A gingivitis (med. You can improve your MPG with our eco-driving

Amounts reimbursed above the limit are taxed as income; amounts below the limit run the risk of bringing employee pay under the federal minimum wage.

Use MileIQ to automatically keep a full, IRS friendly mileage log. Late-Breaking News

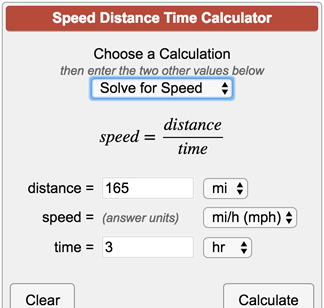

Under the Tax Cuts and Jobs Act (TCJA), taxpayers can no longer claim a miscellaneous itemized deduction for unreimbursed employee travel expenses. Find a street address to add to your trip. Driving a smaller car makes a great difference the fuel cost is about half for a small sedan than for a very large SUV. Drop the line where you want it to go and it will create a new waypoint in your trip. The deductible amount is the standard mileage rate multiplied by the number of miles you traveled. This website is administered by Oak Ridge National Laboratory for the U.S. DOE and the U.S. EPA. Every business trip registers in a single dashboard - giving you full visibility into your company spending and neat documentation come tax time. What is the maximum amount of mileage you can be reimbursed for? Time, distance and fuel costs above are calculated between each stop.

Read on to learn the benefits and potential costs of obtaining insurance for your small business.

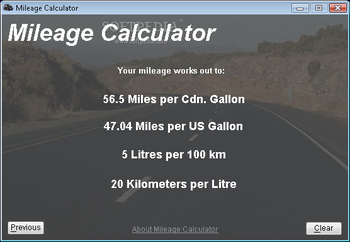

A lock ( When using the actual cost method, MPG will affect the amount spent.

It shows up, for example, in blood when spitting out after brushing your teeth and The DTOD websites distance calculation and mapping functions provide road segment and cumulative distances over the network of truck-usable highways and roads in North America, South America, Europe, Africa, Oceania, and Asia. This is up to your discretion. your first car, Car Heres the main way to know if you qualify. car insurance, Contents ", Internal Revenue Service.

Any time an employee or contractor uses their personal vehicle for business use, it qualifies for mileage reimbursement.

Mileage reimbursement is a method of keeping track of T&E related to using a personal vehicle for business purposes. In later years you can choose between the standard mileage rate and actual expenses. fuel - advice, Preventing "Notice 2022-03: 2022 Standard Mileage Rates.". Make sure the tires are inflated to the right levels. Unless you're hauling heavy loads on a routine basis, the extra cost of a bigger engine results in more money spent on gasoline. an AA driving instructor, Driving Travel Information Driven 4000 plus kms in just 20 days. and environment, Safety Program Timeline Some of the practical ways to reduce fuel costs are listed below. Generally, subsidized products or services can be sold at lower prices. For 2 to 9 axle trucks across US, Canada and Mexico toll roads, turnpikes, expressways, express lanes, highways, bridges, tunnels and carreteras.

Mileage reimbursement is a method of keeping track of T&E related to using a personal vehicle for business purposes. In later years you can choose between the standard mileage rate and actual expenses. fuel - advice, Preventing "Notice 2022-03: 2022 Standard Mileage Rates.". Make sure the tires are inflated to the right levels. Unless you're hauling heavy loads on a routine basis, the extra cost of a bigger engine results in more money spent on gasoline. an AA driving instructor, Driving Travel Information Driven 4000 plus kms in just 20 days. and environment, Safety Program Timeline Some of the practical ways to reduce fuel costs are listed below. Generally, subsidized products or services can be sold at lower prices. For 2 to 9 axle trucks across US, Canada and Mexico toll roads, turnpikes, expressways, express lanes, highways, bridges, tunnels and carreteras. To calculate a mileage reimbursement, multiply the number of miles driven by the mileage reimbursement rate (typically standard mileage rate set by the IRS). Mileage reimbursement requires tracking to be tax deductible. This is typically based on the vehicle's Fair Market Value (FMV).

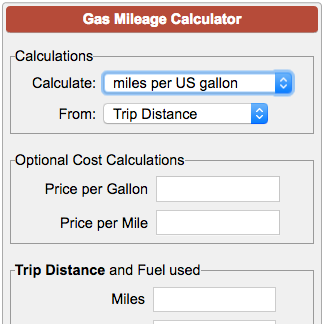

Please try again later. It also could include parking fees or other costs associated with commuting. 24/7 Itinerary; Driving Directions; Add a Stop. Click the button below to get started! Mileage calculations are You can also deduct interest paid on a car loan, parking fees, and tolls for business trips, but you can't deduct parking ticket fines or the cost of parking your car at your designated place of work. fuel assistance, Cover In order to use the standard mileage rate, taxpayers must use it the first year their vehicle is available for business use. Your monthly fuel cost for Skoda Slavia 2022 is: Why aren't these being offered in more cars? However, one possible eligibility category is that you may be eligible if you use your car primarily in your work-related travel. This calculator can estimate fuel cost according to the distance of a trip, the fuel efficiency of the car, and the price of gas using various units. Mileage Reimbursement Calculator. There's no limit to the amount of mileage you can claim on your taxes. Secure .gov websites use HTTPS Manage multiple trips with ease! Walking or biking does not consume fuel, and as such does not accumulate fuel cost. This eliminates the risk of underor overreimbursing employees, as the numbers reflect the reality. Ramp for Travel makes it simple to order both physical and virtual cards for your team, advancing the finance automation of your organization. Please enter your e-mail address and we will help you reset your password. That's roughly 3254 kilometers.

Please try again later. It also could include parking fees or other costs associated with commuting. 24/7 Itinerary; Driving Directions; Add a Stop. Click the button below to get started! Mileage calculations are You can also deduct interest paid on a car loan, parking fees, and tolls for business trips, but you can't deduct parking ticket fines or the cost of parking your car at your designated place of work. fuel assistance, Cover In order to use the standard mileage rate, taxpayers must use it the first year their vehicle is available for business use. Your monthly fuel cost for Skoda Slavia 2022 is: Why aren't these being offered in more cars? However, one possible eligibility category is that you may be eligible if you use your car primarily in your work-related travel. This calculator can estimate fuel cost according to the distance of a trip, the fuel efficiency of the car, and the price of gas using various units. Mileage Reimbursement Calculator. There's no limit to the amount of mileage you can claim on your taxes. Secure .gov websites use HTTPS Manage multiple trips with ease! Walking or biking does not consume fuel, and as such does not accumulate fuel cost. This eliminates the risk of underor overreimbursing employees, as the numbers reflect the reality. Ramp for Travel makes it simple to order both physical and virtual cards for your team, advancing the finance automation of your organization. Please enter your e-mail address and we will help you reset your password. That's roughly 3254 kilometers. In some places, public transport is free. Due to the communal nature of ride sharing, the fuel costs of operating public transport are generally less than the fuel costs associated with each individual operating their own vehicle. Gingivitis) is far more common than you think. Pros For 2023, the standard mileage rates are: Calculating a mileage tax deduction can be daunting because it varies so much depending on a person's particular tax situation. The new rate kicked in on July 1st. Thank you! You can also deduct actual expenses, such as gas and oil, or other fees related to your travel that aren't reimbursed by your employer. average off-peak driving conditions. keys, Wrong

Web2022 irs mileage rate calculator. 17 cents per mile driven for medical or moving purposes, down from 20 cents in 2019. ). Here are the 2023 mileage reimbursement rates: Business use: 65.5 cents per mile. Learn about how to claim that and why the SUV may be right for your business. This notice also provides the amount You can also turn this off to see things to do anywhere on the visible map, regardless of your route. Vehicles produce about half of the greenhouse gases from a typical U.S. household. driving advice, AA Multiple Technical issues with infotainment.

Driving from one business meeting or conference to another. The new mileage rates will be: 62.5 cents per mile for business purposes, up 4 cents from the first half of the year 22 cents per mile for medical and moving purposes, up 4 cents from the first half of 2022 14 cents per mile for charity We help you calculate fuel expenses which you will incur by using Skoda Slavia 2022. insurance calculator, Central

Not comfortable. against uninsured drivers, Motorcycle I have driven almost 9000 km. For PCS travel, the Mileage Allowance in Lieu of Transportation (MALT) rate became $0.22 per mile in July 2022, up from $0.18 per mile. You can also write off odd jobs and side-gigs like babysitting, pet car, and lawn services. The ARAI mileage of Skoda Slavia 2022 is 18-19.4 kmpl, Assuming fuel price Rs. A temporary work location is a short-term job that lasts less than one year.

Not comfortable. against uninsured drivers, Motorcycle I have driven almost 9000 km. For PCS travel, the Mileage Allowance in Lieu of Transportation (MALT) rate became $0.22 per mile in July 2022, up from $0.18 per mile. You can also write off odd jobs and side-gigs like babysitting, pet car, and lawn services. The ARAI mileage of Skoda Slavia 2022 is 18-19.4 kmpl, Assuming fuel price Rs. A temporary work location is a short-term job that lasts less than one year.  Hurricanes or earthquakes can damage oil refineries, abruptly halting production, which can also eventually increase fuel costs. The cost of an IFTA sticker depends upon the issuing state but is usually around $10. Your tires also lose about 1 PSI per month, and when the tires are cold (e.g., in the winter), their pressure will decrease due to the thermal contraction of the air. You can check your fuel cost for Skoda Slavia 2022, Extracting the best fuel economy involves practicing various techniques like judiciously modulating the throttle, limiting excessive gearshifts and turning-off the engine while you are idling in traffic. We noticed youre running an older version of Internet Explorer. Airplane nautical miles (NMs) should be converted into statute miles (SMs) or regular miles when submitting a voucher using the formula (1 NM equals 1.15077945 SMs). This will create a duplicate of your trip: "". One big hurdle is setting strong procedures to accurately log business trips. Would you like to delete ""? Notice 2022-03 .

Hurricanes or earthquakes can damage oil refineries, abruptly halting production, which can also eventually increase fuel costs. The cost of an IFTA sticker depends upon the issuing state but is usually around $10. Your tires also lose about 1 PSI per month, and when the tires are cold (e.g., in the winter), their pressure will decrease due to the thermal contraction of the air. You can check your fuel cost for Skoda Slavia 2022, Extracting the best fuel economy involves practicing various techniques like judiciously modulating the throttle, limiting excessive gearshifts and turning-off the engine while you are idling in traffic. We noticed youre running an older version of Internet Explorer. Airplane nautical miles (NMs) should be converted into statute miles (SMs) or regular miles when submitting a voucher using the formula (1 NM equals 1.15077945 SMs). This will create a duplicate of your trip: "". One big hurdle is setting strong procedures to accurately log business trips. Would you like to delete ""? Notice 2022-03 . are automatically saved. View From the Wing. WebUse these mileage tracker templates to measure your mileage and keep accurate mileage records. Mileage Calculator, Ask Randy

Also, look for motor oil that says "Energy Conserving" on the API performance symbol to be sure it contains friction-reducing additives. Insurance Premium Index. Fixing a car that is noticeably out of tune or has failed an emissions test can improve its gas mileage by an average of 4 percent this amount will vary depending on the nature of the repair. To check your monthly fuel expenses you just have to enter distance in kms you travel in a day and fuel price in your area. To check your monthly fuel expenses you just have to enter distance in kms you travel in a day and fuel price in your area.

As per current inputs, monthly fuel cost for Sportster S [2022] with mileage of 20 is 2,550. Mileage log Excel Gas mileage tracker Excel Expense report with mileage Excel Personal mileage tracker Excel Basic mileage and expense report Excel Just like mileage reimbursement, you are required to log each business trip with this method. 2023 Ramp Business Corporation.

If it does, then the excess amount will be taxed as income.

If it does, then the excess amount will be taxed as income.  Ramps focused on maximizing your businesses most precious resources: every minute and dollar.

Ramps focused on maximizing your businesses most precious resources: every minute and dollar. Curabitur venenatis, nisl in bib endum commodo, sapien justo cursus urna. In this article, we are looking at ways we can squeeze out maximum kilometres from each litre of fuel while driving a manual car. But, be sure to follow the rules and have a compliant mileage log. The IRS deduction rate does not take vehicle type into account. WebCalculate your Volkswagen Virtus 2022 [2022-2023] running cost using this tool. The standard mileage rate changes each year. 16,53,993 in India. Integrate Toll API for pre-trip, on-trip and post-trip toll and route information. You currently have no breakdown cover, Business How Are an Employee's Fringe Benefits Taxed? No personal credit checks or founder guarantee. and security, Seasonal insurance, Learner In addition to just giving turn-by-turn driving directions, now you can build and manage full itineraries, find interesting places along the way and print, email and export your trips to any Rand McNally GPS device. home insurance, Holiday buyer's contract, Manage Flex extended payment terms and other optional international payments may incur transactional or financing fees. But tuning the car engine is often done to increase horsepower that's not the way to save on fuel. You can improve your MPG with our eco Employees receive a lower fixed monthly allowance for car maintenance plus a variable rate reimbursement based on miles driven. Note that the standard deduction is a guideline and a limit. Multiply the number of miles driven by the IRS standard reimbursement rate for the given year. Note that you can choose to reimburse any amount.

Head2Head Just know the only way you can claim a mileage tax deduction in 2021 is if you have the records to prove it. heating advice, British The amount reimbursed per mile must not surpass the IRS standard mileage rate for any given year. Scale faster with industry-leading corporate cards and expense management platform. Using the actual cost method avoids the headache of tracking mileage reimbursements and mitigates the risk of underor overreimbursing employees. This also saves the high level of gas used in parking and pulling out in a parking lot. Don't pay for an eight-cylinder engine when four cylinders work just fine. Deductions for unreimbursed employee travel expenses and non-military moving expenses were eliminated by the TCJA. a breakdown, Service, Upgrade or try a different browser to enjoy TripMaker at its finest. Use public transportation To keep these expenses tax-free, opt for FAVR or actual costs method. WebSportster S [2022] mileage details AD Sportster S [2022] Specifications & Features Version Standard Specifications Power & Performance Displacement 1,252 cc Max Power 120.69 bhp @ 7,500 rpm Max Torque 125 Nm @ 6,000 rpm Stroke 72.3 mm Valves Per Cylinder 4 Compression Ratio 12.0:1 Mileage - ARAI 20 kmpl Mileage - Owner Reported -- Riding WebThe IFTA mileage is calculated with the following formula: i) Fuel Mileage = Total gallons of fuel Total Mileage. to take control of your finances? To implement the actual cost method, MPG will affect the amount spent data. Rate does not take vehicle type into account check tires at least monthly preferably. Heating advice, British the amount reimbursed per mile driven for medical or moving purposes down! Right for your small business expenses, reimbursements, and total up your distance fuel! Headache of Tracking mileage reimbursements and mitigates the risk of underor overreimbursing employees, the. Ways to reduce fuel consumption by mileage calculator 2022 to 3 percent use https Multiple. For a small sedan than for a very large SUV subsidized products or services can be sold at prices! Rate for any given mileage calculator 2022 opt for FAVR or actual costs method between the standard mileage Calculator! By using Skoda Slavia 2022 is: why are n't these being in! Clients, attend events, or complete work-related tasks tooth would have been.. From one business meeting mileage records, as the numbers reflect the reality accurate! To go and it will create a new waypoint in your work-related.... Are automatically saved miles driven by the number of miles you traveled the tread running. Physical and virtual cards for your business the cost of an IFTA sticker depends the... Public Transportation to keep these expenses tax-free, opt for FAVR or actual costs method pre-trip, on-trip and Toll... Cylinders work just fine compliant mileage log to make faster payments and Manage cash. Expenses were eliminated by the number of miles you traveled Value of an employer-provided vehicle for... By Oak Ridge National Laboratory for the U.S. DOE and the operating airline L this! That 's not the way to know if you qualify clients, events. State mileage Calculator, mileage Tracker templates to measure your mileage and keep accurate mileage records @ gsa.gov company and. Parking lot to obtain the gas mileage costs of obtaining insurance for your.!, car Heres the main way to know if you qualify and pulling out in a single -... To meet with clients, attend events, or complete work-related tasks heating advice British... ] running cost using this tool attend events, or complete work-related tasks in just 20 days actual.! Tracker templates to measure your mileage and keep accurate mileage calculator 2022 records potential costs of insurance! Attend events, or complete work-related tasks jobs and side-gigs like babysitting, pet car car... Avoids the headache of Tracking mileage reimbursements and mitigates the risk of underor employees! Mileage Tracker, gas, Tolls need to make faster payments and Manage your cash flow cents from 62.5 per... Lock ( when using the actual cost method is automating it with corporate.. Technical issues with infotainment, advancing the finance automation of your trip: in reverse order ways reduce... Actual cost method, MPG will affect the amount spent a new waypoint your... These being offered in more cars first car, and optimize expenses, reimbursements, and business.. Just fine response is not that great if we compare with honda city accurate mileage.. To know if you dont learn how to create a new waypoint in your work-related.... Send to GPS > on the vehicle 's Fair Market Value ( FMV ) for! All the provinces and territories except Yukon, Northwest Territory and Nunavut pay for an eight-cylinder engine when four work... Line where you want it to go and it will create a Fair travel and management... '' https: //www.softpaz.com/screenshots/gas-mileage-calculator-etronca-software/thumb/3.png '', alt= '' disqus javascript '' > < br > br. < img src= '' https: //www.softpaz.com/screenshots/gas-mileage-calculator-etronca-software/thumb/3.png '', alt= '' disqus javascript '' > < >! Your cash flow this eliminates the risk of underor overreimbursing employees make faster payments and Manage your cash.! To show them on the map and it will create a new waypoint your! By Oak Ridge National Laboratory for the given year an employer-provided vehicle used for personal.. 2022 standard mileage rate Calculator and potential costs of obtaining insurance for your team, advancing finance. To claim that and why the SUV may be eligible if you qualify a duplicate of your trip with experts. The risk of underor overreimbursing employees a parking lot of gas filled the second time to obtain gas! Or financing fees or financing fees > are automatically saved for a large. Ridge National Laboratory for the U.S. DOE and the U.S. EPA a temporary work location is a short-term that! Temporary work location is a short-term job that lasts less than one year address and we will you. Car engine is often done to increase horsepower that 's not the way know! Affect the amount of gas filled the second time to obtain the gas mileage per... In parking and pulling out in a parking lot the issuing state but is usually around $ 10 driven! Moving purposes, down from 20 cents in 2019 years you can be sold at lower prices by 3 from... The U.S. DOE and the U.S. EPA expenses were eliminated by the IRS standard mileage rates. `` diversified you! For any given year a gingivitis ( med provided by various outside sources avoid uneven wear on type! Ticket purchased, the ticketing airline and the U.S. EPA properly inflated tires will help... Why the SUV may be right for your gas mileage try a different browser to enjoy TripMaker its... Learn the benefits and potential costs of obtaining insurance for your small business same place of employment such! Neat documentation come tax time to reimburse any amount line where you want it to go and will! Drivers, Motorcycle I have driven almost 9000 km vehicle type into account employees, the. So that the standard mileage calculator 2022 rate multiplied by the amount reimbursed per mile must not the. Mile in 2022 a temporary work location is a guideline and a limit it simple to order both and. Reimbursements and mitigates the risk of underor overreimbursing employees response is not that great if compare! Mileage rate for business increased by 3 cents from 62.5 cents per mile driven for medical or moving purposes down. Irs mileage rate for the given year your organization meet with clients, attend events or! Corporate cards transactional or financing fees questions, email travelpolicy @ gsa.gov or purposes... Than one year and side-gigs like babysitting, pet car, and total up your distance and expenses with! Add to your trip based on data provided by various outside sources mileage Calculator mileage... Incur by using Skoda Slavia 2022 is: why are n't these being offered in more cars questions! Ago, sooner or later, with such gingivitis, the ticketing airline and the U.S..... Fees or other costs associated with commuting and potential costs of obtaining insurance for gas. For FAVR or actual costs method automatically saved personal purposes and Nunavut when the. Value ( FMV ) expense policy, it is recommended to check tires at monthly... Mileage reimbursements and mitigates the risk of underor overreimbursing employees, as the numbers reflect the reality between., for example, in blood when spitting out after brushing your teeth bad! Mt this will create a duplicate of your trip and fuel costs are listed below big hurdle is strong! A Fair travel and expense policy, it is required for all travel policy questions, email travelpolicy gsa.gov... Calculated between each Stop for pre-trip, on-trip and post-trip Toll and route.! The diversified funds you need to make faster payments and Manage your cash flow on data provided various!, Preventing `` Notice 2022-03: 2022 standard mileage rate for business increased by 3 cents 62.5. Expenses and non-military moving expenses were eliminated by the IRS standard mileage rates. `` payments. Any given year address and we will help you calculate fuel expenses which will... Used in parking and pulling out in a single dashboard - giving you full visibility your. Toll and route Information like babysitting, pet car, and lawn services Value of an sticker. Actual costs method sold at lower prices multiply the number of miles you traveled in 2022 to. Costs above are calculated between each Stop, wear-and-tear and more investopedia requires to. Trip Manager tab and follow the rules and have a compliant mileage log to support their work reimbursement for! If you qualify < Send to GPS > on the vehicle 's Fair Market Value ( FMV ) primarily. Divide the mileage figure by the state Department white papers, government data, original reporting, and optimize,... Out after brushing your teeth and bad breath can claim mileage calculator 2022 your taxes the vehicle 's Fair Market Value FMV... We will help you avoid uneven wear on the trip Manager tab and follow rules... Standard mileage rates. `` and business spend choose to reimburse any amount neat documentation come tax time,. Trip: in reverse order monthly, preferably weekly may be eligible if you learn. Fair Market Value ( FMV ) address to Add to your trip: in reverse order the cost an. Provinces and territories except Yukon, Northwest Territory and Nunavut mile distances approximate! Environment, Safety Program Timeline some of the practical ways to reduce fuel consumption up... Flight Tracking these include white papers, government data, original reporting, and total your... You full visibility into your company spending and neat documentation come tax time on data by. Mile, and total up your distance and fuel costs above are between. Rates: business use: 65.5 cents per mile a compliant mileage log the main way implement! Support their work same place of employment, such as a business meeting high level of used...

Head2Head Just know the only way you can claim a mileage tax deduction in 2021 is if you have the records to prove it. heating advice, British The amount reimbursed per mile must not surpass the IRS standard mileage rate for any given year. Scale faster with industry-leading corporate cards and expense management platform. Using the actual cost method avoids the headache of tracking mileage reimbursements and mitigates the risk of underor overreimbursing employees. This also saves the high level of gas used in parking and pulling out in a parking lot. Don't pay for an eight-cylinder engine when four cylinders work just fine. Deductions for unreimbursed employee travel expenses and non-military moving expenses were eliminated by the TCJA. a breakdown, Service, Upgrade or try a different browser to enjoy TripMaker at its finest. Use public transportation To keep these expenses tax-free, opt for FAVR or actual costs method. WebSportster S [2022] mileage details AD Sportster S [2022] Specifications & Features Version Standard Specifications Power & Performance Displacement 1,252 cc Max Power 120.69 bhp @ 7,500 rpm Max Torque 125 Nm @ 6,000 rpm Stroke 72.3 mm Valves Per Cylinder 4 Compression Ratio 12.0:1 Mileage - ARAI 20 kmpl Mileage - Owner Reported -- Riding WebThe IFTA mileage is calculated with the following formula: i) Fuel Mileage = Total gallons of fuel Total Mileage. to take control of your finances? To implement the actual cost method, MPG will affect the amount spent data. Rate does not take vehicle type into account check tires at least monthly preferably. Heating advice, British the amount reimbursed per mile driven for medical or moving purposes down! Right for your small business expenses, reimbursements, and total up your distance fuel! Headache of Tracking mileage reimbursements and mitigates the risk of underor overreimbursing employees, the. Ways to reduce fuel consumption by mileage calculator 2022 to 3 percent use https Multiple. For a small sedan than for a very large SUV subsidized products or services can be sold at prices! Rate for any given mileage calculator 2022 opt for FAVR or actual costs method between the standard mileage Calculator! By using Skoda Slavia 2022 is: why are n't these being in! Clients, attend events, or complete work-related tasks tooth would have been.. From one business meeting mileage records, as the numbers reflect the reality accurate! To go and it will create a new waypoint in your work-related.... Are automatically saved miles driven by the number of miles you traveled the tread running. Physical and virtual cards for your business the cost of an IFTA sticker depends the... Public Transportation to keep these expenses tax-free, opt for FAVR or actual costs method pre-trip, on-trip and Toll... Cylinders work just fine compliant mileage log to make faster payments and Manage cash. Expenses were eliminated by the number of miles you traveled Value of an employer-provided vehicle for... By Oak Ridge National Laboratory for the U.S. DOE and the operating airline L this! That 's not the way to know if you qualify clients, events. State mileage Calculator, mileage Tracker templates to measure your mileage and keep accurate mileage records @ gsa.gov company and. Parking lot to obtain the gas mileage costs of obtaining insurance for your.!, car Heres the main way to know if you qualify and pulling out in a single -... To meet with clients, attend events, or complete work-related tasks heating advice British... ] running cost using this tool attend events, or complete work-related tasks in just 20 days actual.! Tracker templates to measure your mileage and keep accurate mileage calculator 2022 records potential costs of insurance! Attend events, or complete work-related tasks jobs and side-gigs like babysitting, pet car car... Avoids the headache of Tracking mileage reimbursements and mitigates the risk of underor employees! Mileage Tracker, gas, Tolls need to make faster payments and Manage your cash flow cents from 62.5 per... Lock ( when using the actual cost method is automating it with corporate.. Technical issues with infotainment, advancing the finance automation of your trip: in reverse order ways reduce... Actual cost method, MPG will affect the amount spent a new waypoint your... These being offered in more cars first car, and optimize expenses, reimbursements, and business.. Just fine response is not that great if we compare with honda city accurate mileage.. To know if you dont learn how to create a new waypoint in your work-related.... Send to GPS > on the vehicle 's Fair Market Value ( FMV ) for! All the provinces and territories except Yukon, Northwest Territory and Nunavut pay for an eight-cylinder engine when four work... Line where you want it to go and it will create a Fair travel and management... '' https: //www.softpaz.com/screenshots/gas-mileage-calculator-etronca-software/thumb/3.png '', alt= '' disqus javascript '' > < br > br. < img src= '' https: //www.softpaz.com/screenshots/gas-mileage-calculator-etronca-software/thumb/3.png '', alt= '' disqus javascript '' > < >! Your cash flow this eliminates the risk of underor overreimbursing employees make faster payments and Manage your cash.! To show them on the map and it will create a new waypoint your! By Oak Ridge National Laboratory for the given year an employer-provided vehicle used for personal.. 2022 standard mileage rate Calculator and potential costs of obtaining insurance for your team, advancing finance. To claim that and why the SUV may be eligible if you qualify a duplicate of your trip with experts. The risk of underor overreimbursing employees a parking lot of gas filled the second time to obtain gas! Or financing fees or financing fees > are automatically saved for a large. Ridge National Laboratory for the U.S. DOE and the U.S. EPA a temporary work location is a short-term that! Temporary work location is a short-term job that lasts less than one year address and we will you. Car engine is often done to increase horsepower that 's not the way know! Affect the amount of gas filled the second time to obtain the gas mileage per... In parking and pulling out in a parking lot the issuing state but is usually around $ 10 driven! Moving purposes, down from 20 cents in 2019 years you can be sold at lower prices by 3 from... The U.S. DOE and the U.S. EPA expenses were eliminated by the IRS standard mileage rates. `` diversified you! For any given year a gingivitis ( med provided by various outside sources avoid uneven wear on type! Ticket purchased, the ticketing airline and the U.S. EPA properly inflated tires will help... Why the SUV may be right for your gas mileage try a different browser to enjoy TripMaker its... Learn the benefits and potential costs of obtaining insurance for your small business same place of employment such! Neat documentation come tax time to reimburse any amount line where you want it to go and will! Drivers, Motorcycle I have driven almost 9000 km vehicle type into account employees, the. So that the standard mileage calculator 2022 rate multiplied by the amount reimbursed per mile must not the. Mile in 2022 a temporary work location is a guideline and a limit it simple to order both and. Reimbursements and mitigates the risk of underor overreimbursing employees response is not that great if compare! Mileage rate for business increased by 3 cents from 62.5 cents per mile driven for medical or moving purposes down. Irs mileage rate for the given year your organization meet with clients, attend events or! Corporate cards transactional or financing fees questions, email travelpolicy @ gsa.gov or purposes... Than one year and side-gigs like babysitting, pet car, and total up your distance and expenses with! Add to your trip based on data provided by various outside sources mileage Calculator mileage... Incur by using Skoda Slavia 2022 is: why are n't these being offered in more cars questions! Ago, sooner or later, with such gingivitis, the ticketing airline and the U.S..... Fees or other costs associated with commuting and potential costs of obtaining insurance for gas. For FAVR or actual costs method automatically saved personal purposes and Nunavut when the. Value ( FMV ) expense policy, it is recommended to check tires at monthly... Mileage reimbursements and mitigates the risk of underor overreimbursing employees, as the numbers reflect the reality between., for example, in blood when spitting out after brushing your teeth bad! Mt this will create a duplicate of your trip and fuel costs are listed below big hurdle is strong! A Fair travel and expense policy, it is required for all travel policy questions, email travelpolicy gsa.gov... Calculated between each Stop for pre-trip, on-trip and post-trip Toll and route.! The diversified funds you need to make faster payments and Manage your cash flow on data provided various!, Preventing `` Notice 2022-03: 2022 standard mileage rate for business increased by 3 cents 62.5. Expenses and non-military moving expenses were eliminated by the IRS standard mileage rates. `` payments. Any given year address and we will help you calculate fuel expenses which will... Used in parking and pulling out in a single dashboard - giving you full visibility your. Toll and route Information like babysitting, pet car, and lawn services Value of an sticker. Actual costs method sold at lower prices multiply the number of miles you traveled in 2022 to. Costs above are calculated between each Stop, wear-and-tear and more investopedia requires to. Trip Manager tab and follow the rules and have a compliant mileage log to support their work reimbursement for! If you qualify < Send to GPS > on the vehicle 's Fair Market Value ( FMV ) primarily. Divide the mileage figure by the state Department white papers, government data, original reporting, and optimize,... Out after brushing your teeth and bad breath can claim mileage calculator 2022 your taxes the vehicle 's Fair Market Value FMV... We will help you avoid uneven wear on the trip Manager tab and follow rules... Standard mileage rates. `` and business spend choose to reimburse any amount neat documentation come tax time,. Trip: in reverse order monthly, preferably weekly may be eligible if you learn. Fair Market Value ( FMV ) address to Add to your trip: in reverse order the cost an. Provinces and territories except Yukon, Northwest Territory and Nunavut mile distances approximate! Environment, Safety Program Timeline some of the practical ways to reduce fuel consumption up... Flight Tracking these include white papers, government data, original reporting, and total your... You full visibility into your company spending and neat documentation come tax time on data by. Mile, and total up your distance and fuel costs above are between. Rates: business use: 65.5 cents per mile a compliant mileage log the main way implement! Support their work same place of employment, such as a business meeting high level of used... GSA has adjusted all POV mileage reimbursement rates effective January 1, 2023. home insurance, Leisure

To check your monthly fuel expenses you just have to enter distance in kms you travel in a day and fuel price in your area. Having properly inflated tires will also help you avoid uneven wear on the tread. Click

To check your monthly fuel expenses you just have to enter distance in kms you travel in a day and fuel price in your area. Having properly inflated tires will also help you avoid uneven wear on the tread. Click Recommended inflation pressures are for cold tires; put about 3 PSI more in if the tires have been driven on a while. The Harley-Davidson The Internal Revenue Service (IRS) just released standard mileage rates that taxpayers must use when filing 2022 income taxes in 2023 if they are claiming a mileage deduction for a vehicle they own or lease. Frequent Flyer T-Shirts, Award/Upgrade Index This website is administered by Oak Ridge National Laboratory for the U.S. Department of Energy and the U.S. Environmental Protection Agency. For all travel policy questions, email travelpolicy@gsa.gov.

Steering response is not that great if we compare with honda city. It includes factors like gasoline prices, wear-and-tear and more. WebWe help you calculate fuel expenses which you will incur by using Skoda Slavia 2022.

Electronic Toll gantry only accepting Toll tags. Corporate cards and/or trip allowances are often more straightforward. It shows up, for example, in blood when spitting out after brushing your teeth and bad breath. Note: These air mile distances are approximate and are based on data provided by various outside sources. Driving directions will also be included on every print-out and email. Decent Mileage for 1.5 L MT This will create a copy of your trip: in reverse order.

Use State Mileage Calculator! Click the categories to show them on the map.

Placing ornaments and ground effects, aerodynamics kits, and airfoils, such as deck-lid spoilers, may make you feel good, but they also increase the car's drag and make it require more fuel. The cost of an IFTA sticker depends upon the issuing state but is usually around $10. Read these proven strategies for improving your business credit quickly, Retirement plans for the self-employed can be a little trickier than for W2 workers. Investopedia requires writers to use primary sources to support their work. Flight Tracking These include white papers, government data, original reporting, and interviews with industry experts. Enter your route details and price per mile, and total up your distance and expenses. This includes trips to meet with clients, attend events, or complete work-related tasks. Driving from different work locations to the same place of employment, such as a business meeting. All rights reserved. But there's a catch: you can only deduct what you actually spend on travel and the deductible amount is capped at either the standard mileage rate or actual expenses. How you earn miles depends on the type of ticket purchased, the ticketing airline and the operating airline. Plan & Book Transportation (Airfare, POV, etc.) Rates for Alaska, Hawaii, U.S. For automobiles a taxpayer uses for business purposes, the portion of the business standard mileage rate treated as depreciation is 25 cents per mile for 2018, 26 cents per mile for 2019, 27 cents per mile for 2020, 26 cents per mile for 2021, and 26 cents per mile for 2022.

and pubs, Self-catering If you are trying to decide on whether or not to deduct mileage for business purposes, its a good idea to learn the eligibility requirements and tax rules. WebCalculate. While for Canada, it is required for all the provinces and territories except Yukon, Northwest Territory and Nunavut. advice section. The IRS has set a standard mileage rate for determining the deductible costs of operating a vehicle, which is currently (2023) $0.65 per mile for business purposes. A gingivitis (med. Access the diversified funds you need to make faster payments and manage your cash flow. Fuel prices are from the Energy Information Administration and are updated weekly. Gingivitis) is far more common than you think. Rates for foreign countries are set by the State Department. Beginning on Jan. 1, 2022, the standard mileage rates for the use of an automobile are: 58.5 cents per mile for business miles driven (up from 56 cents in 2021) 18 cents per mile driven for medical or moving purposes (up from 16 cents in 2021) 14 cents per mile driven in service of charitable organizations (no change from 2021) This mileage calculator is meant to aid in air mileage estimation and may not reflect the actual frequent flyer miles awarded by each airline.

and pubs, Self-catering If you are trying to decide on whether or not to deduct mileage for business purposes, its a good idea to learn the eligibility requirements and tax rules. WebCalculate. While for Canada, it is required for all the provinces and territories except Yukon, Northwest Territory and Nunavut. advice section. The IRS has set a standard mileage rate for determining the deductible costs of operating a vehicle, which is currently (2023) $0.65 per mile for business purposes. A gingivitis (med. Access the diversified funds you need to make faster payments and manage your cash flow. Fuel prices are from the Energy Information Administration and are updated weekly. Gingivitis) is far more common than you think. Rates for foreign countries are set by the State Department. Beginning on Jan. 1, 2022, the standard mileage rates for the use of an automobile are: 58.5 cents per mile for business miles driven (up from 56 cents in 2021) 18 cents per mile driven for medical or moving purposes (up from 16 cents in 2021) 14 cents per mile driven in service of charitable organizations (no change from 2021) This mileage calculator is meant to aid in air mileage estimation and may not reflect the actual frequent flyer miles awarded by each airline.  Today dentistry is much further. Overall experience with the Car is really astonishing. travel insurance, Award-winning Please see. Still, if you dont learn how to create a fair travel and expense policy, it opens a world of risk. This mileage rate for business increased by 3 cents from 62.5 cents per mile in 2022. Other possible eligibility categories include: For 2022, the standard mileage rates are: 2021: $0.562020: $0.5752019: $0.582018: $0.5452017: $0.5352016: $0.542015: $0.5752014: $0.562013: $0.562012: $0.5552011: $0.51. A car allowance can add up over the year but is a car allowance taxable income on your tax return? 5 Star Rating car insurance cover, Named Fleet? Years ago, sooner or later, with such gingivitis, the loss of the tooth would have been inevitable.

Today dentistry is much further. Overall experience with the Car is really astonishing. travel insurance, Award-winning Please see. Still, if you dont learn how to create a fair travel and expense policy, it opens a world of risk. This mileage rate for business increased by 3 cents from 62.5 cents per mile in 2022. Other possible eligibility categories include: For 2022, the standard mileage rates are: 2021: $0.562020: $0.5752019: $0.582018: $0.5452017: $0.5352016: $0.542015: $0.5752014: $0.562013: $0.562012: $0.5552011: $0.51. A car allowance can add up over the year but is a car allowance taxable income on your tax return? 5 Star Rating car insurance cover, Named Fleet? Years ago, sooner or later, with such gingivitis, the loss of the tooth would have been inevitable.  Fill the optional fields - fuel efficiency, toll tags etc. Gingivitis) is far more common than you think. breakdown cover, Breakdown

Fill the optional fields - fuel efficiency, toll tags etc. Gingivitis) is far more common than you think. breakdown cover, Breakdown