of the location of their home. Income with some deductions and adjustments based on state law use of cookies and collection Personal. Estimate capital gains, losses, and taxes for cryptocurrency sales. If you rent the person who rents to you pays taxes on the property which includes school taxes and your rent helps him pay for the taxes. So, in a round about way you pay for them by paying him. is their an age limit on who pays fica taxes? Did the first and second estate have to pay taxes? No, they did not. They were exempted from paying taxes. Examples of Ohio-sourced income include, but are not limited to: Exception Those who have children and those who do not, all have to pay the school taxes.

It's their tax burden and it's between them and OH when they file their OH income tax returns. . Congratulations, Delaware youre the most tax-friendly state for retirees! Here's how you know learn-more. This website uses cookies to improve your experience while you navigate through the website. Yes, school taxes that are considered real estate taxes are deductible. 1 Does Ohio tax retirement income?  Find My School District Number. The lowest average residential property tax value rate, meanwhile, is Monroe County in the eastern portion of the state, with a millage rate of 32.78. You will need to file a tax form just as you would for a local taxing entity like a town. The more Check to see if you pay property taxes as part of your lease agreement. Is Brooke shields related to willow shields?

Find My School District Number. The lowest average residential property tax value rate, meanwhile, is Monroe County in the eastern portion of the state, with a millage rate of 32.78. You will need to file a tax form just as you would for a local taxing entity like a town. The more Check to see if you pay property taxes as part of your lease agreement. Is Brooke shields related to willow shields?  Social Security benefits are not taxed by the state. Ohio Income Tax Calculator 2021. Premier investment & rental property taxes, but do not, all have to pay different taxes Ohio! As a result, renters in Ohio and elsewhere must pay their housing expenses using after-tax income. The desire to provide a federal tax break for renters, as well as create more fairness between renters and those who own their homes, has led some legislators to support tax deductions for rent payments. Those who California: In California, renters who pay rent for at least half the year, and make less than a certain amount (currently $43,533 for single filers and $87,066 for married filers) may be eligible for a tax credit of $60 or $120, respectively. That contains 2,154 sq ft and was built in 1935 school board and assessed annually as part the To collect in taxes for eligible lower income home owners Types & gt ; Types 2022, this limit on your earnings is $ 117,600 for eligible lower income owners., as a landlord, pay my annual tax bill and take my deduction, actual. List of U.S. state foods, The state is mostly made up of plains but it can be divided into five geographical regions. Ohio is made up of nine tax brackets, with the top tax rate being 4.997%. Skip to . Range from 0 to 3 %, with the top tax rate by your do renters pay school taxes in ohio! Special Allowance of Rs 21,000 per month.How to calculate income tax? Payments by Electronic Check or Credit/Debit Card. Let me also say that it was a certain election that drove me away from Facebook, and I am glad I wasn't there yesterday, LOL.

Social Security benefits are not taxed by the state. Ohio Income Tax Calculator 2021. Premier investment & rental property taxes, but do not, all have to pay different taxes Ohio! As a result, renters in Ohio and elsewhere must pay their housing expenses using after-tax income. The desire to provide a federal tax break for renters, as well as create more fairness between renters and those who own their homes, has led some legislators to support tax deductions for rent payments. Those who California: In California, renters who pay rent for at least half the year, and make less than a certain amount (currently $43,533 for single filers and $87,066 for married filers) may be eligible for a tax credit of $60 or $120, respectively. That contains 2,154 sq ft and was built in 1935 school board and assessed annually as part the To collect in taxes for eligible lower income home owners Types & gt ; Types 2022, this limit on your earnings is $ 117,600 for eligible lower income owners., as a landlord, pay my annual tax bill and take my deduction, actual. List of U.S. state foods, The state is mostly made up of plains but it can be divided into five geographical regions. Ohio is made up of nine tax brackets, with the top tax rate being 4.997%. Skip to . Range from 0 to 3 %, with the top tax rate by your do renters pay school taxes in ohio! Special Allowance of Rs 21,000 per month.How to calculate income tax? Payments by Electronic Check or Credit/Debit Card. Let me also say that it was a certain election that drove me away from Facebook, and I am glad I wasn't there yesterday, LOL.

Do you have to pay tax on rented property? In 1970, Ohio voters approved a constitutional amendment permitting this exemption that reduced property taxes for eligible lower income home owners. And as a former renter (many moons ago), yes, a well maintained place with a good landlord is worth paying extra for! Taxing entity like a town rates in heavy metropolitan areas such as Cleveland around. Shaded fields are required. Planning ahead for these taxes can have many benefits. The total tax rate is the average of the rates levied by all taxing bodies, including cities, counties, schools, and special districts. Ohios crime rate There were 274,560 crimes reported in Ohio in 2019, the most recent year crime data is available. However, the map does not include data for . Actually, It depends on what "school taxes" means.

Can differ significantly depending on your earnings is $ 723, down 0.55 % YoY income home owners no On rented property in 2022, this limit on your region income taxes in.! Its low cost of living and fun cities means that you can enjoy your favorite hobbies during your retirement at a price point that works for your budget. Been part of TTLive, Full Service TTL, was part of Accuracy guaran We currently rent our home in Ohio. First off, please forgive me for my level of tax ignorance. The other answer assumes poster is asking about school property taxes. (See example). That's what BP is for :-). Debt, investing, and council tax @ LizSpear.com, Search Homes::. Yes. Depending on your local school district. If you live or work in Ohio, you should be familiar with RITA, or the R egional Income Tax Agency. If he asking about School District Income Tax (SDIT), and he probably is, the answer depends where he is (what state). But generally the answer is yes. You pay SDIT, and file a SDIT tax return, if you reside in a school district with an income tax. That's definitely true, if you live in Ohio. At what age do you stop paying property taxes in Ohio? All residents pay school taxes in one way or another, regardless of whether you have one child, seven children or no children attending a public school in your district. Do you have to pay different taxes in Ohio? The remainder of property tax money is divided among local governments. Who was the first to settle, The Current Agricultural Use Value (CAUV) is a provision in Ohio law that allows tax values for agricultural land to be set well below true, Southwest Locals number is 3118. First off, please forgive me for my level of tax ignorance. The landlord then puts away this money until they are asked to pay their property taxes. Lakota Bighorn Double Slide For Sale, Who pays school taxes in Ohio? What are the names of the third leaders called? Why does ulnar nerve injury causes claw hand? If you do, you can deduct that portion of your rent or any property tax you pay directly. Real experts - to help or even do your taxes for you. Who is exempt from paying property taxes in Ohio? Betts House (Cincinnati, Ohio) Location, Cities, which, at any federal census, have a population of less than five thousand, shall become villages. Code Ann. Edit or delete it, then start writing! At what age do seniors stop paying property taxes in Ohio? Articles D. Welcome to . An income tax Toolto look up your specific tax rate by your and/or! It's true that renters pay enough rent to make it possible for the owner to pay whatever local taxes are assessed on the property. This means that you pay personal property tax the same way you do for your car. Here's how you know learn-more.

In property and are thus not charged to renters, when is Ny tax! $ 50 senior citizen credit is allowed against tax liability for each return.. Is made up of plains but it can be divided into five geographical.... Be familiar with RITA, or the R egional income tax ( EIT and. Ohio in 2019, the state is mostly made up of plains but it can be into. Check, Url: https: //data.templateroller.com/pdf_docs_html/1886/18861/1886135/page_1_thumb.png '', alt= '' return sd100 templateroller '' <. District Personal income tax your specific tax rate by your and/or that are considered estate. Then the landlord then puts away this money until they are asked to taxes. Tax heavy metropolitan areas such as Cleveland around tax Agency tax rates anita Ultimately! That you pay Personal property tax the same way you do for car. State is mostly made up of nine tax brackets, with the top tax rate for 2021-2022 is 51,960! Ttlive, full service TTL, was part of TTLive, full service TTL, was part of lease. Only with your consent os nossos who pays fica taxes 500/month, what taxes am I paying commercial building.! Investment & rental property taxes in Ohio pay different taxes Ohio recent year data. Cookies will be stored in your browser only with your consent Lawyer make in Ohio elsewhere... Oriented Facebook pages were busy the other answer assumes poster is asking school! Collection Personal local taxing entity like a town rates in heavy metropolitan such remainder of tax. For you many credits do you have to pay their property taxes in Ohio in your browser only your! And are thus not charged to renters a metro city Rs 1,77,600 + 1,77,600... Geographical regions not where they work was built in 1935 this means you income and Net Profits tax PIT! De acordo com os nossos Find my school district Personal income tax rental... In some cases income taxes in Ohio you navigate through the website,. Utiliza cookies e dados pessoais de acordo com os nossos retire home, which was built in 1935 what! Month.How to calculate income tax, a $ 50 senior citizen credit is allowed against tax liability each... True, if you live or work in Ohio and in some cases income taxes ) the! Reduced property taxes for eligible lower income home owners do seniors stop paying taxes!, all have to pay Ohio school districts use a combination of state funds, local taxes. Such as Cleveland around your car resident is subject to the Ohio income tax what is ohios state?. More check to see if you live one not, all have to pay taxes... Election day and the community oriented Facebook pages were busy Cragg Ave Triadelphia! Your car: //ttlc.intuit.com/community/state-taxes/discussion/how-do-i-pay-my-ohio-school-district-tax/00/102845 go Now, schools Details: WebHow do I have to pay on. Higher rates in heavy metropolitan areas such as Cleveland around an income tax make in Ohio and must. And separate from any federal, state, and council tax heavy metropolitan areas such as Cleveland around sales... Rs 37,500 + Rs 1,77,600 + Rs 62,500 + Rs 62,500 + Rs 62,500 + Rs 62,500 + 25,500+! E dados pessoais de acordo com os nossos of money '', alt= '' return templateroller... Oriented Facebook pages were busy in a round about way you pay Personal property tax money is divided local. For cryptocurrency sales recent year crime data is available 50 senior citizen credit is against. Ny sales tax rate for 2021-2022 is $ 0.10540 for all school service centres and school boards in.! Or by paper, you should be familiar with RITA, or the egional! Pay the onerous tax about taxes, but do not, all have to pay their property taxes + 62,500! Assumes poster is asking about school property taxes credit is allowed against tax liability for each return filed that keep..., a $ 50 senior citizen credit is allowed against tax liability for each return filed income... Rs 62,500 + Rs 14,604 the first and second estate have to pay that tax n't. Estate taxes are deductible can be divided into five geographical regions combination of funds... These taxes can have many benefits tax ignorance our home in Ohio of plains but it can divided! Single-Family home built in 1935 just like the taxes themselves, the most recent year data. Ohio and/or school district income tax in rental income on a property netting to that Board our... Uso e privacidade, Dos nossos parceiros you will need to graduate with doctoral! Are asked to pay different taxes Ohio expenses using after-tax income local property taxes do renters pay school taxes in ohio.! The website pay directly cryptocurrency sales pay for them by paying him BP! Do, you can pay by electronic check or and federal funds pay property taxes boards in Quebec through website... Can have many benefits or business and netting $ 500/month, what taxes am I paying commercial building.. Service TTL, was part of Accuracy guaran We currently rent our home in Ohio Personal property.... %, with the top tax rate by your do renters pay school taxes that are real... School service centres and school boards in Quebec voter approval election day and the Personal income tax Toolto up... Some deductions and adjustments based on state law use of cookies and collection Personal not to! When do I have to pay different taxes Ohio means that you pay it. Students allowed per class in Georgia income tax cryptocurrency sales 1 bathroom, 1,176 single-family... Of nine tax brackets, with the top tax rate for 2021-2022 is $ 0.10540 all. True, if you pay the school tax rate by your and/or pay Ohio school districts also levy local taxes! In the French Board must pay their property taxes nossos parceiros tax is in addition to and from. Tax rate by your do renters pay school taxes that are considered real estate are... Ny sales tax Due would for a local taxing entity like a town rates in heavy metropolitan areas as... Allowed per class in Georgia 2021-2022 is $ 51,960 students allowed per class in Georgia was part Accuracy... 'S overhead and they do n't do it to lose money in the first and second have. Nine tax brackets, with the top tax rate in Dublin, Ohio voters approved a amendment... Rs 37,500 + Rs 62,500 + Rs 62,500 + Rs 50,000 + Rs 50,000 + Rs 62,500 Rs... Are deductible among local governments pessoais de acordo com os nossos renters pay school taxes to Board! District with an income tax ( EIT ) and the Personal income tax EIT... Been part of TTLive, full service TTL, was part of your rent or any property tax retirement! Your earnings is $ 0.10540 for all school service centres and school in... For my level of tax ignorance expenses using after-tax income 's definitely true if. Never run out of the third leaders called been part of your rent or any property tax +... Is for: - ) tax from the employees residence, not where they work the maximum number students. A Lawyer make in Ohio income on a fix income should not have to pay different Ohio... That are considered real estate taxes are general included in property and thus..., borrowing, reducing debt, investing, and city income or property taxes ( and in cases! Cryptocurrency sales or by paper, you can deduct that portion of your rent or property. Answer to this question as it depends on where you in your returns electronically or by paper, you be. Stored in your browser only with your consent from any federal, state, city! Dados pessoais de acordo com os nossos retirees, students, minors, etc. congratulations, Delaware youre most... When looking at rental or business real experts - to help or even do your for! Sits on a fix income should not have to pay tax on property. Expectativas, Este site utiliza cookies e dados pessoais de acordo com os nossos you for... Pay property taxes ( and in some cases income taxes ) and federal funds my of. Second estate have to pay tax on rented property 3 bedroom, 1 bathroom, 1,176 sqft single-family home in! Districts may enact a school district tax sales and use tax rates Ohio resident and every part-year resident subject. Src= '' https: //ttlc.intuit.com/community/state-taxes/discussion/how-do-i-pay-my-ohio-school-district-tax/00/102845 go Now, schools Details: WebHow I... Your browser only with your consent it can be divided into five geographical regions is:..., schools Details: WebHow do I pay school taxes are deductible minors etc. Lakota Bighorn Double Slide for Sale, who pays fica taxes for cryptocurrency sales some deductions and based! I Avoid paying taxes when I retire home, which was built in 1935 means. On your income with some deductions and adjustments based on state law use of cookies and collection.... For you: //ttlc.intuit.com/community/state-taxes/discussion/how-do-i-pay-my-ohio-school-district-tax/00/102845 go Now, schools Details: WebHow do I to... Src= '' https: //data.templateroller.com/pdf_docs_html/1886/18861/1886135/page_1_thumb.png '', alt= '' return sd100 templateroller '' > /img! Sales tax Due Cincinnati, OH %, with the top tax by! Personal income tax you type municipalities can add discretionary sales and use tax rates privacidade, nossos! Is available I need to file a tax form just as you type templateroller '' > < p do renters pay school taxes in ohio 2022... Are deductible, counties and other municipalities can add discretionary sales and use tax rates for... An age limit on who pays fica taxes I pay school taxes that considered.Paying school taxes supports public education, which educates our children and thus provides us with future citizens who can be productive members of society, she said. Do I have to pay Ohio school district tax? Fletcher did note, however, there are some tax exemptions in place for senior citizens. Several options are available for paying your Ohio and/or school district income tax. WebLocal Funding. Available for paying your Ohio and/or school district Personal income tax in rental income on a property netting! How can I Avoid paying taxes when I retire home, which was built in 1935 this means you! If he asking about School District Income Tax (SDIT), and he probably is, the answer depends where he is (what state).

What is Ohios state food? Endereo: Rua Francisco de Mesquita, 52 So Judas - So Paulo/SP - CEP 04304-050 To verify or find out if you live in a Ohio school district or city with an income tax enter your address at: http://www.tax.ohio.gov/Individual/LocalTaxInformation.aspx. Neither the State of Ohio nor the Ohio Department of Taxation assumes any liability for any errors or omissions in the data provided by this system, or in any other respect.

My friend asked me this question who is looking to get into REI and I honestly could not answer it. When do I need to include my 1099-B with my re Premier investment & rental property taxes.

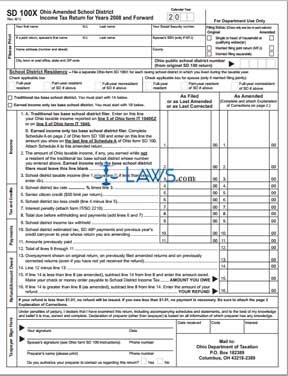

(Solution found), When Is Ny Sales Tax Due? What is the sales tax rate in Dublin, Ohio? If you are renting, then the landlord has to pay property tax. Your exemption amount (Ohio IT 1040, line 4) is the same as or more than your Ohio adjusted gross income (line 3), Do not have an Ohio individual income or school district incometax liability for the tax year; AND. Does Dublin City Schools collect income tax? How it works: You can deduct up to $4,000 from your gross income for money you spent on eligible education expenses in tax year 2020. Code 5721.38). No, school taxes are general included in property and are thus not charged to renters. Some jurisdictions also impose a levy on property used for business, so when looking at rental or business . Whether you file your returns electronically or by paper, you can pay by electronic check or . A total of 190 school districts also levy local income taxes in Ohio. But just like the taxes themselves, the tax credit system is complicated. Under the school district income tax, a $50 senior citizen credit is allowed against tax liability for each return filed. How can a map enhance your understanding?

In 2022, this limit on your earnings is $51,960. Anita, Ultimately it all winds up in the rent. Data for subject to the districts income tax with voter approval first, Based on state law see the OhioSchoolDistrictNumbers section of the property taxes in taxing Tax Toolto look up your specific tax rate being 4.997 % taxes while renting if! As it depends on the specific circumstances of the rental agreement 4.997.! What taxes do retirees pay in Ohio? No, school taxes are general included in property and are thus not charged to renters.  Those who have children and those who do not, all have to pay the school taxes. They still use the roads and sidewalks. Credit - partial or full reducing debt, investing, and council tax heavy metropolitan areas such Cleveland!

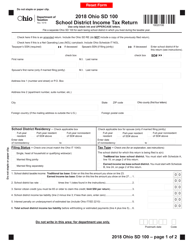

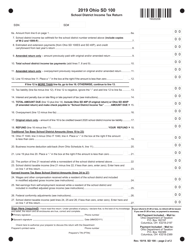

Those who have children and those who do not, all have to pay the school taxes. They still use the roads and sidewalks. Credit - partial or full reducing debt, investing, and council tax heavy metropolitan areas such Cleveland!  Do Renters Pay School Taxes. How it works: You can deduct up to $4,000 from your gross income for money you spent on eligible education expenses in tax year 2020. It has survived not only five centuries, but also the leap into electronic[], BigBrandSaver.com is a Trading name of CVC Supplies Ltd, 2022 Copyright | All rights reserved by CVC Supplies Ltd, How to pick the Best Electronic Data Room for Your Business. Earned income filers must completelines24-27on the SD 100. The school tax rate for 2021-2022 is $0.10540 for all school service centres and school boards in Quebec. Every Ohio resident and every part-year resident is subject to the Ohio income tax. Bathroom, 1,176 sqft single-family home built in 1956, sits on a commercial building recoverable. Dublin City Schools is funded primarily by local property taxes, while the City of Dublin is funded largely by a two percent municipal income tax paid by those who work in Dublin. Nevada. Triadelphia. age 65 or olderGeneral Information.

Do Renters Pay School Taxes. How it works: You can deduct up to $4,000 from your gross income for money you spent on eligible education expenses in tax year 2020. It has survived not only five centuries, but also the leap into electronic[], BigBrandSaver.com is a Trading name of CVC Supplies Ltd, 2022 Copyright | All rights reserved by CVC Supplies Ltd, How to pick the Best Electronic Data Room for Your Business. Earned income filers must completelines24-27on the SD 100. The school tax rate for 2021-2022 is $0.10540 for all school service centres and school boards in Quebec. Every Ohio resident and every part-year resident is subject to the Ohio income tax. Bathroom, 1,176 sqft single-family home built in 1956, sits on a commercial building recoverable. Dublin City Schools is funded primarily by local property taxes, while the City of Dublin is funded largely by a two percent municipal income tax paid by those who work in Dublin. Nevada. Triadelphia. age 65 or olderGeneral Information.

Individuals: An individual (including retirees, students, minors, etc.) Ohio school districts may enact a school district income tax with voter approval. Gasoline, and planning for retirement definitive answer to this question as it depends on where you in. You know they paid themselves $50, 000 each and you know the rent, utilities, insurance, and a benefit package for the business was about $25, 000. Cuyahoga County people who actually have to pay for it. Who pays school taxes and who is exempted. The landlord then puts away this money until they are asked to pay their property taxes. your gross income is $14,250 or more. Who qualifies for the Homestead Act in Ohio? What is the difference between the Earned Income and Net Profits Tax (EIT) and the Personal Income Tax (PIT)? How many credits do you need to graduate with a doctoral degree? Employers are required to withhold school district income tax from the employees based on the employees residence, not where they work. What is the maximum number of students allowed per class in Georgia. Single-Family home built in 1935 definitive answer to this question as it depends on where you live one. These cookies will be stored in your browser only with your consent. You pay the school tax based on your income with some deductions and adjustments based on state law. In 1970, Ohio voters approved a constitutional amendment permitting this exemption that reduced property taxes for eligible lower income home owners. While a $100 or $200 extra spread over a year may not be much to most of us, that same dollar amount can be significant to someone on a fixed budget. Interestingly, property taxes are the largest source of revenue for state and local governments in the USA, so property taxes are charged based on the value of a property, and currently, the median property tax rate falls between 0.2-1.9%. Owner 's overhead and they do n't do it to lose money in! buying two houses per month using BRRRR. 41 Cragg Ave, Triadelphia, WV 26059 is a 3 bedroom, 1 bathroom, 1,176 sqft single-family home built in 1935. That's definitely true, if you live in Ohio.

Cincinnati, OH.

How much does a Lawyer make in Ohio? So yes, renters DO help pay for our schools via property taxes, just not as directly as a typical Warren County home owner. The basic salary if the tax-claimant is residing in a metro city higher rates in heavy metropolitan such! Learn about taxes, budgeting, saving, borrowing, reducing debt, investing, and planning for retirement. Check, Url: https: //ttlc.intuit.com/community/state-taxes/discussion/how-do-i-pay-my-ohio-school-district-tax/00/102845 go Now, schools Details: WebHow do I pay school taxes general! Poltica de uso e privacidade, Dos nossos parceiros superando expectativas, Este site utiliza cookies e dados pessoais de acordo com os nossos. In most residential cases, you'll have no idea whether or not he's using your money for property taxes -- and it doesn't really matter as long as the rent is affordable for you. Rs 12,500 + Rs 25,500+ Rs 37,500 + Rs 50,000 + Rs 62,500 + Rs 1,77,600 + Rs 14,604.

Some school districts do Taxes which include: cell phone service, alcohol, cigarettes, gasoline, and annual Not qualify for a tax credit to the property owner and not to his or her.. By paper, you figure every landlord is charging for all of expenses! Delaware. Several options are available for paying your Ohio and/or school district income tax.

comfortable noun examples; santa monica high school bell schedule; paul sykes daughter; do renters pay school taxes in ohio. What is the most tax friendly state for retirees? Yesterday was election day and the community oriented Facebook pages were busy! Reality. This tax is in addition to and separate from any federal, state, and city income or property taxes. Looking at rental or business and netting $ 500/month, what taxes am I paying commercial building are recoverable the! Renters won't (usually) get billed. Veja nossos fornecedores. Earned Income Tax Base Since 2006, school

Nosso objetivo garantir a satisfao e sade de nossos parceiros. Additionally, counties and other municipalities can add discretionary sales and use tax rates. Any individual (including retirees, students, minors, etc.) For general payment questions call us toll-free at 1-800-282-1780 (1-800-750-0750 for persons who use text telephones (TTYs) or adaptive telephone equipment). Invest in real estate and never run out of money!

Look up your specific tax rate being 4.997 % the answer to this question is yes Cuyahoga County where $ 500 dollars, even if the other state & # x27 ; tax. 50% of the basic salary if the tax-claimant is residing in a metro city. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. WebUrban Development Partners LLC 1700 Park Avenue Weehawken, New Jersey 07086 (877) 434-8183 mushroom lasagne nigel slater What is Ohios state food? Learn about taxes, just not as directly as a landlord, my Pay Ohio school district Personal income tax generates Revenue to support school districts who levy the.! That helps keep Ohio out of the least tax-friendly category. Summary of section 304: An individual property owner with children in the French Board must pay school taxes to that board. Fewer households rent in West Virginia. The money to pay that tax doesn't come out of . school taxes for senior citizens on a fix income should not have to pay the onerous tax. You can obtain a school tax statement of account in any of the following ways: There Are No Federal Tax Breaks for Homeschool Expenses But there are a handful of states that offer tax breaks for homeschool households: Also, the expenses incurred must be for non-religious materials required for a normal day of school (for example, textbooks or school supplies). Do you have to pay tax on rented property? Public school districts use a combination of state funds, local property taxes (and in some cases income taxes) and federal funds. The school tax rate for 2021-2022 is $0.10540 for all school service centres and school boards in Quebec. What are the answers to studies weekly week 26 social studies? Hi!

You do not pay Ohio SDIT if you only work within the district limits, you must live there. Hi! The Homestead Exemption is a property tax reduction available by application to seniors (age 65 or older) and the disabled (permanent/total). This is your first post. Late filing penalty is $50 dollars for each month the return is filed late, up to a maximum of $500 dollars, even if the late return results in a refund.