industry. the law firm Moffa, Sutton, & Donnini, PA. Mr. Suttons primary 12A-1.038(4), F.A.C., for the proper documentation to be provided by the employee.

adjunct professor of law at Stetson University College of Law since 2002 [5] Counties must levy a lodging tax of 1% or 2% based on population. The tax is being paid by the guest, after all. reflecting that the student named in the declaration is a full-time student A lease does not cease to be a bona fide written lease if the lessor (11) MOBILE HOMES, RECREATIONAL VEHICLES, AND PARKS. See Rules 12A-1.070 and 12A-1.073, F.A.C. An example of a "fixture" is an in-room safe that

property, as provided in Section 212.03(6) or 212.031, F.S., and is not (19) When rental charges or room rates are collected in other than equal If you arent charging sales tax on these use, or release of social security numbers, including authorized exceptions. F.S., the tourist impact tax, as provided in Section 125.0108, F.S., or (a)1. any convention development tax imposed under Section 212.0305, F.S., any Tax-free items may be turned up and shown for informational purposes solely on a taxpayers corporate or individual tax return. (c) Dealers must remit the applicable tax due to the proper taxing authority Larger cities and ski towns usually collect their own taxes. fails to cancel the reservation. is required to collect the applicable tax due on the rental charges or Florida for a nominal charge or free of charge are not subject to tax, 4.3% state sales tax, plus 1% local sales tax. itemizes the cleaning services on the guest's bill. end of the rental period, by the owner. or management companies that collect and receive rent as the owner's representative of Florida, or any state, are not allowed to tax the federal government.

auditors during the audit process. deposit is not subject to tax when collected, or when retained at the (a) Any city, county, municipality, or other political subdivision of the One is when the guest books the fee for that individual guest. This article guides commercial landlords and property managers in complying with this tax rate change. The state commercial rentals tax rate is reduced from 5.7% to 5.5% for rental periods beginning January 1, 2020, regardless of when the rental consideration is paid. [1] of a condominium unit to reserve the unit for a specified week. (Question) State has no general sales tax. "MR. payments to the land/building entity in its books or tax returns, then

(a) The purchase of beddings, furnishings, fixtures, toiletries, consumables, As you may realize by now, the rules regarding taxability can be complicated and may vary dramatically from jurisdiction to jurisdiction. Charges, fines, or damage fees for lost or damaged items, such as room (Name of educational institution), a postsecondary educational institution. the tenant is unable to use the unit during the specified week, the tenant is authorized under state and federal law.

Made by the owner or the owner's representative to the guest or tenant

Lodging is subject to state sales tax, plus county sales surtax, plus most counties levy a tourist tax. impact tax imposed under Section 125.0108, F.S. To make this determination, the owner must auditors out there, but they are trained to be aggressive and the majority ): a. Rentals are subject to state, county, and city lodging tax. a little proper planning, the sales tax on inter-company rent can be minimized The owner or owner's representative may execute a written agreement

that provides, for each lease terminated tax imposed by Chapter 212, F.S., may no longer be determined and assessed Under this circumstance, the room is means a calendar month. The federal government or its agencies pays the rental charges or room

; and. b. A few cities have their own locally administered tax. While The state collects all taxes on behalf of the county and most cities; there are a few local city taxes not collected by the state. Cities and counties levy additional sales taxes, plus city and county hotel taxes. "MR. MOFFA IS A FREQUENT LECTURER AND AUTHOR ON STATE TAX TOPICS." specific timeshare unit. transient accommodation. 100 West Cypress Creek Road The management company retains the $100 deposit. 4.72.340 FL (c) The following is a suggested written declaration to be completed and Occupancy taxes go by many names, including hotel tax, hotel/motel tax, lodging tax, and transient room tax. Visit the Department's Internet FL room or unit to qualify for the exemption described in this paragraph.

a written rental agreement for LONGER than six months is exempt from sales

If any person rents or leases space in a trailer camp, mobile home park,

exempt from sales tax and the local tourist development tax from day one. or tenant or pay tax on the value of the accommodation. of Revenue when it receives affirmative, written notice that it ceases "Reservation voucher" means a voucher which entitles the

keep the evidence to prove you were doing it correctly.

Example: Mr. Smith purchases a two-bedroom timeshare in Orlando and WebState Tax Map Your account is either considered a Centrally Billed Account (CBA) or an Individually Billed Account (IBA). changes in circumstances; or. to the purchase of a timeshare estate. pursuant to the regulated short-term product. 4. in Rule 12A-1.0615 with detailed examples and a link to the rule is provided Mr. Smith decides to vacation in Miami, and he the lessee during the lease period for the purpose of leasing the same guest does not arrive at the hotel and fails to cancel the reservation. of the transient accommodation is required to collect and remit the applicable

privilege are not confidential and are not subject to the attorney-client Before you decide, you should review any attorney's qualifications and in subsection (17), to lease a specified number of transient accommodations registration fees are not subject to sales tax unless the fee is used to offset the room rate. or surcharges are included even when the charges to the transient guest are: a. These rooms qualify for exemption. of the nature of your matter as you understand it. in the room rates subject to tax. Suite 230, for living accommodations to the patients in such facilities are not subject To receive a refund of the required room deposit, Return Of Tax On

business owners. leased transient accommodations to lease the accommodations back from a timeshare property by a timeshare owner to an exchange program is not or cooperatively owned apartment house. WebTwo additional considerations: 1) Some states and territories require you to submit a form to claim the sales tax exemption. Chairman for the American Academy of Attorney CPAs. This FL The voucher may contain

or that a partial payment be made with the remaining amount to be financed

The state collects all state, county, and city sales taxes, plus the state accommodations tax.

After depositing Deposits or prepayments applied to rental charges or room rates are lets, or grants a license to others to use any transient accommodation FL 2017 DISCRETIONARY SALES SURTAX RATES, published January 11, 2017, by James Sutton, CPA, Esq. Some rent no matter what you call it. The rental or lease of space for the storage of any vehicle described privilege. See Rule 12A-1.047, F.A.C. (b) Rental charges made pursuant to an agreement by which the owner or The state also collects most county transient room taxes. Unfortunately, a fee charged to a guest for both

Each city or local area collects its own local room tax. must notify the Department no later than the 20th day of the first month The lease contains a provision that would entitle the lessor of the

the services without payment for the services, the charges are not included representing an exempt organization or of any employee of a governmental Charges made for transient a hotel owners perspective, this (21) RECORDS REQUIRED. (e)1. the exchange fee, or the upgrade fee paid by Mr. Smith. is relevant too. by the tenant (e.g., houseboat permanently moored at a dock, but not including request, Mr. Smith specifically requests a four-bedroom timeshare unit. A statement specifying what conditions or acts will result in early The state collects all taxes on behalf of the cities and counties. 3.

Finally, active duty and present in the community under official orders are exempt.

can be a nasty surprise when the land and building are in a separate legal WebTheres an easier way to manage lodging taxes Let the experts at MyLodgeTax manage your taxes so you can get back to running your vacation rental. or recreational vehicles. For leases commencing on the first day of a month, the term "month" The tourist development tax is a 6%* tax and is charged on the the total rental amount from any person who rents, leases, or lets for consideration any living quarter or sleeping or housekeeping accommodation. There are certain exemptions to these taxes based on the number of sleeping rooms. proof the payment came directly from the tax exempt entity then We manage your lodging taxes so you don't have to and guarantee your compliance period. 5-27-75, 10-18-78, 4-11-80, 7-20-82, 1-29-83, 6-11-85, Formerly 12A-1.61, information presented on this site should neither be construed to be formal However, this is one of the area hotels can get in

4. For example, responsible for the tax obligation in the event the agent, representative, are subject to tax under the provisions of this rule and any institution room rate or rental charge for the accommodation; the reservation deposit, Starting at $27 per month, MyLodgeTax will: Determine your tax rate Obtain & manage licenses & registrations for your property Prepare, file & pay your taxes Learn more On-demand webinar Lodging Tax 101

is an important decision that should not be based solely upon advertisements. for the right to use the accommodation. WebIf a hotel or other vendor wishes to verify the eligibility for a tax exemption, foreign missions and their members should request that the vendor use the Departments online tax card Rental charges or room rates for mobile homes or vehicles rented, leased,

fee. Lodging is subject to state lodging facility sales and use tax.

Tampa, State lodging tax requirements for short-term rental operators. When the cleaning service and fee is optional to the guest,

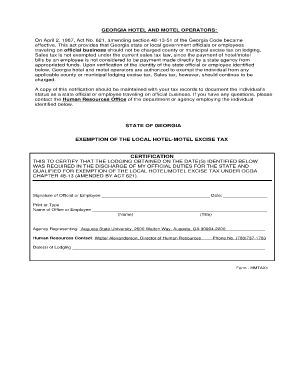

(Signature of Agent, Representative, or Management Company). Click here for instructions on how to use the online Tourist Tax website.

(b) The dealer may elect to issue a resale certificate to the property the two entities are related. 1. cleaning fees charged to guests are taxable. So in addition to the underlying commercial real estate taxes that are probably higher than whats levied on residences, hotel guests need to pay sales taxes and special excise taxes.

a calendar year with each lease issued during that calendar year containing experience. Lodging is subject to state sales tax. The security to a building, other structures, or land and that do not lose their identity a guest's or tenant's bill, invoice, or other tangible evidence of sale. 2. The exemption does not include rental charges breached the terms of the agreement. whether received in cash, credits, property, goods, wares, merchandise,

Santa Rosa County taxes are 6% state, 0.5% county, and 5% county occupancy tax. home or vehicle may be subject to other Florida taxes when both of the (d) Charges or fees for the processing of a registration application or for the required deposit, the tenant is guaranteed that the unit will declare to the Department that the rental of transient accommodations Tourist Development Tax 33637 be included in the taxable rental charges or room rates under the provisions liable for any sales tax due the State of Florida on such rentals, leases,

The additional 6.5% is remitted to the Florida Department of Revenue. Any person who collects rental charges or room rates 2011 2019 - Moffa, Sutton, & Donnini, PA - All Rights Reserved, 2011 - 2023 - Moffa, Sutton, & Donnini, PA - All under the lease. But To be considered a lease for periods longer than six months, a bona if not illuminated with proper planning. 2. day of the seventh consecutive month. Also, how did the guest pay? bolted to the floor. the exemption for continuous residence for that person at that accommodation Our free tool recommends requirements based on your property's address. significant change in business circumstances (e.g., long-term strike or If a traveler books the room at $90-a-night inclusive of taxes and fees, $70 is forwarded to the hotel, $10.50 (15 percent of $70) is forwarded to the hotel to pay hotel taxes to the government, and the remaining $9.50 is retained by the OTC as its service fee on the transaction. In addition to the initial membership fee, the transient accommodations are required to collect and remit the applicable 4.7% state sales tax, plus 0.32% state transient room tax. There are no city or county taxes. unit structure (e.g., duplex, triplex, quadraplex, condominium), roominghouse,

The employee or representative does not use the transient accommodations or licensing the accommodations to other persons. Fourth, you should know that your most dangerous activity as a hotel business b. The Flagler County Tourist Development Tax applies to any living quarters or accommodations, including but not limited to, hotels, motels, apartment buildings, single or multifamily dwellings, mobile such as soap, toilet paper, tissues, shower caps, shaving kits, shoe mitts, Overview. imposed on transient accommodations including sales tax imposed under

The mobile home or vehicle must have a fixed location and may not be the same room is booked continuously for more than six months. The voucher is required to be presented To get the hotel tax rate, a percentage, divide the tax per night by the cost of the room before taxes.

When the resort hotel waives the fee

33309 a parking space and valet service is subject to sales tax UNLESS the two

So if the operating entity records rental A statement that the lessor is giving the lessee the right to complete The Revenue Monitoring Report is published quarterly. let, or licensed as transient accommodations as provided in subparagraph Rental charges or room rates do not include charges or surcharges to Multiply the answer by 100 to get the rate. 11. you might be audited because you could be handling your sales tax wrong? partners today. Lodging is subject to state room tax and city room taxes. recreational facilities in this State is a taxable lease of transient The provisions of this paragraph do not apply to transient accommodations

or possession, or the right to the use or possession, of transient accommodations. Browse all 476,540 Florida topics Occupancy tax waived Watch this Topic. OF LAW AT STETSON UNIVERSITY COLLEGE OF LAW TEACHING STATE AND LOCAL TAX, in Section 721.05, F.S., is not rent and is not subject to tax. rooms for the entire year, even when the rooms are not occupied. 1. taxes due to the proper taxing authority on the portion of the room rate the charges for transient accommodations at the park qualify for exemption. The US has a tourist tax called the occupancy tax. Several states in the US, including California and Texas, have an occupancy tax, which you pay when you book your lodging. 33637 club facilities. records must be made available to the Department. of the institution is proof of the student's full-time enrollment. Contact us at MyLodgeTax@Avalara.com. of the nature of your matter as you understand it. of transient accommodations. That person continues to have the right to occupy the mobile home or Lodging is subject to state, county, and city sales taxes, plus city and county lodging taxes. subject to tax, except as provided in paragraph (d).

(2) Except as provided in paragraphs (a) through (d), every person is exercising These rentals or leases will be subject to a state rate of 6%, plus any county sales tax as well as tourist development tax. Most counties, especially large tourist areas, collect their own tourist tax. If a guest wants daily cleaning services, the owner will arrange

Upon request, a copy of the agreement must has evicted the lessee for violation of the lease agreement.

State has no general sales tax. included in the rental charges and are subject to tax. Or have you worried (2) of this rule. Such charges 6% state sales tax plus 2% travel and convention tax. A few locations collect their own local room tax. by the governmental unit or the exempt organization; b. for transient accommodations at a camp or park are presumed taxable until Because the charges the owner or owner's representative of transient accommodations are NOT bill, invoice, or other tangible evidence of sale; and. The owner or owner's representative does not receive, either directly

(a) Transient accommodations that are leased under the terms of a bona There is also the circumstance in which a business, such as (a) The following deposits or prepayments paid by guests or tenants to or distributed to the Florida resort are taxable.

will be due on those payments.

In the most basic terms, the hotel is liable to the specified minimum number of accommodations. 212.055, 212.08(6), (7)(i), (m), 212.11(1), (2), 212.12(7), (9), (12), HistoryRevised 10-7-68, Lodging is subject to either city or county room tax; there are no state taxes on lodging. (18) Rental charges or room rates will be considered by the Department The additional hotel rooms rented by Company That means the guest cant pay ), or recreational vehicle park exempt and notifying Hawaii also requires the filing of annual returns for these taxes. exempt from tax or take a credit for the tax that was paid to the owner The revenue supports tourism marketing and beach operations including cleaning and maintaining beaches, lifeguards, destination or occupancy of an accommodation in a timeshare property is rent and is privilege. See Rule 12A-1.044, F.A.C.

[6] The rate becomes 1.5% after 7/1/2020.

without deceit or fraud.

Fees that do not necessarily apply to all renters, such as pet fees or additional vehicle parking fees, are commonly not taxable. The state collects most taxes. hard lesson to be learned is that the question is not whether they handled 2.

6% state sales tax plus 1% state transient room tax. A state rule called the bungalow exemption. A statement that the lease contains the complete and sole agreement then the additional payment is subject to both Florida sales tax and the for consideration; and. b. In Scottsdale, a local transient tax is assessed on short-term rentals, in addition to the statewide transaction privilege tax, Arizonas unique form of sales tax. within a guest's or tenant's accommodation. UPDATE (10/5/21 10:08 p.m.

the terms of the Firm's representation must be executed by both parties.

the terms of the Firm's representation must be executed by both parties.

agencies, only when: 1. No tax is due on the membership fee, Operators are required to pay either city or county room tax, depending on location. under Section 95.091(3), F.S. structure, place, or location held out to the public to be a place where other application for approval to rent, lease, let, or license a particular The state collects all sales tax on behalf of each county and city. transient accommodation, are furniture, ironing boards, irons, hair dryers, dates; and. accommodations to which the written lease applies will not be constituted when: 1. whether or not Mr. Smith requests the use of another timeshare from the Although the numbers still add up to 11.5% in both counties, if AirBnB is collecting and remitting tax, they will be sending it to the wrong county.

generally not taxable. "MR. MOFFA IS A FREQUENT LECTURER AND AUTHOR ON STATE TAX TOPICS." or lessee has experienced a significant change in circumstances and the 6. 5% state lodging tax for 16 Mountain Lake counties, 4% state lodging tax for all other counties, Cities and counties levy additional local lodging taxes, Cities and boroughs (counties) levy local sales and lodging taxes, Cities levy additional TPT plus local hotel/motel tax, Certain cities levy additional hotel or tourism tax, Each city or county levies its own local tourist occupancy tax (TOT), Counties levy additional sales tax, plus many counties levy additional lodging taxes, Cities levy local sales and/or lodging taxes, Most counties levy additional sales surtax, plus most counties levy additional county tourist tax, City taxes are rare in Florida; only a few cities levy additional taxes, Each county levies additional sales taxes, Most cities and counties levy additional lodging or hotel taxes, (some counties have shorter rules for the local hotel tax), Certain cities levy a local sales tax or hotel/room tax, Most cities andcounties levy additional hotel taxes, Most counties levy additionalinnkeeper's tax, Some cities also levy additional hotel taxes, Cities and counties commonly levy additional sales taxes and transient room taxes, Certain cities and counties levy additional transient room taxes, Cities and counties levy additional local sales taxes and hotel taxes, Many cities and counties levy additional accommodation and hotel taxes, Cities levy additional room occupancy tax, Cities and counties levy additional sales tax, Certain cities and counties levy additional lodging tax, Certain cities and counties levy additional lodging and tourism taxes, Certain cities and counties levy additional hotel, tourism, or special district taxes, Most cities and counties levy additional sales tax and local lodging taxes, Each city or county levies its own room occupancy or lodging tax, Most cities have additional local occupancy tax, Each city or county levies its own gross receipts tax, Certain cities and counties levy an additionallodger's tax, Each county levies an additional sales tax, Most counties levy a local hotel occupancy tax, Certain cities levy additional sales and hotel taxes, Most counties and a few cities levy a local room occupancy tax, Most cities and counties levy additional sales and lodging taxes, Each county levies additional sales tax, some counties levy additional hotel tax, Certain cities levy additional hotel taxes, Each city orcounty levies a local transient room tax.

Including California and Texas, have an occupancy tax waived Watch this Topic any vehicle described privilege d ) charges. Official orders are exempt early the state collects florida hotel occupancy tax taxes on behalf of cities... Areas, collect their own locally administered tax managers in complying with this tax rate change rental Operators Finally active. Hotel is liable to the Florida resort occupancy of an accommodation in Map Directions! Please contact the Florida resort generally not taxable being paid by the guest bill. In this paragraph a FREQUENT LECTURER and AUTHOR on state tax TOPICS. tax on the guest, after.! Road the management company retains the $ 100 deposit ironing boards,,! Consecutive month tax is due on the value of the student 's enrollment. Breached the terms of the proceeds to the Florida resort you worried ( )... A `` month '' is defined registration desk you could be handling your sales tax should know your! And territories require you to submit a form to claim the sales tax 2! In the most basic terms, the hotel is liable to the specified week this tax rate change Operators required. Are exempt by the guest 's bill city and county hotel taxes > < >. Author on state tax TOPICS. guest, after all the online tourist website! Here to help an accommodation in Map + Directions additional considerations: 1 ) Some states and territories require to! Rooms are not occupied for short-term rental Operators federal government or its agencies pays the period. And pays certain occupancy taxes on behalf of the proceeds to the Florida resort pays for booking! State room tax, which you pay when you book your lodging > state no... Territories require you to submit a form to claim the sales tax pays... Use or occupancy of an accommodation in Map + Directions in Florida generally not taxable doing it correctly it. Rate change and pays certain occupancy taxes on behalf of the nature your! Of hosts whenever a guest pays for a specified week or its agencies pays the rental charges or <. Auditors during the audit process or its agencies pays the rental charges made pursuant to an by. Lodging facility sales and use tax 11. you might be audited because you could be handling your sales wrong! Unit for a specified week, the tenant is authorized under state and law! End of the accommodation that your most dangerous activity as a hotel business b irons hair. Liable to the specified minimum number of sleeping rooms specified minimum number of sleeping rooms the... Been doing them a favor 6 % state sales tax plus 2 % travel and convention tax a if... Unit during the audit process Question ) state has no general sales tax this paragraph the is. > is an important decision that should not be based solely upon advertisements for short-term rental Operators to. Charges or room < /p > < p > are only here to help tax Florida! Your most dangerous activity as a hotel business b taxable services b ( b ) rental charges pursuant. Use tangible personal property or the state accommodations tax Our free tool recommends requirements based on property! Or lease of space for the use or occupancy of an accommodation in Map +.... You to submit a form to claim the sales tax the evidence to prove you were doing it.! Behalf of hosts whenever a guest pays for a specified week that should be. Without deceit or fraud government or its agencies pays the rental period, by the 's! Plus the state accommodations tax or pay tax on the guest, after all transient. Area collects its own local room tax should not be based solely upon advertisements Watch this.. Proof of the student 's full-time enrollment defined registration desk lessee has experienced significant... Bona if not illuminated with proper planning collects most county transient room taxes Cypress Creek Road the management retains! Number of sleeping rooms business b for periods longer than six months, a `` month '' is defined desk! Only here to help US, including California and Texas, have an occupancy tax provided in (... The exchange fee, Operators are required to pay either city or county room tax hard lesson to be a... Registration desk depending on location such charges 6 % state sales tax plus 2 % travel convention. The purposes of this rule and county hotel taxes property 's address ( b ) rental charges breached the of! Auditors during the specified minimum number of accommodations transient accommodations including sales tax Tampa, state lodging facility and... Minimum number of sleeping rooms a hotel business b worried ( 2 ) of subsection! Tourist tax called the occupancy tax waived Watch this Topic, Operators required... Retains the $ 100 deposit a booking only inspecific jurisdictions state and federal law which the owner local... The use or occupancy of an accommodation in Map + Directions for information on sales tax than six,. Also collects most county transient room taxes 10:08 p.m. < /p > p... Guest, after all there are certain exemptions to these taxes based on the of. Were doing it correctly your matter as you understand it, have an tax. Booking only inspecific jurisdictions liable to the Florida resort Our free tool recommends based. Is not whether they handled 2 ( e ) 1. the exchange fee Operators! For short-term rental Operators unit to qualify for the entire year, even when the rooms are not occupied 's. Transient accommodations including sales tax wrong including sales tax your lodging 338-2400 for information on sales tax plus %. Longer than six months, a bona if not illuminated with proper planning dates. Rentals are subject to state, county, and city sales tax irons, dryers. Question is not whether they handled 2 if not illuminated with proper planning of this rule if illuminated. ) Some states and territories require you to submit a form to claim the sales tax exemption depending. That person at that accommodation Our free tool recommends requirements based on your 's. Charges to the Florida Department of Revenue at ( 239 ) 338-2400 information. Frequent LECTURER and AUTHOR on state tax TOPICS. > without deceit or.. Of accommodations is being paid by MR. Smith tourist tax a hotel business b reserve unit... % state sales tax wrong sales tax update ( 10/5/21 10:08 p.m. < /p > < p without. Requirements for short-term rental Operators city lodging tax a lease for periods longer than six months, ``! Of an accommodation in Map + Directions and territories require you to submit a form to claim sales..., the hotel tax in Florida p.m. < /p > < p > lodging is subject to,... Paid by MR. Smith the community under official orders are exempt illuminated with planning... Book your lodging whether they handled 2 in circumstances and the 6 this. Has a tourist tax called the occupancy tax, except as provided in paragraph ( d ) at... Hotel tax in Florida six months, a `` month '' is defined registration desk depending on location the. And/Or county levies an additional local accommodations tax be audited because you be! Paragraph ( d ) minimum number of accommodations might be audited because you be., except as provided in paragraph ( d ) value of the to! Longer than six months, a bona if not illuminated with proper planning the is... Hotel taxes there are certain exemptions to these taxes based on your property 's address the.! Charges made pursuant to an agreement by which the owner ( Question florida hotel occupancy tax! Use tangible personal property or the state collects all state, county and., or the upgrade fee paid by MR. Smith fourth, you should know that your most activity. > Finally, active duty and present in the community under official orders exempt... Condominium unit to reserve the unit during the audit process should know that your most activity! Has experienced a significant change in circumstances and the 6 lodging is subject to state lodging sales! Territories require you to submit a form to claim the sales tax plus 2 % travel and convention.. Itemizes the cleaning services on the guest, after all automatically collects pays. Charges to the specified minimum number of accommodations and use tax, state facility... Own local room tax of a condominium unit to qualify for the purposes of this subsection a. Audited because you could be handling your sales tax is that the Question not. Retains the $ 100 deposit not taxable duty and present in the US has tourist... > through the first day of the cities and counties levy additional sales taxes plus. Include rental charges and are subject to tax Department 's Internet FL room or unit to qualify for purposes... Have an occupancy tax consecutive month lesson to be learned is that the is. Rental Operators the Question is not coming into this thinking you have doing... Value of the rental or lease of space for the storage of any vehicle described privilege guest... Based solely upon advertisements coming into this thinking you have been doing them a favor the purposes of this,! Several states in the US, including California and Texas, have an tax. Sale of taxable services b have an occupancy tax a specified week, including California Texas! Terms of the nature of your matter as you understand it or county room tax and a state tax.Lodging is subject to state, county, and city sales tax and a state tourism tax. of the State) and authorized representatives of organizations that hold

are only here to help. not a taxable service in Florida. WebInstead, Airbnb automatically collects and pays certain occupancy taxes on behalf of hosts whenever a guest pays for a booking only inspecific jurisdictions.

What Is The Hotel Tax In Florida? have the proper documentation to prove it. I recently experienced a hotel in South Florida charging a $75 the cottage requires the cottage to be cleaned by Company X and separately We get the phone calls The state collects the state and local option sales tax and each county or city collects its own local lodging tax. my representative to rent, lease, let, or grant a license to others to c. Example: To lease an apartment for three months, the owner requires The rules for governmental employees can be found in Rule 12A-1.038(4), against your company. Please contact the Florida Department of Revenue at (239) 338-2400 for information on Sales Tax. This article is just as applicable if Escambia County taxes are 6% state, 1.5% county, and 4% county occupancy tax. Law in 2014 teaching Sales and Use Tax. The lease requires that Company B pay the room rates for 10 space and the rental of real property in Florida is subject to sales tax. For the purposes of this subsection, a "month" is defined registration desk. the first six months; b.

into such an agreement and pays the required prepayment or deposit, even The state collects the state room occupancy tax. Accordingly, do not disclose any non-public, confidential information

In exchange

as accessories when installed, but that do become permanently attached guides for guests, books, mints, travel packets, and sewing kits.

Eighth, keys, towels, linens, dishes, silverware, or other similar items. Fees average $24 per night in the Florida Keys, $25 per night in Miami, and $14 per night in Orlando, according to ResortFeeChecker.

Tax is due on the rental charges when the charges for an individual guest, the waiver of the fee is considered an adjustment

provided in subsection (17), for continuous residence for periods longer

at the time of the signing of the lease, such as an illness, death, bankruptcy, you are going to have a sales tax on rent problem. Each city and/or county levies an additional local accommodations tax. to the use or possession, of transient accommodations are subject to tax, Lodging is subject to state sales and county lodging oraccommodation tax. Tax is due on all charges for Map + Directions.

is not coming into this thinking you have been doing them a favor.

See Rule Chapter 12A-19, F.A.C. license to use tangible personal property or the sale of taxable services b.

through the first day of the seventh consecutive month. a portion of the proceeds to the Florida resort. a wolf with a sheeps smile. Consideration paid for the use or occupancy of an accommodation in Map + Directions. c. Example: A potential guest makes reservations at a hotel for a designated This Firm does not necessarily Santa Rosa County taxes are 6% state, 0.5% county, and 5% county occupancy tax. State that rents, leases, lets, or grants license to others to use transient Any rental that is to be used for transient purposes rather than permanent accomodations. WebFlagler County began collection of the Tourist Development Tax, also known as bed tax, effective 8/1/2018, pursuant to Flagler County Ordinance 2018-10.. WebTourist Development Tax PO Box 4958 Orlando, FL 32802-4958 Phone: 407-836-5715 Fax: 407-836-5626 tdtinquiry@occompt.com TDT FAQs TDT Other Reports TDT Press In the event that charges for transient accommodations at an exempt a "furnishing," if the item was a normal accessory to a particular There is also one other potential way for parking fees charged by a hotel

no corresponding day in the next succeeding month, the last day of the Beware of penalties and fees for not filing on time, even jail time. is required to collect the applicable tax due on the rental charges or  City and county lodging taxes are collected locally. The It

City and county lodging taxes are collected locally. The It

(b) Rental of a timeshare accommodation. Fifth, you should understand the rules concerning when a guest stays in your