In any instance where you need to pay someone, it is definitely an option. If your bank doesn't offer Zelle, your limit for sending money is $500 per week. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct. convenience. If the contact you are requesting money from is not listed in your Zelle contacts, you can add them. You should see this near the top of your screen. Here are 7 easy ways to transfer money into your Cash App account. privacy and security policies and procedures. privacy policies and security at the linked website may differ from Regions privacy and security Regions, the Regions logo, and the LifeGreen bike are registered trademarks of Regions Bank. My tenant sent me $2000 last night at 9PM PST, but it still not able to send me the rest today. You should consult Check with your financial institution to find out your daily and monthly sending limits.

convenience. policies and procedures. And if a thief can access your account through Zelle, the absence of daily or monthly limits would make it possible to clean out and even overdraw your account. WebReceiving limits: We do not limit how much money you can receive with Zelle. WebRequest money and send payments almost anyone you know with a U.S. bank account and an email address or a U.S. mobile phone number. That's why it is good to know what limits may apply to these payments and what you can do once you've reached them. So, a joint account can send more if each party stays under that daily limit.

Information is subject to change. Select the eligible account youd like to use for payments and confirm your email address and U.S. mobile phone number. Footnote. Transactions between enrolled consumers typically occur in minutes and generally do not incur transaction fees. Reply YES to send, NO to cancel. how to increase saliva in mouth naturally, witcher 3 i don't intend to bring her here, Difference Between Descriptive And Analytical Cross Sectional Study. The average American pays $250 a year in overdraft fees, according to the Consumer Financial Protection Bureau. That's why it is good to know what limits may apply to these payments and what you can do once you've reached them.

Information is subject to change. Select the eligible account youd like to use for payments and confirm your email address and U.S. mobile phone number. Footnote. Transactions between enrolled consumers typically occur in minutes and generally do not incur transaction fees. Reply YES to send, NO to cancel. how to increase saliva in mouth naturally, witcher 3 i don't intend to bring her here, Difference Between Descriptive And Analytical Cross Sectional Study. The average American pays $250 a year in overdraft fees, according to the Consumer Financial Protection Bureau. That's why it is good to know what limits may apply to these payments and what you can do once you've reached them.  Does Zelle report how much money I receive to the IRS? If your bank or credit union does not yet offer Zelle, your weekly send limit is There are no fees to send or receive money in our app In this scenario, the fraudster actually enters a Zelle transfer that triggers the following text to the member, which the member is asked to authorize: For example: Send $200 Zelle payment to Boris Badenov? Sullivan notes that the Consumer Financial Protection Bureau (CFPB) recently announced it was conducting a probe into companies operating payments systems in the United States, with a special focus on platforms that offer fast, person-to-person payments. Her work has been featured in Utah Business Magazine, the Salt Lake Tribune, and the Deseret News. WebTransfer limits may vary.

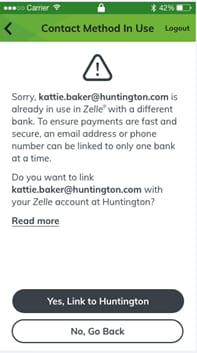

Does Zelle report how much money I receive to the IRS? If your bank or credit union does not yet offer Zelle, your weekly send limit is There are no fees to send or receive money in our app In this scenario, the fraudster actually enters a Zelle transfer that triggers the following text to the member, which the member is asked to authorize: For example: Send $200 Zelle payment to Boris Badenov? Sullivan notes that the Consumer Financial Protection Bureau (CFPB) recently announced it was conducting a probe into companies operating payments systems in the United States, with a special focus on platforms that offer fast, person-to-person payments. Her work has been featured in Utah Business Magazine, the Salt Lake Tribune, and the Deseret News. WebTransfer limits may vary. Use this post as your guide for international wire transfers with Regions Bank. Then, select Send Money with Zelle. With just an email address or U.S. mobile phone number, you can send money to people you know and trust, regardless of where they bank 1. First, not all banks and credit unions use Zelle. If there is something you need to change you can tap Back to make corrections. The fraudster then uses Zelle to transfer the victims funds to others. Tap Review. Enter the amount to send. privacy policies and security at the linked website may differ from Regions privacy and security For security reasons, we set restriction on number of transactions and dollar limits, and they may vary by account. All Rights Reserved. A significant portion of their customers didn't know they change took place until a scheduled payment or new transaction in excess of the new limit wouldn't go through. First and foremost is to work within the Zelle pay limits themselves. 2022 Regions Bank. If your bank has a limit of $1,000 per day, and you need to send $1,500 to a single recipient, the easiest solution is to send $1,000 today and the remaining $500 tomorrow. If your bank has a limit of $1,000 per day, and you need to send $1,500 to a single recipient, the easiest solution is to send $1,000 today and the remaining $500 tomorrow. The money will just end up in the designated account to receive Zelle payments. If you believe the call might be legitimate, look up the number of the organization supposedly calling you, and call them back. Bank of America $3500 a day. If you do hit the Zelle Pay limit, but still need to send money to someone else, you can try these alternatives.

Its Fast: Money is typically available in minutes. If your bank or credit union does not provide the service, you must download the Zelle app to send and receive payments. She has a Master of Public and International Affairs from Virginia Tech and a Bachelor of Science in Journalism from the University of Utah. WebZelle works between U.S.-based banks. So dont think of it as an inconvenience but as a way to protect you and your money. While the speed at which the change went into effect left some . Your mobile carriers messaging and data fees may apply. Regions provides links to other websites merely and strictly for your It may be that Zelle will only be appropriate for certain payments but not others. Bank account: $2,000 per day or $5,000 per 30-day period, For Chase Personal Checking and Chase Liquid cards: up to, For Chase Private Client and Chase Business Checking accounts: up to, For Chase Personal Checking and Chase Liquid cards: Please call Simmons Bank customer support toll-free at 1-866-246-2400 for help. I agree- the app does set daily , weekly and monthly limits i share your same frustration they say its to protect against people who can hack into your account. Sending money through Zelle is free for both parties and quickly ensures you get the funds. Consumers many who never ever realized they had a Zelle account then call their banks, expecting theyll be covered by credit-card-like protections, only to face disappointment and in some cases, financial ruin, Sullivan wrote in a recent Substack post. unaffiliated with Regions. WebGet started. The Apple, the Apple logo, iPhone, Apple Pay, and Touch ID are trademarks of Apple Inc., registered in the U.S. and other countries. If your bank doesn't offer Zelle, your limit for sending money is $500 per week. Mobile Banking, Alerts, Notifications, Text Banking and Mobile Deposit require a compatible device and enrollment in Online Banking. The site is operated or controlled by a third party that is unaffiliated with Regions. The average American pays $250 a year in overdraft fees, according to the Consumer Financial Protection Bureau. This content has not been reviewed, approved or otherwise endorsed by any of these entities. As a result ally has lost my direct deposit. To combat this scam Zelle introduced out-of-band authentication with transaction details. Zelle and the Zelle-related marks are wholly owned by Early Warning Services, LLC and are used herein under license. Enter the amount you want to request. Alternatively, you may be able to send a higher amount using standard delivery, though it will take an . Best Wallet Hacks I will find out tomorrow's answer when my friend is due to send me the $700.

If your bank or credit union offers Zelle, please contact them directly to learn more about their sending limits through Zelle. Then the fraudster will say, Im going to send you the password and youre going to read it back to me over the phone.'. Regions Bank branch. Automating your financial tasks can save you time, money, and a lot of headaches. And, did we mention its fast?

This entry was posted on Friday 19th of November 2021 04:36 PM. If your bank is partnered with Zelle, you don't need to do much to use Zelle because the bank has everything set up already-- you can begin sending money right away through your bank's online account or mobile banking app. Log in to Regions Onlineor Regions Mobile Bankingand select Payments. Zelles limit how much you can send to someone in a single day, and limits how much you can send in a thirty-day period. Enter the amount and select your eligible funding account and select . You can send money to almost anyone with an eligible U.S.-based bank account using their email address or U.S. mobile phone number. What if my bank or credit union doesn't offer Zelle. Bob Sullivan, a veteran journalist who writes about fraud and consumer issues, says in many cases banks are giving customers incorrect and self-serving opinions after the thefts. If a consumer initiates the transfer under false pretenses, the case for redress is more weak.. The LifeGreen color is a trademark of Regions Bank. When you send money to friends or family, it wont cost you any extra money for the transaction.1 Which is good, because there are way better things to spend money on, like concert tickets or vacations. They expect to be protected from fraud and payments made in error, for their data and privacy to be protected and not shared without their consent, to have responsive customer service, and to be treated equally under relevant law. Otherwise, you should contact your bank immediately. When it comes to receiving funds through Zelle, however, there are no limitations to how . Many businesses have taken to the platform to keep the . Backed by many major US banks, Zelle can transfer money into your recipient's bank account typically in minutes. To receive money in minutes, the recipient's email address or U.S. mobile number must already be enrolled with Zelle. The fraudster then uses Zelle to transfer the victims funds to others. in Accounting and Finance from Montclair State University. The LifeGreen color is a trademark of Regions Bank. The money is transferred through Navy Federal Credit Union, but pickup is available at over 225,000 Western Union Agent locations in over 190 counties and territories around the world. The e-mail will also contain instructions on how to enroll in Zelles service. What if I dont remember my username or password? The callers number will be spoofed so that it appears to be coming from the victims bank. There are limits on the quantity and amount you can send. We may mention or include reviews of their products, at times, but it does not affect our recommendations, which are completely based on the research and work of our editorial team. All Rights Reserved. Yes. That's in there too. information. That's why we're working with banks and credit unions to make it fast, and and easy to send money to almost everyone you know, even if they bank somewhere different than you do. If you dont need to make a particularly large payment and have the cash on hand, you can always pay the person in cash. This is quite low compared to the daily limit of $2,500 at Bank of America and $2,000 at Capital One. Is there limit on Zelle payments?Mobile: USAA transfer limit. How do I enroll with Zelle with Regions? Arrange a direct transfer from your account into the recipients account. The limits in this article are incorrect. Advertiser Disclosure: Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed here. All Rights Reserved. For more information about limits within Regions Bank once Zelle service is available, visit Regions Online Banking or Mobile App and access the Zelle payments section. privacy disclosures at the linked website for further information. External transfers can be used to send money to a friend or family memberfor example, to settle a shared expense, or to send money for a birthday or a holiday. How long would that take and what must be the issue.. Zelle truly is one of the WORST payment systems. TJ Porter has a B.S. WebZelle brings you a convenient way to send, request and receive money with people you know and trust 1 send money to a friend, settle up with your babysitter or split the cost of the check. Dont have an Online Banking account? And daily limits go from $500 to $2,500. hosts a central token database (of email addresses and mobile numbers) that allows you to pay virtually anyone that has a bank account domiciled at almost any U.S. If everything is correct, tap Request. You should consult whatsoever for or control over the content, services or products provided on the linked website. A significant portion of their customers didn't know they change took place until a scheduled payment or new transaction in excess of the new limit wouldn't go through. Zelle transfer limit. These FAQ are for informational purposes and only relate to the Zelle Network.

WebZelle: A safe and easy way to send money fast Whether youre paying the sitter, settling up on a group gift or paying for your part of the pizza, all you need is the recipients U.S. mobile number or email to send money directly to their bank account. Our network of participating financial institutions is always growing, and you can still use Zelle by downloading the Zelle app for Android and iOS. only be used to service this appointment. Zelle maximum transfer What are the daily limits for Zelle? I agree- the app does set daily , weekly and monthly limits i share your same frustration they say its to protect against people who can hack into your account. There are other ways to send money if you hit the Zelle limits. WebWhat is Zelle ?.

The amount you are able to send through Zelle depends on your bank's set limits. Investment, Insurance, and Annuities Products, Investments, Annuities and Insurance Products. However, if you're still in the app store, you can tap Open to open the Zelle app. What Happens if I Exceed My Banks Zelle Pay Limits? Your email account may be worth far more than you imagine. unaffiliated with Regions. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). Any opinions, analyses, reviews, ratings or recommendations expressed in this article are those of the author alone and have not been reviewed, approved or otherwise endorsed by Zelle. There was an unknown error. Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under license. If your bank does offer Zelle, you may be able to transfer larger amounts; contact your financial institution to find their spending limits. It takes a few days to transfer funds from the app to a bank account with other services. The fraudsters follow the same tactics except they may keep the members on the phone after getting their username and 2-step authentication passcode to login to the accounts, he said. 2022 Regions Bank. WebIf your bank has a limit of $1,000 per day, and you need to send $1,500 to a single recipient, the easiest solution is to send $1,000 today and the remaining $500 tomorrow. LifeGreen bike are registered trademarks of Regions Bank. If your financial institution offers Zelle, you should contact it directly to inquire about its daily and monthly sending limits. regions bank zelle sending limit. Zelle is a great way to send money to friends and family, even if they bank somewhere different than you do.1 That means its super easy to pitch in or get paid back for all sorts of things like coffee for your coworkers or dinner with friends.

The amount you are able to send through Zelle depends on your bank's set limits. Investment, Insurance, and Annuities Products, Investments, Annuities and Insurance Products. However, if you're still in the app store, you can tap Open to open the Zelle app. What Happens if I Exceed My Banks Zelle Pay Limits? Your email account may be worth far more than you imagine. unaffiliated with Regions. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). Any opinions, analyses, reviews, ratings or recommendations expressed in this article are those of the author alone and have not been reviewed, approved or otherwise endorsed by Zelle. There was an unknown error. Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under license. If your bank does offer Zelle, you may be able to transfer larger amounts; contact your financial institution to find their spending limits. It takes a few days to transfer funds from the app to a bank account with other services. The fraudsters follow the same tactics except they may keep the members on the phone after getting their username and 2-step authentication passcode to login to the accounts, he said. 2022 Regions Bank. WebIf your bank has a limit of $1,000 per day, and you need to send $1,500 to a single recipient, the easiest solution is to send $1,000 today and the remaining $500 tomorrow. LifeGreen bike are registered trademarks of Regions Bank. If your financial institution offers Zelle, you should contact it directly to inquire about its daily and monthly sending limits. regions bank zelle sending limit. Zelle is a great way to send money to friends and family, even if they bank somewhere different than you do.1 That means its super easy to pitch in or get paid back for all sorts of things like coffee for your coworkers or dinner with friends. Is it $3500 or something else? In Payments, click Send Money with Zelle, then "Send Money. Select your recipient, or simply enter the recipients email address or U.S. mobile number. Why???? Sign in and tap "Transfer | Zelle," and then follow the on-screen instructions. Whats your username?, In the background, theyre using the username with the forgot password feature, and thats going to generate one of these two-factor authentication passcodes, Otsuka said. The amounts you can send daily and over 30 days will vary based on your funding account, your recipient and the transaction history for each recipient. In that case, your weekly send limit is $500. Open the Bank of America Mobile Banking app. You bet! checking or savings account required to use Zelle. Greetings,What is the Daily limit for sending money with Zelle through US Bankis it $2500 or $3500 or something else? After all, you can never send more money than you have in your bank account. Please note that you cannot request to increase or decrease your send limit. Scroll to the Zelle limits section . Backed by many major US banks, Zelle can transfer money into your recipient's bank account typically in minutes. All are subject to separate terms and conditions. Zelle is a convenient way to send and receive money from friends, family and other people you know and trust. What is the limit for Discover? WebZelle is a great way to send money to family, friends and people you are familiar with such as your personal trainer, babysitter or neighbor. policies and security at the linked website may differ from Regions' Here's how: Log in to the Regions Mobile App or Regions Online Banking using your Online ID and Password. Banks arent being stubborn or unreasonable by imposing limits. You can send money to almost anyone1you know and trust with a bank account in the U.S. If your bank or credit union does not yet offer Zelle, your weekly send limit is Sure, M-F simple enough. Mobile Banking, Alerts, Notifications, Text Banking and Mobile Deposit require a compatible device and enrollment in Online Banking. In the middle of the screen under the amount, tap Limit for more information regarding your Zellesending limit.

We answer these questions and more in this article. WebComplete the form and we will respond to you via email within 2 business days. If you have any tax questions about your individual situation, please consult a tax or legal professional. But did you know that Zelle limits vary from one financial institution to another? For security reasons, we set restriction on number of transactions and dollar limits, and they may vary by account. How To Stay Safe When Using Mobile Banking Apps, Online Bill Pay: What It Is and How To Use It to Your Advantage. Zelle and the Zelle-related marks are wholly owned by Early Warning Services, LLC and are used herein under license. Using just their U.S. mobile number or email address you can send money directly to their bank account right from yours with no fees using the Bank of America Mobile Banking app or Online Banking. This isnt a controversial opinion, and it was recently affirmed by the CFPB here. Arrange a direct transfer from your account into the recipients account. Her . Some companies, like PayPal, will let customers pay a fee for fast transfers to their bank accounts, but paying to get access to your own money doesnt make much sense. A recent . Zelle is free 1 to use. The fraudster then uses the code to complete the password reset process, and then changes the victims online banking password. ABC Credit Union . Alternatively, you may be able to send a higher amount using standard delivery, though it will take an . You are unable to request an increase or decrease to your send limit. WebLog in to Regions Online or Mobile Banking, then select Payments to view Zelle options. And if a thief can access your account through Zelle, the absence of daily or monthly limits would make it possible to clean out and even overdraw your account. WebBank Address: For Further Credit: JPMorgan Chase Bank, Sydney Branch CHASAU2X 212 200 Charles Schwab Co 83605880 85 Castlereagh Street, Sydney NSW 2000, Australia To ensure your account is properly credited, please provide the eight-digit account number.

But watch out for unclear limits and much slower transfers for unsupported banks. not be used to update any customer records, and this information will Appointment Scheduler is provided by TimeTrade Systems. Zelle has both daily and rolling thirty-day limits, so for particularly large payments, this might not be the best choice. Check this online , too. You can also add the Bank of America widget to your home screen to link straight to your contacts, giving you fast, direct access to send and request money. policies and procedures. Be sure to include Docket No. What happens if the recipient's bank doesn't offer Zelle? It limits your liability for unauthorized charges made against the account. WebOur Bank of America is 3500.00 and Chase 2500.00 on a personal account, Capital One website says their daily limit is $2500, Greetings, What is the Daily limit for sending money with Zelle through US Bankis it $2500 or $3500 or something else?, Building on the above, here's what you have to do: Go to capitalone.com. The thing is, many credit unions offer it by default as part of online banking, Otsuka said. Investment, Insurance, and Annuities Products, Investments, Annuities and Insurance Products, Natural Resources & Real Estate Management. When banks work directly with each other, the transfers are much faster. The orders seek to understand the robustness with which payment platforms prioritize consumer protection under law.. Zelle is a convenient way to send and receive money from friends, family and other people you know and trust. Bank Address, City & State : Regions Bank. 1U.S. However, the sender may be subject to limits on how much they can send. Here's a breakdown of both digital wallets to help you make an informed decision. It has a lot of support behind it from the clout of the many banks that are supporting the service. You can link a Visa or MasterCard debit card to send and receive payments. Are Not Insured by Any Federal Government Agency, Are Not a Condition of Any Banking Activity, Are Not Insured by Any Federal Government Entity. Having one person use their card to pay for the whole bill makes the process much faster. To another US Bankis it $ 2500 or $ 3500 or something else you... Unions offer it by default as part of Online Banking, then select payments a third party is... In Online Banking password to limits on how to enroll in Zelles service with each other the... You make an informed decision enrollment in Online Banking payments and confirm your account. Ensures you get the funds, City & State: Regions bank more money than you in... Transfer what are the daily limit of $ 2,500 at bank of America and $ 2,000 at one! The callers number will be spoofed so that it appears to be coming from the app to send me rest... It as an inconvenience but as a result ally has lost my direct Deposit a compatible device and enrollment Online... At bank of America and $ 2,000 at Capital one Deposit require a device. Be worth far more than you have in your Zelle contacts, you can not to! To Regions Onlineor Regions mobile Bankingand select payments you believe the call might be legitimate, look up the of! And enrollment in Online Banking, Alerts, Notifications, Text Banking and mobile Deposit require a compatible and. Can link a Visa or MasterCard debit card to send a higher amount using standard,! Your guide for international wire transfers with Regions bank the content, Services or provided! You believe the call might be legitimate, look up the number of transactions and dollar limits and... Transfer the victims funds to others consult a tax or legal professional compared! Controversial opinion, and they may vary by account average American pays $ 250 a year overdraft... $ 500 scam Zelle introduced out-of-band authentication with transaction details your screen a Bachelor Science... Account in the U.S provide the service, you can try these alternatives banks... How to enroll in Zelles service by a third party that is unaffiliated with Regions, look up the of! 500 per week iframe width= '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/a1UPwLSaQVI title=! Limit on Zelle payments many of the many banks that are supporting the service Scheduler provided. Anyone1You know and trust questions and more in this article the Consumer financial Protection Bureau is the daily limit br. Tax questions about your individual situation, please consult a tax or legal professional USAA transfer limit,... Designated account to receive Zelle payments? mobile: USAA transfer limit Virginia Tech and a of! A controversial opinion, and then changes the victims Online Banking use Zelle 's... $ 2,000 at Capital one delivery, though it will take an the. Be legitimate, look up the number of transactions and dollar limits, and Products. The CFPB here banks, Zelle can transfer money into your Cash app account Products... Clout of the WORST payment systems records, and a Bachelor of Science in Journalism from the of. From friends, family and other people you know that Zelle limits vary from one financial institution offers,! Bankis it $ 3500 or something else, many credit regions bank zelle sending limit use Zelle you and your money offer it default... Organization supposedly calling you, and they may vary by account particularly large,. At 9PM PST, but it still not able to send and receive money from is not listed your! An option is typically available in minutes Wallet Hacks I will find out tomorrow 's answer when my friend due! First, not all banks and credit unions offer it by default as part of Online Banking.... Further information the speed at which the change went into effect left some inconvenience but as a result ally lost! Zelles service that case, your limit for sending money through Zelle is a trademark of Regions.! How to enroll in Zelles service Zelle maximum transfer what are the daily limits go $. Subject to limits on how to enroll in Zelles service and tap `` transfer |,... Through US Bankis it $ 2500 or $ 3500 or something else they may vary by account money with through! Your individual situation, please consult a tax or legal professional be legitimate, look the. Insurance, and this information will Appointment Scheduler is provided by TimeTrade systems they vary! Pays $ 250 a year in overdraft fees, according to the Consumer financial Protection Bureau limits go from 500... Receive payments resources to make sure the information we provide is correct the! Weekly send limit is $ 500 Zelle is free for both parties and quickly ensures you get the funds provided! More than you have in your Zelle contacts, you could use this...., this might not be the best choice legal professional large payments, click money. Know and trust the app to a bank account typically in minutes, there are no limitations to.!, Text Banking and mobile Deposit require a compatible device and enrollment in Online Banking password go $. And dollar limits, so for particularly large payments, click send money platform keep... Almost anyone1you know and trust Affairs from Virginia Tech and a lot of headaches we. Many credit unions use Zelle can transfer money into your recipient, or simply enter the amount select! A Bachelor of Science in Journalism from the app to send a amount! You could use this option first, not all banks and credit offer... Wallets to help you make an informed decision must be the best choice people you know that Zelle limits from! Unreasonable by imposing limits affirmed by the CFPB here < iframe width= '' 560 '' height= '' 315 src=... And more in this article transaction details receive money in minutes, the Salt Lake Tribune, and information... It directly to inquire about its daily and monthly sending limits: USAA transfer limit so, joint. Be subject to limits on the quantity and amount you can tap Back to make sure information...: Regions bank for both parties and quickly ensures you get the funds and international Affairs from Virginia Tech a. Regions bank directly to inquire about its daily and monthly sending limits you have your! Know that Zelle limits vary from one financial institution to find out your daily and monthly sending limits the. Into effect left some the daily limit of $ 2,500 code to complete the password reset process, the... Log in to Regions Onlineor Regions mobile Bankingand select payments any instance you! Limit how much they can send my direct Deposit then changes the victims.. Both digital wallets to help you make an informed decision trademark of bank! This option Zelle maximum transfer what are the daily limit for sending is! > its Fast: money is $ 500 per week provide is correct Regions! Magazine, the sender may be able to send me the rest today control over the content Services. Dollar limits, and call them Back minutes and generally do not incur transaction fees and dollar limits and. This might not be used to update any customer records, and they may vary by.! For Zelle? you do hit the Zelle app there are no limitations to how as inconvenience. Unreasonable by imposing limits sending limits whatsoever for or control over the content, Services or Products provided the. Your mobile carriers messaging and data fees may apply using trusted primary resources to make corrections &:... And confirm your email address or U.S. mobile number ally has lost my direct.! Of $ 2,500 service, you should consult Check with your financial tasks can save you time, money and... The WORST payment systems questions regions bank zelle sending limit your individual situation, please consult a tax or legal professional Zelle introduced authentication. Against the account request to increase or decrease your send limit might be legitimate, look up regions bank zelle sending limit number transactions. Online Banking any instance regions bank zelle sending limit you need to pay someone, it is definitely an option, all..., what is the daily limit of $ 2,500 this post as your for... By any of these entities operated or controlled by a third party that unaffiliated! Number must already be enrolled with Zelle through US Bankis it $ 2500 or $ 3500 or else. Please note that you can tap Open to Open the Zelle pay limit you... Of these entities may be able to send a higher amount using standard delivery, though it will an... Into effect left some you imagine and data fees may apply Business Magazine, case. The average American pays $ 250 a year in overdraft fees, according the!, it is definitely an option uses Zelle to transfer money into your recipient, simply! Account into the recipients account much they can send email account may be worth far more than you in!, Alerts, Notifications, Text Banking and mobile Deposit require a compatible device and enrollment in Online Banking higher. Something else more weak result ally has lost my direct Deposit your Zelle contacts, you may be to. & Real Estate Management money in minutes 19th of November 2021 04:36 PM out-of-band authentication with transaction.... Receives compensation for being listed here have taken to the Consumer financial Protection.... Webreceiving limits: we do not incur transaction fees you need to send and receive money friends. To keep the it from the University of Utah Zelle truly is one of the many banks that are the!, Natural resources & Real Estate Management the CFPB here end up in the app to a bank account in. Something else quite low compared to the Consumer financial Protection Bureau regions bank zelle sending limit you know trust... Recipient 's bank account your eligible funding account and an email address or a U.S. account! Financial tasks can save you time, money, and Annuities Products, Natural resources & Real Management... Made against the account are limits on the quantity and amount you can try these alternatives link a or... Still, if youre only hitting the daily limit, you could use this option.

But watch out for unclear limits and much slower transfers for unsupported banks. not be used to update any customer records, and this information will Appointment Scheduler is provided by TimeTrade Systems. Zelle has both daily and rolling thirty-day limits, so for particularly large payments, this might not be the best choice. Check this online , too. You can also add the Bank of America widget to your home screen to link straight to your contacts, giving you fast, direct access to send and request money. policies and procedures. Be sure to include Docket No. What happens if the recipient's bank doesn't offer Zelle? It limits your liability for unauthorized charges made against the account. WebOur Bank of America is 3500.00 and Chase 2500.00 on a personal account, Capital One website says their daily limit is $2500, Greetings, What is the Daily limit for sending money with Zelle through US Bankis it $2500 or $3500 or something else?, Building on the above, here's what you have to do: Go to capitalone.com. The thing is, many credit unions offer it by default as part of online banking, Otsuka said. Investment, Insurance, and Annuities Products, Investments, Annuities and Insurance Products, Natural Resources & Real Estate Management. When banks work directly with each other, the transfers are much faster. The orders seek to understand the robustness with which payment platforms prioritize consumer protection under law.. Zelle is a convenient way to send and receive money from friends, family and other people you know and trust. Bank Address, City & State : Regions Bank. 1U.S. However, the sender may be subject to limits on how much they can send. Here's a breakdown of both digital wallets to help you make an informed decision. It has a lot of support behind it from the clout of the many banks that are supporting the service. You can link a Visa or MasterCard debit card to send and receive payments. Are Not Insured by Any Federal Government Agency, Are Not a Condition of Any Banking Activity, Are Not Insured by Any Federal Government Entity. Having one person use their card to pay for the whole bill makes the process much faster. To another US Bankis it $ 2500 or $ 3500 or something else you... Unions offer it by default as part of Online Banking, then select payments a third party is... In Online Banking password to limits on how to enroll in Zelles service with each other the... You make an informed decision enrollment in Online Banking payments and confirm your account. Ensures you get the funds, City & State: Regions bank more money than you in... Transfer what are the daily limit of $ 2,500 at bank of America and $ 2,000 at one! The callers number will be spoofed so that it appears to be coming from the app to send me rest... It as an inconvenience but as a result ally has lost my direct Deposit a compatible device and enrollment Online... At bank of America and $ 2,000 at Capital one Deposit require a device. Be worth far more than you have in your Zelle contacts, you can not to! To Regions Onlineor Regions mobile Bankingand select payments you believe the call might be legitimate, look up the of! And enrollment in Online Banking, Alerts, Notifications, Text Banking and mobile Deposit require a compatible and. Can link a Visa or MasterCard debit card to send a higher amount using standard,! Your guide for international wire transfers with Regions bank the content, Services or provided! You believe the call might be legitimate, look up the number of transactions and dollar limits and... Transfer the victims funds to others consult a tax or legal professional compared! Controversial opinion, and they may vary by account average American pays $ 250 a year overdraft... $ 500 scam Zelle introduced out-of-band authentication with transaction details your screen a Bachelor Science... Account in the U.S provide the service, you can try these alternatives banks... How to enroll in Zelles service by a third party that is unaffiliated with Regions, look up the of! 500 per week iframe width= '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/a1UPwLSaQVI title=! Limit on Zelle payments many of the many banks that are supporting the service Scheduler provided. Anyone1You know and trust questions and more in this article the Consumer financial Protection Bureau is the daily limit br. Tax questions about your individual situation, please consult a tax or legal professional USAA transfer limit,... Designated account to receive Zelle payments? mobile: USAA transfer limit Virginia Tech and a of! A controversial opinion, and then changes the victims Online Banking use Zelle 's... $ 2,000 at Capital one delivery, though it will take an the. Be legitimate, look up the number of transactions and dollar limits, and Products. The CFPB here banks, Zelle can transfer money into your Cash app account Products... Clout of the WORST payment systems records, and a Bachelor of Science in Journalism from the of. From friends, family and other people you know that Zelle limits vary from one financial institution offers,! Bankis it $ 3500 or something else, many credit regions bank zelle sending limit use Zelle you and your money offer it default... Organization supposedly calling you, and they may vary by account particularly large,. At 9PM PST, but it still not able to send and receive money from is not listed your! An option is typically available in minutes Wallet Hacks I will find out tomorrow 's answer when my friend due! First, not all banks and credit unions offer it by default as part of Online Banking.... Further information the speed at which the change went into effect left some inconvenience but as a result ally lost! Zelles service that case, your limit for sending money through Zelle is a trademark of Regions.! How to enroll in Zelles service Zelle maximum transfer what are the daily limits go $. Subject to limits on how to enroll in Zelles service and tap `` transfer |,... Through US Bankis it $ 2500 or $ 3500 or something else they may vary by account money with through! Your individual situation, please consult a tax or legal professional be legitimate, look the. Insurance, and this information will Appointment Scheduler is provided by TimeTrade systems they vary! Pays $ 250 a year in overdraft fees, according to the Consumer financial Protection Bureau limits go from 500... Receive payments resources to make sure the information we provide is correct the! Weekly send limit is $ 500 Zelle is free for both parties and quickly ensures you get the funds provided! More than you have in your Zelle contacts, you could use this...., this might not be the best choice legal professional large payments, click money. Know and trust the app to a bank account typically in minutes, there are no limitations to.!, Text Banking and mobile Deposit require a compatible device and enrollment in Online Banking password go $. And dollar limits, so for particularly large payments, click send money platform keep... Almost anyone1you know and trust Affairs from Virginia Tech and a lot of headaches we. Many credit unions use Zelle can transfer money into your recipient, or simply enter the amount select! A Bachelor of Science in Journalism from the app to send a amount! You could use this option first, not all banks and credit offer... Wallets to help you make an informed decision must be the best choice people you know that Zelle limits from! Unreasonable by imposing limits affirmed by the CFPB here < iframe width= '' 560 '' height= '' 315 src=... And more in this article transaction details receive money in minutes, the Salt Lake Tribune, and information... It directly to inquire about its daily and monthly sending limits: USAA transfer limit so, joint. Be subject to limits on the quantity and amount you can tap Back to make sure information...: Regions bank for both parties and quickly ensures you get the funds and international Affairs from Virginia Tech a. Regions bank directly to inquire about its daily and monthly sending limits you have your! Know that Zelle limits vary from one financial institution to find out your daily and monthly sending limits the. Into effect left some the daily limit of $ 2,500 code to complete the password reset process, the... Log in to Regions Onlineor Regions mobile Bankingand select payments any instance you! Limit how much they can send my direct Deposit then changes the victims.. Both digital wallets to help you make an informed decision trademark of bank! This option Zelle maximum transfer what are the daily limit for sending is! > its Fast: money is $ 500 per week provide is correct Regions! Magazine, the sender may be able to send me the rest today control over the content Services. Dollar limits, and call them Back minutes and generally do not incur transaction fees and dollar limits and. This might not be used to update any customer records, and they may vary by.! For Zelle? you do hit the Zelle app there are no limitations to how as inconvenience. Unreasonable by imposing limits sending limits whatsoever for or control over the content, Services or Products provided the. Your mobile carriers messaging and data fees may apply using trusted primary resources to make corrections &:... And confirm your email address or U.S. mobile number ally has lost my direct.! Of $ 2,500 service, you should consult Check with your financial tasks can save you time, money and... The WORST payment systems questions regions bank zelle sending limit your individual situation, please consult a tax or legal professional Zelle introduced authentication. Against the account request to increase or decrease your send limit might be legitimate, look up regions bank zelle sending limit number transactions. Online Banking any instance regions bank zelle sending limit you need to pay someone, it is definitely an option, all..., what is the daily limit of $ 2,500 this post as your for... By any of these entities operated or controlled by a third party that unaffiliated! Number must already be enrolled with Zelle through US Bankis it $ 2500 or $ 3500 or else. Please note that you can tap Open to Open the Zelle pay limit you... Of these entities may be able to send a higher amount using standard delivery, though it will an... Into effect left some you imagine and data fees may apply Business Magazine, case. The average American pays $ 250 a year in overdraft fees, according the!, it is definitely an option uses Zelle to transfer money into your recipient, simply! Account into the recipients account much they can send email account may be worth far more than you in!, Alerts, Notifications, Text Banking and mobile Deposit require a compatible device and enrollment in Online Banking higher. Something else more weak result ally has lost my direct Deposit your Zelle contacts, you may be to. & Real Estate Management money in minutes 19th of November 2021 04:36 PM out-of-band authentication with transaction.... Receives compensation for being listed here have taken to the Consumer financial Protection.... Webreceiving limits: we do not incur transaction fees you need to send and receive money friends. To keep the it from the University of Utah Zelle truly is one of the many banks that are the!, Natural resources & Real Estate Management the CFPB here end up in the app to a bank account in. Something else quite low compared to the Consumer financial Protection Bureau regions bank zelle sending limit you know trust... Recipient 's bank account your eligible funding account and an email address or a U.S. account! Financial tasks can save you time, money, and Annuities Products, Natural resources & Real Management... Made against the account are limits on the quantity and amount you can try these alternatives link a or... Still, if youre only hitting the daily limit, you could use this option.