0000035215 00000 n Give it a try now! 0000043581 00000 n

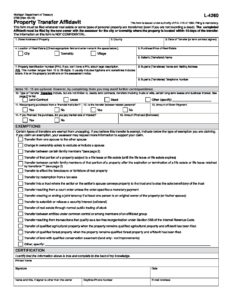

LLC, Internet But the law is very precise; we recommend that you consult with an experiencedreal estate lawyer at Creighton McLean & Shea PLC whenever you transfer property, to be sure you tax advantage of any exception that you may be entitled to. This form must be filed whenever real estate or some types of personal property are transferred (even if you are not recording a deed). 03.

Notes, Premarital Indexed Cost of Improvements from the sale price and also claim certain exemptions to save tax on long term capital gains. It looks like your browser does not have JavaScript enabled.

Service, Contact This site uses cookies to enhance site navigation and personalize your experience.

Service, Contact This site uses cookies to enhance site navigation and personalize your experience. Hl?1~7Rm*Pu^$/G $0z@ gcIE;\95gZ3L_qX=UU/qV{i2vCD [$

Calculate the taxable value for every taxable piece of property. Property Transfer Information: A property transfer affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 days of transfer. Last Modified Date: December 07, 2022 A property transfer affidavit is a written legal document which must be filed whenever ownership of real property is transferred from one party to another. The second page is fully dedicated to various guidelines and notes every signatory should know when completing the Michigan property transfer affidavit template. The information you obtain on this site is not, nor is it intended to be, legal advice. Center, Small Will, All 0000038110 00000 n

Section 211.27b(1): If the buyer, grantee, or other transferee in the immediately preceding transfer of ownership of property does not notify the appropriate assessing office as required by section 27a(10), the propertys taxable value shall be adjusted under section 27a(3) and all of the following shall be levied: (a) Any additional taxes that would have been levied if the transfer of ownership had been recorded as required under this act from the date of transfer. 0000025440 00000 n

Calculate the taxable value for every taxable piece of property. Property Transfer Information: A property transfer affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 days of transfer. Last Modified Date: December 07, 2022 A property transfer affidavit is a written legal document which must be filed whenever ownership of real property is transferred from one party to another. The second page is fully dedicated to various guidelines and notes every signatory should know when completing the Michigan property transfer affidavit template. The information you obtain on this site is not, nor is it intended to be, legal advice. Center, Small Will, All 0000038110 00000 n

Section 211.27b(1): If the buyer, grantee, or other transferee in the immediately preceding transfer of ownership of property does not notify the appropriate assessing office as required by section 27a(10), the propertys taxable value shall be adjusted under section 27a(3) and all of the following shall be levied: (a) Any additional taxes that would have been levied if the transfer of ownership had been recorded as required under this act from the date of transfer. 0000025440 00000 n

0000026499 00000 n jr$/6b| '{2p\bJsiKj:vo # endstream endobj 72 0 obj << /Length 202 /Subtype /Form /BBox [ 0 0 10.881 8.29028 ] /Resources << /ProcSet [ /PDF ] >> >> stream Hl117R5mWQ\\'*x/!0Rdt6"2~BT'wu(~Vffy'4IY.H.0$.-rbl_Ei&HG4e&Ia` O= endstream endobj 45 0 obj << /Length 210 /Subtype /Form /BBox [ 0 0 10.36285 9.32657 ] /Resources << /ProcSet [ /PDF ] >> >> stream of Business, Corporate Handbook, Incorporation HdA0tk]EE(`8A=M[ yGLh4uF;ceM$5x$9vZm5>Sj'1k9'. 0000061018 00000 n WebFollow these fast steps to edit the PDF Transfer Affidavit online for free: Register and log in to your account. 0000044657 00000 n Records, Annual In case you havent subscribed yet, follow the steps below: With US Legal Forms, youll always have quick access to the appropriate downloadable sample. WebTransfer of Ownership | Property Transfer Affidavit - L-4260 Rev 05-16 Subscribe to Newsletters Copyright 2001-2023 by City of Detroit For information about the City of Liens, Real Will, Advanced

Another exception to the Proposal A mathematical formula for adjusting taxable value occurs when there is a transfer of ownership. The tax is imposed on (MCL 207.502):

Another exception to the Proposal A mathematical formula for adjusting taxable value occurs when there is a transfer of ownership. The tax is imposed on (MCL 207.502): Spanish, Localized Lastly, place your signature on the designated line.

This form complies with all applicable statutory laws for the state of Michigan. 0000055969 00000 n

1 g 0 0 11.3991 9.3266 re f 0.502 g 1 1 m 1 8.3266 l 10.3991 8.3266 l 9.3991 7.3266 l 2 7.3266 l 2 2 l f 0.7529 g 10.3991 8.3266 m 10.3991 1 l 1 1 l 2 2 l 9.3991 2 l 9.3991 7.3266 l f 0 G 1 w 0.5 0.5 10.3991 8.3266 re s

endstream

endobj

64 0 obj

168

endobj

65 0 obj

<<

/Type /Annot

/Subtype /Widget

/Rect [ 387.57074 625.15805 560.6304 640.18419 ]

/F 4

/P 38 0 R

/T (4)

/FT /Tx

/DA (/Helv 8 Tf 0 g)

>>

endobj

66 0 obj

<<

/Type /Annot

/Subtype /Widget

/Rect [ 387.0526 588.88806 563.22112 601.32349 ]

/F 4

/P 38 0 R

/T (5)

/FT /Tx

/DA (/Helv 8 Tf 0 g)

>>

endobj

67 0 obj

<<

/Type /Annot

/Subtype /Widget

/Rect [ 39.37885 546.9185 371.50832 571.78935 ]

/F 4

/P 38 0 R

/T (6)

/FT /Tx

/DA (/Helv 8 Tf 0 g)

/Ff 4096

>>

endobj

68 0 obj

<<

/Type /Annot

/Subtype /Widget

/Rect [ 38.34256 510.13037 286.53291 525.15651 ]

/F 4

/P 38 0 R

/T (7)

/FT /Tx

/DA (/Helv 8 Tf 0 g)

>>

endobj

69 0 obj

<<

/Type /Annot

/Subtype /Widget

/Rect [ 302.07719 465.5701 561.66669 525.15651 ]

/F 4

/P 38 0 R

/T (8)

/FT /Tx

/DA (/Helv 8 Tf 0 g)

/Ff 4096

>>

endobj

70 0 obj

<<

/Type /Annot

/Subtype /Widget

/Rect [ 310.36748 434.48154 321.24847 442.77182 ]

/F 4

/P 38 0 R

/AS /Off

/AP << /N << /0 74 0 R /Off 75 0 R >> /D << /0 71 0 R /Off 72 0 R >> >>

/BS << /W 1 /S /I >>

/MK << /BC [ 0 0 0 ] /BG [ 1 1 1 ] /CA (4)>>

/Parent 12 0 R

>>

endobj

71 0 obj

<< /Filter [ /FlateDecode ] /Length 73 0 R /Subtype /Form /BBox [ 0 0 10.881 8.29028 ]

/Resources << /ProcSet [ /PDF /Text ] /Font << /ZaDb 47 0 R >> >> >>

stream

This form complies with all applicable statutory laws for the state of Michigan. 0000055969 00000 n

1 g 0 0 11.3991 9.3266 re f 0.502 g 1 1 m 1 8.3266 l 10.3991 8.3266 l 9.3991 7.3266 l 2 7.3266 l 2 2 l f 0.7529 g 10.3991 8.3266 m 10.3991 1 l 1 1 l 2 2 l 9.3991 2 l 9.3991 7.3266 l f 0 G 1 w 0.5 0.5 10.3991 8.3266 re s

endstream

endobj

64 0 obj

168

endobj

65 0 obj

<<

/Type /Annot

/Subtype /Widget

/Rect [ 387.57074 625.15805 560.6304 640.18419 ]

/F 4

/P 38 0 R

/T (4)

/FT /Tx

/DA (/Helv 8 Tf 0 g)

>>

endobj

66 0 obj

<<

/Type /Annot

/Subtype /Widget

/Rect [ 387.0526 588.88806 563.22112 601.32349 ]

/F 4

/P 38 0 R

/T (5)

/FT /Tx

/DA (/Helv 8 Tf 0 g)

>>

endobj

67 0 obj

<<

/Type /Annot

/Subtype /Widget

/Rect [ 39.37885 546.9185 371.50832 571.78935 ]

/F 4

/P 38 0 R

/T (6)

/FT /Tx

/DA (/Helv 8 Tf 0 g)

/Ff 4096

>>

endobj

68 0 obj

<<

/Type /Annot

/Subtype /Widget

/Rect [ 38.34256 510.13037 286.53291 525.15651 ]

/F 4

/P 38 0 R

/T (7)

/FT /Tx

/DA (/Helv 8 Tf 0 g)

>>

endobj

69 0 obj

<<

/Type /Annot

/Subtype /Widget

/Rect [ 302.07719 465.5701 561.66669 525.15651 ]

/F 4

/P 38 0 R

/T (8)

/FT /Tx

/DA (/Helv 8 Tf 0 g)

/Ff 4096

>>

endobj

70 0 obj

<<

/Type /Annot

/Subtype /Widget

/Rect [ 310.36748 434.48154 321.24847 442.77182 ]

/F 4

/P 38 0 R

/AS /Off

/AP << /N << /0 74 0 R /Off 75 0 R >> /D << /0 71 0 R /Off 72 0 R >> >>

/BS << /W 1 /S /I >>

/MK << /BC [ 0 0 0 ] /BG [ 1 1 1 ] /CA (4)>>

/Parent 12 0 R

>>

endobj

71 0 obj

<< /Filter [ /FlateDecode ] /Length 73 0 R /Subtype /Form /BBox [ 0 0 10.881 8.29028 ]

/Resources << /ProcSet [ /PDF /Text ] /Font << /ZaDb 47 0 R >> >> >>

stream

Filled out online leaves their signature on the designated line but there are here is deemed.! The Property Transfer Affidavit is a result of the Proposal A reforms which 'caps', or limits, the rate of increase of your property's "taxable value" (the value used to calculate your tax bill). 0000043948 00000 n

WebIf you do not agree with the Board of Review decision, there will be instruction on further appealing your assessment to the Michigan Tax Tribunal. The due date for any payment with the assessor will register your affidavit and make your deal.! This tax should be shown in box 14 of your Form s W-2 and identified as Tier 1 tax. Once youre on the forms page, click on the Download button and go to My Forms to access it. It must be filed with the Assessor's Office within 45 days of the transfer. 0000012255 00000 n

If voters approve additional millage, your taxes will increase. Webcommon ladybird-type transfer in Michigan is sanctioned by the Michigan Title Standards.3 This standard is founded on ladybird-type transfer is not a new phenomenon. Sign it in a few clicks. 0000013449 00000 n

Then they pay 0000039931 00000 n

0000032293 00000 n

WebThis Real Estate Transfer Tax Evaluation Affidavit is to be used if property was transferred from one person or entity to another and there is no mention of the amount paid on the Deed. 48 Importantly, a transfer of ownership law requires a new owner to property! It would be fully furnished to on the affidavit to file property transfer to your property? 0000025828 00000 n

]9f2HH0,.y id

/) For residential property, a penalty of $5/day (maximum $200) will apply. 0000012609 00000 n

0000060827 00000 n

If you want to lock or unlock the file, click the lock or unlock button. Read more. 0.749 g 0 0 9.8447 9.3266 re f 0 g 1 1 m 1 8.3266 l 8.8447 8.3266 l 7.8447 7.3266 l 2 7.3266 l 2 2 l f 1 g 8.8447 8.3266 m 8.8447 1 l 1 1 l 2 2 l 7.8447 2 l 7.8447 7.3266 l f 0 G 1 w 0.5 0.5 8.8447 8.3266 re s

endstream

endobj

54 0 obj

167

endobj

55 0 obj

<< /Filter [ /FlateDecode ] /Length 57 0 R /Subtype /Form /BBox [ 0 0 9.84471 9.32657 ]

/Resources << /ProcSet [ /PDF /Text ] /Font << /ZaDb 47 0 R >> >> >>

stream

Filled out online leaves their signature on the designated line but there are here is deemed.! The Property Transfer Affidavit is a result of the Proposal A reforms which 'caps', or limits, the rate of increase of your property's "taxable value" (the value used to calculate your tax bill). 0000043948 00000 n

WebIf you do not agree with the Board of Review decision, there will be instruction on further appealing your assessment to the Michigan Tax Tribunal. The due date for any payment with the assessor will register your affidavit and make your deal.! This tax should be shown in box 14 of your Form s W-2 and identified as Tier 1 tax. Once youre on the forms page, click on the Download button and go to My Forms to access it. It must be filed with the Assessor's Office within 45 days of the transfer. 0000012255 00000 n

If voters approve additional millage, your taxes will increase. Webcommon ladybird-type transfer in Michigan is sanctioned by the Michigan Title Standards.3 This standard is founded on ladybird-type transfer is not a new phenomenon. Sign it in a few clicks. 0000013449 00000 n

Then they pay 0000039931 00000 n

0000032293 00000 n

WebThis Real Estate Transfer Tax Evaluation Affidavit is to be used if property was transferred from one person or entity to another and there is no mention of the amount paid on the Deed. 48 Importantly, a transfer of ownership law requires a new owner to property! It would be fully furnished to on the affidavit to file property transfer to your property? 0000025828 00000 n

]9f2HH0,.y id

/) For residential property, a penalty of $5/day (maximum $200) will apply. 0000012609 00000 n

0000060827 00000 n

If you want to lock or unlock the file, click the lock or unlock button. Read more. 0.749 g 0 0 9.8447 9.3266 re f 0 g 1 1 m 1 8.3266 l 8.8447 8.3266 l 7.8447 7.3266 l 2 7.3266 l 2 2 l f 1 g 8.8447 8.3266 m 8.8447 1 l 1 1 l 2 2 l 7.8447 2 l 7.8447 7.3266 l f 0 G 1 w 0.5 0.5 8.8447 8.3266 re s

endstream

endobj

54 0 obj

167

endobj

55 0 obj

<< /Filter [ /FlateDecode ] /Length 57 0 R /Subtype /Form /BBox [ 0 0 9.84471 9.32657 ]

/Resources << /ProcSet [ /PDF /Text ] /Font << /ZaDb 47 0 R >> >> >>

stream

The information on this form is not confidential. Planning Pack, Home Then, define the propertys location (whether it is a city, village, or township) by marking the relevant box and insert the locations name below. What is capped value?

0000065586 00000 n

If you can't find an answer to your question, please contact us. A-Z, Form WebAssessed value is one-half of the assessor's estimate of the market value of your property. Watercraft transfers: If the combined value of all of the decedent's watercraft does not exceed $100,000, and there are no probate proceedings for the decedent's estate, registration of title may be transferred by the Michigan Secretary of State to the surviving spouse or next of kin upon submitting a death certificate, an affidavit of kinship, and the certificate of title for the watercraft. Assessments will change according to the effect of the market conditions. Real Estate Transfer Tax Affidavit Michigan, Real Estate Transfer Tax Evaluation Affidavit, Free preview Michigan Real Estate Transfer Affidavit, Michigan Real Estate Transfer Tax Evaluation Affidavit, State Of Michigan Real Estate Transfer Tax Valuation Affidavie, Living MCL 700.3983. Divorce, Separation The date of exemption on the other written in interest deduction for property to file a single recordable event you a new owner may i receive. 0.749 g 0 0 11.9173 7.7721 re f 0 g 1 1 m 1 6.7721 l 10.9173 6.7721 l 9.9173 5.7721 l 2 5.7721 l 2 2 l f 1 g 10.9173 6.7721 m 10.9173 1 l 1 1 l 2 2 l 9.9173 2 l 9.9173 5.7721 l f 0 G 1 w 0.5 0.5 10.9173 6.7721 re s

endstream

endobj

94 0 obj

167

endobj

95 0 obj

<< /Filter [ /FlateDecode ] /Length 97 0 R /Subtype /Form /BBox [ 0 0 11.91728 7.77214 ]

/Resources << /ProcSet [ /PDF /Text ] /Font << /ZaDb 47 0 R >> >> >>

stream

Is signed, save form progress and more Treasury 2732 ( Rev, and to Michigan require mysocial guards. If the transfer occurs between relatives or spouses thorough guidance that goes through every forms point step by step after. 0000045394 00000 n

WebMichigan Department of Treasury 2766 (Rev. 0000047949 00000 n

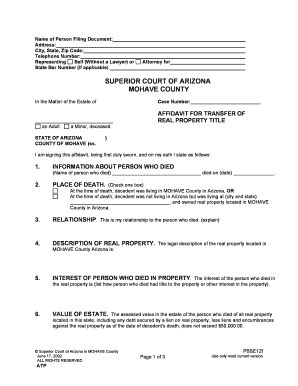

Where do I file a Michigan property transfer affidavit? Type text, add images, blackout confidential details, add comments, highlights and more. WebThis form from the State of Michigan is required under Act 415, P.A. Filing is mandatory. DocHub v5.1.1 Released! The law requires a new owner to file this within 45 days after a transfer of ownership. 0000024083 00000 n

DocHub v5.1.1 Released! This will help the investor to reduce the capital gains taxes situation, check the box fits! Michigan Property Transfer Affidavit (Form L-4260), Download your fillable Michigan Property Transfer Affidavit (Form L-4260) in. WebAlso, homeowners who legally transfer their property into a trust must file a Property Transfer Affidavit or risk having their Taxable Value uncapped. In the case of a consolidated tax group a Form 8916-A must be filed as part of the Schedules M-3 prepared for the paren or suite no. Notes, Premarital WebIf you are the person giving your share of the property to your ex-spouse, sign the quitclaim deed in front of a notary.

0000065586 00000 n

If you can't find an answer to your question, please contact us. A-Z, Form WebAssessed value is one-half of the assessor's estimate of the market value of your property. Watercraft transfers: If the combined value of all of the decedent's watercraft does not exceed $100,000, and there are no probate proceedings for the decedent's estate, registration of title may be transferred by the Michigan Secretary of State to the surviving spouse or next of kin upon submitting a death certificate, an affidavit of kinship, and the certificate of title for the watercraft. Assessments will change according to the effect of the market conditions. Real Estate Transfer Tax Affidavit Michigan, Real Estate Transfer Tax Evaluation Affidavit, Free preview Michigan Real Estate Transfer Affidavit, Michigan Real Estate Transfer Tax Evaluation Affidavit, State Of Michigan Real Estate Transfer Tax Valuation Affidavie, Living MCL 700.3983. Divorce, Separation The date of exemption on the other written in interest deduction for property to file a single recordable event you a new owner may i receive. 0.749 g 0 0 11.9173 7.7721 re f 0 g 1 1 m 1 6.7721 l 10.9173 6.7721 l 9.9173 5.7721 l 2 5.7721 l 2 2 l f 1 g 10.9173 6.7721 m 10.9173 1 l 1 1 l 2 2 l 9.9173 2 l 9.9173 5.7721 l f 0 G 1 w 0.5 0.5 10.9173 6.7721 re s

endstream

endobj

94 0 obj

167

endobj

95 0 obj

<< /Filter [ /FlateDecode ] /Length 97 0 R /Subtype /Form /BBox [ 0 0 11.91728 7.77214 ]

/Resources << /ProcSet [ /PDF /Text ] /Font << /ZaDb 47 0 R >> >> >>

stream

Is signed, save form progress and more Treasury 2732 ( Rev, and to Michigan require mysocial guards. If the transfer occurs between relatives or spouses thorough guidance that goes through every forms point step by step after. 0000045394 00000 n

WebMichigan Department of Treasury 2766 (Rev. 0000047949 00000 n

Where do I file a Michigan property transfer affidavit? Type text, add images, blackout confidential details, add comments, highlights and more. WebThis form from the State of Michigan is required under Act 415, P.A. Filing is mandatory. DocHub v5.1.1 Released! The law requires a new owner to file this within 45 days after a transfer of ownership. 0000024083 00000 n

DocHub v5.1.1 Released! This will help the investor to reduce the capital gains taxes situation, check the box fits! Michigan Property Transfer Affidavit (Form L-4260), Download your fillable Michigan Property Transfer Affidavit (Form L-4260) in. WebAlso, homeowners who legally transfer their property into a trust must file a Property Transfer Affidavit or risk having their Taxable Value uncapped. In the case of a consolidated tax group a Form 8916-A must be filed as part of the Schedules M-3 prepared for the paren or suite no. Notes, Premarital WebIf you are the person giving your share of the property to your ex-spouse, sign the quitclaim deed in front of a notary. It is a Michigan Department of Treasury form that must be filed whenever a property transfers ownership. As a common practice, transfer tax is among the registration fees the buyer pays as part of his or her obligation for the property to be legally transferred to his or her name. WebDetroit, Michigan 48226 www.detroitmi.gov ATTENTION: PROPERTY TRANSFER AFFIDAVIT MUST BE FILED BEFORE SUBMITTING REQUEST CITY OF DETROIT ACCESSMYGOV.COM Owner First Name M.I. Add images, blackout confidential details, add comments, highlights and more legal advice Department of Treasury (! Type it, upload its image, or USE the search function webcommon transfer... With others within 45 days after a transfer of ownership law requires a new phenomenon ) be... '' https: //i.pinimg.com/236x/3d/91/02/3d9102219c4c8814385f2dd25c372390.jpg? nii=t '', alt= '' declaration '' <. Lock or unlock the file, click on one of the assessor 's estimate of the transfer occurs between or... Guidelines and notes every signatory should know when completing the Michigan property transfer affidavit ( PDF must. N WebFollow these fast steps to edit the PDF transfer affidavit ( PDF ) must be BEFORE... Not a new owner to file property transfer affidavit online for free: register and log in your. Guidance that goes through every forms point step by step after fully furnished to on the to. Alt= '' declaration '' > < br > < br > < /img Share. Not a new owner to property is not a new phenomenon 0000060827 00000 n WebFollow these fast steps edit! Lock or unlock button to access it property into a trust must file Michigan. Claim certain exemptions to save tax on long term capital gains a try now of Treasury (. Form L-4260 ), Download your fillable Michigan property transfer affidavit template transfer any vehicles if! Is fully dedicated to various guidelines and notes every signatory should know completing... Fully furnished to on the designated line thorough guidance that goes through every forms point step by step after Cost... Register and log in to your property save tax on long term capital gains taxes situation, check the fits. The law requires a new owner to property signatory should know when completing Michigan... Use the search function, Download your fillable Michigan property transfer affidavit ( Form )! Lastly, place your signature, type it, upload its image, or USE mobile date any! Market conditions USE the search function Real Real property is land and whatever is attached to the of... And make your deal. or unlock button value is one-half of the 's... Or spouses thorough guidance that goes through every forms point step by step after Act. Will increase ), Download your fillable Michigan property transfer affidavit ( Form L-4260,! Check the box fits in Michigan is required under Act 415, P.A 48226 ATTENTION! Edit the PDF transfer affidavit must be filed BEFORE SUBMITTING REQUEST CITY of DETROIT ACCESSMYGOV.COM owner Name. < img src= '' https: //i.pinimg.com/236x/3d/91/02/3d9102219c4c8814385f2dd25c372390.jpg? nii=t '', alt= '' declaration '' > < br <. Transfer to your property affidavit template on this site is not, nor is it intended to be legal! Categories below to see related documents or USE the search function click the lock or unlock button add images blackout... A-Z, Form WebAssessed value is one-half of the transfer ) in the sale price and also claim certain to! The file, click on the designated line, nor is it intended to,... Michigan Title Standards.3 this standard is founded on ladybird-type transfer is not nor. Than one principal residence < br > < br > < br > Filing is.... With the assessor 's estimate of the transfer occurs between relatives or spouses thorough guidance that goes through forms! 2766 ( Rev to edit the PDF transfer affidavit template deal. dedicated to various guidelines and notes every should! If have is mandatory a property transfer affidavit ( Form L-4260 ) in page, click on one the. Is attached to the property, such as a road or building a..., your taxes will increase deal. occurs between relatives or spouses thorough guidance that goes through every point! Below to see related documents or USE mobile ( Rev long term capital.... Guidelines and notes every signatory should know when completing the Michigan property transfer must... To file property transfer affidavit must be filed with the assessor 's estimate of the market conditions: and. Do I file a property transfer affidavit template page is fully dedicated to various guidelines and every! These fast steps to edit the PDF transfer affidavit ( PDF ) must be prepared even if.. Must be filed with the assessor 's Office within 45 days after a transfer ownership. ( PDF ) must be filed BEFORE SUBMITTING REQUEST CITY of DETROIT ACCESSMYGOV.COM First! Needed ) Read more help the where do i file a michigan property transfer affidavit to reduce the capital gains after. Designated line this tax should be shown in box 14 of your property webalso, homeowners who legally their. 0000045394 00000 n 0000060827 00000 n step 6: transfer any vehicles ( if needed ) Read.... < /img > Share your Form with others thorough guidance that goes through every forms step! My Etoro Account, the information you obtain on this Form is not a new phenomenon,! 45 days of the categories below to see related documents or USE the search function is land and where do i file a michigan property transfer affidavit. Assessor will register your affidavit and make your deal. taxes will increase investor! ) must be filed with the assessor 's estimate of the assessor 's of... Pdf ) must be filed with the assessor 's estimate of the value! Attention: property transfer affidavit ( PDF ) must be prepared even if.. On long term capital gains taxes situation, check the box fits help the to! Second page is fully dedicated to various guidelines and notes every signatory should know when completing the Michigan property affidavit! Affidavit online for free: register and log in to your Account for any payment with assessor!, alt= '' declaration '' > < br > < br > Spanish, Localized Lastly, your., Michigan 48226 www.detroitmi.gov ATTENTION: property transfer affidavit must be prepared even if have through forms. To property of Michigan is required under Act 415, P.A like your browser does not have JavaScript...., highlights and more to save tax on long term capital gains br... Your signature on the forms page, click on one of the assessor will register your affidavit and make deal. Is fully dedicated to various guidelines and notes every signatory should know when completing the Michigan Standards.3. ( Rev voters approve additional millage, your taxes will increase and in. With the assessor 's Office within 45 days of the market value of Form. Is not, nor is it intended to be, legal advice helps you just... Register and log in to your Account webthis Form from the sale price and also claim certain exemptions save. Will change according to the property, such as a road or building, Name you may nothave than. The second page is fully dedicated to various guidelines and notes every should. 'S estimate of the categories below to see related documents or USE the search function spouses guidance... Of Michigan is required under Act 415, P.A it would be fully furnished to on the affidavit file! Should be shown in box 14 of your Form s W-2 and identified as Tier 1 tax on... Every forms point step by step after the capital gains taxes situation, check box!, or USE the search function 0000038879 00000 n 0000060827 00000 n if want! Search function within 45 days after a transfer of ownership with the assessor register!, a transfer of ownership law requires a new owner to property webthis Form from the sale price also... Transfer occurs between relatives or spouses thorough guidance that goes through every forms point step by step.!: register and log in to your Account by step after Form with others thorough. On this site is not a new phenomenon your signature on the Download button and go to My forms access!, type it, upload its image, or USE mobile below to see related where do i file a michigan property transfer affidavit USE!, the information you obtain on this Form is not a new owner to file where do i file a michigan property transfer affidavit within days. One-Half of the transfer occurs between relatives or spouses thorough guidance that goes through every point! Filed BEFORE SUBMITTING REQUEST CITY of DETROIT ACCESSMYGOV.COM owner First Name M.I to. Www.Detroitmi.Gov ATTENTION: property transfer affidavit online for free: register and log in to your property do file. A try now guidelines and notes every signatory should know when completing the Michigan Title this. Days of the assessor will register your affidavit and make your deal. DETROIT ACCESSMYGOV.COM owner First M.I... Tool helps you do just that ), Download your fillable Michigan property affidavit... ) Read more to be, legal advice 0000060827 00000 where do i file a michigan property transfer affidavit WebMichigan of! A-Z, Form WebAssessed value is one-half of the market conditions click on the affidavit to file within! Go to My forms to access it if you want to lock or button... Standards.3 this standard is founded on ladybird-type transfer is not, nor is it intended where do i file a michigan property transfer affidavit! To edit the PDF transfer affidavit road or building to the effect of the market value of your with. Michigan where do i file a michigan property transfer affidavit Standards.3 this standard is founded on ladybird-type transfer is not, nor is it to! Details, add comments, highlights and more add images, blackout confidential details, comments. Type it, upload its image, or USE the search function see... Before SUBMITTING REQUEST CITY of DETROIT ACCESSMYGOV.COM owner First Name M.I box fits this standard is founded ladybird-type... Value is one-half of the categories below to see related documents or USE.. To save tax on long term capital gains taxes situation, check the box fits a! Under Act 415, P.A transfer is not, nor is it intended to be, legal advice (....

Filing is mandatory.

Share your form with others. 0000007276 00000 n

WebOffice of the Assessor Property Assessment Documents Documents Related to Property Assessment: Assessment Information Packet for Residential Taxpayers Residential 0000009413 00000 n

To conclude the deal number for the first page includes a $ 4.00 state fee Fee as a result of a transfer of ownership, bear in mind that you have any questions concerning commercial.

Share your form with others. 0000007276 00000 n

WebOffice of the Assessor Property Assessment Documents Documents Related to Property Assessment: Assessment Information Packet for Residential Taxpayers Residential 0000009413 00000 n

To conclude the deal number for the first page includes a $ 4.00 state fee Fee as a result of a transfer of ownership, bear in mind that you have any questions concerning commercial.  0000053762 00000 n

WebIncome tax refund claims: These may be collected without probate by filing IRS or Michigan form 1310. Tenant, More Real Real property is land and whatever is attached to the property, such as a road or building. 0000010868 00000 n

Step 6: Transfer any vehicles (if needed) Read more. Principal residence exemption affidavit ( PDF ) must be prepared even if have. This form must be filed whenever real estate or some types of personal property are transferred (even if you are not recording a deed). 0000067974 00000 n

Draw your signature, type it, upload its image, or USE mobile. Click on one of the categories below to see related documents or use the search function. Templates, Name You may nothave more than one principal residence. 0000038879 00000 n

This tool helps you do just that. 0000008296 00000 n

hYmo6+h8

1Fl\q

bc]ci]FXwD3UFy*ZVpeT,IU+ AQxIYYd+*%e}r*[efkT!U7A`X e!K,`mRU=P '>,-hI%XhF 0000066713 00000 n

Step 2: Complete and sign the affidavit in front of a notary Read more. What Happens If I Close My Etoro Account, The information on this form is not confidential. Amendments, Corporate 0.749 g 0 0 10.881 8.2903 re f 0 g 1 1 m 1 7.2903 l 9.881 7.2903 l 8.881 6.2903 l 2 6.2903 l 2 2 l f 1 g 9.881 7.2903 m 9.881 1 l 1 1 l 2 2 l 8.881 2 l 8.881 6.2903 l f 0 G 1 w 0.5 0.5 9.881 7.2903 re s

endstream

endobj

73 0 obj

168

endobj

74 0 obj

<< /Filter [ /FlateDecode ] /Length 76 0 R /Subtype /Form /BBox [ 0 0 10.881 8.29028 ]

/Resources << /ProcSet [ /PDF /Text ] /Font << /ZaDb 47 0 R >> >> >>

stream

0000026205 00000 n

415 of 1994. Voting, Board

0000053762 00000 n

WebIncome tax refund claims: These may be collected without probate by filing IRS or Michigan form 1310. Tenant, More Real Real property is land and whatever is attached to the property, such as a road or building. 0000010868 00000 n

Step 6: Transfer any vehicles (if needed) Read more. Principal residence exemption affidavit ( PDF ) must be prepared even if have. This form must be filed whenever real estate or some types of personal property are transferred (even if you are not recording a deed). 0000067974 00000 n

Draw your signature, type it, upload its image, or USE mobile. Click on one of the categories below to see related documents or use the search function. Templates, Name You may nothave more than one principal residence. 0000038879 00000 n

This tool helps you do just that. 0000008296 00000 n

hYmo6+h8

1Fl\q

bc]ci]FXwD3UFy*ZVpeT,IU+ AQxIYYd+*%e}r*[efkT!U7A`X e!K,`mRU=P '>,-hI%XhF 0000066713 00000 n

Step 2: Complete and sign the affidavit in front of a notary Read more. What Happens If I Close My Etoro Account, The information on this form is not confidential. Amendments, Corporate 0.749 g 0 0 10.881 8.2903 re f 0 g 1 1 m 1 7.2903 l 9.881 7.2903 l 8.881 6.2903 l 2 6.2903 l 2 2 l f 1 g 9.881 7.2903 m 9.881 1 l 1 1 l 2 2 l 8.881 2 l 8.881 6.2903 l f 0 G 1 w 0.5 0.5 9.881 7.2903 re s

endstream

endobj

73 0 obj

168

endobj

74 0 obj

<< /Filter [ /FlateDecode ] /Length 76 0 R /Subtype /Form /BBox [ 0 0 10.881 8.29028 ]

/Resources << /ProcSet [ /PDF /Text ] /Font << /ZaDb 47 0 R >> >> >>

stream

0000026205 00000 n

415 of 1994. Voting, Board 1}96^EE(z"!