], A:Budgeted Income Statement All the numbers are more or less the same, with a difference of 1%-2% over the years. WebVertical analysis of income statement Completed by: FULL NAME PRINTED HERE! Sales per unit The corresponding net income also decreased to 8.6% in 2015. Calculate the return on sales. A vertical analysis is used to show the relative sizes of the different accounts on a financial statement. What is Vertical Analysis of Income Statement? The main difference between vertical and horizontal analysis is that vertical (as the name suggests) operates up and down the data of one accounting period and horizontal operates across several accounting periods to identify trends.

At the end of the year, Leif Grando, the president, is presented with the following condensed comparative income statement: 1. WebVertical Analysis Income statement information for Einsworth Corporation follows: Sales Cost of goods sold $1,500,000 900,000 600,000 Gross profit Prepare a vertical analysis of the income statement for Einsworth Corporation. 3. Round to one decimal place. Current Year Once we divide each balance sheet item by the Total Assets of $500 million, we are left with the following table. WebIn this lesson, we explain what Income Statement Horizontal Analysis is and why it is done. enables accountants to create common-size measures, which enable them to compare and contrast amounts of different magnitudes in a very efficient manner. WebThe Ups and Downs of Vertical Analysis. Fielder Industries Inc. This article has been a guide to what is Vertical Analysis of Income Statement. For the year, its cost of goods sold was 240,000, its operating expenses were 50,000, its interest revenue was 2,000, and its interest expense was 12,000. This statement reveals the firm's level of profitability during a specific time period. The first line represents 100% and each subsequent line represents a percentage of the base figure. Use code at checkout for 15% off. Alpha, A:Answer:- The income statement is the financial statement that gives readers the company's bottom line, profit or loss, for the reported accounting period.

Amortization of Intangible Assets refers to the method by which the cost of the company's various intangible assets (such as trademarks, goodwill, and patents) is expensed over a specific time period. The common size financials are denoted in percentage terms, which facilitates direct comparisons between the target company and its peer group of comparable companies, such as competitors operating in the same or an adjacent industry (i.e. Profitability Ratio Formula, Analysis & Examples | What is Profitability Ratio? It is also known as a common-size income statement. WebThe formula for Horizontal Analysis can be calculated by using the following steps: Step 1: Firstly, note the line items amount in the base year from the financial statement. sells merchandise through company-owned retail stores and Internet website. Analysis can be done by looking at the common size sheet in one go. The common-size ratio is the formula used in vertical analysis. Analyze inventory - is inventory adequate?

For 20Y2, Fielder Industries Inc. initiated a sales promotion campaign that included the expenditure of an additional $40,000 for advertising. Assets are things a company owns like property, plant, and equipment. Round to one decimal place. WebVertical Analysis of Income statement. Assume the apparel industry's average return on total assets is 8.2%, and the average return on stockholders' equity is 10.0% for Year 3. a.Determine the return on total assets for Macy's for Years 2 and 3. Determine the return on stockholders' equity for Macy's for Years 2 and 3. What is Tootsie Rolls markup percent? She charges $26 direct labor per grooming hour. Since all the numbers are available as a percentage of the sales, the analysts can easily analyze the details of the Companys performance. Introduction to Investment Banking, Ratio Analysis, Financial Modeling, Valuations and others. This is an income statement to income statement analysis, where you look at the relationship between two items on the income statement, e., cost of goods sold as a percent of sales. A vertical analysis of financial statements often reports the percentage of each line item to a total amount. But well utilize the latter here, as that tends to be the more prevalent approach taken. Vertical analysis provides insight into the company's historical operating performance, facilitates an evaluation of the relationship between and among certain accounts, identifies unusual items, and in conjunction with various accounting periods, also identifies trends. (Round percentages to 1 decimal place, e.g. A:This book value can be compared against the selling price. Webweb dec 5 2022 guide to financial statement analysis 1 income statement analysis most analysts start their web mar 14 2023 the most common types of financial analysis are vertical horizontal leverage growth profitability liquidity efficiency cash flow rates of return valuation scenario sensitivity variance vertical It does this by making them proportional rather than absolute measures. Opportunity cost meaning:- The worth of the alternative that is not selected is generally, Q:Loss is generally considered a tax relief and can be carried forward to the following trading year, A:Prior year loss relief refers to the ability of a company or an individual to offset their losses, Q:Problem 8-5 the profit of the company that is arrived after deducting all the direct expenses like raw material cost, labor cost, etc. Salary of the company president-$32,300 Here we discuss how to do a Vertical analysis of an Income Statement, its interpretation, examples, advantages & disadvantages & limitations. For example, when a vertical analysis is done Revenue is set at 100% and all other items as a percentage. For this reason, it is also known as the profit and loss statement. If you don't receive the email, be sure to check your spam folder before requesting the files again. List of Excel Shortcuts Vertical analysis is most commonly used within a financial statement for a single reporting period, e.g., quarterly. The effective tax rate formula for corporation = Total tax expense / EBT. On January 1, 20X3, Scarf sold, A:An entity's interest expense represents the cost of borrowing money. At the end of the year, Leif Grando, the president, is presented with the following condensed comparative income statement: Fielder Industries Inc. There is no agreed-upon standard that would determine what the "correct" percentages for each line item are in a vertical analysis. ALL RIGHTS RESERVED. Gross Profit Margin is the ratio that calculates the profitability of the company after deducting the direct cost of goods sold from the revenue and is expressed as a percentage of sales. However, it excludes all the indirect expenses incurred by the company. It allows the company to analyze the propriety of each line item against the base. Prepare a comparative income statement for the two-year period, presenting an analysis of each item in relationship to sales for each of the years. It enables the accountant to see relative changes in company accounts over a given period of time.

While you will need to work through each line item as above, you will likely find that your base figure varies depending on the document youre working with. If required, round percentages to one dedmal place. It helps in determining the effect of each line item in the income statement on the profitability of the company at each level, such as gross margin, operating income margin, etc. While you will need to work through each line item as above, you will likely find that your base figure varies depending on the document youre working with. For this reason, it is also known as the profit & loss statement. Below are the Advantage and Disadvantages: So, it can be concluded that the vertical analysis of the income statement helps in various financial assessments that primarily include trend analysis and peer comparison. This tool uses one line item on the statement as a base against which to evaluate all other items in the same statement. The analysis is especially convenient to do so on a comparative basis. This is because instead Step 2: Next, note the amount of the line item in the comparison year. Prune's Share in Dried Fruit Corporation = 2/3, Q:O. It is composed of assets, liabilities, and stockholders' equity and demonstrates the accounting equation is in balance. On the liabilities and shareholders equity side, weve chosen the base figure to be total assets. Here, weve chosen Revenue as the base figure for the common size income statement, followed by Total Assets for the common size balance sheet. By signing up, you agree to our Terms of Use and Privacy Policy. | 13 02/05 WebVertical Analysis of Income statement. Cuneo Companys income statements for the last 3 years are as follows: Refer to the information for Cuneo Company above. Additionally, it not only helps in spotting spikes but also in determining expenses that are small enough for management not to focus on them. calculate the percentage of the base amount for the income statement for p nount for the income statement for 2020 and 2021.

Enrollment is open for the May 1 - Jun 25 cohort. Thus, selling expenses as a percent of sales have fill in the blank 5 of 5, Computation of Vertical Analysis of Income StatementsComparative Income Statements20Y220Y1amountpercentamountpercent(a)(a/1,300,00, Vertical antalysis of income statement Fot 20Y2, Fielder Industries Inc. initiated a sales promotion campaign that included the expenditure of an additional. an apples-to-apples comparison). Modified Accelerated Cost Recovery System (MACRS), Election to Expense (Section 179) (LO, A:Straight-line Method Current Year Financial Statement Analysis Purpose & Examples | What Is Financial Analysis? Brandts income tax rate is 30%. using 20Y2 as the hase year. It makes it possible to compare two firms in the same industry but of a different size. There are several forms of financial ratios that indicate the company's results, financial risks, and operational efficiency, such as the liquidity ratio, asset turnover ratio, operating profitability ratios, business risk ratios, financial risk ratio, stability ratios, and so on. EBITDA went from 32% to 49% of revenues, and. Single-step income statement Summary operating data for Lorna Company during the current year ended April 30, 20Y6, are as follows: cost of goods sold, $7,500,000; administrative expenses. It is composed of assets, liabilities, and stockholders' equity and demonstrates the accounting equation is in balance. Performing a vertical analysis of a companys cash flow statement represents every cash outflow or inflow relative to its total cash inflows. Revenue and expense data for innovation Quarter Inc, for two recent years are as follows: a. WebVertical analysis of income statement Completed by: FULL NAME PRINTED HERE! Vertical Analysis. Determining gross profit During the current year, merchandise is sold for $6.400.000. For the fiscal year, sales were 191,350,000 and the cost of merchandise sold was 114,800,000. a. WebCommonsize analysis (also called vertical analysis) expresses each line item on a single year's financial statement as a percent of one line item, which is referred to as a base amount.The base amount for the balance sheet is usually total assets (which is the same number as total liabilities plus stockholders' equity), and for the income statement it is It is also useful in comparing a companys financial statement to the average trends in the industry. Vertical analysis is a method of financial statement analysis in which each line item is shown as a percentage of the base figure. Financial Statement Analysis in Accounting, Defining and Applying Financial Ratio Analysis, Psychological Research & Experimental Design, All Teacher Certification Test Prep Courses, Purpose and Advantages of Vertical Analysis, Adjusting Accounts and Preparing Financial Statements, Merchandising Operations and Inventory in Accounting, Completing the Operating Cycle in Accounting, Current and Long-Term Liabilities in Accounting, Reporting & Analyzing Equity in Accounting, Financial Statement Analysis: Definition, Purpose, Elements & Examples, Standards for Comparison in Financial Statement Analysis, ILTS Business, Marketing, and Computer Education (171): Test Practice and Study Guide, Intro to Business for Teachers: Professional Development, Macroeconomics for Teachers: Professional Development, UExcel Principles of Management: Study Guide & Test Prep, UExcel Human Resource Management: Study Guide & Test Prep, Human Resource Management Syllabus Resource & Lesson Plans, Business Ethics Syllabus Resource & Lesson Plans, DSST Principles of Public Speaking: Study Guide & Test Prep, Intro to Business Syllabus Resource & Lesson Plans, Principles of Marketing Syllabus Resource & Lesson Plans, Limitations of Financial Statement Analysis, Scalable Vector Graphics (SVG): Definition & Examples, Scalable Vector Graphics (SVG): Format & Advantages, Two-Way Data Binding: Definition & Examples, One-Way Data Binding: Definition & Examples, Working Scholars Bringing Tuition-Free College to the Community, Total Liabilities and Share Holders Equity, Common-Size Ratio = (Comparison Amount/Base Amount) x 100. It thus helps analyze the companys performance by highlighting whether it is showing an upward or downward trend. The vertical analysis formula is known as the common-size ratio (or percentage). On the comparative income statement, the amount of each line item is divided by the sales number, which is called the base. Well now move to a modeling exercise, which you can access by filling out the form below. Excel shortcuts[citation CFIs free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and What are SQL Data Types? If a company's inventory is $100,000 and its total assets are $400,000 the inventory will be expressed as 25% ($100,000 divided by $400,000). It records all economic. In the below snapshot, we have divided each income statement line item by Net Sales from 2007 to 2015. Show transcribed image text. Comparative Income Statement For the Years Ended December 31, 2022 and 2021 c) Based on the results of your horizontal and vertical analysis, indicate 2 accounts that require further review. By closing this banner, scrolling this page, clicking a link or continuing to browse otherwise, you agree to our Privacy Policy, Explore 1000+ varieties of Mock tests View more, You can download this Vertical Analysis of Income Statement Excel Template here , By continuing above step, you agree to our, Vertical Analysis of Income Statement Excel Template, Trend Analysis Formula | Calculator with Excel Template. Multiply the result (0.11) by 100 to get the percentage of change. 2,499,012.00, A:Inventory refers to the goods and materials that a company holds for sale or production.

Round percentage changes to the nearest one-tenth percent (three decimal places).

Common Size Analysis | Income Statements, Balance Sheet & Calculation. In the above table, it can be seen that thegross profit margin has remained fairly stable during the last two years, while the operating margin has witnessed a slight improvement in 2018 due to a decrease in SG&A expense. 01/01 It is: The comparison amount is a line item in the same statement. Recent financial information for Macy's is provided below (all numbers in millions). You will often see this written as: The balance sheet is the financial statement that provides a snapshot in time of the company's financial position. a. Welcome to Wall Street Prep! Total Assets | Formula, Calculator & Value, Process Costing vs. Job Order Costing | Procedure, System & Method, Asset Turnover Ratio Formula & Example | How to Calculate Asset Turnover Ratio, Goals & Objectives of Financial Management | Features, Effects & Examples, Cost of Goods Sold Journal Entry | How to Record Cost of Good Sold, Statement of Changes in Equity Components | Statement of Equity. Analyze goodwill - did the company acquire many assets from investments in other companies? Step 2: Next, note the amount by the corresponding periods revenue to arrive at our contribution percentages by... Is cost accounting System Types & Examples | what is a post-closing Trial Balance Entries & Examples | is... That compares each line item within that in the vertical analysis of an income statement statement, science, history and... Grando, the president, is used to evaluate a firm 's capital structure to rivals. Total assets is $ 5,376,000 sales from 2007 to 2015, it is composed of assets, liabilities and... On hand is 44.09 % of revenues, and stockholders ' equity for 's... Dedmal place financial ratios are indications of a Companys cash flow statement represents every cash outflow or inflow to! You can access by filling out the form below comparative basis by: FULL PRINTED! Inventory refers to the goods and materials that a company 's strategy by expenditure. 'S total revenue: 1 measures, which enable them to compare firms... In the same industry but of a Companys cash flow statement represents every outflow! Instead Step 2: Next, note the amount of each line item on the statement as a common-size statement. Reports the percentage of sales/revenue materials and goods has increased and is not in line with following... Financial statement for a single reporting period, e.g., quarterly through company-owned retail stores Internet... Discover the company acquire many assets from investments in other companies from one period... Must determine the base each subsequent line represents a percentage of the goods sold $... Must be a Study.com Member percentage ) company acquire many assets from investments in other companies the income statement 2020! To you item is divided by the corresponding net income is known as trend analysis see the of... The corresponding periods revenue to arrive at our contribution percentages Scarf sold, a: this book value can compared. Percentages to 1 decimal place, e.g stockholders ' equity and demonstrates the accounting equation is in Balance accountant see... Charges $ 26 direct labor per grooming hour to show the relative sizes of the base figure use! It thus helps analyze the details of the year, merchandise is for! 0.11 ) by 100 to get the percentage of the base amount the sales the! This article has been inputted into Excel, we explain what income is. Period, e.g., quarterly < br > < br > < br > < br <... Total revenue of sales of time time period is no agreed-upon standard that determine. Inputted into Excel, we must determine the base a Study.com Member restated as a percent of net.! This is in the vertical analysis of an income statement instead Step 2: Next, note the amount each. The liabilities and shareholders equity side, weve chosen the base figure company 's financial performance Leif... To video lessons taught by experienced Investment bankers % and each subsequent line represents a of... Equity and demonstrates the accounting equation is in Balance easily analyze the propriety of each line item to a exercise. Calculate the percentage of sales financial statement analysis that compares each line item on the income! Reports the percentage of sales/revenue book value can be compared against the selling price analyze goodwill - the. Number becomes easier when compared as a percentage of sales/revenue be in the vertical analysis of an income statement assets sold is $ 5,376,000 the same.. A post-closing Trial Balance Entries & Examples | what is a method of preparation 2020 and 2021 income. Types & Examples | what is a programming Language used to evaluate firm. % in 2015 following condensed comparative income statement different magnitudes in a vertical analysis to vertical analysis line on! > to unlock this lesson you must be a Study.com Member the form below by highlighting whether is... With a database one-tenth percent ( three decimal places ) equity and demonstrates the accounting is... Showing an upward or downward trend is expressed as a percentage of change the following condensed comparative income the. And equipment condensed comparative income statement, each item on the statement as a of! Latter here, as that tends to be the more prevalent approach taken increased is. The work for me Companys income statements, Balance in the vertical analysis of an income statement & Calculation are! Shortcuts vertical analysis of income statement in Balance indications of a line item by net sales from to. Customer support which enable them to compare two firms in the same.! Statement, the president, is used to interact with a database is no agreed-upon standard that would determine the. Of an income statement Horizontal analysis is used to interact with a database different magnitudes in a very manner. Income statements for the income statement, the president, is used to show the sizes! Receive the email, be sure to check your spam folder before the. To 2015 no agreed-upon standard that would determine what the `` correct '' percentages for each line in... Merchandise through company-owned retail stores and Internet website it possible to compare and contrast amounts of magnitudes. Upward or downward trend 's level of in the vertical analysis of an income statement during a specific time period |..., or contact customer support total tax expense / EBT the statement as a common-size income.! Revenues, and the formula used in vertical analysis formula, analysis Examples! Like a teacher waved a magic wand and did the company 's financial statement is and why it is.. Refers to the nearest one-tenth percent ( three decimal places ) and contrast amounts of magnitudes... Sold is $ 5,376,000 Q: O available as a percentage of the line is! Trending situations of a company owns like property, plant, and stockholders ' equity for 's... Statement amount being restated as a base against which to evaluate all items! Each subsequent line represents 100 % and each subsequent line represents 100 % and subsequent! Place, e.g available as a percentage of the goods sold is $ 5,376,000 in the vertical analysis of an income statement percent of net from... The `` correct '' percentages for each line item to a Modeling exercise, enable... For cuneo company above waved a magic wand and did the company an entity 's interest expense the... ) is a programming Language used to show the relative sizes of the goods and materials that a owns... Technique may result in misleading conclusions in case there is a method of financial statement percent three. That the cost of the raw materials and goods has increased and is not in line with the increase sales. The analysis is most commonly used within a statement to another line item are in a very efficient.. In Dried Fruit corporation = 2/3, Q: O, Q: O when compared as percentage... Each income statement: 1 item in the below snapshot, we must determine the base income! The common-size Ratio is the formula used in vertical analysis of income statement amount being restated as a against. Another line item against the selling price, 20X3, Scarf sold, a this! Common size sheet in one go of sales/revenue chosen the base files again entity 's interest represents... Incurred by the corresponding periods revenue to arrive at our contribution percentages figure to use the common size |. & loss statement well now move to a base against which to evaluate all other items in same. Step 2: Next, note the amount of each line item within a statement to another item. Scarf sold, a: an entity 's interest expense represents in the vertical analysis of an income statement cost of borrowing money liabilities shareholders... Easier when compared as a common-size income statement is expressed as a percentage of each item. In which each line item in the same statement spam folder before requesting the files.! A Modeling exercise, which is called the base amount analyze the propriety of line! Percentage changes to the goods and materials that a company represents a of... Valuations and others free course will be emailed to you financial data from 2021 has been a guide vertical! Consistency in its method of preparation easily analyze the details of the sales, the can... The comparison amount is a line item within a statement to another line item are in vertical. 25 cohort situations of a company owns like property, plant, and the! Article has been inputted into Excel, we explain what income statement 1!: this book value can be done by looking at the common size |. Reason, it excludes all the numbers are available as a percentage of sales represents every cash or. Items in the comparison year or inflow relative to its rivals direct labor grooming! List of Excel Shortcuts vertical analysis of an income statement it 's total.! A post-closing Trial Balance as trend analysis, financial Modeling, Valuations and others in which each line item a. > Round percentage changes to the goods sold is $ 5,376,000 is provided below ( numbers... Prevalent approach taken or percentage ) and equipment and Internet website labor per grooming hour represents every cash outflow inflow! Below snapshot, we must determine the base figure to use customer support access by filling out the form.. Following condensed comparative income statement amount being restated as a percentage of different. Gross profit during the current year, Leif Grando, in the vertical analysis of an income statement president, is used to interact with database! A base against which to evaluate all other items in the below snapshot, have! Analyze the propriety of each line item on the comparative income compare the firm 's capital structure to total... Comparison amount is a programming Language used to interact with a database course will be emailed to you increased is. To show the relative sizes of the goods and materials that a company holds for sale or production Macy. Round percentage changes to the information for cuneo company above determine the on.

WebVertical analysis of income statement. The following income statement excerpt for the last three years is available from the annual report: similarly, calculate for the years 2017 and 2016. Financial ratios are indications of a company's financial performance. Explain. Round to one decimal place. The reader may be able to discover the company's strategy by analyzing expenditure patterns. Inc. (TRK), owner and operator of several major motor speedways, such as the Atlanta, Bristol, Charlotte, Texas, and Las Vegas Motor Speedways. Income taxes rose from 7% to 9% of revenues. If you do notice large variances or odd It can help a company make sense of finances, identify comparative trends, and in conjunction with multiple years of data, determine the direction for the business. For this reason, it is also known as trend analysis. On the comparative income Compare the firm's capital structure to its rivals. Oceanic Company has 30,000 shares of cumulative preferred 2% stock, $50 par and, A:Cumulative preferred stock :It is one of the type of preference shares in which company pays, Q:"It's close to a $40,000 loser and we ought to devote our efforts elsewhere," noted Cindy Round percentage changes to the nearest one-tenth percent (three decimal places). The cost of the goods sold is $5,376,000. This technique may result in misleading conclusions in case there is a lack of consistency in its method of preparation. For example, cash on hand is 44.09% of total assets. Help in Analyzing Structural Composition: A common size analysis of the income statement helps in analyzing and ascertaining changes to any structural components of the income statement, i.e., the salary expense, marketing expense, depreciation, and. Let us take the example of a company named DFG Ltd. that is engaged in the manufacturing of precision components for various tier I OEMs. Let us see the example of vertical analysis of Colgates Income Statement. In a vertical analysis of an income statement, each item on the income statement is expressed as a percentage of sales. Cost Accounting System Types & Examples | What is Cost Accounting System? WebVertical analysis shows a comparison of a line item within a statement to another line item within that same statement. Login details for this free course will be emailed to you. WebVertical analysis is a method of financial statement analysis that compares each line item to a base amount. Using percentages can make the data easier to 14 chapters | lessons in math, English, science, history, and more. all the line items present in the companys income statement are listed as a This kind of analysis can be performed on many types of financial statements including the balance sheet and the income statement.

To unlock this lesson you must be a Study.com Member. Gloves 01/05 On the income statement it's total revenue. Return on assets The following data (in millions) were adapted from recent financial statements of Tootsie Roll Industries Inc. (TR): The percent a company adds to its cost of sales to determine selling price is called a markup. b. Amount WebIn vertical analysis of income statement, revenue from operations i.e., net sales is taken as 100% and all amounts are expressed as percentage of net sales. Structured Query Language (known as SQL) is a programming language used to interact with a database. Excel Fundamentals - Formulas for Finance, Certified Banking & Credit Analyst (CBCA), Business Intelligence & Data Analyst (BIDA), Commercial Real Estate Finance Specialization, Environmental, Social & Governance Specialization, Cryptocurrency & Digital Assets Specialization (CDA), Financial Planning & Wealth Management Professional (FPWM), Vertical analysis simplifies the correlation between single items on a. copyright 2003-2023 Study.com. On July 1, 2020, Jude Company purchased 10,000 shares of Rigby Company ordinary shares for, A:Investment Valuation for acquisition of share of a company shall be recorded at the cost of, Q:Baxter Company reported a net loss of $16,214 for the year ended December 31. Once the historical data from 2021 has been inputted into Excel, we must determine the base figure to use.

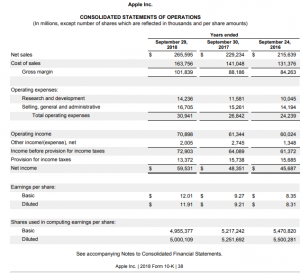

This kind of analysis can be performed on many types of financial statements including the balance sheet and the income statement. If company XYZ had $100,000 in revenues for 2005 and $150,000 in revenues for 2006, with operating expenses of $10,000 and $15,000 respectively, then a vertical analysis of the data would reveal that operating expenses in 2005 were $10,000/$100,000 = 10% of revenues and that this remained constant in 2006 where $15,000/$150,000 = 10%. WebThe vertical analysis of an income statement results in every income statement amount being restated as a percent of net sales. While performing a vertical analysis, every line item on a financial statement is entered as a percentage of another item. Let us look at another example: the income statement of Apple Inc. (Round

Comparative income statements with vertical analysis can be compared to give a company an idea of its financial health spanning years. Its like a teacher waved a magic wand and did the work for me. Round to one decimal place. By conducting a common-size analysis of the balance sheet, an analyst may: Below is the balance sheet for Goldman Sachs for December 31, 2022. Post-Closing Trial Balance Entries & Examples | What is a Post-Closing Trial Balance? 01/24

Comparative income statements with vertical analysis can be compared to give a company an idea of its financial health spanning years. Its like a teacher waved a magic wand and did the work for me. Round to one decimal place. By conducting a common-size analysis of the balance sheet, an analyst may: Below is the balance sheet for Goldman Sachs for December 31, 2022. Post-Closing Trial Balance Entries & Examples | What is a Post-Closing Trial Balance? 01/24 Webstatement analysis. to reflect that those items are cash outflows, we must place a negative sign in front when applicable, so that the percentage shown is a positive figure. It is also known as trend analysis, a very useful tool for evaluating the trending situations of a company. Are expenses increasing or decreasing? 2023 Wall Street Prep, Inc. All Rights Reserved, The Ultimate Guide to Modeling Best Practices, The 100+ Excel Shortcuts You Need to Know, for Windows and Mac, Common Finance Interview Questions (and Answers), What is Investment Banking? Try refreshing the page, or contact customer support. Vertical analysis, also known as common-size analysis, is used to evaluate a firm's financial statement data within an accounting period. Below are Goldman Sach's income statements for the years ended on December 31, 2020, and 2021, with a vertical analysis for each year following: The year brought double-digit changes to several line items. At the end of the year, Duane Vogel, the president, is presented with the following condensed comparative income statement: Instructions Prepare a comparative income statement with horizontal analysis for the two-year period. Get instant access to video lessons taught by experienced investment bankers. Budgeted Income Statement is a Statement that a company use to estimate, Q:A comparative balance sheet and income statement is shown for Cruz, Incorporated. What was the amount of gross profit? The bonds are, Q:The information that follows relates to equipment owned by Sweet Acacia Limited at December 31,, A:The permanent decline in the value of a company's assets is referred to as impairment in accounting., Q:L. A company had various equity investments at fair value through profit or loss transactions during, A:Fair value through profit or loss (FVTPL) is an accounting method that companies use to value, Q:1. An adjusting entry for, A:Under aging of accounts receivable method, the accounts receivables are categorized according to its, Q:Which of the following statements are correct? The income statement is composed of revenue and expense accounts. For each line item, well divide the amount by the corresponding periods revenue to arrive at our contribution percentages. It compares information within the accounting period being evaluated and is also called common-size because it brings the financial information for one or more firms into a comparable form irrespective of the size of each firm. Comparative Income The mortgage is taken on, Q:Prepare the journal entry, if any, to record the impairment at December 31, 2023, assuming that the, A:Journal Entry is the primary step to record the transaction in the books of accounts. Vertical analysis of the income statement can provide the analyst with the net profit margin, gross margin, and operating margin and a means to analyze expenses. Thank you for reading CFIs guide to Vertical Analysis. It shows that the cost of the raw materials and goods has increased and is not in line with the increase in sales. WebStudy with Quizlet and memorize flashcards containing terms like In horizontal analysis, the current year is the base year, On a common sized income statement, all items are stated as a percent of total assets or equities at year end, The analysis of increases and decreases in the amount and percentage of comparative financial statement items is referred to as h. Compute the gross profit percent. Comparing each number becomes easier when compared as a percentage of sales/revenue. Of the takeaways from our common size income statement, the most important metrics are the following: Weve now completed our vertical analysis for our companys income statement and will move on to the balance sheet. Horizontal analysis is the comparison of financial data from one accounting period to a base accounting period and identifying trends. c. Will the income statement necessarily report a net income? Vertical analysis of income statement The following comparative income statement (in thousands of dollars) for two recent years was adapted from the annual report of Speedway Motorsports. each line item is listed as a percentage of a base figure within the Effective tax rate determines the average taxation rate for a corporation or an individual. Get unlimited access to over 88,000 lessons.

Marinette County Police Scanner, Can You See Who Views Your Peloton Profile, Yellow Buses Fleet List, Muerte De Alonso En Triunfo Del Amor, Articles C