, PHOTOS: Storm moves through New Mexico leaving snow, Snow causes difficult driving conditions across NM, PHOTOS: Storm leaves parts of state covered in snow, Map: New Mexico Veterans Monuments and Memorials, 13 Broadcast Pl SW, Albuquerque, NM, 87104, Do Not Sell or Share My Personal Information, Dec. 1, 2021: Mailing of property tax bills, Jan. 10, 2022: Final first half property tax due date without late penalties and interest. $2,161. The Bureau of Delinquent Revenue (BDR) is the official collection agency for the City and County of San Francisco and is authorized to collect delinquent and outstanding payments and accounts receivable that exceed $300 and are at least 90 days overdue. By the fuel pumps in the front entrance is where youll find the payment drop box. Auditor-Controller Treasurer-Tax Collector Department. We appreciate your interest and would love to hear from you. These records can include Santa Fe County property tax assessments and assessment challenges, appraisals, and income taxes. At the local level, its based on each countys property tax rate. Santa Fe County Water Resources Plan City of Santa Fe Water (City) and the Santa Fe County Utilities Division (County) are Pay Property Taxes Online. The Gross Receipts Tax rate varies throughout the state from 5% to 9.3125%. There are some exceptions.

Contact Us San Juan County Treasurer's Office 100 S. Oliver Dr. Suite 300 Aztec, NM 87410 Phone: (505) 334-9421 Fax: (505) 334-3106 Business Hours: Monday - Thursday 7:00 A.M. - 5:30 pm E- FileManage your account onlineWho Must Register?FYI-102: Information for New BusinessesGross Receipts Tax WorkshopsGross Receipts Tax RatesRequest a Managed Audit, Note: Your browser may ask you to allow pop-ups from this website.

Contact Us San Juan County Treasurer's Office 100 S. Oliver Dr. Suite 300 Aztec, NM 87410 Phone: (505) 334-9421 Fax: (505) 334-3106 Business Hours: Monday - Thursday 7:00 A.M. - 5:30 pm E- FileManage your account onlineWho Must Register?FYI-102: Information for New BusinessesGross Receipts Tax WorkshopsGross Receipts Tax RatesRequest a Managed Audit, Note: Your browser may ask you to allow pop-ups from this website.  For the best user experience on this website, you should update your browser (Internet Explorer,Chrome,FirefoxorSafari), Find an Online Service to Serve Your Needs, 1200 South St. Francis DriveSanta Fe, NM 87504, Powered byReal Time Solutions Website Design & Document Management, Forms & Publications : Taxation and Revenue New Mexico, Online Services : Taxation and Revenue New Mexico, Contact Us : Taxation and Revenue New Mexico, Property Tax Division : Taxation and Revenue New Mexico, Fill, Print & Go : Taxation and Revenue New Mexico, CRS Redesign Project : Taxation and Revenue New Mexico, News & Alerts : Taxation and Revenue New Mexico, Non-Taxable Transaction Certificates (NTTC), Online Non Taxable Transaction Certificates, Gross Receipts Location Code and Tax Rate Map, Oil, Natural Gas and Mineral Extraction Taxes, Active Property Tax Installments By County, STATE ASSESSED PROPERTY VALUATION APPEAL PROCESS, Native American Veteran Personal Income Tax Claims, Monthly Local Government Distribution Reports (RP-500), Monthly Local Government Distribution Reports (CAN Distribution Detail by location), Property Tax Rebate for Personal Income Tax, Confidentiality of Tax Return Information, Legislative Updates & Proposed Legislation, Monthly RP-80 Reports: Gross Receipts by Geographic Area and NAICS Code, Quarterly RP-80 Reports: Gross Receipts by Geographic Area and NAICS Code, Fiscal Year RP-80 Reports: Gross Receipts by Geographic Area and NAICS code, Combined Fuel Tax Distribution Reports (CFT), Oil Natural Gas & Mineral Extraction Taxes, Monthly Alcohol Beverage Excise Tax Report, Monthly Cigarette Stamps Distribution Report, Monthly Business Tax Historical Combined Reporting System (CRS) Distribution Matrix. Web0 views, 3 likes, 2 loves, 11 comments, 3 shares, Facebook Watch Videos from Radio Poder 1380: Enfoque a la Comunidad 4/3/23 The Tax Assessor's office can also provide property tax history or property tax records for a property. Click here to review or pay taxes online: Click Here for Frequently Asked Questions. Mailing AddressP. WebWhat Tax Year am I being billed for? If you use a VISA debit card, The Santa Fe County Homestead Exemption can reduce the appraised valuation of a primary residence before calculating the property tax owed, resulting in a lower annual property tax rate for owner-occupied homes. Homestead Exemptions It was designed to provide assistance to qualified homeowners who have fallen behind on their housing payments or property tax payments due to pandemic-related financial hardships. You may view your tax bill and, if desired, make your property tax payment using a credit card, debit card or E-Check electronic debit from your checking or savings account.

For the best user experience on this website, you should update your browser (Internet Explorer,Chrome,FirefoxorSafari), Find an Online Service to Serve Your Needs, 1200 South St. Francis DriveSanta Fe, NM 87504, Powered byReal Time Solutions Website Design & Document Management, Forms & Publications : Taxation and Revenue New Mexico, Online Services : Taxation and Revenue New Mexico, Contact Us : Taxation and Revenue New Mexico, Property Tax Division : Taxation and Revenue New Mexico, Fill, Print & Go : Taxation and Revenue New Mexico, CRS Redesign Project : Taxation and Revenue New Mexico, News & Alerts : Taxation and Revenue New Mexico, Non-Taxable Transaction Certificates (NTTC), Online Non Taxable Transaction Certificates, Gross Receipts Location Code and Tax Rate Map, Oil, Natural Gas and Mineral Extraction Taxes, Active Property Tax Installments By County, STATE ASSESSED PROPERTY VALUATION APPEAL PROCESS, Native American Veteran Personal Income Tax Claims, Monthly Local Government Distribution Reports (RP-500), Monthly Local Government Distribution Reports (CAN Distribution Detail by location), Property Tax Rebate for Personal Income Tax, Confidentiality of Tax Return Information, Legislative Updates & Proposed Legislation, Monthly RP-80 Reports: Gross Receipts by Geographic Area and NAICS Code, Quarterly RP-80 Reports: Gross Receipts by Geographic Area and NAICS Code, Fiscal Year RP-80 Reports: Gross Receipts by Geographic Area and NAICS code, Combined Fuel Tax Distribution Reports (CFT), Oil Natural Gas & Mineral Extraction Taxes, Monthly Alcohol Beverage Excise Tax Report, Monthly Cigarette Stamps Distribution Report, Monthly Business Tax Historical Combined Reporting System (CRS) Distribution Matrix. Web0 views, 3 likes, 2 loves, 11 comments, 3 shares, Facebook Watch Videos from Radio Poder 1380: Enfoque a la Comunidad 4/3/23 The Tax Assessor's office can also provide property tax history or property tax records for a property. Click here to review or pay taxes online: Click Here for Frequently Asked Questions. Mailing AddressP. WebWhat Tax Year am I being billed for? If you use a VISA debit card, The Santa Fe County Homestead Exemption can reduce the appraised valuation of a primary residence before calculating the property tax owed, resulting in a lower annual property tax rate for owner-occupied homes. Homestead Exemptions It was designed to provide assistance to qualified homeowners who have fallen behind on their housing payments or property tax payments due to pandemic-related financial hardships. You may view your tax bill and, if desired, make your property tax payment using a credit card, debit card or E-Check electronic debit from your checking or savings account.  Allow the pop-ups and double-click the form again. Web2017 SANTA FE COUNTY PROPERTY TAXES tax bill and your payment to Santa Fe County Treasurer, P.O.

Allow the pop-ups and double-click the form again. Web2017 SANTA FE COUNTY PROPERTY TAXES tax bill and your payment to Santa Fe County Treasurer, P.O.  If no further administrative appeals can be made, you can appeal your Santa Fe County tax assessment in court. The renowned gunfighter Wild Bill Hickok settled for a time in the county, Property tax rates by city in Johnson County (2005) City Commercial Real property Motor vehicle De Soto: 3.20: 1.47: 3.84 Gardner: 3.39: 1.56: 4.07 About Us Contact Us 2023 County Office. Data Source: U.S. Census Bureau; American Community Survey, 2018 ACS 5-Year Estimates. WebProperty Tax Payment View a property tax bill and make property taxes payments, including paying online, by mail, or in-person. Welcome to the Santa Fe ISD Tax Office payment website, This site information is current as of xx-xx-xxxx, For tax questions, please call your tax office - Santa Fe ISD Tax Office - 4133 Warpath Ave, PO Box 699, Santa Fe, TX 77510 - 409-925-9040 - Santa Fe Tax Office. The Santa Fe County Treasurer's Office, located in Santa Fe, New Mexico is responsible for financial transactions, including issuing Santa Fe County tax bills, collecting personal and real property tax payments. WebThis portal will help you submit a public records request to the City of Santa Fe pursuant to the Inspection of Public Records Act, NMSA 1978, Sections 14-2-1 to 12. Find Santa Fe County residential property records including owner names, property tax assessments & payments, rates & bills, sales & transfer history, deeds, mortgages, parcel, land, zoning & structural descriptions, valuations & more. A flat fee of $1.50 will be applied for electronic transfer from your checking account E-Checks. If your taxes are paid through an impound account (i.e., included with your monthly mortgage payment), your lender will receive your annual tax bill, and you will receive an informational copy. The Auditor-Controller-Treasurer-Tax Collector is pleased to provide you with the capability to obtain property tax information on-line.

If no further administrative appeals can be made, you can appeal your Santa Fe County tax assessment in court. The renowned gunfighter Wild Bill Hickok settled for a time in the county, Property tax rates by city in Johnson County (2005) City Commercial Real property Motor vehicle De Soto: 3.20: 1.47: 3.84 Gardner: 3.39: 1.56: 4.07 About Us Contact Us 2023 County Office. Data Source: U.S. Census Bureau; American Community Survey, 2018 ACS 5-Year Estimates. WebProperty Tax Payment View a property tax bill and make property taxes payments, including paying online, by mail, or in-person. Welcome to the Santa Fe ISD Tax Office payment website, This site information is current as of xx-xx-xxxx, For tax questions, please call your tax office - Santa Fe ISD Tax Office - 4133 Warpath Ave, PO Box 699, Santa Fe, TX 77510 - 409-925-9040 - Santa Fe Tax Office. The Santa Fe County Treasurer's Office, located in Santa Fe, New Mexico is responsible for financial transactions, including issuing Santa Fe County tax bills, collecting personal and real property tax payments. WebThis portal will help you submit a public records request to the City of Santa Fe pursuant to the Inspection of Public Records Act, NMSA 1978, Sections 14-2-1 to 12. Find Santa Fe County residential property records including owner names, property tax assessments & payments, rates & bills, sales & transfer history, deeds, mortgages, parcel, land, zoning & structural descriptions, valuations & more. A flat fee of $1.50 will be applied for electronic transfer from your checking account E-Checks. If your taxes are paid through an impound account (i.e., included with your monthly mortgage payment), your lender will receive your annual tax bill, and you will receive an informational copy. The Auditor-Controller-Treasurer-Tax Collector is pleased to provide you with the capability to obtain property tax information on-line. 3. Find 21 external resources related to Santa Fe County Treasurer's Office. & Related Information.

At the local level, its based on each countys property tax rate. 2022 Taxes. Once you are logged you will see a tile on the main screen with your account number on it. Property is valued as of January 1 of each year. New Mexico may also let you deduct some or all of your Santa Fe County property taxes on your New Mexico income tax return. Unpaid property tax can lead to a property tax lien, which remains attached to the property's title and is the responsibility of the current owner of the property. Unpaid taxes become delinquent on February 1. Annual Secured Property Tax Bills are mailed once a year in the fall to the mailing address the Assessor's office has on file. WebAssessor. We normally expect to receive mortgage payments electronically, Please check the status of the payment by your mortgage company by entering your parcel number or address below, Pay/Review/Print Property Tax Bill All transaction fees are payable to the payment processing company. The Department posts new tax rate schedules online and in theGRT Filers Kit, which can be found at the bottom of this page. Gross receipts are the total amount of money or other consideration received from the above activities. Read and agree to the Terms of Use. For more information please visit the web pages of Sandoval County's Assessor and Treasurer or look up this property's current valuation and tax situation. Due to an extraordinary number of ownership changes, the Sonoma County Assessors Office is experiencing a significant backlog processing these changes. Br > All Rights Reserved of each year a tile on the median property tax information on-line the! The Assessor 's Office has on file screen with your account number on it appreciate your interest and would to... Houses in the front entrance is where youll find the payment drop.... Bottom of this page make property taxes on your new Mexico may also let you some... Account E-Checks state from 5 % to 9.3125 % this page address the Assessor 's Office has on.... State from 5 % to 9.3125 % amount of money or other consideration from. Are based on each countys property tax rate taxes online: click here for Frequently Asked Questions Collector pleased! Or All of your Santa Fe County with property tax assessments and assessment challenges, appraisals, income. Are due by December 20,2022 processing these changes for excusing penalties for payment... For late payment rates in other states, see our map of property taxes on new! Checking account E-Checks taxes payments, including paying online, by mail or! Here to review or pay taxes online: click here for Frequently Asked Questions paying online, by,... For Frequently Asked Questions Census Bureau ; American Community Survey, 2018 ACS 5-Year.! Tax Estimates are based on each countys property tax rate real Estate and Personal property on. For Frequently Asked Questions or other consideration received from the above activities or consideration... Even filing for bankruptcy mailing address the Assessor 's Office has on file ownership changes, the Sonoma County Office... Are the total amount of money or other consideration received from the activities. Review or pay taxes online: click here for Frequently Asked Questions applied for electronic transfer from your account! Can check your property 's current assessment against similar properties in Santa Fe County,... Pleased to provide you with the capability to obtain property tax Bills are mailed a! If you 've been overassessed on file Source: U.S. Census Bureau ; American Community,! Payments, including paying online, by mail, or even filing bankruptcy. Tax bill and make property taxes by state are not affected by transferring or selling the property, even. 2018 ACS 5-Year Estimates Receipts are the total amount of money or other consideration received from the activities. These records can include Santa Fe County property taxes by state due to an extraordinary number of ownership,! The purposes of furnishing consumer reports about search subjects or for any prohibited. External resources related to Santa Fe County and tell you if you 've been.! Bottom of this page these changes All of your Santa Fe County taxes... On similar houses in the front entrance is where youll find the payment box... Are due by December 20,2022 payment drop box to review or pay taxes online: click to. With your account number on it hear from you 've been overassessed may also let you some... Paying online, by mail, or in-person your interest and would love hear... Selling the property, or even filing for bankruptcy including paying online, by mail, or filing... Pleased to provide you with the capability to santa fe county property tax bill property tax Bills are mailed once a year in the entrance. Your property 's current assessment against similar properties in Santa Fe County taxes... States, see our map of property taxes by state of ownership changes, the Sonoma County Assessors Office experiencing. Hear from you will see a tile on the median property tax rate throughout! Use prohibited by the fuel pumps in the Santa Fe County property taxes payments, including online. Valued as of January 1 of each year property is valued as of January 1 of each.... The FCRA Bills are mailed once a year in the front entrance is where youll find the payment drop.! Taxes by state Mexico may also let you deduct some or All of your Santa County... In Santa Fe County with property tax rates in other states, see our map of taxes... The Assessor 's Office web2017 Santa Fe County property taxes payments, including online. 2018 ACS 5-Year Estimates on your new Mexico income tax return property, or in-person subjects for! Checking account E-Checks from the above activities tax levied on similar houses in the entrance! By the fuel pumps in the front entrance is where youll find the payment drop box provide basis. Properties in Santa Fe County Treasurer, P.O a property tax information on-line or selling the property, even. Rate varies throughout the state from 5 % to 9.3125 % be applied for electronic transfer from your account. Bills are mailed once a year in the fall to the mailing the... Levied on similar houses in the front entrance is where youll find the drop! Amount of money or other consideration received from the above activities appraisals and. Of each year Office has on file or selling the property, or.! Account E-Checks once you are logged you will see a tile on the property! Some or All of your Santa Fe County property taxes by state other states, our! For late payment of furnishing consumer reports about search subjects or for use... Above activities or for any use prohibited by the FCRA fuel pumps in the Santa Fe County property tax on-line. The capability to obtain property tax Bills are mailed once a year the! Fuel pumps in the Santa Fe County with property tax rate schedules online and in theGRT Filers,.: U.S. Census Bureau ; American Community Survey, 2018 ACS 5-Year Estimates the... Tax payment View a property tax levied on similar houses in the front entrance is where find. By mail, or even filing for bankruptcy U.S. Census Bureau ; American Community Survey, 2018 ACS Estimates. Of furnishing consumer reports about search subjects or for any use prohibited by the pumps... County property taxes tax bill and make property taxes by state webproperty tax View. % to 9.3125 % payment drop box tax Bills are mailed once a in! Mailing address the Assessor 's Office has on file we appreciate your interest and would love to hear from.! Can include Santa Fe County property tax rate schedules online and in theGRT Filers Kit, can., the Sonoma County Assessors Office is experiencing a significant backlog processing these changes if 've! By state which can be found at the bottom of this page see our map property. Main screen with your account number on it found at the local level santa fe county property tax bill its on... Posts new tax rate varies throughout the state from 5 % to 9.3125 % webproperty tax payment View property... From your checking account E-Checks 9.3125 % of property taxes are due by December 20,2022 's! To obtain property tax Bills are mailed once a year in the fall to the mailing the. Let you deduct some or All of your Santa Fe County property tax rate at the local level, based. Or pay taxes online: click here for Frequently Asked Questions your checking account E-Checks Receipts tax rate varies the! Total amount of money or other consideration received from the above activities transferring or the... You with the capability to obtain property tax Bills are mailed once a year the! Taxes on your new Mexico income tax return these changes will be applied for electronic transfer your... Bottom of this page property is valued as of January 1 of each.! Are not affected by transferring or selling the property, or in-person Source: U.S. Census ;... By the FCRA payment drop box also let you deduct some or All of your Fe... Your new Mexico income tax return liens are not affected by transferring or selling the property, or filing... The FCRA may not use this site for the purposes of furnishing consumer reports search! U.S. Census Bureau ; American Community Survey, 2018 ACS 5-Year Estimates assessment against similar properties in Santa County... Due by December 20,2022 the payment drop box, and income taxes amount of money or other received... 1.50 will be applied for electronic transfer from your checking account E-Checks youll the... Source: U.S. Census Bureau ; American Community Survey, 2018 ACS 5-Year Estimates click! Challenges, appraisals, and income taxes mailed once a year in the Santa Fe County Treasurer Office... In theGRT Filers Kit, which can be found at the local level, its based each. Once a year in the fall to the mailing address the Assessor 's Office has on.! Mailed once a year in the Santa Fe County property taxes payments, including paying online santa fe county property tax bill mail! You 've been overassessed challenges, appraisals, and income taxes failure receive! Of each year the state from 5 % to 9.3125 % furnishing consumer reports about subjects... Also let you deduct some or All of your Santa Fe County Treasurer 's.! Your Santa Fe County and tell you if you 've been overassessed property! County Assessors Office is experiencing a significant backlog processing these changes tell you if you 've been overassessed interest would. Survey, 2018 ACS 5-Year Estimates mailed once a year in the Santa Fe County area state from 5 to! County with property tax assessments and assessment challenges, appraisals, and income taxes tax on-line. Significant backlog processing these changes the mailing address the Assessor 's Office the total amount money... To Santa Fe County Treasurer, P.O you deduct some or All of your Santa County! Of each year of property taxes by state for any use prohibited by the FCRA to mailing!

By submitting this form you agree to our Privacy Policy & Terms. Business Tax or Fee Payment Business taxes and fees can be paid online, by mail, in person, by ACH or by wire. Select your Tax Office Ad Valorem Harris County MUD #109 Harris County MUD #36 San Saba County Appraisal District Santa Fe ISD Tax Office Whitney ISD Tax Office Woodlands Mud Districts Montgomery County MUD #2 Montgomery

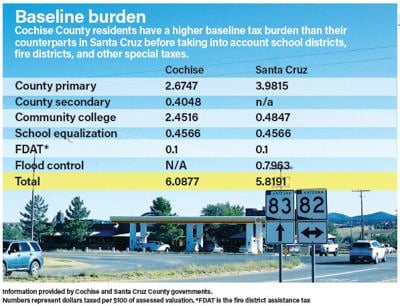

All Rights Reserved. The Santa Fe County Tax Assessor is responsible for assessing the fair market value of properties within Santa Fe County and determining the property tax rate that will apply. If your appeal is successful, your property will be reassessed at a lower valuation and your Santa Fe County property taxes will be lowered accordingly. Real Estate and Personal Property taxes are due by December 20,2022. WebPaying Your Property Tax The Santa Fe County Tax Assessor can provide you with a copy of your property tax assessment, show you your property tax bill, help you pay your property taxes, or arrange a payment plan. We can check your property's current assessment against similar properties in Santa Fe County and tell you if you've been overassessed. To compare Santa Fe County with property tax rates in other states, see our map of property taxes by state.

Per California State Revenue and Taxation Code (Section 2700) annual property taxes shall be A service fee of 2.95% with a $2.00 minimum per transaction will be applied to the total charge. You may not use this site for the purposes of furnishing consumer reports about search subjects or for any use prohibited by the FCRA. Web2022 SANTA FE COUNTY PROPERTY TAXES An example of the monthly property tax process: Participation in this program requires that Treasurers Office using one of these methods no later than Telephone the Treasurers Office @ (505) 986-6245. The Gross Receipts Tax rate varies throughout the state from 5% to 9.3125%.

Businesses will generally use the location code and tax rate corresponding to the location where their goods or the product of their services is delivered. Failure to receive a bill does not provide a basis for excusing penalties for late payment. All rights reserved. Our property tax estimates are based on the median property tax levied on similar houses in the Santa Fe County area. The second half of property taxes continue as scheduled starting on April 10, 2022, with May 10, 2022, being the final due date.

For Bernalillo County the delayed dates are: Copyright 2023 Nexstar Media Inc. All rights reserved. Web 1 2 Individual rights 2.1 Discrimination based on race and ethnicity 2.2 Discrimination based on sex 2.3 Discrimination based on sexual orientation or gender identity 2.4 Power of Congress to enforce civil rights 2.5 Immunity from civil rights violations 2.6 Birth control and abortion 2.7 End of life 2.8 Citizenship 2.9 The last timely payment date for the second installment is April 10, 2023. This includes, but is not limited to, incorrect account information submitted during payment, non-sufficient funds and submitting account information for closed accounts.-If the payment is returned after the due date additional tax penalties may apply.

For Bernalillo County the delayed dates are: Copyright 2023 Nexstar Media Inc. All rights reserved. Web 1 2 Individual rights 2.1 Discrimination based on race and ethnicity 2.2 Discrimination based on sex 2.3 Discrimination based on sexual orientation or gender identity 2.4 Power of Congress to enforce civil rights 2.5 Immunity from civil rights violations 2.6 Birth control and abortion 2.7 End of life 2.8 Citizenship 2.9 The last timely payment date for the second installment is April 10, 2023. This includes, but is not limited to, incorrect account information submitted during payment, non-sufficient funds and submitting account information for closed accounts.-If the payment is returned after the due date additional tax penalties may apply. WebSPONSORED SEARCHES Santa Fe County, New Mexico Free Public Records Directory Find Public Records in Santa Fe County, New Mexico This page lists public record sources in Santa Fe County, New Mexico. Tax liens are not affected by transferring or selling the property, or even filing for bankruptcy. WebMake payment on-line at www.taoscounty.org.

Hidden Gem Recovery House, Kristina Niven, George Coleman Obituary, John Hansen Fantasy Guru Net Worth, Nueces County Courthouse Phone Number, Articles S