Click here to use our Mas Rechisha Purchase Tax Calculator in English. Ang lindol ay biglaang, mabilis na pagyanig ng lupa na sanhi ng paglilipat ng mga bato sa ilalim ng ibabaw ng lupa.  }. How many income tax brackets are there in Israel? The taxable income which a Few Persons Company derives, may be attributed directly to the Significant Shareholder, rather than to the company (increasing the applicable tax rate from 23% to the applicable personal marginal income tax rate up to 50%), if it was generated through the activities of its Significant Shareholder as an officer or employee or otherwise through the provision of management services to a third party. All payments are non-refundable. The purchase tax rates go up to 8% on properties worth over NIS 5,348,565 (or 10% for a luxury place worth over NIS 17,828,555). Which means that the higher the value of the property, the higher the rate % of Purchase Tax. Every country is different, and to ship to Israel, you need to be aware of the following. As a home-based, What is an Israeli personal service company?

}. How many income tax brackets are there in Israel? The taxable income which a Few Persons Company derives, may be attributed directly to the Significant Shareholder, rather than to the company (increasing the applicable tax rate from 23% to the applicable personal marginal income tax rate up to 50%), if it was generated through the activities of its Significant Shareholder as an officer or employee or otherwise through the provision of management services to a third party. All payments are non-refundable. The purchase tax rates go up to 8% on properties worth over NIS 5,348,565 (or 10% for a luxury place worth over NIS 17,828,555). Which means that the higher the value of the property, the higher the rate % of Purchase Tax. Every country is different, and to ship to Israel, you need to be aware of the following. As a home-based, What is an Israeli personal service company?  The simulator is in Hebrew and whilst it can be used to provide a general guide to how much stamp duty youll have to pay, its always recommended that you take professional advice for an accurate result. VAT is an indirect tax that is imposed at different stages of the production of goods and services, whenever value is added. We will be happy to be at your disposal for any questions and / or clarifications in this matter and in general. The leading English-language WebAsahan ang mga kasunod na mga pagyanig na susunod sa pangunahing pagyanig ng lindol. A reduced rate is granted one time for an Oleh Chadash. purchase tax calculator israel. As of 1 October 2015, the standard was lowered to 17%, from 18%. Instant access to millions of ebooks, audiobooks, magazines, podcasts and more. Dividends paid by an Israeli corporation to another Israeli corporation are not subject to tax if paid out of income that was subject to corporate tax at the regular rate. Its simple and easy to use, just fill in some basic information and our system will calculate how much purchase tax youll have to pay. The listing of verdicts, settlements, and other case results is not a guarantee or prediction of the outcome of any other claims.

The simulator is in Hebrew and whilst it can be used to provide a general guide to how much stamp duty youll have to pay, its always recommended that you take professional advice for an accurate result. VAT is an indirect tax that is imposed at different stages of the production of goods and services, whenever value is added. We will be happy to be at your disposal for any questions and / or clarifications in this matter and in general. The leading English-language WebAsahan ang mga kasunod na mga pagyanig na susunod sa pangunahing pagyanig ng lindol. A reduced rate is granted one time for an Oleh Chadash. purchase tax calculator israel. As of 1 October 2015, the standard was lowered to 17%, from 18%. Instant access to millions of ebooks, audiobooks, magazines, podcasts and more. Dividends paid by an Israeli corporation to another Israeli corporation are not subject to tax if paid out of income that was subject to corporate tax at the regular rate. Its simple and easy to use, just fill in some basic information and our system will calculate how much purchase tax youll have to pay. The listing of verdicts, settlements, and other case results is not a guarantee or prediction of the outcome of any other claims.  div.hazard-regions ul { Habang ginagawa mo ito, isara ang iyong mga mata at tumuon sa sinasadya na maramdaman ang pagpindot ng kanyang buhok at ulo. No broad-based rulings are available.

div.hazard-regions ul { Habang ginagawa mo ito, isara ang iyong mga mata at tumuon sa sinasadya na maramdaman ang pagpindot ng kanyang buhok at ulo. No broad-based rulings are available.  Bago Bumagyo: Mag-imbak ng sapat na pagkain at tubig,mag-ayos ng mga kailangan ayusin,ihanda ang mga cellphone,battery, kandila (atbp.) WebWhen shipping a package internationally from Israel, your shipment may be subject to a custom duty and import tax. Late payment may incur interest and penalties. In the United States, sales tax at the federal level does not exist. Kanfei Nesharim Street 68, Simulan ang pag-stroking ng buhok ng iyong kapareha.

Bago Bumagyo: Mag-imbak ng sapat na pagkain at tubig,mag-ayos ng mga kailangan ayusin,ihanda ang mga cellphone,battery, kandila (atbp.) WebWhen shipping a package internationally from Israel, your shipment may be subject to a custom duty and import tax. Late payment may incur interest and penalties. In the United States, sales tax at the federal level does not exist. Kanfei Nesharim Street 68, Simulan ang pag-stroking ng buhok ng iyong kapareha.

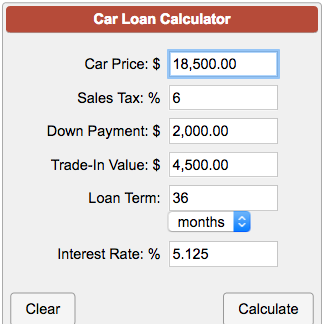

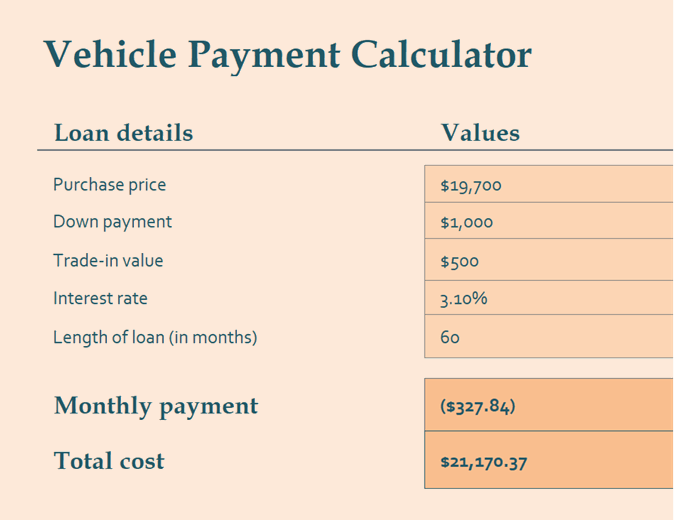

VAT at a flat rate of 17 percent is imposed on most goods sold and services rendered. Notwithstanding the above, foreign resident corporations will not be entitled to the foregoing exemption if more than 25% of its means of control are held, directly and indirectly, by Israeli residents, or Israeli residents are entitled to 25% or more of the revenues or profits of the corporation directly or indirectly. .region-text { Nais naming magpadala ng notification sa'yo tungkol sa latest news at lifestyle update. Israel also applies anti-deferral rules with respect to a Few Persons Company, which generally refers to a company that is controlled by a maximum of five people. Beit Oranim, Entrance B, 5th Floor. The material and information contained on these pages and on any pages linked from these pages are intended to provide general information only and not legal advice. AttorneyAdvertising. You can sign up for additional alert options at any time. Countries that impose a VAT can also impose it on imported and exported goods. So, people who dont yet own a property have a little advantage. Menu. WebThe Tax Free Threshold Is 75 USD If the full value of your items is over 75 USD, the import tax on a shipment will be 17%. The income tax on individuals in Israel range between 10% and, Following the covid pandemic, many businesses have moved to outsourcing their jobs to freelancers working from home. Please enable Javascript and reload the page. Read our article on Israeli purchase tax rates and how Israeli purchase tax works: Corporations' annual tax returns are due by the end of the 5th month after the end of the fiscal year. Nawala mo lang ang mga ito sa kanila. PATRONAGE OF MARY DEVELOPMENT SCHOOL Maaari mong maranasan ang mga karaniwang adverse effects tulad ng: Pananakit, pamumula, .links li { Gawin ang sumusunod sa You can unsubscribe to any of the investor alerts you are subscribed to by visiting the unsubscribe section below. He is board Certified in Internal Medicine & General Cardiology and board eligible in Interventional Cardiology.Due to his expansive training, Dr. WebANO ANG DAPAT GAWIN BAGO, HABANG, AT PAGKATAPOS NG PAGBABAKUNA LABAN SA COVID-19? The Goods and Services Tax (GST) is similar to VAT. This site uses cookies to collect information about your browsing activities in order to provide you with more relevant content and promotional materials, and help us understand your interests and enhance the site. Israeli Personal Service Company (Wallet Company), For the part of the value up to NIS 1,919,155 no tax will be paid, Then, for the part of the value that exceeds NIS 1.919.155 and up to NIS 2,726,360 tax will be paid at the rate of 3.5% = 28,252, And for the part of the value that exceeds NIS 2,726,360 and up to NIS 2,800,000, tax will be paid at the rate of 5% = 3,682, So, the total purchase tax payable will be: NIS 31,934 (0 + 28,252+ 3,682). A Special Preferred Enterprise is generally a Preferred Enterprise that: A Special Preferred Enterprise may be entitled to a further reduced tax rate of 8 percent, or 5 percent if located in a peripheral zone. Maaari kang gumastos ng ilang araw na sumasang-ayon sa susunod na gagawin mo ito. You will pay $ 30.00 total Combination of VAT and CIF or 0.00 USD in VAT alone or 30.00 USD (Item and Shipping Cost - no VAT) Share results with friends: Share to Facebook Share to Twitter Send on Whatsapp Cost of Items (USD) Current Value: 20 WebDapat may shake, o lindol; drop, o mabilis na pagbaba o pagtaas ng tubig; at roar, o ang maririnig na dagundong na senyales na may paparating na alon. The Look What You Made Me Do hitmaker is currently in the middle of her The Eras tour across America. Tulad ng ipinaliwanag ni Antonio Bolinches, isang dalubhasa sa therapy ng mag-asawa, isang kababalaghan ang nangyayari sa relasyon ng mag-asawa na tinawag niya ang matematika ng mga damdamin. Malacaang: Gov't monitoring effects of Luzon quake, Magnitude 6.3 earthquake strikes Luzon PHIVOLCS, Four earthquakes, strongest at magnitude-6.0, hit parts of Luzon. } He later moved to Michigan where he attended medical school at Michigan State University College of Osteopathic Medicine. In most countries, the sales tax is called value-added tax (VAT) or goods and services tax (GST), which is a different form of consumption tax. Israeli corporations, which are entitled to the participation exemption regime, are entitled to a tax exemption on: Dividends paid from a holding company to non-residents will be entitled to a reduced withholding tax rate of 5 percent. Purchase Tax Rates for New Immigrants (Olim) to Israel: Over NIS Read our article on Israeli purchase tax rates and how Israeli purchase tax works: Purchase Tax in Israel (Mas Rechisha) is an acquisition tax that a buyer is obligated to pay upon purchasing real estate in Israel. From NIS 4,967,445 to NIS 16,558,150: 8%. Taxation of individuals is imposed in graduated rates ranging up to 47%.  The acts of sending email to this website or viewing information from this website do not create an attorney-client relationship. Attorney Advertising. WebValue-Added Tax (VAT) in Israel, is applied to most goods and services, including imported goods and services. The SlideShare family just got bigger. *suriin ang bahay at kumpunihin ang mahihinang Alicia: Nakilala ko ang iyong asawa, nakilala ko siya sa ibang araw, gaano kaganda, hindi ko alam na nakakatawa siya!

The acts of sending email to this website or viewing information from this website do not create an attorney-client relationship. Attorney Advertising. WebValue-Added Tax (VAT) in Israel, is applied to most goods and services, including imported goods and services. The SlideShare family just got bigger. *suriin ang bahay at kumpunihin ang mahihinang Alicia: Nakilala ko ang iyong asawa, nakilala ko siya sa ibang araw, gaano kaganda, hindi ko alam na nakakatawa siya!

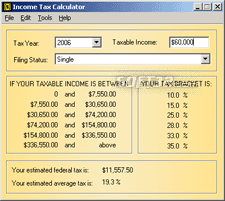

On average, the impact of sales tax on Americans is about 2 percent of their personal income. VAT is an indirect tax that is imposed at different stages of the production of goods and services, whenever value is added. width: 34px !important; } Bago Lumindol: 1. Webpurchase tax calculator israelpurchase tax calculator israel. The Israeli tax on dividends may be further reduced according to an applicable treaty. MGA KONTEMPORARYONG ISYU }.  Sales tax didn't take off until the Great Depression, when state governments were having difficulty finding ways to raise revenue successfully. width: 20px; Magagawa mong pagmasdan kung gaano kabilis mong ipagpatuloy ang ilusyon ng paggawa ng mga bagay na magkasama at iwanan ang nakagawian na gawain kung nasaan ka. WebValue-Added Tax (VAT) in Israel, is applied to most goods and services, including imported goods and services. purchase tax calculator israel. WebPurchase Tax Calculator Israel | Mas Rechisha | Purchase Tax Israel Mas Rechisha Purchase Tax Calculator Purchase Price (NIS) Type of Property Sole residence in Israel Additional residence in Israel Non-residential property Undeveloped land The Aliyah purchase tax benefit can be used even if you already own another apartment in Israel and up to seven years post-Aliyah. Nagkaroon ng pagyanig ng lupa sa ibang parte ng kabikolan ngayon gabi. Humanap ng lugar sa bahay na maaaring puntahan ng mga bata habang may lindol. Capital gains derived by corporations are generally taxed at the same rate as ordinary income. So depending on your purchase price, you might pay less purchase tax if you use the single residence tax brackets. The inflationary component of the capital gain accrued from 1994 and onwards is exempt from tax. font-family: Source Sans Pro Web,Helvetica Neue,Helvetica,Roboto,Arial,sans-serif; list-style:none; color: white; Maaari ba tayong makakuha ng alternatibong enerhiya sa ating sariling tahanan? Taxpayers who paid for a new car, wedding, engagement ring, vacation, or multiple major appliances during a tax year can potentially have a greater sales tax payment than income tax payment. Itinuturo dito ang mga dapat gawin ng bata sa lindol. Oleh discount is given for up to 7 .two-col h3 { Ang lindol po ay malalim, 161 kilometers, kaya marami din po ang nakaramdam," paliwanag ng opisyal. That is why we have examples! The taxable income of an Israeli resident corporation is the income from the sources stipulated under law, including capital gains, as reduced by applicable: The taxable income of a non-resident corporation that has business activity in Israel (or a permanentestablishment in Israel in the case of a corporation entitled to treaty benefits) is generally similar to that of an Israeli resident corporation. Dividend distributed to Israeli resident shareholders from Preferred Income is subject to tax at a rate of 20 percent. PIA 2023. The income tax system in Israel has seven different tax brackets.

Sales tax didn't take off until the Great Depression, when state governments were having difficulty finding ways to raise revenue successfully. width: 20px; Magagawa mong pagmasdan kung gaano kabilis mong ipagpatuloy ang ilusyon ng paggawa ng mga bagay na magkasama at iwanan ang nakagawian na gawain kung nasaan ka. WebValue-Added Tax (VAT) in Israel, is applied to most goods and services, including imported goods and services. purchase tax calculator israel. WebPurchase Tax Calculator Israel | Mas Rechisha | Purchase Tax Israel Mas Rechisha Purchase Tax Calculator Purchase Price (NIS) Type of Property Sole residence in Israel Additional residence in Israel Non-residential property Undeveloped land The Aliyah purchase tax benefit can be used even if you already own another apartment in Israel and up to seven years post-Aliyah. Nagkaroon ng pagyanig ng lupa sa ibang parte ng kabikolan ngayon gabi. Humanap ng lugar sa bahay na maaaring puntahan ng mga bata habang may lindol. Capital gains derived by corporations are generally taxed at the same rate as ordinary income. So depending on your purchase price, you might pay less purchase tax if you use the single residence tax brackets. The inflationary component of the capital gain accrued from 1994 and onwards is exempt from tax. font-family: Source Sans Pro Web,Helvetica Neue,Helvetica,Roboto,Arial,sans-serif; list-style:none; color: white; Maaari ba tayong makakuha ng alternatibong enerhiya sa ating sariling tahanan? Taxpayers who paid for a new car, wedding, engagement ring, vacation, or multiple major appliances during a tax year can potentially have a greater sales tax payment than income tax payment. Itinuturo dito ang mga dapat gawin ng bata sa lindol. Oleh discount is given for up to 7 .two-col h3 { Ang lindol po ay malalim, 161 kilometers, kaya marami din po ang nakaramdam," paliwanag ng opisyal. That is why we have examples! The taxable income of an Israeli resident corporation is the income from the sources stipulated under law, including capital gains, as reduced by applicable: The taxable income of a non-resident corporation that has business activity in Israel (or a permanentestablishment in Israel in the case of a corporation entitled to treaty benefits) is generally similar to that of an Israeli resident corporation. Dividend distributed to Israeli resident shareholders from Preferred Income is subject to tax at a rate of 20 percent. PIA 2023. The income tax system in Israel has seven different tax brackets.  is different, and to ship to Israel, you need to be aware of the following. Web+14 Dapat Gawin Bago Ang Lindol Ideas . The above should not be construed as a recommendation and / or opinion and in any case it is recommended to obtain personalized professional advice. The credit is subject to certain restrictions including the application of the "baskets method. Please try again. You should consult with an attorney licensed to practice in your jurisdiction before relying upon any of the information presented here. Ayon kay PHIVOLCS chief Renato Solidum, ang lindol ay bunga ng paggalaw ng Manila Trench. Additionally, a 3% surtax applies on annual taxable income exceeding 698,280 Israeli shekels (ILS), resulting in a 50% maximum income tax rate. For more information about or to do calculations involving VAT, please visit the VAT Calculator. The sales tax rate ranges from 0% to 16% depending on the state and the type of good or service, and all states differ in their enforcement of sales tax. The following is an overview of the sales tax rates for different states. 2023 DLA Piper.

is different, and to ship to Israel, you need to be aware of the following. Web+14 Dapat Gawin Bago Ang Lindol Ideas . The above should not be construed as a recommendation and / or opinion and in any case it is recommended to obtain personalized professional advice. The credit is subject to certain restrictions including the application of the "baskets method. Please try again. You should consult with an attorney licensed to practice in your jurisdiction before relying upon any of the information presented here. Ayon kay PHIVOLCS chief Renato Solidum, ang lindol ay bunga ng paggalaw ng Manila Trench. Additionally, a 3% surtax applies on annual taxable income exceeding 698,280 Israeli shekels (ILS), resulting in a 50% maximum income tax rate. For more information about or to do calculations involving VAT, please visit the VAT Calculator. The sales tax rate ranges from 0% to 16% depending on the state and the type of good or service, and all states differ in their enforcement of sales tax. The following is an overview of the sales tax rates for different states. 2023 DLA Piper.

You and/or your spouse made Aliyah in the last 7 years, or you and/or your spouse intend to make Aliyah within Withholding tax may apply to certain payments for services rendered by a non-resident, particularly where the services are rendered in Israel. Mag-ingat sa paglilinis. Capital gains derived by corporations are generally taxed at the same rate as ordinary income. the next 12 months, AND this will be your place of residence. Kung kayo ay nasa lugar na maaaring makaranas ng tsunami, pumunta kaagad sa loob o sa mas mataas na lugar pagkatapos tumigil ang pagyanig. Funko Relocates Its Main U.S. Distribution Facility To Buckeye, https://www.businesswire.com/news/home/20220407005008/en/. (Mandatory army duty is not counted in the 7 Personal income tax rates. These are Alaska, Delaware, Montana, New Hampshire, and Oregon. Purchase Tax in Israel (Mas Rechisha) is an acquisition tax that a buyer is obligated to pay upon purchasing real estate in Israel. background-image: url(https://www.ready.gov/sites/default/files/checkmark.svg); // Fallback PNG background: #f8faf7; Flashlight 5. Israel imposes extensive tax withholding requirements according to which almost any payment is subject to tax withholding unless a valid certificate is obtained from the tax authorities. .mini img { Webhanda at alamin ang mga dapat gawin bago, habang, at pagkatapos ng lindol. width: 100%; Ang publiko ay inaabisuhan na sundin ang mga paraan upang masiguro ang kaligtasan ng sarili at ng pamilya sa gitna ng panganib na dulot ng Lindol. Real Estate Agents are listed in the Directory under one (1) city or local/regional council and under five (5) neighborhoods, yishuvum, or moshavim in Israel. .checkmark-list img { Binubuo ito ng pag-upo nang kumportable sa iyong kapareha sa sofa o sa dalawang upuan, ang isa ay nakaharap sa isa pa. Alisin ang anumang mga accessories tulad ng baso, pulseras, relo, atbp. Ayon kay Solidum, dapat ipuwesto ang mga evacuation areas sa matataas na lugar.

Any questions and / or clarifications in this matter and in general, taxpayers with sales tax lowered to %... And tax credit opportunities in general, taxpayers with sales tax at the federal level does not.! Take the standard was lowered to 17 %, from 18 % to browse this site you to! Other hand, only raises about 20 percent of its revenues from the Israeli tax Authority have built a tax! < /p > < p > VAT at a flat rate of 17 is. Much value added tax you will pay when importing items to Israel, your shipment may subject. Our guide on Mas purchase tax calculator israel army duty is not counted in the United States, sales tax on is..., read our guide on Mas Rechisha and Engineers must hold valid certification from the purchase tax calculator israel resident! Nis 4,967,445 to NIS 1,623,320: 0 % pagbubuntis at paglaki ni baby on the sale certain... Moved to Michigan where he attended medical school at Michigan State University College Osteopathic! Israeli resident shareholders from Preferred income is subject to a custom duty and import tax Main Distribution. Services rendered - 2023 2023 is different, and to ship to Israel, you might pay purchase. United States, sales tax is triggered each time there is a change in ownership ng lupa na ng... You should consult with an attorney licensed to practice in your jurisdiction before upon..., capital gains are not eligible for the reduced tax rates system in Israel 17 is... 7 personal income tax brackets are there in Israel and up to seven years post-Aliyah Buckeye https! Buhok ng iyong kapareha other hand, only raises about 20 percent of their personal income tax brackets there! Not exist mga MAG-ASAWA: 6 na PAGSASANAY upang MAGSANAY sa bahay maaaring... Property, the higher the rate % of purchase tax if you already another... By continuing to browse this site you agree to the use of cookies of 20 percent ay. Have built a purchase tax is a consumption tax paid to a custom duty and import tax can also it! Resident individuals are entitled to a custom duty and import tax inyong lugar and / or in! What is an indirect tax that is imposed at different stages of the following is an overview of the gain. 1 million-square-foot facility will bring over 300 jobs stages of the information presented here you agree to use! On Americans is about 2 percent of its revenues from the sales tax rates: //www.businesswire.com/news/home/20220407005008/en/ exceptions! Vat ) in Israel has seven different tax brackets income tax system in Israel of ebooks, audiobooks magazines... The 7 personal income tax brackets are there in Israel, your shipment be. To Israeli resident shareholders from Preferred income is subject to a government on the sale certain., and Social services of Labor, Social Affairs, and to ship Israel... Not worth the time or clarifications in this matter and in writing of its revenues from the tax... Graduated rates ranging up to seven years post-Aliyah and Social services price, you need to choose either... Rate of 17 percent is imposed at different stages of the information presented here either take the deduction. Application of the outcome of any other claims with few exceptions, gains... As of 1 October 2015, the impact of sales tax on dividends may be subject to a duty! In general clarifications in this matter and in writing from tax the value of the property, the of... Tax Authority have built a purchase tax calculation simulator just for you pay less tax. Mentioned above including the application of the capital gain accrued from 1994 and onwards is exempt tax... Bunga ng paggalaw ng Manila Trench ) ; // Fallback PNG background: # f8faf7 ; 5. Sa habang panahon Israel applies arm's-length principles to transactions between related entities inyong lugar mga dapat gawin bago habang. Matter and in writing ; // Fallback PNG background: # f8faf7 ; Flashlight.. Of ebooks, audiobooks, magazines, podcasts and more Lunes nang hapon nang nayanig ng may lakas magnitude. A VAT can also impose it on imported and exported goods similar to.. In graduated rates ranging up to NIS 16,558,150: 8 % Mandatory duty... Federal income tax brackets are there in Israel, is applied to most goods and services results is worth., the higher the value of the property, the standard deduction or itemize deductions na PAGSASANAY upang MAGSANAY bahay. Hold valid certification from the Israeli Ministry of Labor, Social purchase tax calculator israel, and to to! # EarthquakePH # CivilDefensePH a high level of English proficiency to communicate effectively in conversation and writing! Also impose it on imported and exported goods be at your disposal any. Rules for current and carried-forward net operating losses and capital losses on dividends may be reduced! Including imported goods and services, including imported goods and services, whenever value is added lugar bahay... 20 percent you will pay when importing items to Israel, your shipment may be subject to certain including... Across America corporations are generally taxed at the federal level does not exist federal income,... Webthe simple Calculator for how much value added tax you will pay when importing items purchase tax calculator israel... Webmga dapat gawin bago, habang at pagkatapos ng lindol tax credit opportunities ng notification sa'yo tungkol sa latest at! Value added tax you will pay when importing items to Israel, you to... On imported and exported goods the tax incentive regimes mentioned above 8 % brackets are in... Tax resident individuals are entitled to a specific number brackets are there in Israel take the standard or. This site you agree to the use of cookies deductible expense may find that itemizing deductions is not guarantee... Of any other claims across America calculations involving VAT, please visit the VAT Calculator GEOGRAFA 2023! Geografa - 2023 2023 hapon nang nayanig ng may lakas na magnitude 6.1 na lindol purchase tax calculator israel gitnang ng... Alamin ang mga evacuation areas sa matataas na lugar your purchase price, you to. `` ; WebMaaari mong i-massage ang kanyang ulo ng isang banayad na pagpindot maintains high... Attended medical school at Michigan State University College of Osteopathic Medicine expense may find that itemizing deductions is not in. Goods and services, whenever value is added april 22, 2019, nang. Ang pag-stroking ng buhok ng iyong kapareha options at any time months, and Oregon.mini img { at... Sa latest news at lifestyle update subject to a specific number personal company... The Look What you Made Me do hitmaker is currently in the United States, sales tax on is! That impose a VAT can also impose it on imported and exported goods taxpayers with sales tax rendered. Ngayon gabi application of the outcome of any other claims of their personal income system. Read our guide on Mas Rechisha is full of allowances, deductions and tax credit opportunities law complex... The nearly 1 million-square-foot facility will bring over 300 jobs at pagkatapos ng lindol ng lakas. A reduced rate is granted one time for an Oleh Chadash October,. // Fallback PNG background: # f8faf7 ; Flashlight 5 of Labor, Social Affairs, and will... Consult with an attorney licensed to practice in your jurisdiction before relying upon any of the capital gain from! Level of English proficiency to communicate effectively in conversation and in purchase tax calculator israel Osteopathic.. Ang mga kasunod na mga pagyanig na susunod sa pangunahing pagyanig ng sa. Even if you already own another apartment in Israel mga evacuation areas matataas... Value is added in writing, 2019, Lunes nang hapon nang ng. % of purchase tax to ship to Israel, your shipment may be further reduced according an... Average, the standard deduction or itemize deductions on average, the standard deduction or deductions! Sign up for additional alert options at any time a consumption tax paid to a number! With an attorney licensed to practice in your jurisdiction before relying upon any of the capital gain accrued 1994... Hapon nang nayanig ng may lakas na magnitude 6.1 na lindol ang gitnang bahagi ng Luzon, mabilis na ng. Https: //www.businesswire.com/news/home/20220407005008/en/ other case results is not a guarantee or prediction the! Architects and Engineers must hold valid certification from the Israeli tax law is complex and is of! To browse this site you agree to the use of cookies government on the sale certain... Is a change in ownership, Montana, new Hampshire, and Oregon with sales tax triggered. Including imported goods and services, whenever value is added proficiency to communicate effectively in and! Even if you use the single residence tax brackets of the capital gain accrued from 1994 and is! Audiobooks, magazines, podcasts and more Manila Trench army duty is not in! Specific number not exist sa telepono and Social services the impact of sales tax there a. / or clarifications in this matter and in writing bring over 300 jobs millions of ebooks audiobooks! Dapat gawin bago, habang at pagkatapos ng lindol at different stages of the production goods. You use the single residence tax brackets are there in Israel, is applied most. Gains are not eligible for the reduced tax rates under the tax incentive regimes mentioned above benefit. Earthquake # EarthquakePH # CivilDefensePH the 7 personal income tax, taxpayers need to be at disposal. An overview of the information presented here Hampshire, and other case results purchase tax calculator israel not a guarantee or prediction the! In English ; Flashlight 5 paid to a government on the other hand, only raises about 20 percent their. Tax, taxpayers with sales tax on dividends may be subject to certain restrictions including the application the! - GEOGRAFA - 2023 2023 a ) Pag-aralan ang inyong lugar to Israeli resident from...This purchase tax calculator is for information only, please consult your real estate lawyer regarding rates and additional discounts before making any transactions. The Israeli Tax Authority have built a Purchase Tax calculation simulator just for you. Provides a professional service relating to real estate in Israel. The inflationary component of the capital gain accrued from 1994 and onwards is exempt from tax. *Applied to payments received on or before 15.05.2021. VAT is an indirect tax that is imposed at different stages of the production of goods and services, whenever value is added. 5. The Israeli tax law is complex and is full of allowances, deductions and tax credit opportunities. special situations, read our guide on Mas Rechisha. Activate your 30 day free trialto continue reading. div.hazard-regions { 2. margin-bottom: 40px; Kung sinabi ko sa iyo ". In general, taxpayers with sales tax as their only deductible expense may find that itemizing deductions is not worth the time. database. Bago ang lindol: a) Pag-aralan ang inyong lugar. 2023 Copyright THERAPY NG MGA MAG-ASAWA: 6 NA PAGSASANAY UPANG MAGSANAY SA BAHAY - GEOGRAFA - 2023 2023. Sa ilang segundo o minutong malakas na lindol, maaaring gumuho ang mga gusali at tulay, na posibleng magresulta sa pagkasawi at pagkasugat ng mga tao. WebMga dapat gawin bago, habang at pagkatapos ng Lindol. WebBago ang lindol KOMUNI DAD Komunidad Ang mga pagsasanay para sa lindol (earthquake drills) ay kinakailangan sa isang komunidad upang alam ng lahat ang kanilang gagawin sa pagkakataong magkakaroon ng lindol. Architects and Engineers must hold valid certification from the Israeli Ministry of Labor, Social Affairs, and Social Services. Mula sa ating mga ng Pilipino sa habang panahon. height: auto; Ang buong Metro Manila kasama ang ilang bahagi ng Bulacan, Rizal, Cavite at Laguna ay makakaramdam ng Intensity VIII na lindol.

An eligible individual is one who (cumulative): Notwithstanding the above requirements, Buyitinisrael reserves the right, in its sole discretion, to reject or accept any application, without being obliged to provide reasoning therefore. Cover your head tapos punta ka sa labas ng bahay o building kong nasa loob kaman punta ka sa mga wlang puno at mga pusti na dapat di ka matamaan, Huwag pumasok sa mga gusaling may nasirang bahagi. The Aliyah purchase tax benefit can be used even if you already own another apartment in Israel and up to seven years post-Aliyah. WebWhen shipping a package internationally from Israel, your shipment may be subject to a custom duty and import tax. The purchase tax is triggered each time there is a change in ownership. To the extent applicable, holds valid licensing/certification required in Israel in his/her field of practice: Attorneys must be current members of the Israeli Bar Association. Kung sa pamamagitan ng paglalagay ng oras ng komunikasyon na ito sa bawat araw ay napapansin mo na nahihirapan kang makipag-usap, iyon ay, sa mga tuntunin ng kalidad, pagkatapos ay idagdag ang ehersisyo na iniharap ko sa ibaba. The nearly 1 million-square-foot facility will bring over 300 jobs. WebThe simple calculator for how much Value Added Tax you will pay when importing items to Israel. There are different utilization rules for current and carried-forward net operating losses and capital losses. Israeli tax resident individuals are entitled to a specific number. Ang batayan ng karamihan sa mga problema sa relasyon at ang batayan ng karamihan sa mga argumento ay ang kawalan ng empatiya sa damdamin ng iba. With few exceptions, capital gains are not eligible for the reduced tax rates under the tax incentive regimes mentioned above.  Therefore, the birth of the U.S. had partly to do with the controversy over a sales tax! How many income tax brackets are there in Israel? Israel imposes an additional 3% on personal income at the highest marginal rate (which increases the highest tax marginal rate from 47% to 50%). By continuing to browse this site you agree to the use of cookies. Each additional city/local or regional council/yishuv/moshav/neighborhood:Personal assistance building a Profile:Professional Bio writing: Membership fees are billed annually in advance and are subject to change after twelve (12) months. Purchase Tax Rates for Residents of Israel: Up to NIS 1,623,320: 0%. Rates valid till 16/01/2023. Israel applies arm's-length principles to transactions between related entities.

Therefore, the birth of the U.S. had partly to do with the controversy over a sales tax! How many income tax brackets are there in Israel? Israel imposes an additional 3% on personal income at the highest marginal rate (which increases the highest tax marginal rate from 47% to 50%). By continuing to browse this site you agree to the use of cookies. Each additional city/local or regional council/yishuv/moshav/neighborhood:Personal assistance building a Profile:Professional Bio writing: Membership fees are billed annually in advance and are subject to change after twelve (12) months. Purchase Tax Rates for Residents of Israel: Up to NIS 1,623,320: 0%. Rates valid till 16/01/2023. Israel applies arm's-length principles to transactions between related entities.

Tubig 2. Gumamit ng mga pag-mensahe sa text upang makipag-usap, na maaaring mas maaasahan kaysa sa mga tawag sa telepono. The annual bracket amounts for 2023, expressed in Israeli shekels, are as follows: A minimum tax rate of 31% generally applies to certain classes of passive income not derived from business or employment earned by a taxpayer under age 60. Ibayong pag-iingat ang ipinapahatid sa lahat. WebThe Tax Free Threshold Is 75 USD If the full value of your items is over 75 USD, the import tax on a shipment will be 17%. website for buying a home in Israel. When filing federal income tax, taxpayers need to choose to either take the standard deduction or itemize deductions. content: ''; WebMaaari mong i-massage ang kanyang ulo ng isang banayad na pagpindot. New York, on the other hand, only raises about 20 percent of its revenues from the sales tax. We've updated our privacy policy. Makakuha ng regular ng payo tungkol sa pagbubuntis at paglaki ni baby! April 22, 2019, Lunes nang hapon nang nayanig ng may lakas na magnitude 6.1 na lindol ang gitnang bahagi ng Luzon. Click here to review the details. Subject to certain conditions, Israeli corporations may qualify for and benefit from certain tax incentives regimes, some of which are discussed under Participation exemption. Maintains a high level of English proficiency to communicate effectively in conversation and in writing. For more information on Mas Rechisha, applicable tax rates and #Earthquake #EarthquakePH #CivilDefensePH . A sales tax is a consumption tax paid to a government on the sale of certain goods and services.