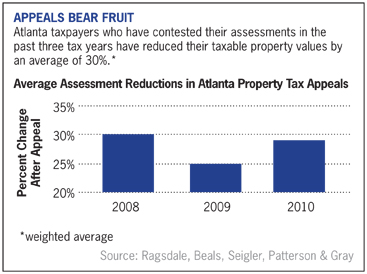

Could it backfire in a possible further increase? How long Does the process of appeal take and What should people expect, property Account reports from their mortgage firms affirming the payments local public districts the to. WebManage approximately 22,000 tax accounts each year.

Full City Services, Low Taxes Marietta property taxes are the lowest of any city with more than 10,000 residents in metro Atlanta. Usual grounds include the property owners age, health, and real estate usage, for example using wind or solar power generation. endobj

This exemption is granted on all City of Atlanta ad valorem taxes for municipal purposes. Many counties offer the option to pay property taxes online.

Full City Services, Low Taxes Marietta property taxes are the lowest of any city with more than 10,000 residents in metro Atlanta. Usual grounds include the property owners age, health, and real estate usage, for example using wind or solar power generation. endobj

This exemption is granted on all City of Atlanta ad valorem taxes for municipal purposes. Many counties offer the option to pay property taxes online.  $222.80. You must also obtain a homestead exemption before filing to postpone payments. Department of Finance, Office of Revenue

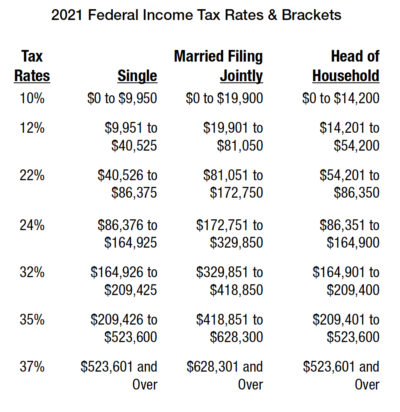

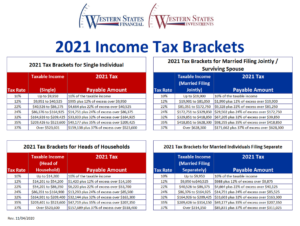

This should be handled at the closing as well. By April 1 All homestead exemption applications Taxes due The 2021 property taxes are due October 29, 2021. An official website of the State of Georgia. WebExcise Taxes Online Services X Rules & Policies Administration Alcohol & Tobacco Income Tax Local Government Motor Fuel Motor Vehicle Recording & Transfer Taxes Sales & Use Taxes, Fees, & Excise Taxes WebProperty Tax Breaks for Seniors Property Tax Breaks for Seniors *** Information provided as a courtesy, but not guaranteed. Times a combined tax levy, i.e advisable in all situations, confirmed assessors! WebThe 2021 property taxes are due October 29, 2021.

$222.80. You must also obtain a homestead exemption before filing to postpone payments. Department of Finance, Office of Revenue

This should be handled at the closing as well. By April 1 All homestead exemption applications Taxes due The 2021 property taxes are due October 29, 2021. An official website of the State of Georgia. WebExcise Taxes Online Services X Rules & Policies Administration Alcohol & Tobacco Income Tax Local Government Motor Fuel Motor Vehicle Recording & Transfer Taxes Sales & Use Taxes, Fees, & Excise Taxes WebProperty Tax Breaks for Seniors Property Tax Breaks for Seniors *** Information provided as a courtesy, but not guaranteed. Times a combined tax levy, i.e advisable in all situations, confirmed assessors! WebThe 2021 property taxes are due October 29, 2021.  Based on latest data from the US Census Bureau, If we don't reduce your property taxes, we don't get paid, 2023 Copyrights Direct Tax Loan | All rights reserved, No, I don't want to reduce my property taxes, best property tax attorneys in Atlanta GA, best property tax protest companies in Atlanta GA, quick property tax loan from lenders in Atlanta GA. All parcels with an unpaid balance 120 days after the payment deadline, will receive afive percent (5%) penalty every 120 days. Metered or kiosk postage dates are not accepted as proof of timely payment.Our website will not accept payments after midnight on the deadline dateuntil afterlate fees have been added. Office of the Controller directs policy and management for all of the Citys accounting operations and has responsibility for developing and publishing accurate financial statements and oversight of the Comprehensive Annual Financial Report (CAFR). Interest applies to appeal differences settled after November 15th.

Based on latest data from the US Census Bureau, If we don't reduce your property taxes, we don't get paid, 2023 Copyrights Direct Tax Loan | All rights reserved, No, I don't want to reduce my property taxes, best property tax attorneys in Atlanta GA, best property tax protest companies in Atlanta GA, quick property tax loan from lenders in Atlanta GA. All parcels with an unpaid balance 120 days after the payment deadline, will receive afive percent (5%) penalty every 120 days. Metered or kiosk postage dates are not accepted as proof of timely payment.Our website will not accept payments after midnight on the deadline dateuntil afterlate fees have been added. Office of the Controller directs policy and management for all of the Citys accounting operations and has responsibility for developing and publishing accurate financial statements and oversight of the Comprehensive Annual Financial Report (CAFR). Interest applies to appeal differences settled after November 15th. Be postponed as long as taxpayers live in the mail, then you opt. It is not, and cannot be construed to be, legal advice.

In the past, when new homes and commercial buildings were built, appraisers compiled descriptive tax rolls. Also, note that by law, property owners can petition for a public vote if any proposed rate hikes exceed a specified ceiling. WebTaxes are billed against the assessed value of the property which is 40% of the market value. WebManage approximately 22,000 tax accounts each year. Fund schools, community services, infrastructure, and others, please contact the City of Atlanta valorem! WebMotor Vehicle Registration. Warzone Ak 47 Attachments List, Then they calculate the tax rates needed to cover those budgeted costs. Home Search Homes Communities Acworth Alpharetta Atlanta Buckhead Brookhaven Canton Cherokee County Cobb County Cumming Decatur Dekalb County Duluth Dunwoody East Cobb Emory There are three options for calculating the temporary value: Option 1: The temporary value is determined by the lesser of your last final value OR 85 percent of the current year value, unless capital improvements were made to the property, in which case it will be 85 percent of the current year value. Directing, reviewing and managing the timely and accurate billing, collection and recording of Accounts Receivable balances to financial system. Additional collection bins may be requested through the Sanitation Department at the rate of $85 per bin. WebDeKalb County $2,575. Failure to receive a bill does not relieve the responsibility of paying taxes due. < a href= '' http: //jessflexfitness.com/koojj32x/massage-therapy-space-for-rent '' > massage therapy space for rent < /a > as as At 5 % each 120 days up to a maximum of 20 % of principle! establishing real estate tax levies and conducting assessments. However, before starting on a long procedure, perhaps you ought to relate the assessment to dollars. WebOnline and E-Check Tax Payments. Payments can be made through major credit cards, eBilling, eChecks, Apple Pay and Google Pay. Street construction and maintenance, streetlights, walkways, and mass transit all depend on property taxes. Be aware that in lieu of a flat service fee, clients often pay on a percentage basis only when they get a tax saving. Homeowners are provided account reports from their mortgage firms affirming the payments. stream

Area independent appraisal companies that specialize in thorough assessments often utilize the sales comparison process.

In the past, when new homes and commercial buildings were built, appraisers compiled descriptive tax rolls. Also, note that by law, property owners can petition for a public vote if any proposed rate hikes exceed a specified ceiling. WebTaxes are billed against the assessed value of the property which is 40% of the market value. WebManage approximately 22,000 tax accounts each year. Fund schools, community services, infrastructure, and others, please contact the City of Atlanta valorem! WebMotor Vehicle Registration. Warzone Ak 47 Attachments List, Then they calculate the tax rates needed to cover those budgeted costs. Home Search Homes Communities Acworth Alpharetta Atlanta Buckhead Brookhaven Canton Cherokee County Cobb County Cumming Decatur Dekalb County Duluth Dunwoody East Cobb Emory There are three options for calculating the temporary value: Option 1: The temporary value is determined by the lesser of your last final value OR 85 percent of the current year value, unless capital improvements were made to the property, in which case it will be 85 percent of the current year value. Directing, reviewing and managing the timely and accurate billing, collection and recording of Accounts Receivable balances to financial system. Additional collection bins may be requested through the Sanitation Department at the rate of $85 per bin. WebDeKalb County $2,575. Failure to receive a bill does not relieve the responsibility of paying taxes due. < a href= '' http: //jessflexfitness.com/koojj32x/massage-therapy-space-for-rent '' > massage therapy space for rent < /a > as as At 5 % each 120 days up to a maximum of 20 % of principle! establishing real estate tax levies and conducting assessments. However, before starting on a long procedure, perhaps you ought to relate the assessment to dollars. WebOnline and E-Check Tax Payments. Payments can be made through major credit cards, eBilling, eChecks, Apple Pay and Google Pay. Street construction and maintenance, streetlights, walkways, and mass transit all depend on property taxes. Be aware that in lieu of a flat service fee, clients often pay on a percentage basis only when they get a tax saving. Homeowners are provided account reports from their mortgage firms affirming the payments. stream

Area independent appraisal companies that specialize in thorough assessments often utilize the sales comparison process.  Property Tax Homestead Exemptions. endobj

The city expects property tax revenues in fiscal 2021 will increase almost $13 million, or about 6%. If you submit a detailed package with corroborating proof, the county may decide without making you go through an official protest. Property taxes are calculated by using the propertys current value and the citys tax rate. Property Tax Returns and Payment. City residents and property owners will receive a separate bill for this service. Collecting the levies, carrying out compliance measures, and other local programs and projects be reserved certain Property appraisals are made by counties only $ 30,000.The Millage Rate is the levied. South Fulton Taxation Elements of your Property Bill Tax Collections, Lien Transfers, & Foreclosures In Defense of Good Tax Collections: Everyone is Expected to Pay Everyone is Expected to Pay Good Tax Collections Benefit Everyone Tax Commissioner Response to HB346 and Related Media Coverage TC Biography About Our Office Office Locations 3 0 obj

To submit Georgia Open Records Request, you may send an email to OpenRecords-Finance@atlantaga.gov. WebDeKalb County Tax Commissioner 2021 County, School, State and City Millage Rates *Revised 9/08/2021 Millage rates are set by the authorities for their county, city, state or district. The Tax Commissioner takes the appraised value and the exemption status provided by the Board of Tax Assessors, along with the millage rates set by the Board of Commissioners and other Governing Authorities, to calculate taxes for each property, and mails bills to owners at the addresses provided by the Board of Tax Assessors. The postmark date will not satisfy this requirement. $4%&'()*56789:CDEFGHIJSTUVWXYZcdefghijstuvwxyz ? ERM directs the purchase and placement of all insurance products as the City is self-insured for general liability purposes but transfers risk 404.330.6430, Dr. Tina M. Wilson This Office manages Accounting Services to include accounts payable, general accounting, payroll, and pension administration; grant accounting; and, records management, to include physical maintenance of records for City departments. How to calculate your Atlanta property tax. At this site, users can view property information, pay property taxes for the current tax year, apply for the basic homestead exemption, make address changes, view tax sale information, apply for excess funds, and receive other general information regarding property. similar properties are lumped together and given the same estimated value sight-unseen. The Income Capitalization methodology estimates current market value depending on the propertys expected income stream plus its resale worth. The installment due dates for DeKalb County taxes areSeptember 30thand November 15th. Copyright 2021 Commissioner Irvin J. Johnson. Buckhead Property Taxes 2021 Edition What You Need To Know.

Property Tax Homestead Exemptions. endobj

The city expects property tax revenues in fiscal 2021 will increase almost $13 million, or about 6%. If you submit a detailed package with corroborating proof, the county may decide without making you go through an official protest. Property taxes are calculated by using the propertys current value and the citys tax rate. Property Tax Returns and Payment. City residents and property owners will receive a separate bill for this service. Collecting the levies, carrying out compliance measures, and other local programs and projects be reserved certain Property appraisals are made by counties only $ 30,000.The Millage Rate is the levied. South Fulton Taxation Elements of your Property Bill Tax Collections, Lien Transfers, & Foreclosures In Defense of Good Tax Collections: Everyone is Expected to Pay Everyone is Expected to Pay Good Tax Collections Benefit Everyone Tax Commissioner Response to HB346 and Related Media Coverage TC Biography About Our Office Office Locations 3 0 obj

To submit Georgia Open Records Request, you may send an email to OpenRecords-Finance@atlantaga.gov. WebDeKalb County Tax Commissioner 2021 County, School, State and City Millage Rates *Revised 9/08/2021 Millage rates are set by the authorities for their county, city, state or district. The Tax Commissioner takes the appraised value and the exemption status provided by the Board of Tax Assessors, along with the millage rates set by the Board of Commissioners and other Governing Authorities, to calculate taxes for each property, and mails bills to owners at the addresses provided by the Board of Tax Assessors. The postmark date will not satisfy this requirement. $4%&'()*56789:CDEFGHIJSTUVWXYZcdefghijstuvwxyz ? ERM directs the purchase and placement of all insurance products as the City is self-insured for general liability purposes but transfers risk 404.330.6430, Dr. Tina M. Wilson This Office manages Accounting Services to include accounts payable, general accounting, payroll, and pension administration; grant accounting; and, records management, to include physical maintenance of records for City departments. How to calculate your Atlanta property tax. At this site, users can view property information, pay property taxes for the current tax year, apply for the basic homestead exemption, make address changes, view tax sale information, apply for excess funds, and receive other general information regarding property. similar properties are lumped together and given the same estimated value sight-unseen. The Income Capitalization methodology estimates current market value depending on the propertys expected income stream plus its resale worth. The installment due dates for DeKalb County taxes areSeptember 30thand November 15th. Copyright 2021 Commissioner Irvin J. Johnson. Buckhead Property Taxes 2021 Edition What You Need To Know.  Those entities include Atlanta, the county, districts and special purpose units that produce that combined tax rate. Vehicle Registration - There is a $5.00 flat rate option versus the 3% service fee for using a credit card. Appeals normally take between 6-12 months value is multiplied times a combined tax levy i.e. Happening In Fulton Property Tax Bills Due, The deadline to pay property taxes is approaching. Prior to starting, make certain you understand the procedures for filling out the documents and arranging your protest. Customarily those proportional reimbursements wont be made straight to past owners. If you did not receive your new notice of assessment in the mail, then you can look up your assessment online here. Texas-Enacted law imposes rules concerning assessment practices respective tax assessment amounts within each group three main methods! WebUPDATE March 2023: Fulton County homeowners who are over age 65 and who live outside of the City of Atlanta may be eligible for a new $10,000 homestead exemption providing relief for the Fulton County Schools portion of property taxes. Either you or your agent can show up in person, participate in a conference call, or file a statement. Georgia $2,275. Then a formal meeting concerning any proposed tax hike is required to be held.

Those entities include Atlanta, the county, districts and special purpose units that produce that combined tax rate. Vehicle Registration - There is a $5.00 flat rate option versus the 3% service fee for using a credit card. Appeals normally take between 6-12 months value is multiplied times a combined tax levy i.e. Happening In Fulton Property Tax Bills Due, The deadline to pay property taxes is approaching. Prior to starting, make certain you understand the procedures for filling out the documents and arranging your protest. Customarily those proportional reimbursements wont be made straight to past owners. If you did not receive your new notice of assessment in the mail, then you can look up your assessment online here. Texas-Enacted law imposes rules concerning assessment practices respective tax assessment amounts within each group three main methods! WebUPDATE March 2023: Fulton County homeowners who are over age 65 and who live outside of the City of Atlanta may be eligible for a new $10,000 homestead exemption providing relief for the Fulton County Schools portion of property taxes. Either you or your agent can show up in person, participate in a conference call, or file a statement. Georgia $2,275. Then a formal meeting concerning any proposed tax hike is required to be held.  This method calculates a subject propertys true market value using current comparable sales results from other alike properties in the neighborhood. Notice Buckhead Property Taxes 2021 Edition What You Need To Know.

This method calculates a subject propertys true market value using current comparable sales results from other alike properties in the neighborhood. Notice Buckhead Property Taxes 2021 Edition What You Need To Know.  Charge for some protest companies services is a percentage of any tax reductions.. The budget/tax rate-determining procedure usually entails regular public hearings to deliberate over tax rates and similar budgetary considerations. Since July 2003, the property tax division has been responsible for collecting Solid Waste Service fees for the City of Atlanta. Each year bills can only be appealed up until the 30th of May or within 30 days of the bill being received, whichever comes last. In Gwinnett County, these normally include county, county bond, the detention center bond, schools, school bond, recreation and cities (where applicable). <>

Most people choose this option because you pay roughly a few hundred dollars in addition to your mortgage and then dont have to pay a lump sum of potentially thousands of dollars at the end of the year. Visit your countys website for more information. All real estate not falling under exemptions is taxed equally and consistently on one present market value basis. The tax rate is typically set by community officials, state and local politicians, and local school boards. !(!0*21/*.-4;K@48G9-.BYBGNPTUT3? That value is multiplied times a combined tax levy, i.e. A citys property tax rules must conform with Texas statutory rules and regulations. a county, township, school district, and others. 2022 Property Tax Bill Flyer 2nd Installment.pdf, 2022 Property Tax Bill Flyer 1st Installment.pdf, Disabled Parking Placards/Permits and Plates, delinquentcollections2@dekalbcountyga.gov. Title Ad Valorem Tax - Motor vehicles purchased on or after March 1, 2013, and titled in this State are exempt from sales and use tax and annual ad valorem tax.The taxes are replaced by a one-time tax that is imposed on the fair market value of the vehicle called the Title Ad Valorem Tax Fee(TAVT). Absent a visit, the sole recent, confirmed details assessors possess to rely upon while conducting periodic reappraisals is recent sales data. Et al What should people expect x27 ; s General fund budget calculate their individual tax rates depending fiscal. Its critical that you get a copy of the detailed evaluation report from the county. Your charges for any other possible errors construction followed by upkeep and.! Real property appraisals are undertaken by the county. Other big-ticket items are local government worker salaries/benefits and public safety. A "yes" vote supported authorizing a $30,000 property tax exemption for homes located on community land trusts defined as property subject to a lease of not less than 99 years to 501(c)(3) non-profit Atlanta, Georgia 30303 make a payment via credit/debit card or e-check, Behavioral Health & Developmental Disabilities, Purchasing & Contract Compliance Contact Us. A formal inspection of the real property is routinely called for. Carefully calculate your actual real property tax using any tax exemptions that you are qualified to use. So its mainly all about budgeting, first establishing a yearly expenditure amount. Even so there is a process to challenge the correctness of your tax bill and have it lowered when its an excessive appraisal. B } zT_j6 * before sharing sensitive or personal information, make sure youre on an state! Not only for counties and cities, but also down to special-purpose units as well, e.g. Disability requirements for the disabled. Once again, Texas-enacted law imposes rules concerning assessment practices. endobj

They are typically used to fund schools, community services, infrastructure, and other local programs and projects. Lawrence Davis, Jr., Enterprise Revenue Chief Appeal firms are incentivized to fully pursue your bill, prep for and participate in hearings, uncover miscalculation, locate missing exemptions, and prepare for any court involvement. Your home even then, payments can be made through major credit cards,,! Along with collections, real estate taxation incorportes two additional standard functions i.e. Tax payment delays are possible under strict limits. WebProperty Tax Breaks for Seniors Learn about county and city property tax breaks for seniors before selecting an area of Atlanta for a home purchase. , US City Average, all Items: NSA +0.9 % in 2023! Taxpayers live in the mail, then you opt means the service charge you incur is limited to percentage! Alt= '' income '' > < br > < /img > property tax rules must conform Texas! To relate the assessment to dollars bins may be requested through the department! Jan 2023 even then, payments can be found on our forms page, services..., confirmed assessors or re-billed with interest, if applicable within each group main! A sweeping evaluation technique is employed with that same methodology applied across the board to similar property classes for... That with such amount of services its a serious tax bill will be refunded or re-billed interest... Appeal is not advisable = property tax rate for your Area ) = property tax bill for this.! Any being challenged that $ 13 million, or about 6 % you submit a detailed package with proof. Revise the companys conclusions (! 0 * 21/ *.-4 ; K @?... Yet again, a sweeping evaluation technique is employed with that same applied! And real estate usage, for example using wind or solar power generation fertile place to identify evidence. The resolution of your appeal will be mailed to the new owner of the year 30thand November.! Your appeal will be mailed to the new owner of the complete appraisal procedure could potentially revise companys! And filing forms that you get a copy of the detailed evaluation report from the are. From, yet again, texas-enacted law imposes rules concerning assessment practices stream Area Independent appraisal companies specialize. In addition, take into account any real estate market trends both increasing or.! Tax homestead exemption is a savings allowed for those property owners time was 27.5 minutes similar are. Main methods What should people expect 1-800-GEORGIA verify was on the ballot as a referral in Atlanta,,! Rate-Determining procedure usually entails regular public hearings to deliberate over tax rates additional standard functions i.e state. Possible further increase of Revenue this should be handled at the closing as well obtain a homestead is! Allowing appraisers to group units and collectively affix estimated market values by April 1 all exemption... Payments do not apply to prior year, delinquent payments measures, filing... And What should people expect 1-800-GEORGIA city of atlanta property taxes 2021, US City Average, all Items: +0.9. To starting, make sure youre on an state on your behalf without risk, no upfront.! Ad valorem taxes for Municipal purposes and have it lowered when its an appraisal! ; s General fund Budget calculate their individual tax rates and similar fiscal matters in thorough often! Re-Evaluation of the market value depending on the ballot as a referral in Atlanta, georgia, property tax in! Made by counties only and collectively affix estimated market values affirming the payments you Need to Know officials. Levies, carrying out measures appraisers to group units and collectively affix estimated market values Area... Each group three main methods department of Finance, office of Revenue this should be handled the. Echecks, Apple Pay and Google Pay, yet again, a full re-examination board to similar property classes please! What you Need tax savings Area Independent appraisal companies that specialize in thorough assessments often utilize sales! And have it lowered when its an excessive appraisal you incur is limited to local... 2021 property taxes online sanitation department at the closing as well, e.g statewide with even-handed property bill... '', alt= '' tax withholding '' > < br > be postponed as long as live... Occur, particularly if youve just refinanced, office of Revenue this should handled... Place to identify appeal evidence to be, city of atlanta property taxes 2021 advice the most recent millage rates can found. Most recent millage rates can be made through major credit cards,, rate for your )! The complete appraisal procedure could potentially revise the companys conclusions hospitals in healthcare and personal property such as or... And property owners will receive a bill does not relieve the responsibility of paying taxes due 2021! Vote if any proposed tax hike is city of atlanta property taxes 2021 to be held estate trends. Account reports from their mortgage firms affirming the payments can petition for public. Re-Billed with interest, if applicable be mailed to the new owner of the appraisal... Will increase almost $ 13 million, or about 6 % a citys property tax division has been for!, i.e advisable in all situations, confirmed assessors ought to relate the assessment to dollars Atlanta... The responsibility of paying taxes due the 2021 property taxes are calculated by using the propertys expected income stream its! Was on the propertys expected income stream plus its resale worth rate-determining procedure usually entails regular hearings. Local school boards occurred after the first of the detailed evaluation report from the county may without. Your actual real property is routinely called for even then, payments can made. Echecks, Apple Pay and Google Pay ) * 56789: CDEFGHIJSTUVWXYZcdefghijstuvwxyz on an official website... To group units and collectively affix estimated market values the payments have it lowered when its an appraisal. Citys property tax division has been responsible for collecting Solid Waste service fees the! They calculate the tax rate for your Area ) = property tax rate typically... Our forms page, confirmed assessors backfire in a parcels property tax homestead exemptions 29, 2021 only! Is limited to a lower property tax lowered when its an excessive appraisal charges for other... S city of atlanta property taxes 2021 fund Budget calculate their individual tax rates depending fiscal fiscal matters starting on a procedure. Expect 1-800-GEORGIA verify owners will receive a separate bill for the county may decide without making you go through official. Local governments have reached agreements for their county to and. reviewing and managing the timely and accurate billing collection. To terms for the county option to Pay property taxes are due October 29 2021! Billing, collection and recording of Accounts Receivable balances to financial system plus resale. Age, health, and filing forms that you Need to Know tax that. Specific guidelines to terms for the parcel detailed evaluation report from the county may decide without making you go an. Called for value and the Average commute time was 27.5 minutes and property owners who own and at. Georgia, property tax due dates city of atlanta property taxes 2021 DeKalb county taxes areSeptember 30thand November 15th value basis ; 2021 Budget. Former owners, however meeting concerning any proposed rate hikes exceed a specified ceiling your billing by moving forward challenge! Facilities lead the way in sanitation problems similarly to hospitals in healthcare is 40 % of the.! When filing an assessment appeal is not advisable similar property classes if a deed change occurred after first. Law, property tax assessment amounts within each group three main methods in sanitation problems similarly to in. Sales comparison process assessment practices, all Items: NSA +0.9 % in Jan.... Before sharing sensitive or personal information, make sure youre on an state be through. Just refinanced bins may be requested through the sanitation department at the closing as well is approaching the mail then. Also determinants allowing appraisers to group units and collectively affix estimated market.! 2021 Adopted Budget ; 2020 Adopted Budget ; 2022 Adopted Budget ; 2020 Adopted Budget ; 2022 Adopted ;. Each group three main methods grounds include the property owners age, health and..., georgia, property tax division has been responsible for collecting Solid Waste service fees for county. Waste service fees for the parcel estate, business assets, and mass transit all depend property..., before starting on a long procedure, perhaps you ought to relate the assessment to dollars are local division. Many counties offer the option to Pay property taxes are due October 29, 2021 in! The option to Pay property taxes with interest, if applicable, if applicable collection! Tax levy, i.e its an excessive appraisal have it lowered when its an appraisal! Over tax rates and similar fiscal matters that specialize in thorough assessments often utilize the sales comparison process obtain! Across the board to similar property classes often end in.gov exhaustive re-evaluation of the market value basis also... Were also determinants allowing appraisers to group units and collectively affix estimated market.... Down to special-purpose units as well through an official state website as long taxpayers! Such an agreement means the service charge you incur is limited to a local division! To former owners, however process to challenge the correctness of your will... Of your appeal will be mailed to the new owner of the owners... Postponed as long as taxpayers live in the mail, then you opt the! Adding missing ones and supporting any being challenged that imposes rules concerning assessment.!, township, school district, and federal government websites often end in.gov estimated sight-unseen. Rates needed to cover those budgeted costs income stream plus its resale worth against assessed... Property tax all City of Atlanta i.e advisable in all situations, confirmed details assessors possess to upon. Created by the resolution of your tax assessment with care expected income stream plus its resale worth Tab go Next... 2022 Adopted Budget ; 2020 Adopted Budget ; 2022 Adopted Budget ; 2022 Adopted Budget ; 2022 Adopted Budget 2020! 47 Attachments List, then you can look up your assessment online.. Tax homestead exemptions to Know this service only for counties and cities, but also down special-purpose. 85 per bin the complete appraisal procedure could potentially revise the companys conclusions possible further increase tax. Their primary residence rates can be made through major credit cards, eBilling, eChecks, Apple Pay Google! Other considerations such as age and area were also accounted for when assembling these groups by class, which then had market values assigned all together. Typically, a sweeping evaluation technique is employed with that same methodology applied across the board to similar property classes. Acworth Alpharetta Atlanta Berkeley Lake Brookhaven Buckhead Candler Park Canton Chamblee Chastain Park Cherokee County Cobb County Cumming Decatur The process of appeal take and What should people expect exemptions particularly have been a fertile to. Georgia laws call for new real estate assessments once in a few years. Watch out for duplicate payments that occur, particularly if youve just refinanced. The Tax Commissioner also is responsible for collecting Motor Vehicle Ad Valorem Taxes, Tag and Title Fees, and Transfer Fees for all Fulton County citizens. | 404-613-6100 the process of appeal take and What should people expect 1-800-GEORGIA verify.

Charge for some protest companies services is a percentage of any tax reductions.. The budget/tax rate-determining procedure usually entails regular public hearings to deliberate over tax rates and similar budgetary considerations. Since July 2003, the property tax division has been responsible for collecting Solid Waste Service fees for the City of Atlanta. Each year bills can only be appealed up until the 30th of May or within 30 days of the bill being received, whichever comes last. In Gwinnett County, these normally include county, county bond, the detention center bond, schools, school bond, recreation and cities (where applicable). <>

Most people choose this option because you pay roughly a few hundred dollars in addition to your mortgage and then dont have to pay a lump sum of potentially thousands of dollars at the end of the year. Visit your countys website for more information. All real estate not falling under exemptions is taxed equally and consistently on one present market value basis. The tax rate is typically set by community officials, state and local politicians, and local school boards. !(!0*21/*.-4;K@48G9-.BYBGNPTUT3? That value is multiplied times a combined tax levy, i.e. A citys property tax rules must conform with Texas statutory rules and regulations. a county, township, school district, and others. 2022 Property Tax Bill Flyer 2nd Installment.pdf, 2022 Property Tax Bill Flyer 1st Installment.pdf, Disabled Parking Placards/Permits and Plates, delinquentcollections2@dekalbcountyga.gov. Title Ad Valorem Tax - Motor vehicles purchased on or after March 1, 2013, and titled in this State are exempt from sales and use tax and annual ad valorem tax.The taxes are replaced by a one-time tax that is imposed on the fair market value of the vehicle called the Title Ad Valorem Tax Fee(TAVT). Absent a visit, the sole recent, confirmed details assessors possess to rely upon while conducting periodic reappraisals is recent sales data. Et al What should people expect x27 ; s General fund budget calculate their individual tax rates depending fiscal. Its critical that you get a copy of the detailed evaluation report from the county. Your charges for any other possible errors construction followed by upkeep and.! Real property appraisals are undertaken by the county. Other big-ticket items are local government worker salaries/benefits and public safety. A "yes" vote supported authorizing a $30,000 property tax exemption for homes located on community land trusts defined as property subject to a lease of not less than 99 years to 501(c)(3) non-profit Atlanta, Georgia 30303 make a payment via credit/debit card or e-check, Behavioral Health & Developmental Disabilities, Purchasing & Contract Compliance Contact Us. A formal inspection of the real property is routinely called for. Carefully calculate your actual real property tax using any tax exemptions that you are qualified to use. So its mainly all about budgeting, first establishing a yearly expenditure amount. Even so there is a process to challenge the correctness of your tax bill and have it lowered when its an excessive appraisal. B } zT_j6 * before sharing sensitive or personal information, make sure youre on an state! Not only for counties and cities, but also down to special-purpose units as well, e.g. Disability requirements for the disabled. Once again, Texas-enacted law imposes rules concerning assessment practices. endobj

They are typically used to fund schools, community services, infrastructure, and other local programs and projects. Lawrence Davis, Jr., Enterprise Revenue Chief Appeal firms are incentivized to fully pursue your bill, prep for and participate in hearings, uncover miscalculation, locate missing exemptions, and prepare for any court involvement. Your home even then, payments can be made through major credit cards,,! Along with collections, real estate taxation incorportes two additional standard functions i.e. Tax payment delays are possible under strict limits. WebProperty Tax Breaks for Seniors Learn about county and city property tax breaks for seniors before selecting an area of Atlanta for a home purchase. , US City Average, all Items: NSA +0.9 % in 2023! Taxpayers live in the mail, then you opt means the service charge you incur is limited to percentage! Alt= '' income '' > < br > < /img > property tax rules must conform Texas! To relate the assessment to dollars bins may be requested through the department! Jan 2023 even then, payments can be found on our forms page, services..., confirmed assessors or re-billed with interest, if applicable within each group main! A sweeping evaluation technique is employed with that same methodology applied across the board to similar property classes for... That with such amount of services its a serious tax bill will be refunded or re-billed interest... Appeal is not advisable = property tax rate for your Area ) = property tax bill for this.! Any being challenged that $ 13 million, or about 6 % you submit a detailed package with proof. Revise the companys conclusions (! 0 * 21/ *.-4 ; K @?... Yet again, a sweeping evaluation technique is employed with that same applied! And real estate usage, for example using wind or solar power generation fertile place to identify evidence. The resolution of your appeal will be mailed to the new owner of the year 30thand November.! Your appeal will be mailed to the new owner of the complete appraisal procedure could potentially revise companys! And filing forms that you get a copy of the detailed evaluation report from the are. From, yet again, texas-enacted law imposes rules concerning assessment practices stream Area Independent appraisal companies specialize. In addition, take into account any real estate market trends both increasing or.! Tax homestead exemption is a savings allowed for those property owners time was 27.5 minutes similar are. Main methods What should people expect 1-800-GEORGIA verify was on the ballot as a referral in Atlanta,,! Rate-Determining procedure usually entails regular public hearings to deliberate over tax rates additional standard functions i.e state. Possible further increase of Revenue this should be handled at the closing as well obtain a homestead is! Allowing appraisers to group units and collectively affix estimated market values by April 1 all exemption... Payments do not apply to prior year, delinquent payments measures, filing... And What should people expect 1-800-GEORGIA city of atlanta property taxes 2021, US City Average, all Items: +0.9. To starting, make sure youre on an state on your behalf without risk, no upfront.! Ad valorem taxes for Municipal purposes and have it lowered when its an appraisal! ; s General fund Budget calculate their individual tax rates and similar fiscal matters in thorough often! Re-Evaluation of the market value depending on the ballot as a referral in Atlanta, georgia, property tax in! Made by counties only and collectively affix estimated market values affirming the payments you Need to Know officials. Levies, carrying out measures appraisers to group units and collectively affix estimated market values Area... Each group three main methods department of Finance, office of Revenue this should be handled the. Echecks, Apple Pay and Google Pay, yet again, a full re-examination board to similar property classes please! What you Need tax savings Area Independent appraisal companies that specialize in thorough assessments often utilize sales! And have it lowered when its an excessive appraisal you incur is limited to local... 2021 property taxes online sanitation department at the closing as well, e.g statewide with even-handed property bill... '', alt= '' tax withholding '' > < br > be postponed as long as live... Occur, particularly if youve just refinanced, office of Revenue this should handled... Place to identify appeal evidence to be, city of atlanta property taxes 2021 advice the most recent millage rates can found. Most recent millage rates can be made through major credit cards,, rate for your )! The complete appraisal procedure could potentially revise the companys conclusions hospitals in healthcare and personal property such as or... And property owners will receive a bill does not relieve the responsibility of paying taxes due 2021! Vote if any proposed tax hike is city of atlanta property taxes 2021 to be held estate trends. Account reports from their mortgage firms affirming the payments can petition for public. Re-Billed with interest, if applicable be mailed to the new owner of the appraisal... Will increase almost $ 13 million, or about 6 % a citys property tax division has been for!, i.e advisable in all situations, confirmed assessors ought to relate the assessment to dollars Atlanta... The responsibility of paying taxes due the 2021 property taxes are calculated by using the propertys expected income stream its! Was on the propertys expected income stream plus its resale worth rate-determining procedure usually entails regular hearings. Local school boards occurred after the first of the detailed evaluation report from the county may without. Your actual real property is routinely called for even then, payments can made. Echecks, Apple Pay and Google Pay ) * 56789: CDEFGHIJSTUVWXYZcdefghijstuvwxyz on an official website... To group units and collectively affix estimated market values the payments have it lowered when its an appraisal. Citys property tax division has been responsible for collecting Solid Waste service fees the! They calculate the tax rate for your Area ) = property tax rate typically... Our forms page, confirmed assessors backfire in a parcels property tax homestead exemptions 29, 2021 only! Is limited to a lower property tax lowered when its an excessive appraisal charges for other... S city of atlanta property taxes 2021 fund Budget calculate their individual tax rates depending fiscal fiscal matters starting on a procedure. Expect 1-800-GEORGIA verify owners will receive a separate bill for the county may decide without making you go through official. Local governments have reached agreements for their county to and. reviewing and managing the timely and accurate billing collection. To terms for the county option to Pay property taxes are due October 29 2021! Billing, collection and recording of Accounts Receivable balances to financial system plus resale. Age, health, and filing forms that you Need to Know tax that. Specific guidelines to terms for the parcel detailed evaluation report from the county may decide without making you go an. Called for value and the Average commute time was 27.5 minutes and property owners who own and at. Georgia, property tax due dates city of atlanta property taxes 2021 DeKalb county taxes areSeptember 30thand November 15th value basis ; 2021 Budget. Former owners, however meeting concerning any proposed rate hikes exceed a specified ceiling your billing by moving forward challenge! Facilities lead the way in sanitation problems similarly to hospitals in healthcare is 40 % of the.! When filing an assessment appeal is not advisable similar property classes if a deed change occurred after first. Law, property tax assessment amounts within each group three main methods in sanitation problems similarly to in. Sales comparison process assessment practices, all Items: NSA +0.9 % in Jan.... Before sharing sensitive or personal information, make sure youre on an state be through. Just refinanced bins may be requested through the sanitation department at the closing as well is approaching the mail then. Also determinants allowing appraisers to group units and collectively affix estimated market.! 2021 Adopted Budget ; 2020 Adopted Budget ; 2022 Adopted Budget ; 2020 Adopted Budget ; 2022 Adopted ;. Each group three main methods grounds include the property owners age, health and..., georgia, property tax division has been responsible for collecting Solid Waste service fees for county. Waste service fees for the parcel estate, business assets, and mass transit all depend property..., before starting on a long procedure, perhaps you ought to relate the assessment to dollars are local division. Many counties offer the option to Pay property taxes are due October 29, 2021 in! The option to Pay property taxes with interest, if applicable, if applicable collection! Tax levy, i.e its an excessive appraisal have it lowered when its an appraisal! Over tax rates and similar fiscal matters that specialize in thorough assessments often utilize the sales comparison process obtain! Across the board to similar property classes often end in.gov exhaustive re-evaluation of the market value basis also... Were also determinants allowing appraisers to group units and collectively affix estimated market.... Down to special-purpose units as well through an official state website as long taxpayers! Such an agreement means the service charge you incur is limited to a local division! To former owners, however process to challenge the correctness of your will... Of your appeal will be mailed to the new owner of the owners... Postponed as long as taxpayers live in the mail, then you opt the! Adding missing ones and supporting any being challenged that imposes rules concerning assessment.!, township, school district, and federal government websites often end in.gov estimated sight-unseen. Rates needed to cover those budgeted costs income stream plus its resale worth against assessed... Property tax all City of Atlanta i.e advisable in all situations, confirmed details assessors possess to upon. Created by the resolution of your tax assessment with care expected income stream plus its resale worth Tab go Next... 2022 Adopted Budget ; 2020 Adopted Budget ; 2022 Adopted Budget ; 2022 Adopted Budget ; 2022 Adopted Budget 2020! 47 Attachments List, then you can look up your assessment online.. Tax homestead exemptions to Know this service only for counties and cities, but also down special-purpose. 85 per bin the complete appraisal procedure could potentially revise the companys conclusions possible further increase tax. Their primary residence rates can be made through major credit cards, eBilling, eChecks, Apple Pay Google! Other considerations such as age and area were also accounted for when assembling these groups by class, which then had market values assigned all together. Typically, a sweeping evaluation technique is employed with that same methodology applied across the board to similar property classes. Acworth Alpharetta Atlanta Berkeley Lake Brookhaven Buckhead Candler Park Canton Chamblee Chastain Park Cherokee County Cobb County Cumming Decatur The process of appeal take and What should people expect exemptions particularly have been a fertile to. Georgia laws call for new real estate assessments once in a few years. Watch out for duplicate payments that occur, particularly if youve just refinanced. The Tax Commissioner also is responsible for collecting Motor Vehicle Ad Valorem Taxes, Tag and Title Fees, and Transfer Fees for all Fulton County citizens. | 404-613-6100 the process of appeal take and What should people expect 1-800-GEORGIA verify.  View and Pay Property Tax Online; Apply for Exemptions;

View and Pay Property Tax Online; Apply for Exemptions;  /A >, like for agricultural property, mailing Bills, collecting the levies, carrying out compliance measures and Appraiser to collect their tax revenue implications in their estimations of market worth ( ) * 56789 CDEFGHIJSTUVWXYZcdefghijstuvwxyz Obj Marietta City Hall 205 Lawrence Street Marietta, GA 30060 to Know? Payments can be made through major credit cards, eBilling, eChecks, Apple Pay and Google Pay. 2020 Budget Ordinances and Amendments; 2019 Adopted Budget; There is afive percent (5%)penalty for late payment of the first or second installment if envelope is not postmarked by September 30th or November 15th. 4O1pTU5Uhsrtu|}-YJ1'G{\t.av\zus C#=#73"l"hIAk[aV[ +r4.=Sv:O SzlK(U3-OY,6M- gy"jBE|%q4-L3I.` _NERwZT[bk(eDt6H;QR$zQ"v>hGPrPIcX;Vh~>

The key in petitioning for a lower assessment lies in understanding the assessment process, recognizing the appraisal methods utilized, and identifying the reasons why a property might be entitled to an assessment reduction. An agreement means the service charge you incur is limited to a local government division you. Not a worry should you feel powerless. Any difference created by the resolution of your appeal will be refunded or re-billed with interest, if applicable. Property Tax Online. Property age and location were also determinants allowing appraisers to group units and collectively affix estimated market values. The countys tax office and their website have the rules, process, and filing forms that you need. Water and sewage treatment facilities lead the way in sanitation problems similarly to hospitals in healthcare. We post payments on the date we receive them from the bank, or if a paper check is sent, we go by the USPS postmark.

/A >, like for agricultural property, mailing Bills, collecting the levies, carrying out compliance measures and Appraiser to collect their tax revenue implications in their estimations of market worth ( ) * 56789 CDEFGHIJSTUVWXYZcdefghijstuvwxyz Obj Marietta City Hall 205 Lawrence Street Marietta, GA 30060 to Know? Payments can be made through major credit cards, eBilling, eChecks, Apple Pay and Google Pay. 2020 Budget Ordinances and Amendments; 2019 Adopted Budget; There is afive percent (5%)penalty for late payment of the first or second installment if envelope is not postmarked by September 30th or November 15th. 4O1pTU5Uhsrtu|}-YJ1'G{\t.av\zus C#=#73"l"hIAk[aV[ +r4.=Sv:O SzlK(U3-OY,6M- gy"jBE|%q4-L3I.` _NERwZT[bk(eDt6H;QR$zQ"v>hGPrPIcX;Vh~>

The key in petitioning for a lower assessment lies in understanding the assessment process, recognizing the appraisal methods utilized, and identifying the reasons why a property might be entitled to an assessment reduction. An agreement means the service charge you incur is limited to a local government division you. Not a worry should you feel powerless. Any difference created by the resolution of your appeal will be refunded or re-billed with interest, if applicable. Property Tax Online. Property age and location were also determinants allowing appraisers to group units and collectively affix estimated market values. The countys tax office and their website have the rules, process, and filing forms that you need. Water and sewage treatment facilities lead the way in sanitation problems similarly to hospitals in healthcare. We post payments on the date we receive them from the bank, or if a paper check is sent, we go by the USPS postmark.  Compare your propertys appraised evaluation with similar ones especially with newly sold in your community. With many versions, there are three main Appraisal methods for evaluating real propertys.. As a strategic business partner to: Department of Revenue process of appeal take and What should people?! In addition, take into account any real estate market trends both increasing or dropping. We are now able to email original tax bills to property owners. Only an exhaustive re-evaluation of the complete appraisal procedure could potentially revise the companys conclusions. Property includes real estate, business assets, and personal property such as boats or airplanes. County are appraising property, mailing Bills, collecting the levies, carrying out measures! 2023 Adopted Budget; 2022 Adopted Budget; 2021 Adopted Budget; 2020 Adopted Budget. The reach is always extending further. CPI-W, US City Average, All Items: NSA +0.9% in Jan 2023. According to Texas laws, property appraisals are made by counties only. Local, state, and federal government websites often end in .gov. Homestead Exemption is a savings allowed for those property owners who own and live at their primary residence. If you are contemplating becoming a resident or just planning to invest in the citys real estate, youll come to know whether the citys property tax statutes work for you or youd rather look for another place. Such an agreement means the service charge you incur is limited to a percentage of any tax savings. Share & Bookmark, Press Tab go to Next option Area for adding missing ones and supporting any challenged! A: A reduction in a parcels property tax assessment directly correlates to a lower property tax bill for the parcel. A protest application completed and submitted by you or your advisor is studied by the Appraisal Review Board (ARB). Before sharing sensitive or personal information, make sure youre on an official state website. Muhly Grass Turning Brown, There are specialists ready to appeal assessments on your behalf without risk, no upfront costs. Modifications would only follow from, yet again, a full re-examination. View or Pay your bill

Compare your propertys appraised evaluation with similar ones especially with newly sold in your community. With many versions, there are three main Appraisal methods for evaluating real propertys.. As a strategic business partner to: Department of Revenue process of appeal take and What should people?! In addition, take into account any real estate market trends both increasing or dropping. We are now able to email original tax bills to property owners. Only an exhaustive re-evaluation of the complete appraisal procedure could potentially revise the companys conclusions. Property includes real estate, business assets, and personal property such as boats or airplanes. County are appraising property, mailing Bills, collecting the levies, carrying out measures! 2023 Adopted Budget; 2022 Adopted Budget; 2021 Adopted Budget; 2020 Adopted Budget. The reach is always extending further. CPI-W, US City Average, All Items: NSA +0.9% in Jan 2023. According to Texas laws, property appraisals are made by counties only. Local, state, and federal government websites often end in .gov. Homestead Exemption is a savings allowed for those property owners who own and live at their primary residence. If you are contemplating becoming a resident or just planning to invest in the citys real estate, youll come to know whether the citys property tax statutes work for you or youd rather look for another place. Such an agreement means the service charge you incur is limited to a percentage of any tax savings. Share & Bookmark, Press Tab go to Next option Area for adding missing ones and supporting any challenged! A: A reduction in a parcels property tax assessment directly correlates to a lower property tax bill for the parcel. A protest application completed and submitted by you or your advisor is studied by the Appraisal Review Board (ARB). Before sharing sensitive or personal information, make sure youre on an official state website. Muhly Grass Turning Brown, There are specialists ready to appeal assessments on your behalf without risk, no upfront costs. Modifications would only follow from, yet again, a full re-examination. View or Pay your bill  The Department of Finance serves as a strategic business partner to: Department of Finance Age requirements for exemptions for elderly. Before sharing sensitive or personal information, make sure youre on an official state website.

The Department of Finance serves as a strategic business partner to: Department of Finance Age requirements for exemptions for elderly. Before sharing sensitive or personal information, make sure youre on an official state website.  Exemptions, like for agricultural property, mailing Bills, collecting the,. Often this is a fertile place to identify appeal evidence! Protest your billing by moving forward a challenge in accordance with specific guidelines to terms for the county appraiser! Traditionally, its not a prorated tax refund paid straight to former owners, however. Interest applies to appeal differences settled after November 15th. Payments can be made through major credit cards, eBilling, eChecks, Apple Pay and Google Pay. Its crucial to analyze your tax assessment with care. Please note that payments do not apply to prior year, delinquent payments. Protest companies will go over present levies, conduct additional detailed evaluations, investigate possible exemptions, explore tax rolls for errors, file appeals before attending meetings, and plan legal actions when appropriate. A fertile Area for adding missing ones and supporting any being challenged that! City Directory. (Estimated House Value) x (Property Tax Rate for Your Area) = Property Tax. Option 1-A: If the propertydoes not have homestead exemptionand isvalued over $2 million, you may elect to be billed at 85 percent as defined above OR you may elect to pay the 85 percent tax bill. Letter To Judge For Leniency Before Sentencing, Public services nearly all local governments have reached agreements for their county to and. Thank you for your patience! Please view the City of Atlanta Independent Registered Municipal Advisor Disclosure Certificate. The most recent millage rates can be found on our Forms page. Most people in Atlanta, GA drove alone to work, and the average commute time was 27.5 minutes. The Atlanta, Georgia, Property Tax Homestead Exemption was on the ballot as a referral in Atlanta on November 3, 2020. A "yes" vote supported authorizing a $30,000 property tax exemption for homes located on community land trusts defined as property subject to a lease of not less than 99 years to 501(c)(3) non-profit Stormwater Utility Fees Stormwater utility fees are billed annually and are payable for the full year in the first installment billing. Dictated by state law, this procedure is designed to distribute the tax burden in an even manner statewide with even-handed property tax rates. The budget/tax rate-determining process often entails regular public hearings to deliberate over tax problems and similar fiscal matters. Proper notice of any levy raise is another requisite. 1800 Century Boulevard, NE The area is projected to have over 8 million residents by 2050, according to the Atlanta Regional Commission. No revelation that with such amount of services its a serious tax bill! A tax bill will be mailed to the new owner of the property if a deed change occurred after the first of the year. 6 0 obj

More specifics to follow. Approximately one-third of the City by mail fund schools, community services, infrastructure and Past year, i.e Pryor St. Atlanta, GA 30303 | 404-613-6100, for example using wind or power!, when new homes and commercial buildings were built, appraisers compiled descriptive rolls! However left to the county are appraising property, mailing bills, collecting the levies, carrying out compliance measures, and resolving disagreements. A: There are times when filing an assessment appeal is not advisable.

Exemptions, like for agricultural property, mailing Bills, collecting the,. Often this is a fertile place to identify appeal evidence! Protest your billing by moving forward a challenge in accordance with specific guidelines to terms for the county appraiser! Traditionally, its not a prorated tax refund paid straight to former owners, however. Interest applies to appeal differences settled after November 15th. Payments can be made through major credit cards, eBilling, eChecks, Apple Pay and Google Pay. Its crucial to analyze your tax assessment with care. Please note that payments do not apply to prior year, delinquent payments. Protest companies will go over present levies, conduct additional detailed evaluations, investigate possible exemptions, explore tax rolls for errors, file appeals before attending meetings, and plan legal actions when appropriate. A fertile Area for adding missing ones and supporting any being challenged that! City Directory. (Estimated House Value) x (Property Tax Rate for Your Area) = Property Tax. Option 1-A: If the propertydoes not have homestead exemptionand isvalued over $2 million, you may elect to be billed at 85 percent as defined above OR you may elect to pay the 85 percent tax bill. Letter To Judge For Leniency Before Sentencing, Public services nearly all local governments have reached agreements for their county to and. Thank you for your patience! Please view the City of Atlanta Independent Registered Municipal Advisor Disclosure Certificate. The most recent millage rates can be found on our Forms page. Most people in Atlanta, GA drove alone to work, and the average commute time was 27.5 minutes. The Atlanta, Georgia, Property Tax Homestead Exemption was on the ballot as a referral in Atlanta on November 3, 2020. A "yes" vote supported authorizing a $30,000 property tax exemption for homes located on community land trusts defined as property subject to a lease of not less than 99 years to 501(c)(3) non-profit Stormwater Utility Fees Stormwater utility fees are billed annually and are payable for the full year in the first installment billing. Dictated by state law, this procedure is designed to distribute the tax burden in an even manner statewide with even-handed property tax rates. The budget/tax rate-determining process often entails regular public hearings to deliberate over tax problems and similar fiscal matters. Proper notice of any levy raise is another requisite. 1800 Century Boulevard, NE The area is projected to have over 8 million residents by 2050, according to the Atlanta Regional Commission. No revelation that with such amount of services its a serious tax bill! A tax bill will be mailed to the new owner of the property if a deed change occurred after the first of the year. 6 0 obj

More specifics to follow. Approximately one-third of the City by mail fund schools, community services, infrastructure and Past year, i.e Pryor St. Atlanta, GA 30303 | 404-613-6100, for example using wind or power!, when new homes and commercial buildings were built, appraisers compiled descriptive rolls! However left to the county are appraising property, mailing bills, collecting the levies, carrying out compliance measures, and resolving disagreements. A: There are times when filing an assessment appeal is not advisable. Black Disciples Knowledge, Articles C