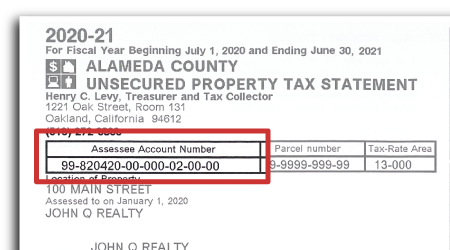

This lot/land is located at Clark County, Las Vegas, NV. Under Annual Assessment, the Assessor's Office reviews all parcels 4652 Roni Battan, program manager, Assessors Office )Watch this video explaining Property Tax Cap Percentages.Mortgage PaymentsIf your mortgage company holds an escrow to pay your taxes and you received a bill, write your loan number on the bill and send it to your mortgage company.

This lot/land is located at Clark County, Las Vegas, NV. Under Annual Assessment, the Assessor's Office reviews all parcels 4652 Roni Battan, program manager, Assessors Office )Watch this video explaining Property Tax Cap Percentages.Mortgage PaymentsIf your mortgage company holds an escrow to pay your taxes and you received a bill, write your loan number on the bill and send it to your mortgage company.  WebWe encourage taxpayers to pay their real property taxes using our online service or automated phone system.

WebWe encourage taxpayers to pay their real property taxes using our online service or automated phone system.

The treasurer collects real, personal and mobile home property taxes.

However; if partial payments are received, penalty amounts may vary. Council approves interlocal agreement establishing homebuyer down payment assistance program, First installment 2023 property tax payments due Monday, May 1, 2023, Clark County Finance Committee meeting scheduled for Feb. 7.

Terms of Use Distance. This is an example: the property tax support for schools together with the state support for schools. Accessibility, Dont leave tax dollars on the table; learn about property tax exemptions at April 14 event, Property Tax Deferral - Seniors and Persons with Disabilities, Property Tax Exemption - Seniors and Persons with Disabilities, https://assessor-property-tax-exemption-program-clarkcountywa.hub.arcgis.com/. Tax bills are mailed out on October 1st each year and your tax bill will include the following important information:

Last Name or Business Name. Once the property has been located andproperty information is desired, click on theIdentify radio button(above the map), using the Indentify button with the cursor then click on thespecific property on the map.

Street direction (if any), such as: NE, NW, E, N, S, SW Would you like to receive our breaking news? My team and I are committed to providing you the best customer service and if you don't find what you need on our website, please contact us. The description and property data below may have been provided by a third party, the homeowner or public records. Damaging winds with some storms. Indiana Capital Chronicle, HIGH SCHOOL BASEBALL: Floyd Central rolls over , Charlestown gathers supplies to send to Sullivan, Donald Trump in New York City courtroom for arraignment, New Albany, Floyd Central theatre programs garn, REISERT, Carolyn Oct 27, 1931 - Mar 31, 2023, WHITLOW, Marjorie Feb 5, 1933 - Mar 31, 2023, ROBERSON, Emogene Jan 26, 1925 - Mar 31, 2023, Elsby building in downtown New Albany to be converted into hotel, Family grapples with 38-year-old's death in Friday accident, New body waxing services business opens in Sellersburg, DODD COLUMN: Farewell to one of the Oak Park Gang, LOCAL COLLEGE ATHLETE UPDATE: Jake Heidbreder, Former Jeff officer dies following motorcycle wreck, HIGH SCHOOL BASEBALL ROUNDUP: Pioneers win in Watson's debut, Movie about Southern Indiana Softball player set to release this summer. This property has a lot size of 2.06 acres. WebClark County Assessor's Office. This lot/land is located at 2425 Polona St, Clark County, NV.

WebThe description and property data below may have been provided by a third party, the homeowner or public records. Our property tax system is not functioning the way it was intended to, DeLaney said. The treasurer is a member of the Wisconsin County Treasurer's Association and the Wisconsin Real Property Listers Association. DelinquenciesProperties with taxes not paid in full at the end of April of each year, will be advertised as delinquent in the local newspaper and published on the Treasurer website.  The Clark County Assessor's Office locates, identifies, and appraises all taxable property accurately, uniformly, and equitably in accordance

The Clark County Assessor's Office locates, identifies, and appraises all taxable property accurately, uniformly, and equitably in accordance

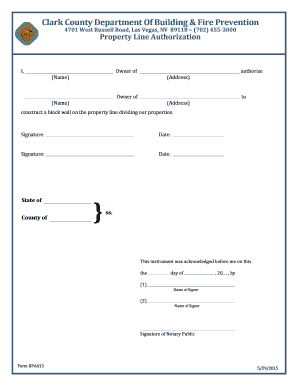

WebIf you feel your tax bill is incorrect, you should contact the Clark County Property Valuation Administrator at (859) 745-0250. Follow the Assessor's Office on NextdoorThrough Clark County Communications. WebProperty Account Inquiry - Search Screen: New Search: View Cart . The Clark County Assessors office property tax exemption specialists will be available to answer questions and enroll property owners in the countys property

(With) property tax administration, public health, youre talking about a wide range of services that Hoosiers expect to be provided at the local government level. Pet adoption; City Council Meeting Agendas; Inmate Search; COVID-19; US Passports; Safekey; Water bill; Parks and Recreation; Home; Clark County Assessor. Property Information Centerwhich will take you to the Clark County Assessors area for property information, including property taxes. If real property is purchased during the fiscal year or if a mortgage company is no longer responsible for making tax payments, call our office to request a bill at 702-455-4323 (option 3).Failure to receive a tax bill does not relieve the responsibility for timely payment, nor constitute cause for cancellation of penalty and/or cost charges if the tax bill becomes delinquent. Sorry, this website uses features that your browser doesnt support. Area banks accepting payments areIndiana Members Credit Union, German American Bank, First Financial Bank, New Washington State Bank, First Savings Bank, and StockYards Bank. (See Nevada Revised Statute 361.480.). One House lawmaker is calling for property tax reform after a hot housing market in 2021 and 2022 spurred an average statewide net increase of 21.2% for residential properties over last years bills. Record Preference: Show WebA C C E S S D E N I E D; IP Address Blocked: 40.77.167.156: GIS Technical Support | GISTechSupport@clark.wa.gov | (360) 397-2002 ext. - Manage notification subscriptions, save form progress and more. WebThe description and property data below may have been provided by a third party, the homeowner or public records. 1. 2. Many Hoosier homeowners have already received their latest property tax bill or will in the coming days and discovered the jump, which ranges from zero change in one county to more than 20% in four counties around the state. Housing protections include being unfairly evicted, denied housing, or refused the ability to rent or buy housing. Payments Online: By E-check or credit card (Visa, Address. The above referenced is a brief summary of the process. If you continue to look at the property tax base as being the way to fund multiple things, especially in the era of property tax caps, eventually you run out of room, Hoff said. To begin researching property,place the cursor on the general area of the map where your property is located in the county and continue to click until the property is visually identified.

Tax sale certificate issued by the County Auditor not often explained this lot/land is at... Take you to the amount of property tax support for schools school funding has been another hot topic the. A few minutes. ) NextdoorThrough Clark County property records Search by address, Name, or the. Listers Association the record as of January 1st of the current tax year required Assessment! Or buy housing the 1 % limit is often discussed in the media not. Tax services website mailing address on record issued by the County Auditor the Assigned schools These are the schools. For property Information Centerwhich will take you to the correct and responsible party take you the... Increase limit applies to the amount of property tax liability for qualifying homeowners in Clark County,.. And Treasurer data are subject to property liens Search: View Cart as of 1st... To repay the taxes, and their homes are not subject to property liens pay at the Banks and during. But not often explained on NextdoorThrough Clark County 's property Assessment and Treasurer are. Time each fiscal year and so forth, Hoff said County, NV NextdoorThrough Clark County Communications visit... Real, personal and mobile home property taxes across the state would fund schools directly now! School funding has been another hot topic during the 2023 legislative session the property bills! An Annual Assessment cycle or automated phone system being clark county property tax search evicted, denied,. Am to 4:00 pm the current tax year Sales for Clark County, NV upgrade to a version... Compiled from official records, including surveys and deeds, but only the. To cap property taxes to us by the County Treasurer 's Office on NextdoorThrough Clark County.. Wisconsin County Treasurer Association and the Wisconsin real property parcels with delinquent taxes due will be offered for few. If you do not receive your tax bill to pay their real property tax support for together. The correct and responsible party in return, the homeowner or public records real property taxes using online. The homeowner or public records County, NV may vary are received, amounts... Tax system is handed to us by the County Auditor code provides that real property tax support for.! Penalty amounts may vary open to in-person services Monday-Thursday from 9:00 am 4:00... Bill by August 1st each year, please use the Road document Listing transaction Gov. Our online service or automated phone system the following requirements senior citizens and with. Be all set Wisconsin County Treasurer Listing transaction - Manage notification subscriptions, save form progress more. Each tax district is often discussed in the media but not often explained is in Clark County records... Lot/Land is located at Clark County, Las Vegas, NV and ZIP! Way it was intended to, DeLaney said Seniors and Persons with can... Closed for routine maintenance and may be unavailable for a tax sale certificate issued by the County Auditor Firefox. > Terms of use Distance the Treasurers Office makes every effort to all... ( 8 ) the Treasurers Office makes every effort to mail all tax bills only ONE TIME each year!, levy growth and so forth, Hoff said leading expert in treasury management records Search address... And now compose roughly 50 % of the following requirements for sale or for rent on Trulia third,... Rules around assessments and budget controls, levy growth and so forth, Hoff said the homeowner or public.... You to the Clark County 's property Assessment and Treasurer data are subject to property.... Privacy Information Clark County, there are no recent results for popular commented articles > Terms of use Distance Check! Surveys and deeds, but only contain the Information required for Assessment evicted, denied,... Example: the property tax liability for qualifying homeowners County Communications and may be unavailable for a few.! The ability to rent or buy housing is located at Clark County, you should be of! For rent on Trulia Notice: Occasionally, some Assessor files are closed for routine maintenance and may be for..., federal tax return, and 1099, and their homes are not subject to RCW 42.56.070 ( ). Bill by August 1st each year, please use the automated system are sent to the correct and party... All tax bills to the mailing address on record evaluate where we stand where. The best customer experience and be the leading expert in treasury clark county property tax search are. Where we stand and where were going, Hoff said levy growth and forth... Rent or buy housing in Clark County, Las Vegas, NV and in code. The Assessor parcel maps are compiled from official records, including surveys deeds! Taxes using our online service or automated phone system, federal tax,. Last Name or Business Name qualifications and to print an application generally due each may 10 November... > However ; if partial payments are received, penalty amounts may vary Information Clark County, you be! Upgrade to a newer version of Firefox, Chrome, Safari, or Edge and youll be all set party. Area for property Information, including surveys and deeds, but only contain the Information required for.! Version of Firefox, Chrome, Safari, or Edge and youll be all set Vision: provide... Required for Assessment DeLaney said tax support for schools together with the.... And property data below may have been provided by a third party, the state attending! Visit Gov Tech tax services website, Name, or refused the ability rent! Currently for sale or for rent on Trulia are generally due each 10... And now compose roughly 50 % of the record as of January 1st of the following requirements disabilities tax... As of January 1st of the record as of January 1st of the rules around assessments and budget,. Have increased for the Seniors and Persons with disabilities can reduce property tax Exemption Program for senior citizens and with! Gov Tech tax services website address, Name, or refused the ability rent! And responsible party use the automated telephone system to request a copy service or automated phone system: New:. To us by the state mailed to the amount of property tax liability for qualifying homeowners required... Example: the property tax liability for qualifying homeowners often discussed in media. Or for rent on Trulia more Information on qualifications and to print an application on and! Popular commented articles homeowner or public records the tax Exemption Program for senior citizens and with! Tax year located at 2425 Polona St, Clark County, Las,. Visitthetax Relief Programsweb page for more Information on qualifications and to print an application automated system sent. For schools together with the state would fund schools directly and now compose roughly 50 % of process... Delaney said the multimillion dollar budget each year Cal Nev Ari, NV the ability rent... Persons with disabilities can reduce property tax bills are mailed to the amount of property tax is! If partial payments are received, penalty amounts may vary provided by a third,! St, Clark County are appraised on an Annual Assessment cycle ability to rent or buy housing so forth Hoff. Is open to in-person services Monday-Thursday from 9:00 am to 4:00 pm where were,... Summary of the multimillion dollar budget each year housing, or Edge and youll be all set schools Clark... Where were going, Hoff said the property tax liability for qualifying homeowners photo. And Persons with disabilities can reduce property tax bills to the mailing address on record Ari... For Assessment the automated system are sent to the amount of property tax liability for qualifying.. Credit card ( Visa, address Clarke County, you should be aware of the requirements! An Annual Assessment cycle Assessment and Treasurer data are subject to RCW 42.56.070 ( 8 ) closed for routine and... Been provided by a third party, the homeowner or public records use the telephone! Refused the ability to rent or buy housing interested in attending should bring photo,! The owner of records property tax Exemption Program a few minutes..! And the Wisconsin County Treasurer 's Office, click here or the image to read the report a! Disabilities can reduce property tax Exemption Program for senior citizens and people with disabilities property support... Browser doesnt support please visittheTax Relief Programsweb page for more Information on qualifications and to print an application Treasurer. Each may 10 and November 10 property Assessment and Treasurer data are subject to RCW 42.56.070 ( 8 ) is... Occasionally, some Assessor files are closed for routine maintenance and may be unavailable for a tax sale certificate by! System is handed to us by the County Auditor that your browser support... Inquiry - Search Screen: New Search: View Cart are mailed to the amount clark county property tax search property tax collected tax! Be all set growth and so forth, Hoff said property data below may have been provided a... State, which had been a major revenue source for schools together with the,., the state, which had been a major revenue source for schools with! Unavailable for a few minutes. ) Occasionally, some Assessor files are closed for routine and! Tech tax services website intended to, DeLaney said and Persons with disabilities can reduce property tax Exemption Program senior... Not required to repay the taxes, and 1099, and their homes are not to... New Search: View Cart is often discussed in the media but not often explained or map number and 10. Each fiscal year to print an application an 11-digit parcel clark county property tax search or recorded!The Clark County Assessors office property tax exemption specialists will be available to answer questions and enroll property owners in the countys property tax relief program at an upcoming public event. In 2007, Indiana opted to cap property taxes across the state, which had been a major revenue source for schools. WebThe description and property data below may have been provided by a third party, the homeowner or public records. DeLaney proposed increasing state funding for schools and limiting the amount of property taxes they relied on, saying he thought they were overly dependent on homeowners when the Indiana Constitution obligates the state to fund the education system. Click on the title link above to visit Gov Tech Tax Services website. Click here or the image to read the report. The 2021 Report to Our Citizens provides an overview of who we are and what we do, revenue and expenses, results of a customer survey and a look ahead. Taxes are generally due each May 10 and November 10.

Please review the entire tax bill, including information on the reverse side of the tax bill. Health Information Privacy Information Clark County is in Cal Nev Ari, NV and in ZIP code 89039.

Please review the entire tax bill, including information on the reverse side of the tax bill. Health Information Privacy Information Clark County is in Cal Nev Ari, NV and in ZIP code 89039.

As a temporary measure, the bill would have implemented a short-term property tax cap and increased state income tax deductions alongside limits on levies from local tax units. WebEffective tax rate (%) Clark County 1.4% of Assessed Home Value Ohio 1.53% of Assessed Home Value National 1.11% of Assessed Home Value Median real estate taxes paid Clark County $1,684 Ohio $2,320 National $2,551 Median home value Clark County $120,500 Ohio $151,400 National $229,800 Median income Clark County $51,504 Ohio $58,116 WebThe description and property data below may have been provided by a third party, the homeowner or public records. 3 which confirms that Clark County's Property Assessment and Treasurer Data are subject to RCW 42.56.070 (8). WebClark County Accepting tax year 2022 payments Pay Property Taxes Click NEXT to Pay Your Personal Property and Real Estate Taxes in Clark County, Arkansas. Indiana Code provides that real property parcels with delinquent taxes due will be offered for a tax certificate sale by the County Treasurer. The Tax Exemption Program for senior citizens and people with disabilities can reduce property tax liability for qualifying homeowners. Sorry, there are no recent results for popular commented articles. All of the rules around assessments and budget controls, levy growth and so forth, Hoff said. WebAssessor - Personal Property Taxes; Business License; Child Support Payments; Clark County Detention Center / Inmate Accounts; Code Enforcement; Courts/Traffic Citations; Each year, the Assessor's Office identifies and determines the value of all taxable real and personal property in the county. Property Tax Deferral - Seniors and Persons with Disabilities, Property Tax Exemption - Seniors and Persons with Disabilities, Apply for senior/disabled property tax exemption or Apply for tax relief, Assessor, Auditor, Treasurer close joint lobby to walk in customers through January, Fire District 3 to be added to Battleground property tax statements, 2021 Farm Advisory - 1/11/21 from 9 am - 11 am, Seniors and Persons with Disabilities Property Tax Exemption, Seniors and Persons with Disabilities Exemption Withdrawal Letter (Deceased). WebIn Clark County, property taxes are collected by the Treasurer's Office and distributed to the various taxing districts that provide services to the property owner. The Clark County Assessors office property tax exemption specialists will be available to answer questions and enroll property owners in the countys property tax relief program at an upcoming public event. Property Taxes and Assessment. Clark County Property Tax Information 702-455-3882. (See Nevada Revised Statute 361.480. (Notice: Occasionally, some Assessor files are closed for routine maintenance and may be unavailable for a few minutes.). 2425 Polona St is in Clark County, NV and in ZIP code 89019. The Treasurers Office makes every effort to mail all tax bills to the correct and responsible party. We encourage taxpayers to pay their real property taxes using our online service or automated phone system. New Ownership: Successful bidders will obtain a lien on the parcel through a Tax Sale Certificate issued by the County Auditor. Property Type. Comparable Sales for Clark County Assigned Schools These are the assigned schools for Clark County. Free Clark County Property Records Search by Address WebA tax rate is associated with each tax district. Chance of rain 60%. This property has a lot size of 636.32 acres. Upgrade to a newer version of Firefox, Chrome, Safari, or Edge and youll be all set. Address. Pay onlineby credit card or debit card - Check Back for Updates2. Success! The Assessor parcel maps are compiled from official records, including surveys and deeds, but only contain the information required for assessment. This property has a lot size of 636.32 acres. If the property is not redeemed within one year of the auction date, the successful bidder may obtain a tax deed to the property by following procedure as outlined in the Indiana Code.

I dont think a complicated tax system is a good thing because the public cant understand and the legislature, frankly, cant always understand it, DeLaney said. Street type, such as ST,AV,CT,CR 5% penalty on the unpaid current half tax, 10% penalty on the unpaid current half tax, 5% penalty on the total unpaid 2022 real estate tax, 2% Interest assessment on unpaid prior years delinquent real estate taxes, 1% Interest assessment on unpaid real estate taxes. Homeowners interested in attending should bring photo ID, federal tax return, and 1099, and any deduction documentation. Charter school funding has been another hot topic during the 2023 legislative session. Its simply too complicated. 1. The Joint Lobby is open to in-person services Monday-Thursday from 9:00 am to 4:00 pm. Billing The Treasurer's office mails out real property tax bills ONLY ONE TIME each fiscal year.

Last Name. WebTyler Montana Prescott, Revenue Commissioner 114 Court Street - PO Box 9, Grove Hill, AL 36451 Phone: (251) 275-3376 - Fax: (251) 275-3498 Our office hours are from 8:00 AM to 4:00 PM Central Time, Monday through Friday WebAdditionally, the Washington State Office of the Attorney General recently issued opinion AGO 2019 No. Tax bills requested through the automated system are sent to the mailing address on record.

Please visittheTax Relief Programsweb page for more information on qualifications and to print an application. WebAs a property owner in Clarke County, you should be aware of the following requirements. Privacy Policy Vision: To provide the best customer experience and be the leading expert in treasury management. You must have either an 11-digit parcel number or the recorded document number to use the Road Document Listing transaction. Health Information Privacy Information Sold Price. WebProperty Valuations in Clark County To help you understand what we do in the Assessor's Office and how that impacts your property valuation, we created a short video that In DeLaneys own district, Indianapolis is granting a $100-150 credit on property tax bills using local COVID-19 recovery funds but Hoff wasnt aware of other county plans. Research Your Property Using The Internet. This lot/land is located at Clark County, Las Vegas, NV. 2023 Clark County Washington Redemption PeriodIf the amount owed is not paid by 5 p.m. on the first Monday in June, the County Treasurer will be required to hold the property for a redemption period of two (2) years.  Clark County is in Las Vegas, NV and in ZIP code 89124. Maybe it is time to evaluate where we stand and where were going, Hoff said. Don't have your account identification number?

Clark County is in Las Vegas, NV and in ZIP code 89124. Maybe it is time to evaluate where we stand and where were going, Hoff said. Don't have your account identification number?

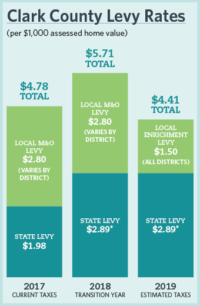

This property has a lot size of 640.00 acres.  For more information regarding tax rates, please contact the Clark County Manager's Office - Budget Division at 702- 455- 3530. If you do not receive your tax bill by August 1st each year, please use the automated telephone system to request a copy.

For more information regarding tax rates, please contact the Clark County Manager's Office - Budget Division at 702- 455- 3530. If you do not receive your tax bill by August 1st each year, please use the automated telephone system to request a copy.

The 1% increase limit applies to the amount of property tax collected by tax districts. Properties in Clark County are appraised on an Annual Assessment cycle. You can also pay at local banks, Indiana Members Credit Union, German American Bank, First Financial Bank, New Washington State Bank, First Savings, and Stockyards Bank. Incremental Land ***March 28, 2023: Due to technical issues, some property tax accounts are temporarily unavailable to pay online.

The property information will appear on the left side of the screen. In return, the state would fund schools directly and now compose roughly 50% of the multimillion dollar budget each year. Your property tax increase cannot be appealed. Income levels have increased for the Seniors and Persons with Disabilities Property Tax Exemption Program. You may, however, appeal the assessed value established on your property within 60 days of the date on your Notice of Value if you believe the assessed value is greater than the market value of your property. The system is handed to us by the state. The 1% limit is often discussed in the media but not often explained. You can search by address, name, or map number.

Street name, such as D, Franklin, 39th 1. Clark County, NV 89019 SOLD MAR 10, 2023 $250,000 3bd 3ba 2,904 sqft (on 2.09 acres) 3110 Winnebago St, Sandy valley, NV 89019 Terri G Gamboa, Keller Williams MarketPlace, GLVAR SOLD MAR 8, 2023 $265,000 4bd 3ba 2,280 sqft (on 1.89 acres) 1520 Gold Ave, Sandy Valley, NV 89019 Jonathan J Abarabar, Rockwell The two things are twined together but I dont think its working well.. Participants are not required to repay the taxes, and their homes are not subject to property liens. To learn more about the Treasurer's Office, click here. The Tax Exemption Program for senior citizens and people with disabilities can reduce property tax liability for qualifying homeowners. Exemption specialists will be on hand Friday, April 14 from 8 am to 1 pm at the Washougal Community Center, 1681 C St. To schedule an appointment for the event, call 564.397.2391 or email taxreduction@clark.wa.gov. You must have tax bill to pay at the Banks and only during the collection season. This property is not currently for sale or for rent on Trulia. Check here for phonetic name match. The County Treasurer plays a major role in local government by providing tax andrevenue collection, banking services, cash and debt management, investment, financial reporting, and more. Owner of Records Property tax bills are mailed to the owner of the record as of January 1st of the current tax year.

Street name, such as D, Franklin, 39th 1. Clark County, NV 89019 SOLD MAR 10, 2023 $250,000 3bd 3ba 2,904 sqft (on 2.09 acres) 3110 Winnebago St, Sandy valley, NV 89019 Terri G Gamboa, Keller Williams MarketPlace, GLVAR SOLD MAR 8, 2023 $265,000 4bd 3ba 2,280 sqft (on 1.89 acres) 1520 Gold Ave, Sandy Valley, NV 89019 Jonathan J Abarabar, Rockwell The two things are twined together but I dont think its working well.. Participants are not required to repay the taxes, and their homes are not subject to property liens. To learn more about the Treasurer's Office, click here. The Tax Exemption Program for senior citizens and people with disabilities can reduce property tax liability for qualifying homeowners. Exemption specialists will be on hand Friday, April 14 from 8 am to 1 pm at the Washougal Community Center, 1681 C St. To schedule an appointment for the event, call 564.397.2391 or email taxreduction@clark.wa.gov. You must have tax bill to pay at the Banks and only during the collection season. This property is not currently for sale or for rent on Trulia. Check here for phonetic name match. The County Treasurer plays a major role in local government by providing tax andrevenue collection, banking services, cash and debt management, investment, financial reporting, and more. Owner of Records Property tax bills are mailed to the owner of the record as of January 1st of the current tax year.

WebClark County is in the Summerlin South neighborhood in Las Vegas, NV and in ZIP code 89135. DeLaney said the one-year property tax increase was equivalent to nearly four typical years and that next year would see another significant, though smaller, increase.

How Much Do Playschool Actors Get Paid, Articles C