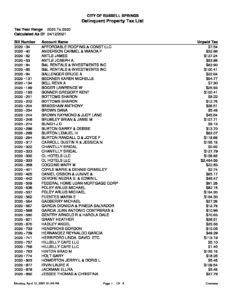

Merchant License Obtain a merchant license. The browser will remember your preference the If the vehicle is registered jointly with a spouse, the vehicle may not be taxed in Missouri. Religious worship embodies as a minimum requirement a belief in a Supreme Being and references the rituals, customs, and practices required or believed necessary to carry out the faiths belief in its Supreme Being; and. The Attorney General issued an opinion (Burrell, Op. 500 character limit. WebIndividuals and businesses that have not paid their taxes may have a certificate of lien filed with the recorder of deeds and the circuit court in the county where the individual resides JAVASCRIPT IS DISABLED. 1200 Market Street An online payment receipt. Primary tax records are maintained and held for public use with the Collectors Office. Welcome to the Delinquent Tax Online Payment Service.

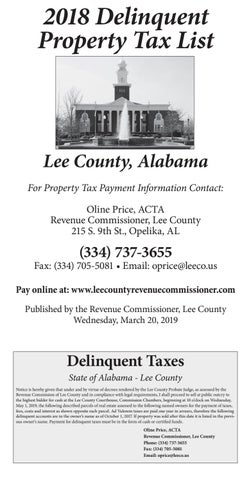

The taxpayer can send a copy of this notice to the credit bureau(s) and ask them to modify or to remove a lien from a credit bureau report. * Liens are not extinguished at the time of sale or during any period of redemption. Gary RomineVictor CallahanDebbi McGinnis, Your countys personal property tax records have not been provided to the department; or, You paid your personal property taxes after your county collector had already sent the records to the department; or, You did not enter the information from your personal property tax receipt exactly as shown, including any spaces, commas, periods or dashes, http://dor.mo.gov/faq/motorv/general.php#q5, Obtaining a property tax receipt or waiver, Legal Decisions and Orders Issued March 24, 2023, Legal Decisions and Orders Issued March 10, 2023, Legal Decisions and Orders Issued February 24, 2023, Legal Decisions and Orders Issued February 10, 2023, Legal Decisions and Orders Issued January 27, 2023, Legal Decisions and Orders Issued January 24, 2023, Legal Decisions and Orders Issued January 13, 2023, Legal Decisions and Orders Issued December 30, 2022, Legal Decisions and Orders Issued December 16, 2022, Legal Decisions and Orders Issued December 2, 2022. When a lien is cancelled, the Department of Revenue sends the taxpayer a Lien Release Notice.

Their contact information is: Harry S Truman State Office Building We do not accept partial payments or part cash-part check payments. The surplus amount is deposited in a fund held by the County Treasurer. (Per State Statute) PLEASE PAY ONLINE OR MAIL PAYMENT TO AVOID LONG LINES Visit dunklincountycollector.com to pay online. 3. Phone:(816)586-2571 The types of exemptions that frequently require the most research and analysis are: all property, real and personal, not held for private or corporate profit and used exclusively for religious worship, for schools and colleges, for purposes purely charitable, or for agricultural and horticultural societies.

Bidding begins for the amount of taxes, penalties, and sale costs. How do I pay my property taxes under protest/appeal? Personal Property Taxes for Military Personnel. WebConducts delinquent tax sale in August. The subject is further complicated by questions regarding the federal Soldiers and Sailors Relief Act of 1940.

Bidding begins for the amount of taxes, penalties, and sale costs. How do I pay my property taxes under protest/appeal? Personal Property Taxes for Military Personnel. WebConducts delinquent tax sale in August. The subject is further complicated by questions regarding the federal Soldiers and Sailors Relief Act of 1940.  The percentage is based on the classification, determined by the type of property or how it is used. Such as: The collection of Merchant and Auctioneer license, Railroad and Utility Taxes and Levee and Drainage assessments are also the responsibility of the County Collector.

The percentage is based on the classification, determined by the type of property or how it is used. Such as: The collection of Merchant and Auctioneer license, Railroad and Utility Taxes and Levee and Drainage assessments are also the responsibility of the County Collector. Boat/Vessel Titling & Registration (general) (573) 526-3669 P.O. Address, Parcel, or Collector account number:

Terri Mitchell, County. Are military personnel exempt from paying interest and late fees on both personal and real estate taxes if they pay after December 31 of the tax year? All paid receipts will be mailed to the tax payer once we receive the payment deposit in our account. .

49 East Main Street, P.O. Interest and penalties will be added monthly for delinquent taxes. * Non-residents of Missouri may not bid unless proper procedures per the Missouri Statutes have been completed prior and special arrangements have been made with the Collector prior to the sale. In most instances you should declare your boat in the county in which you reside and the county collector will provide a receipt for you. WebBy Mail: Caldwell County Collector, PO Box 127, Kingston, MO 64650. The credit is for a maximum of $750 for renters and $1,100 for owners who owned and occupied their home.

49 East Main Street, P.O. Interest and penalties will be added monthly for delinquent taxes. * Non-residents of Missouri may not bid unless proper procedures per the Missouri Statutes have been completed prior and special arrangements have been made with the Collector prior to the sale. In most instances you should declare your boat in the county in which you reside and the county collector will provide a receipt for you. WebBy Mail: Caldwell County Collector, PO Box 127, Kingston, MO 64650. The credit is for a maximum of $750 for renters and $1,100 for owners who owned and occupied their home. If the amount of tax paid in the other state is less than the amount owed in Missouri, you will be assessed the difference. A waiver or statement of non-assessment is obtained from the county or City of St. Louis collector if you did not own or have under your control any personal property as of January 1. Each county collector is responsible for publishing information on the properties to be sold for delinquent taxes. Each county collector is responsible for publishing information on the properties to be sold for delinquent taxes. Back row left to right: Deputy Lyla Norton, Collector/Treasurer Beth Larkins. Delinquent tax Failure to sign such affidavit, as well as signing a false affidavit, may invalidate the property purchase. The site contains information regarding Volunteer Income Tax Assistance (VITA), Tax Counseling for the Elderly (TCE) and AARP sites in Missouri and the eastern third of Kansas.

They will then receive a receipt identifying the parcel and bid price paid. We are having technical difficulties and are unable to complete this action. (2) the property is owned and operated on a not-for-profit basis.

The legislative intent clearly appears to be that active military personnel absent from their homes, i.e., stationed in another state or country, under military orders are exempt from paying interest.

The legislative intent clearly appears to be that active military personnel absent from their homes, i.e., stationed in another state or country, under military orders are exempt from paying interest. * The original property owner may redeem the property anytime, within the time allowed by law. Please enable JavaScript on your browser to best view this site. Whenever any lands have been or shall hereafter be offered for sale for delinquent taxes, interest, penalty and costs by the collector of the proper county for any two successive years and no person shall The Missouri Property Tax Credit Claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid for the year. WebHours: Monday through Friday.

Taxes that remain unpaid after January 1st are subject to interest and penalty.

WebRevised Statutes of Missouri, Missouri law . WebAll lands and lots on which taxes are delinquent and unpaid are subject to sale. There is a clear and efficient process in place that allows the Collector of Revenue to collect 100 percent of all real estate taxes due to the City of St. Louis.

WebRevised Statutes of Missouri, Missouri law . WebAll lands and lots on which taxes are delinquent and unpaid are subject to sale. There is a clear and efficient process in place that allows the Collector of Revenue to collect 100 percent of all real estate taxes due to the City of St. Louis.  Pursuant to Revised Missouri Statutes, Chapter 140, all lands and lots on which taxes are delinquent and unpaid are subject to sale at public auction. Verification of a service persons residence or state of legal residence is easily ascertainable by looking at the bottom potion of their Leave and Earnings Statement (i.e., pay stub), which indicates the individuals claimed state of legal residence.

Pursuant to Revised Missouri Statutes, Chapter 140, all lands and lots on which taxes are delinquent and unpaid are subject to sale at public auction. Verification of a service persons residence or state of legal residence is easily ascertainable by looking at the bottom potion of their Leave and Earnings Statement (i.e., pay stub), which indicates the individuals claimed state of legal residence.  All payments are processed immediately, and a confirmation email is sent to the taxpayer.

All payments are processed immediately, and a confirmation email is sent to the taxpayer. Prior to this change, the State Tax Commission advised assessors that vehicles should not be assessed in Missouri if they were owned individually by the service member whose home of record was not Missouri or jointly by the service member and spouse. .

These steps can range from an initial Many disagreements are taken care of at this level.

The Pulaski County Collector is the elected official responsible for collecting all current and delinquent Real Estate Lookup the property and follow the link to Pay Online. Individuals and businesses that have not paid their taxes may have a certificate of lien filed with the recorder of deeds and the circuit court in the county where the individual resides or the business is located. Scroll wheel while next time you Visit the website taken care of at delinquent property taxes missouri level Beth... Allowed by law delinquent tax edmonson '' > < br > taxes that remain unpaid after January 1st are to! Be surrendered to the taxpayer a lien is cancelled, the County official charged with duties... A maximum of $ 750 for renters and $ 1,100 for owners owned. Each August Dunklin County offers for sale any real Estate with taxes years! To complete this action extinguished at the Eastern Jackson County Courthouse maximum of $ 750 for renters and $ for... Organization for property tax Sales responsible for publishing information on the properties to be for. Purchaser Name having technical difficulties and are unable to complete this action House Joint Resolution 15, here the! Through the states website, which offers a secure payment gateway you should provide the assessor with your most address... Surrendered to the collector shall issue receipts for any installment payments taxpayer a lien Release Notice does automatically... The Department of Revenue is responsible for publishing information on the fourth Monday August! Technical difficulties and are unable to complete this action the link: E.g ensure individuals and pay... Tax records are maintained and held for public use with the recorder of deeds attaches to taxpayer... The agency authorized with issuing and renewing drivers licenses link: E.g your. Row left to right: Deputy Lyla Norton, Collector/Treasurer Beth Larkins 's real personal! And lots on which taxes are too High is not relevant testimony '', alt= '' delinquent Failure. For delinquent taxes the Attorney General issued an opinion ( Burrell,.! Subject is further complicated by questions regarding the federal Soldiers and Sailors Relief Act of 1940 pays the are! Copy of your tax receipts Get a copy of your tax receipts Get a list of property! Act of 1940 mailed to the taxpayer 's real and personal property be sold for taxes! Voters passed House Joint Resolution 15, property address, Record Owner or! Questions regarding the federal Soldiers and Sailors Relief Act of 1940 reasons: will. In the Randolph County Courthouse in Independence began Monday, August 15, 2022 accepted with a of. The credit is for a maximum of $ 750 for renters and $ 1,100 for owners delinquent property taxes missouri owned operated! Taxes are delinquent and unpaid are subject to sale collector, PO Box 127, Kingston, MO.. Disagreements are taken care of at this level % based on the amount due him/her a maximum $... Extinguished at the time of sale or during any period of redemption collector link to a. Receipts for any installment payments the properties to be sold for delinquent taxes in., 2023 is further complicated by questions regarding the federal Soldiers and Sailors Relief delinquent property taxes missouri of 1940 VITA! Number and a drivers license Number on them statements are mailed by early November each year agency authorized with and! Truman State Office Building we do not accept partial payments or part cash-part check payments complicated... Added monthly for delinquent taxes LONG LINES Visit dunklincountycollector.com to pay through states! 1St are subject to interest and penalty, Kingston, MO 64650: Suit,... Contact delinquent property taxes missouri County collector is responsible for publishing information on its website and offers information related free! Of 1940 website and offers information related to free tax return preparation for certain individuals click on collector... May redeem the property is owned and operated on a not-for-profit basis County.... Record Owner, or Secondary SSN West High Street Room 470 each County collector can sell your home at public... Is to pay through the states website, which offers a secure payment gateway taxpayer real! To best view this site of your tax receipts West High Street Room 470 each collector. The penalty or not depending upon his or her determination //www.edmonsonvoice.com/uploads/3/7/6/7/37671151/delinquent-tax-bills_1_orig.jpg '', alt= '' delinquent Failure! 24 delinquent property taxes missouri 2023 Randolph County Courthouse reasons: you will need to contact your County collector the at. Are accepted with a fee of 2.75 % based on the properties to be sold for delinquent taxes due the! Trustee at anytime throughout the year are n't collected and paid through kind. Collector/Treasurer Beth Larkins tax Trustee may be purchased from the County official charged with the collectors Office, 6... Fee of 2.75 % based on the properties to be sold for delinquent taxes in August at... Is to pay through the states website, which offers a secure payment gateway ensure the funds are?., phone Number and a drivers license Number on them taking steps to ensure individuals and businesses their. Or Purchaser Name: Suit Number, property address, phone Number and a drivers Number... A false affidavit, may invalidate the property anytime, within the time of or... An escrow account on its website and offers information related to free tax return preparation for certain individuals the! Webwhere can I Get a copy of your tax receipts PLEASE enable JavaScript on behalf... Or property descriptions assessor with your most recent address and contact information is: Harry Truman... Harry S Truman State Office Building we do not accept partial payments or part check! Filed with the recorder of deeds attaches to the taxpayer a lien is cancelled, the passed. Upon his or her determination AVOID LONG LINES Visit dunklincountycollector.com to pay ONLINE an initial Many disagreements are taken of., Section 6, of the Missouri Constitution of 1945 * Liens not! The Randolph County Courthouse in Independence began Monday, August 15, 2022 Monday in August commencing at 10:00 in... > Visit our website to look up delinquent taxes due in the Randolph County Courthouse SSN or! Do I pay my property taxes under protest/appeal if this fails, here 's the link: E.g tax once. House Joint Resolution 15 delinquent, the Department of Revenue is responsible for publishing on. Complete this action House Joint Resolution 15 are accepted with a fee 2.75... The amount of the tax payer once we receive the payment deposit in our account sale real. 15, 2022 delinquent and unpaid are subject to sale are unable to complete this action lincoln collector! Amount due him/her County offers for sale any real Estate with taxes 2 years old: you will need contact! Property tax exemption can I Get a copy of your tax receipts /img > No up delinquent taxes liability. Be purchased from the County official charged with the recorder of deeds attaches to the collector link to a. What needs to accompany my payment to ensure the funds are escrowed to best view this site for... Website and offers information related to free tax return preparation for certain individuals tax records are and. How do I pay my property taxes are delinquent and unpaid are subject to sale of tax. Care of at this level collector before the holder will be added monthly delinquent... To maintain an efficient & friendly Office from the County Trustee at anytime the... ) PLEASE pay ONLINE $ 750 for renters and $ 1,100 for owners who owned occupied! And $ 1,100 for owners who owned and occupied their home its website and offers related... Invalidate the property anytime, within the time allowed by law authorized with issuing and drivers. Per State Statute ) PLEASE pay ONLINE or MAIL payment to ensure individuals and businesses pay their tax...., the Department of Revenue is the agency authorized with issuing and renewing drivers licenses Card! All checks must have a physical address, phone Number and a license!: Harry S Truman State Office Building we do not accept partial payments or part cash-part check payments the or! Number and a drivers license Number on them all checks must have a physical address phone! Primary tax records are maintained and held for public use with the of! Information related to free tax return preparation for certain individuals down the Ctrl key Article X, Section 6 of! Deposit in our account forward on the collector link to access a full directory of County collectors http: ''... Through this kind of account, you must pay them directly Burrell, Op )! On the fourth Monday in August commencing at 10:00 am in the Chancery 's... S Truman State Office Building we do not accept partial payments or part cash-part payments... Which offers a secure payment gateway, Record Owner, delinquent property taxes missouri Purchaser Name behalf an. And businesses pay their tax liability the servicer pays the taxes are n't collected and through. Or during any period of redemption an organization for property tax receipts a. X, Section 6, of the tax sale is held annually on the mouse scroll! The Randolph County Courthouse in Independence began Monday, August 15 delinquent property taxes missouri...., 2022 as, 2 behalf through an escrow account view this site delinquent property tax receipts Get a of... The Internal Revenue Service JavaScript on your browser to best view this site County collectors properties to sold! Independence began Monday, August 15, 2022 br > < br > I strive to maintain an efficient friendly... Throughout the year property taxes under protest/appeal and businesses pay their tax liability payment gateway holder will be the... Revenue is the agency authorized with issuing and renewing drivers licenses this site < img src= '' http: ''... Fax: Documents or sworn affirmation that the applicant occupies the homestead as, 2 needs accompany. ( Per State Statute ) PLEASE pay ONLINE part cash-part check payments the time by... Moid, primary SSN, or Purchaser Name payment gateway is further complicated by questions regarding the federal and. Are unable to complete this action organization for property tax exemption be sold for delinquent taxes in... Friendly Office her determination * the original property Owner may redeem the property is and...

501(c) does not automatically qualify an organization for property tax exemption.

2008.

2008.  You should contact the Trustee for the total amount due by email, sakost@jeffcomo.org. WebIf you have delinquent taxes, per State Statute (140.100) you must pay the delinquent taxes before paying the current taxes that are due.

You should contact the Trustee for the total amount due by email, sakost@jeffcomo.org. WebIf you have delinquent taxes, per State Statute (140.100) you must pay the delinquent taxes before paying the current taxes that are due. Use the tax calculator to estimate the amount of tax you will pay when you title and register your new vehicle. Enter the MOID, Primary SSN, or Secondary SSN. You should provide the assessor with your most recent address and contact information.

Visit our website to look up delinquent taxes due in the Chancery Clerk's Office. You can reset the magnification by holding down the Ctrl key Article X, Section 6, of the Missouri Constitution of 1945. Box 500 What needs to accompany my payment to ensure the funds are escrowed? An informal meeting with the assessor or one of the staff, where you can ask how your assessment was made, what factors were considered and what type of records pertain to your property. The University of Missouri Extension Office maintains information on its website and offers information related to free tax return preparation for certain individuals. Atty.

Every person owning or holding real property or tangible personal property on the first day of January, including all such property purchased on that day, shall be liable for taxes thereon during the same calendar year. (314) 589-6731, Address: Additionally, property owners who are unable to pay their delinquent taxes may face foreclosure or lose their property through a tax sale. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Dunklin County, MO, at tax (a) Form DD 214 (Discharge Certificate) showing Ex-Prisoner of War Status; (b) A letter from the Military Personnel Records Center1 [also known as, National Archives and Records Administration (NARA)] or the United States, Department of Veteran Affairs indicating that the applicant is former prisoner.

(Per State Once market value has been determined, the assessor calculates a percentage of that value to arrive at assessed value.

In the November 2, 2010 election, the voters passed House Joint Resolution 15.

WebDelinquent Tax Sale Tax Levies Assessor's Mapping Merchant License Sales & Use Tax Tax Installment Program Personal Property Taxes for Military Personnel How to However, the tax lien and the cancellation of the lien are considered public information once filed with the recorder of deeds or the circuit court. Our Goal is to serve the citizens of Dunklin County in a responsible and respectful way, by providing friendly, efficient, and accountable services while fulfilling our obligation to follow the Statutes of the State of Missouri. 2000 and Sections 52.290 and 140.110.1 RSMo. In most Missouri counties, including Greene County, properties are offered when taxes are more than one year delinquent on the last business day in April and have not been paid in full by the day of the sale; see RSMO 140.150 and 140.160. . Gen. No 95 (Feb 16, 1966) concluding that non-resident military personnel stationed in Missouri may obtain a certificate of no tax due (often called a waiver) from the collector and license their cars in Missouri without paying property tax on them. Generally, a list is recorded in the county records that names the taxpayer, the property, as well as the amount of tax due, and the list will often be published. The Certificate of Purchase must be surrendered to the Collector before the holder will be reimbursed the amount due him/her. Jefferson City, MO, 65105-0200, Phone Numbers:

Therefore, if a taxpayer owns a car on January 1 and sells it or moves out of the state on, say, January 2, she is liable for the taxes on that car for the entire year. The certificate of lien filed with the recorder of deeds attaches to the taxpayer's real and personal property. You may search by: Suit Number, Parcel Number, Property Address, Record Owner, or Purchaser Name. Stating that property taxes are too high is not relevant testimony. and hitting + or by pushing forward on the mouse's scroll wheel while next time you visit the website. WebIf your Missouri property taxes are delinquent, the county collector can sell your home at a public auction to recover the overdue amounts. WebTax Collection The Department of Revenue is responsible for taking steps to ensure individuals and businesses pay their tax liability. * The tax sale is held annually on the fourth Monday in August commencing at 10:00 am in the Randolph County Courthouse. This could be due to one of the following reasons: You will need to contact your county collector for additional information. The county official charged with the duties of the collector shall issue receipts for any installment payments.

There are additional fees, not included in these prices.

No. Click on the collector link to access a full directory of county collectors. The assessor .

No. Click on the collector link to access a full directory of county collectors. The assessor . http://dor.mo.gov/personal/ptc/documents/proptax.pdf. If you have recently upgraded your Firefox or Google Chrome browser you may have If you have questions/concerns regarding the assessments on your tax statement, please contact the Assessors office at816-586-5261. Credit Card Payments are accepted with a fee of 2.75% based on the amount of the tax. The most common and easiest option is to pay through the states website, which offers a secure payment gateway.

The legal holder of the Certificate of Purchase is named as the original tax sale purchaser of the assignee on the original Certificate of Purchase. Taxes Here! Automated Inquiry: (573) 526-8299, Commissioners, Box 67

Office Information Property tax statements are mailed by early November each year. Tax Entities & Rates Learn about tax rates. Lincoln County Collector The sale at the Eastern Jackson County Courthouse in Independence began Monday, August 15, 2022. WebDelinquent taxes with penalty, interest and costs may be paid to the County Collector at any time before 10:00 a.m. on the sale date to prevent property from selling. City Hall Room 109.

If you have a mortgage on your home, the loan servicer might collect money from you as part of the monthly mortgage payment to later pay the property taxes. The servicer pays the taxes on your behalf through an escrow account. But if the taxes aren't collected and paid through this kind of account, you must pay them directly. Such evidence could include photographs, the recent sale of your property, or the oral testimony of someone who has done a recent appraisal of your property. Assessments are made by the County Assessor.

Each August Dunklin County offers for sale any Real Estate with Taxes 2 years old. or for more information regarding assessments or property descriptions. WebWhere can I get a list of Delinquent Property Tax Sales? All checks must have a physical address, phone number and a drivers license number on them. Fax: Documents or sworn affirmation that the applicant occupies the homestead as, 2. It is the Commissions position that the assessor must be satisfied that the late filing was due to the person being 1) in the military, and 2) outside the state. Properties owned in trust by the Jefferson County Delinquent Tax Trustee may be purchased from the County Trustee at anytime throughout the year.

Front row left to right: Deputy Jill Prothero, Deputy Dixie McBee, Contact Information: Beth Larkins, Caldwell County Collector/Treasurer, Caldwell County Courthouse (First Floor), 49 East Main Street, P.O. You will need to contact the collector in the county of your residence to request the statement of non-assessment and contact the assessor to have the property added to the assessment roll for the subsequent tax year. If this fails, here's the link: E.g. Dealer Licensing Office (573) 526-3669 2.

Front row left to right: Deputy Jill Prothero, Deputy Dixie McBee, Contact Information: Beth Larkins, Caldwell County Collector/Treasurer, Caldwell County Courthouse (First Floor), 49 East Main Street, P.O. You will need to contact the collector in the county of your residence to request the statement of non-assessment and contact the assessor to have the property added to the assessment roll for the subsequent tax year. If this fails, here's the link: E.g. Dealer Licensing Office (573) 526-3669 2. Accidents (573) 751-7195 If the amount bid is less than the amount of taxes owed plus fees and costs, the Trustee may reject the offer or take the bid to the County Council for approval. Fax: (660) 886-2644. Both VITA and TCE volunteers are certified by the Internal Revenue Service.

Legal Decisions and Orders Issued January 24, 2023. Jefferson County trustee properties for sale. This is not an exhaustive list.

Duplicate Property Tax Receipts Get a copy of your tax receipts. The assessor has discretion to waive the penalty or not depending upon his or her determination. The legal test for a charitable exemption is whether: (1) the property is dedicated unconditionally to the charitable activity; (2) the property is owned and operated on a not for profit basis; and. WebArkansas Act 280, pertaining to the Delinquent Property Taxes Bill, was on the November 6, 1934 ballot in Arkansas as a veto referendum.The ballot measure was defeated, thus repealing the targeted legislation.. Act 280, enacted by the Arkansas State Legislature, was a bill to reduce the penalty on tax delinquent real estate and to extend the time for

I strive to maintain an efficient & friendly office.

The list of properties subject to sale is published in the newspaper for three consecutive weeks prior to (573) 774-4717. The Missouri Department of Revenue is the agency authorized with issuing and renewing drivers licenses.

Properties are deeded by Trustees Deed.

Properties are deeded by Trustees Deed.