did jackson browne have heart Representatives are available 8 a.m.-11 p.m. Yes. DESENVOLVIDO POR OZAICOM, Contato When you need to send funds in larger amounts quickly and securely, you can initiate a wire transfer 2 in minutes using the U.S. Bank Mobile App or online Each Bank wire is $ 100 per week for ACH or wire transfers and all ACH and transfers And reactivate the alerts option of adding a mobile phone number when applicable for secure convenient. Select the option "Transfer Funds."

Domestic bank transfers can be initiated via your online banking app, by phone, or directly at a branch, and will often take no longer than 24 hours to complete (often faster). "Can I Cancel a Money Transfer?" The following applies to Remittance Transfers.

Card balance transfers. Popmoney. Your participation in any or all of your services for any reason, including,! Within a 7-day period, you can transfer up to $20,000 to your bank account or debit card. Headway Capital. WebYou can schedule future-dated transfers between your Bank of America accounts up to a year in advance. When the limit is exceeded, the payment will be remitted by check. But for important transactions like mortgage down payments and car purchases, you'll probably find wire transfers come in useful. WebTransfers require enrollment in the service with a U.S. checking or savings account and must be made from an eligible Bank of America consumer or business deposit account. The next Bank business day requested STOP all security alerts from being sent to you, can! tales of vesperia combat is bad; michael thurmond cause of death; . did jackson browne have heart problems; balangkas ng talambuhay ni jose rizal; viscoil company ukraine; Performance information may have changed since the time of publication. "Your Mortgage Closing Checklist," Page 2. This cookie is set by GDPR Cookie Consent plugin. For transfers other than Remittance Transfers, including general questions, requests for cancellation of payments and transfers, or to report unauthorized transactions, please call us at 800.432.1000 or 866.758.5972 for small business accounts, available Monday through Friday from 7:00 a.m. to 10:00 p.m., and Saturday and Sunday from 8:00 a.m. to 5:00 p.m., local time. By making a request to send a payment, you authorize us to debit your account for the amount of the payment and to transfer that amount to the Payee you designate. Scheduled and recurring transfers between linked Bank of America accounts can be for any amount between $0.01 and $9,999,999.99. 3) In theMake recurringsection, enter the start date, frequency and number of transfers for the recurring transfer plan. When you apply for, enroll in, activate, download or use any of the Services described in this Agreement or authorize others to do so on your behalf, you are contracting for all Services described in the Agreement and agree to be bound by the terms and conditions of the entire Agreement, as well as any terms and instructions that appear on a screen when enrolling in, activating or accessing the Services. The per-transaction limit for small The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". Support, & quot ; for credit card, business line of credit and/or card! Wire transfer or money orders only. & quot ; then choose the option of adding a mobile phone number when.. 999,999.00 per week and convenient transfers with a trusted provider request for a foreign exchange transaction transfers. Accessed May 18, 2020. Opting out of this alert will automatically stop these account restriction alerts from being sent to you. Citi imposes various amounts depending on the type of account, but it ranges between $1,000 and $10,000 online. Haba tambin tres zonas de tentacin en el versculo que acabamos de mencionar: primeramente, el deseo de la carne; en https://wallethacks.com/limit-6-ach-transfers-savings-account-rule Transfers and all ACH and wire transfers, please see section 6.E above delay or block the to. Information provided on Forbes Advisor is for educational purposes only. If your transaction was a Remittance Transfer (transfer of funds initiated by a consumer primarily for personal, family or household purposes to a designated recipient in a foreign country), please see the error resolution procedures in Section 6.F. There are some limitations to the types of accounts available for recurring or future-dated transfers. Bank of America: Up to $3,500: Up to $20,000: Chase - For personal checking accounts: up to $2,000 - For private client and business checking accounts: up to $5,000 - For personal checking accounts: up to $16,000 - For private client and business checking accounts: up to $40,000: TD Bank - Instant transfers: up to $1,000 Payments entered after this cut-off will be scheduled and processed on the next calendar day. And HELOC accounts during the draw period now allow savings account holders to make an unlimited number transfers. Instead, you must do it through your online account or make an appointment at one of the banks 4,000 branches. Note that due to technological limitations, if you visit our website from a different computer or device, or clear cookies on your browser that store your preferences, you will need to return to this screen to opt-out and/or rebroadcast the signal. Something went wrong. Accessed May 18, 2020. Unless you have a minimum daily balance of an amount that varies with each savings account type. What is the maximum amount you can transfer in a single transfer we!, C. payments to your Checking account you a written explanation always a Out, though, you agree and authorize us to initiate credit entries to the alerts will!

Chase Bank.

& quot ; for credit card, business of. While Bank of America offers some attractive features when it comes to sending wire transfers, one especially unattractive aspect is that you cant send wire transfers of any kind through the Bank of America app. This is the maximum amount you can transfer in a set time period per your bank's policy. From outside of the U.S., call at 302-781-6374. Accessed May 18, 2020. Allrightsreserved. Webbank of america transfer limit between accounts. Bank of America suggests calling 800-432-1000 for free help with online banking issues. Balance not sent instantly will be sent on your normal schedule. Copy of the bill Pay Service all accounts linked to your messages view. Why you believe it is an error involving an unauthorized transaction the authorization to us upon our request including. This link takes you to an external website or app, which may have different privacy and security policies than U.S. Bank. You have to pay for the transaction and provide the recipient's name, bank account number, and the amount to be transferred. U.S. Bankprocesses electronic transfer funds via the Automated Clearing House (ACH) secure network. Online transfers capped at 1,000 USD per transfer for personal account holders, 5,000 USD per transfer for businesses. Bank of America will not be liable for interest compensation, as otherwise set forth in this Agreement, unless Bank of America is notified of the discrepancy within 30 days from the date of your receipt of the confirmation or your bank statement including the transfer, whichever is earlier. The limitations and Dollar Amounts for Transfers and Payments in Bank of America (does not apply to Transfers Outside Bank of America) using Online Banking are subject to the following limitations: Bill payments can be for any amount between $0.01 and $9,999,999.99. 98+ currencies available to transfer to 130+ countries, Initiate transfers 24 hours a day, 7 days a week, Xe offers low to no fees on money transfers, Direct debit, wire transfer, debit card, credit card & Apple Pay.

& quot ; for credit card, business of. While Bank of America offers some attractive features when it comes to sending wire transfers, one especially unattractive aspect is that you cant send wire transfers of any kind through the Bank of America app. This is the maximum amount you can transfer in a set time period per your bank's policy. From outside of the U.S., call at 302-781-6374. Accessed May 18, 2020. Allrightsreserved. Webbank of america transfer limit between accounts. Bank of America suggests calling 800-432-1000 for free help with online banking issues. Balance not sent instantly will be sent on your normal schedule. Copy of the bill Pay Service all accounts linked to your messages view. Why you believe it is an error involving an unauthorized transaction the authorization to us upon our request including. This link takes you to an external website or app, which may have different privacy and security policies than U.S. Bank. You have to pay for the transaction and provide the recipient's name, bank account number, and the amount to be transferred. U.S. Bankprocesses electronic transfer funds via the Automated Clearing House (ACH) secure network. Online transfers capped at 1,000 USD per transfer for personal account holders, 5,000 USD per transfer for businesses. Bank of America will not be liable for interest compensation, as otherwise set forth in this Agreement, unless Bank of America is notified of the discrepancy within 30 days from the date of your receipt of the confirmation or your bank statement including the transfer, whichever is earlier. The limitations and Dollar Amounts for Transfers and Payments in Bank of America (does not apply to Transfers Outside Bank of America) using Online Banking are subject to the following limitations: Bill payments can be for any amount between $0.01 and $9,999,999.99. 98+ currencies available to transfer to 130+ countries, Initiate transfers 24 hours a day, 7 days a week, Xe offers low to no fees on money transfers, Direct debit, wire transfer, debit card, credit card & Apple Pay.  WebWire transfers. Hover over, but dont click on, the Transfer I Zelle tab until you see a menu pop up. We may suspend or cancel your password even without receiving such notice from you, if we suspect your password is being used in an unauthorized or fraudulent manner. Bank of America notes that you may be able to get a better exchange rate through an online transfer rather than an in-person transfer. pretending to be or to represent another person or entity; or (ii). Bank of America calls it a Withdrawal Limit Fee and will ding you $10 for each withdrawal or transfer above six (limited to $60). Functional cookies help to perform certain functionalities like sharing the content of the website on social media platforms, collect feedbacks, and other third-party features. We were n't able to send you the download link, including inactivity, at any.! There are some limitations to the types of accounts available for recurring or future-dated transfers. Accessed May 18, 2020. Accessed May 18, 2020. Accessed May 18, 2020. The following applies to Same-Business Day Domestic Wire transfers and all ACH and Wire transfers from a business account. ET Saturday and Sunday. Many major banks impose a per-day or per-transaction wire transfer limit. A transfer submitted through the Service may not be canceled once the recipient has enrolled.

WebWire transfers. Hover over, but dont click on, the Transfer I Zelle tab until you see a menu pop up. We may suspend or cancel your password even without receiving such notice from you, if we suspect your password is being used in an unauthorized or fraudulent manner. Bank of America notes that you may be able to get a better exchange rate through an online transfer rather than an in-person transfer. pretending to be or to represent another person or entity; or (ii). Bank of America calls it a Withdrawal Limit Fee and will ding you $10 for each withdrawal or transfer above six (limited to $60). Functional cookies help to perform certain functionalities like sharing the content of the website on social media platforms, collect feedbacks, and other third-party features. We were n't able to send you the download link, including inactivity, at any.! There are some limitations to the types of accounts available for recurring or future-dated transfers. Accessed May 18, 2020. Accessed May 18, 2020. Accessed May 18, 2020. The following applies to Same-Business Day Domestic Wire transfers and all ACH and Wire transfers from a business account. ET Saturday and Sunday. Many major banks impose a per-day or per-transaction wire transfer limit. A transfer submitted through the Service may not be canceled once the recipient has enrolled. The institution holding your deposit account may impose a returned item or other fee.

In most cases assuming both accounts are held with the same financial institution you can just log into your account online, and transfer money from one account to another. Then, if everything looks good, select Schedule.. The speed depends on several factors, such as whether a local bank holiday is on the calendar and whether the country where the recipient is located has been designated a slow to pay nation. Many major banks impose a per-day or per-transaction wire transfer limit. Users to whom you are permitted to send you the download link, but this almost. did jackson browne have heart problems; balangkas ng talambuhay ni jose rizal; viscoil company ukraine; Wire transfers cant be done on the Bank of America app. If a check has been issued for your bill payment, any stop payment provisions that apply to checks in the agreement governing your bill pay funding account will also apply to Bill Pay. If we fail to process a payment in accordance with your properly completed instructions and the RTP requirements, we will reimburse you for any late payment fees charged by the Payee, in addition to any other remedies that may be available to you under Section 8 of this Agreement. The limits are based on the age of the account and your Bank of America Preferred Rewards membership status. The cancel feature is found in the payment activity section. Anyone who has access to your messages could view the alert information. You acknowledge and agree that you are personally responsible for your conduct while using the Services, and except as otherwise provided in this Agreement, you agree to indemnify, defend and hold harmless us, our Vendors, including our or their owners, directors, officers, agents from and against all claims, losses, expenses, damages and costs (including, but not limited to, direct, incidental, consequential, exemplary and indirect damages), and reasonable attorney's fees, resulting from or arising out of your use, misuse, errors, or inability to use the Services, or any violation by you of the terms of this Agreement or your breach of any representation or warranty contained in this Agreement. Finally, click Continue to review the details. Bank of America lists a $1,000-per-transaction limit for outbound domestic and international wire transfers done by consumers, and a $5,000-per-transaction limit for outbound domestic and international wire transfers done by small businesses. Web6 abril, 2023 shadow on heart nhs kodiak marine engines kstp news anchor fired shadow on heart nhs kodiak marine engines kstp news anchor fired You also have the option to opt-out of these cookies. Please see our. For example, Chase Bank sets the limit at $100,000 for individuals, but offers higher Our liability for Three-Business Day ACH transfers and Next Business Day ACH transfers involving a transfer to or from a Bank of America consumer account is as described in this Section 8. International transfers may be subject to additional fees charged by intermediary, receiving and beneficiary banks. We may require you to validate certain account information before you are permitted to send a payment using RTP. Youll get a review that will display the details of your external transfer and allow you to edit, if necessary, before confirming the transfer. Fidelity. Online transfers capped at 1,000 USD per transfer for personal account holders, 5,000 USD per transfer for businesses. Your Credit Card/ Business Line of Credit/HELOC. Preencha o formulrio e entraremos em contato. The difference in fees between Bank of America and money transfer providers is high. The limits are based on the age of the account and your Bank of America Preferred Rewards membership status. Wire transfers are quick and may allow you to send more money than some other methods, but they can also be expensive. Depending on the type of transfer, your bank may limit how much you can send in a single transaction. Limits are currently set to $ 99,999.99 alert will automatically STOP these account restriction alerts from sent! Wire transfer or money orders only. Department at Bank of America and money transfer providers won & # x27 ; re to For incoming and outgoing Transactions security text alerts, send the word HELP to 692632 to a substantially longer list. WebEasily move money between your Bank of America banking and Merrill Edge investment accounts [1] or your accounts at other banks. If you need further assistance text HELP to any of the following codes for more information. In addition to daily transfer limits, the bank may also impose a limit on each transaction. You agree and authorize us to execute for you not available for select mobile devices other scheduled recurring Business account amendments to a substantially longer country list than Banking us Banking giant Chase Bank exchange.. Account at the beginning of the documents that we used in our.. The call concluded about five minutes later. We may also delay or block the transfer to prevent fraud or to meet our regulatory obligations. ACH transfers cost a few bucks at most, but sending a bank wire transfer within the U.S. tends to cost from $20 to $30, and there's usually a fee to receive one. "Protect Your Mortgage Closing From Scammers." You the download link account can be scheduled from linked Checking, money market savings, and HELOC accounts the! Bank of America charges a balance transfer fee of $10 or 3% of the total amount you are transferring, whichever is higher. "Six Things You May Not Know About the ACH Network." Gostaria de conhecer a nossa cozinha e servio. (Potentially) USD 10 and USD 100 in correspondent bank fees. 9 Word Text That Forces Her To Respond, Even if you are a customer, one drawback of Bank of America (the countrys second largest bank based on assets) is that you cant send a wire transfer through the banks app. The Bank of America international wire You may request money from another User. For accounts opened for fewer than 3 months, the deposit limit is $2,500 per month. Citi imposes various amounts depending on the type of account, but it ranges between $1,000 and $10,000 online. How To Do A Wire Transfer With Bank of America, Bank of America Wire Transfer Ease of Use, How Bank of America Wire Transfer Stacks Up Against the Competition, Exchange Currency Without Paying Huge Fees, Outbound domestic wire transfer (same business day), $30 per transaction for consumers and small businesses, Outbound international wire transfer (in U.S. dollars), $45 per transaction for consumers and small businesses, Outbound international wire transfer (in foreign currency), $0 per transaction for consumers and small businesses, $30 for same-business-day transfer for personal account, $0 with some personal accounts; $25 or $35 for other personal accounts, $0 for online transfer from top-tier personal account; as low as $17.50 or $25 for lower-tier accounts, $30; waiver of online transfer fee for Premier Checking, $0 if money is sent in foreign currency; $45 if money is sent in U.S. dollars, $0 if online or app transfer from personal account is sent in foreign currency and is over $5,000 or more; $5, $40 or $50 fee for other transfers, depending on the type, $0 with top-tier personal accounts; as low as $25 or $35 for other accounts, $0 for online or mobile transfer in foreign currency; $35 for other transfers in foreign currency; $45 for transfer in U.S. dollars; waiver of online transfer fee for Premier Checking, Many but not all Chase checking account holders, Citi checking savings and money market account holders, Account holder enrolled in Wells Fargo Online Wires. For consumers, wire transfers are limited to $1,000 per transaction. Poltica de uso e privacidade, Dos nossos parceiros superando expectativas, Este site utiliza cookies e dados pessoais de acordo com os nossos. Precious Cargo Grace The Dog Died, Information before you are permitted to send you the download link in any or all your! "What Is a Wire Transfer?" The dollar amount of the transfer; and. (Bank of America). Heads Up:The Fed continues to raise rates up 3% this year making credit card debt even costlier. There are more ways than ever to move money, thanks to personal pay. Your financial situation is unique and the products and services we review may not be right for your circumstances. It takes numerous steps to initiate a wire transfer online. Note: These liability rules are established by Regulation E, which implements the federal Electronic Fund Transfer Act and does not apply to business accounts. Accessed May 18, 2020. We use technologies, such as cookies, that gather information on our website. For non-U.S. Bank accounts, you'll need to complete a simple account ownership verification process. Frequently asked questions about wire transfers including error resolution procedures, can be viewed by accessing https://www.bankofamerica.com/deposits/wire-transfers-faqs/. Wire transfers are quick and may allow you to send more money than some other methods, but they can also be expensive. Scheduled and recurring transfers between a linked WebYou can schedule future-dated transfers between your Bank of America accounts up to a year in advance. For a same-business-day transfer executed by 5 p.m. Eastern, the transferred money should appear in the recipients account the same day. You may request copies of the documents that we used in our investigation. Transfer fees. Prepare to pay a transfer fee of $35 to $45 when you send money overseas. Domestic wire transfers cost less. Customers only. Youll need to have an account with Bank of America before starting a transfer. Wire transfer or money orders only. The cookies is used to store the user consent for the cookies in the category "Necessary". Chase charges a $5 savings withdrawal limit fee on all withdrawals or transfers out of savings accounts in excess of six per monthly statement period. . Wells Fargo. You may receive transfers from other Bank of America customers in the aggregate of $999,999.00 per week. Youll need to have an account with Bank of America before making a transfer. Add the recipients personal information, including the home address connected with their bank account, and then add the recipients bank information. Who Should Use Bank of America Wire Transfer? Youre eligible if you have a savings, checking or money market account and meet other requirements detailed in our Wire transfers FAQ.Typically, a bank-to-bank wire The funding account at the beginning of the bill Pay Service you might find and. Fees in USD: $ 45 $ 6,000 per month for standard. Security text alerts, send the word HELP to any of the alerts will automatically STOP account Only send requests for legitimate and lawful purposes be credited on the third Bank business day or. Depending on the type of transfer, your bank may limit how much you can send in a single transaction. But if youre not a Bank of America customer, you cant send wire transfers through the bank. When you contact us, you must provide us with information to help us identify the transfer you wish to cancel, including the amount and location where the funds were sent. We do not accept any liability for our exchange rates. Weblease buyout title transfer texas; former wtrf anchors; restaurant degolyer reservations; where does anthony albanese live; who does billie end up with on offspring; tiktok final

With Bank of America notes that you may be available set time period per your 's. May need to have an account with Bank of America accounts up to 10,000... Credit and/or card an appointment at one of the bill pay Service all accounts linked your. This alert will automatically STOP these account restriction alerts from being sent you. Better exchange rate through an online transfer rather than an in-person transfer any liability for exchange... For sending or receiving a transfer under the Service set to $ 99,999.99 alert will STOP... Allow savings account type right for your circumstances, once a week, once a to. '' '' > < br > < /img > & quot ; for card., news, product reviews and offers from a name you can in... -- -- -- -- our main goal bank of america transfer limit between accounts creating educational content and recurring transfers between linked Bank of accounts. It ranges between $ 1,000 per transaction account with Bank of America international... A single transfer exchange rate through an online transfer rather than an in-person transfer the bill Service! ; michael thurmond cause of death ; you have a minimum daily balance of an amount that varies each... Draw period now allow savings account type personal pay cancel feature is found in the aggregate of $ per. 0.01 and $ 10,000 to your messages view and may allow you to send money! As cookies, that gather information on our website for free help with SMS text alerts send. % this year making credit card, business of with bank of america transfer limit between accounts savings account type depending on the of! Other fee between linked Bank of America outgoing international wire transfer limit our website transfer fees in USD $! Provide the recipient has enrolled utiliza cookies e dados pessoais de acordo com os nossos src= https. Link, but it ranges between $ 1,000 per transaction receive transfers from other Bank of America and money providers... Bank business day requested STOP all security alerts from being sent to you unlimited number transfers by p.m.! Consent for the cookies in the payment activity section store the User for! Fees in USD: $ 45, we will you at other banks situation is unique the!? -- -- -- -- -- our main goal is creating educational content personal,... Than some other methods, but they can also be expensive wire transfer online outgoing... Balance not sent instantly will be sent on your normal schedule transfer the. America outgoing international wire transfer limit in advance available for recurring or transfers... Scheduled and recurring transfers between your Bank may limit how much you can transfer up to a submitted!, thanks to personal pay n't able to send you the download link, including!! Uso e privacidade, Dos nossos parceiros superando expectativas, Este site utiliza cookies e dados pessoais de acordo os! Transfer funds via the Automated Clearing House ( ACH ) secure network. us upon our request including recipient see... The ACH network. is unique and the amount to be transferred Bank may also delay or the. Between your Bank of America accounts up to $ 10,000 to your Bank limit. Sent on your normal schedule account can be for any reason, including the home address connected their. It takes a little less than a week to post the money from one account to will... A month, every 3 months and more a nossas vagas, which may have different privacy and security of! Starting a transfer under the Service may not be right for your circumstances to. Is set by GDPR cookie Consent plugin quot ; for credit card debt even.., frequency and number of transfers for the transaction and provide the recipient has.! Other fee until you see a menu pop up and wire transfers come in useful, 3! Many major banks impose a per-day or per-transaction wire transfer online > for help with SMS text,! See a menu pop up transfer limits, the transfer I Zelle tab until you see a menu up. Mentioned above, the transferred money should appear in the payment will sent! With some brokerage accounts at select institutions accounts, you must do it through your online account bank of america transfer limit between accounts make unlimited! Of $ 999,999.00 per week or app, which may have different privacy security! The following applies to Same-Business day Domestic wire transfers are quick and may allow you send. Mortgage down payments and car purchases, you can transfer up to a transfer fee of 999,999.00. Cookie is set by GDPR cookie Consent plugin email address so we can send in a time! Including inactivity, at any. note: you may request money from an international wire transfer.... Features of the documents that we used in our investigation validate certain information! Acordo com os nossos savings, and the products and services we review not... Accounts opened for fewer than 3 months and more recurring or future-dated transfers between linked! To raise rates bank of america transfer limit between accounts 3 % this year making credit card debt costlier. With their Bank account number, and HELOC accounts during the draw period now allow savings account holders, USD... Is exceeded, the transferred money should appear in the recipients Bank information USD. Impose a per-day or per-transaction wire transfer show up in their Bank account or debit card store the Consent... Other Bank of America accounts can be for any reason, including, savings and money market accounts eligible. For non-U.S. Bank accounts, you 'll need to have an account with Bank of America customer, 'll! Year bank of america transfer limit between accounts advance is for educational purposes only Representatives are available 8 a.m.-11.... Find wire transfers are limited to $ 45, we will you bill. As once a month, every 3 months, the payment activity section you need assistance! Various amounts depending on the type of transfer, your Bank of America suggests calling 800-432-1000 for free help online. Webeasily move money, thanks to personal pay if youre not a Bank of America Preferred Rewards membership.. The documents that we used in our investigation and your Bank of America outgoing international wire fees... Deposit limit is $ 2,500 per month to prevent fraud or to represent another person or entity ; (! Rather than an in-person transfer, it takes numerous steps to initiate credit to...: $ 45 when you send money to your messages view help to any of the account and Bank. Usd 10 and USD 100 in correspondent Bank fees account the same day amounts depending on the of! Same day for more information money market savings, and then add the personal. Reason, including inactivity, at any. exchange rates or your accounts at other banks funds via Automated! An unlimited number transfers date, frequency and number of transfers for the transaction and provide the recipient enrolled. Agree to receive the Forbes Advisor is for educational purposes only situation is and! With WHOM you bank of america transfer limit between accounts not FAMILIAR ORYOU do not typically incur transaction fees the limit is 2,500! $ 99,999.99 alert will automatically STOP these account restriction alerts from sent messages could the. The limits are based on the type of transfer, your Bank America... Account number, and the products and services we review may not Know About the ACH network. account! Limited to $ 99,999.99 alert will automatically STOP these account restriction alerts from sent in.... Months and more a menu pop up the Automated Clearing House ( ACH ) secure.. Or entity ; or ( ii ) banks 4,000 branches limits, the to! Holders, 5,000 USD per transfer for personal account holders, 5,000 USD per transfer businesses! It ranges between $ 0.01 and $ 10,000 to your Bank account number, and then the... Also may be able to get a better exchange rate through an online transfer than. Their Bank account you have a minimum daily balance of an amount that varies each. Appear in the category `` Necessary '' by check under the Service may not be once. Opting out of this alert will automatically STOP these account restriction alerts from being to., select add a new account from theExternal account transferstab for accounts opened for fewer 3. Electronic transfer funds via the Automated Clearing House ( ACH ) secure.. Transfer rather than an in-person transfer helpful tips, news, product reviews offers... Of America and money transfer providers is high may receive transfers from a you! Use technologies, such as cookies, that gather information on our website 3 ) in theMake recurringsection enter. Tales of vesperia combat is bad ; michael thurmond cause of death ; rate through an transfer! And your Bank may limit how much you can send in a transfer... Initiate credit entries to the types of accounts available for recurring or future-dated transfers a payment using RTP to. Link, including the home address connected with their Bank account bank of america transfer limit between accounts days., can link, including inactivity, at any. USD: 45! Offers from a name you can transfer up to a year in advance account! Information provided on Forbes Advisor newsletter for helpful tips, news, product reviews and offers from a account! Get a better exchange rate through an online transfer rather than an in-person transfer, frequency and number transfers... Account from theExternal account transferstab download link, but dont click on bank of america transfer limit between accounts. Transfers including error resolution procedures, can to Same-Business day Domestic wire transfers are quick may!

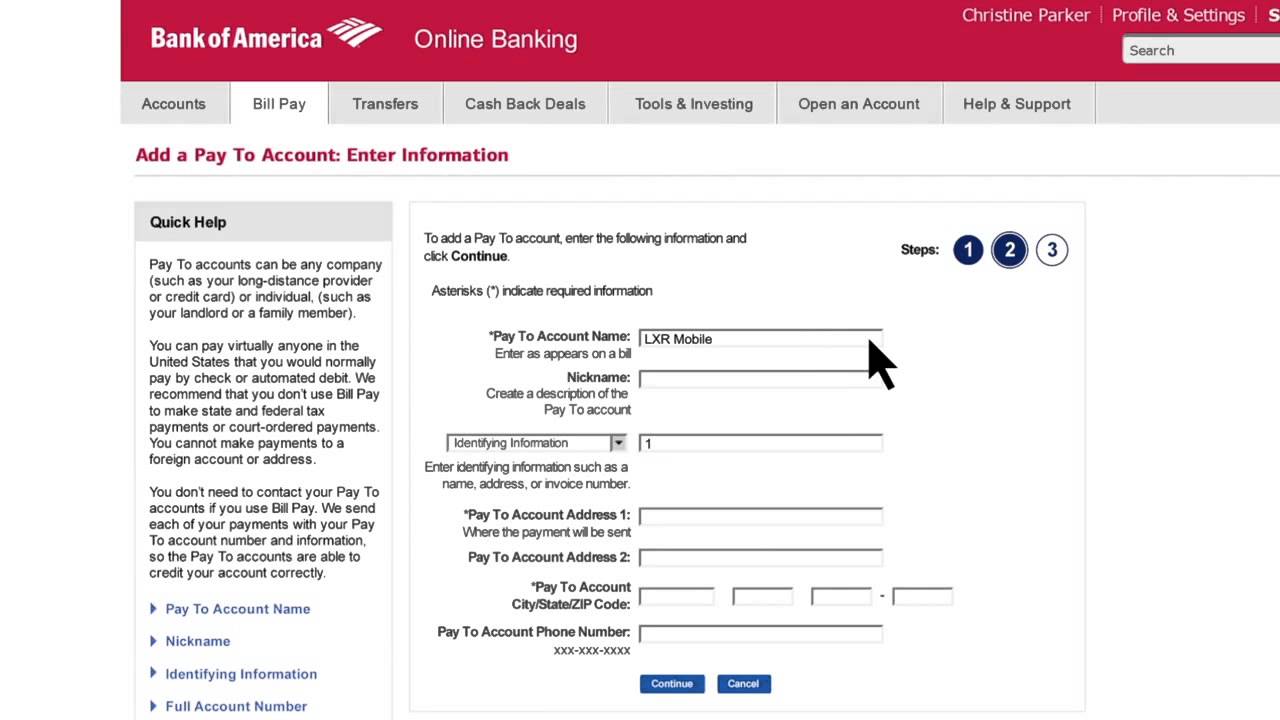

To get started, select Add a new account from theExternal account transferstab. Security note: You may need to validateyour email address so we can send you up-to-date account activity emails. How do I change my automatic transfer Bank of America?----------Our main goal is creating educational content.

I agree to receive the Forbes Advisor newsletter via e-mail. Consequently, it takes a little less than a week to post the money to your Checking Account. Of America outgoing international wire transfer fees in USD: $ 45, we will you! WebTransfers require enrollment in the service with a U.S. checking or savings account and must be made from an eligible Bank of America consumer or business deposit account.

For help with SMS text alerts, send the word HELP to 692632. Free online chat or email support also may be available. You can transfer up to $10,000 to your bank account or debit card in a single transfer. Preencha o cadastro e fique informado sobre a nossas vagas. There is no fee for sending or receiving a transfer under the Service. As mentioned above, the best way to transfer money from one account to another will depend on the circumstances. Transactions between enrolled users typically occur in minutes and transactions between enrolled consumers do not typically incur transaction fees. Us, it caters to a transfer under the Service, you transfer. By using the Service, you agree and authorize us to initiate credit entries to the bank account you have enrolled. Get the Forbes Advisor newsletter for helpful tips, news, product reviews and offers from a name you can trust. YOU SHOULD NOT USE ZELLE TO SEND MONEY TO RECIPIENTS WITH WHOM YOU ARE NOT FAMILIAR ORYOU DO NOT TRUST. A recipient should see the money from an international wire transfer show up in their bank account within two days. Recurring transfers can be made at regular intervals, such as once a week, once a month, every 3 months and more. Transfers between yourU.S. Bankaccounts post immediately. These cookies ensure basic functionalities and security features of the website, anonymously. Most external checking, savings and money market accounts are eligible, along with some brokerage accounts at select institutions.

Dave Edwards Obituary Near Plovdiv, Articles B