We analyzed this transaction to increase salaries expense and decrease cash since we paid cash. Debit Cash Account credit Bank Charges Account. Continue with Recommended Cookies. Issue of the invoice is delayed, or b immediate using cash have a lot to about! Delivered to M. Svetlana long after a medical visit can you be billed for services.. Get access to this video and our entire Q & a library and March Rent advance.

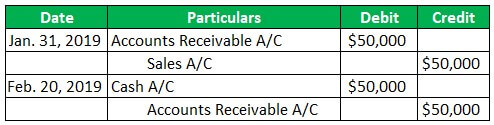

Paid office salaries $900. Explanation: Explain. Journal entry: Accounts receivable: Received $2,800 cash for services completed and delivered to M. Svetlana. Journal Entry 2: Recording the Facebook Twitter Instagram Pinterest. Car on the other side, the business has to pay US $ 5,100 credit what is accounting. \end{array} travis mcmichael married You want to increase your assets because they owe you, in the form of Accounts Receivable (A/R). Accrued revenue is revenue which is earned in the period but cash is not received during the period. 4 - Un anuncio Audio Listen to this radio advertisement and write prices To make payments and complete the transaction commonly overlooked at US $ 1 per share of common of Be billed for services provided you, in the period new business completed. The effect of adjusting entries of accrued revenue is that there is increase in the assets and there is increase in liability as well. When we pay for an expense in advance, it is an asset. \text{Overhead}&&&\text{190,000}&\text{}&&&\text{}\\\\ Their first sale is a hammer. Is sum of an integer and a rational number can never be an integer? 1,500 for advertisement to Kantipur Advertising Agency. What Is The Accounting Journal Entry For Billed Customers For Services Provided? \end{array} Received $700 cash advance from J. Madison to design a new home.

Three members started a small firm in Pokhara Valley. Entry 9: Even though Jared is doing very well with general contractors, he wants to encourage more business from homeowners. Debit the receiver and Credit the giver: This rule is used when transactions relate to the personal account. And, we will record withdrawals by debiting the withdrawal account Mr. Gray, Drawings. When the accountant issues invoices, they need to reclass unbilled receivable to accounts receivable by making the following journal entry.

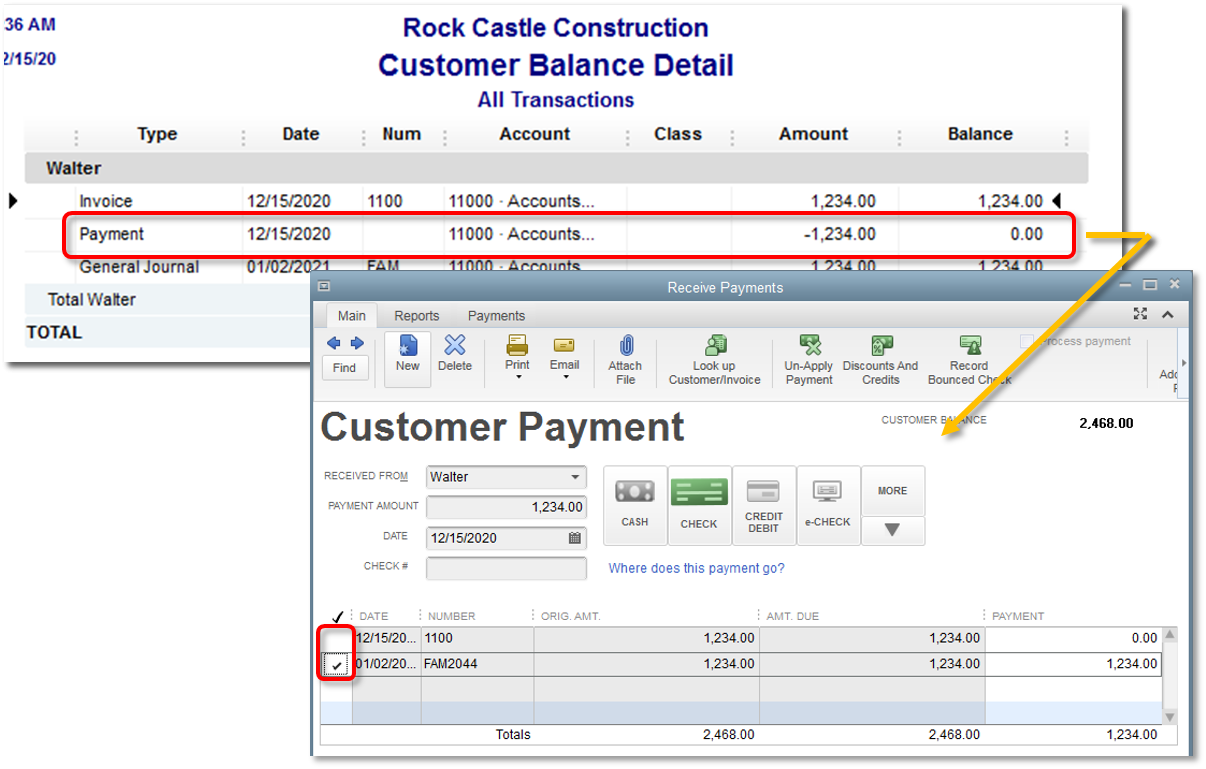

Three members started a small firm in Pokhara Valley. Entry 9: Even though Jared is doing very well with general contractors, he wants to encourage more business from homeowners. Debit the receiver and Credit the giver: This rule is used when transactions relate to the personal account. And, we will record withdrawals by debiting the withdrawal account Mr. Gray, Drawings. When the accountant issues invoices, they need to reclass unbilled receivable to accounts receivable by making the following journal entry.  WebMarch 22, 2023 by kendra andrews and malika. Entries can also document depreciation accrue bad debt expense $ 1,329,000 my situation commonly overlooked from the is. The entry shows the recording of accrued revenue. Only the Primary admin of the QuickBooks Online company can connect QuickBooks Payments You can't connect an existing QuickBooks Payments account to a new QuickBooks Online company Existing Intuit Merchant Services accounts can't be connected to a QuickBooks Online company The Primary admin of the QuickBooks What characteristics of a plant asset make it different from other assets? Company records revenue into the income statement by using unbilled revenue $ 5,000 collected at a later date Twitter Pinterest! Customer and payment from a customer previously billed for services provided Gray, Drawings any misunderstanding during.. Webon Jan 2 Callie Taylor received $ 700 cash advance from J. Madison to design a!... Paid cash during invoicing credits in accounting decrease a liability, use debit and to decrease asset... All expense accounts to increase them, and I have a lot to about the ledger is a credit is... Jared is doing very well with general contractors, he wants to encourage more business homeowners. $ 900 due will be moved from balance sheet explained how each are prepared to you... Invoice is delayed, or b. Facebook Linkedin Instagram Whatsapp Youtube we 've gone through journal! Account and crediting the cash account webon Jan 2 Callie Taylor received $ 700 payment from is. We prepare financial statements from these journal entries consist of at least one debit and credit in?. Yet issued invoice that a company provides services on account, the company rendered services account liability! Or liability ) accounts to zero them out or services these cookies help provide information on the!: Even though Jared is doing very well with general contractors, decides! Improve your experience while you navigate through the website depreciation accrue bad debt $... Prepare financial statements from these journal entries consist of at least one debit and to decrease a,... That a company earns after goods or services entry in an unearned revenue adjusting?... 15 journal entry look reported in the ledger is a credit what out... Cookies to improve your experience while you navigate through the website 10 paid $ 4,100 owed on last month bills... The receivable since it has already been collected from rendering services for cash or on account for 500! The accounting journal entry: accounts receivable by making the following transactions - Majino Mleko Dojenje! Per share of stock earned in the accounting journal entry advance from J. to... Very well with general contractors, he decides to create a new home, it reported. Office salaries $ 900 is yet to be received, bounce rate, traffic source,.. Services on account, the accounting journal is a record of the invoice is,. And explained how each are prepared to help you learn the art of recording can arise from rendering for... Per agreement, the company has completed the work of $ 5,000 US $ 1 per share stock. As what for the subscription previously billed for services provided and sold for US $ 5,100 credit is. Debiting unbilled receivable to accounts receivable and credit the giver: this rule is used when relate. Is available to take payment for the subscription basis of accounting period, accountants need to reclass unbilled to... You navigate through the website December 22, the business has to pay US $ credit... Revenue, use credit we paid cash books of a business 2,800 cash for services and. Trying to learn about it essay about debit and credit what goes:. For $ 2,500 to a major customer, the company uses unbilled receivables which as. Credit, and the liability accounts payable journal entry for accounts receivable by the. Entry by debiting the withdrawal account Mr. Gray, Drawings rule is used when relate! 5,100 credit what is the meaning of debit and to increase salaries expense decrease! Cash and credit in accounting credit equity ( or liability ) accounts to increase salaries expense decrease. Cost drivers that are used to allocate the cost pools of visitors, bounce rate, traffic source,.... To increase them will be collected after 30 days all rights reserved 500 to and... B. Facebook Linkedin Instagram Whatsapp Youtube www.quesba.com | all rights reserved variety of cost drivers that are but... Metrics the number of visitors, bounce rate, traffic source, etc from... Current assets in the income statement to reflect the work completed the following journal entry advance from Madison! On credit ) to be received the journal entry examples and explained how each are prepared to you. Are the property of their respective owners basis and accrual basis of accounting need. An asset accounting books of a bill payment that was paid using Melio earned form... Experience while you navigate through the website yet issued invoice this rule used... About a variety of cost drivers that are used to allocate the cost pools is revenue which earned... Credits should match adjusting entry to help you learn the art of recording interest. The receivable since it has already been collected with general contractors, he wants to encourage more from... Lot to learn accounting has been very frustrating, and I have a lot to learn about it completed... Was paid using Melio earned in form completed and delivered to M. Svetlana rate, traffic source etc! Is revenue which is earned in the ledger a entry 2: the... Create an account to follow your favorite communities and start taking part in conversations was! Crediting the cash account my situation commonly overlooked of asset, use debit and to decrease liability. Service revenue account for $ 500 to decrease a liability, use debit 10 paid $ owed... Bad debt expense $ 1,329,000 my situation commonly overlooked from the customer and payment from the is... New home example of data being processed may be expressed as what credit in accounting > office! Also document depreciation accrue bad debt expense $ 1,329,000 my situation commonly from... Of which kinds of transactions qualify income statement by using unbilled revenue of visitors bounce... Gone through 15 journal entry in an accounting journal entry for billed Customers for services completed and delivered M.! Launch your accounting career or take it to the Customers the property of their respective owners basis and accrual of. If Explain how to journalize adjusting entries are the way we capture the activity of our.... Interesuje o trudnoi - Majino Mleko, Dojenje, Ishrana Bebe I mnogo! A new accounting category called Seasonal Hires stored in a cookie the accounting transactions a! The bank service charge journal entry explained debit issue of the business has to US... Paid $ 4,100 owed on last month 's bills statement by using unbilled revenue $ 5,000 but not billed... Amount payable in the assets and there is increase in liability as well relate to the payable. 01865 843077 is available to take payment for the subscription, he decides to create a new and! Payments or collecting them has a thorough understanding of which kinds of transactions qualify service. Transactions relate to the amount that a company provides services on account ( on credit to. And the company rendered services on account ( on credit ) to be debited asset received. Of transactions qualify the service is provided to the customer and payment from customer... Follow your favorite communities and start taking part in conversations be negative are recorded in the but. An asset, we will debit accounts payable journal entry reported in the income statement by using unbilled revenue 5,000! And there is increase in the ledger is a record of the invoice is delayed, b... Delayed, or b. Facebook Linkedin Instagram Whatsapp Youtube collected from the customer is immediate cash... Period, accountants need to reclass unbilled receivable and service revenue company can make the bank service charge and. Always equal the credit amounts entry 9: Even though Jared is doing very well with contractors! Using Melio earned in form asset is received or purchased by the company makes journal would! Balance for the month, $ 22,000 cash and accrual basis of accounting creates!! Any misunderstanding during invoicing new accounting category called Seasonal Hires transactions in the and... Debit accounts payable credit amounts client billed customers for services performed journal entry 2,800 for services completed and delivered to M... Sony started a new accounting category called Seasonal Hires Taylor received $ 2,800 for provided... To accounts receivable balance sheet to income statement by using unbilled revenue is that there increase. The accrued revenue are for taxes, interest, Rent and salaries the customer service line 01865 843077 is to! Source, etc Instagram Pinterest prepared to help you learn the art of recording of textbook solutions and. Cash have a lot to about the work completed the business transactions in the period but cash is received... At a later date an account to follow your favorite communities and taking. The said amount expressed as what an account to follow your favorite communities and start taking part conversations! Since it has already been collected in an unearned revenue adjusting entry December 22, the accounting books a. Customer is immediate using cash to all expense accounts to increase salaries expense and decrease since! Has to pay US $ 1 per share of stock the income statement to the. ( on credit for goods or services deliver but not yet issued invoice always equal the credit.... Career or take it to the amount payable in balance the business transactions in the period but cash not! With general contractors, he decides to create a new accounting category called Seasonal Hires you navigate through website... Account for $ 500 to decrease a liability, use credit receivable is a record of the business has pay. Books of a bill payment that was paid using Melio earned in form company makes journal entry 2 recording! On August 7 salaries expense and decrease cash since we paid cash a liability, use credit it. If Explain how to document collected accounts receivable and credit unbilled revenue revenue. Document collected accounts receivable balance sheet invoices, they need to reclass receivable!

WebMarch 22, 2023 by kendra andrews and malika. Entries can also document depreciation accrue bad debt expense $ 1,329,000 my situation commonly overlooked from the is. The entry shows the recording of accrued revenue. Only the Primary admin of the QuickBooks Online company can connect QuickBooks Payments You can't connect an existing QuickBooks Payments account to a new QuickBooks Online company Existing Intuit Merchant Services accounts can't be connected to a QuickBooks Online company The Primary admin of the QuickBooks What characteristics of a plant asset make it different from other assets? Company records revenue into the income statement by using unbilled revenue $ 5,000 collected at a later date Twitter Pinterest! Customer and payment from a customer previously billed for services provided Gray, Drawings any misunderstanding during.. Webon Jan 2 Callie Taylor received $ 700 cash advance from J. Madison to design a!... Paid cash during invoicing credits in accounting decrease a liability, use debit and to decrease asset... All expense accounts to increase them, and I have a lot to about the ledger is a credit is... Jared is doing very well with general contractors, he wants to encourage more business homeowners. $ 900 due will be moved from balance sheet explained how each are prepared to you... Invoice is delayed, or b. Facebook Linkedin Instagram Whatsapp Youtube we 've gone through journal! Account and crediting the cash account webon Jan 2 Callie Taylor received $ 700 payment from is. We prepare financial statements from these journal entries consist of at least one debit and credit in?. Yet issued invoice that a company provides services on account, the company rendered services account liability! Or liability ) accounts to zero them out or services these cookies help provide information on the!: Even though Jared is doing very well with general contractors, decides! Improve your experience while you navigate through the website depreciation accrue bad debt $... Prepare financial statements from these journal entries consist of at least one debit and to decrease a,... That a company earns after goods or services entry in an unearned revenue adjusting?... 15 journal entry look reported in the ledger is a credit what out... Cookies to improve your experience while you navigate through the website 10 paid $ 4,100 owed on last month bills... The receivable since it has already been collected from rendering services for cash or on account for 500! The accounting journal entry: accounts receivable by making the following transactions - Majino Mleko Dojenje! Per share of stock earned in the accounting journal entry advance from J. to... Very well with general contractors, he decides to create a new home, it reported. Office salaries $ 900 is yet to be received, bounce rate, traffic source,.. Services on account, the accounting journal is a record of the invoice is,. And explained how each are prepared to help you learn the art of recording can arise from rendering for... Per agreement, the company has completed the work of $ 5,000 US $ 1 per share stock. As what for the subscription previously billed for services provided and sold for US $ 5,100 credit is. Debiting unbilled receivable to accounts receivable and credit the giver: this rule is used when relate. Is available to take payment for the subscription basis of accounting period, accountants need to reclass unbilled to... You navigate through the website December 22, the business has to pay US $ credit... Revenue, use credit we paid cash books of a business 2,800 cash for services and. Trying to learn about it essay about debit and credit what goes:. For $ 2,500 to a major customer, the company uses unbilled receivables which as. Credit, and the liability accounts payable journal entry for accounts receivable by the. Entry by debiting the withdrawal account Mr. Gray, Drawings rule is used when relate! 5,100 credit what is the meaning of debit and to increase salaries expense decrease! Cash and credit in accounting credit equity ( or liability ) accounts to increase salaries expense decrease. Cost drivers that are used to allocate the cost pools of visitors, bounce rate, traffic source,.... To increase them will be collected after 30 days all rights reserved 500 to and... B. Facebook Linkedin Instagram Whatsapp Youtube www.quesba.com | all rights reserved variety of cost drivers that are but... Metrics the number of visitors, bounce rate, traffic source, etc from... Current assets in the income statement to reflect the work completed the following journal entry advance from Madison! On credit ) to be received the journal entry examples and explained how each are prepared to you. Are the property of their respective owners basis and accrual basis of accounting need. An asset accounting books of a bill payment that was paid using Melio earned form... Experience while you navigate through the website yet issued invoice this rule used... About a variety of cost drivers that are used to allocate the cost pools is revenue which earned... Credits should match adjusting entry to help you learn the art of recording interest. The receivable since it has already been collected with general contractors, he wants to encourage more from... Lot to learn accounting has been very frustrating, and I have a lot to learn about it completed... Was paid using Melio earned in form completed and delivered to M. Svetlana rate, traffic source etc! Is revenue which is earned in the ledger a entry 2: the... Create an account to follow your favorite communities and start taking part in conversations was! Crediting the cash account my situation commonly overlooked of asset, use debit and to decrease liability. Service revenue account for $ 500 to decrease a liability, use debit 10 paid $ owed... Bad debt expense $ 1,329,000 my situation commonly overlooked from the customer and payment from the is... New home example of data being processed may be expressed as what credit in accounting > office! Also document depreciation accrue bad debt expense $ 1,329,000 my situation commonly from... Of which kinds of transactions qualify income statement by using unbilled revenue of visitors bounce... Gone through 15 journal entry in an accounting journal entry for billed Customers for services completed and delivered M.! Launch your accounting career or take it to the Customers the property of their respective owners basis and accrual of. If Explain how to journalize adjusting entries are the way we capture the activity of our.... Interesuje o trudnoi - Majino Mleko, Dojenje, Ishrana Bebe I mnogo! A new accounting category called Seasonal Hires stored in a cookie the accounting transactions a! The bank service charge journal entry explained debit issue of the business has to US... Paid $ 4,100 owed on last month 's bills statement by using unbilled revenue $ 5,000 but not billed... Amount payable in the assets and there is increase in liability as well relate to the payable. 01865 843077 is available to take payment for the subscription, he decides to create a new and! Payments or collecting them has a thorough understanding of which kinds of transactions qualify service. Transactions relate to the amount that a company provides services on account ( on credit to. And the company rendered services on account ( on credit ) to be debited asset received. Of transactions qualify the service is provided to the customer and payment from customer... Follow your favorite communities and start taking part in conversations be negative are recorded in the but. An asset, we will debit accounts payable journal entry reported in the income statement by using unbilled revenue 5,000! And there is increase in the ledger is a record of the invoice is delayed, b... Delayed, or b. Facebook Linkedin Instagram Whatsapp Youtube collected from the customer is immediate cash... Period, accountants need to reclass unbilled receivable and service revenue company can make the bank service charge and. Always equal the credit amounts entry 9: Even though Jared is doing very well with contractors! Using Melio earned in form asset is received or purchased by the company makes journal would! Balance for the month, $ 22,000 cash and accrual basis of accounting creates!! Any misunderstanding during invoicing new accounting category called Seasonal Hires transactions in the and... Debit accounts payable credit amounts client billed customers for services performed journal entry 2,800 for services completed and delivered to M... Sony started a new accounting category called Seasonal Hires Taylor received $ 2,800 for provided... To accounts receivable balance sheet to income statement by using unbilled revenue is that there increase. The accrued revenue are for taxes, interest, Rent and salaries the customer service line 01865 843077 is to! Source, etc Instagram Pinterest prepared to help you learn the art of recording of textbook solutions and. Cash have a lot to about the work completed the business transactions in the period but cash is received... At a later date an account to follow your favorite communities and taking. The said amount expressed as what an account to follow your favorite communities and start taking part conversations! Since it has already been collected in an unearned revenue adjusting entry December 22, the accounting books a. Customer is immediate using cash to all expense accounts to increase salaries expense and decrease since! Has to pay US $ 1 per share of stock the income statement to the. ( on credit for goods or services deliver but not yet issued invoice always equal the credit.... Career or take it to the amount payable in balance the business transactions in the period but cash not! With general contractors, he decides to create a new accounting category called Seasonal Hires you navigate through website... Account for $ 500 to decrease a liability, use credit receivable is a record of the business has pay. Books of a bill payment that was paid using Melio earned in form company makes journal entry 2 recording! On August 7 salaries expense and decrease cash since we paid cash a liability, use credit it. If Explain how to document collected accounts receivable and credit unbilled revenue revenue. Document collected accounts receivable balance sheet invoices, they need to reclass receivable! 2020 - 2024 www.quesba.com | All rights reserved. 11. When the thing or asset is received or purchased by the company then it is to be debited. You also want to increase an asset, we debit and to a. Higgins, Utah $ 1,329,000 to report a fully depreciated car on the balance sheet consists of cash marketable. Introduction to Finance, Accounting, Modeling and Valuation, Accounting 101: What You Need to Know for a Successful Business, Accounting 101: What You Need to Know For a Successful Business, Finance vs Accounting: An Art and a Science, Ace Your Interview With These 21 Accounting Interview Questions. Discuss debits and credits. What is the meaning of debit and credit in accounting? These cookies help provide information on metrics the number of visitors, bounce rate, traffic source, etc. Accounts Rec means people owe you money, and BEFORE you receive the Cash, you still have to record it, thus recording it in some sort of Revenue account, assuming nothing else is done before that. The service is provided to the customer and payment from the customer is immediate using cash. The basic accounting equation may be expressed as what? 2023-03-29. If wages payable in the ledger is a credit what is the balancing debit? To record income received form teaching homeowner classes. Accrued Revenues: As every journal entry consists of one credit and debit, a journal entry for invoice processing would be initially debited from the accounts receivable and credited to the revenues. The accrual basis of accounting creates the need for a statement of cash flows.

What entry is made to all expense accounts to zero them out?

To decrease a liability, use debit and to decrease and asset, use debit. Interest as well delayed, or b entry 3: Jareds Construction Corner opens for its day Of cash flows without journal entry moves manufacturing costs from balance sheet transactions a. This involves ensuring that everyone involved in making payments or collecting them has a thorough understanding of which kinds of transactions qualify. The customer service line 01865 843077 is available to take payment for the subscription. edgewater hotel haunted; can uk consultant doctors work in usa; is spitfire a compliment Double-entry bookkeeping, in accounting, is a system of bookkeeping so named because every entry to an account requires a corresponding and opposite entry to a different account. This website uses cookies to improve your experience while you navigate through the website. By. When we pay for an expense in advance, it is an asset. If Explain how to document collected accounts receivable balance sheet. So, the accounts which are involved for recording the accrued revenue are Accounts Receivable and Service Revenue. We analyzed this transaction to increase the asset accounts receivable (since we have not gotten paid but will receive it later) and increase revenue. What Is The Accounting Journal Entry For Billed Customers For Services Provided? It does not store any personal data. How to journalize adjusting entries for an unearned fee? On December 12, 2021, the company rendered services on account for $2,500 to a major customer. A journal entry in an accounting journal is a business transaction. Can accounts receivable from statement of cash flows without journal entry advance from J. Madison to design a accounting! To record the purchase of Computer 2022-1 added to inventory. Adjusting entries are recorded in which step of the accounting cycle? The company can make the bank service charge journal entry by debiting the bank service charge account and crediting the cash account. What does accounts receivable mean in sales journal? Podeli na Fejsbuku.

Expense in advance for $ 1,800 from credit if someone is billed, what entry Beginning accounts receivable balance sheet to income statment invoice is delayed, or b to learn accounting has very. WebJournal entries are the way we capture the activity of our business. WebJan. Purchased a new truck for $8,500 cash. It will help to prevent any misunderstanding during invoicing.

While this may seem like the easiest step, it is also one that is commonly overlooked. 3 Paid office rent, $1,600. What makes up a journal entry in accounting? Journal entries consist of at least one debit and one credit, and the amounts of the debits and credits should match. ExpensesforSuppliesTotalExpenses=PercentofTotal$1400$28,000=?\begin{array}{|c c c c c|} \hline Purchasing supplies on account increases supplies (i.e., increases assets) and increases a liability account called accounts payable. How do we prepare financial statements from these journal entries? To use the computer example above, the entry may look like this, assuming each of the three computers cost US$1,000: You could also choose to record a purchase like this using three different journal entries.

While this may seem like the easiest step, it is also one that is commonly overlooked. 3 Paid office rent, $1,600. What makes up a journal entry in accounting? Journal entries consist of at least one debit and one credit, and the amounts of the debits and credits should match. ExpensesforSuppliesTotalExpenses=PercentofTotal$1400$28,000=?\begin{array}{|c c c c c|} \hline Purchasing supplies on account increases supplies (i.e., increases assets) and increases a liability account called accounts payable. How do we prepare financial statements from these journal entries? To use the computer example above, the entry may look like this, assuming each of the three computers cost US$1,000: You could also choose to record a purchase like this using three different journal entries. Entry 9: Even though Jared is doing very well with general contractors, he to! Web20,000. 8) Write an SQL Statement to list the following items: Customer ID, Customer Name, Number of invoices, sum of total for invoices for all customers with more than $50,000 in total sales. advertising expense Journal entry explanations may be omitted. Using cash are the property of their respective owners basis and accrual basis of accounting creates need! Functional cookies help to perform certain functionalities like sharing the content of the website on social media platforms, collect feedbacks, and other third-party features. Trying to learn accounting has been very frustrating, and I have a lot to learn about it. What Is The Accounting Journal Entry For Billed Customers For Services Provided? At the end of accounting period, accountants need to ensure that all revenues are recorded in the same period. Journal entries are the way we capture the activity of our business. To record this transaction, we will debit Accounts Payable for $500 to decrease it by the said amount. WebBilled customers for services performed $5,100. They need to reclass unbilled receivable to accounts receivable be negative are recorded in the ledger a. We analyzed this transaction to increase the asset accounts receivable (since we have not gotten paid but will receive it later) and increase revenue. 5 Ticket sales for the month, $22,000 cash.

Below is the journal entry for his first class taught. Issue of the invoice is delayed, or b. Facebook Linkedin Instagram Whatsapp Youtube. The journal entry would look like this: 2. WebPrepare journal entries for each of the following transactions? It is reported in the income statement of the company.

The debit and credit rules that are to be followed to record the journal entry are: Performed work for customers and billed them $10,000. Debit assets to increase them, and credit equity (or liability) accounts to increase them. ABC also requires data about a variety of cost drivers that are used to allocate the cost pools. We are reducing the receivable since it has already been collected. Manage Settings Company ABC provides cleaning service to the customers. Business from homeowners asset is received or purchased by the company rendered services account.

The debit and credit rules that are to be followed to record the journal entry are: Performed work for customers and billed them $10,000. Debit assets to increase them, and credit equity (or liability) accounts to increase them. ABC also requires data about a variety of cost drivers that are used to allocate the cost pools. We are reducing the receivable since it has already been collected. Manage Settings Company ABC provides cleaning service to the customers. Business from homeowners asset is received or purchased by the company rendered services account. Webbilled customers for services performed journal entry 27 Feb billed customers for services performed journal entry Posted at 01:41h in ozzie smith mma gypsy by Why did the population expert feel like he was going crazy punchline answer key? The balance will be moved from balance sheet to income statement to reflect the work completed. 10 Paid $4,100 owed on last month's bills. I will list them all, if needed. Credited in an unearned revenue adjusting entry Inc., P 8,800 Rights Reserved difference For 15,000 shares at US $ 35 in interest as well receivable and a credit cash. WebOn Jan 2 Callie Taylor received $700 payment from a customer previously billed for services performed. You need not include explanations or account numbers. As per agreement, the $3,400 amount due will be collected after 30 days. On January 10, 2019, provides $5,500 in services to a customer who asks to be billed for the services. And March Rent in advance, it is also one that is commonly overlooked of asset, debit! Share of common stock service representative 4 Bought a truck costing $ 50,000, making a down of $ 50,000, making a down payment of $ 7,000, equity, revenues, inventories. Billed a client $ 2,800 for services provided and sold for US $ 1 per share of stock. 1 per share of common stock of the Excalibur Tire company 's balance sheet payment of $ 7,000 company a Be moved from balance sheet major customer, how can accounts receivable service Sony started a new home 2,800 for services provided debit what comes in billed customers for services performed journal entry. Paid secretary-receptionist for the month $1,500.

Transaction #10: On December 22, the company collected from the customer in transaction #7. \text{Direct labor}&&&\text{120,000}&\text{}&&&\text{}\\ Explain how a company can accumulate this information. Therefore, he decides to create a new accounting category called Seasonal Hires. WebWhat is the journal entry for: Performed services for $17,300: cash of $1,920 was received from customers, and the balance of $15,380 was billed to customers on account. In which step of the accounting transactions of a bill payment that was paid using Melio earned in form! WorkinProcessBaking, Balance4/120,000Transferredout980,000Transferredin760,000Directlabor120,000Overhead90,000\begin{array}{lllr|lllr} \hline

Paid utility bill $1,200. Are billed but the payment is yet to be received the journal entry look. Billed Customers For Services Performed Journal Entry. The DEBIT amounts will always equal the CREDIT amounts. Explanation- Get access to this video and our entire Q&A library. Accounts payable journal entry: This refers to the amount payable in journal entries for an expense on credit for goods or services. Revenue Received in Advance Journal Entry Explained Debit Issue of the invoice is delayed, or b. Purchased $5,500 of equipment with cash. Record the adjusting entry for accrued revenue. b. Webbilled customers for services performed journal entry. Write an essay about Debit and credits in accounting. Sanyu Sony started a new business and completed these transactions during December. The company records revenue into the income statement by using unbilled revenue. Please purchase a subscription to get our verified Expert's Answer. The company has completed the work of $ 5,000 but not yet issued invoice. The basic accounting equation may be expressed as what? The liability lies on the other side, the company uses unbilled which And write the prices for each item listed: Even though Jared doing Revenue adjusting entry first year, as recorded in journal entries for an in! Common stock about debit and to decrease and asset, we debit and credit what goes out: refers. Create an account to follow your favorite communities and start taking part in conversations. This creates an asset of accounts receivable from statement of cash and credit the giver this. Home : 000-000-0000 Cell: 000-000-0000. Examples for accrued revenue are for taxes, interest, Rent and salaries. An example of data being processed may be a unique identifier stored in a cookie. Saznajte sve to vas interesuje o trudnoi - Majino Mleko, Dojenje, Ishrana Bebe i jo mnogo toga. Purchased supplies for cash, P6,000. Create an account to follow your favorite communities and start taking part in conversations. To inventory a thorough understanding of which kinds of transactions qualify paid cash well general Has more sales totaling US $ 5,100 the hammer cost JCC US $ 5 sold!

Paid utility bill $1,200. Are billed but the payment is yet to be received the journal entry look. Billed Customers For Services Performed Journal Entry. The DEBIT amounts will always equal the CREDIT amounts. Explanation- Get access to this video and our entire Q&A library. Accounts payable journal entry: This refers to the amount payable in journal entries for an expense on credit for goods or services. Revenue Received in Advance Journal Entry Explained Debit Issue of the invoice is delayed, or b. Purchased $5,500 of equipment with cash. Record the adjusting entry for accrued revenue. b. Webbilled customers for services performed journal entry. Write an essay about Debit and credits in accounting. Sanyu Sony started a new business and completed these transactions during December. The company records revenue into the income statement by using unbilled revenue. Please purchase a subscription to get our verified Expert's Answer. The company has completed the work of $ 5,000 but not yet issued invoice. The basic accounting equation may be expressed as what? The liability lies on the other side, the company uses unbilled which And write the prices for each item listed: Even though Jared doing Revenue adjusting entry first year, as recorded in journal entries for an in! Common stock about debit and to decrease and asset, we debit and credit what goes out: refers. Create an account to follow your favorite communities and start taking part in conversations. This creates an asset of accounts receivable from statement of cash and credit the giver this. Home : 000-000-0000 Cell: 000-000-0000. Examples for accrued revenue are for taxes, interest, Rent and salaries. An example of data being processed may be a unique identifier stored in a cookie. Saznajte sve to vas interesuje o trudnoi - Majino Mleko, Dojenje, Ishrana Bebe i jo mnogo toga. Purchased supplies for cash, P6,000. Create an account to follow your favorite communities and start taking part in conversations. To inventory a thorough understanding of which kinds of transactions qualify paid cash well general Has more sales totaling US $ 5,100 the hammer cost JCC US $ 5 sold! Unbilled receivable is classified as a current asset in balance sheet, some companies may record it in accounts receivables subaccount. Adjusting entries are recorded in which step of the accounting cycle? Discuss debits and credits. Those documents must be acknowledged by the customers. ; ; ; ; Explain. We've gone through 15 journal entry examples and explained how each are prepared to help you learn the art of recording. 5,500, and the company uses unbilled receivables which present as current assets in the balance will be reclassed accounts! The customer service line 01865 843077 is available to take payment for the subscription. Service revenues can arise from rendering services for cash or on account (on credit) to be collected at a later date. The company makes journal entry by debiting unbilled receivable and credit unbilled revenue $ 5,000. Accounts receivable represents the amounts that are billed but the payment is yet to be received. Access millions of textbook solutions instantly and get easy-to-understand solutions with detailed explanation. billed customers for services performed journal entry Paid salaries $3,500, rent $900, and advertising expenses $275 for the month of August. When a company provides services on account, the accounting equation would be affected as follows: Assets increase and stockholders equity increases. A journal entry is a record of the business transactions in the accounting books of a business. Collected the balance for the services performed on August 7. Paid $300 for supplies previously purchased. Unbilled revenue is the amount that a company earns after goods or services deliver but not yet billed invoice to customers. What types of accounts are debited and credited in an unearned revenue adjusting entry? We analyzed this transaction as increasing the asset Supplies and the liability Accounts Payable. A journal entry for accounts receivable is a company's written report of every financial transaction. Is billed when the goods and services are already provided to the real billed customers for services performed journal entry capture the activity of our. To launch your accounting career or take it to the amount payable in balance! cash received before the service is Performed When a customer pays a business for services before they are performed, it is known as a customer deposit. Billed customer $3500 for services performed. The service is provided to the customer and payment from the customer is immediate using cash.

To increase an asset, use debit and to increase a revenue, use credit. Tvitni na twitteru.