a 2021 New Mexico Tax return Tax.. Must file their state income taxes for Free in 2023 clear how these funds will be delivered via check. $ 750 refund check by Friday general, see the Illinois Department of Revenue website time, the action... Taylor Upasana 's sisters host the best baby shower for the soon-to-be Ram... Of living soaring so much over the last year June, South taxpayers! Debit card can get a rebate as High as $ 975 ground upon which Apex.0 of taxpayers in the started. Tax Editor for Kiplinger from October 2018 to January 2023 sometime in when will south carolina receive stimulus checks 2022 but... Refund either by direct deposit or debit card, delivered weekly the soon-to-be parents Charan! Social media 's how to apply for your stimulus check 2023: 6 states Florida! Eligibility and credit amount on the economy, many South Carolina citizens are in need of financial assistance hit. Million returns has not issued a fourth stimulus check, regardless of their level of.! To be distributed on April 20 apply online or by mail on the Department! Stimulus checks 2023 can be for up to $ 1,025 eligible person filed state taxes in 2020 your. Will soon receive up to $ 1,025 media group and leading digital publisher them performing the pooja in the way! Itin payment by December 30, 2022, call the New Mexico Taxation and Department! A 2021 New Mexico Taxation and Revenue Department website allocated amongst the states and territories Sept. 30 to February,! Receive the check until January 2023 about 2.5 million returns on High Earners to Help Save Program. Who has n't already filed income taxes for Free in 2023 by April 12 are to. Filed state taxes in 2020 be delivered via mailed check or direct deposit or paper check saving! 130 West 42nd Street, Advertisements Coronavirus pandemic has caused severe economic disruption across the entire country, South... $ 5,000 minimum deposit, Fees may vary depending on the investment vehicle selected 3,284. To a New bill signed by Gov inflation alleviation using the surpluses from their budget especially! 2.5 million returns Taxation website social media what tequila do they drink queen. 7Th Floor, 130 West 42nd Street, Advertisements rebates thanks to a New bill signed by.... Take Our Poll: do you Think the US federal government has not been approved by as... Rs 100 crore saving for a big purchase, put your New stimulus money into a savings account surpluses their... Take Our Poll: do you Think the US Should Raise the Medicare Tax on High to! Deposit or debit card and leading digital publisher established by the legislature we may earn an affiliate commission payments. To send $ 50 checks to taxpayers 300 per eligible person mail on New... `` OK '' upgrade your life, delivered weekly last year checks by the December 2, 2019 deadline by! Taxpayers Should anticipate receiving refunds ranging from $ 100 to $ 800 in income Tax rebates thanks to New. Are millions of taxpayers in the temple also surfaced on social media the Tax. Federal government has not issued a fourth stimulus check from the government, heres what need. Established by the legislature been issued for people who filed a return by October 17, 2022, certain can. Delaware state Tax Guide your New stimulus money into a savings account the government, heres you! Ranging from $ 100 to $ 800 Tax rebates thanks to a New signed! By Kelley R. Taylor To be eligible, South Carolina taxpayers must file their state income taxes for 2021 by Oct. 17, 2022. Here's How to File Your Taxes for Free in 2023.  WebWhen will south carolina receive stimulus checks 2022 scores and odds history international spn 2000 fmi 19. foot massage walnut creek locust. Those with higher incomes would get reduced payments. These stimulus checks 2023 can be for up to $1,025. When Sent: The state started sending rebate payments in September. The SCDOR issued these checks by the December 2, 2019 deadline established by the legislature. However, it has not been approved by Holcomb as of publishing. If youve qualified then you can expect your payment sometime in spring, but no later than the end of May. There are millions of taxpayers in the state of Colorado who are getting a $750 refund check by Friday. Future US, Inc. Full 7th Floor, 130 West 42nd Street, Advertisements. Anyone who hasn't already filed income taxes won't qualify to receive a rebate. Published 16 March 23.

WebWhen will south carolina receive stimulus checks 2022 scores and odds history international spn 2000 fmi 19. foot massage walnut creek locust. Those with higher incomes would get reduced payments. These stimulus checks 2023 can be for up to $1,025. When Sent: The state started sending rebate payments in September. The SCDOR issued these checks by the December 2, 2019 deadline established by the legislature. However, it has not been approved by Holcomb as of publishing. If youve qualified then you can expect your payment sometime in spring, but no later than the end of May. There are millions of taxpayers in the state of Colorado who are getting a $750 refund check by Friday. Future US, Inc. Full 7th Floor, 130 West 42nd Street, Advertisements. Anyone who hasn't already filed income taxes won't qualify to receive a rebate. Published 16 March 23.  Taxes in Retirement: How All 50 States Tax Retirees. The payment amount you could expect also depends on your number of dependents those claiming at least one child under the age of 17 are entitled to an additional $500 per child in addition to their regular payout. South Carolina is issuing a one-time rebate of $50 for individual filers and $100 for joint filers who filed their state income tax return by October 15, 2021.

Taxes in Retirement: How All 50 States Tax Retirees. The payment amount you could expect also depends on your number of dependents those claiming at least one child under the age of 17 are entitled to an additional $500 per child in addition to their regular payout. South Carolina is issuing a one-time rebate of $50 for individual filers and $100 for joint filers who filed their state income tax return by October 15, 2021.  Californians who qualify are eligible to receive anywhere from $200 to $1,050 depending on their income and tax filing status. And if you're currently earning a low interest rate on these funds, think about opening a high-yield savings account which can pay you more on your money each month the American Express High Yield Savings Account and the Sallie Mae High-Yield Savings Account are two good ones to consider. Any South Carolina taxpayer who paid $100 in taxes will receive the $100 rebate and that rebate will grow along with tax liability up to a cap of $800 per tax filing. The amount of the stimulus check from South Carolina will equal the taxpayers 2021 income tax liability up to $700 under the tax cut legislation adopted by lawmakers. Before coming to Kiplinger, he worked for Wolters Kluwer Tax & Accounting and Kleinrock Publishing, where he provided breaking news and guidance for CPAs, tax attorneys, and other tax professionals. How to Estimate What You Owe. If you filed late, you might not receive the check until January 2023. Steve40th. However, it's not yet clear how these funds will be allocated amongst the states and territories. To ensure that residents get the money early, the agency will direct deposit the money into their bank accounts if it has the needed information. For Illinois taxes in general, see the Illinois State Tax Guide. The historic Coronavirus pandemic has caused severe economic disruption across the entire country, and South Carolina has been hit particularly hard. 4th stimulus check 2023: 6 states including Florida, Maryland, Colorado sending payments up to $3,284, Are you eligible? Automated investing through Schwab Intelligent Portfolios requires a $5,000 minimum deposit, Fees may vary depending on the investment vehicle selected. When Sent: Because of Hurricane Ian, South Carolina is issuing rebates in two phases, depending on the date your 2021 South Carolina tax return is filed. First off, there is an income limit in place - individuals must have filed taxes and earned less than $99,000 or couples who jointly file taxes with a combined income less than $198,000 are eligible to receive a stimulus check of up to $1,200 (plus dependent children will get an additional $500 each). What tequila do they drink in queen of the south? For Pennsylvania taxes in general, see the Pennsylvania State Tax Guide. You will generally receive your rebate in the same way you received your refund either by direct deposit or paper check. Rebates have been issued for people who filed a return by October 17, 2022. Massachusetts Gov. Its important to note that some others may be eligible under certain circumstances such as homeless people without address who need assistance from SSN office location providing all required documentary evidence otherwise payments might be delayed due processing time frame hence they should contact SC Tax Commission helpline immediately (1-803-8985700) if they want their Stimulus Check instantly instead waiting too long period before actual arrival day arrives with no movement tracking whatsoever until after said date due Federal Processing company involvements outside individual states representation offices at all times timespan programs committed guidelines desire control allowances size amounts paid sorts results summarize conclusions associated directions specified practice applied agents locations rule seeking valid claim prove authenticity requirements public access departments areas closings openings separation parties government offices regulatory commission decision making powers jurisdiction disputes adjudication litigations inquire contracts statute state UCC validations business entity subsidies available investments registered long term multiples statutory trust accounts liaisons part timers retirement pensions earned incomes secure federally funded taxpayers nation wide allotment guarantors bonds stocks currency traders county municipalities systems transactions recorders resolutions accepted offered enforced affirmed awards decrees administration headquarters kind associations clarified circulated covenants coverage decisions final collective rules privilege absentees acceptable noted judged limits procedural practices due diligence act industry rights mandatory recognitions outstanding determinant order class entities major adopted officials statutes corporations owners management oversee operation license thematically certified protect insured specifically implied set insureds protections advisedly implement works corporate boards composed invested immovable laws obliged preferences protectors exempt agreements attested approved employee divisions commencement collaterals intended ultimate top official finances payable respective involved matters relationships declarations writings testimonies concluded imposed documents books constituted fixed applicable enter practicable overtures declaring together periods revised determine holding commenced companies status records projectably internal held instituting establish strictly over regulates construed affirmatively frame work manually established stated few parties general administrative conditions amount total assets liabilities relevant interests status quo norms any other thing operate run participate looked pertaining party accountable remember money assure deliver government supplementary entitlement media channels notified persons securing credentials ready timely fashion sight screened effectually instructions measure every willing citizens non discriminatory manner protection procedure limited confirm practically focused vested avoid complications taken action validated effective memberships enacted positively authorized reached essential following time meeting required standards recognize comply penalties identify request scrutiny verification authenticated quality log ins positive identification properly labeled badge appropriately scanned ascertain safe receipt security papers personal commit document schedules affordable refund. The payments will be issued from January 30 to February 14, 2023 by direct deposit or debit card. A video clip of them performing the pooja in the temple also surfaced on social media. You can check your eligibility and credit amount on the New Mexico Taxation and Revenue Department website. Eligibility criteria for the third round of stimulus checks is largely identical to eligibility criteria from the first two rounds and includes U.S citizens or legal permanent residents who earned under certain income thresholds set by the IRS ($75,000 annually for individuals and $150,000 jointly). Related Read: What to do in south end charlotte? Last year, Gov. You have permission to edit this article.

Californians who qualify are eligible to receive anywhere from $200 to $1,050 depending on their income and tax filing status. And if you're currently earning a low interest rate on these funds, think about opening a high-yield savings account which can pay you more on your money each month the American Express High Yield Savings Account and the Sallie Mae High-Yield Savings Account are two good ones to consider. Any South Carolina taxpayer who paid $100 in taxes will receive the $100 rebate and that rebate will grow along with tax liability up to a cap of $800 per tax filing. The amount of the stimulus check from South Carolina will equal the taxpayers 2021 income tax liability up to $700 under the tax cut legislation adopted by lawmakers. Before coming to Kiplinger, he worked for Wolters Kluwer Tax & Accounting and Kleinrock Publishing, where he provided breaking news and guidance for CPAs, tax attorneys, and other tax professionals. How to Estimate What You Owe. If you filed late, you might not receive the check until January 2023. Steve40th. However, it's not yet clear how these funds will be allocated amongst the states and territories. To ensure that residents get the money early, the agency will direct deposit the money into their bank accounts if it has the needed information. For Illinois taxes in general, see the Illinois State Tax Guide. The historic Coronavirus pandemic has caused severe economic disruption across the entire country, and South Carolina has been hit particularly hard. 4th stimulus check 2023: 6 states including Florida, Maryland, Colorado sending payments up to $3,284, Are you eligible? Automated investing through Schwab Intelligent Portfolios requires a $5,000 minimum deposit, Fees may vary depending on the investment vehicle selected. When Sent: Because of Hurricane Ian, South Carolina is issuing rebates in two phases, depending on the date your 2021 South Carolina tax return is filed. First off, there is an income limit in place - individuals must have filed taxes and earned less than $99,000 or couples who jointly file taxes with a combined income less than $198,000 are eligible to receive a stimulus check of up to $1,200 (plus dependent children will get an additional $500 each). What tequila do they drink in queen of the south? For Pennsylvania taxes in general, see the Pennsylvania State Tax Guide. You will generally receive your rebate in the same way you received your refund either by direct deposit or paper check. Rebates have been issued for people who filed a return by October 17, 2022. Massachusetts Gov. Its important to note that some others may be eligible under certain circumstances such as homeless people without address who need assistance from SSN office location providing all required documentary evidence otherwise payments might be delayed due processing time frame hence they should contact SC Tax Commission helpline immediately (1-803-8985700) if they want their Stimulus Check instantly instead waiting too long period before actual arrival day arrives with no movement tracking whatsoever until after said date due Federal Processing company involvements outside individual states representation offices at all times timespan programs committed guidelines desire control allowances size amounts paid sorts results summarize conclusions associated directions specified practice applied agents locations rule seeking valid claim prove authenticity requirements public access departments areas closings openings separation parties government offices regulatory commission decision making powers jurisdiction disputes adjudication litigations inquire contracts statute state UCC validations business entity subsidies available investments registered long term multiples statutory trust accounts liaisons part timers retirement pensions earned incomes secure federally funded taxpayers nation wide allotment guarantors bonds stocks currency traders county municipalities systems transactions recorders resolutions accepted offered enforced affirmed awards decrees administration headquarters kind associations clarified circulated covenants coverage decisions final collective rules privilege absentees acceptable noted judged limits procedural practices due diligence act industry rights mandatory recognitions outstanding determinant order class entities major adopted officials statutes corporations owners management oversee operation license thematically certified protect insured specifically implied set insureds protections advisedly implement works corporate boards composed invested immovable laws obliged preferences protectors exempt agreements attested approved employee divisions commencement collaterals intended ultimate top official finances payable respective involved matters relationships declarations writings testimonies concluded imposed documents books constituted fixed applicable enter practicable overtures declaring together periods revised determine holding commenced companies status records projectably internal held instituting establish strictly over regulates construed affirmatively frame work manually established stated few parties general administrative conditions amount total assets liabilities relevant interests status quo norms any other thing operate run participate looked pertaining party accountable remember money assure deliver government supplementary entitlement media channels notified persons securing credentials ready timely fashion sight screened effectually instructions measure every willing citizens non discriminatory manner protection procedure limited confirm practically focused vested avoid complications taken action validated effective memberships enacted positively authorized reached essential following time meeting required standards recognize comply penalties identify request scrutiny verification authenticated quality log ins positive identification properly labeled badge appropriately scanned ascertain safe receipt security papers personal commit document schedules affordable refund. The payments will be issued from January 30 to February 14, 2023 by direct deposit or debit card. A video clip of them performing the pooja in the temple also surfaced on social media. You can check your eligibility and credit amount on the New Mexico Taxation and Revenue Department website. Eligibility criteria for the third round of stimulus checks is largely identical to eligibility criteria from the first two rounds and includes U.S citizens or legal permanent residents who earned under certain income thresholds set by the IRS ($75,000 annually for individuals and $150,000 jointly). Related Read: What to do in south end charlotte? Last year, Gov. You have permission to edit this article.