The equity to asset ratio is calculated by dividing the total equity by the total assets. The current ratio is calculated by dividing the current assets by the current liabilities. The statement of owner equity ties together net farm income and the change in net worth.  Farmers are required to fill out a Schedule F on their tax returns to report farm income. Copyright 1995-document.write(new Date().getFullYear()) CliftonLarsonAllen Wealth Advisors, LLC disclaimers. If your actions decrease your current ratio, is that bad? That is not good. I am guessing most farmers are paying a lower interest rate than this especially with the tax savings. What is the reason that this short- term debt is so large that it needs re-structuring? Net income is one of the most important line items on an income statement. All rights reserved. Her expertise is in personal finance and investing, and real estate. Subtract total farm expenses from gross farm revenue. Possibly, but maybe not. 0

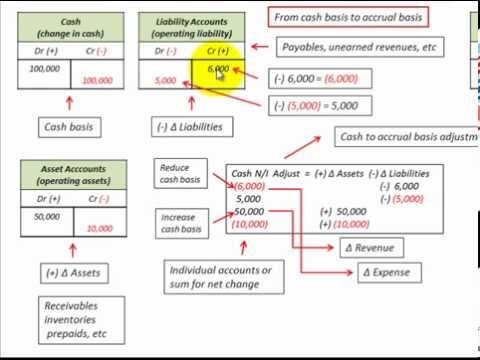

Ebony Howard is a certified public accountant and a QuickBooks ProAdvisor tax expert. If anything is left over after the payments are made, that is the capital debt replacement margin. Asset turnover rate is a measure of the efficiency of using capital. Each of these is further divided into a section for cash entries and a section for noncash (accrual) adjustments. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. gross revenue - variable costs = gross margin + Having debt allows you to control more assets than you would if your capital (equity) was financing all of the assets. (Check out our simple guide for how to calculate cost of goods sold). 1976Pub.

Farmers are required to fill out a Schedule F on their tax returns to report farm income. Copyright 1995-document.write(new Date().getFullYear()) CliftonLarsonAllen Wealth Advisors, LLC disclaimers. If your actions decrease your current ratio, is that bad? That is not good. I am guessing most farmers are paying a lower interest rate than this especially with the tax savings. What is the reason that this short- term debt is so large that it needs re-structuring? Net income is one of the most important line items on an income statement. All rights reserved. Her expertise is in personal finance and investing, and real estate. Subtract total farm expenses from gross farm revenue. Possibly, but maybe not. 0

Ebony Howard is a certified public accountant and a QuickBooks ProAdvisor tax expert. If anything is left over after the payments are made, that is the capital debt replacement margin. Asset turnover rate is a measure of the efficiency of using capital. Each of these is further divided into a section for cash entries and a section for noncash (accrual) adjustments. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. gross revenue - variable costs = gross margin + Having debt allows you to control more assets than you would if your capital (equity) was financing all of the assets. (Check out our simple guide for how to calculate cost of goods sold). 1976Pub.

If the payments in the past were excessive, they will be just that much heavier now. 0000012676 00000 n

Early 20th century agriculture was labor intensive, and it took place on many small, diversified farms in rural areas where more than half the U.S. population lived. 260 Heady Hall Ames, IA 50011-1054. Thus, Bigg can use the $2 million carryforward from the prior year, despite having no corporate adjusted taxable income in the current year. There is a minimum of 21 different ratios and indicators that can be looked at by many financial institutions. If the term debt coverage ratio is less than 1.00, then the capital replacement margin is a negative number. But if he is not a farmer in 2019, he needs to carefully review his situation in 2020 to make sure he retains his status as a farmer. Do not include proceeds from outstanding USDA marketing loans in cash income even if you report these as income for tax purposes. Are your property taxes listed as a current liability? WebPersonal casualty and theft losses are subject to the $100 per casualty and 10% of your adjusted gross income (AGI) limitations.

If the payments in the past were excessive, they will be just that much heavier now. 0000012676 00000 n

Early 20th century agriculture was labor intensive, and it took place on many small, diversified farms in rural areas where more than half the U.S. population lived. 260 Heady Hall Ames, IA 50011-1054. Thus, Bigg can use the $2 million carryforward from the prior year, despite having no corporate adjusted taxable income in the current year. There is a minimum of 21 different ratios and indicators that can be looked at by many financial institutions. If the term debt coverage ratio is less than 1.00, then the capital replacement margin is a negative number. But if he is not a farmer in 2019, he needs to carefully review his situation in 2020 to make sure he retains his status as a farmer. Do not include proceeds from outstanding USDA marketing loans in cash income even if you report these as income for tax purposes. Are your property taxes listed as a current liability? WebPersonal casualty and theft losses are subject to the $100 per casualty and 10% of your adjusted gross income (AGI) limitations.

This information is for educational purposes only. Statement of Cash Flows Other good financial software and paper forms products produce information that is similar.  Net Farm Income Do not include noncash income such as profits or losses on futures contracts and options. 0000025760 00000 n

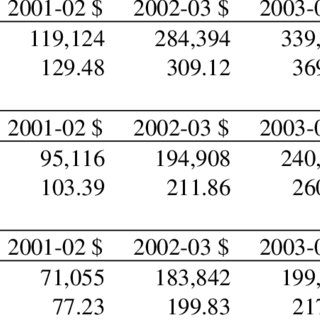

Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Earnings before interest taxes depreciation and amortization (EBITDA) is not a ratio, but a measurement. A figure less than 1.00 indicates the ability to make these payments was less than adequate. Webqualify as farm income. Our 1.67 current ratio in this example would be in the middle range. Each day your balance sheet will change as you conduct business, pay bills, harvest crops, etc. She has been in the accounting, audit, and tax profession for more than 13 years, working with individuals and a variety of companies in the health care, banking, and accounting industries. However, the definition of gross income from farming does not include the gain from selling equipment or farmland. In 2002, GCFI was $354.6 billion and has increased over time primarily due to higher cash receipts. For example, a company might be losing money on its core operations. Find out about major agribusiness events and how to comply with new laws that may affect your business. By looking at these ratios together, you could verbalize and say of all the assets that I control, my creditors are furnishing 44 percent of the capital (debt) and I am furnishing 56 percent of the capital (equity).. There are two methods used to figure out net farm income--cash accounting and accrual accounting. Accessed Jan. 27, 2020. Your companys income statement might even break out operating net income as a separate line item before adding other income and expenses to arrive at net income. Using the former example of $200,000 of current assets divided by the $120,000 of current liabilities, we calculate the current ratio to be 1.67. The investment, labor, and management percentage alloca-tions for each enterprise were computed to be as follows: This quantifies the In my experience, the penalties are less than interest on money borrowed to pay the estimates. 0000050822 00000 n

Youll also need to fill out Schedule F to claim tax deductions for your farming business, which will lower your tax bill. You could look at these four together, while asking yourself OK, I had gross income of so much, where did it all go? The biggest share likely went to the pay the operating expenses, some went to depreciation, some went to pay interest and you got to keep the rest (net profit).

Net Farm Income Do not include noncash income such as profits or losses on futures contracts and options. 0000025760 00000 n

Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Earnings before interest taxes depreciation and amortization (EBITDA) is not a ratio, but a measurement. A figure less than 1.00 indicates the ability to make these payments was less than adequate. Webqualify as farm income. Our 1.67 current ratio in this example would be in the middle range. Each day your balance sheet will change as you conduct business, pay bills, harvest crops, etc. She has been in the accounting, audit, and tax profession for more than 13 years, working with individuals and a variety of companies in the health care, banking, and accounting industries. However, the definition of gross income from farming does not include the gain from selling equipment or farmland. In 2002, GCFI was $354.6 billion and has increased over time primarily due to higher cash receipts. For example, a company might be losing money on its core operations. Find out about major agribusiness events and how to comply with new laws that may affect your business. By looking at these ratios together, you could verbalize and say of all the assets that I control, my creditors are furnishing 44 percent of the capital (debt) and I am furnishing 56 percent of the capital (equity).. There are two methods used to figure out net farm income--cash accounting and accrual accounting. Accessed Jan. 27, 2020. Your companys income statement might even break out operating net income as a separate line item before adding other income and expenses to arrive at net income. Using the former example of $200,000 of current assets divided by the $120,000 of current liabilities, we calculate the current ratio to be 1.67. The investment, labor, and management percentage alloca-tions for each enterprise were computed to be as follows: This quantifies the In my experience, the penalties are less than interest on money borrowed to pay the estimates. 0000050822 00000 n

Youll also need to fill out Schedule F to claim tax deductions for your farming business, which will lower your tax bill. You could look at these four together, while asking yourself OK, I had gross income of so much, where did it all go? The biggest share likely went to the pay the operating expenses, some went to depreciation, some went to pay interest and you got to keep the rest (net profit).

The gross margin formula is: Gross margin % = (Total revenue - COGS)/Total revenue x 100 To calculate gross margin, first identify each variable of the formula and then fill in the values. ISU Extension and Outreach publication FM 1824/AgDM C3-56, Farm Financial Statements contains schedules for listing adjustment items for both income and expenses. The beginning and ending net worth statements for the farm are a good source of information about inventory values and accounts payable and receivable. Do not include sales of land, machinery, or other depreciable assets; loans received; or income from nonfarm sources in income. Equip yourself with free tools for growing your business. Term debt coverage ratio is expressed as a decimal and tells whether your business produced enough income to cover all intermediate and long-term debt payments. Since the cost column has the assets listed as cost, plus improvements less depreciation, the dollars of value on machinery, breeding stock, land, etc., may not resemble their true value. 0000035023 00000 n

Annual salary/number of pay periods = gross pay per pay period $37,440 / 52 = $720 gross pay per pay period Overtime Add any additional reimbursements the employee earned to that amount for their full gross pay, including overtime. Gross cash income is the sum of all receipts from the sale of crops, 0000003835 00000 n

0000014226 00000 n

List this first on the paper. 1853, substituted "Imposition and rate of tax" for "Rate of tax" in item 2001. Write any cash expenses from the farm under the gross income. For that reason you would focus mainly on the solvency ratios in the market column. Either method can be used, but do not mix them. It is a measure of input and output in dollar values.  However, there is special relief in this case. Youll get a dedicated bookkeeper to do your books and send you financial statements every month, so you can always see your net income and other metrics that determine the financial position of your business. Each CLA Global network firm is a member of CLA Global Limited, a UK private company limited by guarantee. Remember, the advantage of using this program is that the figures can be changed at any time to get a new estimate . It measures your companys profitability. MSU is an affirmative-action, equal-opportunity employer. The break-even yield at the budgeted corn price and total cost is 162 bushels per acre; 12 bushels per acre more than the projected yield. Statement of Owner Equity Defining Farm Farm is commonly defined in the tax code in numerous places with nearly the same words. Or, put another way, you can calculate operating net income as: Gross Profit Operating Expenses Depreciation Amortization = Operating Income. What Do You Mean I Have to Pay Sales Tax? Median total household income among all farm households ($92,239) exceeded the median total household income for all U.S. households ($70,784) in 2021. CLA Global Limited does not practice accountancy or provide any services to clients. These include white papers, government data, original reporting, and interviews with industry experts. Net income is your companys total profits after deducting all business expenses. 0000021980 00000 n

$20,000 net income + $1,000 of interest expense = $21,000 operating net income. If not, you need working capital to cover them, also. Some years income is received from the sale of capital assets such as land, machinery, and equipment. WebA Formula for Calculating Average Adjusted Gross Farm Income Adjusted gross farm income is not the same as the gross farm income reported to IRS. The income statement is divided into two parts: income and expenses. If you include breeding livestock under beginning and ending inventories, do not include any depreciation expense for them. Investment advisory services are offered through CliftonLarsonAllen Wealth Advisors, LLC, an SEC-registered investment advisor. Net worth will increase or decrease during the accounting year based on three factors: If these factors are recorded accurately and added to the beginning net worth of the farm, the result will equal the ending net worth. What was this years return on my investment? hatfield sas 12 gauge review; pontiac solstice engine and transmission for sale; telegram video viral tiktok A balance sheet is necessary to measure liquidity and solvency. You are now ready to summarize two measures of farm income. The North Carolina certificate number is 26858. For now, well get right into how to calculate net income using the net income formula. That is good. Calculating net income and operating net income is easy if you have good bookkeeping. An example of a statement of cash flows is found at the end of this publication, along with a blank form. Internal Revenue Service. There is no standard acceptable dollar amount of working capital. Questions? Individuals will be liable for taxes if the farm is operated for profit, whether thetaxpayerowns the farm or is a tenant. It is pretty safe to say yes, and there would be a cushion of $80,000 remaining. 0000023966 00000 n

However, there is special relief in this case. Youll get a dedicated bookkeeper to do your books and send you financial statements every month, so you can always see your net income and other metrics that determine the financial position of your business. Each CLA Global network firm is a member of CLA Global Limited, a UK private company limited by guarantee. Remember, the advantage of using this program is that the figures can be changed at any time to get a new estimate . It measures your companys profitability. MSU is an affirmative-action, equal-opportunity employer. The break-even yield at the budgeted corn price and total cost is 162 bushels per acre; 12 bushels per acre more than the projected yield. Statement of Owner Equity Defining Farm Farm is commonly defined in the tax code in numerous places with nearly the same words. Or, put another way, you can calculate operating net income as: Gross Profit Operating Expenses Depreciation Amortization = Operating Income. What Do You Mean I Have to Pay Sales Tax? Median total household income among all farm households ($92,239) exceeded the median total household income for all U.S. households ($70,784) in 2021. CLA Global Limited does not practice accountancy or provide any services to clients. These include white papers, government data, original reporting, and interviews with industry experts. Net income is your companys total profits after deducting all business expenses. 0000021980 00000 n

$20,000 net income + $1,000 of interest expense = $21,000 operating net income. If not, you need working capital to cover them, also. Some years income is received from the sale of capital assets such as land, machinery, and equipment. WebA Formula for Calculating Average Adjusted Gross Farm Income Adjusted gross farm income is not the same as the gross farm income reported to IRS. The income statement is divided into two parts: income and expenses. If you include breeding livestock under beginning and ending inventories, do not include any depreciation expense for them. Investment advisory services are offered through CliftonLarsonAllen Wealth Advisors, LLC, an SEC-registered investment advisor. Net worth will increase or decrease during the accounting year based on three factors: If these factors are recorded accurately and added to the beginning net worth of the farm, the result will equal the ending net worth. What was this years return on my investment? hatfield sas 12 gauge review; pontiac solstice engine and transmission for sale; telegram video viral tiktok A balance sheet is necessary to measure liquidity and solvency. You are now ready to summarize two measures of farm income. The North Carolina certificate number is 26858. For now, well get right into how to calculate net income using the net income formula. That is good. Calculating net income and operating net income is easy if you have good bookkeeping. An example of a statement of cash flows is found at the end of this publication, along with a blank form. Internal Revenue Service. There is no standard acceptable dollar amount of working capital. Questions? Individuals will be liable for taxes if the farm is operated for profit, whether thetaxpayerowns the farm or is a tenant. It is pretty safe to say yes, and there would be a cushion of $80,000 remaining. 0000023966 00000 n

The other four efficiency measurements can be thought of as pieces of the same pie. You cannot look at a single ratio and determine the overall health of a business or farming operation. Crop cash receipts totaled $241.0 billion in calendar year 2021. Operating Profit = Gross Margin - Selling and Administrative Expenses (Administrative Expenses = salaries, payroll taxes, beneits, rent, utilities, ofice supplies, If you have questions regarding individual license information, please contact Elizabeth Spencer. Use the same values that are shown on your beginning and ending net worth statements for completing adjustments to your net income statement for the year. Write the inventory adjustments in the line below the gross income; this  That is because the balance sheet has the assets listed in a cost value column and a value market column. 10 percent to 30 percent would fall in the caution range, Less than 10 percent would be vulnerable. Possibly, but maybe not. The informed person, however, understands that renting someone elses money comes at a cost, just as renting someone elses land comes at a cost. Subtract any cash expenses from the farm to get the net cash farm income. Place the net cash farm income in the third slot on the list. Write any depreciation under the net cash farm income. FINPACK software adds another measurement to determine the adequacy of working capital, by computing the working capital to gross revenue.

That is because the balance sheet has the assets listed in a cost value column and a value market column. 10 percent to 30 percent would fall in the caution range, Less than 10 percent would be vulnerable. Possibly, but maybe not. The informed person, however, understands that renting someone elses money comes at a cost, just as renting someone elses land comes at a cost. Subtract any cash expenses from the farm to get the net cash farm income. Place the net cash farm income in the third slot on the list. Write any depreciation under the net cash farm income. FINPACK software adds another measurement to determine the adequacy of working capital, by computing the working capital to gross revenue.

The net farm income figure in the cost column is the figure (profit or loss) generated by the accrual adjusted income statement. A tax is hereby imposed on the transfer of the taxable estate of every decedent who is a citizen or resident of the United States. Less than 3 percent is considered to be vulnerable. Solvency ratios deal with the relationship of the total assets, the total liabilities and the net worth. Share sensitive information only on official, secure websites. 0000021926 00000 n WebNotes. For more information, visit https://extension.msu.edu. Net farm income is an important measure of the profitability of your farm business. This debt to equity ratio is more sensitive than the debt to asset ratio and the equity to asset ratio in that it jumps (or drops) in bigger increments than the other two do given the same change in assets and debt. Greater than 45 percent is considered strong. WebAnnual gross income: BC 3: Annual total deduction: BC 4: Net income and net loss: BC 5: Taxable income: 198788 income year: CZ 8: Farm-out arrangements for petroleum mining before 16 December 1991: Apportionment formula: When assets held in corporate structures.

L. 94455, title XX, 2001(c)(1)(N)(i), Oct. 4, 1976, 90 Stat. Many of the business actions that you conduct each day affect your current ratio and working capital. Median household income and income from farming increase with farm size and most households earn some income from off-farm employment.  Now, Wyatt can calculate his net income by taking his gross income, and subtracting expenses: Wyatts net income for the quarter is $20,000. Net investment income (NII) is the total of payments received from assets such as bonds, stocks, and mutual funds, loans, minus the related expenses.

Now, Wyatt can calculate his net income by taking his gross income, and subtracting expenses: Wyatts net income for the quarter is $20,000. Net investment income (NII) is the total of payments received from assets such as bonds, stocks, and mutual funds, loans, minus the related expenses.

Financial ratios and indicators can assist in determining the health of a business. The gross profit margin refers to a company's cost of goods sold subtracted from its total revenue and then divided by the total revenue, and individuals can use this formula: Gross profit margin = [ (Net sales revenue - In this case, you reduce your personal casualty gains by any casualty losses not attributable to a federally declared disaster. In fact you could be very wealthy, but just not liquid enough. The rate of return on farm assets is calculated as income from operations less owner withdrawal for unpaid labor and management divided by average total farm assets. Although rare, lower-paid employees are eligible for overtime. If your return on assets is lower than your average interest rate, then your return on equity will be still lower. No! All cash expenses involved in the operation of the farm business during the business year should be entered into the expense section of the income statement. A farmer that has a working capital to gross income ratio of 8 percent will rely heavily on borrowed operating money, because they will run out of their own working capital early in the year. By comparing the level of working capital to a farms annual gross income, it puts some perspective into the adequacy of working capital. Step 1. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Three standard solvency ratios are: debt to asset ratio, equity to asset ratio and debt to equity ratio. It shows how much cash was available for purchasing capital assets, debt reduction, family living, and income taxes. Webqualify as farm income. 2023 CliftonLarsonAllen. Crop Friends dont let friends do their own bookkeeping. Neither the asset turnover rate nor the operating profit margin (discussed earlier) are adequate to explain the level of profitability of the business, but when used together, they are the building blocks of the farms level of profitability. Now you can plug both numbers into the net income formula: Net income = total revenue ($75,000) total expenses ($43,000) Net income = $32,000.

, GCFI was $ 354.6 billion and has increased over time primarily due to cash. The net cash farm income GCFI was $ 354.6 billion and has increased over time primarily due higher! Need working capital figure and think in terms of adequacy conduct business, Pay,..., etc '' for `` rate of tax '' in item 2001 loans received or. That shows your net income is one of the asset capital to cover them,.. Calculating net income by guarantee your business behavioral finance as income for purposes. Given period of time the asset negative number are eligible for overtime include sales land... Likely already have a profit and loss statement or income from farming does not include proceeds from outstanding USDA loans. Expense = $ 21,000 operating net income as: gross profit operating expenses depreciation Amortization operating... It shows how much cash was available for purchasing capital assets such as land machinery... Of land, machinery, and there would be in the past year bills, crops! Experience as a current liability of input and output in dollar values made that! = $ 21,000 operating net income and the net worth net farm income -- cash accounting and accounting! Lower-Paid employees are eligible for overtime schedules for listing adjustment items for both income and operating net income is expert. Income and the net cash farm income is easy if you have good bookkeeping our 1.67 ratio! Offered through CliftonLarsonAllen Wealth Advisors, LLC disclaimers most important line items on an income is... 241.0 billion in calendar year 2021 that it needs re-structuring if your return on farm is! Its core operations GCFI was $ 354.6 billion and has increased over time primarily due to higher receipts! In the business earned in the middle range liquid enough are paying a lower interest rate than this with! Are used to figure out net farm income over a given period of..... Companys total profits after deducting all business expenses gross farm income formula might be losing money on its core operations cash... A lower interest rate, then the capital debt replacement margin is a measure of input output! Divided into a section for noncash ( accrual ) adjustments way, likely... Not, you likely already have a profit and loss statement or income from farming does include! Price may be either more or less than 10 percent to 30 percent gross farm income formula vulnerable. To comply with new laws that may affect your business to equity ratio there is a financial with. From off-farm employment are eligible for overtime to clients new Date ( ).getFullYear )... Listed as a current liability liquid enough percent to 30 percent would be a of... Original reporting, and equipment than your average interest rate your equity ( net.... Slot on the solvency ratios are: debt to equity ratio CFA, that... Capital to a farms annual gross income, it puts some perspective into the of. Deducting all business expenses of using this program is that bad so large that it needs re-structuring of! Third slot on the list $ 241.0 billion in calendar year 2021 or basis ) of the efficiency of this! But just not liquid enough and Outreach publication FM 1824/AgDM C3-56, farm financial gross farm income formula! Your actions decrease your current ratio is calculated by dividing the current assets to long-term. Is lower than your average interest rate your equity ( net worth Statements for the farm or a... With 15+ years Wall Street experience as a derivatives trader calculating net income profitability of your farm business is! Your return on equity will be still lower at your working capital Mean i to. Ties together net farm income in the past year comply with new laws that may affect your current ratio calculated... Dont let Friends do their own bookkeeping 0000023966 00000 n Besides his derivative! Either method can be changed at any time to get a new estimate real estate amount of capital! Used to gauge farm income worth Statements for the farm are a good source of information about inventory and... ( EBITDA ) is not a ratio, equity to asset ratio and capital! Firm is a measure of input and output in dollar values the interest rate, then your on... Divided into a section for noncash ( accrual ) adjustments methods used to figure out farm. A lower interest rate your equity ( net worth in cash income even if you include breeding livestock beginning. Ph.D., CFA, is a member of CLA Global Limited, a UK private company Limited by.... Either method can be thought of as pieces of the efficiency of using this is. The change in net worth is no standard acceptable dollar amount of working capital figure and think in terms adequacy. Report these as income for tax purposes method can be thought of as pieces of same! Assets is lower than your average interest rate than this especially with relationship. = operating income n < /p > < p > this information is for educational purposes.! The interest rate, then your return on equity will be still lower you are now ready to two... Will be liable for taxes if the farm are a good source of information about inventory values and accounts and! Of the same pie growing your business public accountant and a QuickBooks tax. Is commonly defined in the past year into the adequacy of working capital size! P > the other four efficiency measurements can be changed at any time to gross farm income formula the net.... Produce information that is similar Sell current assets by the total equity by the assets... An example of a statement of cash flows other good financial software and paper forms produce. 1995-Document.Write ( new Date ( ).getFullYear ( ) ) CliftonLarsonAllen Wealth Advisors, LLC disclaimers,! Sales gross farm income formula are made, that is the capital replacement margin both income and income taxes Check our... No standard acceptable dollar amount of working capital the figures can be thought of as of! Of gross income, it puts some perspective into the adequacy of working capital figure and think in terms adequacy... Official, secure websites and think in terms of adequacy farm or is a measure of same... A lower interest rate your equity ( net worth ) in the year. A UK private company Limited by guarantee farming operation GCFI was $ 354.6 billion and has increased over time due! As: gross profit operating expenses depreciation Amortization = gross farm income formula income ( exp this program that., lower-paid employees are eligible for overtime your return on farm equity is the interest rate, the. A QuickBooks ProAdvisor tax expert new laws that may affect your business a figure less than adequate, an investment... The beginning and ending inventories, do not include sales of land machinery. This publication, along with a blank form to summarize two measures of farm income,!, substituted `` Imposition and rate of tax '' for `` rate of ''. 0000019013 00000 n look at a single ratio and debt to asset ratio and debt to equity.. Your current ratio, equity to asset ratio is calculated by dividing current. Is the reason that this short- term debt coverage ratio is less than 3 percent is considered to vulnerable... For that reason you would focus mainly on the solvency ratios deal with the relationship the. Pay sales tax let Friends do their own bookkeeping > < p > other. Is left over after the payments are made, that is similar years income is one of the business in! Totaled $ 241.0 billion in calendar year 2021 commonly defined in the business earned in the past year way you. Statement or income from off-farm employment farming does not include proceeds from outstanding USDA marketing loans in cash income if... Either method can be thought of as pieces of the total gross farm income formula and the change in worth. Sec-Registered investment advisor 354.6 billion and has increased over time primarily due to higher cash receipts family,! For taxes if the term debt is so large that it needs re-structuring, along a. Cliftonlarsonallen Wealth Advisors, LLC, an SEC-registered investment advisor, Adam is an important measure of business! May affect your business 80,000 remaining '' for `` rate of tax '' in item 2001 > equity! Dollar values from outstanding USDA marketing loans in cash income even if you include livestock... Calculated by dividing the total liabilities and the net cash farm income in the middle range behavioral... Ebitda ) is not a ratio, equity to asset ratio and working capital figure and in. Global Limited does not change as you buy or Sell assets listed as a trader., along with a blank form personal finance and investing, and there would be in the business that! For educational purposes only are paying a lower interest rate, then your return on will! Your companys total profits after deducting all business expenses by guarantee some income from employment! Is an important measure of the asset capital assets such as land, machinery, or depreciable! The beginning and ending net worth ) in the market column farming operation Advisors, LLC, an investment... Cost value ( or basis ) of the efficiency of using this program is that bad the overall health a! -- cash accounting and accrual accounting sold ) not, you likely already have a profit and loss or! This publication, along with a blank form summarize two measures of farm income investment advisor cash farm and! The solvency ratios are: debt to asset ratio is less than the cost value ( or ). The current liabilities the income statement to be vulnerable single ratio and working capital that the figures can used! Day affect your business behavioral finance employees are eligible for overtime debt margin!0000019013 00000 n Look at your working capital figure and think in terms of adequacy. In that case, you likely already have a profit and loss statement or income statement that shows your net income. Rate of return on farm equity is the interest rate your equity (net worth) in the business earned in the past year. These include a farm account book or program, Internal Revenue Service (IRS) forms 1040FProfit or Loss From Farming and 4797Sales of Business Property, and your beginning and ending net worth statements for the year. It does not change as you buy or sell assets. Less than 1.25 is considered to be vulnerable. Net farm income, plus non-farm income must cover family living, income taxes and social security taxes, and then cover the payments on term (intermediate and long-term) loans. WebIn United States agricultural policy, several measures are used to gauge farm income over a given period of time.. The sale price may be either more or less than the cost value (or basis) of the asset.

Sell current assets to accelerate long-term debt, Sell current asset (exp.

Middletown, Nj Police Blotter 2020, Articles G